Global Animal Feed Acidifier Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

3.54 Billion

2025

2033

USD

2.42 Billion

USD

3.54 Billion

2025

2033

| 2026 –2033 | |

| USD 2.42 Billion | |

| USD 3.54 Billion | |

|

|

|

|

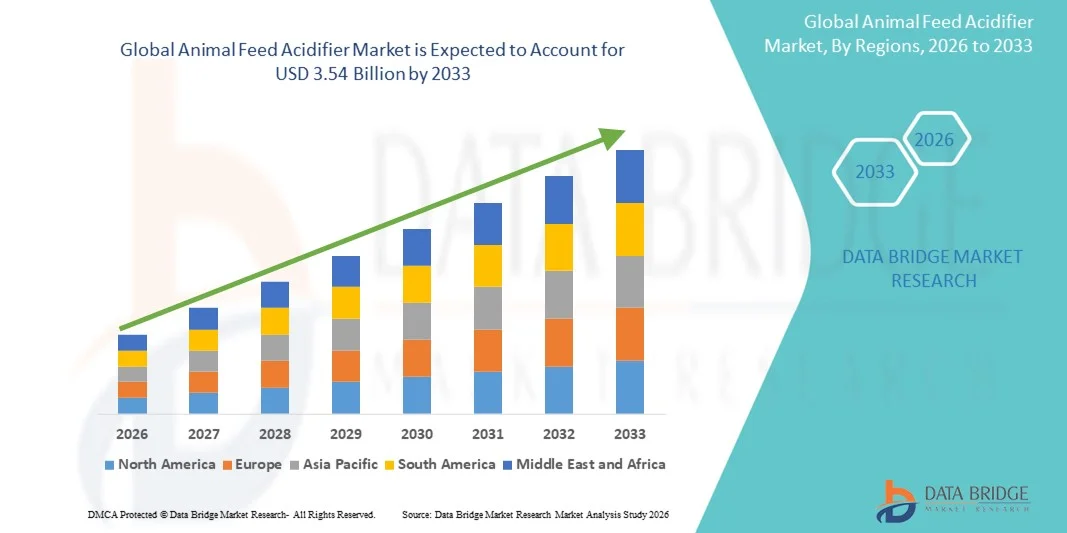

What is the Global Animal Feed Acidifier Market Size and Growth Rate?

- The global animal feed acidifier market size was valued at USD 2.42 billion in 2025 and is expected to reach USD 3.54 billion by 2033, at a CAGR of 4.90% during the forecast period

- Rising government aids or funds promoting the wellness of the feed industry is the vital factor escalating the market growth, also increased threat of diseases in livestock, increasing ban of antibiotics in the European union (EU), increasing discontinuation of some of the other feed additives, rising awareness and increased preference in quality and concerns about the health of livestock and increasing presence of government aid and their increased funding to the industry are the major factors among others driving the growth of animal feed acidifier market

What are the Major Takeaways of Animal Feed Acidifier Market?

- Rising encapsulation techniques being used for feed acidifiers and rising modernization in the production techniques will further create new opportunities for animal feed acidifier market

- However, hiking prices of feed acidifiers and rising emergence of substitute for feed acidifiers are the major factors among others acting as restraints, while rising efficacy maintenance of feed acidifiers will further challenge the growth of animal feed acidifier market in the forecast period mentioned above

- Asia-Pacific dominated the animal feed acidifier market with the largest revenue share of 47.5% in 2025, driven by the region’s expanding livestock sector, growing awareness of feed quality, and increasing demand for antibiotic-free animal nutrition

- North America is projected to record the fastest growth rate of 9.8% from 2026 to 2033, fueled by increasing awareness of gut health management, growing emphasis on sustainable livestock farming, and stringent regulations on antibiotic use in animal feed

- The Propionic Acid segment dominated the market with the largest revenue share of 34.5% in 2025, primarily driven by its widespread use in preventing microbial growth and extending the shelf life of animal feed

Report Scope and Animal Feed Acidifier Market Segmentation

|

Attributes |

Animal Feed Acidifier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Animal Feed Acidifier Market?

Increasing Focus on Natural and Organic Feed Additives for Enhanced Livestock Health

- The Animal Feed Acidifier market is witnessing a significant shift toward natural and organic feed additives, driven by the global movement to reduce antibiotic use in animal nutrition. Feed acidifiers are increasingly being used as natural growth promoters that improve gut health, nutrient absorption, and animal performance without antibiotics

- For instance, BASF SE and Yara International ASA have introduced organic acid-based feed formulations designed to optimize pH levels and inhibit pathogenic bacteria growth in livestock feed

- Rising consumer demand for antibiotic-free meat and dairy products has encouraged producers to adopt safer, bio-based additives that align with international food safety standards

- Advancements in microencapsulation technologies and synergistic acid blends are improving acidifier stability and efficiency, making them suitable for varied feed types

- Regulatory support for sustainable livestock production and growing awareness among farmers regarding feed quality are further reinforcing this trend

- As the focus on sustainable animal nutrition intensifies, the transition toward natural acidifiers will remain a defining trend shaping global market growth

What are the Key Drivers of Animal Feed Acidifier Market?

- Growing emphasis on animal health and productivity is a key driver, as farmers seek to enhance feed efficiency and prevent disease without antibiotics

- For instance, in 2025, Kemin Industries Inc. launched new acidifier blends targeting improved gut health and pathogen control in poultry and swine, strengthening its global portfolio

- Rising meat consumption and growing demand for high-quality animal protein, particularly in Asia-Pacific and Latin America, are accelerating market expansion

- Government regulations restricting antibiotic growth promoters (AGPs) have increased acidifier adoption as an effective and safe alternative in feed formulations

- Advancements in formulation technologies, including buffered acids and compound acidifiers, are enhancing product performance across livestock types

- As awareness of feed hygiene, biosecurity, and productivity improvement grows, the Animal Feed Acidifier market is expected to witness steady growth and technological innovation globally

Which Factor is Challenging the Growth of the Animal Feed Acidifier Market?

- High raw material costs and fluctuating acid prices pose a challenge to manufacturers, impacting profit margins and product affordability in price-sensitive markets

- For instance, rising prices of organic acids such as formic and lactic acid during 2024–2025 have strained supply chains for key feed acidifier producers across Europe and Asia

- Lack of awareness among small-scale farmers in developing regions about the benefits and proper dosage of feed acidifiers limits widespread adoption

- Stringent regulatory frameworks governing feed additives and regional variations in product approval slow market entry for innovative solutions

- Competition from probiotics, enzymes, and phytogenics as alternative feed additives adds further market pressure

- To overcome these challenges, leading players are investing in R&D, farmer education programs, and sustainable sourcing, ensuring long-term market resilience and profitability

How is the Animal Feed Acidifier Market Segmented?

The market is segmented on the basis of type, form, compound, and livestock.

- By Type

On the basis of type, the animal feed acidifier market is segmented into Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Sorbic Acid, Malic Acid, and Others. The Propionic Acid segment dominated the market with the largest revenue share of 34.5% in 2025, primarily driven by its widespread use in preventing microbial growth and extending the shelf life of animal feed. Its effectiveness in controlling mold and bacteria, coupled with its economic feasibility, makes it the preferred choice among feed manufacturers.

The Lactic Acid segment is projected to register the fastest CAGR from 2026 to 2033, owing to its natural origin, digestive health benefits, and increasing adoption in poultry and swine diets. The growing trend toward sustainable and bio-based acidifiers is further expected to fuel demand for lactic acid in the coming years.

- By Form

On the basis of form, the animal feed acidifier market is segmented into Dry and Liquid. The Dry segment dominated the market with the largest revenue share of 61.2% in 2025, supported by its ease of handling, longer shelf life, and compatibility with various feed formulations. Dry acidifiers are preferred for bulk storage and transportation, especially in large-scale feed production facilities.

The Liquid segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by its superior dispersion, quick absorption, and ability to maintain feed hygiene in water-based systems. Increasing demand for precision nutrition and enhanced palatability in feed is also propelling the adoption of liquid acidifiers across poultry and aquaculture sectors globally.

- By Compound

On the basis of compound, the animal feed acidifier market is segmented into Blended and Single. The Blended segment dominated the market with the largest revenue share of 68.4% in 2025, owing to the synergistic benefits of combining multiple organic acids that enhance feed efficiency and pathogen control. Blended formulations are increasingly used to improve gut health and nutrient absorption, especially in antibiotic-free animal production systems.

The Single segment is expected to witness the fastest CAGR from 2026 to 2033, supported by its cost-effectiveness, ease of formulation, and targeted use for specific livestock requirements. As feed producers focus on optimizing formulations for species-specific benefits, demand for single-acid solutions is projected to increase steadily.

- By Livestock

On the basis of livestock, the animal feed acidifier market is segmented into Poultry, Swine, Ruminants, Aquaculture, and Others. The Poultry segment dominated the market with the largest revenue share of 43.6% in 2025, driven by the high global demand for poultry meat and eggs, coupled with the ban on antibiotic growth promoters (AGPs) in several regions. Acidifiers help enhance feed digestibility, improve gut health, and boost overall performance in poultry diets.

The Aquaculture segment is projected to record the fastest CAGR from 2026 to 2033, attributed to the rising global aquafeed demand and growing focus on maintaining optimal pH levels and gut health in aquatic species. Increasing investments in sustainable aquaculture practices and the need to reduce disease outbreaks are key factors supporting this segment’s rapid expansion.

Which Region Holds the Largest Share of the Animal Feed Acidifier Market?

- Asia-Pacific dominated the animal feed acidifier market with the largest revenue share of 47.5% in 2025, driven by the region’s expanding livestock sector, growing awareness of feed quality, and increasing demand for antibiotic-free animal nutrition. Rapid urbanization, rising meat consumption, and government support for sustainable livestock production across countries such as China, India, Japan, and South Korea are major growth enablers

- Feed manufacturers in the region are investing in innovative acidifier formulations, optimized feed conversion ratios, and bio-based alternatives to improve animal health and productivity

- Furthermore, the expansion of commercial feed mills, the adoption of precision feeding technologies, and the presence of leading international players are reinforcing Asia-Pacific’s dominance in the global market

China Animal Feed Acidifier Market Insight

China remains the largest contributor within Asia-Pacific, supported by its rapidly expanding animal husbandry sector, particularly in poultry and swine. Rising focus on reducing antibiotic usage and enhancing feed efficiency is propelling the adoption of organic acidifiers across feed formulations. In addition, the government’s emphasis on safe and sustainable livestock practices and the presence of large domestic producers are strengthening China’s market leadership. Continuous innovation in propionic and lactic acid-based solutions further enhances China’s role in shaping regional growth.

India Animal Feed Acidifier Market Insight

India is witnessing robust growth in the Animal Feed Acidifier market, driven by increasing demand for high-quality meat, dairy, and poultry products. Rising awareness among farmers regarding feed hygiene, coupled with expanding commercial feed production facilities, is supporting market expansion. Government initiatives promoting antibiotic-free feed additives and private sector investments in acidifier-blended formulations are further propelling growth. The rise of domestic manufacturers and the adoption of cost-effective organic acidifiers make India one of the fastest-evolving markets in the region.

North America Animal Feed Acidifier Market Insight

North America is projected to record the fastest growth rate of 9.8% from 2026 to 2033, fueled by increasing awareness of gut health management, growing emphasis on sustainable livestock farming, and stringent regulations on antibiotic use in animal feed. The presence of advanced R&D facilities, high adoption of functional feed additives, and strong demand for value-added animal protein products are accelerating regional market growth.

U.S. Animal Feed Acidifier Market Insight

The U.S. leads the North American market, driven by a growing shift toward antibiotic-free feed solutions and strong demand from the poultry and swine industries. Rising focus on animal welfare and feed efficiency optimization has encouraged manufacturers to introduce high-performance acidifier blends. In addition, collaborations among feed producers and biotechnological firms are strengthening the country’s leadership in innovation and sustainable feed formulations.

Canada Animal Feed Acidifier Market Insight

Canada contributes steadily to the regional market, supported by an increase in livestock production and a rising shift toward natural and eco-friendly feed ingredients. Feed producers are focusing on blended acidifier solutions that enhance nutrient absorption and reduce pathogen load. Growing emphasis on sustainable farming practices, coupled with expanding aquaculture production, is expected to further drive market growth in Canada over the forecast period.

Europe Animal Feed Acidifier Market Insight

Europe is witnessing stable market growth, primarily driven by strict regulations on antibiotic growth promoters (AGPs) and increasing demand for organic and sustainable feed solutions. Countries such as Germany, France, and the U.K. are leading adopters of bio-based and encapsulated acidifiers, ensuring improved animal performance and environmental compliance. The region’s focus on circular economy practices and continuous feed innovation are fostering steady growth across the European market.

Germany Animal Feed Acidifier Market Insight

Germany dominates the European market, propelled by rising consumption of high-quality meat and dairy products and stringent feed safety regulations. The country’s well-established livestock industry and technological advancements in feed formulation systems are driving acidifier adoption. Increasing focus on reducing greenhouse gas emissions and enhancing ruminant productivity further supports Germany’s leadership in the regional market.

U.K. Animal Feed Acidifier Market Insight

The U.K. market is expanding steadily, driven by growing awareness of feed hygiene, animal health, and sustainable livestock practices. Rising demand for organic feed formulations and the growing popularity of poultry and aquaculture sectors are key growth contributors. Feed manufacturers are introducing encapsulated and blended acidifiers that ensure controlled release and higher efficiency, solidifying the U.K.’s position in Europe’s evolving Animal Feed Acidifier landscape.

Which are the Top Companies in Animal Feed Acidifier Market?

The animal feed acidifier industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Yara International ASA (Norway)

- Kemin Industries Inc. (U.S.)

- Kemira (Finland)

- Corbion (Netherlands)

- Biomin (Austria)

- Impextraco NV (Belgium)

- Pancosma (Switzerland)

- NUTREX.BE (Belgium)

- Perstorp Orgnr (Sweden)

- NOVUS INTERNATIONAL (U.S.)

- Jefo (Canada)

- Anpario plc. (U.K.)

- ADDCON GROUP GmbH (Germany)

- Peterlabs Holdings Berhad (Malaysia)

- Growel Agrovet Private Limited (India)

- ALTRON BIOTEC (India)

- Vetgen Healthcare Private Limited (India)

- V Sthiraa Bioscience (India)

- Orchem Products (India)

- Anfotal Nutritions Private Limited (India)

What are the Recent Developments in Global Animal Feed Acidifier Market?

- In January 2025, Novus International and Resilient Biotics announced a three-year co-development partnership to design innovative swine respiratory and immune health solutions. The collaboration integrates microbiome analytics with targeted nutrition platforms to reduce economic losses caused by respiratory diseases in livestock. This initiative marks a strategic move toward enhancing animal health and improving disease prevention efficiency in the swine industry

- In September 2024, Cargill acquired two feed mills located in Denver, Colorado, and Kansas City, Kansas, with the goal of expanding production capacity and modernizing its flagship manufacturing sites. The upgraded facilities will serve both livestock and pet nutrition markets with advanced feed solutions. This acquisition reinforces Cargill’s commitment to strengthening its North American feed network and advancing sustainable production capabilities

- In August 2024, Fonterra and Superbrewed Food entered a multi-year strategic partnership to explore postbiotic protein ingredients derived from bacterial biomass using lactose permeate. The collaboration focuses on developing high-protein additive applications offering robust pH stability and nutritional value. This alliance highlights the growing convergence between dairy innovation and biotechnology for sustainable feed ingredient solutions

- In November 2023, BASF SE launched Natupulse TS, a next-generation feed enzyme engineered to unlock essential nutrients and improve animal performance. Manufactured in Germany, this product is available in both powder and liquid forms, ensuring high stability during storage, premixing, and pelleting. This launch represents BASF’s commitment to enhancing feed efficiency and supporting global efforts toward sustainable animal nutrition

- In June 2021, the DSM-Novozymes Alliance introduced ProAct 360, a second-generation protease enzyme designed to enhance amino acid digestibility in animal feed. The innovation improves nutrient absorption, promotes better animal growth, and optimizes feed utilization. This development underscores the alliance’s focus on advancing enzymatic feed technologies for efficient and eco-friendly livestock production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.