Global Anthracycline Based Oncology Drug Class Market

Market Size in USD Billion

CAGR :

%

USD

5.40 Billion

USD

7.33 Billion

2025

2033

USD

5.40 Billion

USD

7.33 Billion

2025

2033

| 2026 –2033 | |

| USD 5.40 Billion | |

| USD 7.33 Billion | |

|

|

|

|

Anthracycline-Based Oncology Drug Class Market Size

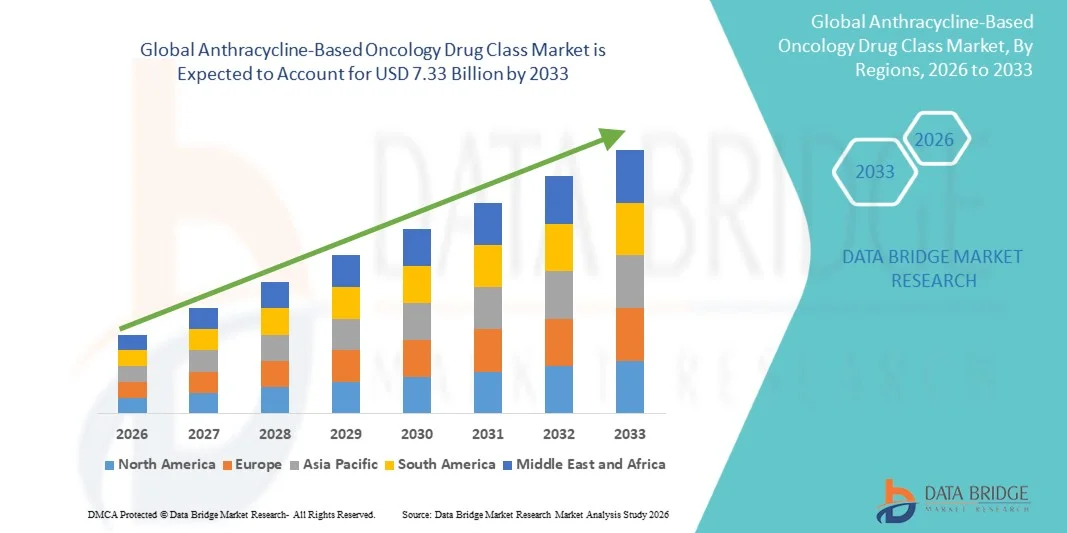

- The global anthracycline-based oncology drug class market size was valued at USD 5.40 billion in 2025 and is expected to reach USD 7.33 billion by 2033, at a CAGR of3.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cancer worldwide, coupled with the rising adoption of anthracycline-based therapies and ongoing technological advancements in oncology drug formulations, including liposomal and targeted delivery systems

- Furthermore, growing awareness among healthcare professionals and patients about the efficacy of anthracyclines in treating breast cancer, leukemia, lymphoma, and other solid tumors is driving higher demand. These converging factors are accelerating the uptake of Anthracycline-Based Oncology Drug Class therapies, thereby significantly boosting the industry's growth

Anthracycline-Based Oncology Drug Class Market Analysis

- Anthracycline-based oncology drugs, including Doxorubicin, Epirubicin, Daunorubicin, and Idarubicin, are increasingly vital components of modern cancer therapy across indications such as breast cancer, leukemia, lymphoma, and other solid tumors due to their proven efficacy, broad clinical adoption, and ongoing advancements in formulation and delivery technologies

- The escalating demand for anthracycline-based therapies is primarily fueled by the rising prevalence of cancer globally, growing awareness among healthcare professionals and patients about treatment efficacy, and increasing adoption of advanced formulations such as liposomal and targeted delivery systems

- North America dominated the anthracycline-based oncology drug class market with the largest revenue share of approximately 36.2% in 2025, characterized by early adoption of advanced oncology therapies, high healthcare expenditure, and a strong presence of key pharmaceutical players, with the U.S. experiencing substantial growth driven by new drug approvals, increasing clinical adoption, and advancements in combination therapies and targeted delivery mechanisms

- Asia-Pacific is expected to be the fastest-growing region in the anthracycline-based oncology drug class market during the forecast period, with India, China, and Japan leading growth due to increasing cancer incidence, expanding healthcare infrastructure, rising patient awareness, and growing adoption of innovative formulations

- The Intravenous Injection segment dominated with the largest revenue share of 45.2%, driven by its standard use in hospital settings for various cancers

Report Scope and Anthracycline-Based Oncology Drug Class Market Segmentation

|

Attributes |

Anthracycline-Based Oncology Drug Class Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Anthracycline-Based Oncology Drug Class Market Trends

“Enhanced Focus on Efficacy and Safety in Chemotherapy”

- A significant and accelerating trend in the global Anthracycline-Based Oncology Drug Class market is the growing emphasis on improving therapeutic efficacy while minimizing cardiotoxicity and other side effects. This focus is driving the adoption of advanced formulations, such as liposomal and targeted anthracyclines, across hospitals and oncology centers

- For instance, in July 2023, Jazz Pharmaceuticals launched a liposomal anthracycline formulation designed to reduce cardiotoxicity in high-risk patients, enabling safer chemotherapy administration

- Improved formulations and delivery mechanisms allow clinicians to administer effective doses with reduced adverse effects, increasing patient compliance and overall treatment outcomes

- The integration of multidisciplinary treatment protocols and monitoring systems supports safer administration of anthracycline therapies, particularly in complex cases, and encourages broader adoption in both developed and emerging regions

- This trend is reshaping clinician expectations and patient care standards, prompting pharmaceutical companies to prioritize research and development in safer, more effective anthracycline-based therapies

- Demand for anthracycline-based therapies with enhanced safety profiles is growing across hospitals, specialty oncology clinics, and outpatient infusion centers, driven by the need to balance treatment efficacy with patient well-being

Anthracycline-Based Oncology Drug Class Market Dynamics

Driver

“Rising Cancer Incidence and Increasing Demand for Effective Chemotherapy”

- The increasing prevalence of cancer globally, including breast cancer, leukemia, and lymphomas, is a significant driver for the heightened demand for anthracycline-based therapies

- For instance, in January 2025, Pfizer expanded distribution of its anthracycline formulations across multiple oncology centers in North America and Europe to meet rising patient demand

- As patients and clinicians seek effective chemotherapy options, hospitals and specialty clinics are adopting advanced anthracycline therapies, enabling improved treatment outcomes and patient survival rates

- Furthermore, the rising adoption of combination chemotherapy regimens that include anthracyclines is further driving market growth

- Accessibility through hospitals, oncology centers, and outpatient infusion clinics enhances treatment availability, supporting sustained market expansion

Restraint/Challenge

“Potential Toxicity and Adverse Side Effects”

- The cardiotoxicity and myelosuppression associated with anthracycline-based therapies pose a significant challenge to broader market adoption

- For instance, high-risk patients and elderly populations may require dose adjustments or alternative therapies, limiting the widespread use of standard anthracyclines

- Long-term exposure to anthracyclines may result in chronic heart damage or secondary malignancies, causing clinicians to be cautious with repeated cycles

- Patient adherence can be affected due to the intensity of side effects such as nausea, fatigue, and immunosuppression, which may reduce overall treatment effectiveness

- The need for frequent monitoring, specialized equipment, and skilled healthcare professionals increases the complexity and cost of administering these therapies

- Regulatory requirements for safety monitoring and reporting of adverse events can slow market adoption, especially in emerging regions with limited infrastructure

- The relatively high cost of advanced formulations, such as liposomal anthracyclines, compared to standard chemotherapy, can be a barrier for healthcare providers and patients in price-sensitive markets

- Even with dose optimization and cardioprotective strategies, concerns over safety can influence physician preference, leading some clinicians to consider alternative chemotherapy regimens

- Ensuring proper patient education, access to monitoring, and risk mitigation strategies is vital to overcome these challenges and sustain market growth

Anthracycline-Based Oncology Drug Class Market Scope

The market is segmented on the basis of type, formulation, and application.

- By Type

On the basis type the market is segmented into Doxorubicin, Epirubicin, Daunorubicin, Idarubicin, and Others. In 2025, the Doxorubicin segment dominated the market with the largest revenue share of 38.6%, driven by its long-standing clinical efficacy in treating a broad spectrum of cancers, including breast cancer, leukemia, and lymphomas. Physicians often prefer Doxorubicin due to its well-established dosing protocols, predictable pharmacokinetics, and proven combination therapy options. Its extensive availability in intravenous and liposomal formulations further enhances its adoption in oncology centers worldwide. Hospitals and cancer treatment centers rely heavily on Doxorubicin for both first-line and adjuvant therapy. Patient familiarity and clinician trust contribute to its sustained demand. In addition, ongoing research and inclusion in treatment guidelines reinforce its dominant market position. Doxorubicin’s compatibility with combination regimens in aggressive cancers also strengthens its widespread use. Cost-effectiveness compared to newer anthracyclines makes it an accessible choice for emerging markets. The drug’s efficacy in pediatric and adult oncology expands its application base. Moreover, robust manufacturing pipelines ensure consistent global supply. Regulatory approvals across multiple regions support its continued market leadership. Overall, Doxorubicin remains the benchmark anthracycline in terms of revenue and clinical preference.

The Epirubicin segment is expected to witness the fastest CAGR of 6.8% from 2026 to 2033. The growth is fueled by increasing adoption in breast cancer treatments due to its improved safety profile and reduced cardiotoxicity compared to Doxorubicin. Hospitals and oncology centers are gradually shifting toward Epirubicin for adjuvant therapy in early and advanced-stage cancers. Its integration into combination chemotherapy regimens enhances treatment outcomes while minimizing side effects. Rising awareness among clinicians about safer anthracycline alternatives contributes to the segment’s rapid growth. Moreover, the availability of generic formulations makes Epirubicin more accessible in emerging markets. Research focusing on nanoparticle and liposomal Epirubicin formulations further supports adoption. Patients’ preference for therapies with manageable adverse effects drives market demand. Strategic collaborations between pharmaceutical companies and cancer hospitals facilitate increased usage. Marketing efforts highlighting reduced cardiotoxicity resonate with healthcare providers and patients alike. The segment benefits from growing breast cancer incidence globally. Regulatory approvals in Europe, North America, and Asia Pacific support wider clinical adoption. Epirubicin’s combination with targeted therapies also fuels its expanding market footprint.

- By Formulation

On the basis of formulation, the market is segmented into Intravenous Injection, Oral Formulation, Liposomal Injection, and Others. In 2025, the Intravenous Injection segment dominated with the largest revenue share of 45.2%, driven by its standard use in hospital settings for various cancers. IV administration ensures rapid bioavailability, precise dosing, and compatibility with combination chemotherapy regimens. Oncology centers prefer IV formulations for acute treatment schedules and patient monitoring. The segment’s dominance is further reinforced by extensive clinical data supporting efficacy and safety. Availability of both generic and branded IV anthracyclines ensures wide access globally. Hospitals also benefit from IV formulations’ predictable pharmacokinetics, facilitating complex therapy planning. Moreover, IV delivery remains the preferred choice for high-dose chemotherapy protocols. Patient outcomes and clinician familiarity strengthen its adoption. Regulatory approvals and guideline recommendations continue to prioritize IV use. The segment enjoys consistent demand across adult and pediatric oncology settings. Cost considerations and insurance coverage further support its market leadership.

The Liposomal Injection segment is expected to witness the fastest CAGR of 7.3% from 2026 to 2033. Growth is driven by its reduced cardiotoxicity and targeted delivery benefits, particularly in metastatic cancers. Liposomal formulations enhance drug accumulation in tumor tissues, improving efficacy while minimizing side effects. Increasing adoption in advanced-stage cancers and relapsed patients boosts market potential. Hospitals and cancer centers are expanding use of liposomal anthracyclines for safer outpatient chemotherapy. Research innovations and formulation improvements further accelerate adoption. Patients favor liposomal options due to lower risk of cardiac complications. Strategic partnerships between pharmaceutical companies and hospitals facilitate wider distribution. Cost reductions for liposomal drugs in certain regions also drive uptake. Regulatory support in key markets enables rapid commercialization. Marketing campaigns emphasize improved safety and targeted therapy advantages. The growing trend of personalized oncology treatments aligns with liposomal formulation adoption.

- By Application

On the basis of application, the market is segmented into Breast Cancer, Leukemia, Lymphoma, Other Solid Tumors, and Others. In 2025, the Breast Cancer segment dominated with a revenue share of 42.7%, reflecting the high incidence of breast cancer globally and the reliance on anthracyclines as a cornerstone in treatment regimens. Anthracyclines like Doxorubicin and Epirubicin are widely used in adjuvant, neoadjuvant, and metastatic therapy settings. Strong clinical evidence, guideline recommendations, and combination therapy compatibility reinforce their use. Healthcare providers prioritize efficacy and long-term survival benefits in treatment selection. The segment benefits from growing awareness and screening programs that increase early detection and therapy initiation. Pharmaceutical companies focus marketing and educational initiatives on breast cancer specialists. Cost-effectiveness and insurance coverage further drive adoption. The segment also sees continuous innovation in safer delivery methods, such as liposomal formulations. Rising patient demand for effective treatment options enhances market growth. Global initiatives for breast cancer management indirectly stimulate anthracycline usage. Research into combination with targeted therapies ensures sustained relevance. Breast cancer remains a primary driver of market revenue across regions.

The Leukemia segment is expected to witness the fastest CAGR of 6.9% from 2026 to 2033, propelled by rising leukemia incidence, especially acute forms in both adults and children. Anthracyclines remain critical in multi-agent chemotherapy protocols for various leukemia types. Improved safety profiles of newer anthracyclines encourage wider adoption. Pediatric oncology centers increasingly integrate these drugs into treatment regimens. Clinical trials and research supporting efficacy in rare leukemia subtypes drive demand. Growth is further supported by better accessibility of generic formulations. Hospital protocols favor anthracyclines for standardized therapy schedules. Rising awareness among clinicians about optimized dosing regimens enhances adoption. Strategic partnerships with healthcare providers facilitate rapid adoption in specialized centers. Insurance coverage and reimbursement programs support patient access. Regulatory approvals for pediatric and adult leukemia indications expand market reach. Advancements in combination therapies, including targeted treatments, bolster growth potential.

Anthracycline-Based Oncology Drug Class Market Regional Analysis

- North America dominated the anthracycline-based oncology drug class market with the largest revenue share of approximately 36.2% in 2025, characterized by early adoption of advanced oncology therapies, high healthcare expenditure, and a strong presence of key pharmaceutical players

- The market, in particular, experienced substantial growth driven by new drug approvals, increasing clinical adoption, and advancements in combination therapies and targeted delivery mechanisms

- Hospitals, specialty oncology centers, and outpatient infusion clinics are rapidly adopting liposomal and targeted anthracycline formulations to improve treatment efficacy while minimizing adverse effects

U.S. Anthracycline-Based Oncology Drug Class Market Insight

The U.S. anthracycline-based oncology drug class market captured the largest revenue share of approximately in North America in 2025, fueled by the availability of advanced chemotherapy infrastructure, strong government funding for oncology research, and high patient awareness. The adoption of innovative drug formulations, improved safety protocols, and combination therapy regimens is driving higher utilization. In addition, the presence of leading pharmaceutical companies and ongoing clinical trials for new anthracycline-based drugs support sustained market growth.

Europe Anthracycline-Based Oncology Drug Class Market Insight

The Europe anthracycline-based oncology drug class market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established oncology healthcare infrastructure, increasing cancer awareness, and growing adoption of advanced chemotherapy protocols. Countries such as the U.K. and Germany are experiencing significant growth due to government initiatives supporting cancer care, increasing patient access to specialized oncology centers, and rising investment in innovative drug formulations.

U.K. Anthracycline-Based Oncology Drug Class Market Insight

The U.K. anthracycline-based oncology drug class market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the expansion of specialty oncology centers, rising prevalence of cancers, and increasing adoption of combination chemotherapy protocols. Hospitals are adopting advanced anthracycline formulations, while national healthcare initiatives promoting early cancer detection and treatment accessibility further stimulate market growth.

Germany Anthracycline-Based Oncology Drug Class Market Insight

The Germany anthracycline-based oncology drug class market is expected to expand at a considerable CAGR during the forecast period, driven by increasing investments in oncology infrastructure, high-quality healthcare services, and growing patient awareness. Hospitals and specialty clinics are adopting targeted and liposomal anthracycline therapies to improve treatment outcomes and reduce side effects. Government-backed research programs and oncology-focused collaborations are also supporting market expansion.

Asia-Pacific Anthracycline-Based Oncology Drug Class Market Insight

The Asia-Pacific anthracycline-based oncology drug class market is expected to be the fastest-growing region in the Anthracycline-Based Oncology Drug Class market during the forecast period, with India, China, and Japan leading growth. Rising cancer incidence, expanding healthcare infrastructure, increasing patient awareness, and growing adoption of innovative formulations are driving demand. Countries such as India and China are witnessing rapid expansion of oncology centers, while Japan benefits from a technologically advanced healthcare system supporting adoption of modern anthracycline therapies.

Japan Anthracycline-Based Oncology Drug Class Market Insight

The Japanese anthracycline-based oncology drug class market is growing steadily due to an aging population, rising cancer prevalence, and increasing adoption of advanced anthracycline-based therapies. Hospitals and outpatient infusion centers are implementing liposomal and targeted formulations to improve safety and efficacy. Government initiatives and private healthcare investments supporting oncology infrastructure further accelerate market growth.

China Anthracycline-Based Oncology Drug Class Market Insight

China anthracycline-based oncology drug class market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by increasing cancer incidence, rising healthcare expenditure, and expanding hospital networks. The adoption of innovative anthracycline formulations, government support for cancer care, and growing clinical awareness are key factors propelling market growth. In addition, improvements in patient access to oncology centers and advanced treatment protocols are further accelerating adoption in the country.

India Anthracycline-Based Oncology Drug Class Market Insight

The India anthracycline-based oncology drug class market is poised for rapid growth during the forecast period, fueled by rising cancer prevalence, expansion of specialized oncology hospitals, and increasing patient awareness about advanced chemotherapy options. The growing availability of modern drug formulations and targeted therapies, coupled with healthcare modernization initiatives, supports higher adoption of anthracycline-based treatments across hospitals and specialty clinics.

Anthracycline-Based Oncology Drug Class Market Share

The Anthracycline-Based Oncology Drug Class industry is primarily led by well-established companies, including:

- Pfizer (U.S.)

- Novartis (Switzerland)

- Roche (Switzerland)

- Bristol-Myers Squibb (U.S.)

- Teva Pharmaceuticals (Israel)

- Sun Pharmaceutical Industries (India)

- Cipla (India)

- Johnson & Johnson (U.S.)

- Hikma Pharmaceuticals (U.K.)

- Celltrion (South Korea)

- Shanghai Pharmaceuticals (China)

- Lupin (India)

- Amgen (U.S.)

- Takeda Pharmaceutical (Japan)

- Eisai Co., Ltd. (Japan)

- Astellas Pharma (Japan)

- Servier (France)

- Sanofi (France)

- AstraZeneca (U.K.)

Latest Developments in Global Anthracycline-Based Oncology Drug Class Market

- In December 2022, Capstone Development Services Company LLC announced that its doxorubicin hydrochloride liposomal injection received regulatory approval from the U.S. FDA and the European Commission for the treatment of ovarian cancer, multiple myeloma, AIDS‑related Kaposi’s sarcoma, and metastatic breast cancer, highlighting the growing adoption of advanced liposomal anthracycline formulations that improve therapeutic outcomes and reduce toxicity

- In May 2023, Dr. Reddy’s Laboratories received approval from the U.S. Food and Drug Administration (FDA) for its Doxorubicin Hydrochloride Liposome Injection, expanding treatment options in the U.S. oncology market for ovarian and breast cancer patients and strengthening access to liposomal anthracycline therapy

- In August 2024, Lupin Limited launched its Doxorubicin Hydrochloride Liposome Injection for oncology indications including ovarian cancer and Kaposi’s sarcoma, reflecting pharmaceutical innovation in anthracycline drug delivery aimed at reducing systemic side effects and improving efficacy

- In January 2025, a multicenter randomized bioequivalence trial of liposomal doxorubicin hydrochloride was published, marking an advancement in formulation research to optimize pharmacokinetics and therapeutic performance in patients with metastatic breast cancer, underlining ongoing clinical research efforts in anthracycline delivery technologies

- In June 2025, Alembic Pharmaceuticals Limited received U.S. FDA approval for its Doxorubicin Hydrochloride Liposome Injection, expanding its oncology drug portfolio and enhancing access to advanced chemotherapy agents in the U.S. market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.