Global Anti Acne Cosmetics Market

Market Size in USD Billion

CAGR :

%

USD

4.27 Billion

USD

8.48 Billion

2024

2032

USD

4.27 Billion

USD

8.48 Billion

2024

2032

| 2025 –2032 | |

| USD 4.27 Billion | |

| USD 8.48 Billion | |

|

|

|

|

Anti-Acne Cosmetics Market Size

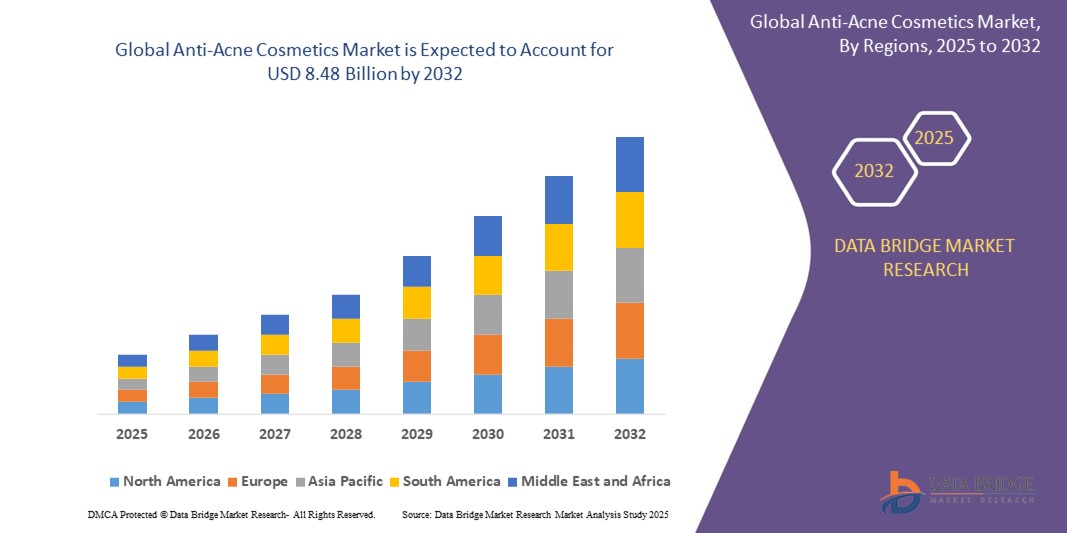

- The global anti-acne cosmetics market size was valued at USD 4.27 billion in 2024 and is expected to reach USD 8.48 billion by 2032, at a CAGR of 8.96% during the forecast period

- The market growth is largely fueled by rising incidences of acne among adolescents and adults, driven by factors such as pollution, stress, hormonal imbalances, and changing dietary habits, which are increasing the demand for targeted skincare solutions

- Furthermore, growing consumer awareness about skincare, the influence of social media beauty trends, and the expansion of e-commerce platforms are promoting easy access to a wide range of anti-acne cosmetic products, thereby accelerating market growth across both developed and emerging economies

Anti-Acne Cosmetics Market Analysis

- Anti-acne cosmetics, designed to prevent, treat, and manage acne-related skin conditions, are becoming essential components of personal care routines across a broad consumer base, particularly among adolescents and young adults, due to rising concerns over appearance, skin health, and confidence

- The escalating demand for anti-acne cosmetics is primarily driven by increasing acne prevalence globally, growing awareness of skincare through digital platforms, and a strong consumer shift toward preventive and active-ingredient-based products such as salicylic acid, benzoyl peroxide, and herbal formulations

- Asia-Pacific dominated the anti-acne cosmetics market with a share of 41.6% in 2024, due to high adolescent population, rising awareness about skincare, and increasing demand for beauty and personal care products

- North America is expected to be the fastest growing region in the anti-acne cosmetics market during the forecast period due to a strong culture of skincare routines, high awareness about dermatological issues, and the proliferation of clean-label and tech-enabled skincare brands

- Creams and lotions segment dominated the market with a market share of 29.1% in 2024, due to their multifunctional use as moisturizers and treatment solutions. These products are widely accepted due to their convenience, non-greasy texture, and ability to deliver active ingredients such as benzoyl peroxide, salicylic acid, and retinoids over extended periods. Their compatibility with all skin types, especially dry and combination skin, and their inclusion in both day and night skincare routines have made them a staple in consumer regimens

Report Scope and Anti-Acne Cosmetics Market Segmentation

|

Attributes |

Anti-Acne Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Acne Cosmetics Market Trends

“Increasing Consumer Awareness About Skincare”

- A significant and accelerating trend in the global anti-acne cosmetics market is the rising consumer awareness about skincare, fueled by increasing access to dermatological information, beauty influencers, and ingredient-focused marketing. This growing knowledge is shifting consumer preferences toward scientifically backed, personalized, and preventive skincare solutions

- For instance, consumers are increasingly seeking out products with active ingredients such as salicylic acid, niacinamide, benzoyl peroxide, and tea tree oil, recognizing their effectiveness in treating acne and improving skin texture. Brands are responding by launching targeted formulations with clear labeling and transparent ingredient lists

- Social media platforms such as Instagram, YouTube, and TikTok play a key role in spreading skincare education, empowering consumers to make informed choices based on skin type, condition, and lifestyle. Influencer-led product reviews and dermatologist content are particularly influential in driving product trials and brand trust

- This trend is also contributing to the surge in demand for clean-label, non-comedogenic, and cruelty-free formulations, as consumers seek safer, skin-friendly alternatives without harsh chemicals or synthetic additives

- As a result, companies are investing in product innovation, clinical validation, and sustainable packaging to align with the growing demand for effective and ethically formulated anti-acne products

- The increased emphasis on skincare literacy is expanding the market across genders and age groups and is also pushing brands to differentiate through transparency, performance, and holistic skin wellness approaches

Anti-Acne Cosmetics Market Dynamics

Driver

“Increasing Prevalence of Acne Among Adolescents”

- The increasing prevalence of acne among adolescents is a significant driver for the growing demand in the anti-acne cosmetics market, as hormonal changes during puberty contribute to higher susceptibility to acne breakouts in this age group

- For instance, according to the American Academy of Dermatology, acne affects approximately 85% of individuals between the ages of 12 and 24, making it one of the most common skin conditions among teenagers globally. This widespread occurrence has led to a surge in demand for specialized anti-acne skincare solutions tailored for younger consumers

- As awareness around skin health and appearance intensifies among adolescents, especially due to social media exposure and peer influence, they are increasingly seeking products that can prevent and treat acne effectively without damaging sensitive skin

- Brands are responding by offering gentle, dermatologist-recommended, and teen-friendly formulations in various forms such as gels, face washes, spot treatments, and moisturizers, often supported by educational campaigns focused on skincare routines

- The rising trend of self-care and grooming among teenagers, along with the societal emphasis on clear skin as a standard of beauty, continues to drive product innovation and market expansion within the adolescent demographic

Restraint/Challenge

“Adverse Effects on Sensitive Skin”

- Adverse effects on sensitive skin present a significant challenge to the growth of the anti-acne cosmetics market, as certain formulations—particularly those containing strong active ingredients such as benzoyl peroxide or salicylic acid—can cause irritation, redness, dryness, or allergic reactions in individuals with delicate or reactive skin

- For instance, consumers with sensitive skin often report discomfort or worsening of symptoms after using harsh anti-acne products, leading to a lack of trust and hesitation in adopting over-the-counter solutions

- Addressing this challenge requires brands to invest in dermatologically tested, hypoallergenic, and fragrance-free formulations that minimize irritation while maintaining efficacy. Companies such as Cetaphil and La Roche-Posay have gained consumer trust by emphasizing their gentle yet effective anti-acne lines tailored for sensitive skin types

- Furthermore, the variability in skin responses makes it difficult for manufacturers to develop universal formulations, necessitating greater personalization and skin-type-specific solutions. This complexity can delay product development and limit scalability for brands targeting mass-market appeal

- Overcoming this challenge is crucial to retaining consumer confidence, especially as demand increases for safe, inclusive, and well-tolerated skincare across diverse demographic segments

Anti-Acne Cosmetics Market Scope

The market is segmented on the basis of product type, type, gender, price range, formulation, availability, end user, and distribution channel.

• By Product Type

On the basis of product type, the anti-acne cosmetics market is segmented into emulsions, mask/pack, creams and lotions, gels, cleanser and toner, face wash, anti-acne cream, and others. The creams and lotions segment held the largest market revenue share of 29.1% in 2024, attributed to their multifunctional use as moisturizers and treatment solutions. These products are widely accepted due to their convenience, non-greasy texture, and ability to deliver active ingredients such as benzoyl peroxide, salicylic acid, and retinoids over extended periods. Their compatibility with all skin types, especially dry and combination skin, and their inclusion in both day and night skincare routines have made them a staple in consumer regimens.

The mask/pack segment is projected to witness the fastest growth from 2025 to 2032, owing to increasing consumer interest in deep-cleansing and detoxifying solutions. Rising adoption of self-care and spa-at-home trends, fueled by social media and influencer marketing, is contributing to the popularity of masks. These products often contain clays, charcoal, or tea tree extracts that help control oil production and reduce bacterial growth, making them highly effective for acne-prone skin. Their visible, short-term results and ease of use are attracting younger consumers, particularly in urban areas.

• By Type

On the basis of type, the market is segmented into pharmacological and non-pharmacological. The pharmacological segment accounted for the highest market share in 2024, due to the medically-backed efficacy of products formulated with clinically proven ingredients. Consumers with moderate to severe acne rely on dermatologist-recommended pharmacological solutions, such as antibiotic creams, azelaic acid, and topical retinoids. These products are available both over-the-counter and by prescription, providing flexibility in access while ensuring reliable results.

The non-pharmacological segment is anticipated to grow at the fastest pace from 2025 to 2032, driven by increasing preference for natural and preventive skincare approaches. Consumers are becoming more cautious about long-term side effects of chemicals, leading to greater adoption of non-pharmacological products that use botanical extracts, vitamins, and minerals. The rising clean beauty movement, along with awareness of skin barrier health, is encouraging brands to formulate gentle, plant-based alternatives, particularly appealing to sensitive-skin users.

• By Gender

Based on gender, the market is categorized into men and women. The women segment dominated the market in 2024, fueled by strong awareness of skincare, early adoption of beauty routines, and widespread product offerings specifically designed for female consumers. Women often use multiple skincare products daily, which increases cross-selling opportunities for anti-acne cosmetics. Social, professional, and cultural emphasis on appearance further drives demand, with many women integrating acne solutions into their full-face regimens that include moisturizers, serums, and sunscreens.

The men segment is forecasted to experience the fastest CAGR from 2025 to 2032, due to shifting perceptions around male grooming and increased visibility of male skincare in marketing and media. Brands are launching targeted products to address male-specific concerns such as post-shave breakouts and oily skin, while simultaneously offering minimalist, multi-use formulations preferred by male consumers. Growth is especially pronounced in emerging markets where grooming habits are evolving rapidly among urban youth.

• By Price Range

By price range, the market is segmented into economic and premium. The economic segment led the market in 2024, as cost-effective options appeal to younger consumers such as students and first-time buyers. Mass-market brands dominate this segment with wide availability, affordability, and basic efficacy. Drugstore products and private label offerings maintain steady demand due to competitive pricing and decent performance.

The premium segment is set to register the highest growth from 2025 to 2032, as more consumers seek advanced formulations and are willing to pay for perceived quality, safety, and brand trust. Dermatologist-endorsed brands, luxury packaging, ingredient transparency, and clean-label claims have made premium products desirable. In addition, rising disposable incomes and growing interest in cosmeceuticals and personalized skincare solutions are contributing to a premiumization trend across all consumer age groups.

• By Formulation

On the basis of formulation, the market is divided into organic and inorganic. The inorganic segment dominated in 2024, benefiting from its long-standing presence and scientifically validated ingredients that provide fast, measurable results. These products often include synthetic actives known for their efficacy in clearing moderate to severe acne and are widely prescribed by dermatologists.

The organic segment is expected to witness the fastest CAGR from 2025 to 2032, supported by growing consumer concerns about ingredient safety, environmental impact, and cruelty-free testing. Organic formulations that exclude parabens, sulfates, artificial fragrances, and other irritants are gaining popularity, especially among millennials and Gen Z consumers. The demand for vegan, sustainable, and eco-friendly skincare solutions is further accelerating growth in this category.

• By Availability

Based on availability, the market is segmented into general departmental store, supermarkets/hypermarkets, pharmacy/drug stores, brand outlets, online sales, specialty stores, and others. The pharmacy/drug store segment held the largest share in 2024, driven by consumer trust in pharmacy-sourced skincare and ease of access to professional guidance. Many consumers seek pharmacist recommendations for effective acne treatments and prefer purchasing from outlets perceived as medically reliable.

The online sales channel is expected to grow at the fastest rate through 2032, due to increasing internet penetration, rise in mobile commerce, and growth of e-commerce platforms offering skincare products with detailed descriptions and user reviews. D2C (direct-to-consumer) brands are thriving in this space, offering personalization, subscription-based deliveries, and flexible pricing, which resonate with digitally savvy consumers.

• By End User

On the basis of end user, the market is segmented into dermatology clinics and medspa. The dermatology clinics segment held the highest revenue share in 2024, as consumers with chronic or cystic acne often consult dermatologists for personalized treatment plans. These clinics frequently recommend or retail high-strength topical formulations and clinical skincare brands, ensuring product credibility and compliance with medical standards.

The medspa segment is projected to grow at the fastest rate from 2025 to 2032, owing to rising demand for non-invasive cosmetic procedures and premium skincare experiences. Medspas offer advanced therapies such as blue light treatment, microdermabrasion, and custom facials targeting acne, combined with luxury services and personalized consultation. The blending of aesthetics with clinical efficacy is appealing to affluent consumers seeking holistic skin solutions.

• By Distribution Channel

By distribution channel, the market is segmented into direct tender, retail sales, and others. The retail sales segment led the market in 2024, with widespread consumer access across brick-and-mortar and online retail platforms. The presence of both established global brands and emerging indie labels in retail stores ensures a diverse product mix, catering to different preferences, price points, and skin types.

The direct tender segment is expected to record the fastest growth from 2025 to 2032, primarily through partnerships between manufacturers and clinics, hospitals, and medspas. Institutional procurement allows for the bulk supply of clinical-grade acne cosmetics and cosmeceuticals, especially those intended for post-treatment skincare. This B2B distribution model ensures quality assurance and supports recurring product usage in professional settings.

Anti-Acne Cosmetics Market Regional Analysis

- Asia-Pacific dominated the anti-acne cosmetics market with the largest revenue share of 41.6% in 2024, driven by high adolescent population, rising awareness about skincare, and increasing demand for beauty and personal care products

- Growing disposable incomes, widespread social media influence, and expanding e-commerce access are key drivers promoting the adoption of anti-acne solutions across both urban and rural areas

- The regional market is further supported by rising investments from global cosmetics brands, strong K-beauty and J-beauty trends, and consumer preference for natural, organic ingredients in skincare products

Japan Anti-Acne Cosmetics Market Insight

Japan's market growth is fueled by increasing demand for gentle, fragrance-free formulations suited for sensitive skin, particularly among adult women dealing with hormonal or stress-related acne. Local brands emphasize dermatologically tested, minimalist skincare routines, while Japanese consumers show a strong inclination toward clean beauty and multifunctional products.

China Anti-Acne Cosmetics Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by its vast youth population, social media-driven beauty culture, and rapid expansion of local cosmetic brands. E-commerce platforms such as Tmall and JD.com enable broad product accessibility, while growing concern about pollution-induced skin issues drives the use of anti-acne skincare products with antioxidant and soothing properties.

Europe Anti-Acne Cosmetics Market Insight

Europe’s market is projected to grow steadily due to high skincare awareness, rising demand for vegan and cruelty-free products, and strong regulatory frameworks ensuring product safety. The focus on ingredient transparency and dermatologically backed solutions is driving brand differentiation. Countries in Western Europe, especially France and Germany, are leading in product innovation and sustainable packaging.

U.K. Anti-Acne Cosmetics Market Insight

The U.K. market is driven by a strong grooming culture, increasing demand for men's skincare products, and rising popularity of targeted solutions for adult acne. Influencer marketing and retailer initiatives around ingredient education are influencing purchase decisions, while a shift towards premium and organic formulations is gaining traction among millennials and Gen Z consumers.

Germany Anti-Acne Cosmetics Market Insight

Germany’s market is supported by consumer emphasis on clinically validated, pharmaceutical-grade skincare. The country's strong dermocosmetics segment and widespread use of apothecaries for skincare consultations are boosting adoption. Interest in probiotic and microbiome-friendly anti-acne products is rising as consumers seek science-based solutions with minimal irritation.

North America Anti-Acne Cosmetics Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, driven by a strong culture of skincare routines, high awareness about dermatological issues, and the proliferation of clean-label and tech-enabled skincare brands. Online sales, tele-dermatology platforms, and product personalization technologies are accelerating product penetration across consumer segments.

U.S. Anti-Acne Cosmetics Market Insight

The U.S. market captured the largest revenue share in North America in 2024, supported by early adoption of active skincare regimens, growth in teen and adult acne cases, and widespread product innovation. Demand for dermatologist-recommended, non-comedogenic, and inclusive skincare is rising, with strong brand presence across drugstores, specialty beauty chains, and D2C channels.

Anti-Acne Cosmetics Market Share

The anti-acne cosmetics industry is primarily led by well-established companies, including:

- Higher Education Skincare (U.S.)

- Taro Pharmaceutical Industries Ltd. (U.S.)

- L’Oréal S.A. (France)

- Glexon Healthcare. (India)

- Xieon (India)

- Urban Skin Rx (U.S.)

- Dr.Jart+ (South Korea)

- COSRX (South Korea)

- Johnson & Johnson Services, Inc (U.S.)

- Clinique Laboratories, llc. (U.S.)

- Ancalima Lifesciences Limited (India)

- Sesderma (Spain)

- DECIEM Beauty Group Inc. (Canada)

- Unilever (U.K.)

- HUM Nutrition Inc. (U.S.)

- GALDERMA (Switzerland)

- Murad LLC (U.S.)

- ROHTO Pharmaceutical Co.,Ltd. (Japan)

- KOSÉ Corporation. (Japan)

Latest Developments in Global Anti-Acne Cosmetics Market

- In January 2023, L’Oréal reveals a minority investment in micro-printing startup, Prinker Korea Inc., through its venture fund BOLD Business Opportunities for L’Oreal Development, aligning with its commitment to innovation in the beauty industry and expanding its portfolio with cutting-edge technology solutions

- In January 2023, L’Oréal launches two groundbreaking technology prototypes: HAPTA, a handheld computerized makeup applicator tailored for individuals with limited hand and arm mobility, and L’Oréal Brow Magic, an electronic eyebrow makeup applicator enabling users to create customized brow looks effortlessly and quickly at home

- In November 2022, Murad announces a partnership with Remedy Place, the world's first social wellness club, fostering connections between beauty, wellness, and science. This collaboration underscores Murad's commitment to holistic wellness and its ongoing efforts to integrate scientific innovation into beauty and wellness practices

- In October 2020, GALDERMA's Cetaphil brand launches a premium product line featuring the innovative HydroSensitiv complex, delivering 48-hour hydration. This strategic introduction spurred revenue generation and also catalyzed market growth, enhancing Cetaphil's position as a leading skincare brand catering to diverse hydration needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.