Global Antifreeze Coolant Market

Market Size in USD Billion

CAGR :

%

USD

7.05 Billion

USD

10.26 Billion

2025

2033

USD

7.05 Billion

USD

10.26 Billion

2025

2033

| 2026 –2033 | |

| USD 7.05 Billion | |

| USD 10.26 Billion | |

|

|

|

|

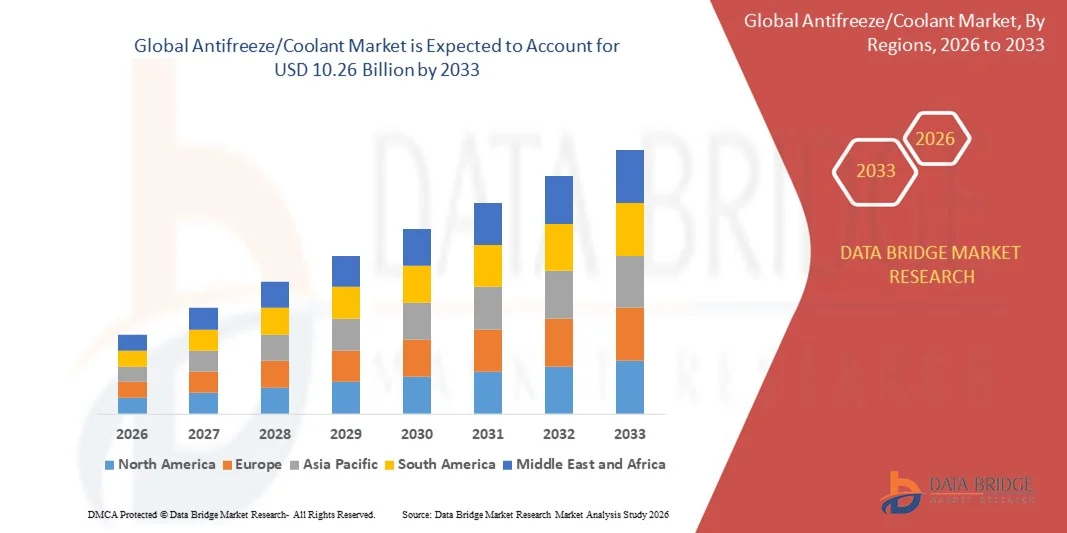

What is the Global Antifreeze/Coolant Market Size and Growth Rate?

- The global antifreeze/coolant market size was valued at USD 7.05 billion in 2025 and is expected to reach USD 10.26 billion by 2033, at a CAGR of5.50% during the forecast period

- The rise in number of vehicles in operation driving the demand for antifreeze/coolant is expected to influence the growth of the antifreeze/coolant market. In line with this, the rise in sales of construction equipment fueling consumption of antifreeze/coolants and high growth in demand for HVAC systems are also anticipated to act as key determinants favoring the growth of the antifreeze/coolant market

What are the Major Takeaways of Antifreeze/Coolant Market?

- Rise in population, emerging economies, enhanced infrastructure and increase in vehicle fleet are also expected to positively impact the growth of the antifreeze/coolant market. The major factor accountable for the growth of the market is the rise in industrial developments across the globe

- However, the introduction of coolants with long service life and rise in trend of engine downsizing are such asly to act as key restraints towards antifreeze/coolant market growth rate, whereas the volatile price of raw material and recycling of antifreeze/coolant can challenge the growth of the antifreeze/coolant market

- Asia-Pacific dominated the Antifreeze/Coolant market with 34.49% revenue share in 2025, driven by rapid industrialization, growing automotive production, and expansion of commercial and passenger vehicle markets across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.48% from 2026 to 2033, driven by increasing EV penetration, fleet modernization, and growing adoption of smart engine management systems across the U.S. and Canada

- The Ethylene Glycol segment dominated the market with a 44.7% share in 2025, driven by its superior heat transfer efficiency, low freezing point, and wide adoption in passenger vehicles, commercial fleets, and industrial cooling systems

Report Scope and Antifreeze/Coolant Market Segmentation

|

Attributes |

Antifreeze/Coolant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Antifreeze/Coolant Market?

Increasing Demand for Eco-Friendly, Long-Life, and Multi-Functional Antifreeze/Coolant

- The antifreeze/coolant market is witnessing strong adoption of advanced formulations that combine engine protection, corrosion inhibition, and extended service life for gasoline, diesel, and hybrid vehicles

- Manufacturers are introducing low-toxicity, biodegradable, and ethylene-glycol-free coolants, which offer multi-vehicle compatibility, enhanced heat transfer, and reduced environmental impact

- Growing demand for pre-mixed, ready-to-use coolants and smart fluid monitoring systems is driving usage across passenger vehicles, commercial fleets, and industrial machinery

- For instance, companies such as Shell, BASF, Motul, and ExxonMobil have launched next-generation antifreeze products with enhanced thermal stability, long-lasting corrosion inhibitors, and color-coded formulations for easy maintenance

- Increasing need for energy-efficient cooling systems, higher engine performance, and reduced maintenance cycles is accelerating adoption of multi-functional coolants

- As emission regulations tighten and engines become more technologically advanced, antifreeze/coolants will remain essential for engine longevity, performance optimization, and environmental compliance

What are the Key Drivers of Antifreeze/Coolant Market?

- Rising demand for high-performance, low-maintenance engine fluids that protect against corrosion, freezing, and overheating is driving market growth

- For instance, in 2024–2025, major manufacturers upgraded product portfolios to include long-life, universal coolants compatible with hybrid and EV systems

- Increasing production of vehicles, growth in automotive aftermarket services, and rising preference for eco-friendly products are boosting global adoption across U.S., Europe, and Asia-Pacific

- Technological improvements in additive packages, heat transfer efficiency, and fluid stability have strengthened performance, durability, and environmental compliance

- Growing awareness of engine longevity, lower operational costs, and stricter OEM specifications are creating demand for premium and multi-purpose antifreeze solutions

- Supported by steady automotive production, fleet expansion, and regulatory incentives, the Antifreeze/Coolant market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Antifreeze/Coolant Market?

- Higher costs of advanced, eco-friendly, and long-life antifreeze/coolants limit adoption among small-scale workshops and cost-sensitive end-users

- For instance, during 2024–2025, fluctuations in raw material prices and specialty additive availability increased production costs for several global vendors

- Complexity in meeting diverse OEM specifications for different engine types and fuel systems increases R&D and production challenges

- Limited consumer awareness regarding coolant longevity, environmental impact, and proper maintenance reduces adoption in emerging markets

- Competition from generic or conventional coolants, engine oils with integrated cooling properties, and local brands creates pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on sustainable formulations, cost-effective packaging, educational campaigns, and high-performance product development to strengthen global adoption of Antifreeze/Coolants

How is the Antifreeze/Coolant Market Segmented?

The market is segmented on the basis of base fluid, type, technology, and application.

- By Base Fluid

On the basis of base fluid, the antifreeze/coolant market is segmented into Glycerine, Propylene Glycol, Ethylene Glycol, Methanol, and Others. The Ethylene Glycol segment dominated the market with a 44.7% share in 2025, driven by its superior heat transfer efficiency, low freezing point, and wide adoption in passenger vehicles, commercial fleets, and industrial cooling systems. Ethylene glycol-based coolants are preferred for their stability, compatibility with various metals, and long service life, making them essential in automotive and industrial applications.

The Glycerine segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for eco-friendly and non-toxic alternatives in electric vehicles, renewable energy applications, and sustainable industrial operations. Rising awareness of environmental regulations further accelerates glycerine-based coolant adoption globally.

- By Type

On the basis of type, the market is segmented into Green Anti-Freeze, OAT Anti-Freeze, HOAT Anti-Freeze, and NOAT Anti-Freeze. The OAT (Organic Acid Technology) segment dominated the market with a 41.2% share in 2025, supported by its long-life corrosion protection, compatibility with modern engines, and extended drain intervals. OAT coolants are widely used in passenger cars, commercial vehicles, and heavy-duty equipment due to reduced maintenance needs and enhanced performance in aluminum and mixed-metal engines.

The Green Anti-Freeze segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising preference for environmentally friendly formulations with biodegradable and low-toxicity ingredients. Adoption is further fueled by government regulations and increasing demand from electric vehicles and hybrid engines.

- By Technology

On the basis of technology, the market is segmented into Inorganic Acid Technology (IAT), Organic Acid Technology (OAT), and Hybrid Organic Acid Technology (HOAT). The HOAT segment dominated the market with a 38.5% share in 2025, supported by its balanced protection against corrosion, cavitation, and scaling in modern engines, offering a blend of long-life performance and reliability. HOAT coolants are extensively used in North America, Europe, and Asia-Pacific automotive fleets and industrial machinery.

The OAT segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of long-life coolants, electric and hybrid vehicles, and sustainable industrial applications. Growth is accelerated by R&D in additive chemistry and enhanced performance formulations.

- By Application

On the basis of application, the market is segmented into Automobile, Aerospace, Industrial, Construction, Electronics, and Others. The Automobile segment dominated the market with a 46.8% share in 2025, fueled by growing vehicle production, rising engine complexity, and stringent temperature management requirements. Coolants are widely used in passenger cars, commercial trucks, and EVs for engine thermal management, heat dissipation, and anti-freeze protection.

The Electronics segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use of liquid cooling systems in data centers, semiconductors, batteries, and industrial electronics. Rising demand for high-performance cooling solutions and compact thermal management systems further accelerates market expansion in this application segment.

Which Region Holds the Largest Share of the Antifreeze/Coolant Market?

- Asia-Pacific dominated the Antifreeze/Coolant market with 34.49% revenue share in 2025, driven by rapid industrialization, growing automotive production, and expansion of commercial and passenger vehicle markets across China, India, Japan, South Korea, and Southeast Asia. Strong demand for long-life, eco-friendly, and high-performance coolants in automotive, industrial machinery, and construction equipment continues to fuel market growth

- Leading companies in Asia-Pacific are introducing innovative antifreeze/coolant solutions with extended service life, multi-vehicle compatibility, and enhanced corrosion protection, reinforcing the region’s technological leadership. Increasing focus on EVs, hybrid vehicles, and energy-efficient engines drives long-term market expansion

- Strong automotive manufacturing hubs, government incentives, and high R&D investment in engine cooling systems further strengthen regional dominance

China Antifreeze/Coolant Market Insight

China is the largest contributor in Asia-Pacific due to massive automotive production, strong industrial machinery demand, and government emphasis on eco-friendly fluids. Rising adoption of long-life, multi-functional antifreeze/coolants for ICE, hybrid, and EV systems fuels growth. OEM collaboration, local manufacturing capabilities, and cost-competitive products further expand domestic and export market penetration.

Japan Antifreeze/Coolant Market Insight

Japan shows steady growth, supported by precision automotive manufacturing, advanced industrial equipment, and stringent emission regulations. Strong emphasis on reliability, thermal stability, and high-performance formulations drives adoption of premium antifreeze/coolants. Increasing electrification and hybrid vehicle production reinforces long-term market expansion.

India Antifreeze/Coolant Market Insight

India is emerging as a major growth hub, propelled by rising vehicle production, government-backed automotive manufacturing initiatives, and growing fleet expansions. High demand for long-life and eco-friendly antifreeze/coolants in passenger cars, commercial vehicles, and industrial applications supports market adoption. Expansion of R&D, digital infrastructure, and awareness of engine maintenance accelerates growth.

South Korea Antifreeze/Coolant Market Insight

South Korea contributes significantly due to strong automotive and electronics manufacturing, high-performance consumer vehicles, and EV adoption. Rapid development of hybrid vehicles, industrial machinery, and advanced cooling systems drives demand for premium antifreeze/coolants with enhanced corrosion protection and heat-transfer efficiency.

North America Antifreeze/Coolant Market

North America is projected to register the fastest CAGR of 9.48% from 2026 to 2033, driven by increasing EV penetration, fleet modernization, and growing adoption of smart engine management systems across the U.S. and Canada. High demand for multi-functional, long-life, and eco-friendly antifreeze/coolants in automotive, industrial, and commercial applications accelerates market growth. Expansion of e-commerce, aftermarket services, and OEM collaboration further strengthens the growth trajectory.

Which are the Top Companies in Antifreeze/Coolant Market?

The antifreeze/coolant industry is primarily led by well-established companies, including:

- Royal Dutch Shell (Netherlands)

- Exxon Mobil Corporation (U.S.)

- Kost USA Inc. (U.S.)

- Motul (France)

- BP plc (U.K.)

- Ashland (U.S.)

- Castrol Limited (U.K.)

- Lukoil (Russia)

- PETRONAS Lubricants International (Malaysia)

- BASF SE (Germany)

- Chevron Philips Chemical Corporation (U.S.)

- Total (France)

- China Petroleum & Chemical Corporation (China)

- Prestone Products Corporation (U.S.)

- SONAX (Germany)

- DOW (U.S.)

- Evans Cooling Systems Inc. (U.S.)

- DuPont (U.S.)

- Tate & Lyle (U.K.)

- Havoline (U.S.)

- Huntsman Corporation LLC (U.S.)

What are the Recent Developments in Global Antifreeze/Coolant Market?

- In June 2025, Setco Automotive Limited expanded its portfolio by launching an Automotive Water Pump for LCVs and MHCVs, strengthening its presence in engine cooling solutions. The product supports efficient coolant circulation and thermal stability and incorporates a long-life seal, high load-bearing capability, enhanced NVH isolation, and a thermally optimized impeller material. This launch highlights Setco’s strategic move toward advanced and durable engine cooling components

- In March 2024, Schaeffler Korea introduced the new Schaeffler TruPower CV Coolant in the Korean market, offered in a 4-liter specification through Junwoo APS, a specialized aftermarket distributor. The coolant is formulated with corrosion-inhibiting additives that protect engine and internal components, thereby extending engine life. This development reinforces Schaeffler’s focus on high-performance aftermarket coolant solutions

- In February 2024, Volkswagen reached a settlement related to defective engine coolant pumps, offering compensation to affected vehicle owners. The incident emphasized the critical role of reliable coolant systems in preventing engine damage, recalls, and high repair costs. This case underscores the growing importance of quality assurance in automotive cooling technologies

- In August 2021, Valvoline Inc., in collaboration with Haertol, launched advanced coolant technologies for modern engines, including Valvoline Antifreeze Coolant HT-12 Green and HT-12 Pink. These products were designed to meet evolving thermal management and material compatibility requirements. The launch marked Valvoline’s commitment to innovation in next-generation engine coolants

- In July 2021, Castrol introduced Castrol ON e-thermal fluid, a next-generation direct battery e-thermal fluid developed for electric vehicles. The solution enables faster charging, improved thermal control, enhanced protection, and greater sustainability. This innovation positioned Castrol at the forefront of EV-focused thermal management solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antifreeze Coolant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antifreeze Coolant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antifreeze Coolant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.