Global Antistatic Agents Market

Market Size in USD Million

CAGR :

%

USD

543.90 Million

USD

807.27 Million

2024

2032

USD

543.90 Million

USD

807.27 Million

2024

2032

| 2025 –2032 | |

| USD 543.90 Million | |

| USD 807.27 Million | |

|

|

|

|

Antistatic Agents Market Size

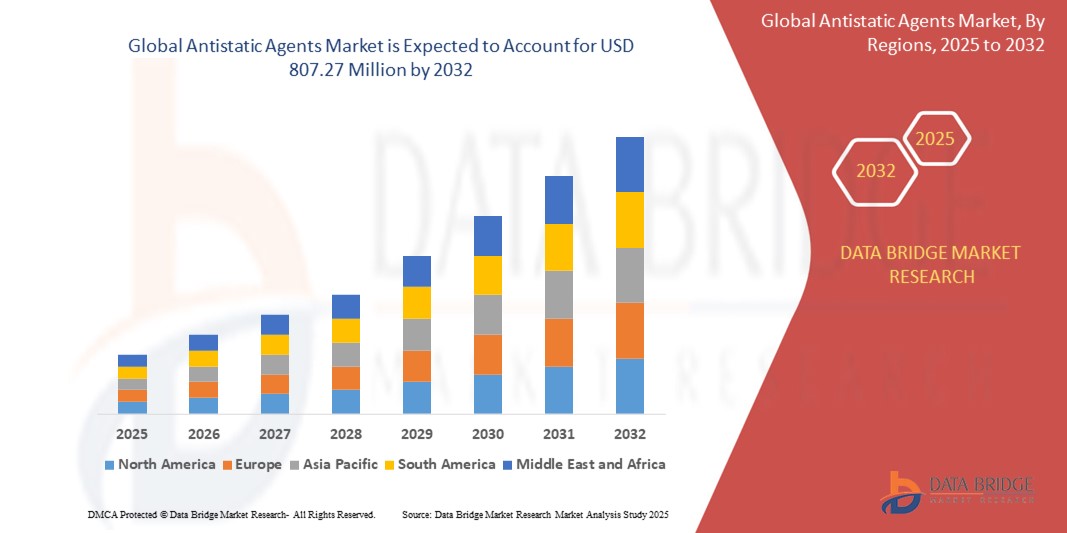

- The Global Antistatic Agents Market was valued at USD 543.9 Million in 2024 and is projected to reach USD 807.27 Million by 2032

- During the forecast period from 2025 to 2032, the market is expected to grow at a CAGR of 5.06%, driven primarily by increasing demand from the chemical and petrochemical industries across developed and developing economies

- The growth is further supported by expanding application areas in sectors such as healthcare, food & beverage, and personal care, along with the rapid growth of various end-user industries, particularly in emerging markets

Antistatic Agents Market Analysis

- Antistatic Agents are extensively used across industries such as plastics, packaging, electronics, textiles, and automotive due to their ability to reduce or eliminate static electricity buildup, thereby enhancing product safety, performance, and lifespan

- The rising demand for Antistatic Agents is primarily driven by increased usage of plastic materials, growing electronics manufacturing, and strict regulations regarding safety and electrostatic discharge (ESD) protection in industrial environments

- Asia-Pacific dominates the Global Antistatic Agents Market in terms of revenue share in 2025, supported by the expansion of manufacturing sectors, infrastructure growth, and robust demand from countries like China, India, Japan, and South Korea

- North America is projected to witness the fastest growth during the forecast period, fueled by the technological advancements in the electronics industry, increased automation, and stringent safety standards in end-use industries

- The packaging segment is expected to lead the market with a market share of 34.2% in 2025, driven by the growing demand for ESD-safe packaging, improved material handling efficiency, and sustainability-focused plastic innovations

Report Scope and Antistatic Agents Market Segmentation

|

Attributes |

Antistatic Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antistatic Agents Market Trends

“Growing Demand for Electrostatic Discharge (ESD) Protection and Sustainable Additives”

- There is a growing demand for effective ESD protection across the electronics, automotive, and packaging sectors, prompting manufacturers to develop advanced Antistatic Agents that improve safety, material handling, and product longevity

- Innovations in polymer compatibility, additive concentration, and long-lasting performance are enabling the production of high-efficiency Antistatic Agents suited for a wide range of thermoplastics and applications

- Leading companies are significantly investing in sustainable and biodegradable antistatic solutions, aligning with increasing environmental concerns and tightening global regulations around plastic waste and chemical additives

- For instance, in January 2024, Croda International introduced a new bio-based antistatic additive derived from renewable resources, designed for use in polyethylene and polypropylene packaging to enhance recyclability and reduce environmental footprint.

- This trend highlights a broader industry shift toward technologically advanced, sustainable, and compliant antistatic solutions, driven by consumer safety concerns, regulatory compliance, and the circular economy movement.

Antistatic Agents Market Dynamics

Driver

“Rising Demand from Plastics, Electronics, and Packaging Industries”

- Increasing use of plastics in packaging, consumer electronics, and automotive components is driving the demand for Antistatic Agents to prevent static charge buildup and improve material handling and safety

- The rapid growth of the electronics industry, especially in emerging economies, is fueling demand for ESD-protective materials where antistatic agents are essential

- Expansion of smart packaging and flexible electronics applications requires reliable static control, boosting the use of antistatic additives in polymers and films

- Regulatory emphasis on workplace safety and product protection in electronics and industrial settings further supports market expansion

- Rising automation and digital transformation across manufacturing sectors are increasing the adoption of antistatic solutions to ensure uninterrupted operations and material stability

Restraint/Challenge

“Volatile Raw Material Prices and Regulatory Pressures”

- Many Antistatic Agents are derived from petrochemical-based compounds, making their production vulnerable to fluctuations in crude oil prices and supply disruptions

- Growing environmental concerns over chemical additives and plastic pollution have led to stricter regulations on the use and disposal of antistatic compounds

- Compliance with regional environmental laws (e.g., REACH in Europe or EPA regulations in the U.S.) imposes additional testing and documentation costs

- The shift toward eco-friendly and biodegradable alternatives places pressure on manufacturers to innovate while maintaining performance and cost efficiency

- Global supply chain constraints and transportation bottlenecks—exacerbated by geopolitical tensions and post-pandemic impacts—pose challenges to timely product delivery and consistent raw material sourcing

Antistatic Agents Market Scope

The market is segmented on the basis of type, category, form, product, polymer and end user industry.

- By Type

On the basis of type, the antistatic agents market is segmented into cationic antistatic agent, anionic antistatic agent and non-ionic antistatic agent. The non-ionic antistatic agents segment dominates the market with the largest revenue share of 44.5% in 2025, owing to their compatibility with a wide range of polymers and low toxicity, making them suitable for packaging, automotive, and electronics applications.

The cationic antistatic agents segment is anticipated to witness the fastest CAGR of 7.5% from 2025 to 2032, driven by their strong performance in synthetic fibers and textiles, as well as increasing use in industrial applications requiring effective static charge dissipation.

- By Category

On the basis of category, the antistatic agents market is segmented into external antistatic agents and internal antistatic agents. The internal antistatic agents segment is expected to hold the largest market revenue share in 2025, due to their integration during polymer processing, which provides long-lasting protection and cost efficiency.

The external antistatic agents segment is projected to register the fastest growth rate during the forecast period, supported by their versatility in surface applications, especially in films, sheets, and packaging materials.

- By Form

On the basis of form, the antistatic agents market is segmented into liquid, powder and others. The liquid segment accounted for the largest market revenue share in 2025, driven by its ease of application, high dispersion rate, and strong compatibility with polymer blends.

The powder form is forecasted to experience the highest growth rate from 2025 to 2032, due to increasing demand in masterbatch formulations, cost-effective transportation, and storage advantages.

- By Product

On the basis of product, the antistatic agents market is segmented into ethoxylated fatty acid amines, glycerol Mon stearate, diethanolamides and others. The glycerol monostearate segment is expected to dominate in 2025, owing to its widespread use in food packaging, plastics, and cosmetics, and its dual function as a lubricant and antistatic additive.

The ethoxylated fatty acid amines segment is projected to witness significant growth due to their high efficiency in reducing surface resistivity and compatibility with polyethylene and polypropylene.

- By Polymer

On the basis of polymer, the antistatic agents market is segmented into polypropylene, acrylonitrile butadiene styrene, polyethylene, polyvinyl chloride and others. The polypropylene segment is expected to lead in 2025, due to the widespread use of PP in packaging, textiles, and automotive parts, where antistatic performance is critical.

The polyethylene segment is forecasted to register the fastest CAGR during the forecast period, driven by the increasing demand for ESD-safe flexible packaging and industrial films.

- By End User Industry

On the basis of end user industry, the antistatic agents market is segmented into packaging, electronics, automotive, textiles and others. The packaging segment accounted for the largest revenue share in 2025, driven by rising demand for antistatic packaging films, bags, and containers, especially in electronics and food sectors.

The electronics industry is expected to experience the fastest growth rate from 2025 to 2032, fueled by increased production of semiconductors, circuit boards, and mobile devices, requiring static control for sensitive components.

Antistatic Agents Market Regional Analysis

- Asia-Pacific dominates the Antistatic Agents Market with the largest revenue share of 34.8% in 2024, driven by rapid industrialization, expanding manufacturing capabilities, and rising demand for plastics in packaging, automotive, and electronics industries

- The region’s strong base of polymer processing and plastic conversion, particularly in China, India, Japan, and South Korea, fuels demand for both internal and external antistatic agents

- Rising e-commerce activity, increasing disposable incomes, and supportive government initiatives for industrial expansion and sustainable packaging solutions are further enhancing regional growth

- Key manufacturers are expanding their regional footprint and investing in production innovations and R&D to meet the growing demand for environmentally friendly and performance-optimized antistatic agents

U.S. Antistatic Agents Market Insight

The U.S. captured the largest revenue share of over 69.34% within North America in 2025, attributed to the widespread usage of antistatic agents in flexible packaging, automotive components, and consumer electronics. Market growth is driven by a high level of polymer consumption, stringent ESD regulations, and a mature end-use industry landscape. Innovation in biodegradable and non-toxic antistatic additives, along with supportive government policies, is boosting domestic production and sustainable material adoption.

Europe Antistatic Agents Market Insight

The Europe Antistatic Agents Market is projected to grow at a steady CAGR through the forecast period, supported by stringent environmental regulations, focus on recyclability, and demand for ESD-safe packaging. Major countries like Germany, France, and the Netherlands are leading demand due to robust industrial production and sustainability goals. The Europe Green Deal and Circular Economy Action Plan are fostering innovation in antistatic solutions tailored for eco-friendly plastic applications and durable consumer goods.

U.K. Antistatic Agents Market Insight

The U.K. market is set to grow at a robust CAGR, driven by increasing consumer awareness of ESD protection, especially in electronics packaging and personal care. The country's focus on green manufacturing and material innovation has prompted demand for antistatic agents in flexible films and automotive polymers. Post-Brexit regulations are influencing a more localized and compliant supply chain, promoting domestic development of polymer additives.

Germany Antistatic Agents Market Insight

In Germany, market growth is steady and supported by strong demand from automotive and electronics manufacturing sectors. The country’s engineering excellence and innovation ecosystem are fostering the adoption of advanced, durable, and sustainable antistatic agents, especially in ABS and PP applications. German firms are increasingly investing in bio-based polymers and ESD-safe industrial packaging solutions, aligning with EU environmental targets.

Asia-Pacific Antistatic Agents Market Insight

Asia-Pacific is expected to register the fastest CAGR of over 9% in 2025, with major traction in India, China, and Southeast Asian nations. High population density, increasing consumer electronics production, and booming logistics sectors are fueling demand for antistatic packaging. Government-backed manufacturing initiatives and infrastructure growth are pushing companies to innovate in cost-effective and compliant antistatic formulations. Demand is further supported by automotive electrification, smart appliance adoption, and urban retail expansion.

Japan Antistatic Agents Market Insight

The Japan Antistatic Agents Market is expanding steadily, driven by demand for high-precision and cleanroom-compatible materials in electronics and semiconductor industries. Consumers and industries prioritize high-performance, compact, and eco-conscious materials, encouraging the use of advanced antistatic agents in automotive interiors, consumer goods, and packaging. Manufacturers are leveraging innovation in viscous polymer coatings, conductive additives, and non-migratory antistatic solutions tailored for low-emission environments.

China Antistatic Agents Market Insight

China holds the largest market share within Asia-Pacific in 2025, supported by an expansive manufacturing sector and rising demand for durable, static-free plastics in both domestic and export markets. Government programs like “Made in China 2025”, combined with growing e-commerce and digital transformation, are driving demand for antistatic agents in flexible packaging, electronics, and automotive interiors. R&D initiatives, low production costs, and increasing environmental scrutiny are spurring innovation in non-toxic and sustainable additives, positioning China as a major global supplier of antistatic solutions.

Antistatic Agents Market Share

The Antistatic Agents industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Croda International Plc (U.K.)

- Arkema S.A. (France)

- Clariant AG (Switzerland)

- Dow Inc. (U.S.)

- Ampacet Corporation (U.S.)

- SABIC (Saudi Arabia)

- Stepan Company (U.S.)

- Solvay S.A. (Belgium)

- DuPont de Nemours, Inc. (U.S.)

- PolyOne Corporation (now Avient Corporation) (U.S.)

- KAO Corporation (Japan)

- Riken Vitamin Co., Ltd. (Japan)

- Fine Organics Industries Ltd. (India)

Latest Developments in Global Antistatic Agents Market

- In March 2023, Croda International Plc launched a new range of bio-based internal antistatic agents for polyolefins, aimed at improving processing efficiency and surface quality in packaging and automotive applications. This move reinforces Croda’s commitment to sustainable chemistry and renewable raw materials.

- In June 2023, BASF SE expanded its production capacity of ethoxylated antistatic agents at its plant in Antwerp, Belgium. The expansion supports growing demand from electronics and packaging industries across Europe and North America.

- In September 2023, Evonik Industries AG introduced a next-generation anionic antistatic additive under its TEGO Antistatic brand. Designed for high-performance coatings and films, the product offers improved conductivity and transparency.

- In January 2024, Clariant AG collaborated with a leading Asian electronics manufacturer to develop customized antistatic masterbatches for use in semiconductor packaging, enhancing static protection and reducing product failure rates.

- In May 2024, Fine Organics Industries Ltd. announced its plans to build a new plant dedicated to antistatic and slip additives in Maharashtra, India. This facility is aimed at catering to growing regional demand in packaging and industrial plastics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antistatic Agents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antistatic Agents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antistatic Agents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.