Global Anti Viral Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.08 Billion

USD

6.36 Billion

2024

2032

USD

2.08 Billion

USD

6.36 Billion

2024

2032

| 2025 –2032 | |

| USD 2.08 Billion | |

| USD 6.36 Billion | |

|

|

|

|

What is the Global Anti-Viral Coatings Market Size and Growth Rate?

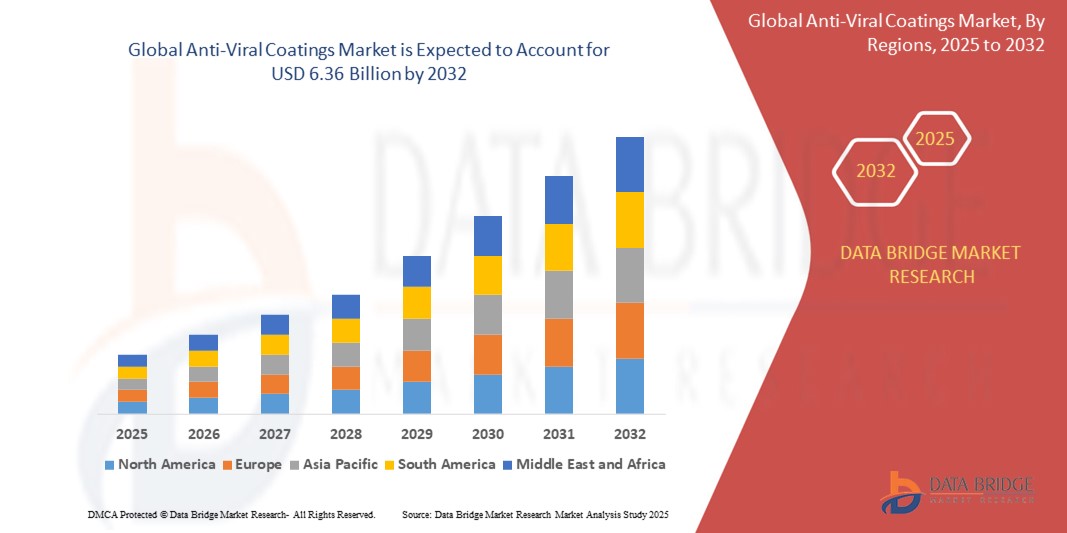

- The global anti-viral coatings market size was valued at USD 2.08 billion in 2024 and is expected to reach USD 6.36 billion by 2032, at a CAGR of 15.00% during the forecast period

- The anti-viral coatings market is experiencing significant growth, driven by heightened awareness of infection control and technological advancements in coating formulations. The COVID-19 pandemic has underscored the importance of effective infection prevention measures, leading to increased demand for anti-viral coatings

- Recent developments include innovations in antimicrobial agents and improved application techniques, which enhance the durability and effectiveness of these coatings

- Companies are actively investing in research and development to create coatings with longer-lasting protective properties, addressing both public health concerns and industry needs. Such advancements are fuelling market expansion as stakeholders adapt to evolving demands and leverage new technologies to improve infection control and safety

What are the Major Takeaways of Anti-Viral Coatings Market?

- Rising construction and renovation activities are significantly driving the demand for anti-viral coatings, reflecting a crucial market driver. The World Economic Forum highlights that construction-related spending accounts for approximately 13% of global GDP, underscoring the sector's substantial economic impact

- As the industry evolves to meet new safety standards and address heightened public health concerns, the incorporation of anti-viral coatings into both new builds and renovations has become increasingly strategic. Such is shift is driven by the need to enhance hygiene and prevent the spread of infections in various environments, from residential and commercial spaces to industrial facilities. Consequently fostering the anti-viral coatings market growth

- North America dominated the anti-viral coatings market with the largest revenue share of 39.8% in 2024, attributed to strong demand across healthcare, construction, and packaging sectors, especially in the U.S.

- Asia-Pacific is projected to grow at the fastest CAGR of 10.43% from 2025 to 2032, driven by large-scale construction, public health infrastructure upgrades, and rapid urbanization in China, India, and Southeast Asia

- The Nano Coatings segment dominated the market with the largest revenue share of 44.3% in 2024, owing to their superior antiviral efficacy, durability, and ability to be applied across various substrates

Report Scope and Anti-Viral Coatings Market Segmentation

|

Attributes |

Anti-Viral Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Anti-Viral Coatings Market?

“Development of Multifunctional, Long-Lasting, and Eco-Friendly Formulations”

- A key trend in the global anti-viral coatings market is the rapid innovation of multifunctional coatings that offer antiviral, antimicrobial, and self-cleaning properties. These formulations are being adopted across healthcare, transportation, and public infrastructure for enhanced surface protection

- For instance, researchers from the University of Queensland developed a copper-based coating that kills 99.9% of viruses within minutes, while companies such as Kastus Technologies are commercializing glass and ceramic coatings that are both durable and effective against viruses such as SARS-CoV-2

- The market is also shifting toward eco-friendly formulations. Water-based, VOC-free coatings are replacing traditional solvent-based alternatives to meet environmental standards

- Nanotechnology is playing a major role, with embedded nanoparticles (e.g., silver, zinc oxide, copper) providing extended antiviral activity without toxic side effects

- Major industry players such as Nano-Care Deutschland AG and Bio-Gate AG are investing heavily in R&D to create long-lasting coatings with improved adhesion and surface compatibility

- This trend is reshaping product design and regulatory compliance, pushing the market toward sustainable, performance-oriented antiviral solutions

What are the Key Drivers of Anti-Viral Coatings Market?

- Increasing global health concerns, especially post-COVID-19, have significantly boosted the demand for anti-viral coatings across hospitals, airports, schools, and public spaces, where infection control is a top priority

- In November 2023, Sherwin-Williams introduced an antimicrobial coating for commercial interiors that combines virus-killing and stain-resistance properties, further expanding the product's appeal

- The expansion of the healthcare sector, along with rising hygiene awareness among consumers, is driving widespread adoption in residential, commercial, and transportation applications

- Regulatory bodies across Europe, North America, and Asia are issuing hygiene mandates, prompting the use of antiviral surfaces in high-touch areas

- Rapid urbanization and growing investments in smart infrastructure projects are also contributing to the increased use of anti-viral coatings on building materials, transport interiors, and electronics

- Rising demand for touchless and hygienic environments in hospitality, retail, and consumer goods is expected to sustain market growth in the long term

Which Factor is challenging the Growth of the Anti-Viral Coatings Market?

- One of the major challenges in the anti-viral coatings market is the high cost of advanced formulations, particularly those involving nanomaterials or rare metal compounds, which limits affordability for mass-scale applications

- For instance, in June 2022, several U.S. schools delayed implementation of antiviral coating projects due to budget constraints and the premium pricing of certified antimicrobial paints

- Regulatory scrutiny is tightening across regions such as the E.U. and U.S., where proving efficacy against specific viruses requires expensive and time-consuming clinical trials

- Supply chain volatility, especially in sourcing silver, copper, and zinc nanoparticles, affects production timelines and pricing

- Limited awareness in developing countries, coupled with the lack of standardization in antiviral efficacy testing, impedes market penetration

- Despite innovation, challenges related to cost, regulatory hurdles, and scalability continue to restrict the broader adoption of anti-viral coatings, especially in price-sensitive and rural markets

How is the Anti-Viral Coatings Market Segmented?

The market is segmented on the basis of type of coatings, type of material, application, and form.

- By Type of Coatings

On the basis of type of coatings, the anti-viral coatings market is segmented into High-Performance Coatings, Nano Coatings, and Others. The Nano Coatings segment dominated the market with the largest revenue share of 44.3% in 2024, owing to their superior antiviral efficacy, durability, and ability to be applied across various substrates. Their nanoscale particles enable targeted virus deactivation, making them ideal for high-touch surfaces in healthcare and public infrastructure.

The High-Performance Coatings segment is projected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by their rising adoption in transportation, construction, and packaging sectors for long-lasting surface protection under extreme conditions.

- By Type of Material

On the basis of material, the market is segmented into Graphene, Silver, Silicon Dioxide, Copper, and Others. The Silver segment held the largest market revenue share of 39.6% in 2024, due to its broad-spectrum antimicrobial properties, long-lasting performance, and increasing use in hospitals, masks, gloves, and air filtration systems.

The Graphene segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2032, owing to its superior mechanical strength, high surface area, and recent advancements in graphene-based coatings for virus deactivation and wearable applications.

- By Application

On the basis of application, the anti-viral coatings market is segmented into Protective Clothing, Medical, Air and Water Treatment, Packaging, Building and Construction, and Others. The Medical segment dominated the market with a revenue share of 41.2% in 2024, driven by demand for antiviral surfaces in hospitals, clinics, and diagnostic labs. Increasing usage in medical devices, surgical tools, and patient-care environments is also fueling this segment.

The Protective Clothing segment is projected to record the fastest CAGR of 10.9% from 2025 to 2032, supported by rising demand for PPE kits, antiviral masks, gloves, and textiles in healthcare and industrial workplaces post-COVID-19.

- By Form

On the basis of form, the market is segmented into Spray, Powder, Liquid, and Others. The Liquid segment accounted for the largest revenue share of 45.8% in 2024, due to its ease of application, surface adhesion, and wide use across industries such as construction, automotive, and electronics.

The Spray segment is anticipated to register the fastest CAGR of 9.8% from 2025 to 2032, owing to increased demand for user-friendly, aerosol-based antiviral products for both personal and industrial use, especially in home care and facility management.

Which Region Holds the Largest Share of the Anti-Viral Coatings Market?

- North America dominated the anti-viral coatings market with the largest revenue share of 39.8% in 2024, attributed to strong demand across healthcare, construction, and packaging sectors, especially in the U.S.

- The region's growth is supported by advanced R&D infrastructure, strict infection control standards, and rising healthcare-associated infection (HAI) awareness in medical environments

- In addition, collaborations between coating manufacturers and government bodies for pandemic preparedness are boosting innovation and large-scale adoption of high-performance anti-viral coatings

U.S. Anti-Viral Coatings Market Insight

The U.S. dominates the North American market due to its robust pharmaceutical, medical devices, and smart coatings industries. The increasing demand for hospital-grade disinfectant surfaces and growing application in public infrastructure are major growth drivers. Leading companies such as Sherwin-Williams, Dow, and Hydromer are pioneering advanced nano-coating technologies. Federal initiatives around infection control, aging infrastructure upgrades, and rising consumer demand for antimicrobial packaging are reinforcing U.S. market dominance.

Canada Anti-Viral Coatings Market Insight

Canada’s anti-viral coatings market is expanding steadily, supported by increasing investments in healthcare infrastructure and public facility upgrades. Government-funded projects for long-term care centers and hospitals are driving the demand for antiviral surfaces. Academic-industry collaborations are promoting innovation in silver and copper-based coatings. Sustainability and infection-prevention standards are also increasing interest in eco-friendly formulations, enhancing Canada's position in North America’s protective coatings value chain.

Mexico Anti-Viral Coatings Market Insight

Mexico is witnessing rising demand for anti-viral coatings across commercial buildings, packaging, and food processing industries. The adoption of health-compliant coatings in schools, transport hubs, and public spaces has grown post-pandemic. Government emphasis on export-oriented pharmaceutical and food sectors has created demand for surface coatings that meet international hygiene standards. Partnerships with U.S.-based suppliers and local production capabilities are aiding market growth.

Which Region is the Fastest Growing in the Anti-Viral Coatings Market?

Asia-Pacific is projected to grow at the fastest CAGR of 10.43% from 2025 to 2032, driven by large-scale construction, public health infrastructure upgrades, and rapid urbanization in China, India, and Southeast Asia. Rising awareness of airborne infections and surface contamination post-COVID-19 has accelerated the adoption of anti-viral coatings in public facilities, healthcare, and transport. Government investments in hygiene improvement, especially in densely populated areas, are propelling demand for long-lasting, anti-pathogen surfaces. Strategic alliances with global coating technology firms and rising R&D spending in countries such as Japan and South Korea support regional market expansion.

China Anti-Viral Coatings Market Insight

China dominates the Asia-Pacific anti-viral coatings market owing to massive public infrastructure and healthcare construction. Government mandates for antimicrobial coating use in hospitals, metros, and airports have stimulated industry growth. Domestic companies are leveraging nanotechnology and rare-earth materials to produce high-efficacy coatings. In addition, export demand for coated packaging and medical equipment is contributing to China's growing influence in the global anti-viral coatings market.

India Anti-Viral Coatings Market Insight

India is emerging as a high-growth market, supported by expanding pharmaceutical, FMCG, and education sectors. Government schemes such as Swachh Bharat Abhiyan and the Smart Cities Mission have fueled demand for anti-viral coatings in public toilets, buses, and municipal buildings. Local manufacturers, in collaboration with academic institutions, are developing cost-effective antiviral formulations suited for tropical environments. Rising middle-class awareness about hygiene further drives the market.

Japan Anti-Viral Coatings Market Insight

Japan's market is driven by advanced research in material science and hygiene-centric consumer behavior. High adoption in electronics, healthcare devices, and residential construction reflects a preference for long-lasting antimicrobial surfaces. Innovations in graphene and silver-based coatings, supported by public-private R&D funding, are positioning Japan as a technology leader. Stringent regulatory standards and proactive government policy for elderly care infrastructure further support growth.

Which are the Top Companies in Anti-Viral Coatings Market?

The anti-viral coatings industry is primarily led by well-established companies, including:

- BioFence (Germany)

- Metalgrass LTD. (U.K.)

- Nova Surface-Care Center Pvt. Ltd. (India)

- NIPSEA Group (Singapore)

- Nano-Care Deutschland AG (Germany)

- Kastus Technologies Company Limited (Ireland)

- Arkema (France)

- Dais Corporation (U.S.)

- Hydromer (U.S.)

- KOBE STEEL, LTD. (Japan)

- Huntsman International LLC. (U.S.)

- The Sherwin-Williams Company (U.S.)

- EnvisionSQ (U.S.)

- Bio-Gate AG (Germany)

- dsm-firmenich (Netherlands)

- Dow (U.S.)

- DuPont (U.S.)

- Covestro AG (Germany)

- BASF (Germany)

- Evonik Industries AG (Germany)

What are the Recent Developments in Global Anti-Viral Coatings Market?

- In August 2022, PPG announced that two of its top-tier antiviral and antimicrobial coating products received the 2022 R&D 100 awards in the mechanical/materials category. The recognized products include Copper Armor antimicrobial paint—powered by Corning Guardiant technology—and Comex Vinimex Total antiviral and antibacterial paint. This recognition highlights PPG’s leadership in innovation and effectiveness in virus-resistant coatings

- In February 2022, Nippon Paint expanded its PROTECTON brand portfolio with the launch of two new antiviral and antibacterial water-based coating products designed for application on interior walls and floors. This strategic move strengthened Nippon Paint’s commitment to health-centric surface protection solutions

- In October 2020, Japan-based Yamamoto Holding Co. Ltd.'s proprietary antiviral glass coating technology, branded as Dr. HardoLass, was introduced in India through Nohara India. This launch marked a significant international expansion for Japanese antiviral technologies

- In June 2020, NIPSEA Group—the leading paint and coatings manufacturer in Asia—introduced a specialized anti-virus coil coating solution aimed at supporting global and Chinese public health efforts against infectious diseases. This product showcased the company’s proactive stance in responding to health crises with industrial innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Anti Viral Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Anti Viral Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Anti Viral Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.