Global Anti Infective Drugs Market

Market Size in USD Billion

CAGR :

%

USD

135.00 Billion

USD

184.70 Billion

2022

2030

USD

135.00 Billion

USD

184.70 Billion

2022

2030

| 2023 –2030 | |

| USD 135.00 Billion | |

| USD 184.70 Billion | |

|

|

|

|

Anti-Infective Drugs Market Analysis and Size

Anti-infective drugs have been a primary segment for several pharmaceutical companies for decades. Since the last two decades, the infection rate has increased considerably, mainly across the low and middle-income countries. Several advances in the formulation such as fixed-dose combination and increasing demand of diseases specific treatment are some of the major factors for the demand of antiviral drugs. The anti-infective drugs market is anticipated to grow hugely due to the increasing incidence of targeted diseases and awareness initiatives on anti-infective drugs.

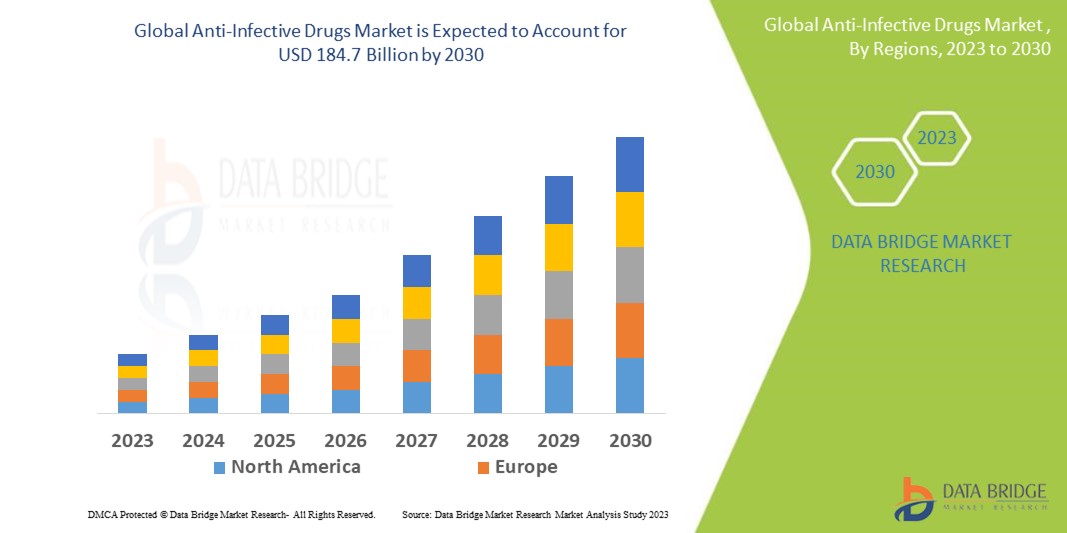

Data Bridge Market Research analyses a growth rate in the anti-infective drugs market in the forecast period 2023-2030. The expected CAGR of anti-infective drugs market is tend to be around 4% in the mentioned forecast period. The market was valued at USD 135 billion in 2022, and it would grow upto USD 184.7 billion by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Anti-Infective Drugs Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Antibiotics, Antivirals, Antifungals, Others), Indication (HIV Infections, Pneumonia, Hepatitis, Herpes Simplex Virus, Influenza, Others), Route of Administration (Oral, Topical, Parenteral, Others), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Takeda Pharmaceutical Company Limited (Japan), Johnsons & Johnsons Services Inc (U.S.), Boehringer Ingelheim International GmbH (Germany), Abbvie, Inc (U.S.), Sun Pharmaceutical Industries Ltd. (India), Sanofi (France), GSK Plc. (U.K.), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Amneal Pharmaceuticals LLC. (U.S.), Alvogen (U.S), and Hikma Pharmaceuticals PLC (U.K.), Amneal Pharmaceuticals LLC. (U.S.), Alembic Pharmaceuticals Limited (India), Zydus Group (India) |

|

Market Opportunities |

|

Market Definition

Anti-infective drugs belongs to a class of therapeutics which causes suppression of muscle spasms. These type of drugs help in the stimulation of smooth muscle relaxation especially in the gastrointestinal tract. Antispasmodic medications generally treat symptoms such as stomach pain and cramping. They are most commonly used for the treatment of irritable bowel syndrome symptoms.

Global Anti-Infective Drugs Market Dynamics

Drivers

- Increasing Awareness About Infectious Diseases

There has been major growth in the number of multidrug-resistant organisms across numerous parts of the world, that further surges the importance of innovation in the anti-infective agents. Numerous institutes have established specific initiatives or campaigns to increase the awareness about infectious diseases among the public. For instance, the World Health Organization performed the World Antimicrobial Awareness Week (WAAW) with the theme, ‘Spread Awareness, Stop Resistance’ in November 2021 to raise awareness about antimicrobial resistance. Thus, this awareness initiatives boost the market growth.

- Growing Demand for Oral Drugs

Oral drugs is estimated to increase the market growth. The segment is expected to rise the global market as many of the products are available in capsule form and tablet form and it is a very common and convenient route of administration.

Opportunities

- Launch of Anti-infective Drugs

Major market players are releasing many products that are helping in boosting the growth of the market. For instance, in February 2021, Pfizer announced the launch of the C. difficile Awareness Initiative. C. difficile is an infectious bacterium that can cause a serious and potentially life-threatening infection related with symptoms from diarrhea to severe intestinal inflammation. The article specified that an estimate of about 462,000 C. difficile infection cases were being registered in the U.S. each year. The growing number of initiatives by several organizations and major market players on spreading awareness regarding infectious diseases are projected to boost the market growth. Furthermore, Xellia Pharmaceuticals, which is a pharmaceutical manufacturer specializing in anti-infective treatments, in August 2021, opened its manufacturing site in Cleveland, Ohio in U.S. The company released the first anti-infectives which is manufactured at the site for distribution to U.S. hospitals. Such activities are projected to increase the market growth during the forecast period.

Restraints/Challenges

- Lack of skilled professionals

The huge lack of qualified personnel who are not aware of the drugs options to give patients to could hamper the growth of the global anti-infective drugs market during the forecast period 2023-2030.

- Side-effects of anti-infective drugs

Several side effects such as weakness, dizziness, blurred vision, rashes, nausea, dry mouth, and abdominal bloating hamper the market growth. Any of the drug use is restricted because of the government developed guidelines to monitor how and where the medications are utilized.

This anti-infective drugs market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the anti-infective drugs market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Anti-Infective Drugs Market Scope

The anti-infective drugs market is segmented on the basis of product type, indication, route of administration, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Antibiotics

- Antivirals

- Antifungals

- Others

Indication

- HIV Infections

- Pneumonia

- Hepatitis

- Herpes Simplex Virus

- Influenza

- Others

Route of Administration

- Oral

- Topical

- Parenteral

- Others

End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Anti-Infective Drugs Market Regional Analysis/Insights

The anti-infective drugs market is analyzed and market size insights and trends are provided by product type, indication, route of administration, distribution channel and end-user as referenced above.

The major countries covered in the anti-infective drugs market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America has been witnessing a positive growth for anti-infective drugs market throughout the forecasted period because of the sophisticated healthcare infrastructure, increasing awareness in society, well-established distribution channels, and a huge presence of e-commerce across the U.S. and Canada.

Asia-Pacific dominates the market because of the increasing attention of major market players to establish numerous emerging economics with significant growth. With the opening of several new hospitals and pharmacies in this area, the market is expanding.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Anti-Infective Drugs Market Share Analysis

The anti-infective drugs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to anti-infective drugs market

Key players operating in the anti-infective drugs market include:

- Takeda Pharmaceutical Company Limited (Japan)

- Johnsons & Johnsons Services Inc (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Abbvie, Inc (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Sanofi (France)

- GSK Plc. (U.K.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Amneal Pharmaceuticals LLC. (U.S.)

- Alvogen (U.S)

- Hikma Pharmaceuticals PLC (U.K.)

- Alembic Pharmaceuticals Limited (India)

- Zydus Group (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTI-INFECTIVE DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTI-INFECTIVE DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTI-INFECTIVE DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 INDUSTRY INSIGHTS

7 EPIDEMIOLOGY

7.1 DISEASE PREVALENCE BY COUNTRY

7.2 DISEASE INCIDENCE BY COUNTRY

7.3 RISK FACTORS

(FACTORS THAT INCREASE THE LIKELIHOOD OF DEVELOPING A DISEASE, SUCH AS AGE, GENDER, LIFESTYLE FACTORS, ENVIRONMENTAL EXPOSURES, AND GENETIC PREDISPOSITION)

7.4 HEALTHCARE UTILIZATION

(HOW THE DISEASE AFFECTS HEALTHCARE UTILIZATION, SUCH AS HOSPITALIZATIONS, EMERGENCY ROOM VISITS, AND OUTPATIENT VISITS)

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIAL STATUS

9.1.1 CANDIDATE/AGENT

9.1.2 PROPERTIES

9.1.3 COMPANY NAME

9.1.4 THERAPEUTIC AREA

9.1.5 PRODUCT NAME

9.1.6 GENERIC NAME

9.1.7 TYPE

9.1.8 RESEARCH CODE

9.1.9 INDICATION

9.1.10 ORIGINATOR

9.1.11 SPONSOR

9.1.12 COLLABORATOR

9.1.13 LICENSOR

9.1.14 LICENSEE

9.2 DISTRIBUTION OF PRODUCTS BY PHASE

9.2.1 PRECLINICAL/RESEARCH PROJECT

9.2.2 PHASE I

9.2.3 PHASE II

9.2.4 PHASE III

9.2.5 PHSE IV

9.3 NUMBER OF SUBJECTS IN CLINICAL TRIALS

9.3.1 PHASE I

9.3.2 PHASE II

9.3.3 PHASE III

9.4 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

9.4.1 PRECLINICAL/RESEARCH PROJECT

9.4.2 PHASE I

9.4.3 PHASE II

9.4.4 PHASE III

9.4.5 PHASE IV

9.5 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

9.5.1 PRECLINICAL/RESEARCH PROJECT

9.5.2 PHASE I

9.5.3 PHASE II

9.5.4 PHASE III

9.5.5 PHASE IV

9.6 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

9.6.1 PRECLINICAL/RESEARCH PROJECT

9.6.2 PHASE I

9.6.3 PHASE II

9.6.4 PHASE III

9.6.5 PHASE IV

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.12.1 FORECAST MARKET OUTLOOK

10.12.2 CROSS COMPETITION

10.12.3 THERAPEUTIC PORTFOLIO

10.12.4 CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13 PATENT ANALYSIS

13.1 PATENT LANDSCAPE

13.2 USPTO NUMBER

13.3 PATENT EXPIRY

13.3.1 US PATENT EXPIRY

13.3.2 EUROPE PATENT EXPIRY

13.4 EPIO NUMBER

13.5 PATENT STRENGTH AND QUALITY

13.6 PATENT CLAIMS

13.7 PATENT CITATIONS

13.8 PATENT LITIGATION AND LICENSING

13.9 FILE OF PATENT

13.1 PATENT RECEIVED CONTRIES

13.11 TECHNOLOGY BACKGROUND

14 COMPETITIVE INTELLIGENCE TRACKING DATA

14.1 CLINICAL TRIAL MONITORING ANALYSIS

14.2 REGULATORY AND COMMERCIAL MONITORING ANALYSIS

15 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY PRODUCT TYPE

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS )

15.1 OVERVIEW

15.2 ANTIBIOTICS DRUGS

15.2.1 CEPHALOSPORINS

15.2.1.1. CEPHALEXIN

15.2.1.1.1. MARKET VALUE (USD MILLION)

15.2.1.1.2. MARKET VOLUME (UNITS)

15.2.1.1.3. AVERAGE SELLING PRICE (USD)

15.2.1.2. CEFTRIAXONE

15.2.1.3. CEFUROXIME

15.2.1.4. CEFTAZIDIME

15.2.1.5. CEFIXIME

15.2.1.6. OTHER

15.2.2 PENICILLIN

15.2.2.1. AMOXICILLIN

15.2.2.2. AMPICILLIN

15.2.2.3. PENICILLIN G

15.2.2.4. METHICILLIN

15.2.2.5. AUGMENTIN

15.2.2.6. OTHER

15.2.3 FLUOROQUINOLONES

15.2.3.1. CIPROFLOXACIN

15.2.3.2. LEVOFLOXACIN

15.2.3.3. MOXIFLOXACIN

15.2.3.4. NORFLOXACIN

15.2.3.5. OTHER

15.2.4 MACROLIDES

15.2.4.1. AZITHROMYCIN

15.2.4.2. CLARITHROMYCIN

15.2.4.3. ERYTHROMYCIN

15.2.4.4. OTHER

15.2.5 CARBAPENEM

15.2.5.1. IMIPENEM

15.2.5.2. MEROPENEM

15.2.5.3. DORIPENEM

15.2.5.4. OTHER

15.2.6 TETRACYCLINES

15.2.6.1. DOXYCYCLINE

15.2.6.2. TETRACYCLINE

15.2.6.3. MINOCYCLINE

15.2.6.4. OTHER

15.2.7 AMINOGLYCOSIDES

15.2.7.1. GENTAMICIN

15.2.7.2. TOBRAMYCIN

15.2.7.3. AMIKACIN

15.2.7.4. STREPTOMYCIN

15.2.7.5. OTHER

15.2.8 GLYCOPEPTIDES

15.2.8.1. VANCOMYCIN

15.2.8.2. TEICOPLANIN

15.2.8.3. OTHER

15.2.9 OXAZOLIDINONES

15.2.9.1. LINEZOLID

15.2.9.2. OTHER

15.2.10 SULFONAMIDES

15.2.10.1. TRIMETHOPRIM-SULFAMETHOXAZOLE (TMP-SMX)

15.2.10.2. OTHER

15.2.11 OTHERS

15.2.11.1. CLINDAMYCIN

15.2.11.2. METRONIDAZOLE

15.2.11.3. NITROFURANTOIN

15.2.11.4. RIFAMPIN

15.2.11.5. OTHER

15.3 ANTIVIRALS DRUGS

15.3.1 NUCLEOSIDE/NUCLEOTIDE REVERSE TRANSCRIPTASE INHIBITORS (NRTIS)

15.3.1.1. LAMIVUDINE

15.3.1.2. ZIDOVUDINE

15.3.1.3. TENOFOVIR DISOPROXIL FUMARATE

15.3.1.4. EMTRICITABINE

15.3.1.5. ABACAVIR

15.3.1.6. OTHER

15.3.2 NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITORS (NNRTIS)

15.3.2.1. EFAVIRENZ

15.3.2.2. NEVIRAPINE

15.3.2.3. DELAVIRDINE

15.3.2.4. RILPIVIRINE

15.3.2.5. OTHER

15.3.3 PROTEASE INHIBITORS (PIS)

15.3.3.1. RITONAVIR

15.3.3.2. SAQUINAVIR

15.3.3.3. LOPINAVIR/RITONAVIR

15.3.3.4. ATAZANAVIR

15.3.3.5. DARUNAVIR

15.3.3.6. OTHER

15.3.4 INTEGRASE INHIBITORS

15.3.4.1. RALTEGRAVIR

15.3.4.2. DOLUTEGRAVIR

15.3.4.3. ELVITEGRAVIR

15.3.4.4. OTHER

15.3.5 FUSION INHIBITORS

15.3.5.1. ENFUVIRTIDE

15.3.5.2. IBALIZUMAB

15.3.5.3. OTHER

15.3.6 CCR5 ANTAGONISTS

15.3.6.1. MARAVIROC

15.3.6.2. OTHER

15.3.7 NEURAMINIDASE INHIBITORS

15.3.7.1. OSELTAMIVIR

15.3.7.2. ZANAMIVIR

15.3.7.3. PERAMIVIR

15.3.7.4. BALOXAVIR MARBOXIL

15.3.7.5. OTHER

15.3.8 POLYMERASE INHIBITORS (HCV)

15.3.8.1. SOFOSBUVIR

15.3.8.2. LEDIPASVIR-SOFOSBUVIR

15.3.8.3. GLECAPREVIR-PIBRENTASVIR

15.3.8.4. DACLATASVIR

15.3.8.5. OTHER

15.3.9 NEURAMINIDASE INHIBITORS (INFLUENZA)

15.3.9.1. OSELTAMIVIR

15.3.9.2. ZANAMIVIR

15.3.9.3. PERAMIVIR

15.3.9.4. BALOXAVIR MARBOXIL

15.3.9.5. OTHER

15.3.10 OTHER

15.4 ANTIFUNGAL

15.4.1 AZOLES

15.4.1.1. FLUCONAZOLE

15.4.1.2. ITRACONAZOLE

15.4.1.3. VORICONAZOLE

15.4.1.4. POSACONAZOLE

15.4.1.5. KETOCONAZOLE

15.4.1.6. OTHER

15.4.2 POLYENES

15.4.2.1. AMPHOTERICIN B

15.4.2.2. NYSTATIN

15.4.2.3. OTHER

15.4.3 ECHINOCANDINS

15.4.3.1. CASPOFUNGIN

15.4.3.2. MICAFUNGIN

15.4.3.3. ANIDULAFUNGIN

15.4.3.4. OTHER

15.4.4 ALLYLAMINES

15.4.4.1. TERBINAFINE

15.4.4.2. NAFTIFINE

15.4.4.3. OTHER

15.4.5 PYRIMIDINE ANALOGS

15.4.5.1. FLUCYTOSINE

15.4.5.2. GRISEOFULVIN

15.4.5.3. OTHER

15.4.6 TOPICAL ANTIFUNGALS

15.4.6.1. CLOTRIMAZOLE

15.4.6.2. MICONAZOLE

15.4.6.3. ECONAZOLE

15.4.6.4. KETOCONAZOLE

15.4.6.5. TERBINAFINE

15.4.6.6. OTHER

15.4.7 ANTIFUNGAL ANTIBIOTICS

15.4.7.1. NATAMYCIN

15.4.7.2. AMPHOTERICIN B

15.4.7.3. OTHER

15.4.8 TRIAZOLES

15.4.8.1. ISAVUCONAZOLE

15.4.8.2. RAVUCONAZOLE

15.4.8.3. ALBACONAZOLE

15.4.9 OTHER ANTIFUNGAL AGENTS:

15.4.9.1. CICLOPIROX

15.4.9.2. TAVABOROLE

15.4.9.3. EFINACONAZOLE

15.4.9.4. OTHER

15.5 ANTIPARASITIC DRUGS

15.5.1 ANTIMALARIAL DRUGS

15.5.1.1. CHLOROQUINE

15.5.1.2. ARTEMISININ AND ITS DERIVATIVES (ARTEMETHER, ARTESUNATE)

15.5.1.3. QUININE

15.5.1.4. MEFLOQUINE

15.5.1.5. ATOVAQUONE-PROGUANIL

15.5.1.6. PRIMAQUINE

15.5.1.7. DOXYCYCLINE

15.5.1.8. TAFENOQUINE

15.5.1.9. OTHER

15.5.2 ANTHELMINTICS

15.5.2.1. BENZIMIDAZOLES

15.5.2.1.1. ALBENDAZOLE

15.5.2.1.2. MEBENDAZOLE

15.5.2.1.3. OTHER

15.5.2.2. NICOTINIC AGONISTS

15.5.2.2.1. PYRANTEL PAMOATE

15.5.2.2.2. PYRVINIUM PAMOATE

15.5.2.2.3. OTHER

15.5.2.3. IVERMECTIN

15.5.2.4. PRAZIQUANTEL

15.5.2.5. DIETHYLCARBAMAZINE

15.5.2.6. OTHER

15.5.3 ANTIPROTOZOAL DRUGS

15.5.3.1. NITROIMIDAZOLES

15.5.3.1.1. METRONIDAZOLE

15.5.3.1.2. TINIDAZOLE

15.5.3.1.3. OTHER

15.5.3.2. QUINOLINES

15.5.3.2.1. CHLOROQUINE

15.5.3.2.2. HYDROXYCHLOROQUINE

15.5.3.2.3. OTHER

15.5.3.3. NITROFURANS

15.5.3.3.1. FURAZOLIDONE

15.5.4 PENTAMIDINE

15.5.5 ATOVAQUONE

15.5.6 OTHER

16 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY INDICATION

16.1 OVERVIEW

16.2 BACTERIAL INFECTIONS

16.2.1 PNEUMONIA

16.2.2 BRONCHITIS

16.2.3 SINUSITIS

16.2.4 CELLULITIS

16.2.5 WOUND INFECTIONS

16.2.6 GONORRHEA

16.2.7 SYPHILIS

16.2.8 CHLAMYDIA

16.2.9 PERITONITIS

16.2.10 DIVERTICULITIS

16.2.11 OSTEOMYELITIS

16.2.12 SEPTIC ARTHRITIS

16.2.13 BLOODSTREAM INFECTIONS (BACTEREMIA OR SEPSIS)

16.2.14 SURGICAL SITE INFECTIONS

16.2.15 MENINGITIS

16.2.16 DENTAL INFECTIONS

16.2.17 CONJUNCTIVITIS

16.2.18 KERATITIS

16.2.19 OTHER

16.3 VIRAL INFECTIONS

16.3.1 HUMAN IMMUNODEFICIENCY VIRUS (HIV) INFECTION

16.3.2 ACQUIRED IMMUNODEFICIENCY SYNDROME (AIDS)

16.3.3 INFLUENZA (FLU)

16.3.4 HERPES SIMPLEX VIRUS (HSV) INFECTIONS

16.3.5 VARICELLA-ZOSTER VIRUS (VZV) INFECTIONS

16.3.6 HEPATITIS B

16.3.7 HEPATITIS C

16.3.8 RESPIRATORY SYNCYTIAL VIRUS (RSV) INFECTION

16.3.9 HUMAN PAPILLOMAVIRUS (HPV) INFECTIONS

16.3.10 CYTOMEGALOVIRUS (CMV) INFECTIONS

16.3.11 OTHER

16.4 FUNGAL INFECTIONS

16.4.1 RAL THRUSH

16.4.2 VAGINAL YEAST INFECTION

16.4.3 RINGWORM

16.4.4 ATHLETE'S FOOT

16.4.5 CANDIDIASIS

16.4.6 ASPERGILLOSIS

16.4.7 CRYPTOCOCCAL MENINGITIS

16.4.8 OTHER

16.5 PARASITIC INFECTIONS

16.5.1 MALARIA

16.5.2 INTESTINAL WORM INFECTIONS

16.5.3 SCABIES

16.5.4 LICE INFESTATIONS

16.5.5 TOXOPLASMOSIS

16.5.6 TRYPANOSOMIASIS

16.5.7 LEISHMANIASIS

16.5.8 FILARIASIS (ELEPHANTIASIS)

16.5.9 OTHERS

17 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY DRUG TYPE

17.1 OVERVIEW

17.2 BRANDED

17.2.1 ANTIBIOTICS

17.2.1.1. AMOXIL

17.2.1.2. ZITHROMAX

17.2.1.3. CIPRO

17.2.1.4. BIAXIN

17.2.1.5. CLEOCIN

17.2.1.6. OTHER

17.2.2 ANTIVIRAL

17.2.2.1. TAMIFLU

17.2.2.2. RELENZA

17.2.2.3. ZOVIRAX

17.2.2.4. VALTREX

17.2.2.5. FAMVIR

17.2.2.6. CYTOVENE

17.2.2.7. COPEGUS

17.2.2.8. SOVALDI

17.2.2.9. HARVONI

17.2.2.10. VEKLURY

17.2.2.11. OTHER

17.2.3 ANTIFUNGAL

17.2.3.1. SPORANOX

17.2.3.2. DIFLUCAN

17.2.3.3. VFEND

17.2.3.4. NOXAFIL

17.2.3.5. NIZORAL

17.2.3.6. FUNGIZONE

17.2.3.7. MYCOSTATIN

17.2.3.8. OTHER

17.2.4 ANTIPARASITIC DRUGS

17.2.4.1. ARALEN

17.2.4.2. LARIAM

17.2.4.3. STROMECTOL

17.2.4.4. ALBENZA

17.2.4.5. BILTRICIDE

17.2.4.6. MALARONE

17.2.4.7. FLAGYL

17.2.4.8. OTHER

17.3 GENERICS

18 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY MODE OF PURCHASE

18.1 OVERVIEW

18.2 PRESCRIPTION

18.3 OVER THE COUNTER

19 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY ROUTE OF ADMINISTRATION

19.1 OVERVIEW

19.2 ORAL

19.2.1 TABLET

19.2.2 CAPSULE

19.2.3 LIQUID

19.2.4 OTHER

19.3 PARENTERAL

19.3.1 INTRAMUSCULARLY

19.3.2 SUBCUTANEOUSLY

19.3.3 INTRAVENOUS

19.4 TOPICAL

19.4.1 CREAMS

19.4.2 OINTMENTS

19.4.3 POWDERS

19.4.4 SPRAYS

19.5 INTRAVAGINAL

19.6 RECTAL

19.7 OTHER

20 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY PATIENT TYPE

20.1 OVERVIEW

20.2 PEDIATRIC

20.3 ADULT

20.3.1 MALE

20.3.2 FEMALE

20.4 GERIATRIC

20.4.1 MALE

20.4.2 FEMALE

21 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITAL & CLINICS

21.2.1 PUBLIC

21.2.2 PRIVATE

21.3 SPECIALTY CENTRES

21.4 AMBULATORYSURGICAL CENTER

21.5 TRAUMA CENTERS

21.6 HOME HEALTHCARE

21.7 OTHERS

22 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL PAHRMACIES

22.3.1 HOSPITAL ASSOCIATED PHARMACY

22.3.2 RETAIL PHARMACY

22.3.3 ONLINE PHARMACY

22.3.4 OTHER

22.4 OTHERS

23 GLOBAL ANTI-INFECTIVE DRUGS MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL ANTI-INFECTIVE DRUGS MARKET, BY GEOGRAPHY

GLOBAL ANTI-INFECTIVE DRUGS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1 NORTH AMERICA

24.1.1 U.S.

24.1.2 CANADA

24.1.3 MEXICO

24.2 EUROPE

24.2.1 GERMANY

24.2.2 U.K.

24.2.3 ITALY

24.2.4 FRANCE

24.2.5 SPAIN

24.2.6 RUSSIA

24.2.7 SWITZERLAND

24.2.8 TURKEY

24.2.9 BELGIUM

24.2.10 NETHERLANDS

24.2.11 DENMARK

24.2.12 SWEDEN

24.2.13 POLAND

24.2.14 NORWAY

24.2.15 FINLAND

24.2.16 REST OF EUROPE

24.3 ASIA-PACIFIC

24.3.1 JAPAN

24.3.2 CHINA

24.3.3 SOUTH KOREA

24.3.4 INDIA

24.3.5 SINGAPORE

24.3.6 THAILAND

24.3.7 INDONESIA

24.3.8 MALAYSIA

24.3.9 PHILIPPINES

24.3.10 AUSTRALIA

24.3.11 NEW ZEALAND

24.3.12 VIETNAM

24.3.13 TAIWAN

24.3.14 REST OF ASIA-PACIFIC

24.4 SOUTH AMERICA

24.4.1 BRAZIL

24.4.2 ARGENTINA

24.4.3 PERU

24.4.4 REST OF SOUTH AMERICA

24.5 MIDDLE EAST AND AFRICA

24.5.1 SOUTH AFRICA

24.5.2 EGYPT

24.5.3 BAHRAIN

24.5.4 UNITED ARAB EMIRATES

24.5.5 KUWAIT

24.5.6 OMAN

24.5.7 QATAR

24.5.8 SAUDI ARABIA

24.5.9 REST OF MEA

24.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL ANTI-INFECTIVE DRUGS MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL ANTI-INFECTIVE DRUGS MARKET, COMPANY PROFILE

26.1 JOHNSONS & JOHNSONS SERVICES INC

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPEMNTS

26.2 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPEMNTS

26.3 ABBVIE, INC

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPEMNTS

26.4 SUN PHARMACEUTICAL INDUSTRIES LTD.

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPEMNTS

26.5 SANOFI

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPEMNTS

26.6 GSK PLC.

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPEMNTS

26.7 NOVARTIS AG

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPEMNTS

26.8 PFIZER INC.

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPEMNTS

26.9 HIKMA PHARMACEUTICALS PLC

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPEMNTS

26.1 AMNEAL PHARMACEUTICALS LLC.

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPEMNTS

26.11 ALEMBIC PHARMACEUTICALS LIMITED

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPEMNTS

26.12 ZYDUS GROUP

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPEMNTS

26.13 FRESENIUS KABI

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPEMNTS

26.14 MERCK & CO., INC.

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPEMNTS

26.15 ROCHE HOLDING AG

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPEMNTS

26.16 ASTRAZENECA PLC

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPEMNTS

26.17 BAYER AG

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPEMNTS

26.18 ELI LILLY AND COMPANY

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPEMNTS

26.19 GILEAD SCIENCES, INC.

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPEMNTS

26.2 BRISTOL MYERS SQUIBB COMPANY

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPEMNTS

26.21 ASTELLAS PHARMA INC.

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPEMNTS

26.22 TAKEDA PHARMACEUTICAL COMPANY LIMITED

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPEMNTS

26.23 CIPLA LTD

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPEMNTS

26.24 LUPIN

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPEMNTS

26.25 GLENMARK PHARMACEUTICALS LTD.

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPEMNTS

26.26 DR. REDDY'S LABORATORIES LTD.

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPEMNTS

26.27 REGENERON PHARMACEUTICALS, INC.

26.27.1 COMPANY OVERVIEW

26.27.2 REVENUE ANALYSIS

26.27.3 GEOGRAPHIC PRESENCE

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPEMNTS

26.28 JIANGSU HENGRUI MEDICINE CO., LTD.

26.28.1 COMPANY OVERVIEW

26.28.2 REVENUE ANALYSIS

26.28.3 GEOGRAPHIC PRESENCE

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPEMNTS

26.29 GENETECH

26.29.1 COMPANY OVERVIEW

26.29.2 REVENUE ANALYSIS

26.29.3 GEOGRAPHIC PRESENCE

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPEMNTS

26.3 HETERO

26.30.1 COMPANY OVERVIEW

26.30.2 REVENUE ANALYSIS

26.30.3 GEOGRAPHIC PRESENCE

26.30.4 PRODUCT PORTFOLIO

26.30.5 RECENT DEVELOPEMNTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.