Global Anti Slip Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

4.10 Billion

2024

2032

USD

2.50 Billion

USD

4.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 4.10 Billion | |

|

|

|

|

Anti-Slip Coatings Market Size

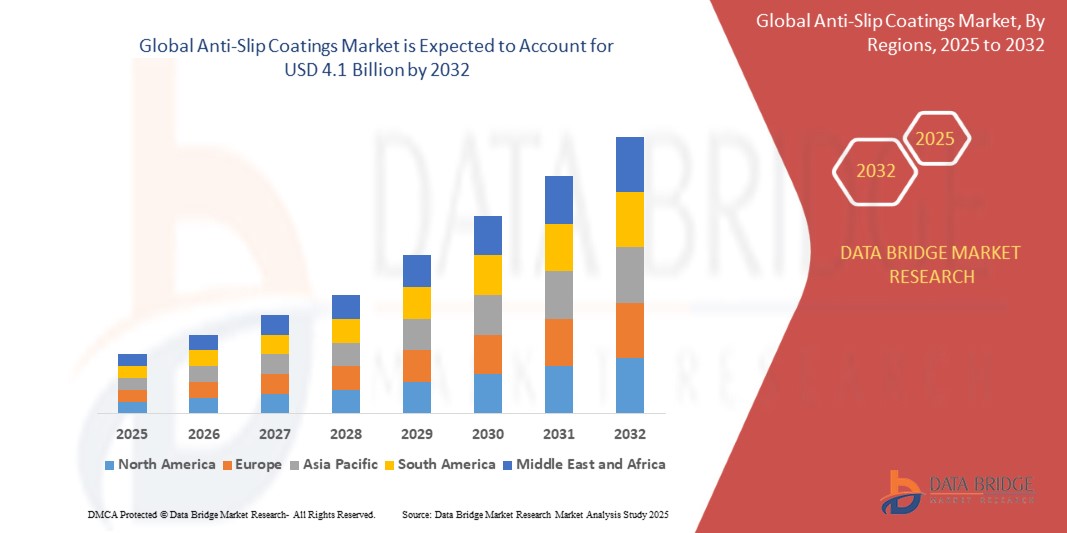

- The Global Anti-Slip Coatings Market size was valued at USD 2.5 billion in 2024 and is expected to reach USD 4.1 billion by 2032, at a CAGR of 6.70% during the forecast period

- This growth is driven by Rising adoption for anti-slip coatings in end-use industry including building and construction which includes commercial building, residential building, and industrial building is the vital factor escalating the market growth, also rising adoption of anti-slip coating products helps in the improvement of shine and luster.

Anti-Slip Coatings Market Analysis

- Anti-slip coatings are very helpful in avoiding accidents caused at high slippery areas including kitchen floor or bathroom floor where there are huge chances of spills. They are applied on rails, decks, floors, steps, and ramp and these coatings are wear resistant and resists acids, detergents, oils, among others.

- rising demand from coating industry owing to its superior properties, rise in cases of injuries caused due to slips and falls and imposing the regulations of application of anti-slip products and solutions are the major factors among others driving the anti-slip coatings market.

- North America is set to dominate the Anti-Slip Coatings Market with a 35% market share in 2024, driven by strong industrial demand, early tech adoption, and sustainability initiatives. R&D collaborations and regulatory backing enhance product innovation and eco-friendly development.

- Asia-Pacific is the fastest-growing region, expected to grow at a CAGR of 7.2% through 2032. Industrial expansion and rising production in China, India, and Japan are key drivers, with the region’s share projected to reach 32% by 2032

- Water-based coatings dominate the market, accounting for over 60% share in 2025, due to their low VOC content, environmental compliance, and ease of application across residential, commercial, and industrial sectors, especially in North America and Europe.

Report Scope and Anti-Slip Coatings Market Segmentation

|

Attributes |

Sol-Gel Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Slip Coatings Market Trends

“Growing Demand for Eco-Friendly and Low-VOC Coatings”

- A significant trend shaping the Global Anti-Slip Coatings Market is the rising preference for environmentally friendly, low-VOC (volatile organic compound) formulations due to increasing environmental regulations and sustainability goals.

- Manufacturers are investing in the development of water-based and bio-based anti-slip coatings that reduce emissions and health hazards without compromising on performance and durability.

For Instance,

- waterborne epoxy and polyurethane coatings are gaining popularity in industrial and commercial settings for their balance of slip resistance, ease of application, and minimal environmental impact.

- This trend is being driven by stricter regulations in regions like North America and Europe (e.g., REACH, EPA standards), as well as growing awareness among consumers and industries seeking safer, greener alternatives across sectors such as food processing, healthcare, and transportation.

Anti-Slip Coatings Market Dynamics

Driver

“Rising Emphasis on Workplace Safety and Regulatory Compliance”

- The growing focus on occupational safety standards across industries such as manufacturing, construction, transportation, and healthcare is a key driver for the Anti-Slip Coatings Market.

- Anti-slip coatings help reduce slip-and-fall incidents, which are among the most common workplace accidents globally. As a result, businesses are increasingly adopting these coatings to ensure safer work environments and comply with regulatory standards.

For instance,

- OSHA (Occupational Safety and Health Administration) in the U.S. and EU-OSHA in Europe have stringent regulations requiring non-slip surfaces in industrial and commercial facilities.

- This trend is particularly prominent in high-risk environments such as factories, warehouses, hospitals, and public infrastructure, where anti-slip solutions are essential for minimizing liability and ensuring employee and public safety.

For instance

- In March 2023, a major logistics company in Germany applied industrial-grade anti-slip floor coatings in its distribution centers to reduce injury claims and improve compliance with EU safety mandates, resulting in a 25% reduction in reported workplace accidents within a year.

- As safety continues to be a top priority across sectors, demand for anti-slip coatings is expected to rise globally, especially in developing economies modernizing their industrial and commercial facilities.

Restraint/Challenge

“Rising Emphasis on Workplace Safety and Regulatory Compliance”

- The growing focus on occupational safety standards across industries such as manufacturing, construction, transportation, and healthcare is a key driver for the Anti-Slip Coatings Market.

- Anti-slip coatings help reduce slip-and-fall incidents, which are among the most common workplace accidents globally. As a result, businesses are increasingly adopting these coatings to ensure safer work environments and comply with regulatory standards.

- For instance, OSHA (Occupational Safety and Health Administration) in the U.S. and EU-OSHA in Europe have stringent regulations requiring non-slip surfaces in industrial and commercial facilities.

- This trend is particularly prominent in high-risk environments such as factories, warehouses, hospitals, and public infrastructure, where anti-slip solutions are essential for minimizing liability and ensuring employee and public safety.

For instance,

- In March 2023, a major logistics company in Germany applied industrial-grade anti-slip floor coatings in its distribution centers to reduce injury claims and improve compliance with EU safety mandates, resulting in a 25% reduction in reported workplace accidents within a year.

- As safety continues to be a top priority across sectors, demand for anti-slip coatings is expected to rise globally, especially in developing economies modernizing their industrial and commercial facilities.

Anti-Slip Coatings Market Scope

The market is segmented on the basis of type, resin and end-user industries.

- By type

On the basis of type, the anti-slip coatings market is segmented into water-based and solvent-based. Water-based coatings dominate the market, accounting for over 60% share in 2025, due to their low VOC content, environmental compliance, and ease of application across residential, commercial, and industrial sectors, especially in North America and Europe.

Water-based coatings are also the fastest-growing segment, projected to grow at a CAGR of 6.8%, driven by increasing environmental regulations, sustainability trends, and rising demand for safer, eco-friendly solutions in emerging economies like India and China.

- By resin

On the basis of resin, the anti-slip coatings market is segmented into epoxy resin, polyurethane resin and polyaspartic & acrylic. Epoxy resin dominates the market due to its superior adhesion, chemical resistance, and durability, making it ideal for industrial and commercial flooring. Its cost-effectiveness and widespread use across construction and manufacturing sectors drive its market leadership.

Polyaspartic & acrylic resins are the fastest-growing segment owing to rapid curing times, UV stability, and decorative finish suitability. Their growing use in decorative and outdoor applications boosts adoption, especially in high-performance architectural and infrastructure projects.

- By end-user industries

On the basis of end-user industries, the anti-slip coatings market is segmented into building and construction and marine deck. The building and construction segment leads due to high demand for slip-resistant surfaces in residential, commercial, and industrial spaces. Increasing urbanization and stringent safety regulations across developed and emerging markets support continued dominance in this sector.

The marine deck segment is the fastest-growing, driven by rising maritime trade, port infrastructure upgrades, and safety standards requiring anti-slip surfaces on ship decks and docks. Growth is particularly strong in coastal economies and naval construction projects.

Anti-Slip Coatings Market Regional Analysis

- North America is set to dominate the Anti-Slip Coatings Market with a 35% market share in 2024, driven by strong industrial demand, early tech adoption, and sustainability initiatives. R&D collaborations and regulatory backing enhance product innovation and eco-friendly development.

- Continuous investments in R&D, supported by government and private funding, as well as collaborations between universities and industry players, are enhancing innovation in coating technologies

- In addition, the growing emphasis on sustainability and regulatory push for eco-friendly, low-VOC coatings further propels the market across North America.

U.S. Anti-Slip Coatings Market Insight

The U.S. leads in North America with 22.3% share in 2025, propelled by demand in aerospace, automotive, and electronics. High-performance, corrosion-resistant coatings and robust research funding continue to advance the country’s market position.

Canada Anti-Slip Coatings Market Insight

Canada’s market is growing through increased use in energy-efficient construction, healthcare, and defense. Investments in nanotechnology and sustainable building materials support innovation and broader adoption of advanced anti-slip coatings.

Europe Anti-Slip Coatings Market Insight

Europe held a 27.9% share in 2024, driven by strict environmental norms, demand for low-VOC coatings, and innovation in multifunctional and protective coatings for electronics, transport, and industrial uses.

U.K. Anti-Slip Coatings Market Insight

The U.K. benefits from advanced manufacturing and smart coating technologies, with rising demand in healthcare, public infrastructure, and defense. Emphasis on anti-microbial, anti-slip, and self-cleaning coatings boosts long-term growth.

Germany Anti-Slip Coatings Market Insight

Germany leads regional innovation with strong applications in automotive, semiconductors, and industrial sectors. Focus on performance-enhancing coatings like thermal, anti-scratch, and durable surface treatments drives high-value market growth.

Asia Pacific Anti-Slip Coatings Market Insight

Asia-Pacific is the fastest-growing region, expected to grow at a CAGR of 7.2% through 2032. Industrial expansion and rising production in China, India, and Japan are key drivers, with the region’s share projected to reach 32% by 2032.

China Anti-Slip Coatings Market Insight

China held a 21.1% global share in 2025, supported by growth in automotive, electronics, and renewable sectors. Government support for high-tech materials and domestic demand for safe, high-performance coatings propel rapid development.

Anti-Slip Coatings Market Share

The Sol-Gel Coatings industry is primarily led by well-established companies, including:

- Axalta Coating Systems LLC (U.S.)

- The Sherwin-Williams Company (U.S.)

- 3M (U.S.)

- RPM International Inc. (U.S.)

- CleanSafe Services (U.K.)

- PPG Industries Inc. (U.S.)

- No Skidding Products Inc. (Canada)

- Amstep Products (U.S.)

- HEMPEL A/S (Denmark)

- Paramelt (Netherlands)

- Randolph Products (U.S.)

- Wooster Products Inc. (U.S.)

- ITW Polymers Sealants North America (U.S.)

- Bonasystems (U.K.)

- Industrial Applications Inc. (U.S.)

- SafeMate Antislip Pty Ltd (Australia)

- Anti-Slip Anywhere (U.S.)

- Halo Surfaces Ltd (U.K.)

- Diamond Safety Concepts (U.S.)

Latest Developments in Global Anti-Slip Coatings Market

- In March 2025, PPG Industries launched a new water-based anti-slip floor coating with enhanced abrasion resistance and low VOC content for industrial and commercial use. The product targets eco-conscious markets in North America and Europe, aligning with growing sustainability regulations and offering improved safety in high-traffic areas.

- In January 2025, Axalta Coating Systems expanded its anti-slip product line with a nanotechnology-infused polyurethane coating designed for marine and offshore platforms. The new solution improves grip, corrosion resistance, and UV stability, addressing the harsh environmental conditions in maritime applications and supporting growing offshore infrastructure development.

- In November 2024, Sherwin-Williams announced a partnership with a U.S. construction firm to supply slip-resistant coatings for infrastructure renovation projects across five states. The initiative supports enhanced public safety in government buildings and transit systems, reflecting the increasing adoption of coatings in compliance with federal safety mandates.

- In August 2024, 3M introduced a high-performance anti-slip surface film targeted at the healthcare and hospitality sectors. The new film, featuring antimicrobial properties and easy-clean functionality, addresses growing concerns over hygiene and safety in high-footfall indoor spaces such as hospitals, airports, and hotels.

- In June 2024, HEMPEL A/S launched a solvent-free, anti-slip epoxy coating for the Asia-Pacific market. Designed for industrial floors, ports, and oil & gas facilities, the product aligns with regional environmental regulations and increasing demand for durable, high-performance coatings in expanding industrial zones across China and Southeast Asia.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Anti Slip Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Anti Slip Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Anti Slip Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.