Global Aquaculture Feed Premix Market

Market Size in USD Billion

CAGR :

%

USD

15.22 Billion

USD

35.59 Billion

2025

2033

USD

15.22 Billion

USD

35.59 Billion

2025

2033

| 2026 –2033 | |

| USD 15.22 Billion | |

| USD 35.59 Billion | |

|

|

|

|

Aquaculture Feed Premix Market Size

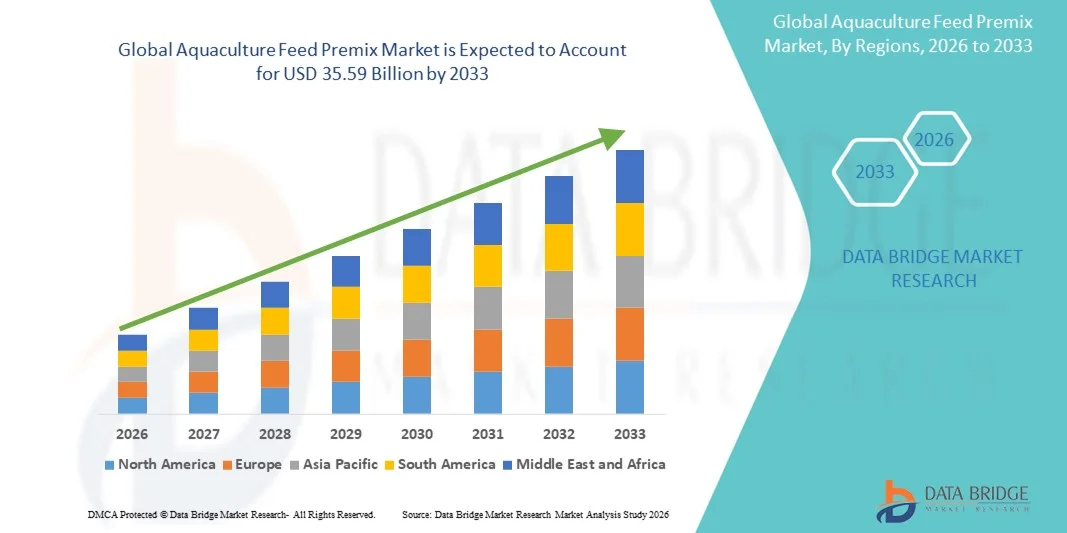

- The global aquaculture feed premix market size was valued at USD 15.22 billion in 2025 and is expected to reach USD 35.59 billion by 2033, at a CAGR of 11.20% during the forecast period

- The market growth is largely fuelled by the rising demand for nutrient-enriched feed to enhance fish growth, improve feed conversion ratios, and ensure overall aquatic health

- Increasing aquaculture production globally, supported by government initiatives and sustainable farming practices, is driving the adoption of specialized feed premixes

Aquaculture Feed Premix Market Analysis

- The market is witnessing technological advancements in premix formulations, including the integration of vitamins, minerals, amino acids, and probiotics to optimize fish nutrition

- Rising investment in research and development by feed manufacturers to create species-specific premixes is enhancing product effectiveness and supporting market growth

- North America dominated the aquaculture feed premix market with the largest revenue share in 2025, driven by the growing adoption of fortified feed formulations, advanced aquaculture practices, and increasing awareness regarding the nutritional benefits of premixes

- Asia-Pacific region is expected to witness the highest growth rate in the global aquaculture feed premix market, driven by rising seafood demand, rapid urbanization, government support for sustainable aquaculture, and the presence of major feed manufacturers enhancing accessibility and adoption of premixes

- The vitamins segment held the largest market revenue share in 2025, driven by the essential role of vitamins in supporting fish growth, immunity, and overall health. Vitamin-enriched premixes ensure consistent nutrient intake and are widely adopted in commercial aquaculture operations across various species

Report Scope and Aquaculture Feed Premix Market Segmentation

|

Attributes |

Aquaculture Feed Premix Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• DSM (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aquaculture Feed Premix Market Trends

Rise of Nutrient-Enriched Premixes in Aquaculture

- The growing shift toward nutrient-enriched premixes is transforming the aquaculture feed landscape by enabling optimal growth, improved feed conversion ratios, and enhanced immunity in farmed fish. The use of premixes ensures consistent nutritional intake, which leads to better survival rates and overall production efficiency

- The high demand for fortified feed in emerging and remote aquaculture regions is accelerating the adoption of vitamin, mineral, amino acid, and probiotic premixes. These formulations are particularly effective in reducing disease prevalence and supporting sustainable fish farming practices

- The affordability and ease of integration of modern premixes are making them attractive for routine feed formulation, leading to improved fish health management. Farmers benefit from enhanced growth performance without incurring excessive feed costs or complicated preparation processes

- For instance, in 2023, several shrimp and tilapia farms in Southeast Asia reported higher growth rates and reduced mortality after incorporating fortified premixes into their feed programs. The premixes helped maintain consistent nutrient levels, improved immunity, and reduced feed wastage

- While premix adoption is accelerating growth and supporting sustainable aquaculture, its impact depends on continued innovation, species-specific formulations, and cost-effectiveness. Manufacturers must focus on localized product development and efficient supply chain strategies to fully capitalize on this growing demand

Aquaculture Feed Premix Market Dynamics

Driver

Rising Demand for Sustainable and High-Quality Aquaculture Products

- The increasing global demand for protein-rich seafood is pushing both producers and feed manufacturers to prioritize nutrient-enriched premixes as a key solution. Healthier, faster-growing fish and shrimp reduce production cycles and support consistent market supply

- Farmers are becoming more aware of the economic benefits of high-quality feed, including improved growth, reduced disease incidence, and better marketability of farmed species. This awareness is driving routine adoption of fortified premixes in commercial aquaculture operations

- Public sector initiatives, subsidies, and international programs promoting sustainable aquaculture practices are strengthening infrastructure for high-quality feed adoption. From quality audits to farmer training programs, these frameworks are encouraging effective premix utilization

- For instance, in 2022, aquaculture associations in India implemented nutritional guidelines recommending fortified premixes, increasing adoption among mid- and large-scale farms

- While demand and regulatory support are driving market growth, there is still a need for enhanced distribution networks, cost-effective formulations, and technology adoption to ensure widespread and sustained usage

Restraint/Challenge

High Cost of Specialized Premixes and Limited Accessibility in Remote Areas

- The high price of advanced premix formulations, including specialized amino acids, vitamins, and probiotics, limits access for small-scale and resource-constrained farmers. These premixes are often used primarily by commercial operations

- In many remote aquaculture regions, limited infrastructure and distribution channels restrict availability of high-quality premixes. Farmers often rely on basic or unfortified feed, reducing growth efficiency and increasing vulnerability to disease

- Supply chain inconsistencies, seasonal raw material shortages, and logistical barriers further hinder timely availability of premixes, impacting farm productivity

- For instance, in 2023, aquaculture surveys in Sub-Saharan Africa revealed that over 60% of small-scale fish farmers had limited access to fortified feed premixes, citing cost and distribution challenges as primary barriers

- While formulation technologies are improving, addressing cost and supply challenges remains critical. Industry stakeholders must focus on localized production, scalable solutions, and efficient logistics to bridge the accessibility gap and unlock long-term market potential

Aquaculture Feed Premix Market Scope

The global aquaculture feed premix market is segmented on the basis of ingredient type and form.

- By Ingredient Type

On the basis of ingredient type, the aquaculture feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, and others. The vitamins segment held the largest market revenue share in 2025, driven by the essential role of vitamins in supporting fish growth, immunity, and overall health. Vitamin-enriched premixes ensure consistent nutrient intake and are widely adopted in commercial aquaculture operations across various species.

The amino acids segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to enhance protein synthesis, improve feed conversion ratios, and promote rapid growth in farmed fish and shrimp. Amino acid premixes are particularly preferred for their effectiveness in optimizing feed formulations and supporting species-specific nutritional requirements.

- By Form

On the basis of form, the aquaculture feed premix market is segmented into dry and liquid. The dry form segment held the largest revenue share in 2025, fueled by its ease of storage, long shelf life, and compatibility with conventional feed manufacturing processes. Dry premixes are widely used across commercial aquaculture farms due to their cost-effectiveness and convenience.

The liquid form segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its rapid solubility, uniform distribution in feed, and enhanced nutrient bioavailability. Liquid premixes are increasingly adopted in specialized aquaculture operations that require precise dosing and improved nutrient absorption for optimal fish and shrimp growth.

Aquaculture Feed Premix Market Regional Analysis

- North America dominated the aquaculture feed premix market with the largest revenue share in 2025, driven by the growing adoption of fortified feed formulations, advanced aquaculture practices, and increasing awareness regarding the nutritional benefits of premixes

- Producers in the region are focusing on enhancing fish growth, feed efficiency, and immunity, which is boosting the demand for vitamins, minerals, amino acids, and probiotic-enriched premixes

- The widespread presence of commercial aquaculture farms and supportive government programs for sustainable aquaculture are further strengthening market growth

U.S. Aquaculture Feed Premix Market Insight

The U.S. aquaculture feed premix market captured the largest revenue share in North America in 2025, fueled by the rising demand for high-quality fish and seafood products and the growing focus on sustainable aquaculture practices. Farmers are increasingly prioritizing nutrient-enriched feed formulations to improve growth performance, survival rates, and feed conversion efficiency. In addition, research and development initiatives by feed manufacturers, coupled with government-led nutritional guidelines for aquaculture, are significantly contributing to market expansion.

Europe Aquaculture Feed Premix Market Insight

The Europe aquaculture feed premix market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent regulations regarding fish nutrition and food safety, along with the rising need for sustainable aquaculture practices. Increasing urbanization and demand for protein-rich seafood are fostering the adoption of premix solutions. European producers are also emphasizing fortified feed to improve productivity and reduce disease prevalence, boosting the overall market across commercial farms, hatcheries, and R&D centers.

U.K. Aquaculture Feed Premix Market Insight

The U.K. aquaculture feed premix market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer demand for safe and high-quality seafood products and the rising trend of precision aquaculture. Farmers are incorporating specialized premixes into feed formulations to ensure optimal nutrient intake and improve fish health. Government policies promoting sustainable aquaculture practices, along with growing awareness of fortified feed benefits, are further propelling market growth.

Germany Aquaculture Feed Premix Market Insight

The Germany aquaculture feed premix market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing investments in aquaculture technology and rising adoption of species-specific premixes. Producers are increasingly using vitamins, minerals, and probiotics to optimize growth and immunity in farmed fish and shrimp. Germany’s focus on sustainability and quality standards in aquaculture operations is driving the demand for high-performance feed premixes across commercial farms and hatcheries.

Asia-Pacific Aquaculture Feed Premix Market Insight

The Asia-Pacific aquaculture feed premix market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing seafood consumption in countries such as China, Japan, and India. The region's growing aquaculture industry, supported by government initiatives promoting sustainable farming practices, is accelerating premix adoption. Furthermore, the presence of major feed manufacturers and technological advancements in premix formulations are enhancing accessibility and affordability for commercial and small-scale aquaculture operations.

Japan Aquaculture Feed Premix Market Insight

The Japan aquaculture feed premix market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s emphasis on high-quality seafood, technological advancements in feed formulation, and demand for sustainable aquaculture practices. Farmers are increasingly adopting premixes enriched with vitamins, minerals, and amino acids to optimize fish growth and health. In addition, government support and a strong R&D ecosystem in aquaculture feed are contributing to market growth across commercial farms and research centers.

China Aquaculture Feed Premix Market Insight

The China aquaculture feed premix market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding aquaculture industry, increasing seafood consumption, and rising awareness of fish nutrition. China is one of the largest markets for fortified feed solutions, with premixes being widely adopted across commercial farms, hatcheries, and aquaculture research centers. Government initiatives promoting sustainable aquaculture practices and the presence of domestic premix manufacturers are key factors driving the market in China.

Aquaculture Feed Premix Market Share

The Aquaculture Feed Premix industry is primarily led by well-established companies, including:

• DSM (Netherlands)

• Nutreco N.V. (Netherlands)

• Cargill, Incorporated (U.S.)

• DLG (Denmark)

• ADM (U.S.)

• Charoen Pokphand Foods PCL. (Thailand)

• Land O’ Lakes, Inc. (U.S.)

• AB Agri Ltd (U.K.)

• Phibro Animal Health Corporation (U.S.)

• BEC Feed Solutions (Thailand)

• Devenish Nutrition (Ireland)

• Lexington (U.K.)

• DE HEUS (Netherlands)

• LLC "MEGAMIX" (Russia)

• Agrofeed Kft (Hungary)

• Kaesler Nutrition GmbH (Germany)

• Cladan S.A. (France)

• ForFarmers (Netherlands)

• ERBER Group (Austria)

• InVivo NSA (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.