Global Apheresis Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.11 Billion

USD

9.61 Billion

2024

2032

USD

4.11 Billion

USD

9.61 Billion

2024

2032

| 2025 –2032 | |

| USD 4.11 Billion | |

| USD 9.61 Billion | |

|

|

|

|

Apheresis Equipment Market Size

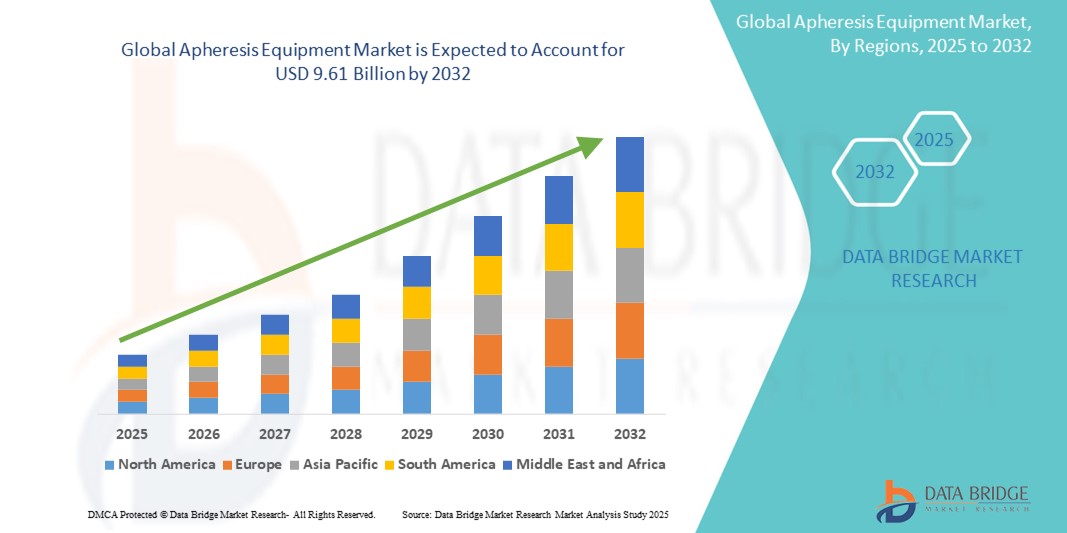

- The global apheresis equipment market size was valued at USD 4.11 billion in 2024 and is expected to reach USD 9.61 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, including cancer, autoimmune disorders, and hematological conditions, which necessitate therapeutic apheresis procedures as part of disease management and treatment

- Furthermore, technological advancements in apheresis machines—such as improved automation, portability, and precision—combined with a growing demand for personalized medicine and increased blood component donation, are significantly driving adoption across hospitals, blood banks, and research centers

Apheresis Equipment Market Analysis

- Apheresis equipment, designed for the separation and collection of specific blood components such as plasma, platelets, and leukocytes, is increasingly becoming a critical tool in therapeutic and donation-based procedures across hospitals, blood banks, and research institutions due to its precision, efficiency, and ability to target individual blood elements

- The escalating demand for apheresis equipment is primarily fueled by the rising incidence of chronic and autoimmune diseases, growing use of apheresis in oncology, neurology, and hematology, and an increasing number of blood donations and transfusion procedures requiring component separation

- North America dominates the apheresis equipment market with the largest revenue share of 35.4% in 2024, characterized by advanced healthcare infrastructure, growing awareness of therapeutic apheresis applications, and the presence of leading manufacturers offering technologically advanced systems

- Asia-Pacific is expected to be the fastest growing region in the apheresis equipment market during the forecast period due to rising healthcare investments, an expanding patient population with chronic diseases, and growing government support for blood collection and transfusion services

- Disposable apheresis kits segment dominates the apheresis equipment market with a market share of 72.22% in 2024, driven by its single-use safety, reduced risk of cross-contamination, and growing demand for cost-effective, sterile procedures across hospitals and blood banks

Report Scope and Apheresis Equipment Market Segmentation

|

Attributes |

Apheresis Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Apheresis Equipment Market Trends

“Automation, Portability, and Integration with Digital Health Systems”

- A significant and accelerating trend in the global apheresis equipment market is the evolution of automated, portable, and digitally integrated apheresis systems, which are enhancing procedure efficiency, patient comfort, and overall clinical outcomes. These advancements are transforming apheresis from a hospital-centric treatment into a more flexible and accessible therapeutic solution

- For instance, devices such as the Terumo BCT Spectra Optia offer real-time monitoring, user-friendly touch-screen interfaces, and protocol customization capabilities, allowing clinicians to perform multiple types of procedures with a single platform. Similarly, Haemonetics’ NexSys PCS system incorporates automation and digital connectivity to optimize plasma collection and donor management

- Automation in apheresis equipment improves consistency and safety by reducing manual interventions, while digital integration with electronic medical records (EMRs) and data analytics platforms supports better tracking of patient treatments and outcomes. These systems also enable predictive maintenance and remote diagnostics, ensuring higher operational efficiency for healthcare providers

- Portability is emerging as a key design focus, with lightweight, compact devices being deployed in mobile blood drives and outpatient clinics. This shift is particularly impactful in developing regions where access to fixed healthcare infrastructure is limited

- This trend towards more intelligent, portable, and digitally connected apheresis systems is redefining operational workflows in blood centers and hospitals. Companies such as Fresenius Kabi are investing in next-generation devices with wireless data transmission, smart sensors, and simplified setup procedures to meet the growing need for flexible, tech-enabled solutions

- The demand for advanced apheresis systems is rapidly increasing across both developed and emerging markets, as healthcare providers seek greater efficiency, scalability, and precision in therapeutic blood processing and component collection

Apheresis Equipment Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases and Demand for Blood Component Therapy”

- The increasing global burden of chronic diseases such as cancer, autoimmune disorders, and hematological conditions is a major driver for the growing demand for apheresis equipment, as these conditions often require therapeutic apheresis for effective treatment

- For instance, in January 2024, Terumo Blood and Cell Technologies announced the expansion of its Rika Plasma Donation System into emerging markets, aiming to improve access to high-efficiency, donor-friendly plasma collection technologies. Such developments from key players are expected to drive sustained growth in the apheresis equipment industry

- As medical professionals and healthcare systems increasingly adopt personalized treatment approaches, apheresis enables the targeted removal or collection of specific blood components, offering a precise, patient-centric therapeutic option

- Furthermore, the rise in voluntary blood and plasma donations, supported by government initiatives and awareness campaigns, has boosted the demand for apheresis equipment in blood banks and donation centers, particularly for plasma-derived therapies and component separation

- The demand is further propelled by advancements in apheresis technology, including automation, enhanced safety profiles, and user-friendly interfaces, making these systems more accessible for use in a variety of clinical and outpatient settings. The adoption of digitally connected and portable systems is also contributing to the expansion of therapeutic apheresis beyond tertiary care hospitals into mobile units and satellite clinics

Restraint/Challenge

“High Cost of Equipment and Limited Accessibility in Low-Resource Settings”

- The high initial cost associated with acquiring and maintaining apheresis equipment presents a significant barrier to widespread adoption, particularly in low- and middle-income countries and smaller healthcare facilities. These costs include not only the equipment itself but also disposable kits, maintenance, and the need for trained operators.

- For instance, advanced systems such as Spectra Optia or NexSys PCS are technologically sophisticated but come at a premium, making them less accessible in resource-constrained healthcare environments, which may opt for more conventional blood collection and transfusion methods

- In addition, the requirement for skilled personnel to operate the machines, monitor patients, and manage potential complications during procedures further limits the implementation of apheresis systems, especially in rural or underserved areas lacking specialized training infrastructure

- The availability of support infrastructure, such as proper storage, power supply, and reliable supply chains for consumables such as disposable kits, also remains a concern in several developing regions, restricting consistent and safe usage of apheresis technology

- Overcoming these challenges will require public-private partnerships, subsidized pricing models, localized training programs, and the development of cost-effective, simplified apheresis systems that can function in diverse clinical settings with minimal setup and operation complexities

Apheresis Equipment Market Scope

The market is segmented on the basis of equipment type, technology type, procedure type, application, and end use.

- By Equipment Type

On the basis of equipment type, the apheresis equipment market is segmented into disposable apheresis kits and apheresis machines. The disposable apheresis kits segment dominates the market with the largest revenue share of 72.22% in 2024, driven by the growing demand for single-use components that reduce cross-contamination risks, ensure sterility, and simplify regulatory compliance. These kits are widely used in both therapeutic and donor apheresis procedures, ensuring consistency and ease of use.

The apheresis machines segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by continuous advancements in machine automation, precision, and user-friendly interfaces. The increasing adoption of portable and smart machines in both hospital and blood donation settings further supports its rapid growth.

- By Technology Type

On the basis of technology type, the market is segmented into centrifugation and membrane filtration. The centrifugation segment held the largest market share in 2024 due to its long-standing use in effectively separating blood components for both therapeutic and collection purposes. It remains the preferred method in most clinical and blood bank settings for its reliability and scalability.

The membrane filtration segment is expected to grow at the fastest rate from 2025 to 2032, driven by its advantages in precision filtration, minimal cell damage, and growing applications in LDL apheresis and immunotherapy. The technology’s compatibility with newer biocompatible materials is also contributing to its rising adoption.

- By Procedure Type

On the basis of procedure type, the market is segmented into photopheresis, plasmapheresis, LDL apheresis, plateletpheresis, leukapheresis, erythrocytapheresis, and others. The plasmapheresis segment dominates the market in 2024, attributed to its extensive use in both therapeutic plasma exchange and plasma donation, as well as its application in treating a range of autoimmune and hematologic disorders.

The photopheresis segment is projected to grow at the fastest pace from 2025 to 2032, supported by increasing usage in immune-related conditions such as graft-versus-host disease and cutaneous T-cell lymphoma, and rising clinical awareness of its therapeutic benefits.

- By Application

On the basis of application, the apheresis equipment market is categorized into renal disorders, neurological disorders, hematological disorders, and other disorders. The hematological disorders segment lead the market in 2024, driven by the increasing incidence of conditions such as multiple myeloma, leukemia, and thrombocytosis that require regular apheresis procedures for blood component management.

The neurological disorders segment is projected to register the fastest growth from 2025 to 2032 due to the growing prevalence of autoimmune neurological conditions such as multiple sclerosis and Guillain-Barré syndrome, which are increasingly being treated with plasma exchange therapy.

- By End User

On the basis of end use, the market is segmented into hospitals and clinics, ambulatory surgical centers, blood donation centers, and others. The hospitals and clinics segment dominates the global market in 2024, owing to their high patient intake, broad application of apheresis across multiple departments, and availability of advanced infrastructure.

The blood donation centers segment is expected to exhibit the fastest growth from 2025 to 2032, driven by rising global demand for plasma-derived medicinal products, increasing voluntary blood donations, and the expansion of collection networks in developing regions.

Apheresis Equipment Market Regional Analysis

- North America dominates the apheresis equipment market with the largest revenue share of 35.4% in 2024, driven by advanced healthcare infrastructure, growing awareness of therapeutic apheresis applications, and the presence of leading manufacturers offering technologically advanced systems

- The region benefits from a well-established healthcare infrastructure, high healthcare spending, and a strong presence of leading market players actively engaged in product innovation and clinical research

- In addition, favorable reimbursement policies, early adoption of advanced medical technologies, and a growing number of blood donations further accelerate the utilization of apheresis equipment across hospitals, clinics, and blood centers in the region

U.S. Apheresis Equipment Market Insight

The U.S. apheresis equipment market captured the largest revenue share of 80.5% in North America in 2024, driven by the high incidence of autoimmune and hematologic disorders and an advanced healthcare infrastructure. The presence of leading manufacturers, widespread adoption of therapeutic apheresis in clinical settings, and favorable reimbursement frameworks are propelling market demand. In addition, the expansion of blood donation and transfusion services, alongside increasing awareness of plasma therapies, is significantly contributing to the market's growth.

Europe Apheresis Equipment Market Insight

The Europe apheresis equipment market is projected to expand at a substantial CAGR during the forecast period, supported by government-funded healthcare systems and strong demand for advanced blood purification technologies. The region benefits from increased utilization of apheresis in treating rare diseases and neurological disorders, as well as robust clinical research activity. Furthermore, initiatives by health authorities to ensure an adequate blood supply and growing investments in upgrading medical devices within hospitals are boosting market expansion.

U.K. Apheresis Equipment Market Insight

The U.K. apheresis equipment market is expected to witness notable growth, driven by the rising need for plasma-derived therapies and increasing cases of chronic illnesses such as Guillain-Barré syndrome and multiple sclerosis. The country’s emphasis on personalized medicine and growing adoption of innovative therapeutic techniques in the NHS system are driving demand. In addition, collaborations between academic centers and medical device companies are accelerating the development and availability of advanced apheresis technologies.

Germany Apheresis Equipment Market Insight

The Germany apheresis equipment market is anticipated to grow steadily due to the country’s strong healthcare infrastructure, rising number of clinical trials, and the increasing prevalence of hematological diseases. The German market shows strong demand for automated apheresis systems, particularly in transplant medicine and immunotherapy. Government initiatives aimed at modernizing hospital technologies and a proactive approach to rare disease treatment further support growth.

Asia-Pacific Apheresis Equipment Market Insight

The Asia-Pacific apheresis equipment market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rising healthcare awareness, increasing investments in medical infrastructure, and a growing patient population in countries such as China, Japan, and India. Government support for blood donation programs, expanding clinical applications of apheresis in renal and autoimmune conditions, and the availability of cost-effective equipment from local manufacturers are key market drivers.

Japan Apheresis Equipment Market Insight

The Japan apheresis equipment market is advancing rapidly, supported by a highly developed healthcare system, strong government backing for therapeutic innovations, and the high prevalence of lifestyle-related chronic diseases. The integration of precision medicine and advanced treatment modalities has increased the adoption of apheresis in oncology, neurology, and nephrology. Furthermore, Japan's leadership in medical technology innovation is fostering the development of compact, user-friendly apheresis machines.

India Apheresis Equipment Market Insight

The India apheresis equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by increasing demand for blood components and therapeutic plasma exchange procedures. With a rapidly growing healthcare infrastructure, government support for rare disease management, and rising awareness about blood safety and donation, the market is witnessing strong momentum. Domestic manufacturers and public-private partnerships are playing a crucial role in improving access to apheresis technology across urban and semi-urban healthcare centers.

Apheresis Equipment Market Share

The apheresis equipment industry is primarily led by well-established companies, including:

- Haemonetics Corporation (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- Asahi Kasei Medical Co., Ltd. (Japan)

- Terumo BCT, Inc. (U.S.)

- B. Braun SE (Germany)

- KANEKA CORPORATION (Japan)

- Nikkiso Co., Ltd. (Japan)

- Cerus Corporation (U.S.)

- SB-KAWASUMI LABORATORIES, INC. (Japan)

- Medica SPA (Italy)

- Macopharma (France)

- Miltenyi Biotec (Germany)

- Therakos LLC (U.S.)

- Baxter (U.S.)

- Charles River Laboratories Cell Solutions, Inc. (U.S.)

- Grifols S.A. (Spain)

- Lmb Technologie GmbH (Germany)

- Infomed SA (Switzerland)

- Aferetica srl (Italy)

- Cytosorbents Corporation (U.S.)

Latest Developments in Global Apheresis Equipment Market

- In April 2023, Terumo BCT announced the expansion of its Spectra Optia Apheresis System's capabilities to include therapeutic plasma exchange for pediatric patients. This development underscores the company's commitment to addressing the unique needs of younger patients requiring apheresis treatments

- In March 2023, Fresenius Kabi launched a next-generation apheresis machine, the COM.TEC 2.0, featuring an enhanced user interface and improved efficiency. This advancement aims to streamline blood component collection processes and improve donor comfort during procedures

- In February 2023, Haemonetics Corporation received FDA approval for its NexSys PCS plasma collection system with Persona technology. This system personalizes plasma collection based on individual donor characteristics, optimizing yield and enhancing donor safety

- In January 2023, B. Braun Melsungen AG introduced an updated version of its Plasauto Sigma apheresis device, incorporating advanced monitoring features and improved automation. This upgrade is designed to increase treatment precision and reduce procedure times

- In December 2022, Asahi Kasei Medical Co., Ltd. announced the development of a new membrane-based apheresis filter, aiming to improve the selectivity and efficiency of LDL apheresis treatments. This innovation reflects the company's dedication to advancing therapeutic options for patients with refractory hypercholesterolemia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.