Global Antimicrobial Additives Market

Market Size in USD Billion

CAGR :

%

USD

4.75 Billion

USD

7.81 Billion

2024

2032

USD

4.75 Billion

USD

7.81 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 7.81 Billion | |

|

|

|

|

What is the Global Antimicrobial Additives Market Size and Growth Rate?

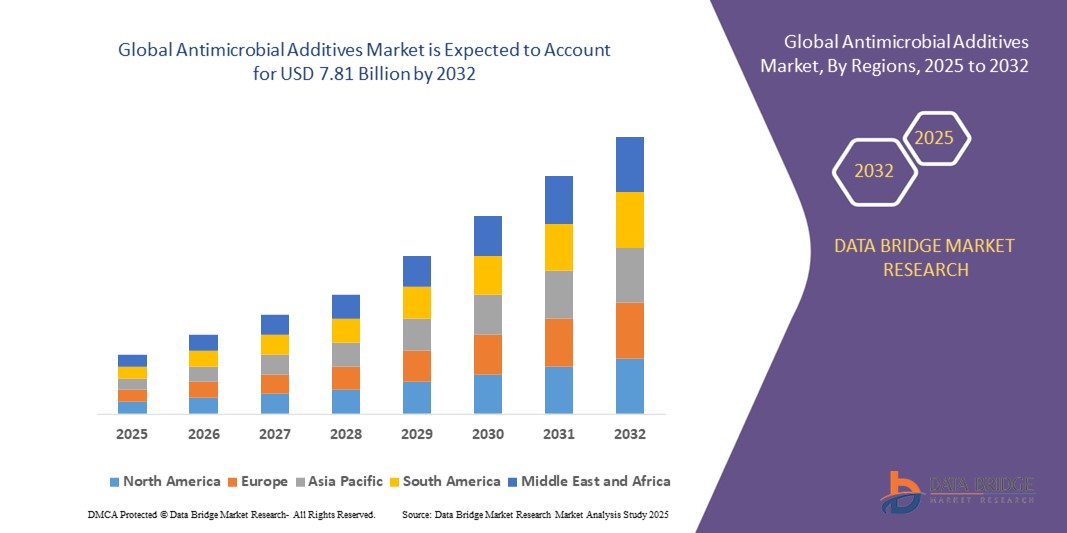

- The global antimicrobial additives market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 7.81 billion by 2032, at a CAGR of 6.40% during the forecast period

- Antimicrobial additives are substances that are incorporated into various materials and products to inhibit or kill the growth of microorganisms, such as bacteria, viruses, fungi, and algae. These additives are designed to provide an additional layer of protection against the growth and spread of harmful microorganisms, helping to maintain cleanliness, hygiene, and durability in a wide range of applications

- Antimicrobial additives can be incorporated into various materials during the manufacturing process, including plastics, coatings, textiles, ceramics, and metals. They work by disrupting the biological processes of microorganisms, thereby preventing their growth, reproduction, and survival. The specific mode of action may vary depending on the type of antimicrobial additive used. These additives can be effective in reducing the risk of cross-contamination, controlling odors caused by microbial activity, and prolonging the lifespan of products by inhibiting microbial degradation

What are the Major Takeaways of Antimicrobial Additives Market?

- Increasing awareness of the importance of hygiene and health, both in personal and public settings, is a significant driver of the global antimicrobial additive market. Consumers, as well as industries such as healthcare, food and beverages, and personal care, are seeking products that offer enhanced protection against harmful microorganisms, driving the demand for antimicrobial additives

- Asia-Pacific dominated the antimicrobial additives market with the largest revenue share of 41.6% in 2024, driven by rapid industrialization, expanding healthcare infrastructure, and increasing demand for antimicrobial protection across consumer goods and packaging

- North America antimicrobial additives market is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, supported by stringent regulatory frameworks, strong R&D investments, and rising awareness of infection control across industries

- The Inorganic segment dominated the market with a revenue share of 62.4% in 2024, driven by the widespread use of silver, copper, and zinc-based additives across healthcare, packaging, and building materials

Report Scope and Antimicrobial Additives Market Segmentation

|

Attributes |

Antimicrobial Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Antimicrobial Additives Market?

Growing Demand for Sustainable and Eco-Friendly Solutions

- A significant trend in the global antimicrobial additives market is the rising focus on sustainability and eco-friendly formulations, driven by stricter regulations and increasing consumer demand for safe and non-toxic solutions

- Manufacturers are shifting toward biobased, silver-free, and halogen-free additives to reduce environmental impact and enhance safety in applications such as packaging, healthcare, and construction

- For instance, in 2024, BASF SE launched IrgaCycle a range of additives designed to improve the mechanical recycling process and provide sustainable antimicrobial protection. Similarly, Microban International is expanding its portfolio of environmentally responsible antimicrobial technologies to meet the growing need for safer solutions

- The development of sustainable antimicrobial additives is reshaping the industry, offering opportunities for companies to align with global sustainability goals while meeting regulatory standards. This trend will continue to redefine product innovation and consumer preference in the market

What are the Key Drivers of Antimicrobial Additives Market?

- The rising incidence of hospital-acquired infections (HAIs) and increasing concerns over hygiene in healthcare facilities, food packaging, and consumer goods are major growth drivers

- For instance, in February 2024, Lonza Group introduced new antimicrobial coatings for medical devices to help minimize infection risks in hospitals, highlighting how product innovations are fueling market expansion

- Growing urbanization, heightened awareness of hygiene post-COVID-19, and demand for durable, germ-resistant materials in construction, automotive, and textiles are accelerating adoption

- In addition, the push for enhanced product longevity and performance is boosting demand for antimicrobial additives in plastics, paints, and coatings, where they provide both functional and protective benefits

- The integration of these additives into daily-use products—ranging from kitchenware to medical equipment—continues to drive their widespread acceptance across industries

Which Factor is Challenging the Growth of the Antimicrobial Additives Market?

- A key challenge is the stringent regulatory framework surrounding the approval and use of antimicrobial substances, particularly those containing silver, copper, or other heavy metals. These restrictions can delay product launches and increase compliance costs for manufacturers

- For instance, the European Chemicals Agency (ECHA) has tightened rules on biocidal products, impacting how antimicrobial additives can be marketed and used across consumer applications

- Concerns over antimicrobial resistance (AMR) and potential health risks from overexposure to certain chemicals further create hesitation among consumers and regulators

- In addition, the high cost of advanced, sustainable formulations compared to traditional additives remains a barrier, especially in price-sensitive regions

- Addressing these challenges through cost-effective green alternatives, transparent safety testing, and consumer education will be crucial for unlocking the market’s full potential in the coming years

How is the Antimicrobial Additives Market Segmented?

The market is segmented on the basis of type, application, and end-user.

- By Type

On the basis of type, the antimicrobial additives market is segmented into Organic Antimicrobial Additives and Inorganic Antimicrobial Additives. The Inorganic segment dominated the market with a revenue share of 62.4% in 2024, driven by the widespread use of silver, copper, and zinc-based additives across healthcare, packaging, and building materials. Their durability, thermal stability, and broad-spectrum antimicrobial efficacy make them the preferred choice for long-term applications where consistent protection is required. These additives are extensively adopted in medical devices, paints, and food packaging to prevent microbial contamination.

The Organic segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by rising demand for environmentally sustainable and biodegradable solutions. Organic additives, such as quaternary ammonium compounds and triclosan alternatives, are increasingly favored in personal care and consumer goods due to lower toxicity concerns and alignment with green chemistry trends.

- By Application

On the basis of application, the antimicrobial additives market is segmented into Paints and Coatings, Plastic, Pulp and Paper, Packaging, and Others. The Plastic segment accounted for the largest revenue share of 39.7% in 2024, primarily due to the extensive use of antimicrobial plastics in healthcare devices, consumer goods, and automotive interiors. The ability of antimicrobial additives to enhance durability and inhibit microbial growth on surfaces has made plastics a leading application area. Plastics infused with antimicrobial properties are increasingly used in medical instruments, packaging, and household products, driving significant demand.

The Paints and Coatings segment is expected to record the fastest CAGR between 2025 and 2032, fueled by growing applications in construction and healthcare infrastructure. Hospitals, schools, and public buildings are increasingly relying on antimicrobial coatings to improve hygiene and reduce infection risks. Rising demand for protective coatings in both developed and emerging economies further supports this growth trajectory.

- By End-User

On the basis of end-user, the antimicrobial additives market is segmented into Automotive, Construction, Food and Beverages, Healthcare, Agriculture, Personal Care, and Others. The Healthcare segment dominated the market with a revenue share of 34.5% in 2024, driven by stringent hygiene standards and the urgent need to reduce hospital-acquired infections (HAIs). Antimicrobial additives are widely used in medical devices, surgical equipment, hospital furnishings, and packaging materials to maintain sterility and improve patient safety. Increasing investments in healthcare infrastructure globally continue to support this dominance.

The Food and Beverages segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by rising demand for antimicrobial packaging and surface treatments that extend shelf life and ensure product safety. With consumers increasingly prioritizing food hygiene and preservation, manufacturers are integrating antimicrobial solutions into packaging films, containers, and processing equipment, making it a critical growth area for the market.

Which Region Holds the Largest Share of the Antimicrobial Additives Market?

- Asia-Pacific dominated the antimicrobial additives market with the largest revenue share of 41.6% in 2024, driven by rapid industrialization, expanding healthcare infrastructure, and increasing demand for antimicrobial protection across consumer goods and packaging

- The region’s strong manufacturing base, particularly in China, Japan, and India, enables large-scale production and cost-efficient supply of antimicrobial solutions across industries

- Rising disposable incomes, urbanization, and heightened awareness of hygiene standards are further accelerating adoption, making Asia-Pacific the central hub for Antimicrobial Additives in both residential and industrial applications

China Antimicrobial Additives Market Insight

China dominated the antimicrobial additives market in 2024, holding the largest share due to its robust manufacturing ecosystem, growing middle class, and expanding food safety standards. The country’s rapid urbanization and push toward smart cities have increased demand for antimicrobial materials across packaging, construction, and healthcare sectors. With strong domestic producers and cost-effective raw material availability, China remains a major exporter of antimicrobial solutions globally. Government-backed initiatives on sustainability and hygiene regulations are expected to further accelerate adoption, particularly in plastics, coatings, and medical applications, reinforcing China’s leadership in the regional market.

Japan Antimicrobial Additives Market Insight

Japan’s antimicrobial additives market is steadily expanding, fueled by its high-tech industrial base, advanced healthcare infrastructure, and rising hygiene awareness. With an aging population, demand for antimicrobial applications in medical devices, pharmaceuticals, and elderly care products is increasing significantly. The country is also seeing rapid adoption of additives in plastics, coatings, and food packaging, driven by consumer preference for safety and quality. Japan’s strong focus on R&D and innovation ensures the development of advanced, eco-friendly antimicrobial technologies. Moreover, integration into smart manufacturing and IoT-enabled production lines enhances efficiency, strengthening Japan’s role as a key growth driver in Asia-Pacific.

Which Region is the Fastest Growing Region in the Antimicrobial Additives Market?

North America antimicrobial additives market is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, supported by stringent regulatory frameworks, strong R&D investments, and rising awareness of infection control across industries. Increasing adoption in healthcare, food packaging, and construction is driving demand, while consumer preference for antimicrobial personal care products further boosts growth.

U.S. Antimicrobial Additives Market Insight

The U.S. held a dominant 79% share of the North American antimicrobial additives market in 2024, driven by stringent FDA and EPA regulations, a strong emphasis on infection control, and high consumer hygiene standards. Major applications include healthcare, food and beverage packaging, construction, and personal care products. The market benefits from extensive R&D investment and innovation in biotechnology, enabling the development of advanced antimicrobial solutions. Rising awareness of hospital-acquired infections (HAIs) and stricter food safety requirements further propel demand. With robust consumer adoption and well-established distribution channels, the U.S. remains the central hub for antimicrobial technologies in North America.

Canada Antimicrobial Additives Market Insight

Canada’s antimicrobial additives market is growing at a steady pace, supported by public health initiatives, food safety regulations, and sustainability goals. Applications are expanding across healthcare, food packaging, construction coatings, and water treatment, reflecting rising consumer awareness of hygiene and environmental safety. Government emphasis on green and sustainable materials is driving demand for eco-friendly antimicrobial solutions. In addition, Canada’s construction and healthcare sectors are increasingly adopting additives for surface protection and infection prevention. With strong cross-border trade links to the U.S. and increasing investment in advanced materials, Canada is emerging as a promising growth contributor within North America.

Which are the Top Companies in Antimicrobial Additives Market?

The antimicrobial additives industry is primarily led by well-established companies, including:

- Bodycote (U.K.)

- H.C. Starck GmbH (Germany)

- Metallisation Ltd (U.K.)

- ASB Industries Inc. (U.S.)

- Kennametal Inc. (U.S.)

- Praxair Surface Technologies Inc. (U.S.)

- Brenntag Austria GmbH (Austria)

- DuPont (U.S.)

- DOW (U.S.)

- BASF SE (Germany)

- Nexeo Plastics, LLC (U.S.)

What are the Recent Developments in Global Antimicrobial Additives Market?

- In July 2023, BioCote Limited entered into a strategic partnership with Eco Finish to integrate BioCote technology into antimicrobial surfaces for residential and commercial pools. The antimicrobial additives are designed to suppress the growth of bacteria, algae, viruses, and other microbes, thereby enhancing swimmer safety and protection. This collaboration highlights the increasing adoption of antimicrobial technologies in aquatic environments

- In April 2023, Microban International partnered with Berry Global to introduce Color Scents scented trash bags featuring antimicrobial technology. The initiative combined Berry Global’s strong manufacturing expertise with Microban’s market leadership in antimicrobial solutions. This partnership demonstrates the growing demand for everyday consumer products with added antimicrobial benefits

- In April 2022, Momentive Performance Materials Inc. announced plans to relocate its Tarrytown, New York facility and establish a Global Innovation Center (GIC). The new center was intended to include advanced R&D laboratories, office space, and development facilities for innovative, trend-driven solutions to support its Performance Additives business. This move underlines the company’s focus on fostering collaboration and driving innovation in performance materials

- In January 2022, Polygiene AB signed an agreement to acquire SteriTouch, aligning with its growth strategy and leveraging Biomaster’s antimicrobial portfolio. This acquisition reflects Polygiene’s commitment to strengthening its market position in antimicrobial technologies

- In May 2021, Avient introduced GLS thermoplastic elastomer formulations embedded with antimicrobial technology to protect against microbial growth. These formulations provide up to 99.9% bacteria reduction and effectively resist mold and fungal proliferation in molded plastic components. This launch highlights the importance of antimicrobial solutions in material science and manufacturing

- In May 2021, SteriTouch collaborated with Enso Rings to launch antimicrobial silicone wedding rings, available in Thin and Standard variations, along with a range of sizes and colors. The rings were designed to prevent ring avulsion, an injury caused by forceful removal of traditional metal rings. This collaboration emphasizes innovation in personal accessories by integrating health and safety features

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTIMICROBIAL ADDITIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTIMICROBIAL ADDITIVE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 CURRENCY AND PRICING

2.8 RESEARCH METHODOLOGY

2.9 TECHNOLOGY LIFE LINE CURVE

2.1 MULTIVARIATE MODELLING

2.11 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.12 DBMR MARKET POSITION GRID

2.13 MARKET APPLICATION COVERAGE GRID

2.14 DBMR MARKET CHALLENGE MATRIX

2.15 IMPORT AND EXPORT DATA

2.16 SECONDARY SOURCES

2.17 GLOBAL ANTIMICROBIAL ADDITIVE MARKET : RESEARCH SNAPSHOT

2.18 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 IMPORT EXPORT SCENARIO

5.2 RAW MATERIAL ANALYSIS

5.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.4 PORTER’S FIVE FORCES

5.5 PESTEL ANALYSIS

5.6 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, BY TYPE,(USD MILLION), (KILO TONS), 2021-2030

8.1 OVERVIEW

8.2 SILVER

8.3 ZINC

8.4 COPPER

8.5 ORGANIC

8.5.1 PHENOLIC BIOCIDES

8.5.2 QUATERNARY AMMONIUM COMPOUNDS (QAC OR QUAT)

8.5.3 FUNGICIDES

8.6 OTHERS

9 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, BY FORM,(USD MILLION), 2021-2030

9.1 OVERVIEW

9.2 LIQUID

9.3 POWDER

10 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, BY CARRIER,(USD MILLION), 2021-2030

10.1 OVERVIEW

10.2 SILICATE CARRIERS

10.3 PHOSPHATE CARRIERS

10.4 TITANIUM DIOXIDE CARRIERS

10.5 GLASS CARRIERS

10.6 OTHERS

11 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, BY APPLICATION,(USD MILLION), 2021-2030

11.1 OVERVIEW

11.2 PAINTS AND COATINGS

11.2.1 PAINTS AND COATINGS, BY APPLICATION

11.2.1.1. GENERAL INDUSTRIAL COATINGS

11.2.1.2. DECORATIVE COATINGS

11.2.1.3. SPECIALITY COATINGS

11.2.1.4. SPECIALITY INKS

11.2.1.5. VARNISHES

11.2.2 PAINTS AND COATINGS, BY FORM

11.2.2.1. LIQUID

11.2.2.2. POWDER

11.3 TEXTILES

11.3.1 TEXTILES, BY APPLICATION

11.3.1.1. POLYPROPYLENE (PE)

11.3.1.2. POLYETHYLENE TEREPHTHALATE (PET)

11.3.1.3. NYLON (PA)

11.3.1.4. WOOL

11.3.1.5. COTTON

11.3.1.6. SILK

11.3.2 TEXTILES, BY FORM

11.3.2.1. LIQUID

11.3.2.2. POWDER

11.4 POLYMERS

11.4.1 POLYMERS, BY APPLICATION

11.4.1.1. ACRYLONITRILE BUTADIENE STYRENE (ABS)

11.4.1.2. ETHYLENE VINYL ACETATE (EVA)

11.4.1.3. HIGH IMPACT POLYSTYRENE (HIPS)

11.4.1.4. POLYETHYLENE (PE)

11.4.1.5. POLYMETHYL METHACRYLATE (PMMA)

11.4.1.6. POLYPROPYLENE (PP)

11.4.1.7. POLYCARBONATE (PC)

11.4.1.8. POLYSTYRENE (PS)

11.4.1.9. POLYVINYL CHLORIDE (PVC)

11.4.1.10. SILICONE

11.4.1.11. THERMOPLASTIC POLYURETHANE (TPU)

11.4.1.12. OTHERS

11.4.2 POLYMERS, BY FORM

11.4.2.1. LIQUID

11.4.2.2. POWDER

11.5 CERAMIC

11.5.1 CERAMIC, BY APPLICATION

11.5.1.1. EARTHENWARE

11.5.1.2. STONEWARE

11.5.1.3. PORCELAIN

11.5.1.4. OTHERS

11.5.2 CERAMIC, BY FORM

11.5.2.1. LIQUID

11.5.2.2. POWDER

11.6 OTHERS

11.6.1 OTHERS, BY FORM

11.6.1.1. LIQUID

11.6.1.2. POWDER

12 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, BY GEOGRAPHY,(USD MILLION), (KILO TONS), 2021-2030

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 SWITZERLAND

12.2.7 RUSSIA

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA AND NEW ZEALAND

12.3.6 SINGAPORE

12.3.7 THAILAND

12.3.8 INDONESIA

12.3.9 MALAYSIA

12.3.10 PHILIPPINES

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AMERICA

13 GLOBAL ANTIMICROBIAL ADDITIVE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT ANALYSIS

15 GLOBAL ANTIMICROBIAL ADDITIVE MARKET - COMPANY PROFILE

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 MICROBAN

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 TOAGOSEI

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 SCIESSENT

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MILLIKEN

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 DOW

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 PURE BIOSCIENCE

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ISHIZUKA GLASS GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 SANITIZED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 SINANEN ZEOMIC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 ADDMASTER

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 BIOCOTE LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 CLARIANT

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 POLYONE CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 MOMENTIVE

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.