Global Antidotes Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

3.94 Billion

2022

2030

USD

1.91 Billion

USD

3.94 Billion

2022

2030

| 2023 –2030 | |

| USD 1.91 Billion | |

| USD 3.94 Billion | |

|

|

|

|

Antidotes Market Analysis and Size

Over 1 million snake bites are recorded in Africa annually, the World Health Organization reports, resulting in 50,000 individuals needing medical attention, 25,000 deaths, and another 25,000 people with long-term disabilities. The rise in medical conditions requiring antidotes, such as nerve agent poisoning, methotrexate rescue, methanol poisoning, mercury poisoning, lead poisoning, and gold poisoning, is likely to fuel the market's growth during the forecast period.

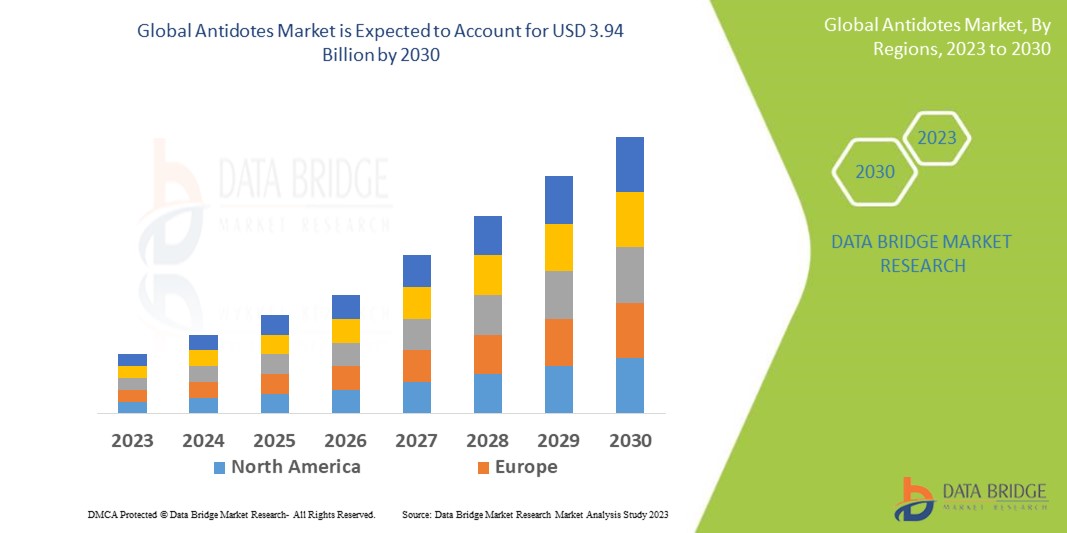

Data Bridge Market Research analyses that the antidotes market, which is USD 1.91 billion in 2022, is expected to reach USD 3.94 billion by 2030, at a CAGR of 9.5% during the forecast period 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Antidotes Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Chemical Antidotes, Physical Antidotes, Pharmacological Antidotes, Others), Route of Administration (Oral, Parenteral, Injectable, Others), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Pfizer Inc (U.S.), Hikma Pharmaceuticals PLC (U.K.), Dr. Reddy's Laboratories Ltd (India), Aurobindo Pharma (India), Mylan N.V. (U.S.), Akorn Operating Company LLC (U.S.), Alvogen (U.S.), Fresenius Kabi AG (Germany), Zydus Cadila (India), Daiichi Sanko Inc. (Japan), Nichi-Iko Pharmaceutical Co., Ltd (Japan) |

|

Market Opportunities |

|

Market Definition

Antidotes are agents that counter the effects of a poison or toxin. Antidotes counter the toxin's effects by either limiting absorption, binding with the poison, and neutralizing it, countering the poison's end-organ effects, or inhibiting the toxin's conversion to more hazardous metabolites. By using mechanisms such as competitive inhibition, receptor blockage, or direct antagonism of the toxin, antidote delivery may not only decrease the level of free or active toxin. Still, it may also mitigate the effects of the toxin on end organs.

Antidotes Market Dynamics

Drivers

- Rising prevalence of snake bites will propel the market growth

The main market drivers are the prevalence of snake bites and the unfavourable outcomes related to them. The WHO estimates that 4.5–5.4 million people are bitten by snakes annually, 1.8–2.7 million of them develop clinical illness (envenoming), and 81,000–138,000 people die from the bite. This is the main factor fueling the market for antidotes. The rise in drug overdoses also fuels the demand for antidotes.

For instance, The World Health Organization estimates that more than 1 million snake bites occur in Africa each year, leaving 50,000 people in need of medical attention, 25,000 people dead, and another 25,000 permanently disabled. An increase in medical issues requiring antidotes is due to nerve agent poisoning, methotrexate rescue, methanol poisoning, mercury poisoning, lead poisoning, and gold poisoning. The market is anticipated to expand quickly during the forecast period.

Opportunities

- Rising metal toxicity will act as an opportunity

An important component of the market is dominated by heavy metal toxicity. In addition to rising water contamination, using herbal remedies containing heavy metals is one of the main factors driving category expansion. The most frequent effects of heavy metal toxicity include anemia, miscarriages and early labor. Chelation, or using chemical countermeasures, is a crucial component of treatment. 25.8% of the world's population, or 1.62 billion, suffer from anemia (95 percent confidence interval: 1.50-1.74 billion). Therefore, these variables play a role in sector growth.

Restraints/Challenges

- Lack of skilled professionals and other miscellaneous factors will hinder the growth

The development of the worldwide antidotes market during the forecast period may be restrained by a shortage of competent employees who cannot treat patients with these compounds. In addition, a number of limitations in the antidote market, including the poor availability of anti-venoms due to growing anti-venom costs and restricted demand are anticipated to impede the market's expansion.

This antidotes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the antidotes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Antidotes Market

COVID-19 has left behind an extraordinary global public health disaster that has impacted almost every industry. Its long-term effects are anticipated to have an impact on industry growth during the forecast period. Clinical trial delays and drug launch cancellations have resulted from the shift in healthcare infrastructure toward addressing COVID-19. The need for a COVID-19 vaccine and treatment medications in the post-pandemic era is anticipated to fuel significant future growth in the biotechnology and pharmaceutical sectors. As a result, the market for antidotes will be significantly impacted.

Global Antidotes Market Scope

The antidotes market is segmented on the basis of type, end-users, route of administration, distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Chemical Antidotes

- Physical Antidotes

- Pharmacological Antidotes

- Others

Route of Administration

- Oral

- Capsules/tablets

- Syrups

- Parenteral

- Injectable

- Others

End-Users

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Antidotes Market Regional Analysis/Insights

The antidotes market is analysed and market size insights and trends are provided by country, type, end-users, route of administration, distribution channel as referenced above.

The countries covered in the antidotes market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the antidotes market due to an increase in antidote research and development activities, an increase in poison incidents.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 due to an increase in activities by the government and specialized communities, the vast number of generic manufacturers and expanding healthcare facilities.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Antidotes Market Share Analysis

The antidotes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to antidotes market.

Some of the major players operating in the antidotes market are:

- Pfizer Inc (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy's Laboratories Ltd (India)

- Aurobindo Pharma (India)

- Mylan N.V. (U.S.)

- Akorn Operating Company LLC (U.S.)

- Alvogen (U.S.)

- Fresenius Kabi AG (Germany)

- Zydus Cadila (India)

- Daiichi Sanko Inc (Japan)

- Nichi-Iko Pharmaceutical Co., Ltd (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTIDOTES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTIDOTES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTIDOTES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL ANTIDOTES MARKET, BY TYPE

17.1 OVERVIEW

17.2 CHEMICAL ANTIDOTES

17.2.1 BY ANTAGONIST

17.2.1.1. ATROPINE

17.2.1.2. BUDESONIDE

17.2.1.3. BETAMETHASONE

17.2.1.4. CALCIUM GLUCONATE

17.2.1.5. DIMERCAPTOPROPANE SULPHONATE

17.2.1.6. HYDROXOCOBALAMIN

17.2.1.7. OTHERS

17.2.2 BY TOXIN/INDICATION

17.2.2.1. CYANIDES/ NITRILES

17.2.2.2. IRRITANT GASES

17.2.2.3. HYDROFLUORIC ACID

17.2.2.4. ARSENIC/ MERCURY

17.2.2.5. ORGANOPHOSPHATES

17.2.2.6. OTHERS

17.3 PHYSICAL ANTIDOTES

17.3.1 ACTIVATED CHARCOAL

17.3.2 DEMULCENTS

17.4 PHARMACOLOGICAL ANTIDOTES

17.4.1 BY ANTAGONIST

17.4.1.1. ACETYLCYSTEINE

17.4.1.2. FLUMAZENIL

17.4.1.3. LACTRODECTUS ANTIVENOM

17.4.1.4. BOTULINUM ANTITOXIN

17.4.1.5. GLUCAGON

17.4.1.6. CALCIUM

17.4.1.7. ATROPINE

17.4.1.8. CROTALINAE POLYVALENT IMMUNE FAB

17.4.1.9. HYDROXOCOBALAMIN

17.4.1.10. IDARUCIZUMAB

17.4.1.11. SODIUM BICARBONATE

17.4.1.12. VITAMINS

17.4.1.13. OTHERS

17.4.2 BY TOXIN/INDICATION

17.4.2.1. ACETAMINOPHEN/ TYLENOL/ PARACETAMOL

17.4.2.2. POTASSIUM

17.4.2.3. PARALYTICS

17.4.2.4. ANTICHOLINESTERASE

17.4.2.5. FLUORIDE INGESTION

17.4.2.6. DIGOXIN

17.4.2.7. BENZODIAZEPINES

17.4.2.8. BETA BLOCKERS AND CALCIUM CHANNEL BLOCKERS

17.4.2.9. METHOTREXATE

17.4.2.10. OPIOID ANALGESICS

17.4.2.11. NARCOTICS

17.4.2.12. ORGANOPHOSPHATE POISONING

17.4.2.13. METHANOL POISONING

17.4.2.14. HEREDITARY OROTIC ACIDURIA

17.4.2.15. ENCEPHALOPATHY

17.4.2.16. RADIATION EMERGENCY

17.4.2.17. PNEUMOCYSTIS PNEUMONIA PROPHYLAXIS

17.4.2.18. DIAGNOSTIC BRONCHOGRAMS

17.4.2.19. DIGITALIS GLYCOSIDE TOXICITY

17.4.2.20. ALCOHOL USE DISORDER

17.4.2.21. MEGALOBLASTIC ANEMIA

17.4.2.22. OTHERS

17.5 OTHERS

18 GLOBAL ANTIDOTES MARKET, BY ROUTE OF ADMINISTRATION

18.1 OVERVIEW

18.2 ORAL

18.2.1 TABLETS

18.2.2 CAPSULES

18.2.3 OTHERS

18.3 TOPICAL

18.4 INJECTABLE

18.5 INHALATION

18.6 PARENTERAL

18.7 OTHERS

19 GLOBAL ANTIDOTES MARKET, BY CLASS

19.1 OVERVIEW

19.2 BRANDED

19.3 GENERIC

20 GLOBAL ANTIDOTES MARKET, BY TOXIN/ INDICATION

20.1 OVERVIEW

20.2 ACETAMINOPHEN

20.3 ANTICHOLINERGICS

20.4 ANTICOAGULANTS

20.5 BENZODIAZEPINES

20.6 INSECT AND ANIMAL BITES

20.7 BETA-BLOCKERS

20.8 CARBAMATES

20.9 CYANIDE

20.1 HEAVY METALS

20.11 METHOTREXATE

20.12 OPIOIDS

20.13 ORGANOPHOSPHATE POISONING

20.14 METHANOL POISONING

20.15 HEREDITARY OROTIC ACIDURIA

20.16 ENCEPHALOPATHY

20.17 RADIATION EMERGENCY

20.18 PNEUMOCYSTIS PNEUMONIA PROPHYLAXIS

20.19 DIAGNOSTIC BRONCHOGRAMS

20.2 DIGITALIS GLYCOSIDE TOXICITY

20.21 ALCOHOL USE DISORDER

20.22 MEGALOBLASTIC ANEMIA

20.23 OTHERS

21 GLOBAL ANTIDOTES MARKET, BY GENDER

21.1 OVERVIEW

21.2 MALE

21.3 FEMALE

22 GLOBAL ANTIDOTES MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 PRIVATE

22.2.2 PUBLIC

22.3 HOMECARE

22.4 SPECIALTY CLINICS

22.5 OTHERS

23 GLOBAL ANTIDOTES MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 HOSPITAL PHARMACY

23.3 ONLINE PHARMACY

23.4 OTHERS

24 GLOBAL ANTIDOTES MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.2 COMPANY SHARE ANALYSIS: EUROPE

24.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.4 MERGERS & ACQUISITIONS

24.5 NEW PRODUCT DEVELOPMENT & APPROVALS

24.6 EXPANSIONS

24.7 REGULATORY CHANGES

24.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL ANTIDOTES MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL ANTIDOTES MARKET, BY REGION

GLOBAL ANTIDOTES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 FRANCE

26.2.3 U.K.

26.2.4 HUNGARY

26.2.5 LITHUANIA

26.2.6 AUSTRIA

26.2.7 IRELAND

26.2.8 NORWAY

26.2.9 POLAND

26.2.10 ITALY

26.2.11 SPAIN

26.2.12 RUSSIA

26.2.13 TURKEY

26.2.14 NETHERLANDS

26.2.15 SWITZERLAND

26.2.16 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 AUSTRALIA

26.3.6 SINGAPORE

26.3.7 THAILAND

26.3.8 MALAYSIA

26.3.9 INDONESIA

26.3.10 PHILIPPINES

26.3.11 VIETNAM

26.3.12 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 PERU

26.4.4 COLOMBIA

26.4.5 VENEZUELA

26.4.6 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 SAUDI ARABIA

26.5.3 UAE

26.5.4 EGYPT

26.5.5 KUWAIT

26.5.6 ISRAEL

26.5.7 REST OF MIDDLE EAST AND AFRICA

26.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL ANTIDOTES MARKET, COMPANY PROFILE

27.1 PFIZER INC.

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 AKORN OPERATING COMPANY LLC

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 HIKMA PHARMACEUTICALS USA INC

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 BTG INTERNATIONAL INC.

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 MERCK KGAA

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 WELLSTAT THERAPEUTICS CORPORATION

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 GHANSHYAM CHEMICALS

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 LIVEALTH

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 FLAGSHIP BIOTECH INTERNATIONAL PVT LTD

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 SPECTRUM PHARMACEUTICALS, INC.

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 FRESENIUS KABI PVT. LTD.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 CHEPLAPHARM ARZNEIMITTEL GMBH

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 HOPE PHARMACEUTICALS

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 AMERICAN REGENT, I3NC.

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 EMERGENT BIOSOLUTIONS INC.

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 CHIESI USA, INC.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 MALLINCKRODT.

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 ALKERMES, INC.

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 TEVA PHARMACEUTICAL INDUSTRIES LTD.

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 VINS BIOPRODUCTS LTD

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.