Global Animal Antimicrobials And Antibiotics Market

Market Size in USD Billion

CAGR :

%

USD

2.67 Billion

USD

3.80 Billion

2024

2032

USD

2.67 Billion

USD

3.80 Billion

2024

2032

| 2025 –2032 | |

| USD 2.67 Billion | |

| USD 3.80 Billion | |

|

|

|

|

Animal Antimicrobials and Antibiotics Market Size

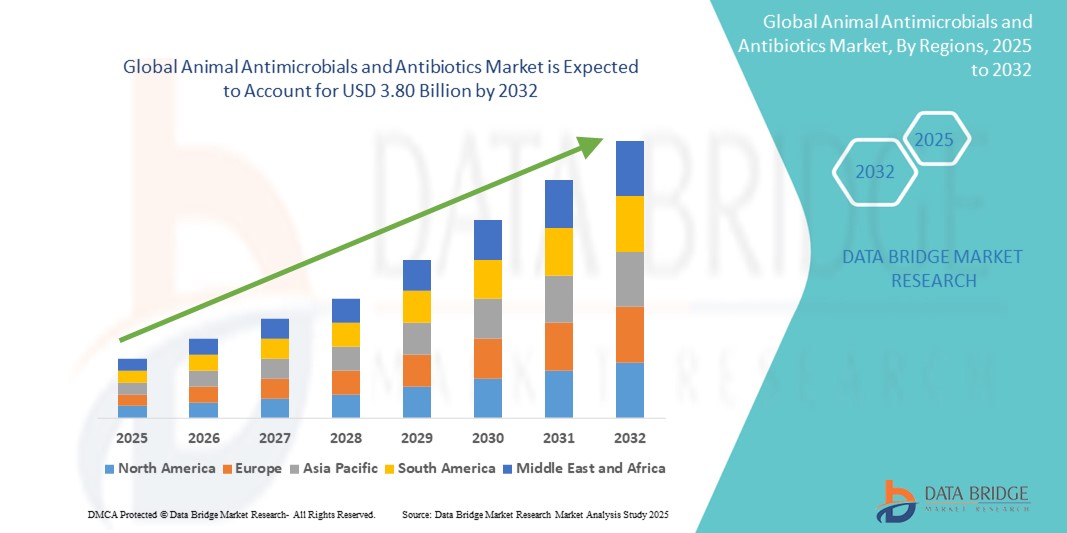

- The global animal antimicrobials and antibiotics market size was valued at USD 2.67 billion in 2024 and is expected to reach USD 3.80 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of infectious diseases in livestock and companion animals, coupled with rising demand for animal-derived food products, prompting widespread use of antibiotics to ensure animal health and productivity across both developed and developing regions

- Furthermore, growing awareness among farmers and pet owners regarding disease prevention, along with regulatory support for veterinary healthcare and the introduction of broad-spectrum, targeted antimicrobial agents, is driving the adoption of animal antibiotics, thereby significantly boosting the industry's growth

Animal Antimicrobials and Antibiotics Market Analysis

- Animal antimicrobials and antibiotics are pharmaceutical agents used to prevent, control, and treat bacterial infections in livestock and companion animals. These drugs play a critical role in maintaining animal welfare, improving feed efficiency, and safeguarding the global food supply

- The escalating demand is primarily driven by the intensification of livestock farming, rising incidences of zoonotic diseases, and the introduction of novel antibiotic formulations by key market players to address evolving bacterial resistance and regulatory compliance

- Europe dominated the animal antimicrobials and antibiotics market with a share of 34.5% in 2024, due to the region’s advanced veterinary healthcare infrastructure, strong regulatory oversight, and increased awareness around animal health and food safety

- Asia-Pacific is expected to be the fastest growing region in the animal antimicrobials and antibiotics market during the forecast period due to population growth, dietary shifts toward animal protein, and expansion of livestock production systems

- Food-producing animals segment dominated the market with a market share of 76.9% in 2024, due to the growing global demand for meat, dairy, and eggs, which necessitates consistent disease prevention and productivity maintenance. Antibiotics and antimicrobials are extensively used in livestock to control infectious diseases, improve feed efficiency, and reduce mortality, especially in intensive farming systems. Emerging economies are seeing increased usage due to expanding animal agriculture and commercial farming practices

Report Scope and Animal Antimicrobials and Antibiotics Market Segmentation

|

Attributes |

Animal Antimicrobials and Antibiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Animal Antimicrobials and Antibiotics Market Trends

“Rising Concerns About Zoonotic Diseases”

- The animal antimicrobials and antibiotics market is expanding as public health authorities, veterinarians, and producers respond to increasing threats of zoonotic diseases, which can transfer from animals to humans and disrupt both food security and global trade

- For instance, leading companies such as Zoetis and Elanco are actively investing in new antimicrobial and antibiotic formulations to address outbreaks of diseases such as avian influenza and swine fever, and are contributing to global disease surveillance efforts for early detection and containment

- The globalization of the food supply chain and intensification of livestock production have heightened scrutiny on disease control, driving significant R&D investment into broad-spectrum and targeted antimicrobial therapies

- Regulatory organizations and governments are introducing stricter regulations and monitoring, as well as traceability initiatives, to control the use of antibiotics in animal health while simultaneously containing potential zoonotic outbreaks

- Technological advances such as rapid diagnostic tools and digital health monitoring in livestock management are being adopted to enable earlier intervention, limit the spread of infectious disease, and optimize the use of antimicrobials

- Consumer awareness of food safety and responsible antibiotic use continues to influence the market, as large food retailers and processors increasingly demand verification of animal health protocols from their suppliers

Animal Antimicrobials and Antibiotics Market Dynamics

Driver

“Increasing Demand for Animal Protein”

- Surging global demand for animal protein—including meat, eggs, and dairy—is accelerating the need for effective disease management resources, boosting growth in the antimicrobials and antibiotics sector

- For instance, Merck Animal Health and Boehringer Ingelheim have reported notable increases in product sales from large-scale meat producers in Asia and Latin America seeking to optimize herd health and productivity amid intensifying livestock operations

- Rising incomes, urbanization, and changing dietary preferences in emerging economies are fueling continued growth of the livestock industry, which relies on antimicrobials and antibiotics for disease prevention and growth promotion

- Growth in companion animal ownership, coupled with increasing willingness to invest in animal health, is also supporting demand for broader-spectrum and more specialized antimicrobial products

- International trade and export requirements in the livestock sector incentivize adherence to health protocols involving responsible antimicrobial use, as importing countries often mandate disease-free certification and residue compliance to ensure food safety

Restraint/Challenge

“Concern of Antibiotic Resistance”

- Escalating concerns over antibiotic resistance—whereby pathogens become resistant to treatment—are a major challenge, prompting tighter controls and reductions in the use of certain antibiotic classes across global markets

- For instance, companies such as Elanco and Zoetis are investing in the development of alternative therapies, including vaccines and probiotics, and are implementing stewardship programs in partnership with industry groups to combat the risk of antimicrobial resistance (AMR)

- Regulatory agencies such as the FDA, EMA, and WHO have enacted strict guidelines for veterinary antibiotic usage, withdrawal periods, and prescription requirements, especially for medically important antimicrobials

- Persistent consumer and advocacy group pressure, particularly in North America and Europe, is driving food producers and retailers to adopt antibiotic-free and reduced-antibiotic supply chains, which can limit market growth in traditional product segments

- The narrowing pipeline for new antibiotic approvals, high R&D costs, and frequent supply chain disruptions add to the operational challenges faced by manufacturers, necessitating the adoption of innovative, cost-effective solutions to maintain market viability

Animal Antimicrobials and Antibiotics Market Scope

The market is segmented on the basis of product type, mode of delivery, and animal type.

- By Product Type

On the basis of product type, the animal antimicrobials and antibiotics market is segmented into tetracycline, penicillin, sulfonamide, macrolide, cephalosporin, fluoroquinolone, aminoglycosides, and lincosamides. The tetracycline segment accounted for the largest market revenue share in 2024, owing to its broad-spectrum efficacy, cost-effectiveness, and long-standing usage across various livestock species. It is particularly favored in food-producing animals due to its ability to combat a wide range of bacterial infections while maintaining a low resistance profile when properly managed. Its consistent demand is also supported by its use in both therapeutic and prophylactic applications across poultry, swine, and cattle.

The fluoroquinolone segment is projected to register the fastest growth rate from 2025 to 2032, driven by its potent bactericidal action and growing preference for advanced and targeted treatments in high-value livestock. These antibiotics are especially effective in treating respiratory and enteric infections and are gaining traction in regions with advanced veterinary infrastructure. Rising concerns over antimicrobial resistance are also encouraging the selective and judicious use of fluoroquinolones, thereby boosting their demand as part of precision veterinary care.

- By Mode of Delivery

On the basis of mode of delivery, the market is segmented into premixes, oral powder, oral solutions, and injection. The injection segment dominated the largest revenue share in 2024, primarily due to its rapid bioavailability, accurate dosing, and effectiveness in treating acute infections in livestock and companion animals. Veterinary practitioners often rely on injectable formulations for immediate therapeutic outcomes, especially in severe bacterial infections or in cases where oral administration is impractical.

The oral solutions segment is anticipated to witness the highest growth rate from 2025 to 2032, supported by increasing adoption in large-scale farming operations where mass administration through drinking water is preferred for ease and efficiency. Oral solutions also promote better compliance and uniform dosing in herds or flocks, making them highly suitable for preventive healthcare in poultry and swine production systems. Enhanced shelf stability and ongoing innovation in palatable formulations are further fueling their uptake.

- By Animal

On the basis of animal, the market is segmented into food-producing animals and companion animals. The food-producing animals segment held the largest revenue share of 76.9% in 2024, driven by the growing global demand for meat, dairy, and eggs, which necessitates consistent disease prevention and productivity maintenance. Antibiotics and antimicrobials are extensively used in livestock to control infectious diseases, improve feed efficiency, and reduce mortality, especially in intensive farming systems. Emerging economies are seeing increased usage due to expanding animal agriculture and commercial farming practices.

The companion animals segment is expected to record the fastest growth from 2025 to 2032, fueled by rising pet ownership, growing awareness of pet health, and a surge in veterinary healthcare spending. Owners are increasingly opting for regular treatments, preventive antibiotics, and advanced diagnostics to manage chronic conditions and infections in pets. Urbanization, lifestyle changes, and humanization of pets are also contributing to the expansion of this segment, particularly in North America and Europe.

Animal Antimicrobials and Antibiotics Market Regional Analysis

- Europe dominated the animal antimicrobials and antibiotics market with the largest revenue share of 34.5% in 2024, driven by the region’s advanced veterinary healthcare infrastructure, strong regulatory oversight, and increased awareness around animal health and food safety

- The European market benefits from stringent EU regulations on antimicrobial use in food-producing animals, which promote responsible usage and encourage the development of targeted antibiotic therapies

- High livestock density, widespread companion animal ownership, and a shift toward preventive veterinary care are further accelerating demand for effective antimicrobial solutions across both rural and urban regions

Germany Animal Antimicrobials and Antibiotics Market Insight

The Germany market held a leading share within Europe in 2024, supported by the country’s robust veterinary healthcare infrastructure and advanced livestock management practices. German authorities strictly monitor antimicrobial usage, promoting responsible practices across swine, poultry, and cattle sectors. Growing focus on preventive healthcare, combined with increased investments in sustainable livestock production, is driving the continued use of targeted and regulated antibiotic solutions.

North America Animal Antimicrobials and Antibiotics Market Insight

The North America market is poised for consistent growth, primarily driven by the intensive livestock farming industry, especially in the U.S. and Canada. High demand for meat, dairy, and poultry products continues to necessitate the use of antibiotics to prevent and control diseases in food-producing animals. The region benefits from well-defined veterinary guidelines and widespread access to veterinary pharmaceuticals, supporting the adoption of both traditional and advanced antimicrobial products.

U.S. Animal Antimicrobials and Antibiotics Market Insight

The U.S. market accounted for over 78% of North America’s revenue in 2024, supported by large-scale commercial animal farming and the presence of leading veterinary drug manufacturers. Rising focus on food safety, animal welfare, and antimicrobial stewardship programs is shaping the responsible use of antibiotics in livestock, while demand for companion animal antibiotics is rising due to growing pet ownership and veterinary awareness.

Asia-Pacific Animal Antimicrobials and Antibiotics Market Insight

The Asia-Pacific market is projected to expand at the fastest CAGR from 2025 to 2032, fueled by population growth, dietary shifts toward animal protein, and expansion of livestock production systems. Countries such as China, India, and Indonesia are investing in veterinary healthcare improvements, driving greater adoption of antimicrobial solutions to manage widespread bacterial infections in animal populations.

China Animal Antimicrobials and Antibiotics Market Insight

China held the largest market share within Asia-Pacific in 2024, supported by its vast livestock population, rapidly growing meat consumption, and government-backed initiatives for veterinary public health. The country’s focus on increasing agricultural productivity and modernizing animal health infrastructure has led to steady demand for antibiotics, especially in swine and poultry segments.

India Animal Antimicrobials and Antibiotics Market Insight

India is projected to register the fastest growth within Asia-Pacific during the forecast period, owing to the expanding dairy and poultry sectors and increased awareness regarding animal disease prevention. Government-supported veterinary health programs and rising investments in livestock development are encouraging the adoption of antimicrobial treatments in rural and peri-urban areas.

Animal Antimicrobials and Antibiotics Market Share

The animal antimicrobials and antibiotics industry is primarily led by well-established companies, including:

- Zoetis Services LLC (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Merck & Co., Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Bayer AG (Germany)

- Dechra Pharmaceuticals Limited (U.K.)

- Virbac (France)

- Vetoquinol (France)

- Sanofi (France)

- Elanco (U.S.)

- Endovac Animal Health (U.S.)

- ECO - Animal Health Ltd. (U.K.)

- Indian Immunologicals Ltd. (India)

- Ashish Life Science (India)

- Lutim Pharma Private Limited (India)

Latest Developments in Global Animal Antimicrobials and Antibiotics Market

- In April 2023, Elanco Animal Health introduced Draxxin, a once-daily injectable antibiotic targeting severe gram-negative bacterial infections. This product launch boosted Elanco’s injectable solutions portfolio and reinforced market growth by addressing rising demand for effective treatment options in livestock health

- In March 2023, Virbac announced the launch of Synulox, a broad-spectrum antibiotic formulated to treat multiple animal infections. This addition expanded Virbac’s antibiotic offerings and enhanced its market footprint, particularly in the segment focusing on multipurpose solutions for respiratory, urinary, and skin infections

- In February 2023, Boehringer Ingelheim GmbH introduced Clavamox, a combination antibiotic containing amoxicillin and clavulanic acid. This launch significantly contributed to the market by supporting the use of combination therapies, offering increased efficacy against resistant strains, and fulfilling the demand for advanced infection management tools

- In January 2023, Ceva Santé Animale rolled out Enrofloxacin, a broad-spectrum antibiotic effective against various infections in animals. The launch of Enrofloxacin added momentum to the market’s expansion by catering to the growing need for potent, single-agent solutions across companion and food-producing animal sectors

- In July 2020, Trianni Inc. (USA) and Zoetis (USA) initiated a collaboration aimed at developing transgenic monoclonal antibody platforms to innovate veterinary medications. This partnership seeks to leverage Trianni's expertise in antibody discovery and Zoetis's leadership in animal health solutions. The FDA recently approved Zoetis's acquisition of Marboquin (USA), marking a strategic move to bolster their portfolio and capabilities in the veterinary pharmaceutical sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.