Global Application Delivery Controller Market

Market Size in USD Billion

CAGR :

%

USD

4.85 Billion

USD

13.26 Billion

2024

2032

USD

4.85 Billion

USD

13.26 Billion

2024

2032

| 2025 –2032 | |

| USD 4.85 Billion | |

| USD 13.26 Billion | |

|

|

|

|

Global Application Delivery Controller Market Size

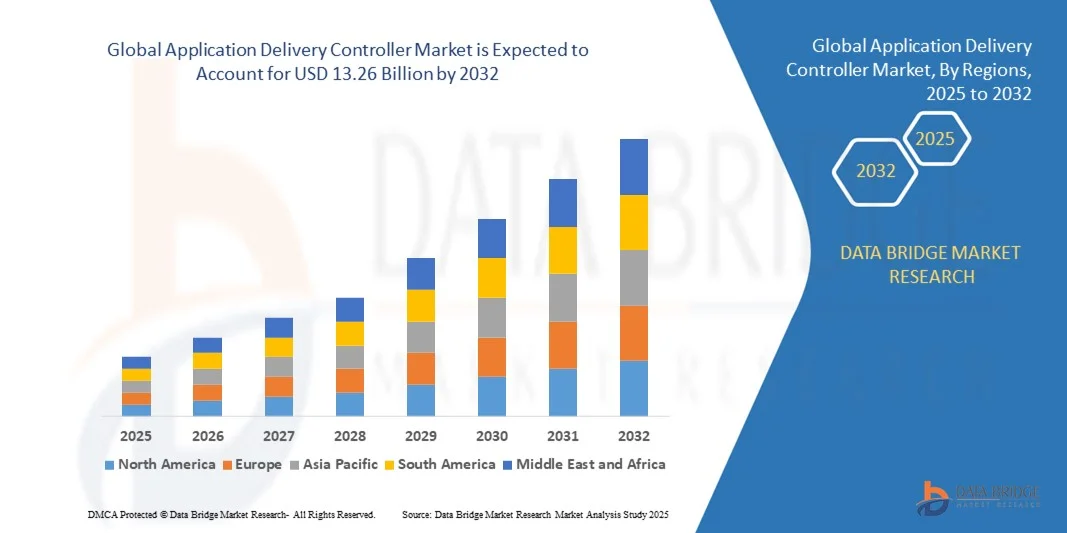

- The global application delivery controller market size was valued at USD 4.85 billion in 2024 and is projected to reach USD 13.26 billion by 2032, growing at a CAGR of 13.4% during the forecast period

- Market expansion is driven by increasing demand for high-performance applications, rising internet traffic, and the proliferation of cloud services and data centers across various industries

- Additionally, the need for enhanced application security, availability, and scalability is prompting organizations to adopt advanced ADC solutions, fueling robust market growth across enterprise and service provider segments

Global Application Delivery Controller Market Analysis

- Application Delivery Controllers (ADCs), which manage and optimize the delivery of applications over networks, are becoming critical components in modern IT infrastructure across enterprises and service providers due to their capabilities in traffic management, load balancing, and application acceleration

- The growing demand for ADCs is primarily driven by rapid cloud adoption, the surge in mobile and web-based applications, and the increasing need for secure, seamless, and high-performance user experiences

- North America dominated the application delivery controller market with the largest revenue share of 36.7% in 2024, supported by early cloud adoption, the presence of leading tech companies, and increasing investments in data center infrastructure, particularly in the U.S., which is witnessing strong demand from BFSI, healthcare, and e-commerce sectors

- Asia-Pacific is expected to be the fastest growing region in the application delivery controller market during the forecast period due to accelerated digital transformation, expanding internet penetration, and growing cloud-native application deployments

- The hardware-based ADCs segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its reliability, high throughput, and ability to handle large volumes of data traffic in on-premise enterprise data centers and service provider networks

Report Scope and Global Application Delivery Controller Market Segmentation

|

Attributes |

Application Delivery Controller Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Application Delivery Controller Market Trends

Enhanced Performance and Automation Through AI and Cloud Integration

- A significant and accelerating trend in the global Application Delivery Controller (ADC) Market is the growing integration with artificial intelligence (AI), machine learning (ML), and cloud-native ecosystems. This convergence is transforming how applications are delivered, secured, and optimized across hybrid and multi-cloud environments.

- For instance, modern ADCs from providers such as F5 Networks and Fortinet now leverage AI-driven analytics to automatically detect traffic anomalies, optimize load balancing, and predict network bottlenecks before they impact user experience. These solutions adapt in real-time to changing traffic patterns, ensuring consistent application performance.

- AI integration in ADCs also enables intelligent automation of security policies and threat detection. For instance, Radware ADCs use machine learning to detect advanced persistent threats (APTs) and DDoS attacks with high accuracy, minimizing false positives and enabling faster mitigation.

- The synergy of ADCs with cloud platforms such as AWS, Microsoft Azure, and Google Cloud allows centralized, scalable control across distributed application environments. Through unified dashboards and APIs, IT teams can manage application traffic, deploy updates, and apply consistent security policies across multiple regions and cloud providers.

- This trend is further supported by the rise of DevOps and containerization, with next-generation ADCs offering seamless integration with Kubernetes and CI/CD pipelines. Vendors such as A10 Networks are delivering AI-powered, cloud-native ADC solutions that enable real-time visibility and dynamic scaling in microservices architectures.

- The demand for intelligent, adaptive, and cloud-ready ADC solutions is surging across enterprises and service providers, driven by the need for high availability, low latency, and robust application security in an increasingly digital-first world.

Global Application Delivery Controller Market Dynamics

Driver

Growing Need Due to Rising Security Demands and Cloud Adoption

- The surge in application usage across industries, along with escalating cybersecurity threats and the rapid shift to cloud-based infrastructures, is a key driver fueling demand for Application Delivery Controllers (ADCs). Enterprises are increasingly prioritizing performance, availability, and security in digital environments, making ADCs critical components in IT networks.

- For Instance, in March 2024, F5 Inc. announced AI-powered enhancements to its distributed cloud services to improve real-time traffic management and cyber threat protection across hybrid and multi-cloud environments. Such advancements are reinforcing the value proposition of ADCs in the evolving threat landscape.

- As businesses expand their digital operations, ADCs offer vital functionalities such as load balancing, web application firewalls, SSL offloading, and DDoS mitigation—essential tools for ensuring high-performance, secure, and uninterrupted user experiences.

- The proliferation of SaaS platforms, mobile applications, and IoT devices is also accelerating ADC adoption, as organizations seek centralized traffic management and security enforcement across distributed and multi-cloud architectures.

- Additionally, the integration of ADCs with automation, DevOps tools, and container environments like Kubernetes allows for seamless deployment and management of modern application workloads. The demand is rising across sectors such as BFSI, healthcare, retail, and telecommunications, where performance, scalability, and security are non-negotiable.

Restraint/Challenge

Complex Deployment and Cost Barriers in SME Segment

- Despite their advantages, Application Delivery Controllers face challenges in terms of complex deployment, management, and high initial costs, particularly for small and medium-sized enterprises (SMEs). Traditional hardware-based ADCs often require specialized expertise and infrastructure, creating barriers for smaller organizations with limited IT resources.

- For instance, while large enterprises can afford dedicated ADC appliances from vendors like Fortinet or Citrix, many SMEs are reluctant to invest due to ongoing operational expenses and integration complexity in hybrid or multi-cloud environments.

- Furthermore, evolving application architectures—especially the shift towards microservices and containers—demand more agile and lightweight solutions. Some legacy ADCs may struggle to adapt without significant reconfiguration or added cost, creating friction in digital transformation initiatives.

- Cloud-native ADCs and as-a-service models are emerging to address these limitations, offering flexible and scalable options with lower entry barriers. However, concerns around performance consistency, subscription pricing, and vendor lock-in persist among potential adopters.

- Overcoming these challenges will require vendors to streamline deployment processes, enhance user-friendly interfaces, and offer competitively priced solutions tailored to SMEs. Education around the ROI of ADCs, especially regarding application security and availability, will be crucial for expanding adoption across underpenetrated markets.

Global Application Delivery Controller Market Scope

The market is segmented on the basis of deployment, enterprise size, and end use.

- By Deployment

On the basis of deployment, the global application delivery controller market is segmented into hardware-based ADCs and virtual ADCs. The hardware-based ADC segment dominated the market with the largest revenue share of 45.3% in 2024, driven by its reliability, high throughput, and ability to handle large volumes of data traffic in on-premise enterprise data centers and service provider networks. Hardware appliances are preferred in environments requiring consistent performance and robust security, particularly in sectors like BFSI and telecom, where latency and downtime are critical.

The virtual ADC segment is expected to witness the fastest CAGR from 2025 to 2032, owing to growing cloud adoption and the increasing preference for scalable, software-defined solutions. Virtual ADCs provide deployment flexibility across hybrid and multi-cloud environments and are well-suited for DevOps-driven and containerized applications. The ability to spin up ADC functions as needed in virtual environments makes this option ideal for enterprises focused on digital transformation and operational agility.

- By Enterprise Size

Based on enterprise size, the global application delivery controller market is segmented into Small & Medium Enterprises (SMEs) and Large Enterprises. Large enterprises held the largest market revenue share in 2024, driven by the complexity of their application infrastructure, large user base, and the need for high-performance load balancing, security, and availability. These enterprises often maintain hybrid IT environments and invest heavily in data center and cloud infrastructure, making ADCs an essential component of their network architecture.

The SMEs segment is projected to register the fastest CAGR from 2025 to 2032, due to increasing digital adoption, remote work trends, and reliance on SaaS platforms. As SMEs shift towards cloud-native operations, they are increasingly adopting virtual ADCs and as-a-service delivery models, which are more cost-effective and easier to manage. The growing awareness of cybersecurity risks and the need for application performance optimization are also encouraging SMEs to invest in scalable and affordable ADC solutions.

- By End Use

On the basis of End Use, The global application delivery controller market is segmented by end use into IT & Telecom, BFSI, Government, Healthcare, Retail, and Others. The IT & Telecom segment dominated the market with the highest revenue share in 2024, driven by the sector's massive data traffic, need for high availability, and rapid expansion of cloud services and mobile applications. ADCs are widely used by telecom providers and tech companies to optimize traffic flow, enable secure connectivity, and ensure service continuity.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing digitization of healthcare records, telemedicine adoption, and the critical need for secure and reliable access to applications. ADCs support healthcare institutions in managing sensitive patient data, ensuring HIPAA compliance, and maintaining service availability for mission-critical applications. The growing use of cloud-based Electronic Health Records (EHR) systems and mobile health apps further accelerates ADC adoption in this sector.

Global Application Delivery Controller Market Regional Analysis

- North America dominated the global application delivery controller market with the largest revenue share of 36.7% in 2024, driven by the region’s advanced IT infrastructure, high cloud adoption rates, and strong demand for secure and scalable application delivery solutions

- Enterprises in North America prioritize application performance, availability, and cybersecurity, leading to widespread deployment of ADCs across industries such as BFSI, IT & telecom, healthcare, and e-commerce. The growing shift toward hybrid and multi-cloud environments further accelerates the demand for advanced ADC technologies

- The region benefits from the strong presence of leading market players such as F5 Networks, Cisco Systems, and Fortinet, as well as a large number of cloud service providers and tech-driven enterprises. Additionally, the increasing adoption of AI and automation in network infrastructure supports the growth of intelligent, software-defined ADC solutions tailored to dynamic workloads and complex application ecosystems

U.S. Application Delivery Controller Market Insight

The U.S. global application delivery controller market is propelled by rapid cloud adoption, digital transformation initiatives, and the growing complexity of application environments. Organizations prioritize application performance, security, and availability across hybrid and multi-cloud infrastructures. The expanding adoption of AI-driven automation and edge computing further accelerates demand. Additionally, strong investments in IT infrastructure, combined with a mature tech ecosystem and presence of major ADC vendors, support continuous market growth. Enterprises increasingly leverage ADCs for optimizing load balancing, enhancing cybersecurity, and ensuring seamless user experiences in both on-premise and cloud environments.

Europe Application Delivery Controller Market Insight

Europe’s global application delivery controller market t is expected to grow steadily, driven by stringent data protection regulations such as GDPR and increasing emphasis on secure application delivery. The region’s focus on digital innovation across BFSI, government, and healthcare sectors fuels the need for scalable and secure ADC solutions. Rising adoption of cloud services and hybrid IT architectures in Western Europe, alongside modernization of legacy networks, further encourages ADC deployment. Countries like Germany, France, and the U.K. lead with significant investments in IT infrastructure and cybersecurity measures, boosting the demand for advanced ADCs.

U.K. Application Delivery Controller Market Insight

The U.K. global application delivery controller market is anticipated to expand at a strong CAGR due to the country’s increasing digitalization and enterprise cloud migration. Heightened focus on cybersecurity and regulatory compliance is driving demand for ADCs that offer robust traffic management and threat mitigation capabilities. The U.K.’s dynamic financial and tech sectors contribute significantly to the ADC market, supported by a growing preference for software-defined and cloud-native ADC solutions. Additionally, the rise in remote work and digital services is increasing dependency on reliable, high-performance application delivery systems.

Germany Application Delivery Controller Market Insight

Germany’s global application delivery controller market growth is fueled by the country’s strong industrial base, increasing adoption of Industry 4.0 technologies, and rising demand for secure and efficient application delivery in manufacturing and enterprise IT. The government’s focus on digital transformation and cybersecurity frameworks supports ADC adoption in both public and private sectors. Germany’s enterprises seek scalable ADC solutions to manage complex hybrid cloud environments and comply with data sovereignty regulations. Moreover, the integration of ADCs with AI and automation tools is becoming a key trend, aligning with Germany’s innovation-driven economy.

Asia-Pacific Application Delivery Controller Market Insight

The Asia-Pacific global application delivery controller market is poised for the fastest growth with a CAGR of approximately 22% from 2025 to 2032, driven by rapid digitalization, growing cloud adoption, and expanding IT infrastructure across countries like China, India, Japan, and Australia. Government initiatives promoting smart cities, digital governance, and broadband expansion accelerate the need for efficient application delivery and security solutions. The increasing number of SMEs adopting cloud services and the presence of emerging tech hubs fuel market expansion. Affordability and scalability of virtual ADCs are also propelling adoption in this diverse region.

Japan Application Delivery Controller Market Insight

Japan’s global application delivery controller market growth is supported by the country’s advanced IT infrastructure, early adoption of cloud and edge computing, and the focus on Industry 4.0 applications. The demand for reliable, low-latency application delivery solutions across manufacturing, healthcare, and finance sectors drives ADC investments. Japan’s enterprises emphasize security, automation, and integration of AI technologies within their ADC deployments. Additionally, the government’s push for digital transformation and IoT proliferation is further accelerating ADC adoption across both private and public sectors.

China Application Delivery Controller Market Insight

China holds the largest market revenue share in the Asia-Pacific global application delivery controller market as of 2024, propelled by massive investments in cloud infrastructure, digital transformation in government and enterprises, and rapid growth of e-commerce and telecom sectors. The country’s commitment to building smart cities and expanding 5G networks drives demand for scalable, high-performance ADC solutions. Strong domestic technology firms and increased adoption of virtualized and software-defined ADCs also contribute to market growth. Additionally, regulatory focus on cybersecurity and data localization creates opportunities for advanced ADC deployments tailored to meet compliance requirements.

Global Application Delivery Controller Market Share

The global application delivery controller industry is primarily led by well-established companies, including:

- Fortinet Inc. (U.S.)

- F5 Networks Inc. (U.S.)

- Citrix Systems Inc. (U.S.)

- Barracuda Networks Inc. (U.S.)

- Cloudflare Inc. (U.S.)

- A10 Networks Inc. (U.S.)

- Radware (Israel)

- Cisco Systems (U.S.)

- Kemp Technologies (U.S.)

- ZEVENET (Spain)

- Array Networks Inc. (U.S.)

- Brocade Communications Systems Inc. (U.S.)

- Dell Inc. (U.S.)

What are the Recent Developments in Global Application Delivery Controller Market?

- In April 2023, F5 Networks Inc., a global leader in application delivery and security solutions, announced the expansion of its cloud-native ADC portfolio aimed at enhancing multi-cloud application performance and security. This initiative emphasizes F5’s commitment to delivering scalable, intelligent ADC solutions that address the growing complexity of hybrid cloud environments. By leveraging advanced AI and automation technologies, F5 is strengthening its position in the rapidly evolving global ADC market, enabling enterprises to optimize application delivery with improved agility and resilience.

- In March 2023, Cisco Systems Inc. launched a new version of its Application Services Engine (ASE) designed specifically for telecom and large enterprise networks. This upgrade integrates advanced load balancing, security features, and network analytics, enhancing application performance and threat detection capabilities. The development highlights Cisco’s focus on innovation in ADC technology to support 5G infrastructure and cloud-native applications, underscoring its strategic commitment to address the increasing demands of digital transformation across industries.

- In March 2023, Citrix Systems Inc. successfully deployed a large-scale ADC solution for a major financial services provider in Europe, aimed at optimizing application delivery and ensuring compliance with stringent security standards. This deployment utilizes Citrix’s intelligent ADC technology to enhance user experience, reduce latency, and provide robust protection against cyber threats. The project reflects Citrix’s expertise in delivering high-performance, secure ADC solutions tailored to complex regulatory environments and mission-critical applications.

- In February 2023, Barracuda Networks Inc. announced a strategic partnership with a leading cloud service provider to integrate its ADC and application security solutions into the provider’s cloud infrastructure. This collaboration aims to offer customers enhanced application performance and protection through seamless integration of Barracuda’s next-generation ADC technology. The initiative showcases Barracuda’s commitment to driving innovation and improving cloud-native ADC adoption in both enterprise and service provider markets.

- In January 2023, Fortinet Inc. unveiled the latest version of its FortiADC platform at a major industry conference, featuring AI-powered traffic management, enhanced security controls, and simplified orchestration capabilities. The new release enables enterprises to deliver applications with greater efficiency and protection across hybrid and multi-cloud environments. Fortinet’s innovation underscores its strategic focus on integrating cybersecurity and application delivery in a unified platform, catering to the growing needs of digital enterprises worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.