Global Anticoagulants Rodenticides Market

Market Size in USD Million

CAGR :

%

USD

767.40 Million

USD

1,034.19 Million

2025

2033

USD

767.40 Million

USD

1,034.19 Million

2025

2033

| 2026 –2033 | |

| USD 767.40 Million | |

| USD 1,034.19 Million | |

|

|

|

|

Anticoagulants Rodenticides Market Size

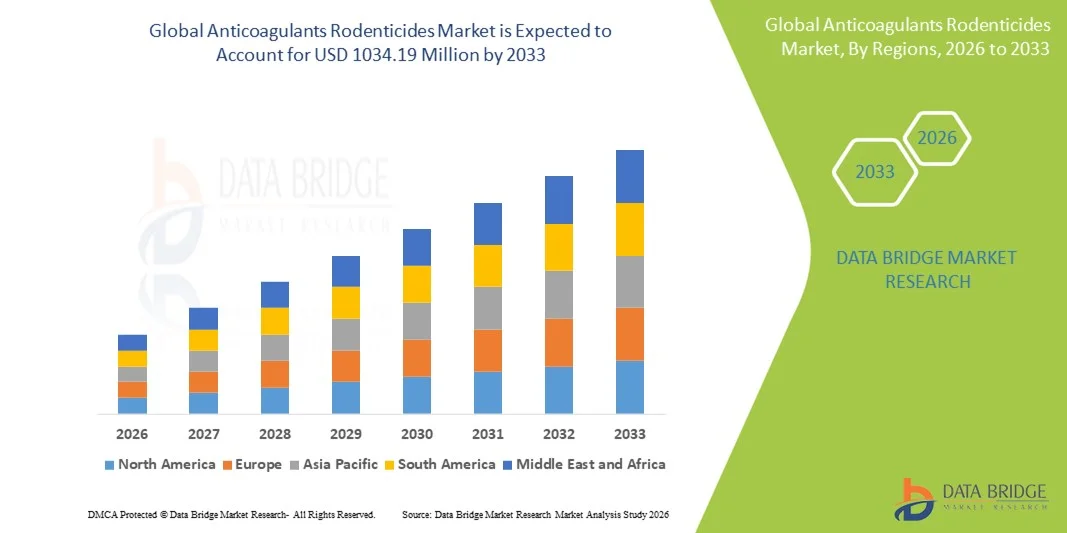

- The global anticoagulants rodenticides market size was valued at USD 767.4 million in 2025 and is expected to reach USD 1034.19 million by 2033, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by the increasing need for effective rodent control across agricultural, residential, and commercial sectors, driven by rising awareness of crop protection, food safety, and public health concerns

- Furthermore, growing adoption of high-efficacy anticoagulant rodenticides, including both FGAR and SGAR formulations, is establishing these solutions as the preferred choice for professional pest control services and DIY users alike. These converging factors are accelerating the uptake of anticoagulant rodenticides, thereby significantly boosting the industry's growth

Anticoagulants Rodenticides Market Analysis

- Anticoagulant rodenticides, offering targeted and long-lasting control of rodent populations, are increasingly vital in modern pest management programs across farms, warehouses, commercial establishments, and urban households due to their effectiveness, safety features, and ease of application

- The escalating demand for these rodenticides is primarily fueled by increasing rodent infestations, growing regulatory emphasis on food and environmental safety, and rising consumer preference for reliable, easy-to-use, and environmentally responsible pest control solutions

- North America dominated the anticoagulants rodenticides market with a share of 36.5% in 2025, due to increasing demand for effective rodent control in agricultural, residential, and commercial settings, as well as heightened awareness of food safety and public health concerns

- Asia-Pacific is expected to be the fastest growing region in the anticoagulants rodenticides market during the forecast period due to rapid urbanization, rising agricultural production, and increasing awareness of pest-borne diseases in countries such as China, Japan, and India

- SGAR segment dominated the market with a market share of 59.3% in 2025, due to their higher potency and ability to control resistant rodent populations with fewer doses. These compounds are preferred in both agricultural and urban settings due to their long-lasting effects and broader efficacy against various rodent species. SGARs are often chosen for areas where rapid and effective rodent management is critical, providing consistent results for both professional pest control services and large-scale farms. The market growth for SGARs is further supported by ongoing innovations in formulations and controlled-release pellets that enhance performance and safety. Their compatibility with automated bait stations and integration with digital monitoring systems also increases their adoption

Report Scope and Anticoagulants Rodenticides Market Segmentation

|

Attributes |

Anticoagulants Rodenticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anticoagulants Rodenticides Market Trends

Adoption of High-Efficacy and Eco-Friendly Rodenticides

- The growing concern over rodent-borne diseases and crop losses is significantly driving the adoption of high-efficacy anticoagulant rodenticides that can control resistant rodent populations effectively, offering both farmers and commercial establishments reliable solutions for infestation management

- For instance, BASF SE relaunched Neosorexa Plus Blocks with an improved flocoumafen formula, providing enhanced palatability and durability for effective rodent control even under extreme conditions, thereby reinforcing the trend of adopting high-performance rodenticides in agriculture and urban pest management

- The increasing focus on environmental safety and wildlife protection is accelerating the development and use of eco-friendly rodenticides that reduce the risk to non-target species while maintaining effective rodent control, helping manufacturers cater to regulatory and consumer demands

- Manufacturers are integrating rodenticides with smart monitoring systems and automated baiting solutions to improve precision and efficiency in rodent management, enabling better tracking of rodent activity and targeted application in both commercial and residential settings

- The rising preference for sustainable pest control products among commercial farms, warehouses, and urban households is creating a shift from traditional chemical rodenticides to formulations that are safer for humans, pets, and the environment, promoting broader adoption across regions

- This trend towards combining efficacy with environmental responsibility is expected to continue, as consumers and professional pest control operators increasingly prioritize solutions that deliver reliable results while minimizing ecological impact, shaping the overall growth trajectory of the market

Anticoagulants Rodenticides Market Dynamics

Driver

Rising Demand for Effective Rodent Control

- The surge in rodent populations across urban, agricultural, and commercial areas is compelling both individuals and organizations to seek reliable anticoagulant rodenticides that ensure comprehensive control and prevention of infestations

- For instance, Syngenta’s SecureChoice remote rodent monitoring system in the U.K. provides real-time detection of rodent activity, allowing pest professionals to implement timely control measures, demonstrating how technological integration drives the adoption of effective rodent control solutions

- Increasing awareness about the health risks associated with rodent-borne diseases and contamination of food products is driving demand for rodenticides that are potent, easy to apply, and safe for non-target species, emphasizing the critical role of effective pest management

- The need to protect high-value crops, stored grains, and commercial facilities from rodent damage is encouraging the use of advanced anticoagulants that offer longer-lasting results and require fewer applications, enhancing operational efficiency for users

- The adoption of rodenticides that combine high efficacy with safety compliance is becoming essential for integrated pest management strategies, as businesses and households increasingly rely on these solutions to maintain hygienic and safe environments

Restraint/Challenge

Regulatory and Environmental Constraints

- Strict regulations governing the use of anticoagulant rodenticides in different regions pose challenges for manufacturers and users, requiring adherence to safety guidelines and limiting the types or concentrations of active ingredients that can be marketed

- For instance, the European regulatory renewal of eight key anticoagulant substances with use-specific restrictions requires companies to adjust formulations and application methods, creating operational challenges while ensuring compliance with environmental safety standards

- Environmental concerns over bioaccumulation and impact on non-target species are restricting widespread application of certain high-potency anticoagulants, necessitating careful handling, monitoring, and disposal practices to mitigate ecological risks

- Compliance with national and regional safety standards increases production and operational costs, which can impact market penetration, particularly for smaller manufacturers or in price-sensitive regions where regulatory adaptation requires additional investment

- Overcoming these regulatory and environmental challenges requires innovation in safer, more targeted formulations and monitoring technologies, ensuring that effective rodent control can continue without compromising ecological integrity or legal compliance

Anticoagulants Rodenticides Market Scope

The market is segmented on the basis of type, first-generation anticoagulants, second-generation anticoagulants, end use, and mode of application.

- By Type

On the basis of type, the anticoagulants rodenticides market is segmented into FGAR (First-Generation Anticoagulants) and SGAR (Second-Generation Anticoagulants). The SGAR segment dominated the market with the largest market revenue share of 59.3% in 2025, driven by their higher potency and ability to control resistant rodent populations with fewer doses. These compounds are preferred in both agricultural and urban settings due to their long-lasting effects and broader efficacy against various rodent species. SGARs are often chosen for areas where rapid and effective rodent management is critical, providing consistent results for both professional pest control services and large-scale farms. The market growth for SGARs is further supported by ongoing innovations in formulations and controlled-release pellets that enhance performance and safety. Their compatibility with automated bait stations and integration with digital monitoring systems also increases their adoption.

The FGAR segment is anticipated to witness the fastest growth rate of 18.9% from 2026 to 2033, fueled by rising awareness of environmental safety and non-target species protection. FGARs are preferred in sensitive ecosystems due to their lower toxicity and shorter residual activity, making them suitable for residential and urban applications. Companies such as Bell Laboratories are increasingly promoting FGAR-based solutions for safe rodent control in public spaces and educational institutions. In addition, regulatory emphasis on minimizing environmental contamination is driving the gradual adoption of FGARs across various regions.

- By First-Generation Anticoagulants

On the basis of first-generation anticoagulants, the market is segmented into Chlorophacinone, Diphacinone, Coumatetralyl, and Warfarin. Chlorophacinone held the largest market revenue share in 2025, driven by its proven effectiveness in controlling rodents over multiple doses and its extensive use in agricultural and warehouse applications. Its moderate toxicity allows safe application in areas with human or pet activity, increasing adoption in residential settings. The market demand for Chlorophacinone is supported by its availability in diverse formulations such as pellets and powders, allowing flexible application according to infestation type. It is commonly used by professional pest control operators due to its predictability and reliability in integrated rodent management programs.

Diphacinone is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing demand in commercial and urban environments. For instance, companies such as Syngenta have developed Diphacinone-based rodenticides tailored for high-density areas where targeted, low-dose application is essential. Its versatility and compatibility with both bait stations and manual application make it attractive for end users seeking controlled rodent management. Increasing consumer preference for formulations that reduce risk to non-target species further supports its adoption.

- By Second-Generation Anticoagulants

On the basis of second-generation anticoagulants, the market is segmented into Brodifacoum, Bromadiolone, Difenacoum, Difethialone, and Flocoumafone. Brodifacoum dominated the segment with the largest market revenue share of 48.6% in 2025, driven by its extreme potency and effectiveness in eradicating resistant rodent populations in a single feeding. It is widely applied in commercial and agricultural areas where immediate rodent elimination is critical. The market growth for Brodifacoum is bolstered by its controlled formulation options, allowing precise dosing and safer handling. Its compatibility with automated bait stations enhances adoption in large-scale operations, while ongoing research improves palatability and environmental safety.

Difethialone is anticipated to witness the fastest CAGR from 2026 to 2033, driven by increasing adoption in both urban and rural pest management programs. For instance, BASF’s Difethialone-based rodenticides are promoted for their high efficacy with minimal environmental impact, supporting adoption in sensitive ecosystems. Its longer residual activity ensures effective control over successive rodent generations, providing cost-effective and reliable solutions for pest management professionals.

- By End Use

On the basis of end use, the anticoagulants rodenticides market is segmented into agricultural fields, warehouses, residential, and commercial. Agricultural fields dominated the market with the largest revenue share of 45.2% in 2025, driven by the need to protect crops from rodents that cause significant yield losses. Rodent infestations in large-scale farms often require high-potency SGAR formulations to manage resistant species effectively. The market demand is further supported by integrated pest management strategies that combine rodenticides with traps and monitoring systems. Agricultural operations also benefit from long-lasting formulations that reduce labor requirements and ensure sustained protection.

The residential segment is expected to witness the fastest growth rate of 19.4% from 2026 to 2033, fueled by increasing awareness of household rodent prevention and safety concerns. For instance, Reckitt Benckiser offers user-friendly rodenticide solutions suitable for homes and apartments, emphasizing non-toxic and controlled application. Rising urbanization and increased consumer focus on hygienic living conditions are driving the adoption of rodenticides in residential settings.

- By Mode of Application

On the basis of mode of application, the market is segmented into pellet, spray, and powder. The pellet segment dominated the market with the largest revenue share of 52.8% in 2025, driven by its ease of use, precise dosing, and compatibility with bait stations. Pellets provide consistent effectiveness, making them ideal for both agricultural and urban applications, while reducing accidental exposure to non-target species. Manufacturers are increasingly offering flavored and attractant-enhanced pellets to improve palatability and rodent consumption. The demand for pellet formulations is further reinforced by their long shelf life, ease of storage, and adaptability to various rodent management programs.

The spray segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for quick-action rodent control in localized areas. For instance, companies such as Tomcat provide spray-based anticoagulants that allow targeted application in tight spaces such as warehouses and commercial kitchens. The flexibility, rapid action, and ease of direct application to nests and burrows make sprays a growing preference among pest management professionals.

Anticoagulants Rodenticides Market Regional Analysis

- North America dominated the anticoagulants rodenticides market with the largest revenue share of 36.5% in 2025, driven by increasing demand for effective rodent control in agricultural, residential, and commercial settings, as well as heightened awareness of food safety and public health concerns

- Consumers in the region highly value advanced rodenticide solutions that offer prolonged efficacy, safety for non-target species, and ease of application in diverse environments such as farms, warehouses, and urban households

- This widespread adoption is further supported by strong regulatory frameworks, high disposable incomes, and the presence of leading pest control companies, establishing anticoagulant rodenticides as a preferred solution for both professional and DIY pest management

U.S. Anticoagulants Rodenticides Market Insight

The U.S. anticoagulants rodenticides market captured the largest revenue share in 2025 within North America, fueled by widespread adoption in agriculture and commercial facilities. Increasing concerns over crop losses and rodent-borne diseases are driving demand for potent SGAR formulations. The market is further propelled by growing adoption of integrated pest management strategies and increasing consumer preference for pellet-based and easy-to-use solutions. Moreover, the presence of leading market players such as Bell Laboratories and Syngenta is significantly contributing to product innovation and market expansion.

Europe Anticoagulants Rodenticides Market Insight

The Europe anticoagulants rodenticides market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent regulations on food safety and pest control standards. Rising urbanization and the need for effective rodent management in commercial, residential, and industrial spaces are fostering adoption. Consumers and businesses in the region prefer solutions that balance efficacy with environmental safety, driving demand for FGAR formulations. The region also sees increasing growth across warehouses, farms, and residential sectors where rodent infestations pose significant challenges.

U.K. Anticoagulants Rodenticides Market Insight

The U.K. anticoagulants rodenticides market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by concerns over food contamination, urban rodent infestations, and demand for efficient pest control. The growing preference for non-toxic and controlled application products encourages both households and commercial operators to adopt modern rodenticides. The U.K.’s robust pest control industry infrastructure and rising awareness about integrated rodent management strategies continue to stimulate market growth.

Germany Anticoagulants Rodenticides Market Insight

The Germany anticoagulants rodenticides market is expected to expand at a considerable CAGR during the forecast period, fueled by strict regulations on environmental protection and rodenticide use. Germany’s advanced agricultural sector and well-established warehousing facilities drive the adoption of high-efficacy rodenticides. The emphasis on eco-friendly and sustainable pest control solutions is encouraging manufacturers to provide FGAR and SGAR options that align with regulatory compliance while maintaining performance standards.

Asia-Pacific Anticoagulants Rodenticides Market Insight

The Asia-Pacific anticoagulants rodenticides market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, rising agricultural production, and increasing awareness of pest-borne diseases in countries such as China, Japan, and India. The region’s growing middle class and government initiatives promoting food safety are fueling adoption of effective rodent control solutions. Furthermore, the expansion of domestic manufacturers and cost-effective product offerings is increasing accessibility for farmers and commercial users.

Japan Anticoagulants Rodenticides Market Insight

The Japan anticoagulants rodenticides market is gaining momentum due to high technological adoption in agriculture and urban pest management. Increasing demand for safe and easy-to-apply rodent control solutions in both residential and commercial sectors is supporting market growth. Integration of pellet and spray formulations, along with awareness campaigns on rodent-borne diseases, is further driving adoption. The aging population is also likely to boost demand for convenient, ready-to-use rodenticides in household applications.

China Anticoagulants Rodenticides Market Insight

The China anticoagulants rodenticides market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expanding agricultural activities, and increasing concern over public health. China is a key market for both FGAR and SGAR formulations, with strong domestic manufacturing capabilities supporting wide availability. The growing focus on rodent control in warehouses, commercial establishments, and residential areas, along with affordability of rodenticide products, are major factors propelling the market in China.

Anticoagulants Rodenticides Market Share

The anticoagulants rodenticides industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta AG (Switzerland)

- UPL Limited (India)

- Liphatech Inc. (U.S.)

- JT Eaton (U.S.)

- Neogen Corporation (U.S.)

- Pelgar International (U.K.)

- Senestech Inc. (U.S.)

- Bell Laboratories (U.S.)

- Impex Europa (U.K.)

- Rentokil Initial Plc (U.K.)

- Terminix (U.S.)

- Ecolab Inc. (U.S.)

- Anticimex (Sweden)

- Rollins Inc. (U.S.)

- Truly Nolen (U.S.)

- Abell Pest Control (U.S.)

Latest Developments in Global Anticoagulants Rodenticides Market

- In August 2025, Bayer AG introduced a new line of biodegradable anticoagulant rodenticides designed to maintain high rodent-control efficacy while significantly reducing environmental impact. This development addresses increasing regulatory and consumer demand for eco-friendly pest management solutions, enabling adoption in environmentally sensitive areas such as agricultural fields, urban spaces, and conservation zones. The introduction of these products is expected to strengthen market growth by appealing to a wider range of end-users who prioritize sustainable pest control practices

- In May 2025, Neogen Corporation secured exclusive licensing rights to distribute Syngenta’s brodifacoum-based rodenticides, including Talon-G and Talon Weatherblok XT, across the U.S. and Canada. This strategic collaboration enhances product availability, optimizes supply chain efficiency, and ensures timely delivery to commercial and agricultural customers. The expanded distribution network is expected to accelerate adoption of high-efficacy rodenticides in North America, supporting growth in both professional pest control services and large-scale agricultural operations

- In May 2025, the European regulatory authorities renewed approval for eight key anticoagulant rodenticide active substances, including Brodifacoum, Flocoumafen, Coumatetralyl, Chlorophacinone, Difethialone, Difenacoum, and Bromadiolone, with certain use-specific restrictions. This approval stabilizes market supply across Europe and reassures manufacturers and distributors regarding the continued legality and compliance of their products. The regulatory clarity fosters investor confidence, encourages product innovation, and sustains the widespread availability of both FGAR and SGAR formulations

- In October 2024, BASF relaunched its popular rodenticide, Neosorexa, and introduced the new Neosorexa Plus Blocks with an improved flocoumafen formulation. The new product combines enhanced palatability and durability, ensuring effective control of rodents, including resistant species, even under extreme environmental conditions. Its rapid action, achieving results in as little as 14 days, strengthens BASF’s market position and provides farmers with a reliable and high-performance solution

- In October 2023, Syngenta launched its SecureChoice remote rodent monitoring system in the U.K., offering 24/7 proactive detection of rodent activity in real time. The system improves operational efficiency, reduces labor costs, and enables precise, targeted pest management. By integrating digital monitoring with rodent control strategies, this innovation enhances the adoption of smart rodenticide solutions in commercial and urban applications, setting new standards for effective pest management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.