Global Animal Feed Probiotics Market

Market Size in USD Billion

CAGR :

%

USD

4.29 Billion

USD

8.43 Billion

2025

2033

USD

4.29 Billion

USD

8.43 Billion

2025

2033

| 2026 –2033 | |

| USD 4.29 Billion | |

| USD 8.43 Billion | |

|

|

|

|

Global Animal Feed Probiotics Market Size

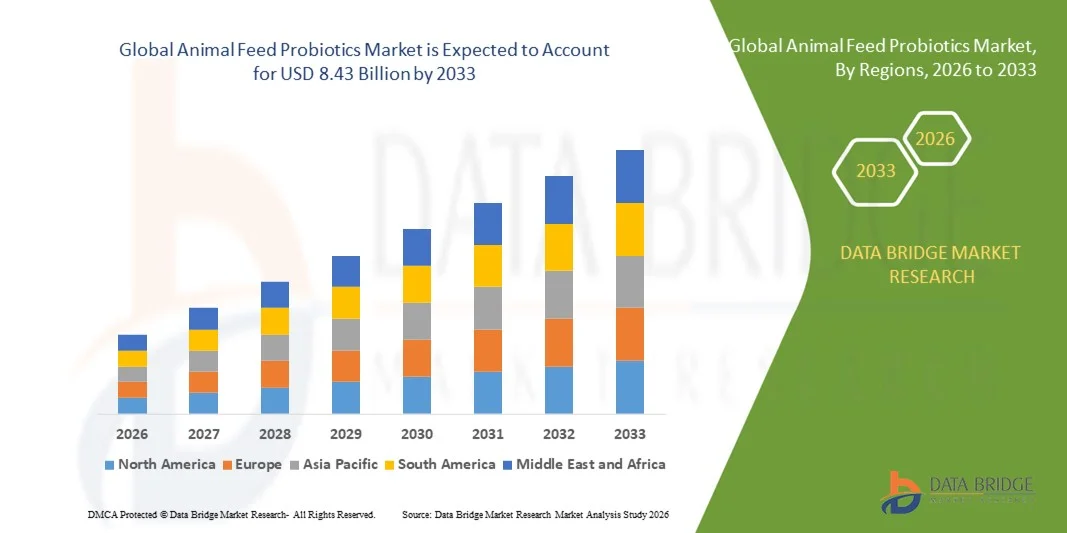

- The global Animal Feed Probiotics Market size was valued at USD 4.29 billion in 2025 and is expected to reach USD 8.43 billion by 2033, at a CAGR of 8.81% during the forecast period.

- The market growth is largely driven by increasing demand for natural and sustainable feed additives, along with advancements in probiotic formulations that enhance animal health and productivity.

- Furthermore, rising awareness among livestock farmers and integrated animal nutrition strategies are encouraging the adoption of probiotics across poultry, swine, and ruminant sectors. These converging factors are accelerating the uptake of probiotic solutions, thereby significantly boosting the industry's growth.

Global Animal Feed Probiotics Market Analysis

- Animal feed probiotics, comprising beneficial microorganisms added to livestock and poultry diets, are increasingly important in modern animal nutrition due to their ability to enhance gut health, improve nutrient absorption, and support overall productivity across various animal species.

- The rising demand for animal feed probiotics is primarily driven by increasing awareness of antibiotic alternatives, growing livestock production, and a focus on sustainable and natural feed additives.

- Asia-Pacific dominated the Global Animal Feed Probiotics Market with the largest revenue share of 34.1% in 2025, supported by advanced livestock farming practices, strong regulatory frameworks promoting animal health, and the presence of major industry players investing in innovative probiotic formulations for poultry, swine, and ruminants.

- Europe is expected to be the fastest-growing region in the Global Animal Feed Probiotics Market during the forecast period, owing to rapid growth in animal farming, rising disposable incomes, and increasing adoption of modern feed management practices.

- The poultry segment dominated the market with the largest revenue share of 43.5% in 2025, driven by the high demand for poultry meat and eggs globally, coupled with the proven benefits of probiotics in improving gut health, feed conversion, and immunity in poultry flocks.

Report Scope and Global Animal Feed Probiotics Market Segmentation

|

Attributes |

Animal Feed Probiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Chr. Hansen Holding A/S (Denmark) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Animal Feed Probiotics Market Trends

Enhanced Productivity Through Advanced Probiotic Formulations

- A significant and accelerating trend in the global Animal Feed Probiotics Market is the development and adoption of advanced probiotic formulations tailored for specific livestock and poultry needs. These innovations are significantly enhancing animal health, growth performance, and overall farm productivity.

- For instance, multi-strain probiotic blends designed for poultry can improve gut microbiota balance, boost nutrient absorption, and enhance immunity, leading to higher growth rates and reduced mortality. Similarly, probiotic supplements for swine and ruminants are formulated to support digestion, optimize feed efficiency, and minimize the need for antibiotic growth promoters.

- Integration of probiotics with precision farming and farm management technologies enables features such as monitoring animal health indicators, predicting potential digestive or immune issues, and providing data-driven recommendations for optimized feed strategies. For example, some next-generation probiotic products are paired with digital tracking systems to assess livestock gut health and adjust supplementation levels automatically.

- The seamless integration of probiotics into broader animal nutrition programs allows farmers to manage animal health alongside feed efficiency, environmental control, and disease prevention measures, creating a holistic and data-driven approach to livestock management.

- This trend towards more targeted, science-backed, and integrated probiotic solutions is fundamentally reshaping livestock farming practices. Consequently, companies such as Chr. Hansen and Novozymes are developing precision probiotics with strain-specific benefits and formulations optimized for different animal species and growth stages.

- The demand for advanced probiotic solutions that enhance productivity, immunity, and overall animal health is growing rapidly across poultry, swine, and ruminant sectors, as farmers increasingly prioritize sustainable, efficient, and antibiotic-free production systems.

Global Animal Feed Probiotics Market Dynamics

Driver

Growing Need Due to Rising Demand for Sustainable and Antibiotic-Free Livestock Production

- The increasing demand for natural and sustainable animal feed solutions, coupled with rising concerns over antibiotic resistance and livestock health, is a significant driver for the heightened adoption of animal feed probiotics.

- For instance, in 2025, Chr. Hansen introduced next-generation probiotic blends for poultry and swine that enhance gut health and reduce reliance on antibiotics, reflecting strategies by key companies to drive market growth during the forecast period.

- As livestock farmers become more aware of the impact of gut health on growth performance and disease prevention, probiotics offer advanced benefits such as improved nutrient absorption, enhanced immunity, and reduced incidence of gastrointestinal disorders, providing a compelling alternative to conventional feed additives.

- Furthermore, the growing popularity of integrated animal nutrition programs and precision farming practices is making probiotics an essential component of modern livestock management, allowing seamless integration with feed management, health monitoring, and farm productivity optimization.

- The convenience of easy supplementation, improved feed efficiency, and the ability to achieve healthier livestock with fewer chemical interventions are key factors propelling the adoption of probiotics across poultry, swine, and ruminant sectors. Increased availability of ready-to-use and species-specific probiotic formulations further contributes to market growth.

Restraint/Challenge

Regulatory Hurdles and High Product Costs

- Regulatory compliance and stringent safety standards for feed additives pose a significant challenge to broader market penetration. Probiotics must meet strict guidelines regarding strain safety, efficacy, and labeling, which can delay product launches and limit accessibility in certain regions.

- For instance, variations in approval processes between the U.S., EU, and Asia-Pacific regions have created hurdles for companies seeking rapid global expansion.

- Addressing these regulatory challenges through robust scientific validation, compliance with local and international safety standards, and clear labeling is crucial for building trust among farmers and feed manufacturers. Companies such as DuPont and Novozymes emphasize extensive research and documentation to reassure customers of product efficacy and safety. Additionally, the relatively high cost of some advanced probiotic formulations compared to conventional feed additives can be a barrier for price-sensitive farmers, particularly in developing countries. While basic probiotics have become more affordable, premium multi-strain or species-specific blends often carry higher price points.

- While prices are gradually decreasing and economies of scale are improving accessibility, the perceived premium for advanced probiotic solutions can still hinder widespread adoption, especially for small-scale or resource-limited farms.

- Overcoming these challenges through regulatory harmonization, farmer education on the benefits of probiotics, and development of cost-effective formulations will be vital for sustained market growth.

Global Animal Feed Probiotics Market Scope

Animal feed probiotics market is segmented on the basis of livestock, source, form, function and distribution channel.

- By Livestock

On the basis of livestock, the Global Animal Feed Probiotics Market is segmented into poultry, swine, ruminants, aquaculture, pets, and others. The poultry segment dominated the market with the largest revenue share of 43.5% in 2025, driven by the high demand for poultry meat and eggs globally, coupled with the proven benefits of probiotics in improving gut health, feed conversion, and immunity in poultry flocks. Farmers prioritize probiotic supplementation in poultry due to its ability to reduce disease incidence, enhance growth rates, and minimize antibiotic usage.

The swine segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, owing to the increasing adoption of probiotics in pig farming to support digestive health, enhance immunity, and boost growth performance, particularly in regions with expanding pork consumption and intensive pig farming practices. Rising awareness about animal welfare and regulatory restrictions on antibiotics are key factors driving this growth.

- By Source

On the basis of source, the Global Animal Feed Probiotics Market is segmented into bacteria, yeast, and fungi. The bacteria segment held the largest market revenue share of 47.2% in 2025, due to the widespread use of bacterial strains such as Lactobacillus, Bifidobacterium, and Bacillus species that are highly effective in improving digestive efficiency and immunity across poultry, swine, and ruminants. Bacterial probiotics are preferred for their ease of formulation, stability in feed, and proven efficacy in enhancing animal health and productivity.

The yeast segment is expected to register the fastest CAGR of 22.3% during the forecast period, driven by increasing adoption in ruminant diets to improve fiber digestion and nutrient absorption. Yeast-based probiotics also support gut microbiota balance and enhance overall herd performance, making them highly sought-after in modern livestock management practices.

- By Form

On the basis of form, the Global Animal Feed Probiotics Market is segmented into dry and liquid. The dry form dominated the market with a 58.1% revenue share in 2025, attributed to its longer shelf life, ease of storage, and compatibility with various feed formulations, making it a practical choice for large-scale commercial farms. Dry probiotics can be directly mixed into feed without special handling, offering convenience and stability.

The liquid form is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by rising demand for easy-to-administer solutions in drinking water or feed supplements, particularly in intensive poultry and swine operations. Liquid probiotics offer rapid absorption, flexibility in dosing, and precise delivery, supporting targeted interventions for gut health and immune support.

- By Function

On the basis of function, the Global Animal Feed Probiotics Market is segmented into nutrition, gut health, yield, immunity, and productivity. The gut health segment dominated the market with a 42.7% revenue share in 2025, as maintaining intestinal microbiota balance is critical for nutrient absorption, disease prevention, and overall animal growth performance. Probiotics targeting gut health are increasingly preferred across poultry, swine, and ruminants due to their effectiveness in reducing diarrhea, improving feed efficiency, and lowering reliance on antibiotics.

The productivity segment is expected to witness the fastest CAGR of 21.5% during the forecast period, driven by demand for solutions that enhance growth rates, egg or milk yield, and overall farm profitability. Rising adoption of integrated nutrition strategies and precision feeding systems further supports the growth of productivity-focused probiotic solutions.

- By Distribution Channel

On the basis of distribution channel, the Global Animal Feed Probiotics Market is segmented into modern trade, online retailers, specialty stores, convenience stores, direct sales, and others. The direct sales segment dominated the market with a revenue share of 39.8% in 2025, attributed to strong relationships between probiotic manufacturers and livestock farmers, ensuring customized product offerings, technical support, and bulk supply. Direct sales facilitate trust, consistent supply, and guidance on proper usage, which is critical for efficacy.

The online retailers segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by increasing internet penetration, e-commerce adoption in rural areas, and the convenience of doorstep delivery. Online platforms enable farmers to compare products, access multiple brands, and benefit from detailed product information, fueling the rapid adoption of probiotics through digital channels.

Global Animal Feed Probiotics Market Regional Analysis

- Asia-Pacific dominated the Global Animal Feed Probiotics Market with the largest revenue share of 34.1% in 2025, driven by the growing demand for sustainable livestock production, rising awareness about animal health, and increased adoption of advanced feed solutions.

- Livestock farmers in the region increasingly prioritize probiotics for their proven benefits in enhancing gut health, improving feed efficiency, boosting immunity, and reducing dependence on antibiotics, which aligns with stringent food safety and regulatory standards.

- This widespread adoption is further supported by well-established commercial farming practices, high investment capacity, and access to innovative probiotic formulations from leading industry players, establishing probiotics as a preferred solution for poultry, swine, and ruminant health management across both large-scale and medium-sized farms.

U.S. Animal Feed Probiotics Market Insight

The U.S. animal feed probiotics market captured the largest revenue share of 81% in 2025 within North America, driven by the increasing adoption of sustainable livestock practices and the growing awareness of animal health and welfare. Producers are prioritizing probiotics to improve gut health, enhance feed efficiency, boost immunity, and reduce dependence on antibiotics. The growing trend of intensive poultry, swine, and dairy farming, coupled with rising demand for high-quality meat, eggs, and dairy products, further propels market growth. Moreover, the availability of innovative probiotic formulations and strong distribution networks ensures easy access for livestock farmers, supporting widespread adoption across both large-scale and medium-sized farms.

Europe Animal Feed Probiotics Market Insight

The Europe animal feed probiotics market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulations on antibiotic usage in livestock and increasing demand for safe, high-quality animal products. Rising urbanization and growing awareness of animal nutrition and health are fostering the adoption of probiotics. The market is witnessing significant growth across poultry, swine, and ruminant sectors, with probiotics being incorporated into both commercial farming operations and small-scale livestock holdings to enhance productivity and animal welfare.

U.K. Animal Feed Probiotics Market Insight

The U.K. animal feed probiotics market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising consumer demand for antibiotic-free meat and dairy products and increasing regulatory pressure to reduce antibiotic usage in livestock. Livestock producers are adopting probiotics to improve gut health, immunity, and overall productivity. Additionally, the U.K.’s strong focus on sustainable farming practices, combined with efficient e-commerce and feed distribution channels, is expected to support market expansion across poultry, swine, and ruminant segments.

Germany Animal Feed Probiotics Market Insight

The Germany animal feed probiotics market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of animal health, nutrition, and sustainable livestock farming. Germany’s well-developed agricultural infrastructure, emphasis on quality control, and strong regulatory framework promote the adoption of probiotics in poultry, swine, and ruminant operations. The integration of probiotics into modern feeding strategies, alongside the demand for high-quality animal products, is fueling market growth, particularly in commercial and industrial farming setups.

Asia-Pacific Animal Feed Probiotics Market Insight

The Asia-Pacific animal feed probiotics market is poised to grow at the fastest CAGR of 24% during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing demand for animal protein in countries such as China, India, Japan, and South Korea. The region’s growing livestock production, coupled with the adoption of modern farming techniques, is accelerating the use of probiotics. Furthermore, government initiatives promoting sustainable livestock practices and food safety, along with a rise in intensive poultry, swine, and aquaculture farming, are expanding the accessibility and affordability of probiotic products in the region.

Japan Animal Feed Probiotics Market Insight

The Japan animal feed probiotics market is gaining momentum due to high technological adoption, focus on food safety, and the growing emphasis on sustainable livestock production. Japanese farmers are increasingly incorporating probiotics into poultry, swine, and dairy operations to enhance gut health, immunity, and productivity. Additionally, the aging farmer population is driving demand for easy-to-use, effective feed additives, making probiotics an attractive solution for improving animal health and farm efficiency across residential and commercial livestock operations.

China Animal Feed Probiotics Market Insight

The China animal feed probiotics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s large livestock population, expanding middle class, and growing demand for high-quality animal protein. Probiotics are increasingly used in poultry, swine, and aquaculture to enhance feed conversion, immunity, and overall productivity. Government initiatives promoting sustainable and antibiotic-free farming practices, coupled with strong domestic manufacturing capabilities for probiotics, are key factors propelling market growth in China.

Global Animal Feed Probiotics Market Share

The Animal Feed Probiotics industry is primarily led by well-established companies, including:

• Chr. Hansen Holding A/S (Denmark)

• Lallemand Animal Nutrition (Canada)

• Evonik Industries AG (Germany)

• Alltech Inc. (U.S.)

• Danisco Animal Nutrition (DuPont) (U.S.)

• ADM Animal Nutrition (U.S.)

• Novozymes A/S (Denmark)

• Cargill, Inc. (U.S.)

• Provimi (Netherlands)

• BIOMIN Holding GmbH (Austria)

• Kemin Industries, Inc. (U.S.)

• Adisseo (France)

• Saflager (Spain)

• Perstorp AB (Sweden)

• Oriental Yeast Co., Ltd. (Japan)

• Meiji Holdings Co., Ltd. (Japan)

• Sinofeed (China)

• Hunan Hengxin Bio-Engineering Co., Ltd. (China)

• BASF SE (Germany)

• Novus International, Inc. (U.S.)

What are the Recent Developments in Global Animal Feed Probiotics Market?

- In April 2023, Chr. Hansen Holding A/S, a global leader in bioscience solutions, launched a new line of next-generation probiotics for poultry and swine in Southeast Asia. The initiative focuses on improving gut health, feed efficiency, and immunity in livestock, highlighting the company’s commitment to providing science-backed solutions tailored to regional farming practices. By leveraging its global expertise and advanced probiotic strains, Chr. Hansen is addressing local challenges while strengthening its position in the rapidly growing global animal feed probiotics market.

- In March 2023, Lallemand Animal Nutrition, a Canadian-based probiotic manufacturer, introduced a specialized yeast-based probiotic for aquaculture applications in India. Designed to enhance feed digestibility and improve fish health, the product demonstrates Lallemand’s dedication to developing targeted solutions for diverse livestock sectors. This advancement reinforces the company’s focus on sustainable farming and maximizing productivity across emerging markets.

- In March 2023, Evonik Industries AG successfully launched its Probiotic Boost program in Brazil, aimed at promoting sustainable livestock production through improved gut health and immunity in swine and poultry. The initiative highlights Evonik’s commitment to applying innovative feed additives to enhance productivity and animal welfare, contributing to the development of safer and more efficient livestock systems.

- In February 2023, Alltech Inc. announced a strategic partnership with the China Animal Agriculture Association (CAAA) to introduce a range of probiotic solutions for ruminants and poultry. The collaboration focuses on improving feed conversion rates, reducing antibiotic use, and supporting sustainable livestock practices. This initiative underscores Alltech’s dedication to driving innovation and operational efficiency in the animal feed sector.

- In January 2023, Danisco Animal Nutrition (part of DuPont) unveiled its latest liquid probiotic formulation for swine and poultry at the Global Animal Nutrition Conference. The product, designed for easy incorporation into feed and water systems, enables livestock producers to enhance immunity, productivity, and overall animal health. This launch highlights Danisco’s commitment to integrating advanced biotechnologies into animal nutrition solutions, providing farmers with practical and effective tools to optimize livestock performance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Animal Feed Probiotics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Animal Feed Probiotics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Animal Feed Probiotics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.