Global Antioxidant Vitamin Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

2.00 Billion

2024

2032

USD

1.17 Billion

USD

2.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 2.00 Billion | |

|

|

|

|

Antioxidant Vitamin Market Size

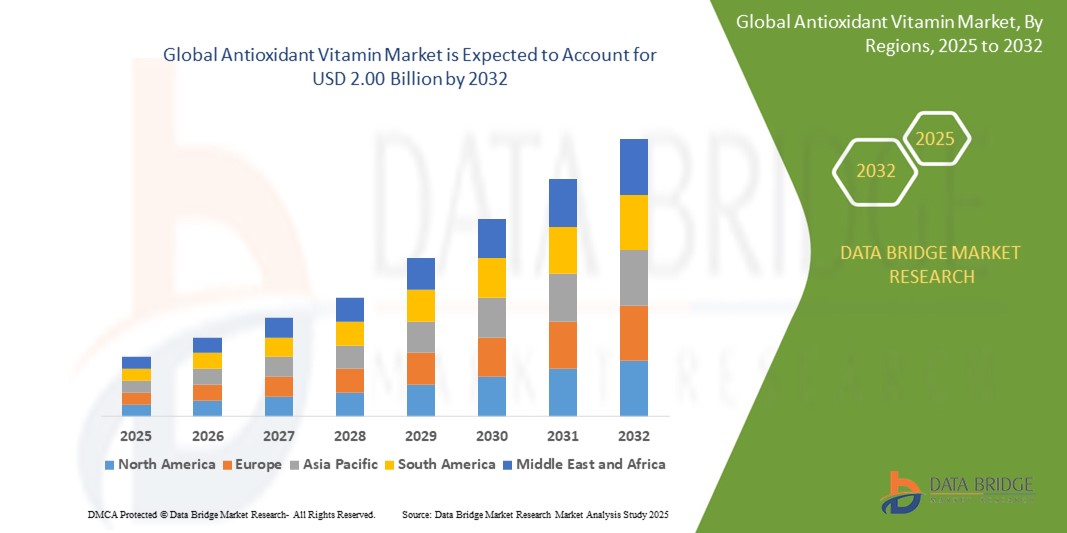

- The global antioxidant vitamin market size was valued at USD 1.17 billion in 2024 and is expected to reach USD 2.00 billion by 2032, at a CAGR of 6.9% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of preventive healthcare, aging populations, and the rising incorporation of antioxidant vitamins in dietary supplements, functional foods, and personal care products

- Furthermore, the growing demand for clean-label, plant-based, and natural antioxidant sources is driving product innovation and market expansion across both developed and emerging economies. These converging factors are significantly boosting the adoption of antioxidant vitamins across industries

Antioxidant Vitamin Market Analysis

- Antioxidant vitamins, including vitamins C and E, help neutralize free radicals in the body, reducing oxidative stress and supporting immune function, skin health, and chronic disease prevention. These compounds are widely used in pharmaceuticals, functional foods, beverages, dietary supplements, and cosmetics

- The escalating demand for antioxidant vitamins is driven by the growing health and wellness trend, rising consumer interest in anti-aging and immunity-boosting products, and increased usage of antioxidants as natural preservatives in food and personal care formulations

- Asia-Pacific dominated the antioxidant vitamin market with a share of 44.3% in 2024, due to increasing health awareness, rising disposable incomes, and the growing use of vitamin supplements in preventive healthcare

- North America is expected to be the fastest growing region in the antioxidant vitamin market during the forecast period due to rising consumption of dietary supplements, plant-based nutrition, and anti-aging skincare products

- Natural antioxidants segment dominated the market with a market share of 61.9% in 2024, due to rising consumer preference for clean-label, plant-based ingredients and growing awareness regarding the long-term health risks associated with synthetic additives. Naturally sourced antioxidants such as vitamin C and E from fruits, vegetables, and nuts are widely favored in both dietary supplements and food formulations due to their holistic nutritional profiles and lower toxicity risk. Regulatory support and marketing campaigns emphasizing organic and sustainable health products further boost the demand for natural antioxidants across global markets

Report Scope and Antioxidant Vitamin Market Segmentation

|

Attributes |

Antioxidant Vitamin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antioxidant Vitamin Market Trends

“Rising Demand for Natural Antioxidants”

- The antioxidant vitamin market is witnessing rapid growth as consumers increasingly seek out natural sources of antioxidants—such as vitamins C, E, and carotenoids—in response to concerns around oxidative stress, aging, and chronic diseases

- For instance, Amway has expanded its Nutrilite line to include vitamin C and E supplements sourced from plant extracts, responding to consumer demand for natural, clean-label products with scientifically backed health benefits

- Consumer preference for naturally derived ingredients is propelling the development and marketing of antioxidant-rich multivitamins, fortified foods, and beverages positioned for immune support, skin health, and anti-aging

- Innovations in extraction and formulation technologies are improving the bioavailability and efficacy of antioxidant vitamins in both dietary supplements and functional foods, increasing product appeal and market penetration

- The influence of health and wellness trends, coupled with recommendations from health authorities and influencers, is shaping the adoption of vitamin-based antioxidant formulations across diverse demographics

- Expanding applications in the food and beverage, cosmetic, and pharmaceutical industries—where antioxidants serve roles beyond supplementation, such as preservative or skin-care agent—are broadening market opportunities for vitamin antioxidants

Antioxidant Vitamin Market Dynamics

Driver

“Growing Health Consciousness”

- Heightened awareness of the role antioxidants play in reducing free radical damage and promoting long-term health is fueling demand for vitamin antioxidants among consumers prioritizing preventive self-care

- For instance, Nestlé Health Science has developed specialized antioxidant vitamin blends for medical nutrition products targeting aging populations, further capitalizing on rising interest in personalized nutrition

- The prevalence of chronic health issues, such as cardiovascular disease and diabetes, is motivating individuals to incorporate antioxidant vitamins into daily regimens as part of wider lifestyle management strategies

- Regulatory support and public health guidelines endorsing higher intake of antioxidants—including vitamins C, E, and A—are validating market growth while prompting manufacturers to innovate with compliant, high-potency formulations

- Rising educational initiatives, digital health platforms, and social media campaigns are increasing consumer understanding and driving greater adoption of antioxidant vitamin products in various forms—from capsules to fortified foods

Restraint/Challenge

“Changing Consumer Preferences”

- Rapidly evolving consumer trends—including shifting perceptions about supplement efficacy, safety, and potential overconsumption—can affect long-term demand for antioxidant vitamins

- For instance, Bayer’s shift in marketing and SKU strategy for its One A Day multivitamin range reflects ongoing challenges in aligning vitamin antioxidant offerings with fluctuating preferences for ingredient source, form, and dosage

- Competition from whole food solutions, such as superfoods and plant-based diets, as well as skepticism about synthetic or mega-dose supplements, is prompting manufacturers to adapt positioning and educate on the value of their antioxidant vitamin products

- Raw material sourcing, particularly for naturally derived vitamins, can be challenged by agricultural variability and supply chain disruptions that affect product availability and pricing

- Oversaturation and confusion in the supplements market, combined with differing regulations and standards across countries, present hurdles for brands trying to maintain trust and differentiate antioxidant vitamin products from competitors

Antioxidant Vitamin Market Scope

The market is segmented on the basis of product, type, and application.

- By Product

On the basis of product, the antioxidant vitamin market is segmented into natural antioxidants and synthetic antioxidants. The natural antioxidants segment accounted for the largest market revenue share of 61.9% in 2024, owing to rising consumer preference for clean-label, plant-based ingredients and growing awareness regarding the long-term health risks associated with synthetic additives. Naturally sourced antioxidants such as vitamin C and E from fruits, vegetables, and nuts are widely favored in both dietary supplements and food formulations due to their holistic nutritional profiles and lower toxicity risk. Regulatory support and marketing campaigns emphasizing organic and sustainable health products further boost the demand for natural antioxidants across global markets.

The synthetic antioxidants segment is projected to witness the fastest growth rate from 2025 to 2032, supported by cost-effective production, higher stability, and extended shelf life benefits in industrial applications. These antioxidants, including synthetic vitamin E variants and BHA/BHT, are extensively used in processed foods, cosmetics, and animal feed to prevent oxidative spoilage. Their scalability and functional consistency make them attractive for large-scale manufacturers despite growing scrutiny over their safety in long-term use.

- By Type

On the basis of type, the market is categorized into medical grade and food grade antioxidant vitamins. The medical grade segment dominated the largest market share in 2024, primarily driven by rising use in pharmaceuticals and nutraceuticals aimed at addressing chronic diseases, aging-related conditions, and oxidative stress. Medical grade antioxidant vitamins undergo stringent purity and potency evaluations, ensuring their effectiveness in clinical applications. The increasing prevalence of cardiovascular disorders, cancer, and neurodegenerative diseases has fueled demand for high-quality antioxidants as preventive and therapeutic agents.

The food grade segment is expected to experience the fastest growth from 2025 to 2032, driven by increasing incorporation into functional foods and beverages for preventive health. Consumers are becoming more proactive about dietary wellness, seeking fortified products rich in antioxidants to combat free radical damage and boost immunity. Food-grade antioxidants are also gaining popularity due to their versatility in a wide range of applications including bakery, dairy, snacks, and health drinks.

- By Application

On the basis of application, the antioxidant vitamin market is segmented into pharmaceuticals, food and beverages, feed additives, cosmetics, and others. The pharmaceuticals segment held the largest market revenue share in 2024 due to expanding research into the role of antioxidants in disease prevention and treatment. The segment benefits from high demand for vitamin supplements in managing oxidative stress-related disorders, as well as supportive clinical guidelines promoting antioxidant therapy in integrative medicine.

The cosmetics segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by growing consumer interest in anti-aging and skin-repair solutions. Antioxidant vitamins such as vitamin C and E are widely used in skincare formulations for their role in collagen synthesis, protection against UV-induced damage, and brightening effects. Clean beauty trends and increasing emphasis on skin health have prompted cosmetic brands to innovate with antioxidant-enriched products, driving robust segmental growth.

Antioxidant Vitamin Market Regional Analysis

- Asia-Pacific dominated the antioxidant vitamin market with the largest revenue share of 44.3% in 2024, driven by increasing health awareness, rising disposable incomes, and the growing use of vitamin supplements in preventive healthcare

- The region’s demand is supported by rapid urbanization, expansion of the dietary supplement industry, and increased use of antioxidants in cosmetics and functional food products

- Local production capabilities, favorable government initiatives promoting nutritional health, and a shift toward clean-label, plant-based antioxidants are further propelling market growth across Asia-Pacific

Japan Antioxidant Vitamin Market Insight

The Japan market is expanding due to an aging population and strong consumer focus on anti-aging and wellness products. Antioxidant vitamins, particularly vitamin C and E, are widely used in supplements and high-end skincare products. Demand is also driven by Japan’s tradition of preventative healthcare and innovation in functional foods enriched with natural antioxidants.

China Antioxidant Vitamin Market Insight

China held the largest share in the Asia-Pacific antioxidant vitamin market in 2024, fueled by its large health-conscious population and the surge in demand for dietary supplements. Government efforts to promote nutrition and health, rising middle-class income, and growing consumption of fortified foods and beverages are key growth drivers. Domestic manufacturers are also investing in plant-based antioxidant ingredients to meet rising consumer expectations for natural products.

Europe Antioxidant Vitamin Market Insight

The Europe antioxidant vitamin market is projected to grow at a significant CAGR over the forecast period, supported by strong regulatory frameworks favoring clean-label ingredients and sustainable sourcing. Growing demand for anti-aging cosmetics, functional foods, and preventive healthcare solutions is boosting antioxidant vitamin uptake. The region also benefits from a well-established nutraceutical industry and growing vegan population demanding plant-based antioxidants.

U.K. Antioxidant Vitamin Market Insight

The U.K. market is anticipated to grow steadily, driven by increased awareness of immunity and skin health, especially post-COVID. Rising demand for natural food supplements and clean-label skincare products is shaping market trends. Government-led nutrition campaigns and a high level of consumer engagement with wellness trends are encouraging product innovation and adoption.

Germany Antioxidant Vitamin Market Insight

Germany’s antioxidant vitamin market is expanding considerably, underpinned by its strong nutraceutical sector and demand for organic, high-quality vitamins. Health-conscious consumers are opting for supplements with proven efficacy, especially for heart, brain, and skin health. Germany also leads in research and development of bioavailable antioxidant formulations, supporting market innovation and growth.

North America Antioxidant Vitamin Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumption of dietary supplements, plant-based nutrition, and anti-aging skincare products. Increased consumer preference for natural ingredients and functional health products is driving demand. Supportive regulatory standards, growth of e-commerce distribution, and emphasis on preventive wellness are accelerating antioxidant vitamin adoption.

U.S. Antioxidant Vitamin Market Insight

The U.S. antioxidant vitamin market captured the largest revenue share in 2024 within North America, driven by strong demand for clean-label supplements, fortified foods, and advanced skincare products. The country’s aging population and widespread use of preventive healthcare are major contributors. Brands are responding with innovative antioxidant-rich formulations targeting immunity, cardiovascular health, and cognitive function, supporting robust market growth.

Antioxidant Vitamin Market Share

The antioxidant vitamin industry is primarily led by well-established companies, including:

- Jarrow Formulas, Inc. (U.S.)

- NOW Foods (U.S.)

- Nature's Bounty (U.S.)

- Bactolac Pharmaceutical, Inc. (U.S.)

- DSM (Netherlands)

- BASF SE (U.S.)

- DuPont (U.S.)

- ADM (U.S.)

- Amster Pharmacrit (India)

- Cargill, Incorporated (U.S.)

- Kalsec Inc. (U.S.)

- Kemin Industries, Inc. (U.S.)

- Bio-Botanica (U.S.)

- Garden of Life (U.S.)

- Medicant Nutrients (India)

Latest Developments in Global Antioxidant Vitamin Market

- In November 2023, Florida Food Products introduced VegStable Fresh, a plant-based antioxidant solution that enhances food preservation by delaying oxidation in poultry and meat. This innovation strengthens the company’s position in the natural food additive market by addressing shelf life, flavor retention, and clean-label demands in the processed meat segment

- In September 2023, Galderma launched the C-RADICAL Defense Antioxidant Serum, featuring a proprietary encapsulated Vitamin C and 14 vital antioxidants. This release reinforced Galderma’s leadership in dermatological skincare by meeting rising consumer demand for effective, non-irritating, and science-backed antioxidant formulations

- In 2023, Now Foods initiated a wellness campaign featuring celebrity and dermatologist endorsements to promote lifestyle and skincare products. This move expanded its market influence by boosting brand visibility and driving consumer engagement in the antioxidant-rich personal care and supplement segments

- In 2023, NutriJa launched NutriJa Advance Electrolyte +, an antioxidant supplement designed to support performance and recovery by preventing cramps and balancing electrolytes. This product aligns with growing trends in sports nutrition and functional wellness, enhancing the brand’s appeal to health-conscious and active consumers

- In 2022, Layn Natural expanded its Plantae by Layn range with botanical antioxidant extracts that offer clean-label solutions for flavor enhancement and shelf-life extension. This expansion positioned the company to capitalize on increasing demand for natural, low-sodium, and low-sugar alternatives in the food and beverage industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antioxidant Vitamin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antioxidant Vitamin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antioxidant Vitamin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.