Global Antacids Market

Market Size in USD Million

CAGR :

%

USD

6,958.64 Million

USD

9,756.34 Million

2022

2030

USD

6,958.64 Million

USD

9,756.34 Million

2022

2030

| 2023 –2030 | |

| USD 6,958.64 Million | |

| USD 9,756.34 Million | |

|

|

|

|

Antacids Market Analysis and Size

The global antacids market is expected to witness significant growth during the forecast period. Growing cases of gastric ulcers, heartburn and ingestion drive the antacids market. However, easily availability of antacids OTC drugs and the rising prevalence of gastric diseases will also enhance the antacids market. Researchers are developing new drugs that help boost the market growth. Many major market players are contributing a lot to drug discovery and development. COVID-19 also had a major impact on the market growth.

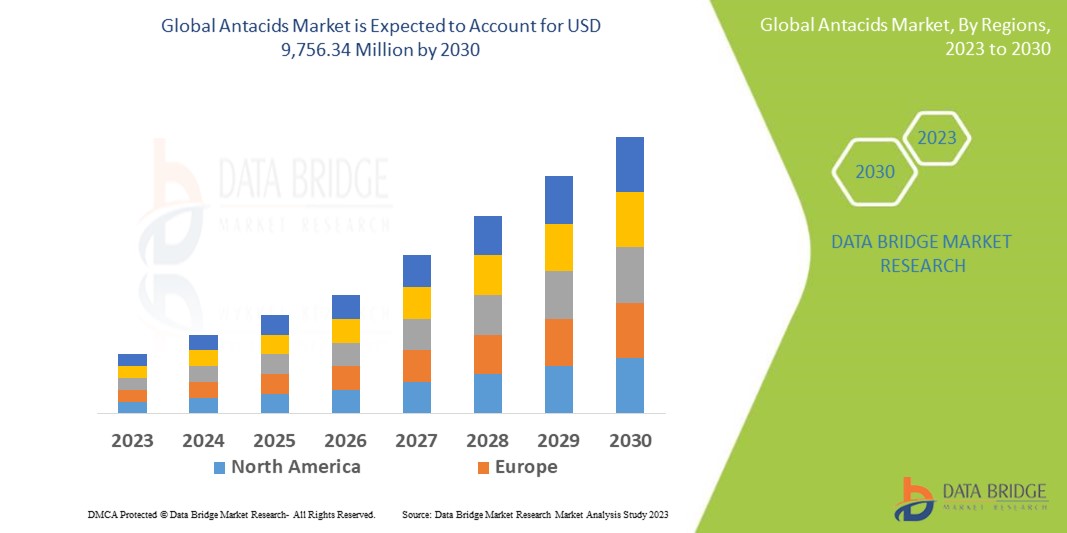

Data Bridge Market Research analyses that the global antacids market which was USD 6,958.64 million in 2022, would rocket up to USD 9,756.34 million by 2030, and is expected to undergo a CAGR of 5.2% during the forecast period. This indicates that the market value. “Sodium Antacids” dominates the type segment of the antacids market owing to the high demand for this type of product. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Antacids Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Sodium Antacids, Calcium Antacids, Magnesium Antacids, Aluminium Antacids, Others), Indication (Gastroesophageal Reflux Disease, Heartburn, Indigestion, others), Dosage Form (Tablets, Liquid, Others), Route of Administration (Oral, Others), End-Users (Hospitals, Homecare, Speciality Centres, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Pfizer Inc (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Mylan N.V. (U.S.), Fresenius Kabi AG (Germany), Hikma Pharmaceuticals PLC (Japan), Novartis AG (Switzerland), Teva Pharmaceutical Industries Ltd. (Israel), Bristol Myers Squibb Company (U.S.) GSK Plc. (U.K.), Bayer AG (Germany), Sun Pharmaceutical Industries Ltd (India), Lupin (India), Cipla Inc (India), Aurobindo Pharma (India), Procter & Gamble (U.S.), Reckitt Benckiser Group PLC (U.K.) |

|

Market Opportunities |

|

Market Definition

Antacids are the medical agents that help neutralize acid present in the stomach. The normal pH of gastric acid is in the range of 1.5-3.5. Antacids are alkaline and contain sodium, aluminum, magnesium and calcium. The alkaline nature of antacids assists in neutralizing gastric acid. In contrast to this, antacids relieve pain, inflammation and gastric acidity. It is of great importance to the healthcare sector and thus is expected to rise high in the forecast period.

Global Antacids Market Dynamics

Drivers

- Rising Awareness For GERD

The rising awareness about GERD is expected to boost market growth. As per the reports of the International Foundation for Gastrointestinal Disorders, the 19th Annual GERD Awareness Week provided information and support associated with this condition in November 2018. In addition, the International Foundation for Functional Gastrointestinal Disorders (IFFGD) boosts patients suffering from GERD-related symptoms to visit physicians.

- Increase in Geriatric Population

As per the reports of the United Nations World Ageing 2019, in 2019, there were approximately 703 million people who were aged 65 years or over globally. It is expected to increase to 1.5 billion in 2050. Globally, the share of the population aged 65 years or over increased from 6% in 1990 to 9% in 2019, and almost 65% of the elderly population has to deal with acid reflux. This creates an opportunity for the market.

- Growing investment for healthcare facilities

Surging focus on improving the condition of healthcare facilities and improving the overall healthcare infrastructure is another important factor fostering the growth of the market. The rising number of partnerships and strategic collaborations between the public and private players pertaining to funding and application of new and improved technology is further creating lucrative market opportunities.

Opportunities

- Increasing Demand for Retail Pharmacies

The rise in the number of antacids being delivered through retail pharmacies and the surge in the number of retail pharmacies in developed countries create opportunities for market growth. In addition to this, patients prefer retail pharmacies for purchasing drugs, as these are easily accessible.

-

Rising Cases of Heartburn

The growing prevalence of heartburn is expected to boost the market over the forecast period. As per the reports of Medical Xpress, a web-based medical and health news service, researchers from the University of Michigan recognized that acid reflux and heartburn affected more than 20% of the U.S. population in 2017.

Restraints/Challenges

- Rising competition

The antacids market is highly competitive, with numerous companies offering a wide range of products. This can make it challenging for new entrants or smaller companies to gain market share and establish a strong presence.

-

Side effects and safety concerns

Antacids, especially those containing aluminum or magnesium, can have side effects such as constipation or diarrhea. Additionally, long-term use of certain antacids has been associated with potential health risks, such as kidney problems. These safety concerns can affect consumer confidence and lead to a decline in sales.

This antacids market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global antacids market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In 2021, Sanofi announced a partnership with Roche to develop and commercialize a novel antacid product for the treatment of gastroesophageal reflux disease (GERD). This collaboration aims to bring a new treatment option to patients suffering from GERD

- In 2021, Johnson & Johnson announced the launch of their antacid product, Pepcid Complete, which combines an acid reducer (famotidine) with an antacid (calcium carbonate). This combination is aimed at providing dual-action relief for heartburn symptoms.

Global Antacids Market Scope

The antacids market is segmented on the basis of type, indication, dosage form, route of administration, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Sodium Antacids

- Calcium Antacids

- Magnesium Antacids

- Aluminium Antacids

- Others

Indication

- Gastroesophageal Reflux Disease

- Heartburn

- indigestion

- Others

Dosage Form

- Tablets

- Liquid

- Others

Route of Administration

- Oral

- Others

End-Users

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Global Antacids Market Regional Analysis/Insights

The antacids market is analysed and market size insights and trends are provided by country, type, indication, dosage form, route of administration, distribution channel and end-user, as referenced above.

The countries covered in the antacids market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the antacids Market because of the strong base of healthcare facilities, strong presence of major players in the market, and rising number of research activities in this region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the increase in government initiatives to promote awareness, rise in healthcare facilities, growing research activities in the region, availability of massive untapped markets, large population pool, and the growing demand for quality healthcare in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The antacids market also provides you with detailed market analysis for every country's growth in healthcare expenditure for capital equipment, installed base of different kind of products for the antacids market, the impact of technology using lifeline curves and changes in healthcare regulatory scenarios and their impact on the antacids market. The data is available for the historic period 2015-2020.

Competitive Landscape and Global Antacids Market Share Analysis

The global antacids market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global antacids market.

Some of the major players operating in the global antacids market are:

- Pfizer Inc (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Mylan N.V. (U.S.)

- Fresenius Kabi AG (Germany)

- Hikma Pharmaceuticals PLC (Japan)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bristol Myers Squibb Company (U.S.

- GSK Plc. (U.K.)

- Bayer AG (Germany)

- Sun Pharmaceutical Industries Ltd (India)

- Lupin (India)

- Cipla Inc (India)

- Aurobindo Pharma (India)

- Procter & Gamble (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTACIDS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTACIDS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTACIDS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 VALUE CHAIN ANALYSIS

14 HEALTHCARE ECONOMY

14.1 HEALTHCARE EXPENDITURE

14.2 CAPITAL EXPENDITURE

14.3 CAPEX TRENDS

14.4 CAPEX ALLOCATION

14.5 FUNDING SOURCES

14.6 INDUSTRY BENCHMARKS

14.7 GDP RATION IN OVERALL GDP

14.8 HEALTHCARE SYSTEM STRUCTURE

14.9 GOVERNMENT POLICIES

14.1 ECONOMIC DEVELOPMENT

15 PIPELINE ANALYSIS

15.1 PHASE III CANDIDATES

15.2 PHASE II CANDIDATES

15.3 PHASE I CANDIDATES

15.4 OTHERS (PRE-CLINICAL AND RESEARCH)

16 GLOBAL ANTACIDS MARKET, BY TYPE

16.1 OVERVIEW

16.2 SYSTEMIC ANTACIDS

16.2.1 BY DOSAGE FORM

16.2.1.1. TABLETS

16.2.1.2. LIQUID

16.2.1.3. CHEWABLE GUMMIES

16.2.1.4. SUSPENSION

16.2.1.5. OTHERS

16.2.2 BY COMPOSISTION

16.2.2.1. ALUMINIUM HYDROXIDE

16.2.2.2. CALCIUM CARBONATE

16.2.2.3. MAGNESIUM HYDROXIDE

16.2.2.4. MAGNESIUM CARBONATE

16.2.2.5. MAGNESIUM TRISILICATE

16.2.2.6. SODIUM BICARBONATE

16.2.2.7. COMBINATION DRUGS

16.2.2.8. OTHERS

16.3 NONSYSTEMIC ANTACIDS

16.3.1 BY DOSAGE FORM

16.3.1.1. TABLETS

16.3.1.2. LIQUID

16.3.1.3. CHEWABLE GUMMIES

16.3.1.4. SUSPENSION

16.3.1.5. OTHERS

16.3.2 BY COMPOSISTION

16.3.2.1. ALUMINIUM HYDROXIDE

16.3.2.2. CALCIUM CARBONATE

16.3.2.3. MAGNESIUM HYDROXIDE

16.3.2.4. MAGNESIUM CARBONATE

16.3.2.5. MAGNESIUM TRISILICATE

16.3.2.6. SODIUM BICARBONATE

16.3.2.7. COMBINATION DRUGS

16.3.2.8. OTHERS

16.4 COMPLEX ANTACIDS

16.4.1 BY DOSAGE FORM

16.4.1.1. TABLETS

16.4.1.2. LIQUID

16.4.1.3. CHEWABLE GUMMIES

16.4.1.4. SUSPENSION

16.4.1.5. OTHERS

16.4.2 BY COMPOSISTION

16.4.2.1. ALUMINIUM HYDROXIDE

16.4.2.2. CALCIUM CARBONATE

16.4.2.3. MAGNESIUM HYDROXIDE

16.4.2.4. MAGNESIUM CARBONATE

16.4.2.5. MAGNESIUM TRISILICATE

16.4.2.6. SODIUM BICARBONATE

16.4.2.7. COMBINATION DRUGS

16.4.2.8. OTHERS

17 GLOBAL ANTACIDS MARKET, BY COMPOSITION

17.1 OVERVIEW

17.2 ALUMINIUM HYDROXIDE

17.3 CALCIUM CARBONATE

17.4 MAGNESIUM HYDROXIDE

17.5 MAGNESIUM CARBONATE

17.6 MAGNESIUM TRISILICATE

17.7 SODIUM BICARBONATE

17.8 COMBINATION DRUGS

17.9 OTHERS

18 GLOBAL ANTACIDS MARKET, BY DOSAGE FORM

18.1 OVERVIEW

18.2 TABLETS

18.3 LIQUID

18.4 CHEWABLE

18.4.1 CHEWABLE GUMMIES

18.4.2 CHEWABLE TABLETS

18.5 EFFERVESCENT

18.6 SUSPENSION

18.7 GEL

18.8 OTHERS

19 GLOBAL ANTACIDS MARKET, BY FLAVOUR

19.1 OVERVIEW

19.2 MINT

19.3 FRUITS

19.4 CITRUS

19.5 HONEY

19.6 UNFLAVOURED

19.7 OTHERS

20 GLOBAL ANTACIDS MARKET, BY DRUG TYPE

20.1 OVERVIEW

20.2 GENERICS

20.3 BRANDED

20.3.1 ALKA-SELTZER

20.3.2 MAALOX

20.3.3 MYLANTA

20.3.4 ROLAIDS

20.3.5 TUMS

20.3.6 NEUT

20.3.7 OTHERS

21 GLOBAL ANTACIDS MARKET, BY INDICATION

21.1 OVERVIEW

21.2 GASTROESOPHAGEAL REFLUX DISEASE

21.2.1 SYSTEMIC ANTACIDS

21.2.2 NONSYSTEMIC ANTACIDS

21.2.3 COMPLEX ANTACIDS

21.3 HEARTBURN

21.3.1 SYSTEMIC ANTACIDS

21.3.2 NONSYSTEMIC ANTACIDS

21.3.3 COMPLEX ANTACIDS

21.4 INDIGESTION

21.4.1 SYSTEMIC ANTACIDS

21.4.2 NONSYSTEMIC ANTACIDS

21.4.3 COMPLEX ANTACIDS

21.5 STOMACH ULCER

21.5.1 SYSTEMIC ANTACIDS

21.5.2 NONSYSTEMIC ANTACIDS

21.5.3 COMPLEX ANTACIDS

21.6 NON-ULCER DYSPEPSIA

21.6.1 SYSTEMIC ANTACIDS

21.6.2 NONSYSTEMIC ANTACIDS

21.6.3 COMPLEX ANTACIDS

21.7 URINARY ALKALINIZATION

21.7.1 SYSTEMIC ANTACIDS

21.7.2 NONSYSTEMIC ANTACIDS

21.7.3 COMPLEX ANTACIDS

21.8 GAS AND BLOATING

21.8.1 SYSTEMIC ANTACIDS

21.8.2 NONSYSTEMIC ANTACIDS

21.8.3 COMPLEX ANTACIDS

21.9 OSTEOPOROSIS

21.9.1 SYSTEMIC ANTACIDS

21.9.2 NONSYSTEMIC ANTACIDS

21.9.3 COMPLEX ANTACIDS

21.1 OTHERS

22 GLOBAL ANTACIDS MARKET, BY AGE GROUP

22.1 OVERVIEW

22.2 ADULT

22.3 PEDIATRIC

22.4 GERIARTIC

23 GLOBAL ANTACIDS MARKET, BY GENDER

23.1 OVERVIEW

23.2 MALE

23.3 FEMALE

24 GLOBAL ANTACIDS MARKET, BY END USER

24.1 OVERVIEW

24.2 HOSPITALS

24.2.1 PRIVATE

24.2.2 PUBLIC

24.3 SPECIALTY CLINICS

24.4 HOME HEALTHCARE

24.5 OTHERS

25 GLOBAL ANTACIDS MARKET, BY DISTRIBUTION CHANNEL

25.1 OVERVIEW

25.2 DIRECT TENDER

25.3 RETAIL SALES

25.3.1 HOSPITAL PHARMACIES

25.3.2 DRUGS STORES

25.3.3 ONLINE PHARMACIES

25.3.4 OTHERS

25.4 OTHERS

26 GLOBAL ANTACIDS MARKET, COMPANY LANDSCAPE

26.1 COMPANY SHARE ANALYSIS: GLOBAL

26.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

26.3 COMPANY SHARE ANALYSIS: EUROPE

26.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

26.5 MERGERS & ACQUISITIONS

26.6 NEW PRODUCT DEVELOPMENT & APPROVALS

26.7 EXPANSIONS

26.8 REGULATORY CHANGES

26.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

27 GLOBAL ANTACIDS MARKET, BY GEOGRAPHY

27.1 MCNEIL CONSUMER PHARMACEUTICALS CO (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC)

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 SWISS CHEM HEALTHCARE

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 GLAXOSMITHKLINE PLC

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 BIOZENTA LIFESCIENCE PVT. LTD

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 SUN PHARMACEUTICAL INDUSTRIES LTD

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 PFIZER INC.

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 SPI PHARMA

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 ASTRAZENECA

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 BAYER AG

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 SANOFI

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 RECKITT BENCKISER GROUP PLC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 PHARMACEUTICAL ASSOCIATES INC.

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 ALLEGIANT HEALTH

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 HUBLORE HEALTHCARE PVT LTD

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 UNIBIOTECH FORMULATIONS

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 LUPIN

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 CIPLA

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 ZOIC PHARMACEUTICALS

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.