Global Aphakia Market

Market Size in USD Billion

CAGR :

%

USD

3.43 Billion

USD

7.57 Billion

2024

2032

USD

3.43 Billion

USD

7.57 Billion

2024

2032

| 2025 –2032 | |

| USD 3.43 Billion | |

| USD 7.57 Billion | |

|

|

|

|

Aphakia Market Size

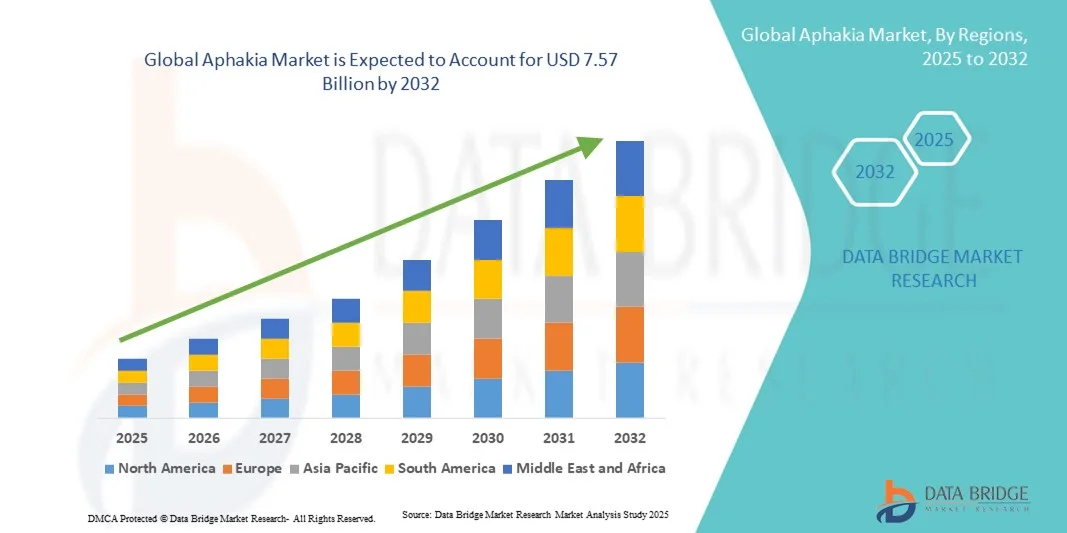

- The global aphakia market size was valued at USD 3.43 billion in 2024 and is expected to reach USD 7.57 billion by 2032, at a CAGR of 10.40% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within ophthalmic devices and vision correction solutions, leading to increased prevalence of corrective procedures and treatments for lens disorders in both developed and emerging regions

- Furthermore, rising consumer demand for safe, effective, and advanced intraocular lens (IOL) solutions is establishing aphakia correction procedures as the preferred choice for restoring vision post-cataract surgery or trauma. These converging factors are accelerating the uptake of Aphakia solutions, thereby significantly boosting the industry's growth

Aphakia Market Analysis

- Global Aphakia, a condition characterized by the absence of the natural lens of the eye, is increasingly gaining attention due to the rising prevalence of cataracts, advancements in surgical techniques, and growing awareness of corrective treatment options such as intraocular lens (IOL) implantation

- The escalating demand for aphakia treatment is primarily fueled by the increasing number of cataract surgeries worldwide, technological innovations in surgical procedures, and improved access to ophthalmic healthcare services, particularly in developing regions

- North America dominated the aphakia market with the largest revenue share of 38.6% in 2024, supported by advanced healthcare infrastructure, high adoption of innovative treatments, and a strong presence of key ophthalmic product manufacturers. The U.S. experienced substantial growth in aphakia treatments, driven by surgical advancements and increasing patient awareness

- Asia-Pacific is expected to be the fastest-growing region in the aphakia market during the forecast period due to a large patient population, rising healthcare expenditures, increasing availability of modern ophthalmic facilities, and growing awareness of corrective treatments in countries such as China, India, and Japan

- The Secondary aphakia segment dominated the global aphakia market with the largest revenue share of 62.5% in 2024, primarily because most cases of aphakia arise as a consequence of cataract extraction surgeries where the natural lens is removed

Report Scope and Aphakia Market Segmentation

|

Attributes |

Aphakia Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aphakia Market Trends

Enhanced Convenience Through Advanced Ophthalmic Solutions

- A significant and accelerating trend in the global aphakia market is the growing adoption of advanced intraocular lenses (IOLs), artificial iris implants, and improved surgical techniques that provide enhanced visual rehabilitation for patients. This shift is significantly improving treatment outcomes and overall patient quality of life

- For instance, new premium intraocular lenses (multifocal and accommodative IOLs) are offering patients greater convenience by reducing dependence on corrective eyewear post-surgery, thereby transforming the long-term management of aphakia. Similarly, foldable IOLs and minimally invasive implantation techniques are offering discreet and effective solutions for patients with congenital or surgical aphakia

- Integration of AI-driven diagnostic platforms and digital imaging in ophthalmology is enabling more accurate preoperative assessments, helping surgeons select the most suitable IOLs and personalize treatment. This enhances patient satisfaction and reduces postoperative complications. Furthermore, continuous innovation in ophthalmic biomaterials is making IOLs safer, more durable, and more compatible with different patient needs

- The seamless integration of digital health platforms with ophthalmic practices also facilitates remote monitoring of patients after aphakia correction procedures, providing follow-ups and early intervention through teleophthalmology. This unified and connected approach is improving accessibility, particularly in underserved regions

- This trend towards more intelligent, patient-centered, and technologically advanced ophthalmic solutions is fundamentally reshaping expectations in eye care. Consequently, companies such as Alcon, Bausch + Lomb, and Carl Zeiss Meditec are developing innovative IOLs and surgical solutions aimed at improving precision, reducing risks, and offering long-lasting vision correction

- The demand for advanced aphakia management solutions is growing rapidly across both developed and emerging markets, as healthcare systems increasingly prioritize restoring functional vision and enhancing overall quality of life for patients

Aphakia Market Dynamics

Driver

Growing Need Due to Rising Cataract Surgeries and Ophthalmic Advancements

- The global burden of aphakia is strongly linked to the rising number of cataract surgeries performed worldwide, as aphakia often results from cataract extraction when the natural lens is removed

- With cataracts remaining the leading cause of blindness globally, the demand for corrective treatments such as intraocular lenses (IOLs) has been growing consistently. Aging populations in both developed and emerging markets are driving an unprecedented rise in surgical procedures, directly fueling the demand for aphakia correction

- In addition, rapid technological advancements in ophthalmology are making treatments more effective and widely acceptable. Modern IOLs — including foldable, accommodative, and multifocal designs — are increasingly preferred due to their ability to restore functional vision and reduce dependence on spectacles

- Companies like Alcon, Carl Zeiss Meditec, and Bausch + Lomb are actively investing in next-generation IOL platforms, which not only address aphakia but also enhance visual performance by correcting refractive errors

- The growing integration of advanced imaging systems, AI-driven diagnostics, and precision surgical tools ensures that patients receive highly personalized treatments. This minimizes complications, improves surgical outcomes, and increases patient confidence in aphakia interventions. Improved reimbursement policies in developed nations, along with growing government support for eye care initiatives in developing countries, further strengthen the growth outlook of the market

Restraint/Challenge

Concerns Regarding High Treatment Costs and Limited Access in Developing Regions

- Despite strong demand, the adoption of advanced aphakia treatments faces significant obstacles, particularly in resource-limited regions. One of the major challenges is the high cost of premium intraocular lenses and advanced surgical technologies. While basic monofocal IOLs are relatively affordable, newer premium lenses designed for multifocal or accommodative vision correction remain prohibitively expensive for a large segment of patients in low- and middle-income countries. This creates a disparity in access to care, where only patients in higher-income brackets can afford advanced solutions

- Another key barrier is the limited availability of skilled ophthalmic surgeons and advanced healthcare infrastructure in rural and underserved areas. Patients in these regions often experience delayed diagnosis and treatment, which increases the risk of long-term vision impairment. Moreover, the high cost of setting up state-of-the-art eye care facilities discourages widespread adoption in developing countries

- Concerns about potential postoperative complications, such as posterior capsule opacification (PCO), infections, or the need for secondary surgeries, can also make some patients hesitant to undergo treatment. These risks, combined with the perception of high costs, limit acceptance of advanced aphakia correction procedures

- To overcome these challenges, companies and healthcare providers are increasingly focusing on affordable product innovations, government-subsidized eye care programs, and training initiatives for ophthalmic professionals. Expanding outreach programs and teleophthalmology services may also play a critical role in improving access to aphakia treatment in underpenetrated markets, thereby unlocking significant growth potential in the long term

Aphakia Market Scope

The market is segmented on the basis of type, cause, treatment and end users.

- By Type

On the basis of type, the Aphakia market is segmented into Primary and Secondary. The Secondary aphakia segment dominated the market with the largest revenue share of 62.5% in 2024, primarily because most cases of aphakia arise as a consequence of cataract extraction surgeries where the natural lens is removed. With cataract surgeries being among the most frequently performed ophthalmic procedures globally, the prevalence of secondary aphakia remains significantly high. This dominance is further reinforced by rising awareness and improved surgical accessibility, particularly in developed regions. Secondary aphakia management typically involves intraocular lens (IOL) implantation, spectacles, or contact lenses, making it the central focus of ophthalmic treatment approaches. Additionally, the rising geriatric population, particularly in regions such as North America, Europe, and Asia-Pacific, continues to fuel the need for secondary aphakia treatment, sustaining its leadership in the market.

The Primary aphakia segment is anticipated to witness the fastest CAGR of 9.8% from 2025 to 2032, driven by growing awareness and improved early diagnosis of congenital conditions. Although primary aphakia is rare, advances in neonatal eye screening programs, especially in developed and emerging economies, are leading to higher detection rates. Pediatric ophthalmology has advanced significantly, and supportive government and NGO-led initiatives focusing on child health are expected to improve access to treatment for congenital aphakia cases. Increasing investments in neonatal ophthalmic care, coupled with innovations in pediatric intraocular lenses and contact lenses, are expected to drive long-term growth of this segment.

- By Cause

On the basis of cause, the Aphakia market is segmented into Congenital Aphakia, Surgical Aphakia, and Acquired Aphakia.The Surgical aphakia segment dominated the market with the largest revenue share of 54.3% in 2024, owing to the massive global volume of cataract surgeries, which are the leading cause of aphakia. With cataracts being a major contributor to blindness worldwide, surgical intervention often results in lens removal without immediate IOL implantation in some cases, thereby contributing significantly to aphakia incidence. Surgical aphakia management has become more structured with the availability of advanced corrective methods like IOLs and contact lenses. Moreover, the global aging population and the rise in diabetes-related ocular complications further add to the number of cataract-related surgeries, reinforcing the dominance of surgical aphakia in the overall market.

The Acquired aphakia segment is expected to witness the fastest CAGR of 10.4% from 2025 to 2032, driven by rising incidences of trauma, accidental injuries, and complications from eye surgeries beyond cataract removal. Acquired aphakia is also linked to higher prevalence in developing countries due to insufficient access to advanced surgical interventions during emergencies. Increasing cases of corneal disorders, ocular trauma in industrial regions, and sports-related eye injuries are fueling demand for corrective solutions. With innovations in tailored corrective treatments and wider availability of IOL implantation in emerging economies, the acquired aphakia segment is anticipated to see robust long-term growth.

- By Treatment

On the basis of treatment, the Aphakia market is segmented into Spectacles, Contact Lenses, Intraocular Lens (IOL) Implantation, Refractive Surgery, and Others. The Intraocular Lens (IOL) Implantation segment dominated the market with the largest revenue share of 58.7% in 2024, owing to the growing preference for permanent corrective solutions that restore near-normal vision. IOL implantation is the standard treatment following cataract surgery and is widely recommended due to its effectiveness, durability, and ability to significantly enhance quality of life. The adoption of premium IOLs, such as multifocal and toric designs, is expanding rapidly in developed countries, while foldable and cost-effective IOLs are gaining traction in developing regions. Supportive reimbursement policies in advanced healthcare systems and increasing government-backed cataract surgery programs globally further cement this segment’s leading position.

The Refractive Surgery segment is projected to witness the fastest CAGR of 11.2% from 2025 to 2032, fueled by technological innovations such as femtosecond lasers and advanced corneal inlays. Patients seeking long-term, spectacle-free vision correction are increasingly opting for refractive surgeries to address aphakia when suitable. The growing popularity of minimally invasive techniques and shorter recovery periods enhances adoption rates. Furthermore, rising disposable incomes in developing economies and increasing awareness about elective corrective procedures are accelerating growth. Although refractive surgery adoption is currently more common in urban populations, its gradual expansion to wider demographics is expected to sustain strong growth momentum in the coming years.

- By End Users

On the basis of end users, the Aphakia market is segmented into Hospitals, Ophthalmic Clinics, and Others. The Hospitals segment dominated the market with the largest revenue share of 61.9% in 2024, due to the high volume of cataract and other ophthalmic surgeries performed in these facilities. Hospitals are equipped with advanced surgical infrastructure, skilled ophthalmologists, and access to comprehensive diagnostic tools, making them the primary centers for aphakia treatment. Moreover, the availability of reimbursement schemes, government-funded cataract surgery programs, and better patient awareness campaigns strengthen the dominance of hospitals in the global aphakia market. The capacity to handle both elective and emergency cases gives hospitals a significant advantage over other facilities.

The Ophthalmic Clinics segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, supported by the growing trend toward outpatient care and specialized eye treatment facilities. Ophthalmic clinics offer personalized care, reduced waiting times, and focused expertise, making them increasingly preferred by patients seeking aphakia management solutions such as IOL implantation or contact lens fitting. The expansion of private ophthalmology practices in emerging economies, coupled with rising investments in clinic-based surgical technologies, is accelerating growth. Clinics also play a pivotal role in rural and semi-urban outreach, where hospitals may be less accessible, further boosting their growth trajectory.

Aphakia Market Regional Analysis

- North America dominated the aphakia market with the largest revenue share of 38.6% in 2024, supported by advanced healthcare infrastructure, high per-capita healthcare spending, and a strong presence of leading ophthalmic device manufacturers

- The region benefits from widespread availability of modern cataract and refractive surgery facilities, well-established referral networks, high patient awareness of corrective options after lens removal, and relatively quick regulatory clearances for new intraocular lens (IOL) technologies. Reimbursement coverage and private insurance penetration help patients access premium IOLs and surgical options, which in turn drives demand for aphakia correction solutions such as IOL implantation and specialized contact lenses

- There is also a steady pipeline of clinical trials and product launches originating from North American R&D centers, which sustains technology refresh and creates recurring demand for consumables and follow-up care. Aging demographics in the region further underpin procedural volumes, while urban centers concentrate high volumes of elective ophthalmic procedures

U.S. Aphakia Market Insight

The U.S. aphakia market accounted for roughly North America’s aphakia market in 2024, making it the single largest national market globally. Growth in the U.S. is propelled by high surgical throughput (large numbers of cataract procedures annually), broad access to advanced surgical platforms and premium IOLs, and a dense network of specialty ophthalmic clinics. Strong private-sector investment, active adoption of premium and multipurpose IOLs (e.g., multifocal, toric, extended depth of focus), and well-developed ambulatory surgery center infrastructure support higher average selling prices and volume. Patient education programs, routine vision screenings, and high levels of post-operative follow-up care also increase uptake of corrective measures for aphakia. The U.S. market is innovation-led: device approvals, surgeon training programs, and payer interactions (coverage for certain IOLs/procedures) shape near-term demand and product mix.

Europe Aphakia Market Insight

The Europe aphakia market is set to expand steadily during the forecast period, supported by mature healthcare systems, robust clinical expertise, and strong public and private funding for ophthalmology. Pan-European demand is driven by an aging population, the standardization of cataract care pathways, and increasing adoption of improved IOL designs in both public hospitals and private clinics. Cross-country variations exist—some nations rely more on public health services while others have significant private ophthalmic sectors—yet the overall region benefits from coordinated clinical guidelines and reimbursement policies that facilitate access to corrective lens implantation and follow-up care. Continued investments in surgical training and the adoption of minimally invasive techniques help raise procedural volumes and patient outcomes, supporting steady market expansion across Europe.

U.K. Aphakia Market Insight

The U.K. aphakia market is expected to grow at a noteworthy pace as public and private providers expand capacity for cataract and lens-replacement procedures. Growth is underpinned by an aging population, increasing patient expectations for visual outcomes, and growing uptake of premium IOLs in the private segment. The mix of NHS-funded cataract services (which drive baseline volumes) plus a sizeable private market for premium optics creates a two-tier demand structure: high procedural volumes in the public system and margin-enhancing premium uptake in private clinics. Improvements in referral pathways, surgical throughput initiatives, and enhanced patient awareness campaigns are contributing to higher corrective procedure rates and stronger demand for aphakia management solutions.

Germany Aphakia Market Insight

The Germany aphakia market is a key European market driven by sophisticated medical infrastructure, a strong domestic medical-device industry, and high standards of clinical practice. German ophthalmic clinics and university hospitals adopt advanced IOL technologies early, and there is particular emphasis on precision, safety, and device performance. This market’s characteristics—high procedure quality, regulatory rigor, and willingness among some patients to pay for premium lenses—support robust demand for IOL implants and related surgical accessories. Additionally, Germany’s strong ties between clinical research centers and manufacturers accelerate product validation and surgeon training, reinforcing the country’s position as a leading adopter of new aphakia solutions.

Asia-Pacific Aphakia Market Insight

The Asia-Pacific aphakia market is expected to be the fastest-growing region, with an estimated CAGR driven by a very large patient pool, rising healthcare expenditures, expanding access to modern ophthalmic facilities, and increasing awareness of corrective treatments. Rapid urbanization, improving surgical infrastructure, and government and private investments in eye-care services are expanding procedural capacity across the region. Demand is also boosted by greater affordability of surgeries and the scaling of high-volume surgical centers that can treat large patient cohorts efficiently. The mix of rising diagnostic screening, NGO-led outreach programs, and expanding private ophthalmology chains further accelerates penetration of aphakia treatments.

China Aphakia Market Insight

The China aphakia market accounted for the largest aphakia market share within Asia-Pacific in 2024, reflecting rapid urbanization, a growing middle class, and substantial investment in tertiary eye-care centers. High surgical volumes in tier-1 and tier-2 cities, increasing availability of modern intraocular lenses, and domestic manufacturing of ophthalmic consumables contribute to both affordability and scale. Public screening campaigns and growing insurance or employer-sponsored care options are increasing access, while leading Chinese hospitals often serve as regional referral centers for complex cases and advanced lens implants. Local manufacturers and global suppliers both compete actively, which helps push innovation and price accessibility for aphakia solutions.

Japan Aphakia Market Insight

The Japan aphakia market is supported by an advanced healthcare system, high technology adoption, and one of the world’s fastest-aging populations, which together sustain demand for corrective lens solutions. Japanese surgeons are early adopters of precision surgical techniques and novel lens designs, and patient expectations for post-operative visual function (including lifestyle optics) are high. The demographic trend toward older age cohorts means consistent procedure volumes, and strong clinical training programs ensure widespread availability of specialized ophthalmic care. Demand for user-friendly, safe solutions for elderly patients—such as foldable IOLs and improved biocompatible materials—remains a major growth driver.

India Aphakia Market Insight

The India aphakia market is positioned for rapid expansion in the global aphakia market due to a large unmet need: high cataract prevalence, substantial numbers of untreated cases in rural and semi-urban areas, and expanding surgical outreach programs. The country’s combination of low-cost, high-volume surgical models (driven by some established eye-care chains and NGO initiatives) and rising private sector capacity creates strong potential for increased uptake of IOL implantation and other corrective interventions. Affordability improvements, scale-up of tertiary eye centers, enhanced reimbursement/charitable funding models, and growing patient awareness are expected to accelerate adoption. India is often seen as a market where volume growth will be steep, even as per-case revenues rise with greater access to premium IOL options over time.

Aphakia Market Share

The Aphakia industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Johnson & Johnson and its affiliates (U.S.)

- Bausch + Lomb (U.S.)

- Carl Zeiss AG (Germany)

- HOYA Corporation (Japan)

- Rayner Intraocular Lenses Limited (U.K.)

- Lenstec, Inc. (U.S.)

- STAAR Surgical Company (U.S.)

- PhysIOL (Belgium)

- Medicontur Medical Engineering (Hungary)

- Appasamy Associates (India)

- Care Group (India)

- ASICO (U.S.)

- HumanOptics AG (Germany)

- IOLTech (France)

- Ophtec BV (Netherlands)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Geuder AG (Germany)

- ReVision Optics (U.S.)

- Kowa Company Ltd. (Japan)

Latest Developments in Global Aphakia Market

- In September 2024, Johnson & Johnson introduced the TECNIS Odyssey IOL in the U.S.. This next-generation intraocular lens offers continuous vision across all distances and lighting conditions, aiming to reduce patients' dependence on glasses. The TECNIS Odyssey IOL features a unique freeform diffractive surface designed to eliminate gaps between near, intermediate, and far distances, providing uninterrupted vision. Clinical trials indicated that 93% of patients achieved freedom from glasses at all distances, with high satisfaction rates for both near and distance vision

- In June 2025, Johnson & Johnson expanded the availability of the TECNIS Odyssey IOL to Europe, the Middle East, and Canada. This launch followed its initial introduction in the U.S. and aimed to offer cataract patients in these regions precise vision at every distance and in any lighting. The TECNIS Odyssey IOL has received regulatory approval in multiple countries, including Japan, the EU, Korea, Canada, Singapore, Australia, and New Zealand

- In March 2025, Bausch + Lomb initiated a voluntary recall of certain intraocular lenses from its enVista platform, including enVista Aspire, enVista Envy, and certain enVista Monofocal IOLs. The recall was prompted by an increased number of reports of toxic anterior segment syndrome (TASS), a serious inflammatory reaction that can occur after cataract surgery. The company identified the cause as an issue with a raw material from a specific vendor and implemented enhanced inspection protocols. Affected lots were removed from the market, and unaffected lots were returned after thorough investigation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.