Global Antimicrobial Hospital Textiles Market

Market Size in USD Billion

CAGR :

%

USD

1.59 Billion

USD

2.64 Billion

2025

2033

USD

1.59 Billion

USD

2.64 Billion

2025

2033

| 2026 –2033 | |

| USD 1.59 Billion | |

| USD 2.64 Billion | |

|

|

|

|

Antimicrobial Hospital Textiles Market Size

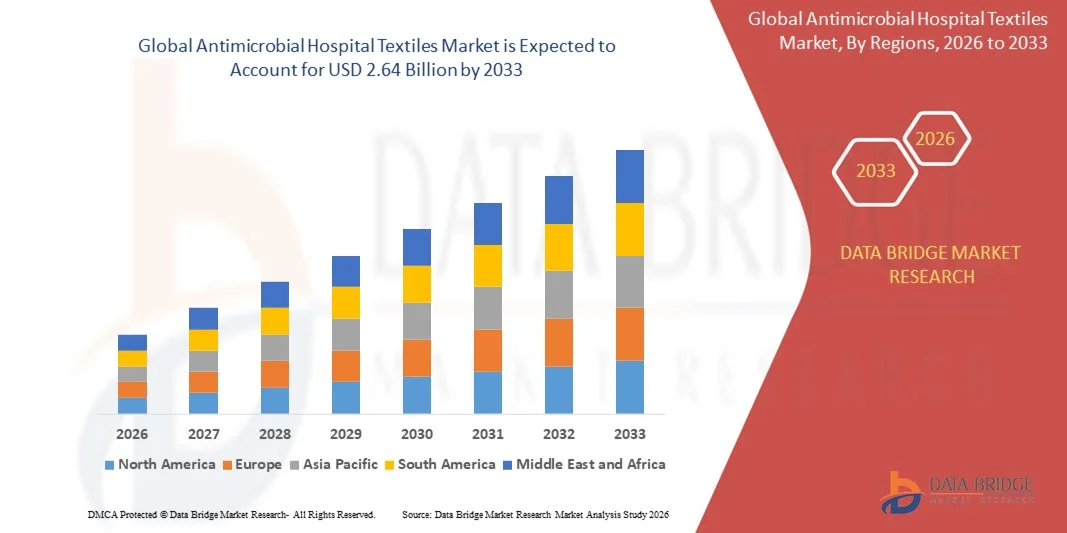

- The global antimicrobial hospital textiles market size was valued at USD 1.59 billion in 2025 and is expected to reach USD 2.64 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of hospital-acquired infections (HAIs) and rising demand for infection prevention measures in healthcare facilities

- Growing adoption of antimicrobial fabrics in surgical gowns, bedding, and uniforms, combined with rising awareness of hygiene standards, is further supporting market expansion

Antimicrobial Hospital Textiles Market Analysis

- Rising focus on infection control and patient safety is driving the adoption of antimicrobial textiles in hospitals and clinics worldwide

- Increased healthcare expenditure, modernization of medical facilities, and implementation of stringent regulatory standards for hospital hygiene are boosting market growth

- North America dominated the antimicrobial hospital textiles market with the largest revenue share of 38.75% in 2025, driven by the rising focus on infection prevention, stringent hospital hygiene regulations, and increasing awareness of hospital-acquired infections (HAIs)

- Asia-Pacific region is expected to witness the highest growth rate in the global antimicrobial hospital textiles market, driven by rapid healthcare infrastructure development, expanding hospital networks, and rising adoption of antimicrobial fabrics across hospitals and clinics

- The reusable segment held the largest market revenue share in 2025, driven by hospitals’ preference for durable and cost-effective fabrics that can withstand multiple wash cycles while retaining antimicrobial efficacy. Reusable textiles offer long-term savings, reduce waste, and support consistent infection-control practices, making them ideal for high-traffic hospital environments

Report Scope and Antimicrobial Hospital Textiles Market Segmentation

|

Attributes |

Antimicrobial Hospital Textiles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Microban International (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antimicrobial Hospital Textiles Market Trends

Rise of Antimicrobial Textiles in Healthcare Settings

- The growing adoption of antimicrobial textiles is transforming hospital operations by reducing the spread of infections and improving patient safety. These textiles, treated with antimicrobial agents, help minimize microbial contamination on hospital linens, uniforms, and bedding, supporting better hygiene and lowering infection rates. They also contribute to overall patient satisfaction and hospital reputation by creating safer environments and reducing cross-contamination risks

- High demand for hygienic and durable fabrics in hospitals, clinics, and care facilities is accelerating the use of antimicrobial textiles. These fabrics are particularly effective in high-risk areas such as operating rooms and intensive care units, helping prevent hospital-acquired infections and ensuring safer patient care. Hospitals are increasingly prioritizing such fabrics for staff uniforms, patient gowns, and bedding to meet rigorous hygiene standards and compliance requirements

- The affordability and durability of modern antimicrobial textiles make them suitable for routine hospital usage. Features such as repeated wash resistance, long-lasting antimicrobial efficacy, and comfort for staff and patients support consistent application, improving overall hospital hygiene management. In addition, these textiles reduce the frequency of linen replacement and laundry costs, providing operational efficiency

- For instance, in 2023, several hospitals in North America reported a noticeable reduction in surgical site infections and contamination of patient linens after implementing antimicrobial textile solutions, resulting in enhanced patient outcomes and lower infection-control costs. The adoption of these textiles also supported accreditation compliance and enhanced hospital safety ratings, strengthening institutional trust and market credibility

- While antimicrobial textiles are enhancing hygiene and patient safety, their long-term impact depends on continuous innovation, compliance with health standards, and staff training. Manufacturers must focus on advanced fabric treatments and durable textile solutions to fully capitalize on growing demand. Expanded awareness campaigns and partnerships with healthcare providers can further drive adoption and standardize usage practices globally

Antimicrobial Hospital Textiles Market Dynamics

Driver

Rising Incidence of Healthcare-Associated Infections and Increased Awareness Among Medical Facilities

- The increasing prevalence of hospital-acquired infections (HAIs) is pushing hospitals and healthcare providers to adopt antimicrobial textiles as a preventive measure. The risk of contamination on linens, uniforms, and other fabrics has accelerated investment in treated hospital textiles. In addition, these fabrics reduce the need for frequent disinfection, allowing hospitals to optimize operational workflows and staff productivity

- Hospitals and clinics are increasingly aware of the financial and operational risks associated with HAIs, including longer patient stays, increased medical expenses, and regulatory penalties. This awareness has led to the widespread use of antimicrobial fabrics in healthcare facilities. Adoption of such textiles also minimizes patient readmissions, improves staff confidence, and enhances compliance with infection-control protocols

- Government regulations, healthcare accreditation standards, and international guidelines are reinforcing hygiene protocols, encouraging the adoption of antimicrobial textiles. Subsidies, awareness campaigns, and quality certification programs further support market growth. Hospitals are incentivized to implement these textiles to meet accreditation requirements and maintain competitive advantage in patient care standards

- For instance, in 2022, multiple European healthcare networks implemented guidelines recommending antimicrobial fabrics for high-risk areas, boosting demand for treated textiles across patient care and clinical applications. These initiatives also fostered collaboration between textile manufacturers and hospitals to innovate specialized fabrics addressing local healthcare challenges

- While infection awareness and institutional support are driving adoption, there is a need to improve supply chains, optimize costs, and ensure proper usage protocols in hospitals to sustain long-term market growth. Further integration of antimicrobial textiles into hospital procurement strategies can ensure broader access and consistent quality standards globally

Restraint/Challenge

High Cost of Advanced Antimicrobial Textiles and Limited Access in Smaller Healthcare Facilities

- The premium pricing of advanced antimicrobial hospital textiles limits adoption among smaller clinics, low-budget hospitals, and rural healthcare facilities. High-quality treated fabrics are often reserved for larger hospitals or specialized care units, restricting market penetration. This cost barrier slows the adoption rate in emerging markets and creates disparities in patient care standards between regions

- Limited awareness and technical knowledge among staff regarding proper usage, maintenance, and laundering of antimicrobial textiles can reduce effectiveness, leading to suboptimal infection control outcomes. Improper care may compromise antimicrobial efficacy, necessitating additional training programs and educational initiatives to maximize benefits

- Supply chain challenges, including consistent availability of treated textiles and specialized antimicrobial fabrics in remote or underdeveloped regions, impede market growth. Facilities may face delays in procurement or substitute lower-quality alternatives. Variations in regional production capacity and logistical inefficiencies also contribute to inconsistent supply and adoption rates

- For instance, in 2023, surveys in Sub-Saharan Africa revealed that over 65% of small-scale hospitals had limited access to antimicrobial textiles due to high costs and logistical constraints, impacting hygiene and infection-control efforts. The lack of localized manufacturing and distribution networks further exacerbated the problem, highlighting the need for scalable and cost-effective solutions

- While antimicrobial textile technologies continue to advance, overcoming cost, accessibility, and awareness barriers remains essential. Market players must focus on cost-effective, durable fabrics, training programs, and scalable distribution solutions to expand adoption globally. Partnerships with governments, NGOs, and healthcare providers can help address regional disparities and enhance market penetration

Antimicrobial Hospital Textiles Market Scope

The antimicrobial hospital textiles market is segmented on the basis of usability, FDA class, application, and antimicrobial agents.

- By Usability

On the basis of usability, the market is segmented into disposable and reusable textiles. The reusable segment held the largest market revenue share in 2025, driven by hospitals’ preference for durable and cost-effective fabrics that can withstand multiple wash cycles while retaining antimicrobial efficacy. Reusable textiles offer long-term savings, reduce waste, and support consistent infection-control practices, making them ideal for high-traffic hospital environments.

The disposable segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its convenience, reduced cross-contamination risk, and suitability for high-risk procedures and temporary usage scenarios. Disposable antimicrobial textiles are particularly popular in surgical settings, isolation units, and temporary healthcare facilities, ensuring immediate hygiene and minimizing infection risks.

- By FDA Class

On the basis of FDA classification, the market is segmented into Class I, Class II, and Class III textiles. Class II textiles held the largest market share in 2025 due to their wide adoption in critical hospital applications that require moderate to high regulatory oversight, balancing safety and cost-efficiency. These textiles are commonly used in surgical linens, patient gowns, and staff uniforms, offering standardized antimicrobial protection.

Class III textiles are expected to register the fastest growth from 2026 to 2033, driven by advanced antimicrobial treatments and higher regulatory requirements for specialized surgical and clinical applications. Hospitals increasingly adopt Class III textiles in intensive care units and high-risk surgical procedures to ensure maximum protection against healthcare-associated infections.

- By Application

On the basis of application, the market is segmented into medical uniforms & apparels, upholstery, surgical textiles, incontinence care garments, wound treatment, and others. Surgical textiles accounted for the largest revenue share in 2025 due to their critical role in infection prevention during operations, coupled with repeated usage and stringent hygiene standards. The growing emphasis on patient safety and compliance with infection-control protocols is supporting sustained demand.

Incontinence care garments are expected to witness the fastest growth from 2026 to 2033, driven by rising geriatric populations and increasing prevalence of chronic conditions in healthcare settings. Hospitals and care facilities are focusing on comfort, durability, and antimicrobial protection in these garments, which helps reduce infection risks and improve patient care quality.

- By Agents

On the basis of antimicrobial agents, the market is segmented into metal & metallic salts, synthetic organic compounds, and bio-based agents. Metal & metallic salts, such as silver and copper, held the largest market share in 2025 due to their proven antimicrobial efficacy, long-lasting performance, and compatibility with various hospital textile applications. These agents are widely incorporated in reusable and surgical fabrics to provide continuous protection against microbes.

Bio-based agents are expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for eco-friendly, non-toxic, and sustainable antimicrobial solutions. The rising focus on environmental sustainability and patient-safe treatments is encouraging hospitals and manufacturers to adopt bio-based antimicrobial agents across textiles used in patient care and hospital operations.

Antimicrobial Hospital Textiles Market Regional Analysis

- North America dominated the antimicrobial hospital textiles market with the largest revenue share of 38.75% in 2025, driven by the rising focus on infection prevention, stringent hospital hygiene regulations, and increasing awareness of hospital-acquired infections (HAIs)

- Healthcare facilities in the region highly value antimicrobial textiles for their ability to reduce microbial contamination on linens, uniforms, and surgical garments, enhancing patient safety and operational efficiency

- The widespread adoption is further supported by well-established healthcare infrastructure, high investment in infection-control measures, and the preference for durable, reusable textile solutions in both hospitals and clinics

U.S. Antimicrobial Hospital Textiles Market Insight

The U.S. antimicrobial hospital textiles market captured the largest revenue share in 2025 within North America, fueled by rising concerns over HAIs and growing emphasis on patient safety. Hospitals are increasingly prioritizing the adoption of antimicrobial fabrics in surgical settings, incontinence care, and general hospital linens. The integration of durable, washable, and long-lasting textiles into infection-control protocols is driving market expansion, alongside government regulations and accreditation standards that encourage hygienic practices.

Europe Antimicrobial Hospital Textiles Market Insight

The Europe antimicrobial hospital textiles market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict hospital hygiene standards, rising healthcare expenditure, and increasing awareness of infection prevention. The region is witnessing significant adoption of antimicrobial textiles across surgical, wound care, and upholstery applications. The demand for reusable, eco-friendly, and high-performance fabrics is particularly high in hospitals and long-term care facilities, supporting market growth.

U.K. Antimicrobial Hospital Textiles Market Insight

The U.K. antimicrobial hospital textiles market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of HAIs, adoption of advanced hospital hygiene protocols, and increasing focus on patient safety and quality care. The growth is further supported by healthcare investments, modern hospital infrastructure, and regulatory compliance standards that encourage the use of antimicrobial fabrics across medical uniforms, bedding, and surgical textiles.

Germany Antimicrobial Hospital Textiles Market Insight

The Germany antimicrobial hospital textiles market is expected to witness the fastest growth rate from 2026 to 2033, fueled by stringent infection-control regulations, growing demand for durable and washable fabrics, and rising healthcare awareness. Hospitals and clinical facilities are increasingly adopting antimicrobial textiles for upholstery, surgical garments, and incontinence care, prioritizing patient safety and operational hygiene. The push for eco-friendly, reusable fabrics is also accelerating adoption in both public and private healthcare sectors.

Asia-Pacific Antimicrobial Hospital Textiles Market Insight

The Asia-Pacific antimicrobial hospital textiles market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing hospital infrastructure, rising awareness of HAIs, and rapid expansion of healthcare facilities in countries such as China, Japan, and India. The adoption of antimicrobial textiles in surgical, wound care, and patient apparel applications is increasing, supported by government initiatives promoting hygiene and infection prevention. Furthermore, the region’s growing production capabilities are making advanced antimicrobial fabrics more affordable and accessible to a wider range of hospitals.

Japan Antimicrobial Hospital Textiles Market Insight

The Japan antimicrobial hospital textiles market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high focus on patient safety, technological advancements in textile treatments, and increasing hospital modernization. Adoption is driven by the need for durable, washable, and high-performance fabrics across surgical, wound care, and hospital apparel applications. Japan’s aging population further fuels demand for safer, infection-resistant textiles in both acute and long-term care facilities.

China Antimicrobial Hospital Textiles Market Insight

The China antimicrobial hospital textiles market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising awareness of infection control, and increasing adoption of hospital hygiene standards. Antimicrobial textiles are gaining popularity in surgical settings, patient apparel, and upholstery applications. Government initiatives, rapid hospital expansion, and cost-effective domestic production of antimicrobial fabrics are key factors propelling the market in China.

Antimicrobial Hospital Textiles Market Share

The Antimicrobial Hospital Textiles industry is primarily led by well-established companies, including:

• Microban International (U.S.)

• Sciessent LLC (U.S.)

• UNITIKA LTD (Japan)

• BASF SE (Germany)

• Dow (U.S.)

• Lonza (Switzerland)

• BioCote Limited (U.K.)

• Trevira GmbH (Germany)

• Herculite (U.S.)

• Milliken Chemical (U.S.)

• Vestagen Protective Technologies, Inc. (U.S.)

• Resil Chemicals Pvt. Ltd. (India)

• Archroma (Switzerland)

• HeiQ Materials AG (Switzerland)

• smartfiber AG (Germany)

• PurThread Technologies Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antimicrobial Hospital Textiles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antimicrobial Hospital Textiles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antimicrobial Hospital Textiles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.