Global Anti Slip Additives Market

Market Size in USD Million

CAGR :

%

USD

469.72 Million

USD

667.99 Million

2024

2032

USD

469.72 Million

USD

667.99 Million

2024

2032

| 2025 –2032 | |

| USD 469.72 Million | |

| USD 667.99 Million | |

|

|

|

|

Anti-Slip Additives Market Size

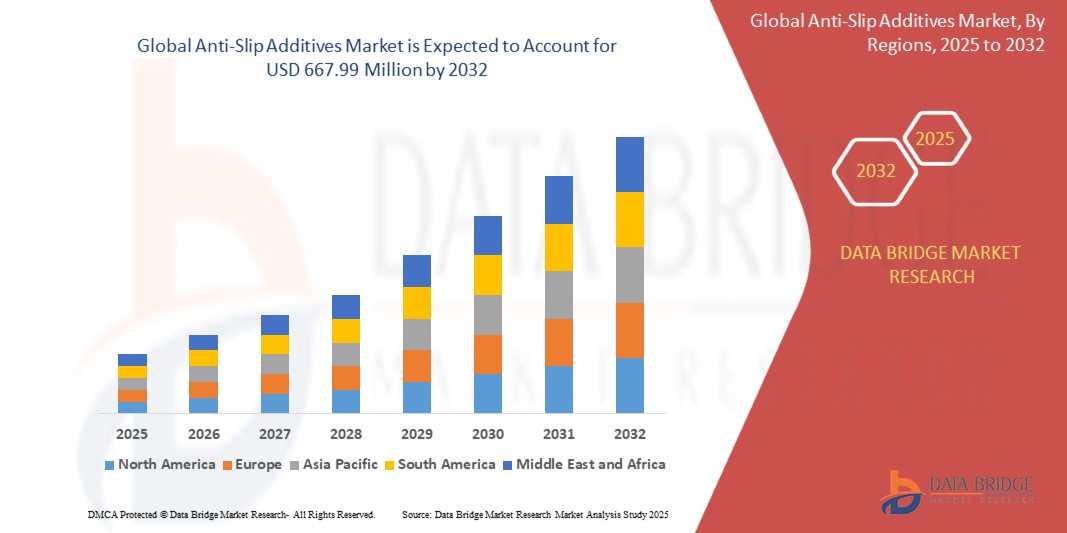

- The global anti-slip additives market size was valued at USD 469.72 million in 2024 and is expected to reach USD 667.99 million by 2032, at a CAGR of 4.50% during the forecast period

- Growth is primarily driven by rising demand for enhanced safety and slip resistance in construction, automotive, footwear, and electronics sectors globally.

- Increasing infrastructure investments, urbanization, and rising industrial production foster extensive use of anti-slip additives in building materials, flooring, and vehicle components.

- Sustainability trends and technological innovations leading to formulation of more durable, eco-friendly adhesives with superior bonding and slip resistance further fuel market growth.

Anti-Slip Additives Market Analysis

- Anti-slip additives are functional materials incorporated into coatings, sealants, and flooring systems to enhance surface traction and reduce the risk of slips and falls. Commonly used in flooring, decking, stairs, ramps, pool areas, industrial walkways, and marine applications, these additives ensure safety and durability in residential, commercial, and industrial environments.

- The market growth is primarily driven by stringent global safety regulations mandating slip-resistant surfaces in workplaces, public facilities, and residential spaces, along with rising awareness of occupational health and safety standards.

- Silica, aluminum oxide, and polymer-based additives are among the most widely used due to their durability, high friction performance, and compatibility with paints, epoxies, and sealants. Silica-based additives dominate in decorative flooring and construction, while aluminum oxide is preferred in heavy-duty industrial and marine coatings. Polymer and glass bead-based additives are gaining traction for eco-friendly and aesthetic applications.

- Asia-Pacific holds the largest market share, supported by booming construction activity, rapid urbanization, strong automotive and industrial growth, and large-scale infrastructure projects across China, India, Japan, and South Korea. Rising exports of paints, coatings, and flooring products further reinforce the region’s dominance.

- Europe exhibits steady demand, backed by mature automotive and construction sectors, along with strict EU occupational safety regulations. The region is also witnessing increasing adoption of sustainable and low-VOC coating solutions aligned with green building standards.

Report Scope and Anti-Slip Additives Market Segmentation

|

Attributes |

Anti-Slip Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Slip Additives Market Trends

Shift Towards Sustainable, High-Performance Surface Solutions

- Growing preference for eco-friendly, bio-based, and low-VOC additives due to stricter environmental regulations and rising consumer awareness.

- Development of high-performance additives with superior durability, abrasion resistance, and slip-prevention under extreme conditions.

- Increasing adoption of anti-slip additives in construction coatings, industrial flooring, and marine applications to enhance safety and longevity.

- Advances in nano-enhanced and polymer-modified additives providing better dispersion, slip resistance, and surface texture control.

- Post-pandemic emphasis on hygienic, safe, and sustainable environments has redefined demand in flooring, decking, and textile coatings, aligning with corporate sustainability goals.

Anti-Slip Additives Market Dynamics

Rising Construction, Industrial Growth, and Safety Regulations

- Rapid urbanization and infrastructure development drive demand for anti-slip flooring, decks, tiles, and coatings using additives for safety and durability.

- Expanding industrial and marine sectors are increasingly using anti-slip additives in paints and coatings for equipment, walkways, and ship decks.

- Stringent global workplace and building safety standards mandate slip-resistant surfaces, fueling adoption in residential, commercial, and industrial sectors.

- Growing consumer preference for safety-enhanced flooring and decorative coatings supports widespread use of anti-slip additives across end-use industries.

Restraint/Challenge

Raw Material Volatility and Performance Optimization Challenges

- Price fluctuations in raw materials such as silica, aluminum oxide, and polymer resins impact manufacturing costs and pricing strategies.

- Increasing demand for additives that ensure long-lasting slip resistance, weatherability, and eco-compliance requires continuous innovation, raising R&D investments.

- Competition from mechanical anti-slip methods and surface treatments may restrict adoption in certain applications.

- Challenges in achieving uniform dispersion, compatibility with diverse coating systems, and maintaining slip resistance under harsh conditions can limit broader market penetration.

Anti-Slip Additives Market Scope

The market is segmented on the basis of type, grit size and application.

- By Type

On the basis of type, the anti-slip additives market is segmented into aluminium oxide, fatty amides, polymer anti-slip additives, silica, and others. The aluminium oxide dominates the largest revenue share in 2024, attributed to its excellent hardness, durability, and high slip-resistance properties, making it the preferred choice in flooring, decks, and industrial coatings. Silica additives are widely used in architectural and decorative coatings due to their transparency and ability to maintain aesthetic appeal while improving surface grip.

Polymer-based anti-slip additives are gaining traction for their versatility, lightweight nature, and compatibility with a variety of coatings and substrates. Fatty amides provide cost-effective solutions in packaging and film applications by reducing surface friction. The others category includes specialty additives tailored for niche applications, such as eco-friendly and bio-based products. Aluminium oxide is further expected to witness the fastest growth from 2025 to 2032, driven by rising construction safety regulations and increasing demand for durable flooring solutions.

- By Grit Size

On the basis of grit size, the market is segmented into fine, medium, and coarse. The Fine-grit additives held the largest market share in 2024, owing to their widespread use in decorative coatings, paints, and flooring where a balance of aesthetics and slip resistance is critical. Medium-grit additives are commonly used in construction applications such as tiles, stair nosings, and wall claddings, providing enhanced traction without compromising finish quality.

Coarse-grit additives are favored in heavy-duty industrial environments, warehouses, and outdoor decks where maximum grip and durability are required. The construction sector continues to drive significant demand across all grit sizes, with medium-grit additives projected to record the highest CAGR during the forecast period, supported by urbanization and stricter workplace safety standards.

- By Application

On the basis of application, the Anti-Slip Additives market is segmented into packaging, adhesives, concrete sealers, paints and coatings, flooring, decks, and others. Paints and coatings represent the largest application segment in 2024, as anti-slip additives are extensively incorporated into architectural, marine, and industrial coatings to enhance surface safety. Flooring and decking applications also hold substantial shares due to the need for slip-resistant surfaces in residential, commercial, and outdoor spaces. Concrete sealers integrate anti-slip additives to ensure durable, safe surfaces in high-traffic and industrial areas.

The packaging sector leverages anti-slip additives in films and wraps to reduce slippage during storage and transportation. Adhesives and industrial applications continue to expand with the growing demand for chemical-resistant and high-performance bonding solutions. Building and construction remains the leading end-use industry, while paints and coatings are projected to witness the highest growth rate during 2025–2032, fueled by rising demand for sustainable, eco-friendly, and safety-compliant surface finishes.

Anti-Slip Additives Market Regional Analysis

- Asia-Pacific dominates the global anti-slip additives market with a 40.01% revenue share in 2024, driven by rapid urbanization, large-scale infrastructure development, and the expansion of construction, marine, industrial, and flooring applications across countries such as China, India, Japan, and South Korea. The region benefits from government-backed building safety regulations, rising consumer awareness about slip hazards, and a growing emphasis on sustainable and durable coatings.

- Consumers, construction firms, and industrial buyers in Asia-Pacific are increasingly adopting advanced and eco-friendly anti-slip additives in flooring, decking, tiles, paints, and coatings. Abundant raw materials, availability of cost-effective labor, and a strong manufacturing base further support the region’s market leadership.

- Growth is also boosted by government initiatives promoting green buildings, workplace safety compliance, and environmentally friendly formulations. Asia-Pacific’s role as a global manufacturing hub, combined with expanding exports and rising consumer demand for safety and quality, reinforces its dominant position in the anti-slip additives sector.

India Anti-Slip Additives Market Insight

India is expected to register strong CAGR growth, driven by infrastructure expansion, government urban development programs, and rapid growth in construction and industrial sectors. Initiatives such as “Smart Cities Mission” and “Make in India” accelerate the adoption of anti-slip coatings and flooring solutions enhanced with additives. Rising consumer safety awareness and stricter enforcement of building codes further support market growth.

China Anti-Slip Additives Market Insight

China leads the Asia-Pacific market, supported by its vast construction industry, strong industrial base, and global export presence. Large-scale infrastructure projects, booming real estate, and industrial manufacturing drive consumption of anti-slip additives in paints, flooring, and marine coatings. Proactive government policies promoting workplace safety, eco-friendly construction, and emission reduction are pushing manufacturers toward high-performance, sustainable additives. China’s focus on innovation and exports further solidifies its leadership in the global market.

U.S. Anti-Slip Additives Market Insight

The U.S. dominates the North American anti-slip additives market in 2024, supported by advanced infrastructure, stringent workplace safety regulations, and growing adoption in construction coatings, industrial flooring, marine, and transportation sectors. Rising preference for eco-friendly, low-VOC, and durable coating solutions fuels demand. Innovation in silica-based, aluminum oxide, and polymer-modified additives for paints and coatings further accelerates growth, with leading companies focusing on sustainability and compliance with OSHA standards.

Europe Anti-Slip Additives Market Insight

Europe is positioned for significant growth, driven by strict occupational safety laws, EU sustainability commitments, and high consumer awareness of slip hazards. Germany, France, and the U.K. are leading markets, supported by construction, marine, and automotive industries. EU-funded projects and technological advancements in durable, environmentally responsible additives are fostering adoption in flooring, decking, and decorative coatings. The region’s commitment to green construction practices is boosting the demand for advanced anti-slip additives.

U.K. Anti-Slip Additives Market Insight

The U.K. market is expected to grow steadily, supported by rising demand for slip-resistant flooring and coatings in hospitals, care facilities, transportation hubs, and retail spaces. Increasing regulatory focus on occupational safety and consumer brands launching slip-resistant products are key drivers. Adoption of eco-friendly and durable additives aligns with the country’s net-zero and sustainability targets, making it a key growth market within Europe.

Germany Anti-Slip Additives Market Insight

Germany’s anti-slip additives market is expanding consistently, supported by its strong industrial base, advanced construction practices, and strict safety regulations. The automotive, marine, and industrial flooring sectors are major adopters of high-performance additives. With Germany’s leadership in chemical innovations, manufacturers are investing in environmentally conscious and high-durability anti-slip additives for paints, coatings, and flooring solutions.

Anti-Slip Additives Market Share

The Anti-Slip Additives industry is primarily led by well-established companies, including:

- Sika AG (Switzerland)

- Henkel AG & Co. KGaA (Germany)

- 3M Company (U.S.)

- H.B. Fuller Company (U.S.)

- Arkema (France)

- Bostik SA (France)

- LORD Corporation (U.S.)

- Ashland Global Holdings Inc. (U.S.)

- Huntsman Corporation (U.S.)

- Dow (U.S.)

- BYK-Chemie GmbH (Germany)

- Evonik Industries AG (Germany)

- Rust-Oleum Corporation (U.S.)

- Associated Chemicals (U.S.)

- Saicos Colour GmbH (Germany)

Latest Developments in Global Anti-Slip Additives Market

- In March 2022, Daich Coatings introduced its innovative TracSafe Anti-Slip Color Coat, a product designed to enhance both safety and aesthetics. This advanced coating provides a durable, slip-resistant surface while adding a vibrant color finish, making it suitable for a wide range of residential and commercial applications. The launch reflects the company’s commitment to addressing growing consumer demand for multifunctional solutions that combine safety, style, and long-term protection.

- In May 2020, Ampacet unveiled its BOPE Film Masterbatch portfolio as part of its efforts to promote the circular economy. The product line, marketed under the BIAX4CETM additives range, includes anti-block, antistatic, migrating and non-migrating slip additives, along with high-performance antifog solutions. These innovations are specifically developed to enhance the functionality, recyclability, and sustainability of flexible packaging films, highlighting Ampacet’s strategic focus on eco-friendly product development.

- In May 2019, DuPont launched a new masterbatch solution for polyethylene (PE) blown film applications that integrates anti-blocking and anti-slip functionalities. This dual-purpose masterbatch improves process efficiency and film quality while reducing surface friction, making it highly beneficial for packaging films used in industries such as food, consumer goods, and industrial packaging. The development underscores DuPont’s continuous investment in advanced material technologies aimed at enhancing performance and safety in end-use applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Anti Slip Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Anti Slip Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Anti Slip Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.