Global Antibody Drug Conjugate Adc Oncology Market

Market Size in USD Billion

CAGR :

%

USD

1.28 Billion

USD

2.91 Billion

2025

2033

USD

1.28 Billion

USD

2.91 Billion

2025

2033

| 2026 –2033 | |

| USD 1.28 Billion | |

| USD 2.91 Billion | |

|

|

|

|

Antibody-Drug Conjugate (ADC) Oncology Market Size

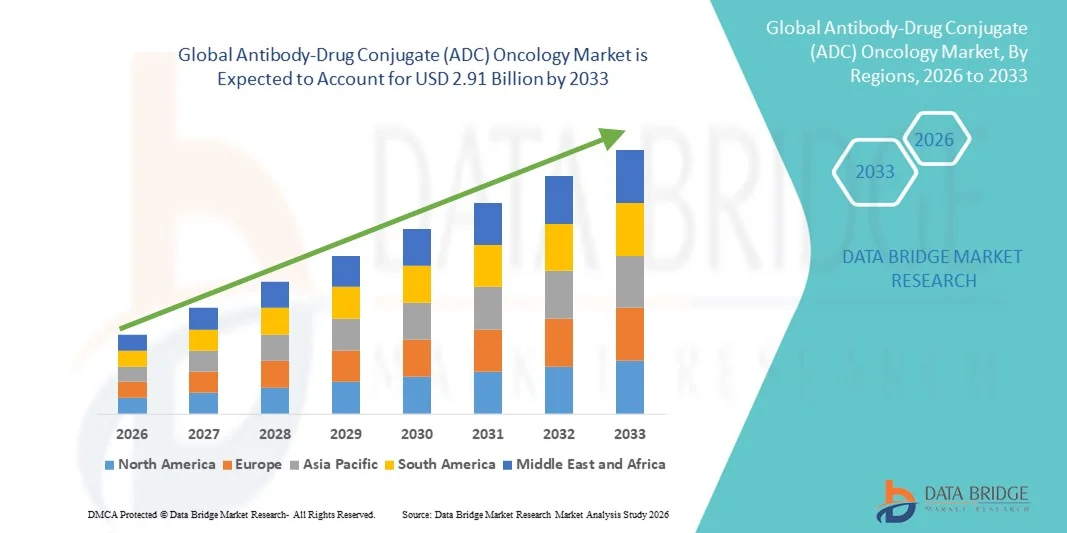

- The global Antibody-Drug Conjugate (ADC) oncology market size was valued at USD 1.28 billion in 2025 and is expected to reach USD 2.91 billion by 2033, at a CAGR of 10.80% during the forecast period

- The market growth is largely driven by the rising global cancer burden, increasing adoption of targeted cancer therapies, and strong advancements in ADC technology, including novel payloads, linkers, and site-specific conjugation methods

- Furthermore, growing clinical success of approved ADCs, expanding oncology pipelines, and increasing investment by biopharmaceutical companies are positioning ADCs as a highly effective and preferred treatment modality, thereby significantly accelerating overall market growth

Antibody-Drug Conjugate (ADC) Oncology Market Analysis

- Antibody-drug conjugates (ADCs), which combine the targeting specificity of monoclonal antibodies with the cytotoxic potency of chemotherapeutic agents, are increasingly becoming critical components of modern oncology treatment paradigms due to their ability to selectively destroy cancer cells while minimizing systemic toxicity

- The rising demand for ADCs is primarily driven by the growing global cancer incidence, increasing preference for targeted and personalized therapies, and continuous advancements in linker technologies, payloads, and tumor-specific antigens

- North America dominated the ADC oncology market with a revenue share of 48.2% in 2025, supported by a strong oncology drug pipeline, early adoption of biologics, favorable reimbursement frameworks, and the presence of leading biopharmaceutical companies, with the U.S. accounting for the majority of regional revenue

- Asia-Pacific is expected to be the fastest-growing region driven by expanding healthcare infrastructure, rising cancer prevalence, growing clinical trial activity, and increasing regulatory approvals in China and Japan

- The breast cancer segment dominated the ADC oncology market with a share of 42.9% in 2025, driven by the commercial success of HER2-targeted ADCs, expanding treatment indications, and strong adoption in both metastatic and early-stage breast cancer settings

Report Scope and Antibody-Drug Conjugate (ADC) Oncology Market Segmentation

|

Attributes |

Antibody-Drug Conjugate (ADC) Oncology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Antibody-Drug Conjugate (ADC) Oncology Market Trends

Shift Toward Next-Generation and Precision-Engineered ADCs

- A major and accelerating trend in the global ADC oncology market is the transition toward next-generation ADCs featuring improved linker stability, novel cytotoxic payloads, and enhanced tumor selectivity, significantly improving therapeutic efficacy and safety profiles

- For instance, the development of trastuzumab deruxtecan has demonstrated superior clinical outcomes across multiple HER2-expressing solid tumors, reinforcing industry focus on broader tumor applicability and optimized drug-to-antibody ratios

- Advances in site-specific conjugation and novel payload classes, such as topoisomerase I inhibitors, are enabling ADCs to overcome traditional limitations such as off-target toxicity and limited tumor penetration, thereby expanding their clinical potential

- The increasing integration of biomarker-driven patient selection and precision oncology approaches is allowing ADC developers to target specific tumor antigens more effectively, improving response rates and reducing adverse effects

- This evolution toward more potent, durable, and personalized ADC platforms is reshaping oncology drug development strategies, prompting companies such as Daiichi Sankyo and Seagen to aggressively expand their ADC pipelines and strategic collaborations

- The demand for advanced ADCs capable of addressing resistant and heterogeneous tumors is rising rapidly across both solid tumor and hematological cancer indications, reinforcing ADCs as a cornerstone of next-generation cancer therapeutics

- Growing partnerships between biopharmaceutical companies and contract development and manufacturing organizations (CDMOs) are further accelerating ADC innovation and reducing development timelines

Antibody-Drug Conjugate (ADC) Oncology Market Dynamics

Driver

Rising Cancer Burden and Demand for Targeted Therapies

- The increasing global incidence of cancer, coupled with the growing need for highly targeted and effective therapies, is a major driver fueling demand for antibody-drug conjugates in oncology

- For instance, in 2024, several ADCs received expanded regulatory approvals across new indications, reflecting strong clinical efficacy and reinforcing physician confidence in targeted biologic therapies

- As limitations of conventional chemotherapy, such as systemic toxicity and drug resistance, become more evident, ADCs offer a compelling alternative by selectively delivering potent cytotoxins directly to cancer cells

- Furthermore, rising investments in oncology R&D, coupled with favorable regulatory pathways for biologics, are accelerating ADC development and commercialization across global market

- The increasing adoption of personalized medicine approaches in oncology is further propelling ADC utilization, as these therapies align closely with biomarker-based treatment strategies

- Expanding clinical trial activity across solid tumors and hematological malignancies is strengthening the ADC pipeline and broadening future commercial opportunities

- Increased collaboration between academic research institutes and pharmaceutical companies is also supporting the discovery of novel tumor antigens suitable for ADC targeting

Restraint/Challenge

Complex Manufacturing, High Costs, and Safety Management Challenges

- The technical complexity of ADC development and manufacturing, including precise antibody conjugation and payload stability, presents a significant challenge to large-scale production and cost efficiency

- For instance, stringent quality control requirements and specialized manufacturing infrastructure can increase production timelines and costs, limiting rapid scalability for emerging ADC developers

- Managing ADC-associated toxicities, such as interstitial lung disease or hematological adverse events, requires careful patient monitoring and may restrict broader clinical adoption in certain populations

- In addition, the high treatment costs of ADCs compared to conventional therapies can limit accessibility, particularly in cost-sensitive healthcare systems and emerging markets

- Overcoming these challenges through manufacturing innovation, improved safety profiling, cost optimization, and expanded reimbursement coverage will be critical for sustaining long-term growth in the ADC oncology market

- Limited availability of specialized manufacturing facilities and skilled personnel further constrains ADC production capacity on a global scale

- Regulatory scrutiny related to long-term safety outcomes and post-marketing surveillance may also slow approvals and increase compliance burdens for ADC developers

Antibody-Drug Conjugate (ADC) Oncology Market Scope

The market is segmented on the basis of product, antibody type, application, and end user.

- By Product

On the basis of product, the global ADC oncology market is segmented into Enhertu, Kadcyla, Trodelvy, Adcetris, Polivy, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak, and Other ADC Products. The Enhertu segment dominated the market in 2025, driven by its strong clinical efficacy across multiple HER2-expressing cancers, including breast, gastric, and lung cancers. Enhertu’s ability to target both HER2-positive and HER2-low tumors has significantly expanded its eligible patient population. Its superior progression-free survival outcomes compared to earlier HER2-targeted therapies have led to rapid physician adoption globally. In addition, regulatory approvals across multiple indications and regions have strengthened its commercial performance. The drug’s innovative topoisomerase I inhibitor payload further enhances its therapeutic differentiation. These factors collectively position Enhertu as the leading revenue-generating ADC product in the market.

The Trodelvy segment is expected to witness the fastest growth during the forecast period, owing to its expanding use in triple-negative breast cancer and urothelial cancer. Trodelvy’s Trop-2 targeting mechanism addresses cancers with limited treatment options, driving high unmet clinical demand. Ongoing clinical trials evaluating its efficacy across additional solid tumors are expected to broaden its label indications. Increasing real-world evidence supporting survival benefits is further boosting physician confidence. Strategic partnerships and geographic expansion initiatives are accelerating market penetration. As a result, Trodelvy is anticipated to record robust growth compared to other ADC products.

- By Antibody Type

On the basis of antibody type, the market is segmented into monoclonal antibodies, bispecific antibodies, and antibody fragments. The monoclonal antibodies segment dominated the ADC oncology market in 2025, supported by their established clinical validation, manufacturing scalability, and regulatory familiarity. Most approved ADCs currently utilize monoclonal antibodies due to their high target specificity and predictable pharmacokinetics. Extensive historical data supporting their safety and efficacy has encouraged continued investment in this antibody format. Pharmaceutical companies favor monoclonal antibodies because of their compatibility with existing conjugation technologies. Their widespread use across multiple cancer types further reinforces their dominance. Consequently, monoclonal antibodies remain the backbone of current ADC development.

The bispecific antibodies segment is projected to grow at the fastest rate over the forecast period, driven by their ability to simultaneously target two tumor antigens or immune pathways. This dual-targeting capability enhances tumor selectivity and may reduce resistance mechanisms. Bispecific ADCs are gaining attention for treating heterogeneous and antigen-variable tumors. Advances in protein engineering are improving their stability and manufacturability. Increased R&D investment and early-stage clinical successes are accelerating pipeline expansion. These advantages position bispecific antibodies as a high-growth innovation area within the ADC market.

- By Application

On the basis of application, the market is segmented into breast cancer, hematological cancers, lung cancer, gynecological cancer, gastrointestinal cancer, genitourinary cancer, and other solid tumors / rare cancers. The breast cancer segment dominated the ADC oncology market in 2025 with a market share of 42.9%, primarily due to the widespread use of HER2-targeted ADCs such as Enhertu and Kadcyla. High global prevalence of breast cancer and established biomarker testing practices support ADC adoption. Strong clinical trial outcomes demonstrating improved survival have reinforced treatment guidelines favoring ADCs. The availability of multiple approved products across disease stages further strengthens market leadership. Continuous expansion into HER2-low populations has significantly enlarged the addressable patient base. These factors collectively drive sustained dominance of breast cancer applications.

The lung cancer segment is expected to witness the fastest growth during the forecast period, driven by rising lung cancer incidence and increasing identification of actionable molecular targets. ADCs addressing HER2 mutations and other emerging biomarkers are gaining momentum in non-small cell lung cancer treatment. Ongoing clinical trials are evaluating ADCs as alternatives to conventional chemotherapy and immunotherapy. Improved diagnostic testing and biomarker screening are facilitating patient selection. Pharmaceutical companies are prioritizing lung cancer in ADC pipeline development due to high unmet need. As a result, lung cancer applications are anticipated to grow rapidly.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty cancer centers, ambulatory care centers, home healthcare, research laboratories, and pharmaceutical companies. The hospitals segment dominated the ADC oncology market in 2025, as hospitals serve as primary treatment centers for cancer diagnosis, infusion therapy, and patient monitoring. ADC administration often requires specialized oncology infrastructure and trained healthcare professionals, which are readily available in hospital settings. Complex dosing regimens and management of adverse effects further necessitate hospital-based care. Hospitals also play a central role in clinical trial participation and post-approval surveillance. High patient inflow and reimbursement support reinforce hospital dominance. Consequently, hospitals remain the leading end users of ADC therapies.

The specialty cancer centers segment is expected to register the fastest growth during the forecast period, driven by increasing patient preference for specialized oncology care. These centers offer advanced diagnostic capabilities, precision medicine approaches, and access to novel ADC therapies through clinical trials. Growing investment in standalone cancer institutes is expanding their global footprint. Multidisciplinary treatment models enable optimized ADC utilization and patient outcomes. Rising awareness of targeted cancer treatments is further driving patient migration to specialty centers. This trend positions specialty cancer centers as a rapidly expanding end-user segment

Antibody-Drug Conjugate (ADC) Oncology Market Regional Analysis

- North America dominated the ADC oncology market with a revenue share of 48.2% in 2025, supported by a strong oncology drug pipeline, early adoption of biologics, favorable reimbursement frameworks, and the presence of leading biopharmaceutical companies, with the U.S. accounting for the majority of regional revenue

- Healthcare providers in the region highly value the clinical efficacy, targeted delivery, and improved safety profiles offered by ADCs compared to conventional chemotherapy, supporting their widespread use across major cancer indications

- This strong market position is further reinforced by favorable reimbursement policies, early regulatory approvals, extensive clinical trial activity, and the presence of leading biopharmaceutical companies, establishing North America as the primary hub for ADC innovation and commercialization

U.S. Antibody-Drug Conjugate (ADC) Oncology Market Insight

The U.S. ADC oncology market captured the largest revenue share of 75% in 2025 within North America, driven by high cancer prevalence, rapid adoption of advanced biologic therapies, and strong clinical trial activity. Oncologists in the U.S. increasingly prioritize targeted treatments that deliver improved efficacy with reduced systemic toxicity. The country’s well-established regulatory framework and early FDA approvals for novel ADCs further accelerate market uptake. Moreover, strong reimbursement coverage and significant investments by leading biopharmaceutical companies are reinforcing the U.S. position as the global leader in ADC innovation and commercialization.

Europe Antibody-Drug Conjugate (ADC) Oncology Market Insight

The Europe ADC oncology market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising cancer incidence and increasing adoption of precision oncology therapies. Growing awareness of targeted biologics among clinicians and patients is supporting ADC utilization across major European countries. The region benefits from strong academic research networks and collaborative clinical trials. In addition, favorable regulatory pathways for innovative oncology drugs and expanding access through national healthcare systems are fostering market growth across both Western and Eastern Europe.

U.K. Antibody-Drug Conjugate (ADC) Oncology Market Insight

The U.K. ADC oncology market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service’s focus on advanced cancer treatments and personalized medicine. Increasing investments in oncology research and early adoption of innovative biologics are driving ADC uptake. The presence of leading research institutions and active participation in global clinical trials further supports market expansion. In addition, rising awareness of targeted therapies among healthcare professionals is strengthening ADC adoption across multiple cancer indications.

Germany Antibody-Drug Conjugate (ADC) Oncology Market Insight

The Germany ADC oncology market is expected to expand at a considerable CAGR, fueled by the country’s strong healthcare infrastructure and emphasis on cutting-edge cancer treatment technologies. Germany’s leadership in clinical research and oncology innovation supports rapid integration of newly approved ADCs into treatment protocols. High healthcare expenditure and a strong focus on precision medicine are key contributors to market growth. Furthermore, favorable reimbursement policies and increasing collaboration between pharmaceutical companies and research centers are accelerating ADC adoption.

Asia-Pacific Antibody-Drug Conjugate (ADC) Oncology Market Insight

The Asia-Pacific ADC oncology market is poised to grow at the fastest CAGR during the forecast period, driven by rising cancer prevalence, expanding healthcare infrastructure, and improving access to advanced biologic therapies. Countries such as China, Japan, and India are witnessing increased investment in oncology R&D and clinical trials. Government initiatives supporting innovative drug development and faster regulatory approvals are further boosting market growth. In addition, growing awareness of targeted cancer therapies among physicians and patients is accelerating ADC adoption across the region.

Japan Antibody-Drug Conjugate (ADC) Oncology Market Insight

The Japan ADC oncology market is gaining momentum due to the country’s advanced healthcare system, strong focus on oncology innovation, and aging population with rising cancer incidence. Japanese clinicians increasingly adopt ADCs for their precision targeting and improved safety profiles. The presence of domestic pharmaceutical leaders actively developing ADC pipelines supports market growth. Moreover, Japan’s efficient regulatory approval process and strong participation in global oncology trials are facilitating faster ADC commercialization.

India Antibody-Drug Conjugate (ADC) Oncology Market Insight

The India ADC oncology market accounted for a significant revenue share within Asia-Pacific in 2025, driven by a rapidly growing cancer patient population and improving access to advanced cancer therapies. Expanding healthcare infrastructure and increasing adoption of biologics in major oncology centers are supporting market growth. India’s strong pharmaceutical manufacturing base and growing participation in global clinical trials further enhance market potential. In addition, rising awareness of targeted cancer treatments and gradual improvements in reimbursement are contributing to increased ADC adoption across the country.

Antibody-Drug Conjugate (ADC) Oncology Market Share

The Antibody-Drug Conjugate (ADC) Oncology industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Gilead Sciences, Inc. (U.S.)

- GSK plc (U.K.)

- ADC Therapeutics SA (Switzerland)

- Astellas Pharma Inc. (Japan)

- Mersana Therapeutics, Inc. (U.S.)

- Genmab A/S (Denmark)

- Amgen Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Regeneron Pharmaceuticals, Inc., (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Eli Lilly and Company (U.S.)

- Genentech, Inc. (U.S.)

- Sotio s.r.o. (Czech Republic)

- Oxford BioTherapeutics Ltd. (U.K.)

- ImmunoGen, Inc. (U.S.)

What are the Recent Developments in Global Antibody-Drug Conjugate (ADC) Oncology Market?

- In August 2025, the U.S. FDA granted Breakthrough Therapy Designation to ifinatamab deruxtecan (I-DXd), a potential first-in-class B7-H3 directed ADC, for patients with pretreated extensive-stage small cell lung cancer, recognizing its promising clinical benefit in a difficult-to-treat cancer

- In May 2025, China’s National Medical Products Administration (NMPA) approved disitamab vedotin (Aidixi/RC48) for treatment of HER2-positive advanced breast cancer with liver metastasis, marking expanded clinical availability of this HER2-targeted ADC in the Asia-Pacific region

- In January 2025, the U.S. Food and Drug Administration (FDA) approved Datroway (datopotamab deruxtecan), an antibody-drug conjugate developed by AstraZeneca and Daiichi Sankyo, for the treatment of unresectable or metastatic hormone receptor-positive, HER2-negative breast cancer, offering a new targeted therapy option for a common breast cancer subtype

- In March 2022, global pharma Sanofi and Seagen announced an exclusive collaboration to design, develop, and commercialize multiple antibody-drug conjugates for cancer targets, highlighting strategic industry partnerships shaping the ADC pipeline

- In June 2021, disitamab vedotin became the first homegrown antibody-drug conjugate approved in China for HER2-overexpressing locally advanced or metastatic gastric cancer, representing a landmark regulatory milestone for ADCs in the Chinese oncology market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.