Global Apremilast Market

Market Size in USD Billion

CAGR :

%

USD

2.67 Billion

USD

3.95 Billion

2024

2032

USD

2.67 Billion

USD

3.95 Billion

2024

2032

| 2025 –2032 | |

| USD 2.67 Billion | |

| USD 3.95 Billion | |

|

|

|

|

Apremilast Market Size

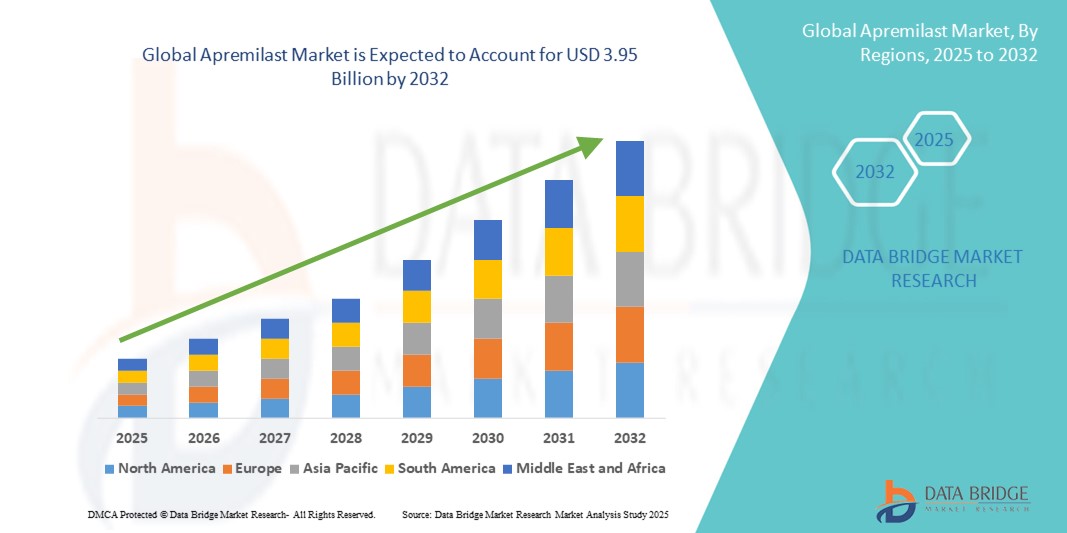

- The global apremilast market size was valued at USD 2.67 billion in 2024 and is expected to reach USD 3.95 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within immunomodulatory therapies and targeted small-molecule drugs, leading to increased digitalization and innovation in chronic inflammatory disease management across both hospital and outpatient settings

- Furthermore, rising consumer demand for safe, effective, and orally administered treatment options for conditions such as psoriasis, psoriatic arthritis, and Behçet’s disease is establishing apremilast as the therapy of choice. These converging factors are accelerating the uptake of apremilast solutions, thereby significantly boosting the industry's growth

Apremilast Market Analysis

- The global apremilast market is witnessing robust growth, primarily driven by increasing prevalence and awareness of chronic inflammatory diseases such as psoriasis and psoriatic arthritis, coupled with advancements in targeted oral immunomodulatory therapies. apremilast, a phosphodiesterase-4 (PDE4) inhibitor, offers a convenient oral treatment option with a favorable safety profile, addressing unmet needs in patient populations who require alternatives to biologics or systemic therapies

- Market expansion is further supported by ongoing clinical research exploring new indications and improved formulations, as well as increasing adoption of Apremilast in both developed and emerging markets. Strong collaborations among pharmaceutical companies, healthcare providers, and patient advocacy groups are enhancing disease education and access to treatment, helping to expand the patient pool benefiting from apremilast

- North America dominated the apremilast market with the largest revenue share of 42.8% in 2024, fueled by robust healthcare infrastructure, favorable reimbursement policies, and high patient awareness. The presence of leading pharmaceutical companies, active clinical trials, and well-established dermatology and rheumatology care networks contribute significantly to regional growth

- Asia-Pacific is projected to be the fastest-growing region in the apremilast market over the forecast period, driven by increasing healthcare expenditure, rising diagnosis rates of psoriasis and psoriatic arthritis, and expanding healthcare coverage. Countries such as China, India, and Japan are witnessing growing demand for effective oral therapies and improved patient access programs, which are critical for market growth in this region

- Tablet segment dominated the apremilast market with a market share of 94.5% in 2024, as apremilast is exclusively marketed in this convenient oral form. Tablets offer a patient-friendly mode of administration, which significantly contributes to treatment adherence in long-term therapy

Report Scope and Apremilast Market Segmentation

|

Attributes |

Apremilast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Apremilast Market Trends

Enhanced Convenience Through Targeted Therapies

- A significant and accelerating trend in the global apremilast market is the growing demand for personalized, targeted therapies that offer improved convenience and patient compliance. Apremilast, an oral small-molecule phosphodiesterase 4 (PDE4) inhibitor, is increasingly being favored over traditional biologics due to its non-invasive administration, lower monitoring requirements, and favorable safety profile. This shift is particularly noticeable among patients with chronic inflammatory conditions such as psoriasis, psoriatic arthritis, and Behçet’s disease, where long-term disease management and ease of use are critical factors

- Patients and healthcare providers are showing a strong preference for Apremilast due to its ability to be self-administered, reducing the burden on clinical infrastructure and minimizing the need for frequent hospital visits. This convenience is especially important in remote or underserved regions, where access to infusion centers and specialist care may be limited. Moreover, the oral route of administration enhances adherence to therapy, as it eliminates the discomfort and complexity associated with injectable treatments

- The convenience offered by Apremilast is also supported by a growing body of real-world evidence demonstrating its efficacy in maintaining disease control with a manageable side effect profile. This has led to increased confidence among physicians in prescribing Apremilast as a first-line or maintenance therapy. As a result, pharmaceutical companies are expanding their patient support programs and digital engagement strategies to ensure timely access and adherence, further driving market expansion

- Overall, the emphasis on convenience, safety, and long-term disease management is contributing to the sustained growth of the Apremilast market across both developed and emerging healthcare systems

Apremilast Market Dynamics

Driver

Growing Need Due to Rising Chronic Inflammatory Conditions and Increased Treatment Awareness

- The global apremilast market is witnessing substantial growth primarily driven by the increasing burden of chronic inflammatory and autoimmune disorders such as plaque psoriasis, psoriatic arthritis, and Behçet’s disease

- These conditions not only cause significant physical discomfort but also impact patients’ quality of life, productivity, and mental health. With the rising prevalence of these diseases—attributed to factors such as genetic predisposition, environmental triggers, and lifestyle changes—the demand for effective long-term treatment options is intensifying

- apremilast, as a selective phosphodiesterase 4 (PDE4) inhibitor, offers a novel mechanism of action that helps modulate the immune response and reduce inflammation without the need for injectable biologics

- Its oral administration and relatively favorable safety profile make it a compelling choice for patients and clinicians alike. In addition, growing awareness among healthcare providers and patients about early diagnosis and the importance of proactive disease management is supporting wider adoption

- Pharmaceutical companies are also playing a critical role in this growth by investing heavily in awareness campaigns, physician education programs, and patient outreach efforts to highlight apremilast’s advantages over conventional therapies

- Moreover, the expansion of clinical research into new therapeutic areas such as atopic dermatitis, ankylosing spondylitis, and other dermatological and rheumatological conditions is expected to further broaden the drug's application spectrum

- These ongoing studies not only validate Apremilast’s efficacy in new indications but also strengthen its competitive edge in the immunomodulatory therapy landscape. Together, these factors are significantly contributing to the sustained growth of the Apremilast market worldwide

Restraint/Challenge

Concerns Regarding Side Effects, Affordability, and Competition from Alternative Therapies

- Despite its therapeutic benefits, the growth of the apremilast market faces several restraints that could hinder its widespread adoption, particularly in cost-sensitive and developing regions. One of the foremost challenges is the high price point associated with apremilast therapy

- As a branded pharmaceutical product, apremilast is not always accessible to patients who lack comprehensive health insurance or reside in regions with limited healthcare funding. This financial burden can discourage patients from initiating or continuing treatment, thereby affecting overall market penetration

- Although some insurance plans cover apremilast, variations in coverage and reimbursement policies across countries and healthcare systems create inconsistencies in access and affordability

- Another significant concern is the potential side effects associated with Apremilast, including gastrointestinal disturbances such as diarrhea, nausea, and weight loss, particularly in the early phases of treatment

- While these adverse effects are generally manageable, they can lead to poor compliance or treatment discontinuation, especially among elderly patients or those with preexisting gastrointestinal conditions. This aspect often prompts clinicians to consider alternative therapies with more predictable tolerability profiles

- Moreover, apremilast faces intense competition from biologic therapies and conventional systemic treatments that have long been established in the market. Many biologics offer robust clinical efficacy and are now available in biosimilar forms at reduced costs, further challenging apremilast’s market share

- In addition, generic versions of traditional immunosuppressants continue to appeal to healthcare systems aiming to manage budget constraints

- To address these limitations, companies must prioritize strategies such as enhancing patient support programs, working toward broader insurance coverage, launching patient education initiatives to manage side effect concerns, and exploring the development of more affordable or generic formulations of apremilast. Without these interventions, market expansion—particularly in emerging economies—may remain constrained

Apremilast Market Scope

The market is segmented into strength, drug class, demographic, application, dosage form, route of administration, end-users, and distribution channel.

- By Strength

On the basis of strength, the apremilast market is segmented into 10 mg, 20 mg, and 30 mg. The 30 mg segment dominated the market with the largest revenue share of 58.3% in 2024, as this dosage is most commonly prescribed for maintenance therapy in moderate to severe plaque psoriasis and psoriatic arthritis. It offers optimal therapeutic benefit and aligns with standard dosing protocols across major healthcare systems.

Meanwhile, the 10 mg segment is projected to witness the fastest CAGR of 9.2% from 2025 to 2032, owing to its increasing adoption for initial titration, especially in patients who are sensitive to higher doses or at risk of gastrointestinal side effects.

- By Drug Class

On the basis of drug class, the apremilast market is segmented into antirheumatics and others. The antirheumatics segment accounted for the largest share of 81.6% in 2024, as Apremilast is classified as a phosphodiesterase 4 (PDE4) inhibitor—a subset of antirheumatic agents. Its mechanism of action directly targets inflammatory pathways, making it suitable for autoimmune and chronic inflammatory disorders.

The others segment is expected to grow at the fastest CAGR of 8.7% during the forecast period. This growth is driven by ongoing clinical investigations into apremilast’s effectiveness in treating additional conditions beyond its primary indications, such as hidradenitis suppurativa, Behçet’s disease, and atopic dermatitis.

- By Demographic

On the basis of demographic, the market is segmented into adult and pediatric. The adult segment held the dominant market share of 92.4% in 2024, as the majority of regulatory approvals and prescribing practices cater to adult populations. Chronic diseases such as psoriasis and psoriatic arthritis predominantly manifest in adulthood, reinforcing this trend.

The pediatric segment is projected to grow at the fastest CAGR of 10.1% from 2025 to 2032, fueled by expanding research, off-label use, and growing demand for safe, oral therapies for autoimmune diseases in children and adolescents.

- By Application

On the basis of application, the apremilast market is segmented into psoriasis, psoriatic arthritis, and others. The psoriasis segment captured the largest market share of 65.8% in 2024, owing to the high global burden of plaque psoriasis and increasing preference for oral systemic therapies over injectable biologics. Apremilast is particularly preferred for patients who are needle-averse or have contraindications to immunosuppressive biologics.

The psoriatic arthritis segment is anticipated to record the fastest CAGR of 9.9% during the forecast period, driven by rising awareness, early diagnosis initiatives, and updated clinical guidelines that recognize Apremilast as a frontline oral option for joint-related symptoms.

- By Dosage Form

On the basis of dosage form, the apremilast market is segmented into tablet and others. The tablet segment held the dominant market share of 94.5% in 2024, as Apremilast is exclusively marketed in this convenient oral form. Tablets offer a patient-friendly mode of administration, which significantly contributes to treatment adherence in long-term therapy.

The others segment is expected to grow at the highest CAGR of 6.5% from 2025 to 2032, supported by exploratory development of newer formats such as controlled-release tablets or combinations with other anti-inflammatory or immunomodulatory agents.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and others. The oral segment dominated the market with a revenue share of 96.7% in 2024, as the oral route remains the only approved method for Apremilast administration. Its oral availability enhances patient comfort and supports outpatient management of chronic conditions.

The others segment is projected to grow at the fastest CAGR of 5.8%, supported by ongoing innovations in drug delivery systems. Although still in early stages, the exploration of topical, transdermal, or combination formats may pave the way for future growth.

- By End-Users

On the basis of end-users, the apremilast market is segmented into clinic, hospital, and others. The hospital segment held the highest revenue share of 51.2% in 2024, attributed to the high number of patients initiating treatment or being diagnosed in hospital-based dermatology and rheumatology departments. Hospitals also act as key centers for clinical trials and complex case management.

The clinic segment is expected to register the highest CAGR of 8.3% from 2025 to 2032, owing to the decentralization of specialty care and increasing availability of dermatological and rheumatological services in outpatient and private clinic settings.

- By Distribution Channel

On the basis of distribution channel, the apremilast market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment led with a market share of 46.8% in 2024, driven by convenience and high patient preference for refilling chronic medications from neighborhood pharmacies. These outlets are easily accessible and often offer support for insurance coverage and patient counseling.

The online pharmacy segment is projected to grow at the fastest CAGR of 10.7% from 2025 to 2032, supported by increasing digital adoption, availability of e-prescriptions, and growing patient reliance on online platforms for home delivery of long-term therapies, particularly in urban areas.

Apremilast Market Regional Analysis

- North America dominated the apremilast market with the largest revenue share of 42.8% in 2024, driven by the high prevalence of psoriatic diseases, early access to novel therapeutic options, and strong presence of key biopharmaceutical players. The region benefits from widespread awareness, favorable reimbursement frameworks, and rapid physician adoption of oral PDE4 inhibitors such as apremilast

- Consumers in the region highly value non-biologic oral treatment options due to their reduced immunosuppressive risks, convenience of oral dosing, and effective symptom control. These preferences are supporting a consistent growth in Apremilast prescriptions across various care settings

- This widespread adoption is further supported by rising healthcare expenditure, increasing diagnosis rates of plaque psoriasis and psoriatic arthritis, and frequent updates in clinical guidelines endorsing apremilast, making it a preferred second-line or add-on therapy in both primary and specialty care

U.S. Apremilast Market Insight

The U.S. apremilast market captured the largest revenue share of 67% in 2024 within North America, fueled by strong clinical acceptance, favorable payer coverage, and growing demand for non-invasive therapeutic options in chronic inflammatory diseases. The U.S. also benefits from aggressive marketing by manufacturers, robust patient support programs, and a significant volume of dermatology and rheumatology consultations. The continuous expansion of FDA-approved indications and real-world evidence of long-term safety and tolerability are further accelerating its clinical utilization.

Europe Apremilast Market Insight

The Europe apremilast market is projected to expand at a substantial CAGR of 11.4% during the forecast period, primarily driven by expanding treatment guidelines, increasing prevalence of autoimmune conditions, and a growing patient preference for oral medications over injectables. Government support for biosimilar alternatives and cost-effective treatment strategies is promoting Apremilast adoption in public healthcare systems. In addition, improved diagnosis rates and centralized treatment protocols across Western and Northern Europe are contributing to the market’s upward trajectory.

U.K. Apremilast Market Insight

The U.K. apremilast market is anticipated to grow at a noteworthy CAGR of 12.8% during the forecast period, supported by the National Health Service's focus on personalized care pathways and the prioritization of chronic disease management. The increasing incidence of plaque psoriasis and psoriatic arthritis, along with NICE’s endorsement of Apremilast as a cost-effective option in select patient groups, is aiding its expanded adoption. Moreover, an aging population and strong adherence to national treatment guidelines are expected to bolster future growth.

Germany Apremilast Market Insight

The Germany apremilast market is expected to expand at a considerable CAGR of 12.1% during the forecast period, bolstered by a high standard of care, structured reimbursement mechanisms, and growing awareness among dermatologists and rheumatologists. The nation’s advanced clinical infrastructure and digital health ecosystem are facilitating broader reach of Apremilast therapies. Moreover, increasing physician preference for safer, long-term oral options over systemic immunosuppressants continues to drive market momentum.

Asia-Pacific Apremilast Market Insight

The Asia-Pacific apremilast market is poised to grow at the fastest CAGR from 2025 to 2032, propelled by rapid urbanization, increasing healthcare access, and a growing middle-class population. Rising awareness of psoriatic conditions and advancements in diagnostic capabilities are improving disease recognition across the region. Government initiatives aimed at modernizing healthcare infrastructure, particularly in China and India, are further supporting the penetration of oral targeted therapies such as Apremilast.

Japan Apremilast Market Insight

The Japan apremilast market is gaining strong momentum due to the country’s emphasis on precision medicine and growing recognition of psoriatic arthritis as a significant comorbidity. Japan’s efficient regulatory system and high patient compliance rates make it a favorable market for novel oral therapies. Continued efforts in clinician education and inclusion of Apremilast in national guidelines for psoriasis and arthritis are strengthening its demand across both specialty and general practice settings.

China Apremilast Market Insight

The China apremilast market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a rising burden of autoimmune skin and joint conditions, increased government focus on expanding access to chronic care treatments, and rapid local production of branded generics. China’s growing patient pool, supported by digital health platforms and online pharmacies, is enabling widespread distribution and awareness of Apremilast. In addition, initiatives under the Healthy China 2030 plan are prioritizing improved chronic disease management, thereby encouraging treatment uptake.

Apremilast Market Share

The apremilast industry is primarily led by well-established companies, including:

- Amneal Pharmaceuticals LLC. (U.S.)

- Amgen Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Aurobindo Pharma (India)

- Lupin (India)

- APINO PHARMA CO., LTD. (China)

- Senova Technology Co. Ltd. (China)

- Tiefenbacher API + Ingredients GmbH & Co. KG (Germany)

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Lilly (U.S.)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Merck & Co., Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- UCB S.A. (Belgium)

Latest Developments in Global Apremilast Market

- In April 2024, the U.S. Food and Drug Administration (FDA) approved Otezla (apremilast) for the treatment of moderate to severe plaque psoriasis in pediatric patients aged 6 years and above, making it the only oral therapy available for this age group

- In August 2024, Amgen announced that Otezla is now commercially available in the U.S. for children and adolescents (ages 6–17) with moderate to severe plaque psoriasis, filling a critical treatment gap for pediatric patients who previously had limited systemic options

- In October 2024, the European Union (EU) granted marketing authorization for Apremilast Accord—a generic version of apremilast—for the treatment of psoriatic arthritis, psoriasis, and Behçet’s disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.