Global Anterior Lumbar Interbody Fusion Alif Market

Market Size in USD Billion

CAGR :

%

USD

10.62 Billion

USD

16.67 Billion

2024

2032

USD

10.62 Billion

USD

16.67 Billion

2024

2032

| 2025 –2032 | |

| USD 10.62 Billion | |

| USD 16.67 Billion | |

|

|

|

|

Anterior Lumbar Interbody Fusion (ALIF) Market Size

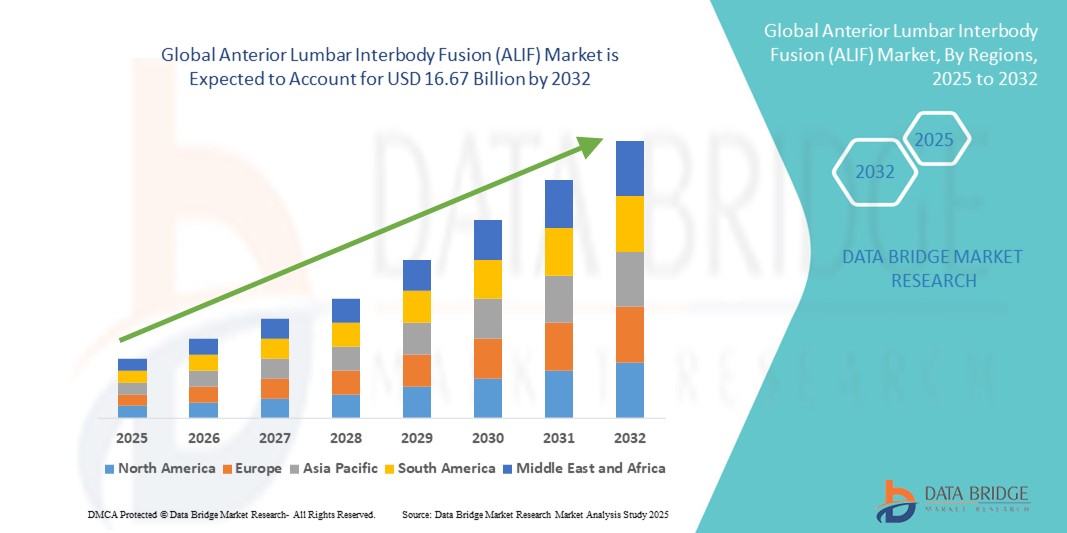

- The global anterior lumbar interbody fusion (ALIF) market size was valued at USD 10.62 billion in 2024 and is expected to reach USD 16.67 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by the increasing prevalence of degenerative spinal disorders, spinal injuries, and chronic back pain, coupled with technological advancements in minimally invasive spinal fusion procedures

- Moreover, rising demand for effective and durable spinal correction solutions in both hospitals and specialized surgical centers is positioning ALIF as a preferred treatment option. These factors collectively are accelerating the adoption of ALIF procedures, thereby propelling the market’s growth

Anterior Lumbar Interbody Fusion (ALIF) Market Analysis

- Anterior lumbar interbody fusion (ALIF), a surgical procedure to treat spinal disorders by fusing lumbar vertebrae from the front, is increasingly recognized as an effective solution for chronic back pain, degenerative disc disease, and spinal instability in both hospital and specialized surgical center settings due to its minimally invasive approach and favorable patient outcomes

- The rising demand for ALIF procedures is primarily fueled by the growing prevalence of spinal disorders, increasing awareness of advanced spinal fusion techniques, and technological advancements in surgical implants and biologics that improve procedure safety and fusion success rates

- North America dominated the anterior lumbar interbody fusion (ALIF) market with the largest revenue share of 39.5% in 2024, driven by advanced healthcare infrastructure, high adoption of minimally invasive spinal surgeries, and strong presence of key medical device manufacturers, with the U.S. leading in ALIF procedures due to innovations in interbody cages and biologics

- Asia-Pacific is expected to be the fastest-growing region in the anterior lumbar interbody fusion (ALIF) market during the forecast period owing to rising geriatric population, increasing prevalence of spinal disorders, and expanding healthcare facilities equipped for advanced spinal surgeries

- Interbody segment dominated the anterior lumbar interbody fusion (ALIF) market with a market share of 45.8% in 2024, attributed to its proven clinical efficacy, compatibility with minimally invasive techniques, and widespread adoption among spinal surgeons globally

Report Scope and Anterior Lumbar Interbody Fusion (ALIF) Market Segmentation

|

Attributes |

Anterior Lumbar Interbody Fusion (ALIF) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anterior Lumbar Interbody Fusion (ALIF) Market Trends

Advancements in Minimally Invasive and Navigation-Assisted Surgeries

- A significant trend in the global ALIF market is the increasing adoption of minimally invasive and navigation-assisted surgical techniques, which are improving surgical precision, reducing operative time, and enhancing patient recovery

- For instance, the use of robotic-assisted systems and intraoperative navigation platforms allows surgeons to accurately place interbody cages and screws while minimizing tissue disruption. Companies such as Medtronic and NuVasive are developing advanced ALIF solutions integrated with real-time imaging and robotic guidance

- These innovations also enable personalized surgical planning and improved patient outcomes, reducing complications such as nerve damage and post-operative pain

- Integration of advanced imaging and navigation tools with ALIF procedures is facilitating safer and more predictable surgeries, particularly in complex spinal deformity cases

- This trend is driving demand for technologically advanced ALIF implants and instruments that support minimally invasive approaches, attracting both hospitals and specialty spinal centers

- The growing focus on surgical efficiency, patient safety, and faster recovery is reshaping expectations for spinal fusion procedures and driving market adoption globally

Anterior Lumbar Interbody Fusion (ALIF) Market Dynamics

Driver

Rising Prevalence of Spinal Disorders and Technological Advancements

- The increasing prevalence of degenerative spinal disorders, chronic back pain, and spinal injuries is a major driver for ALIF market growth

- For instance, the adoption of advanced interbody cages, biologics, and fixation devices by companies such as Stryker and Zimmer Biomet is enhancing surgical outcomes and fusion rates

- Growing awareness among patients and healthcare providers regarding the benefits of ALIF procedures, including pain reduction and improved mobility, is fueling demand

- Technological advancements such as minimally invasive surgery, navigation-assisted systems, and improved biomaterials are making ALIF procedures safer and more effective, further boosting adoption

- Rising investments in healthcare infrastructure and the expansion of spinal surgery centers in both developed and emerging regions are also propelling market growth

- The aging global population is more prone to spinal degeneration and chronic back conditions, creating additional demand for ALIF procedures

- Improved reimbursement policies for spinal fusion surgeries in key regions are enabling broader access to ALIF procedures, further driving market expansion

Restraint/Challenge

High Procedure Costs and Surgical Complexity

- The relatively high cost of ALIF procedures, including implants, biologics, and surgical equipment, poses a challenge for wider adoption, especially in price-sensitive markets

- For instance, In 2023, a study reported vascular complications in approximately 2–5% of ALIF surgeries, highlighting the procedural risks that can limit adoption.

- The complexity of ALIF surgery requires highly skilled surgeons and specialized operating room setups, limiting availability in smaller hospitals or regions with limited healthcare infrastructure

- Potential complications, such as vascular injury or implant-related issues, may also deter some patients and healthcare providers from opting for ALIF procedures

- Addressing these challenges through cost-effective implants, improved surgical training programs, and minimally invasive approaches is crucial for expanding the ALIF market

- Companies such as NuVasive and Globus Medical are investing in surgeon education, standardized procedural protocols, and affordable solutions to mitigate these barriers and promote broader adoption

- A shortage of trained spinal surgeons in emerging markets restricts access to ALIF procedures, affecting regional market growth

- Variations in regulatory approvals for spinal implants and inconsistent insurance coverage across countries can delay procedure adoption and increase operational costs

Anterior Lumbar Interbody Fusion (ALIF) Market Scope

The market is segmented on the basis of type, procedure, and end user.

- By Type

On the basis of type, the anterior lumbar interbody fusion (ALIF) market is segmented into biologics, interbody, and others. The interbody segment dominated the market with the largest revenue share of 45.8% in 2024, driven by its proven clinical efficacy, compatibility with minimally invasive techniques, and widespread adoption among spinal surgeons. Interbody cages provide structural support and facilitate spinal fusion, making them the preferred choice in both hospitals and specialty clinics. The segment also benefits from continuous innovation in implant materials, designs, and integration with navigation-assisted surgical systems.

The biologics segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing use of bone graft substitutes, growth factors, and stem-cell-based therapies to enhance fusion rates. Rising adoption in complex spinal cases and increased awareness among surgeons regarding the benefits of biologics are key factors supporting this growth.

- By Procedure

On the basis of procedure, the anterior lumbar interbody fusion (ALIF) market is segmented into open surgery and minimally invasive surgery (MIS). The MIS segment held the largest market revenue share of 51.2% in 2024, attributed to reduced operative time, lower complication rates, faster recovery, and growing surgeon preference for less invasive spinal procedures. MIS approaches also allow for smaller incisions, reduced blood loss, and improved post-operative outcomes, making it highly attractive in both hospitals and specialty spinal centers.

Open surgery is expected to witness the fastest growth from 2025 to 2032 in global anterior lumbar interbody fusion (ALIF) market, particularly for complex spinal deformities and revision procedures where minimally invasive approaches are limited. Although MIS techniques are increasingly preferred, open ALIF procedures are projected to grow at a strong pace during the forecast period. This growth is supported by rising cases requiring multi-level corrections, improved patient safety through advanced intraoperative imaging, surgical navigation, and robotics, as well as continuous innovations in implants and instrumentation.

- By End User

On the basis of end user, the anterior lumbar interbody fusion (ALIF) market is segmented into hospitals, ambulatory centers, specialty clinics, and others. Hospitals dominated the market with a revenue share of 62.5% in 2024, owing to their well-equipped surgical suites, availability of specialized spinal surgeons, and high patient inflow for complex spinal procedures. Hospitals are also primary adopters of advanced implants, navigation-assisted systems, and minimally invasive techniques.

Ambulatory centers are emerging as the fastest-growing segment in the global anterior lumbar interbody fusion (ALIF) market, driven by the rising adoption of outpatient spinal surgery models that provide cost-effective care, shorter hospital stays, and improved patient convenience. Increasing advancements in minimally invasive ALIF techniques and enhanced pain management protocols have enabled complex procedures to be safely performed in these settings. Meanwhile, specialty clinics and academic research centers are increasingly investing in advanced imaging, navigation systems, and surgeon training, further accelerating the shift toward outpatient ALIF procedures globally.

Anterior Lumbar Interbody Fusion (ALIF) Market Regional Analysis

- North America dominated the anterior lumbar interbody fusion (ALIF) market with the largest revenue share of 39.5% in 2024, driven by advanced healthcare infrastructure, high adoption of minimally invasive spinal surgeries, and strong presence of key medical device manufacturers, with the U.S. leading in ALIF procedures due to innovations in interbody cages and biologics

- Patients and healthcare providers in the region increasingly prefer minimally invasive ALIF procedures due to faster recovery, reduced complications, and improved surgical outcomes. The availability of advanced interbody cages, biologics, and navigation-assisted surgical systems further supports this adoption

- This widespread adoption is also supported by high healthcare expenditure, a technologically advanced medical workforce, and growing awareness of advanced spinal fusion techniques, establishing ALIF procedures as a preferred treatment option in both hospitals and specialty spinal centers

U.S. Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The U.S. anterior lumbar interbody fusion (ALIF) market captured the largest revenue share of 42% in 2024 within North America, fueled by the high prevalence of degenerative spinal disorders and chronic back pain. Patients and healthcare providers increasingly prefer minimally invasive ALIF procedures due to faster recovery, reduced complications, and improved surgical outcomes. The availability of advanced interbody cages, biologics, and navigation-assisted surgical systems further supports market growth. Moreover, rising awareness about spinal health and strong healthcare infrastructure continue to drive adoption in hospitals and specialty spinal centers.

Europe Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The Europe anterior lumbar interbody fusion (ALIF) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of spinal disorders, aging population, and advancements in surgical technologies. The demand for minimally invasive procedures, combined with well-established healthcare systems, is fostering the adoption of ALIF. European patients are increasingly seeking improved quality of life and reduced recovery times, prompting hospitals and specialty clinics to adopt advanced spinal fusion solutions.

U.K. Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The U.K. anterior lumbar interbody fusion (ALIF) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising incidence of degenerative spinal conditions and increasing awareness about minimally invasive spinal surgeries. In addition, government initiatives to improve healthcare infrastructure and the presence of leading medical device manufacturers support market expansion. The adoption of advanced interbody implants and biologics further enhances procedural efficacy and patient outcomes.

Germany Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The Germany anterior lumbar interbody fusion (ALIF) market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing spinal disorder prevalence, advanced healthcare facilities, and technological advancements in spinal implants and surgical systems. Germany’s focus on innovation and patient safety encourages adoption of minimally invasive ALIF procedures, while hospitals and specialty clinics continue to invest in navigation-assisted systems and biologics to improve fusion rates and post-operative recovery.

Asia-Pacific Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The Asia-Pacific anterior lumbar interbody fusion (ALIF) market is poised to grow at the fastest CAGR during the forecast period, driven by rising geriatric population, increasing spinal disorder prevalence, and expansion of healthcare infrastructure in countries such as China, Japan, and India. The growing awareness of advanced surgical procedures, coupled with adoption of minimally invasive techniques, is accelerating market growth. In addition, emerging economies are improving access to high-quality spinal care, boosting the adoption of ALIF in hospitals and specialty clinics.

Japan Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The Japan anterior lumbar interbody fusion (ALIF) market is gaining momentum due to the country’s aging population, high prevalence of degenerative spinal disorders, and advanced healthcare infrastructure. The increasing focus on minimally invasive spinal surgeries and integration of navigation-assisted systems is driving adoption. Japan’s healthcare providers are investing in state-of-the-art implants and biologics, ensuring better patient outcomes and faster recovery, particularly in specialized spinal centers and hospitals.

India Anterior Lumbar Interbody Fusion (ALIF) Market Insight

The India anterior lumbar interbody fusion (ALIF) market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising prevalence of spinal disorders, expanding healthcare infrastructure, and increasing awareness of advanced surgical procedures. The growing number of specialty clinics and hospitals offering minimally invasive ALIF, coupled with affordability of implants and biologics, is propelling market adoption. In addition, government initiatives to improve access to healthcare and increasing private investment in spine care facilities support market expansion in India.

Anterior Lumbar Interbody Fusion (ALIF) Market Share

The anterior lumbar interbody fusion (ALIF) industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- NuVasive, Inc. (U.S.)

- Globus Medical, Inc. (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Orthofix International N.V. (U.S.)

- K2M Group Holdings, Inc. (U.S.)

- B. Braun SE (Germany)

- Aesculap Implant Systems (Germany)

- RTI Surgical, Inc. (U.S.)

- Nuvasive Specialized Orthopedics, Inc. (U.S.)

- Alphatec Spine, Inc. (U.S.)

- SeaSpine Holdings Corporation (U.S.)

- Medicrea International (France)

- Paradigm Spine, LLC (U.S.)

- EIT Emerging Implant Technologies GmbH (Germany)

What are the Recent Developments in Global Anterior Lumbar Interbody Fusion (ALIF) Market?

- In March 2025, Globus Medical announced two new commercial launches: the COHERE ALIF Spacer, the first Porous PEEK interbody spacer for ALIF surgery, and Modulus ALIF Blades, an extension of its existing spacer system. The COHERE spacer is designed to combine the imaging benefits of PEEK with the potential for bone in-growth, while the Modulus blades offer different fixation options for increased surgical efficiency and reduced procedural complexity

- In March 2025, Axis Spine Technologies presented their research at the International Society for the Advancement of Spine Surgery (ISASS) conference. The study provided initial data supporting the benefits of modular precision ALIF implants in preserving spinal alignment and reducing the risk of subsidence. The company emphasized its commitment to building strong clinical data that validates the role of modular technology in empowering surgeons to achieve lasting alignment

- In September 2024, Zavation Medical Products, LLC announced the launch of its Varisync ALIF System. The system is engineered to streamline ALIF procedures by offering two spacer fixation options: anchors and screws. It incorporates the company's patented Mimetic Metal cage technology, which is designed to emulate natural bone with a porous structure to promote bony in-growth

- In October 2022, Stryker unveiled the Monterey AL Interbody System, a stand-alone interbody fusion device for ALIF procedures. The system incorporates Stryker’s proprietary Tritanium In-Growth Technology, designed to mimic cancellous bone and promote bone regeneration and fusion

- In July 2021, NuVasive introduced the Modulus ALIF, a 3D-printed porous titanium implant designed for anterior spine surgery. This implant aims to enhance bone in-growth and fusion rates, offering improved clinical outcomes for ALIF procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.