Global Anti Ageing Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

3.61 Billion

USD

7.25 Billion

2024

2032

USD

3.61 Billion

USD

7.25 Billion

2024

2032

| 2025 –2032 | |

| USD 3.61 Billion | |

| USD 7.25 Billion | |

|

|

|

|

Anti-Ageing Ingredients Market Size

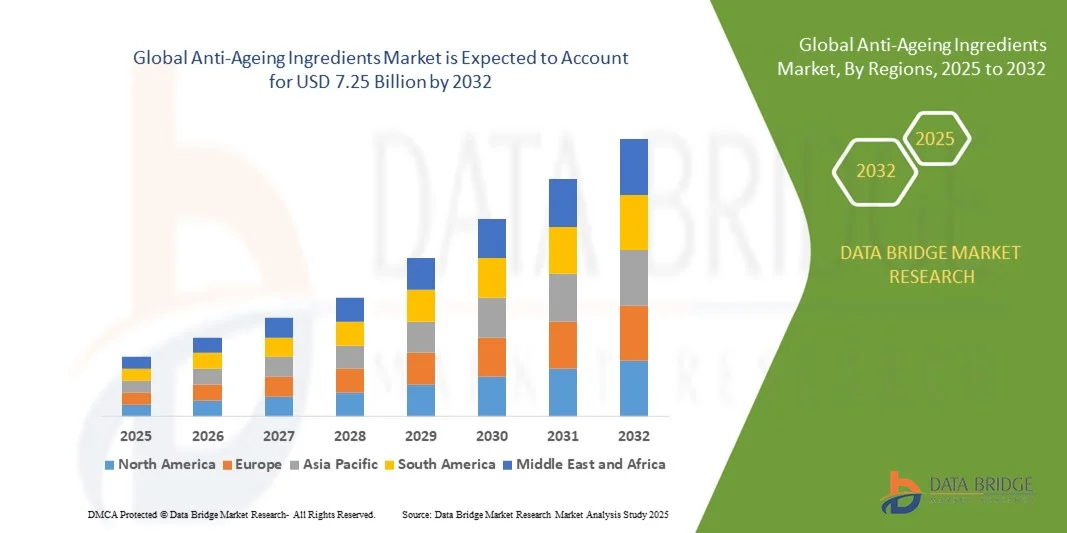

- The global anti-ageing ingredients market size was valued at USD 3.61 billion in 2024 and is expected to reach USD 7.25 billion by 2032, at a CAGR of 9.11% during the forecast period

- The market growth is largely fuelled by the rising consumer awareness regarding skin health, increasing demand for anti-ageing skincare products, and innovations in bioactive and natural ingredients

- Growing e-commerce penetration and rising disposable incomes are further driving the adoption of anti-ageing formulations across developed and emerging markets

Anti-Ageing Ingredients Market Analysis

- The market is witnessing increased focus on natural and plant-based ingredients, peptides, and antioxidants that offer effective skin rejuvenation and anti-ageing benefits

- Innovations in delivery systems, such as nano-encapsulation and liposomal formulations, are enhancing ingredient efficacy and consumer acceptance

- North America dominated the anti-ageing ingredients market with the largest revenue share of 38.75% in 2024, driven by high consumer awareness of skincare, widespread adoption of premium cosmetic products, and growing demand for natural and bioactive ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global anti-ageing ingredients market, driven by expanding middle-class population, rising disposable income, rapid urbanization, and increasing demand for innovative anti-ageing products across cosmetics and personal care sectors

- The peptides segment held the largest market revenue share in 2024, driven by its proven efficacy in reducing wrinkles, improving skin elasticity, and promoting collagen synthesis. Peptides are widely incorporated in premium skincare formulations, enhancing consumer trust and product adoption

Report Scope and Anti-Ageing Ingredients Market Segmentation

|

Attributes |

Anti-Ageing Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Ageing Ingredients Market Trends

Rise of Natural and Bioactive Ingredients in Anti-Ageing Products

- The increasing consumer preference for natural, plant-based, and bioactive anti-ageing ingredients is transforming the skincare landscape. Products containing antioxidants, peptides, and vitamins allow for targeted skin rejuvenation and wrinkle reduction, driving higher adoption across diverse demographics. This trend also encourages innovation in ingredient combinations, promoting multi-functional formulations that improve hydration, elasticity, and overall skin health

- The high demand for anti-ageing formulations in emerging markets is accelerating the use of innovative ingredients and delivery technologies. Products with enhanced bioavailability, such as nano-encapsulated or liposomal formulations, are particularly effective in improving skin health and ensuring visible results. The trend is further supported by collaborations between cosmetic brands and ingredient suppliers to develop advanced, research-backed solutions

- The affordability and accessibility of modern anti-ageing ingredients are making them attractive for both premium and mass-market products. Manufacturers benefit from a wider consumer base, allowing more frequent product trials and increasing overall market penetration. Expansion of retail and online distribution channels also contributes to broader product reach and faster adoption

- For instance, in 2023, several cosmetic brands in Southeast Asia reported a significant increase in sales after launching serums and creams containing plant-derived peptides and antioxidants, improving skin elasticity and consumer satisfaction. These launches also helped brands strengthen their market positioning and brand loyalty in competitive skincare segments

- While natural and bioactive ingredients are accelerating product innovation and consumer adoption, their impact depends on regulatory compliance, ingredient sourcing, and product efficacy. Companies must focus on research-driven development, sustainable sourcing, and targeted marketing strategies to fully capitalize on this growing demand and differentiate their offerings

Anti-Ageing Ingredients Market Dynamics

Driver

Rising Awareness of Skin Health and Anti-Ageing Solutions

- Increasing consumer awareness regarding skin aging, UV exposure, and oxidative stress is prompting individuals to invest in preventive and corrective skincare products. This shift is encouraging regular use of anti-ageing ingredients and formulations. In addition, rising interest in wellness and self-care routines is driving higher engagement with anti-ageing skincare products

- The growing preference for high-quality, clinically proven, and scientifically backed ingredients is boosting demand for advanced bioactive compounds, antioxidants, and peptides in skincare products. Consumers increasingly prioritize efficacy over price, driving premium product adoption. Continuous innovation in ingredient efficacy and safety also strengthens consumer trust and brand reputation

- E-commerce platforms and social media are amplifying consumer education, enabling wider access to anti-ageing products and influencing purchase behavior. This trend is strengthening market penetration and promoting innovative formulations. Influencer partnerships and online tutorials further increase product awareness and trial, contributing to market expansion

- For instance, in 2022, several European cosmetic brands partnered with dermatology experts to launch new anti-ageing ranges, resulting in increased product trust and market demand. These collaborations also facilitated clinical validation and marketing campaigns that highlighted tangible skincare benefits

- While awareness and education are driving growth, companies must continue innovating and ensuring product safety, efficacy, and affordability to sustain adoption. Investment in R&D, formulation improvements, and consumer-centric product design remains essential for maintaining competitive advantage

Restraint/Challenge

High Cost of Premium Ingredients and Regulatory Compliance

- The high cost of advanced anti-ageing ingredients, such as bioactive peptides and rare plant extracts, limits accessibility for price-sensitive consumers and small-scale cosmetic brands. This cost barrier can restrict widespread market penetration. In addition, fluctuating raw material prices can impact production planning and profitability

- Strict regulatory frameworks in various countries require rigorous testing and compliance, increasing production time and costs. Non-compliance can result in product recalls or bans, impacting brand reputation and market growth. Varying regional standards also add complexity for companies operating in multiple markets

- Supply chain challenges, including sourcing high-quality natural ingredients and maintaining consistency, can disrupt production and delay product launches. Limited availability of certain botanicals or actives may affect formulation strategies. Dependence on international suppliers and seasonal variations in raw material availability further exacerbate supply risks

- For instance, in 2023, several cosmetic companies in North America and Europe had to adjust production volumes due to high raw material costs and compliance requirements. These adjustments affected product launch timelines, sales projections, and overall market competitiveness

- While technological advancements continue to enhance ingredient efficacy, addressing cost and regulatory hurdles remains critical for sustained growth in the global anti-ageing ingredients market. Companies must implement strategic sourcing, scalable production methods, and regulatory expertise to mitigate risks and ensure long-term market expansion

Anti-Ageing Ingredients Market Scope

The market is segmented on the basis of type, form, and application.

- By Type

On the basis of type, the anti-ageing ingredients market is segmented into chemical peels, sunscreen ingredients, peptides, hyaluronic acid, anti-oxidants, retinol, niacinamide, and others. The peptides segment held the largest market revenue share in 2024, driven by its proven efficacy in reducing wrinkles, improving skin elasticity, and promoting collagen synthesis. Peptides are widely incorporated in premium skincare formulations, enhancing consumer trust and product adoption.

The retinol segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its strong anti-ageing properties, ability to accelerate skin cell turnover, and effectiveness in treating fine lines and pigmentation. Retinol-based formulations are increasingly popular in both luxury and mass-market products, contributing to rising demand across global skincare markets.

- By Form

On the basis of form, the market is segmented into liquid and powder. The liquid form dominated the market in 2024 due to its ease of incorporation into creams, serums, and lotions, as well as its superior absorption and efficacy in topical applications. Liquid formulations are preferred by cosmetic manufacturers for their consistency, versatility, and compatibility with other active ingredients.

The powder form is expected to witness significant growth during the forecast period from 2025 to 2032, driven by its stability, longer shelf life, and convenience in formulation. Powdered ingredients are particularly favored in customized skincare and nutraceutical applications, allowing manufacturers to optimize concentration and potency.

- By Application

On the basis of application, the market is segmented into cosmetics, food and beverages, and others. The cosmetics segment accounted for the largest market share in 2024, fueled by the rising adoption of anti-ageing skincare products, increasing consumer awareness of skin health, and growing demand for anti-wrinkle and rejuvenation solutions. Cosmetic formulations including creams, serums, and masks are the primary drivers of this segment.

The food and beverages segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing inclusion of anti-oxidants, peptides, and other bioactive ingredients in functional foods and nutraceutical products. These ingredients cater to the growing consumer preference for beauty-from-within solutions, promoting skin health and overall wellness.

Anti-Ageing Ingredients Market Regional Analysis

- North America dominated the anti-ageing ingredients market with the largest revenue share of 38.75% in 2024, driven by high consumer awareness of skincare, widespread adoption of premium cosmetic products, and growing demand for natural and bioactive ingredients

- Consumers in the region highly value clinically proven, high-quality ingredients such as peptides, hyaluronic acid, and antioxidants, which are perceived to improve skin health and reduce visible signs of aging

- This widespread adoption is further supported by rising disposable incomes, strong presence of global cosmetic brands, and increasing e-commerce penetration, establishing North America as a key revenue-generating region for anti-ageing ingredients

U.S. Anti-Ageing Ingredients Market Insight

The U.S. anti-ageing ingredients market captured the largest revenue share in 2024 within North America, fueled by growing awareness about skin aging, UV protection, and oxidative stress. Consumers are increasingly investing in preventive and corrective skincare products containing advanced bioactive compounds. The rising popularity of premium cosmetic formulations, coupled with increasing e-commerce and direct-to-consumer channels, further propels the market. Moreover, partnerships between cosmetic brands and dermatologists are strengthening product trust and adoption.

Europe Anti-Ageing Ingredients Market Insight

The Europe anti-ageing ingredients market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent cosmetic safety regulations and growing preference for high-quality, natural ingredients. The region is witnessing strong demand for plant-derived antioxidants, peptides, and vitamins, especially in anti-ageing serums and creams. Increasing urbanization and disposable income, along with consumers’ inclination toward scientifically backed skincare, are further accelerating market growth.

U.K. Anti-Ageing Ingredients Market Insight

The U.K. anti-ageing ingredients market is expected to witness robust growth from 2025 to 2032, driven by rising skin health awareness and demand for premium cosmetic products. Consumers are increasingly seeking products with proven anti-ageing efficacy, leading to higher adoption of ingredients such as retinol, niacinamide, and hyaluronic acid. E-commerce growth and strong retail infrastructure are supporting market expansion. In addition, the trend toward sustainable and natural formulations is encouraging innovation among cosmetic manufacturers.

Germany Anti-Ageing Ingredients Market Insight

The Germany anti-ageing ingredients market is expected to witness rapid growth from 2025 to 2032, fueled by increasing consumer focus on anti-ageing solutions, digital skincare education, and preference for eco-friendly, bioactive ingredients. The market benefits from strong R&D capabilities, the presence of leading cosmetic companies, and regulatory emphasis on product safety. German consumers’ preference for high-quality and clinically tested skincare formulations further supports market adoption.

Asia-Pacific Anti-Ageing Ingredients Market Insight

The Asia-Pacific anti-ageing ingredients market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising disposable incomes, growing beauty and personal care industry, and increasing awareness of skin health. Countries such as China, Japan, and India are witnessing strong demand for premium, natural, and bioactive ingredients in anti-ageing products. Government initiatives promoting dermatological research, coupled with expanding e-commerce penetration, are boosting accessibility and adoption of advanced ingredients.

Japan Anti-Ageing Ingredients Market Insight

The Japan anti-ageing ingredients market is expected to witness significant growth from 2025 to 2032 due to high consumer awareness of skin aging, technological advancements in cosmetic formulations, and demand for convenience. Japanese consumers are increasingly adopting serums, creams, and supplements containing bioactive peptides, hyaluronic acid, and antioxidants. The integration of science-backed formulations and natural ingredients, along with a focus on premium product quality, is driving market expansion.

China Anti-Ageing Ingredients Market Insight

The China anti-ageing ingredients market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly growing middle class, increasing urbanization, and high adoption of beauty and personal care products. Chinese consumers are favoring natural, bioactive, and premium ingredients for skincare. Rising disposable income, booming e-commerce channels, and the presence of domestic and international cosmetic brands are key factors propelling market growth.

Anti-Ageing Ingredients Market Share

The Anti-Ageing Ingredients industry is primarily led by well-established companies, including:

• DOW (U.S.)

• Evonik Industries AG (Germany)

• Lonza (Switzerland)

• Ashland (U.S.)

• Contipro a.s. (Czech Republic)

• Croda International Plc (U.K.)

• BASF SE (Germany)

• Wacker Chemie AG (Germany)

• Clariant (Switzerland)

• BioThrive Sciences (U.S.)

• NUTRA HEALTHCARE (India)

• Auric (U.S.)

• Sollice Biotech (South Korea)

• Symrise (Germany)

• SpecialChem (France)

• Zymo Cosmetics (U.S.)

• Eastman Chemical Company (U.S.)

• Vantage Specialty Chemicals (U.S.)

• DSM (Netherlands)

• ADEKA CORPORATION (Japan)

Latest Developments in Global Anti-Ageing Ingredients Market

- In May 2023, SHISEIDO, product innovation, launched its "Revitalizing Complex EX+" technology in skincare products. This advanced formulation aims to improve skin elasticity, reduce wrinkles, and enhance overall skin appearance. The introduction of this technology strengthens SHISEIDO’s product portfolio, catering to growing consumer demand for effective anti-ageing solutions, and is expected to positively influence market adoption and brand loyalty.

- In March 2022, Beiersdorf AG, product launch, introduced the "NIVEA Cellular Filler" anti-ageing line targeting mature skin. The products feature innovative ingredients designed to restore skin volume, firmness, and smoothness. This launch enhances Beiersdorf’s presence in the premium anti-ageing segment, supports consumer trust in clinically backed formulations, and contributes to market growth through expanded product offerings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Anti Ageing Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Anti Ageing Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Anti Ageing Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.