Global Antibacterial Market

Market Size in USD Billion

CAGR :

%

USD

14.23 Billion

USD

20.39 Billion

2024

2032

USD

14.23 Billion

USD

20.39 Billion

2024

2032

| 2025 –2032 | |

| USD 14.23 Billion | |

| USD 20.39 Billion | |

|

|

|

|

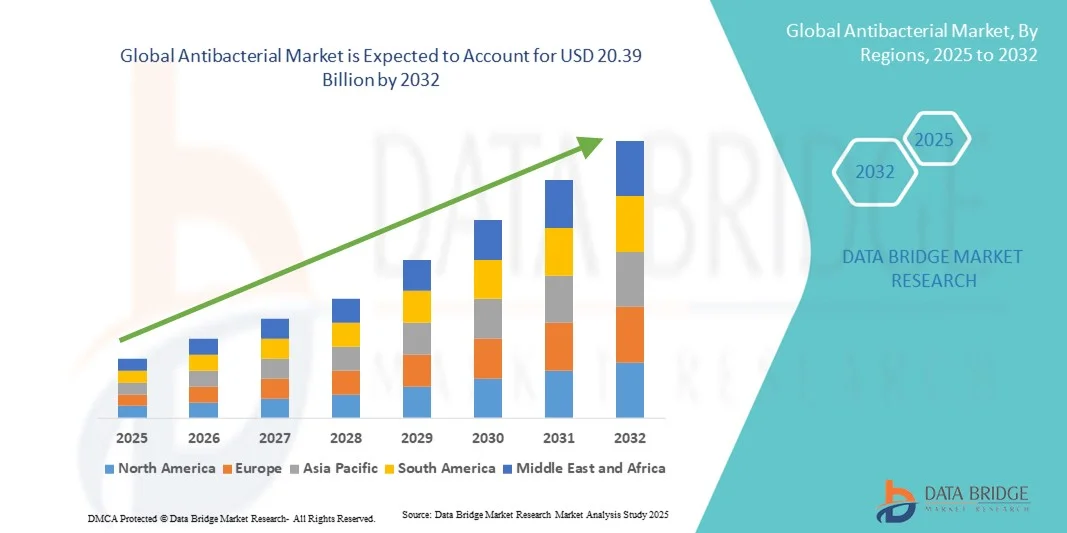

What is the Global Antibacterial Market Size and Growth Rate?

- The global antibacterial market size was valued at USD 14.23 billion in 2024 and is expected to reach USD 20.39 billion by 2032, at a CAGR of 4.60% during the forecast period

- Growing demand to control various crop related diseases, rising demand for new and mechanized techniques for farming or agriculture especially in the developing countries, rapidly changing climatic condition that causes bacterial infection, rising integration of advanced technology with the agricultural equipment and increasing industry competitiveness are the major factors attributable to the growth of antibacterial market

What are the Major Takeaways of Antibacterial Market?

- Growing prevalence of bacterial infections and other crop related diseases, rising production of cereals and food grains, growing demand for fruits and vegetables and increased focus on the research and development proficiencies will emerge as the major factors fostering the growth of the market

- Also, growing demand for effective and efficient crop protection tools to improve the crop productivity coupled with ever-rising global population is another important factor fostering the growth of the market. Growth in the demand for fruit and vegetable food items, growing demand for effective food safety protocols and rising globalization will further create lucrative and remunerative growth opportunities for the market

- North America dominated the antibacterial market with the largest revenue share of 35.35% in 2024, driven by rising demand for advanced crop protection solutions, technological adoption in agriculture, and increasing awareness about sustainable farming practices

- The Asia-Pacific antibacterial market is poised to grow at the fastest CAGR of 5.52% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Copper-Based segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its broad-spectrum efficacy, affordability, and established use in controlling bacterial and fungal plant diseases

Report Scope and Antibacterial Market Segmentation

|

Attributes |

Antibacterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Antibacterial Market?

Rising Demand for Sustainable and Eco-Friendly Formulations

- A major and rapidly emerging trend in the global antibacterial market is the growing focus on sustainable and eco-friendly formulations. Manufacturers are increasingly replacing harsh chemicals with biodegradable, plant-based, and low-toxicity ingredients to meet consumer preferences for safer, environmentally responsible products

- For instance, in 2024, Ecolab introduced a new line of eco-certified surface disinfectants, formulated to reduce environmental impact while maintaining high antimicrobial efficacy. Similarly, diverse plant-based antibacterials are being adopted in healthcare, food processing, and household segments to minimize chemical exposure

- Sustainability integration in antibacterials extends to packaging, with brands adopting recyclable, refillable, and minimal-waste formats, thus promoting circular economy principles. This approach aligns with regulatory and consumer demands for greener alternatives, while maintaining product effectiveness

- The trend encourages research into innovative delivery systems such as slow-release coatings, biodegradable wipes, and non-toxic liquid formulations, providing safer and more convenient solutions across industries

- Companies such as Reckitt Benckiser and Diversey are actively developing eco-friendly antibacterial solutions with certifications for reduced environmental footprint

- The growing consumer preference for sustainable, high-performance antibacterials is reshaping product development priorities across healthcare, industrial, and household sectors globally

What are the Key Drivers of Antibacterial Market?

- Increasing awareness of hygiene and infection control, particularly in healthcare, food processing, and residential settings, is driving the demand for Antibacterials globally

- For instance, in 2023, Clorox expanded its antibacterial portfolio with hospital-grade disinfectants to cater to heightened infection-prevention needs, supporting market growth

- Rising regulatory requirements and stringent hygiene standards in healthcare and food industries are compelling businesses to adopt advanced antibacterial solutions, boosting demand

- The COVID-19 pandemic accelerated adoption, making frequent cleaning, hand hygiene, and surface disinfection integral to public and workplace safety protocols

- Convenience features such as ready-to-use sprays, wipes, and automated dispensing systems, combined with multipurpose applications, further propel adoption in residential, commercial, and institutional segments

- The trend towards innovative, easy-to-use formulations and multi-surface compatibility is expanding the market across global sectors

Which Factor is Challenging the Growth of the Antibacterial Market?

- Concerns about chemical toxicity, skin irritation, and environmental impact of certain antibacterial agents present challenges for market expansion

- High reliance on synthetic chemicals such as quaternary ammonium compounds and chlorine-based disinfectants has raised regulatory scrutiny and consumer hesitancy

- For instance, reports highlighting potential toxicity and environmental persistence of some conventional antibacterials have slowed adoption in eco-conscious markets

- Manufacturers must invest in research for safer alternatives and educate consumers on correct usage to mitigate these concerns

- In addition, the relatively higher cost of green and certified antibacterial formulations compared to conventional products can limit adoption, especially in price-sensitive regions

- Overcoming these barriers with safer, cost-effective, and environmentally friendly solutions will be essential for sustained growth and wider market penetration

How is the Antibacterial Market Segmented?

The market is segmented on the basis of product type, crop type, mode of application, and form.

- By Product Type

On the basis of product type, the antibacterial market is segmented into Copper-Based, Dithiocarbamate, Amide, Antibiotic, and Others. The Copper-Based segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its broad-spectrum efficacy, affordability, and established use in controlling bacterial and fungal plant diseases. Farmers rely on copper-based formulations for their versatility across various crops and compatibility with integrated pest management programs. The segment’s demand is further strengthened by regulatory approvals and global familiarity among growers.

The Antibiotic segment is anticipated to witness the fastest growth at a CAGR of 19.2% from 2025 to 2032, fueled by increasing R&D and the adoption of advanced formulations for high-value crops. Rising awareness about crop yield protection and resistance management is expected to further drive the uptake of antibiotics and other specialty antibacterial products.

- By Crop Type

On the basis of crop type, the antibacterial market is segmented into Fruits and Vegetables, Cereals and Grains, Pulses and Oilseeds, and Others. The Fruits and Vegetables segment held the largest market revenue share of 42% in 2024, owing to their high susceptibility to bacterial infections, post-harvest losses, and the critical need for quality produce. Farmers increasingly adopt antibacterial treatments to prevent contamination and ensure export-grade yields.

The Cereals and Grains segment is projected to witness the fastest CAGR of 18.5% from 2025 to 2032, driven by rising demand for staple crops, technological adoption, and advanced antibacterial formulations to protect yield and quality. The segment benefits from mechanized application methods and improved disease forecasting, enhancing efficiency and crop protection outcomes.

- By Mode of Application

On the basis of mode of application, the antibacterial market is segmented into Foliar Spray, Soil Treatment, and Others. The Foliar Spray segment dominated the market with a revenue share of 45% in 2024, driven by its direct application on leaves, rapid absorption, and effectiveness in preventing bacterial infections at critical crop growth stages. Foliar sprays are preferred for their ease of use, immediate action, and compatibility with other crop protection chemicals.

The Soil Treatment segment is expected to witness the fastest growth at a CAGR of 20% from 2025 to 2032, fueled by the growing emphasis on root disease prevention, nutrient uptake enhancement, and integrated soil health management practices. Increasing awareness of preventive measures and long-term crop productivity is driving adoption in both commercial farms and high-value crop production.

- By Form

On the basis of form, the antibacterial market is segmented into Liquid, Water Dispersible Granule (WDG), and Wettable Powder. The Liquid segment held the largest revenue share of 40.7% in 2024, due to its ease of mixing, uniform application, rapid absorption, and suitability for large-scale spraying equipment. Liquids are widely used across fruits, vegetables, and cereals, providing consistent disease control and efficient crop coverage.

The Water Dispersible Granule (WDG) segment is anticipated to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by its convenience, precise dosing, reduced packaging waste, and compatibility with modern spraying systems. Increasing adoption of WDG formulations is particularly notable among commercial growers seeking efficiency, safety, and environmental compliance.

Which Region Holds the Largest Share of the Antibacterial Market?

- North America dominated the antibacterial market with the largest revenue share of 35.35% in 2024, driven by rising demand for advanced crop protection solutions, technological adoption in agriculture, and increasing awareness about sustainable farming practices

- Farmers and agribusinesses in the region highly value the efficiency, effectiveness, and consistency offered by antibacterial products in managing bacterial diseases and enhancing crop yield

- This widespread adoption is further supported by high investments in modern farming infrastructure, government incentives, and the growing preference for integrated pest management solutions, establishing Antibacterials as a preferred choice across various crop types

U.S. Antibacterial Market Insight

The U.S. antibacterial market captured the largest revenue share in 2024 within North America, fueled by strong adoption in fruits, vegetables, and cereals. Increasing use of precision agriculture, automated spraying systems, and advanced formulations is driving demand. In addition, the growing focus on food safety, disease prevention, and sustainable crop management is significantly contributing to market expansion.

Europe Antibacterial Market Insight

The Europe antibacterial market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict regulatory compliance, the need for crop protection, and rising adoption of modern agriculture techniques. Increasing urbanization and the growing demand for high-quality produce are fostering the use of Antibacterials across commercial farms. European farmers are particularly drawn to products that are environmentally safe, effective, and compatible with integrated pest management programs. The market is witnessing notable growth in fruits, vegetables, and cereals, with Antibacterials being applied in both conventional and organic farming setups.

U.K. Antibacterial Market Insight

The U.K. antibacterial market is anticipated to grow at a noteworthy CAGR, driven by the rising adoption of precision farming and a strong emphasis on sustainable crop protection solutions. Concerns about bacterial infections impacting yields and the increasing adoption of modern spraying equipment encourage farmers to integrate Antibacterials into regular crop management. In addition, government programs promoting eco-friendly agricultural practices are further supporting the growth of this market.

Germany Antibacterial Market Insight

The Germany antibacterial market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of crop diseases and a demand for technologically advanced, eco-conscious products. Germany’s highly developed agricultural infrastructure and emphasis on innovation promote the adoption of Antibacterials, particularly in high-value crops. Integration with precision agriculture solutions, soil and foliar monitoring systems, and eco-friendly application methods is becoming increasingly prevalent, aligning with local consumer and regulatory expectations.

Which Region is the Fastest Growing Region in the Antibacterial Market?

The Asia-Pacific antibacterial market is poised to grow at the fastest CAGR of 5.52% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing inclination toward modern farming techniques, coupled with government initiatives promoting sustainable agriculture, is driving Antibacterial adoption. Furthermore, as APAC emerges as a manufacturing and export hub for Antibacterial products, affordability and accessibility are expanding to a wider agricultural base.

Japan Antibacterial Market Insight

The Japan antibacterial market is gaining momentum due to the country’s high-tech agricultural practices, rapid urbanization, and increasing demand for high-value crops. Japanese farmers emphasize disease prevention, and Antibacterials are widely adopted in vegetables, fruits, and cereals. Integration with smart spraying equipment and precision agriculture systems is driving market growth, while Japan’s aging farmer population is encouraging solutions that simplify application and improve efficiency.

China Antibacterial Market Insight

The China antibacterial market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, an expanding middle class, and high adoption of modern agricultural technologies. China is a major market for vegetables, fruits, and cereals, and Antibacterials are increasingly applied to prevent crop losses and maintain yield quality. Government-backed smart farming initiatives, affordable Antibacterial options, and strong domestic manufacturing are key factors fueling market expansion across the country.

Which are the Top Companies in Antibacterial Market?

The antibacterial industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DuPont (U.S.)

- Dow (U.S.)

- Hanfeng Evergreen (Canada)

- LUXI GROUP (China)

- EcoChem (Belgium)

- Yara (Norway)

- Mosaic (U.S.)

- DAYANG CHEM (HANGZHOU) CO., LTD. (China)

- Shanxi Lvhai Agrochemicals (China)

- MITSUI & CO., LTD. (Japan)

- UPL (India)

- Syngenta Crop Protection AG (Switzerland)

- LANXESS (Germany)

- FMC Corporation (U.S.)

- ADAMA (Israel)

- ICL Fertilizers (Israel)

- Helena Agri-Enterprises, LLC (U.S.)

- Borealis AG (Austria)

- SABIC (Saudi Arabia)

What are the Recent Developments in Global Antibacterial Market?

- In May 2025, BioGenyx Therapeutics announced the introduction of NeoCillin X, a next-generation intravenous antibiotic effective against multidrug-resistant Gram-negative bacteria, following the completion of Phase 3 trials and conditional approval for emergency use in critical care units across the U.S., marking a major advancement in life-saving treatments

- In May 2025, Pharma Nova Inc., a Canadian startup, inaugurated its antibiotic innovation lab focusing on AI-integrated bacteriophage screening, representing a significant step forward in personalized infection control and the future of precision therapeutics

- In November 2024, Proactiv, a brand by Taro Pharmaceuticals Inc., launched a new line of innovation-driven skincare products specifically designed for acne-prone skin, including smoothing BHA cleanser, solution minis trial packs, resurfacing mask, and blemish control body cream, enhancing consumer options for effective skincare routines

- In October 2024, Dettol, a brand by Reckitt Benckiser Group PLC, in collaboration with NDTV, launched the 11th season of the Banega Swasth India campaign, originally initiated in 2014 to promote cleanliness and healthy living, reaffirming their long-term commitment to public health awareness in India

- In February 2021, a division of Novartis, Sandoz, signed a contract to acquire GSK’s cephalosporin business, aiming to strengthen its global market position and expand its portfolio in essential antibiotics, reinforcing its influence in the pharmaceutical sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.