Global Antimicrobial Drugs Market

Market Size in USD Billion

CAGR :

%

USD

122.89 Billion

USD

174.76 Billion

2025

2033

USD

122.89 Billion

USD

174.76 Billion

2025

2033

| 2026 –2033 | |

| USD 122.89 Billion | |

| USD 174.76 Billion | |

|

|

|

|

Antimicrobial Drugs Market Size

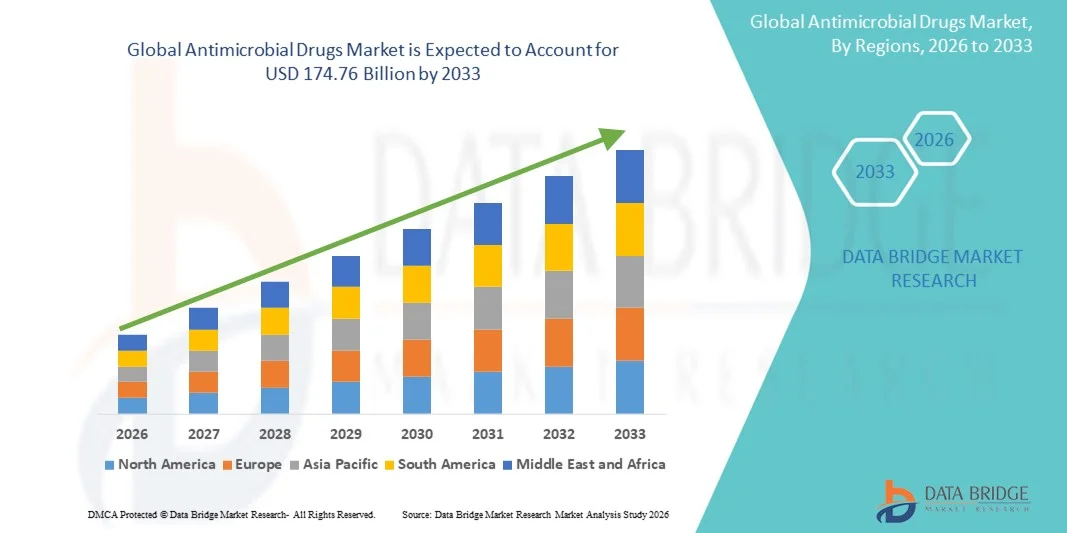

- The global antimicrobial drugs market size was valued at USD 122.89 billion in 2025 and is expected to reach USD 174.76 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of infectious diseases, rising incidence of antibiotic-resistant pathogens, and growing demand for effective treatment options across both developed and emerging economies

- Furthermore, advancements in pharmaceutical research and development, expanding healthcare infrastructure, and increasing awareness about antimicrobial therapies are driving the adoption of antimicrobial drugs solutions, thereby significantly boosting the industry's growth

Antimicrobial Drugs Market Analysis

- Antimicrobial drugs, including antibiotics, antivirals, antifungals, and antiparasitic agents, are increasingly vital components of modern healthcare systems due to their critical role in preventing and treating infectious diseases in both hospital and community settings

- The escalating demand for antimicrobial drugs is primarily fueled by the rising prevalence of infectious diseases, increasing incidence of antibiotic-resistant pathogens, and growing awareness about early and effective treatment, driving the adoption of advanced antimicrobial therapies

- North America dominated the antimicrobial drugs market with the largest revenue share of 36.55% in 2025, supported by advanced healthcare infrastructure, high adoption of novel drugs, strong regulatory frameworks, and the presence of leading pharmaceutical companies, with the U.S. experiencing substantial growth due to high incidence of infections and proactive antibiotic stewardship programs

- Asia-Pacific is expected to be the fastest growing region in the Antimicrobial Drugs market during the forecast period due to rising healthcare expenditure, improving healthcare access, growing population, and increasing awareness about infectious disease management in countries such as China, India, and Japan

- The Oral segment dominated the largest market revenue share of 53.2% in 2025, driven by convenience, patient adherence, and compatibility with both acute and chronic infection management. Oral antimicrobials are widely available across hospitals, clinics, and pharmacies

Report Scope and Antimicrobial Drugs Market Segmentation

|

Attributes |

Antimicrobial Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Antimicrobial Drugs Market Trends

Focus on Novel Formulations and Combination Therapies

- Pharmaceutical companies are increasingly focusing on novel antimicrobial formulations to improve patient compliance and therapeutic outcomes

- For instance, in March 2023, Pfizer launched a new oral fixed-dose combination antibiotic targeting multidrug-resistant bacterial infections, offering simplified dosing and improved efficacy

- Combination therapies, including antibiotic-antifungal or antiviral-antibacterial blends, are gaining traction to address polymicrobial infections

- Innovation in extended-release tablets, injectables, and topical formulations is enhancing drug stability, efficacy, and patient convenience

- Researchers are developing drugs with targeted action to minimize side effects while maximizing therapeutic effect, particularly for immunocompromised patient

- Several biotech firms are leveraging nanotechnology and liposomal delivery systems to improve drug penetration and bioavailability in hard-to-reach infection sites

- The rising trend toward personalized medicine and pathogen-specific treatments is influencing the development of novel antimicrobial portfolios

- Regulatory approvals for innovative drug formulations, coupled with increasing investment in clinical trials, support the rapid adoption of these therapies

- Focus on oral, injectable, and inhalable formulations addresses both inpatient and outpatient requirements, enhancing treatment flexibility

Antimicrobial Drugs Market Dynamics

Driver

Rising Incidence of Infectious Diseases and Increasing Awareness

- The global rise in bacterial, viral, and fungal infections is a major driver of the antimicrobial drugs market. increasing cases of hospital-acquired infections, community-acquired infections, and multi-drug-resistant pathogens are driving the need for effective antimicrobial therapies

- For instance, in June 2024, the World Health Organization reported a significant increase in multidrug-resistant tuberculosis cases, prompting several nations to reinforce antimicrobial stewardship programs

- Growing awareness among healthcare professionals and patients regarding the importance of early and effective treatment is boosting the demand for advanced antimicrobial drugs

- The expansion of healthcare infrastructure in emerging economies is facilitating better access to antimicrobial medications, particularly in hospitals, clinics, and community health centers

- Furthermore, the rise in outpatient care, vaccination drives, and preventive therapies is supporting consistent consumption of antimicrobial drugs. The increasing prevalence of chronic diseases that compromise immunity, such as diabetes and cancer, also contributes to higher demand for prophylactic and therapeutic antimicrobials

- Strategic initiatives by pharmaceutical companies to develop broad-spectrum antibiotics, antivirals, and antifungals are creating more targeted and effective treatment options, strengthening market growth. Increasing government and private investment in research and development of new antimicrobials to tackle drug-resistant strains further supports market expansion

- Pharmaceutical collaborations for improving drug delivery systems, enhancing oral bioavailability, and extending shelf-life are increasing product efficacy

Restraint/Challenge

Rising Antimicrobial Resistance and High Treatment Costs

- Antimicrobial resistance (AMR) is a critical challenge, reducing the efficacy of existing drugs and necessitating the development of newer, more expensive therapies

- For instance, in 2022, the Centers for Disease Control and Prevention reported a 15% increase in drug-resistant bacterial infections in hospital settings in North America, highlighting the severity of AMR

- High treatment costs, particularly for novel antibiotics, monoclonal antibody therapies, and combination drugs, limit accessibility for patients in low- and middle-income regions

- Limited availability of certain antimicrobials in rural and underdeveloped areas further constrains treatment reach

- Inadequate insurance coverage and reimbursement policies in some countries create financial barriers to therapy access

- Side effects and prolonged treatment regimens can reduce patient adherence, impacting therapeutic outcomes and market acceptance

- Overuse and misuse of antimicrobial drugs exacerbate resistance, prompting stricter regulatory controls that may slow market growth

- Supply chain challenges, including raw material shortages and logistical hurdles, occasionally disrupt drug availability

Antimicrobial Drugs Market Scope

The market is segmented on the basis of type, source, dosage, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the Antimicrobial Drugs market is segmented into Antibiotics, Antifungals, Antivirals, Antiprotozoal, and Others. The Antibiotics segment dominated the largest market revenue share of 48.6% in 2025, driven by the rising incidence of bacterial infections and the widespread use of broad-spectrum antibiotics in hospitals and clinics. Antibiotics remain the first line of treatment for most infectious diseases, which reinforces their high demand. The increasing prevalence of hospital-acquired infections, community-acquired infections, and drug-resistant strains has further boosted the segment. Furthermore, government initiatives and hospital protocols emphasizing timely bacterial infection control contribute to segment dominance. Availability across oral, injectable, and topical formulations ensures comprehensive patient coverage. Strategic partnerships and consistent supply from leading pharmaceutical companies strengthen the market share. Antibiotics are also increasingly used prophylactically in surgeries and chronic disease management. The segment benefits from strong R&D pipelines aimed at developing next-generation antibiotics with improved efficacy and fewer side effects. Public awareness campaigns regarding responsible antibiotic use enhance patient adherence, reinforcing demand. Overall, antibiotics continue to dominate due to their essential role in infection management and wide therapeutic applicability.

The Antivirals segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, fueled by the rising prevalence of viral infections such as influenza, hepatitis, and emerging viral pandemics. Rapid adoption of antiviral therapies in both outpatient and hospital settings supports market growth. Innovations in combination therapies and long-acting oral antivirals enhance patient compliance and treatment outcomes. Additionally, government vaccination and treatment programs promote antiviral use. Increasing prevalence of chronic viral infections, including HIV and hepatitis B/C, necessitates continuous antiviral therapy. Pharmaceutical companies are focusing on antiviral drugs targeting novel viral strains, further accelerating growth. Online pharmacy platforms and home delivery of antiviral medications increase accessibility and convenience. Greater awareness about early antiviral treatment improves patient uptake. Expanding healthcare infrastructure in emerging economies further drives demand. Research initiatives to develop broad-spectrum antivirals also contribute to rapid market expansion. Overall, the antivirals segment is poised for robust growth due to increasing viral disease burden and treatment awareness.

- By Source

On the basis of source, the Antimicrobial Drugs market is segmented into Natural, Synthetic, and Semi-synthetic. The Synthetic segment held the largest market revenue share of 52.3% in 2025, owing to the ease of mass production, consistency in efficacy, and ability to modify chemical structures to combat resistant strains. Synthetic antimicrobials are widely adopted in hospitals, clinics, and laboratories due to predictable potency and regulatory approval. Their compatibility with oral, injectable, and topical formulations enhances versatility. Strong R&D pipelines for new synthetic antibiotics, antivirals, and antifungals support segment dominance. Pharmaceutical companies focus on synthetic drugs for chronic and acute infections, ensuring consistent demand. The segment benefits from extensive clinical trial data supporting efficacy and safety. Wide availability across hospital and retail pharmacies strengthens revenue share. Strategic collaborations for bulk production improve supply chain stability. Synthetic antimicrobials are increasingly preferred in prophylactic and postoperative treatments. Government initiatives promoting antimicrobial stewardship enhance responsible synthetic drug usage. Cost-effectiveness compared to certain natural or semi-synthetic alternatives also drives adoption. Overall, synthetic drugs dominate due to accessibility, efficacy, and broad-spectrum applications.

The Semi-synthetic segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by modifications of natural compounds to enhance potency and reduce resistance. Semi-synthetic antibiotics, especially beta-lactams, are widely used to treat resistant bacterial infections. Pharmaceutical innovations improving solubility, bioavailability, and reduced side effects encourage adoption. Hospitals increasingly rely on semi-synthetic drugs for post-surgical infection prevention. Rising demand for semi-synthetic antifungals and antivirals in specialty care boosts growth. Targeted therapies for chronic infections further support market expansion. Online and retail pharmacy channels increase accessibility for semi-synthetic products. Strategic partnerships for R&D accelerate product launches. Regulatory approvals for new semi-synthetic formulations also strengthen the segment. Growing awareness among healthcare providers regarding effectiveness against resistant strains drives adoption. Clinical guidelines increasingly recommend semi-synthetic drugs in complex infection management. Overall, semi-synthetic antimicrobials are rapidly gaining traction due to enhanced efficacy and targeted therapeutic profiles.

- By Dosage

On the basis of dosage, the market is segmented into Tablet, Injection, Cream, and Others. The Tablet segment dominated the largest market revenue share of 45.1% in 2025, due to ease of administration, patient compliance, and widespread availability. Tablets are preferred for both acute and chronic infections, offering consistent dosing and minimal preparation. Hospitals and clinics rely heavily on oral tablets for outpatient treatments. The segment benefits from the development of fixed-dose combinations and extended-release tablets. Patient-friendly formulations enhance adherence to treatment regimens. Tablets are also cost-effective compared to injectable therapies, encouraging broad adoption. Regulatory approvals for new tablet formulations increase market confidence. Online pharmacy platforms have made tablet distribution more convenient. The segment is further supported by educational campaigns promoting oral antimicrobial therapy. Tablets are suitable for prophylactic and therapeutic use across multiple indications. Overall, tablets maintain dominance due to convenience, compliance, and cost-effectiveness.

The Injection segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, driven by the need for rapid and targeted therapy in hospital settings, especially for severe and resistant infections. Injectable antimicrobials provide faster onset of action and higher bioavailability compared to oral formulations. Hospitals rely on injectable therapies in intensive care units and for post-surgical infection prevention. Biopharmaceutical advancements have led to safer and less painful injection delivery systems. Injectable antivirals and antibiotics are increasingly prescribed for multi-drug-resistant infections. Expanding hospital infrastructure in emerging regions further supports segment growth. Strategic partnerships for bulk injectable supply enhance accessibility. Increasing awareness of early hospital intervention and intravenous therapy encourages adoption. Clinical guidelines recommending injections for severe infections contribute to market expansion. Injectable antimicrobials are also preferred in emergency care and inpatient treatments. Overall, the injection segment is poised for rapid growth due to efficacy, critical care reliance, and rising complex infections.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Intravenous, Topical, and Others. The Oral segment dominated the largest market revenue share of 53.2% in 2025, driven by convenience, patient adherence, and compatibility with both acute and chronic infection management. Oral antimicrobials are widely available across hospitals, clinics, and pharmacies. Fixed-dose combinations, tablets, and capsules enhance patient compliance. The oral route allows home-based treatment, reducing hospital visits and healthcare costs. It is suitable for both prophylactic and therapeutic purposes. Regulatory approvals for oral antimicrobials further strengthen segment dominance. Pharmaceutical innovations improve bioavailability and reduce gastrointestinal side effects. Oral therapy is preferred in outpatient care and chronic disease management. Healthcare campaigns promoting early infection treatment support adoption. Tablets, capsules, and syrup formulations enhance versatility. Overall, oral administration dominates due to convenience, accessibility, and patient preference.

The Intravenous segment is expected to witness the fastest CAGR of 12.3% from 2026 to 2033, driven by critical care requirements, rapid onset of action, and the treatment of severe infections. Intravenous antimicrobials are essential in hospitals, ICUs, and post-operative care. Expanding hospital infrastructure globally drives increased use. IV therapy ensures controlled dosing and higher drug bioavailability. The segment also benefits from advancements in infusion technologies and safer administration. Growth is supported by increased inpatient admissions and chronic infection prevalence. Injectable antivirals and antibiotics are widely administered via the IV route for drug-resistant infections. Clinical guidelines recommend IV therapy for severe cases, supporting rapid adoption. Pharmaceutical companies are investing in IV formulations to enhance stability and reduce adverse effects. Hospitals are the major end-users driving this segment. Overall, IV administration is experiencing strong growth due to critical care reliance and therapeutic efficacy.

- By End-Users

On the basis of end-users, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated the largest market revenue share of 58.7% in 2025, due to high patient volume, bulk procurement, and the need for both oral and injectable antimicrobials. Hospitals manage inpatient and outpatient treatments, post-surgical care, and critical infections, driving demand. The segment benefits from strategic contracts with pharmaceutical suppliers. Regulatory compliance and centralized procurement strengthen leadership. Hospitals are also the primary setting for treating resistant infections, supporting segment dominance. Expansion of healthcare infrastructure globally further drives growth. Training and awareness programs enhance correct drug usage. Hospital pharmacies ensure consistent availability and distribution. Collaborations with biotech firms provide access to advanced formulations. Overall, hospitals dominate due to scale, diversity of cases, and procurement capabilities.

The Clinic segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by rising outpatient visits, early diagnosis trends, and increasing patient awareness. Clinics offer convenient access, shorter waiting times, and home-based prescription services. Expansion of specialized clinics focusing on infectious diseases supports growth. Adoption of portable diagnostic devices increases clinic-based antimicrobial prescription. Clinics in suburban and rural areas improve healthcare accessibility, boosting demand. Telemedicine and online pharmacy integration further encourage growth. Patient education initiatives enhance timely antimicrobial therapy. Clinics are increasingly involved in preventive care, supporting ongoing use. The growing preference for early intervention drives rapid adoption. Overall, the clinic segment is witnessing strong growth due to accessibility, awareness, and preventive care trends.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated the largest market revenue share of 57.4% in 2025, as hospitals procure both oral and injectable therapies in bulk for inpatient and outpatient care. Centralized procurement, regulatory compliance, and quality assurance reinforce leadership. Strategic partnerships with pharmaceutical companies ensure consistent supply. Hospitals maintain strong inventory to manage emergencies and resistant infections. Additionally, dedicated hospital pharmacies streamline distribution within hospital networks.

The Online Pharmacy segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by the growth of digital healthcare and e-commerce platforms. Online pharmacies provide convenience, home delivery, and subscription models for chronic therapies. Increasing smartphone penetration and internet access support this trend. Online channels improve accessibility for rural and remote populations. Competitive pricing and promotions encourage patient adoption. Telemedicine integration facilitates prescription-based purchases. Rapid delivery options enhance patient convenience. Online pharmacies also expand access to novel antimicrobial drugs. Patient awareness campaigns boost online purchase confidence. Expanding e-commerce adoption in healthcare accelerates segment growth. Overall, online pharmacy distribution is growing rapidly due to convenience, accessibility, and integration with digital health solutions.

Antimicrobial Drugs Market Regional Analysis

- North America dominated the antimicrobial drugs market with the largest revenue share of 36.55% in 2025

- Supported by advanced healthcare infrastructure, high adoption of novel drugs, strong regulatory frameworks, and the presence of leading pharmaceutical companies

- The market experiencing substantial growth due to high incidence of infections and proactive antibiotic stewardship programs

U.S. Antimicrobial Drugs Market Insight

The U.S. antimicrobial drugs market captured the largest revenue share in North America in 2025, driven by the increasing prevalence of infectious diseases, strong research and development capabilities, and proactive government initiatives promoting early diagnosis and treatment. Growing awareness among healthcare professionals and patients regarding appropriate antimicrobial use further fuels market growth.

Europe Antimicrobial Drugs Market Insight

The Europe antimicrobial drugs market is projected to grow steadily throughout the forecast period, primarily supported by stringent healthcare regulations, high adoption of advanced therapies, and rising awareness about antimicrobial resistance. Key countries such as Germany, France, and the U.K. are witnessing increasing investments in R&D and hospital infrastructure, driving demand for effective antimicrobial drugs.

U.K. Antimicrobial Drugs Market Insight

The U.K. antimicrobial drugs market is anticipated to expand at a notable CAGR, backed by government-led screening programs, rising prevalence of infectious diseases, and increasing focus on hospital and community-based antimicrobial management programs.

Germany Antimicrobial Drugs Market Insight

The Germany antimicrobial drugs market is expected to expand steadily due to advanced healthcare infrastructure, widespread adoption of novel antibiotics, and growing emphasis on antimicrobial stewardship programs to combat resistance.

Asia-Pacific Antimicrobial Drugs Market Insight

The Asia-Pacific antimicrobial drugs market is poised to grow at the fastest CAGR during the forecast period, driven by improving healthcare infrastructure, increasing government healthcare initiatives, rising awareness about infectious diseases, and the growing middle-class population in countries such as China, India, and Japan.

Japan Antimicrobial Drugs Market Insight

The Japan antimicrobial drugs market is gaining momentum due to a high prevalence of infections, advanced healthcare systems, and strong R&D investment in novel antimicrobial therapies. Increasing government support for antimicrobial stewardship programs further supports market growth.

China Antimicrobial Drugs Market Insight

The China antimicrobial drugs market accounted for a significant revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing prevalence of infectious diseases, expanding healthcare infrastructure, and growing awareness about early diagnosis and treatment options. Strong domestic pharmaceutical manufacturers and government initiatives promoting infectious disease management are key factors driving growth.

Antimicrobial Drugs Market Share

The Antimicrobial Drugs industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• GlaxoSmithKline plc (U.K.)

• Johnson & Johnson (U.S.)

• Novartis AG (Switzerland)

• Roche Holding AG (Switzerland)

• Merck & Co., Inc. (U.S.)

• AstraZeneca plc (U.K.)

• Sanofi S.A. (France)

• Bayer AG (Germany)

• Cipla Limited (India)

• Hikma Pharmaceuticals PLC (U.K.)

• Takeda Pharmaceutical Company Limited (Japan)

• Celgene Corporation (U.S.)

• Fresenius Kabi AG (Germany)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Sumitomo Dainippon Pharma Co., Ltd. (Japan)

Latest Developments in Global Antimicrobial Drugs Market

- In May 2023, the U.S. FDA approved Xacduro (sulbactam/durlobactam), a fixed‑dose combination antibiotic for treating pneumonia caused by Acinetobacter baumannii-calcoaceticus complex. This approval provided a much-needed option for difficult‑to-treat, resistant gram‑negative infections

- In April 2024, a new combination antibiotic Emblaveo (aztreonam/avibactam) gained EU regulatory approval for treating multidrug-resistant gram-negative bacterial infections. This drug pairs a monobactam with a β-lactamase inhibitor, enhancing efficacy against resistant strains

- In February 2025, the U.S. FDA approved Emblaveo (aztreonam/avibactam) for treating complicated intra-abdominal infections in adults with limited treatment options, marking another step in the fight against resistant bacteria

- In March 2025, the FDA approved Gepotidacin (Blujepa), the first new oral antibiotic class in decades, for uncomplicated urinary tract infections (UTIs). This drug uses a novel mechanism to inhibit bacterial DNA replication and may help reduce resistance risk

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.