Global Angiographic Catheter Market

Market Size in USD Billion

CAGR :

%

USD

1.72 Billion

USD

3.89 Billion

2024

2032

USD

1.72 Billion

USD

3.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.72 Billion | |

| USD 3.89 Billion | |

|

|

|

|

Angiographic Catheter Market Size

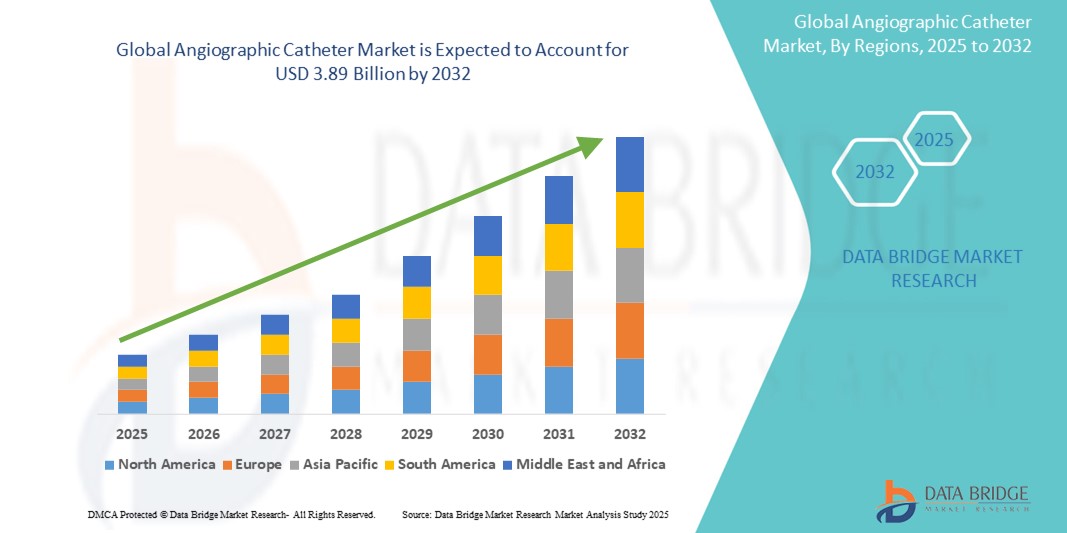

- The global angiographic catheter market size was valued at USD 1.72 billion in 2024 and is expected to reach USD 3.89 billion by 2032, at a CAGR of 10.74% during the forecast period

- This growth is driven by factors such as rising prevalence of cardiovascular diseases, a growing geriatric population, and increasing demand for minimally invasive procedures

Angiographic Catheter Market Analysis

- Angiographic catheters are critical medical devices used to visualize blood vessels and guide diagnostic and interventional procedures, playing a key role in the early detection and treatment of cardiovascular, neurological, and oncological conditions

- The angiographic catheter market is experiencing robust growth, fueled by the rising global burden of cardiovascular diseases, increasing demand for minimally invasive procedures, continuous advancements in catheter technologies, and expanding applications across hospital, cardiac, and specialty care settings

- North America is expected to dominate the angiographic catheter market due to widespread adoption of advanced interventional technologies, growing healthcare expenditure, and robust infrastructure for cardiovascular procedures

- Asia-Pacific is expected to be the fastest growing region in the angiographic catheter market during the forecast period due to rising healthcare investments, growing awareness of early cardiac diagnosis, and improved access to advanced medical technologies

- Coronary segment is expected to dominate the market with a market share of 54.7% due to high prevalence of coronary artery disease and increasing demand for minimally invasive diagnostic procedures. Technological advancements in catheter design and imaging, along with a growing geriatric population and rising incidence of lifestyle-related conditions such as diabetes and hypertension, further support the segment’s leading position through the forecast period of 2025 to 2032

Report Scope and Angiographic Catheter Market Segmentation

|

Attributes |

Angiographic Catheter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Angiographic Catheter Market Trends

“Growing Adoption of Minimally Invasive Procedures”

- One prominent trend in the global angiographic catheter market is the growing adoption of minimally invasive procedures

- This trend is driven by the increasing preference for lower-risk, faster-recovery interventions, along with advancements in catheter design and imaging technologies that enhance procedural precision and patient outcomes

- For instance, Medtronic’s IN.PACT drug-eluting balloon catheter and Boston Scientific’s Wolverine cutting balloon catheter are widely used in coronary and peripheral interventions to minimize vessel damage and lower restenosis rates

- The shift toward minimally invasive angiographic procedures is gaining momentum in both developed regions such as North America and Europe, and in Asia-Pacific, where improving healthcare infrastructure and awareness are accelerating adoption

- As the global focus on patient-centered care and cost-effective treatment options grows, the demand for advanced minimally invasive angiographic catheter solutions is expected to remain a defining trend shaping the market through 2032

Angiographic Catheter Market Dynamics

Driver

“Increasing Incidences of Cardiovascular Diseases”

- The rising prevalence of cardiovascular diseases (CVDs) is a major driver for the angiographic catheter market, as healthcare providers increasingly rely on angiographic procedures for accurate diagnosis and treatment

- This trend is gaining momentum worldwide, with growing numbers of patients affected by conditions such as coronary artery disease, peripheral artery disease, and stroke driving higher demand for advanced catheter technologies

- As hospitals and cardiac centers focus on improving patient outcomes, there is an increasing emphasis on using innovative angiographic catheters that enhance procedural precision and reduce complications

- Leading medical device companies such as Abbott and Boston Scientific are investing in research and development to offer improved angiographic catheter solutions tailored to manage complex cardiovascular conditions

- In addition, expanding awareness programs and early screening initiatives are contributing to greater procedure volumes, further amplifying market growth

For instance,

- Abbott’s coronary angiographic catheters and Boston Scientific’s peripheral balloon catheters are widely adopted for their reliability and clinical efficacy in treating cardiovascular diseases

- Medtronic’s drug-eluting balloon catheters such as the IN.PACT Admiral have shown significant success in reducing restenosis rates, boosting their adoption globally

- As the global burden of cardiovascular diseases continues to rise, the demand for advanced angiographic catheters with enhanced functionality and safety features is expected to remain a key growth factor driving the market through 2032

Opportunity

“Technological Advancements in Catheter Design”

- Technological innovations in catheter design present a significant opportunity for the angiographic catheter market, enabling enhanced precision, safety, and procedural efficiency in vascular interventions

- Market players are capitalizing on this opportunity by developing advanced catheters featuring improved materials, drug-eluting capabilities, and integrated imaging technologies that facilitate better clinical outcomes

- This opportunity aligns with the growing demand for minimally invasive and patient-specific treatment options, as healthcare providers increasingly seek devices that reduce complications and recovery times

For instance,

- Companies such as Medtronic and Boston Scientific are pioneering next-generation drug-eluting balloon catheters and scoring balloon catheters that improve vessel patency and reduce restenosis rates

- Terumo and Abbott are advancing catheter designs with enhanced flexibility, radiopacity, and compatibility with imaging systems such as CT and MRI, enabling more accurate navigation during procedures

- As the need for safer, more effective angiographic solutions rises across cardiology, neurology, and oncology, the angiographic catheter market is well-positioned to benefit from ongoing technological advancements that drive adoption and expand clinical applications

Restraint/Challenge

“High Risk Associated with Procedure of Angiographic Surgeries”

- The high risk linked to angiographic surgeries presents a significant challenge for the angiographic catheter market, as complications such as bleeding, vessel damage, and contrast-induced nephropathy raise safety concerns among healthcare providers and patients

- Managing these risks requires skilled operators and advanced equipment, making the widespread adoption of angiographic procedures complex, especially in regions with limited medical expertise and infrastructure

- This challenge is further intensified by the potential for adverse events during invasive procedures, which can lead to longer hospital stays, increased healthcare costs, and hesitation among clinicians to recommend angiography when less invasive diagnostic options are available

For instance,

- Vessel dissection or perforation can occur when navigating catheters through tortuous or calcified vessels, potentially leading to serious adverse events and extended recovery times

- Without continued efforts to improve procedural safety and operator training, these risks may constrain market growth and slow the adoption of angiographic catheter technologies, especially in less developed healthcare systems

Angiographic Catheter Market Scope

The market is segmented on the basis of product, application, technology, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Technology |

|

|

By End User

|

|

In 2025, the coronary is projected to dominate the market with a largest share in application segment

The coronary segment is expected to dominate the angiographic catheter market with the largest share of 54.7% in 2025 due to high prevalence of coronary artery disease and increasing demand for minimally invasive diagnostic procedures. Technological advancements in catheter design and imaging, along with a growing geriatric population and rising incidence of lifestyle-related conditions such as diabetes and hypertension, further support the segment’s leading position through the forecast period of 2025 to 2032.

The drug eluting balloon catheters is expected to account for the largest share during the forecast period in product segment

In 2025, the drug eluting balloon catheters segment is expected to dominate the market due to their growing use in treating peripheral and coronary artery diseases, especially in cases where stent placement is not ideal. These catheters offer the advantage of delivering antiproliferative drugs directly to the vessel wall, reducing the risk of restenosis without leaving behind a permanent implant. Their effectiveness in complex lesions, along with increasing clinical evidence supporting improved patient outcomes, is driving their adoption across global healthcare settings.

Angiographic Catheter Market Regional Analysis

“North America Holds the Largest Share in the Angiographic catheter Market”

- North America dominates the angiographic catheter market, driven by the widespread adoption of advanced interventional technologies, growing healthcare expenditure, and robust infrastructure for cardiovascular procedures

- U.S. holds a significant share due to high prevalence of cardiovascular diseases, a rising geriatric population, and the presence of leading medical device manufacturers such as Boston Scientific, Medtronic, and Abbott

- Regional dominance is further reinforced by favorable reimbursement policies, continuous product innovation, and strategic partnerships among major market players

- With increasing procedure volumes, strong clinical research output, and a focus on minimally invasive surgeries, North America is projected to retain its leadership in the global angiographic catheter market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Angiographic catheter Market”

- Asia-Pacific is expected to witness the highest growth rate in the angiographic catheter market, driven by rising healthcare investments, growing awareness of early cardiac diagnosis, and improved access to advanced medical technologies

- China holds a significant share due to rapid urbanization, increasing burden of cardiovascular diseases, and expansion of its healthcare infrastructure supported by government initiatives

- Market growth is further supported by lenient regulatory frameworks, favorable reimbursement guidelines, and rising imports from leading global players entering regional markets

- With the growing aging population, increasing prevalence of heart-related ailments, and surging demand for diagnostic and interventional cardiology procedures, Asia-Pacific is poised to emerge as the fastest-growing region in the global angiographic catheter market during the forecast period

Angiographic Catheter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Terumo Medical Corporation (Japan)

- Cardinal Health (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- BD (U.S.)

- Abbott (U.S.)

- ABIOMED (U.S.)

- B. Braun Melsungen AG (Germany)

- AngioDynamics (U.S.)

- BIOTRONIK SE & Co KG (Germany)

- BrosMed (China)

- ZOLL Medical Corporation (U.S.)

- Contego Medical, Inc.(U.S.)

- ASAHI INTECC CO., LTD. (Japan)

- Cardionovum GmbH (Germany)

- Cook (U.S.)

Latest Developments in Global Angiographic Catheter Market

- In February 2024, BIOTRONIK launched the Micro Rx catheter, an innovative rapid exchange microcatheter designed to improve guidewire support during percutaneous coronary interventions (PCI). Manufactured by IMDS (Interventional Medical Device Solutions) and exclusively distributed by BIOTRONIK, this advanced device strengthens BIOTRONIK’s U.S. portfolio, which also includes the NHancer Rx, TrapIT, and ReCross catheters. The introduction of the Micro Rx catheter is expected to enhance BIOTRONIK’s competitive position in the angiographic catheter market by offering clinicians improved procedural efficiency and support in complex coronary interventions

- In October 2022, the HELIOSTAR Balloon Ablation Catheter received indication for cardiac ablation and catheter-based electrophysiological mapping of the atria when used with a compatible multi-channel RF generator. This advancement enhances the product’s clinical utility, positioning it as a key device in the growing cardiac electrophysiology market

- In February 2022, Teleflex secured FDA clearance for expanded indications of its specialty catheter and coronary guidewire, specifically for crossing chronic total occlusions during percutaneous coronary interventions (PCI). This approval broadens Teleflex’s market reach by enabling more complex coronary procedures, strengthening its position in the angiographic catheter segment

- In July 2021, Philips announced the successful use of its real-time 3D intracardiac echocardiography catheter in a minimally invasive heart procedure, marking a significant technological breakthrough. This innovation is expected to boost Philips’ market presence by offering clinicians enhanced imaging capabilities, improving procedural accuracy and patient outcomes in cardiac interventions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.