Global Aquafeed Acidifiers Market

Market Size in USD Billion

CAGR :

%

USD

8.67 Billion

USD

13.71 Billion

2025

2033

USD

8.67 Billion

USD

13.71 Billion

2025

2033

| 2026 –2033 | |

| USD 8.67 Billion | |

| USD 13.71 Billion | |

|

|

|

|

Aquafeed Acidifiers Market Size

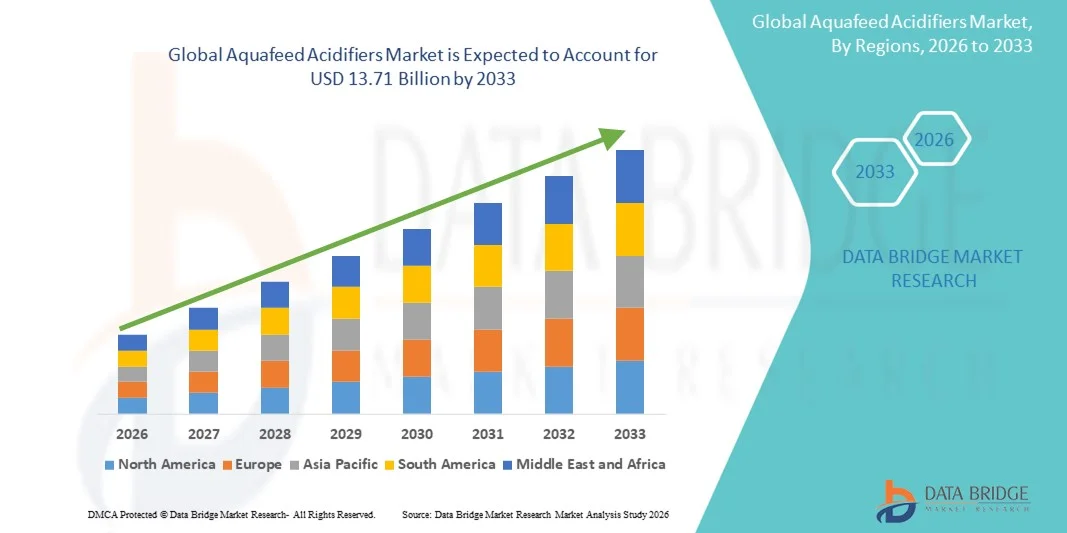

- The global aquafeed acidifiers market size was valued at USD 8.67 billion in 2025 and is expected to reach USD 13.71 billion by 2033, at a CAGR of 5.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality aquafeed that enhances fish and shrimp growth, improves gut health, and boosts feed conversion efficiency. Rising aquaculture production and focus on sustainable farming practices are further driving adoption of acidifiers

- Growing awareness among aquaculture farmers regarding the benefits of feed acidification, such as pathogen control, pH regulation, and improved nutrient absorption, is accelerating market penetration across key regions

Aquafeed Acidifiers Market Analysis

- The global market is witnessing strong adoption of organic and natural acidifiers due to increasing preference for environmentally friendly and residue-free feed additives, aligning with regulatory standards

- Continuous research and development in feed additive technology are enhancing the efficacy of acidifiers, enabling precise dosing, controlled release, and better compatibility with other feed ingredients, which drives market growth

- North America dominated the aquafeed acidifiers market with the largest revenue share in 2025, driven by the increasing adoption of acidifiers in commercial aquaculture and rising demand for sustainable, nutrient-dense feed

- Asia-Pacific region is expected to witness the highest growth rate in the global aquafeed acidifiers market, driven by rising aquaculture production, increasing disposable incomes, and government initiatives promoting sustainable and high-efficiency feed solutions

- The formic acid segment held the largest market revenue share in 2025, driven by its effectiveness in enhancing gut health, improving feed conversion ratios, and promoting growth performance in aquaculture species. Formic acid is widely preferred for its antimicrobial properties and ease of incorporation into feed formulations, making it a popular choice among aquafeed manufacturers

Report Scope and Aquafeed Acidifiers Market Segmentation

|

Attributes |

Aquafeed Acidifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Roquette Frères (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aquafeed Acidifiers Market Trends

Rising Adoption of Acidifiers in Aquafeed

- The growing incorporation of acidifiers in aquafeed is transforming the aquaculture nutrition landscape by enhancing gut health, feed efficiency, and nutrient absorption in farmed fish and shrimp. These additives improve growth performance, reduce disease incidence, and promote better feed conversion, contributing to higher productivity and profitability for aquaculture operations. The trend is driving increased utilization across both freshwater and marine species, supporting sustainable farming practices

- The rising demand for sustainable and high-quality aquaculture products is accelerating the adoption of organic and mineral-based acidifiers. These additives help maintain optimal pH levels in the gastrointestinal tract, promote beneficial microbial populations, and reduce dependency on antibiotics, while improving overall fish health and survival rates. Government programs and industry guidelines supporting sustainable feed practices are further bolstering adoption

- The affordability and ease of incorporation of acidifiers into feed formulations are encouraging their use across diverse aquaculture species and feed types. Manufacturers can develop customized feed solutions with improved shelf life, nutrient bioavailability, and product consistency. The trend supports broader adoption in commercial aquaculture operations worldwide, improving operational efficiency and farm profitability

- For instance, in 2023, aquafeed manufacturers in China and Southeast Asia introduced blends of formic, citric, and lactic acid-based acidifiers into shrimp and tilapia diets, resulting in improved feed conversion ratios, reduced disease outbreaks, and overall farm profitability. This demonstrates the tangible benefits of integrating acidifiers into standard feed formulations

- While acidifier adoption is increasing, sustained growth depends on continued product innovation, feed formulation expertise, and regulatory compliance. Manufacturers must focus on efficacy, safety, product standardization, and market education to fully capitalize on the growing demand and meet evolving aquaculture industry requirements

Aquafeed Acidifiers Market Dynamics

Driver

Growing Demand for Sustainable and Nutrient-Dense Aquaculture Feed

- Increasing global aquaculture production and the need for efficient, high-quality feed are driving the adoption of acidifiers. By enhancing digestibility, nutrient absorption, and gut microbiota balance, acidifiers help improve growth performance, reduce feed waste, and lower environmental impact. This trend is supported by the rising demand for safe, high-protein seafood products worldwide

- The focus on sustainable aquaculture practices, including the reduction of antibiotics and chemical growth promoters, is encouraging manufacturers to incorporate natural and organic acidifiers. Acidifiers provide a viable alternative to antibiotics while maintaining gut health, immunity, and disease resistance in farmed species. This shift aligns with global regulatory frameworks promoting safer and cleaner aquaculture production

- Aquaculture companies are increasingly prioritizing feed additives that enhance profitability, product quality, and operational efficiency. Acidifiers improve feed conversion ratios, weight gain, and survival rates, driving adoption across both small-scale and industrial farms. These benefits support long-term business sustainability and market expansion

- For instance, in 2022, large-scale aquafeed producers in Vietnam and Thailand implemented acidifier-enriched diets for tilapia and shrimp, reporting higher survival rates, lower disease incidence, and reduced feed costs. This highlights the tangible operational and economic advantages of using acidifiers

- While demand is being fueled by performance and sustainability benefits, continuous research, quality control, and formulation expertise are critical to ensure long-term adoption and market growth. Stakeholders must invest in product optimization, efficacy testing, and technical support to meet industry standards and consumer expectations

Restraint/Challenge

High Cost of Specialized Acidifiers and Regulatory Restrictions

- The cost of high-performance acidifiers, particularly organic and multi-component formulations, can be a barrier for small and mid-sized aquaculture operators. Price sensitivity in emerging markets may limit large-scale adoption despite the evident performance benefits. Additional investment in feed infrastructure and storage adds to operational costs, constraining uptake

- In many regions, regulatory frameworks governing feed additives and acidifier usage are complex and vary by country. Compliance requirements, registration processes, and regional restrictions can delay product introduction and restrict market penetration, particularly for new entrants and smaller manufacturers seeking to expand

- Supply chain limitations, including sourcing of raw acids, blending facilities, and transportation logistics, may affect consistent availability and quality. This can result in variable performance outcomes, increased lead times, and hesitancy among feed manufacturers and farmers, impacting adoption and customer trust

- For instance, in 2023, aquafeed producers in Sub-Saharan Africa reported difficulties accessing certified citric and formic acids, limiting their ability to produce standardized acidifier-enriched diets and meet production schedules. This underscores the need for improved local sourcing and supply chain resilience

- While aquafeed acidifiers are gaining traction, overcoming cost, regulatory, and supply chain challenges is essential. Industry stakeholders must invest in local production, quality assurance, distribution networks, and regulatory alignment to unlock the market’s full potential and support sustainable aquaculture growth

Aquafeed Acidifiers Market Scope

The market is segmented on the basis of type, form, compound, and species type.

- By Type

On the basis of type, the aquafeed acidifiers market is segmented into propionic acid, formic acid, lactic acid, citric acid, sorbic acid, and malic acid. The formic acid segment held the largest market revenue share in 2025, driven by its effectiveness in enhancing gut health, improving feed conversion ratios, and promoting growth performance in aquaculture species. Formic acid is widely preferred for its antimicrobial properties and ease of incorporation into feed formulations, making it a popular choice among aquafeed manufacturers.

The lactic acid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its natural origin, compatibility with probiotics, and ability to regulate gut pH. Lactic acid improves nutrient absorption and supports overall health, making it particularly attractive for shrimp, tilapia, and salmon diets. The rising preference for organic and sustainable feed additives is further boosting its adoption.

- By Form

On the basis of form, the market is segmented into dry and liquid. The liquid segment dominated in 2025, fueled by its ease of handling, uniform mixing with feed ingredients, and rapid bioavailability in farmed species. Liquid acidifiers allow precise dosage and reduce dust-related handling issues, making them suitable for large-scale aquaculture operations.

The dry segment is expected to witness robust growth from 2026 to 2033, driven by its longer shelf life, lower transportation costs, and ease of storage. Dry acidifiers are preferred in regions with logistical constraints and are increasingly incorporated into pelleted feeds and premixes for various aquaculture species.

- By Compound

On the basis of compound, the market is segmented into blended and single. The blended segment held the largest revenue share in 2025, due to the synergistic benefits of combining multiple acids to optimize gut health, feed efficiency, and disease resistance. Blended formulations offer balanced pH regulation and enhanced antimicrobial effects, making them highly suitable for multi-species aquaculture farms.

The single compound segment is expected to register the fastest growth rate from 2026 to 2033, driven by targeted applications and cost-effectiveness for specific species. Single acid formulations are increasingly adopted for small-scale farms and species-specific feed programs, enabling precise nutrition management.

- By Species Type

On the basis of species type, the market is segmented into carp, rainbow trout, salmon, crustaceans, tilapia, catfish, sea bass, grouper, and others. The tilapia segment accounted for the largest revenue share in 2025, driven by the high global demand for tilapia and its significance in freshwater aquaculture. Tilapia farmers increasingly incorporate acidifiers to improve growth performance, gut health, and feed efficiency.

The salmon segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising salmon production, premium market prices, and the growing focus on sustainable aquaculture practices. Acidifiers enhance nutrient absorption, disease resistance, and overall farm profitability, supporting rapid adoption in salmon feed formulations.

Aquafeed Acidifiers Market Regional Analysis

- North America dominated the aquafeed acidifiers market with the largest revenue share in 2025, driven by the increasing adoption of acidifiers in commercial aquaculture and rising demand for sustainable, nutrient-dense feed

- The trend is supported by advanced aquaculture infrastructure, strong R&D capabilities, and government initiatives promoting efficient feed practices. The widespread adoption of acidifiers is improving growth performance and feed conversion ratios across farmed fish and shrimp species

- Consumers and aquaculture operators in the region highly value the benefits of acidifiers, including enhanced gut health, improved nutrient absorption, and reduced disease incidence. These additives are increasingly incorporated into feeds for salmon, tilapia, and crustaceans to optimize productivity and profitability

U.S. Aquafeed Acidifiers Market Insight

The U.S. aquafeed acidifiers market captured the largest revenue share in North America in 2025, fueled by the adoption of organic and mineral-based acidifiers across commercial aquaculture farms. Operators are prioritizing feed additives that improve growth performance, reduce antibiotic usage, and enhance product quality. In addition, government programs supporting sustainable aquaculture practices and stricter regulations on feed additives are driving demand for acidifier-enriched feeds.

Europe Aquafeed Acidifiers Market Insight

The Europe aquafeed acidifiers market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by regulatory support for sustainable feed practices and the increasing demand for high-quality seafood. Rising urbanization, modernization of aquaculture facilities, and focus on environmental sustainability are fostering adoption. European operators are increasingly using blended and single acidifier formulations to optimize feed efficiency across diverse aquaculture species.

U.K. Aquafeed Acidifiers Market Insight

The U.K. aquafeed acidifiers market is expected to witness rapid growth from 2026 to 2033 due to increasing consumer awareness of seafood quality and safety, coupled with rising demand for sustainable aquaculture practices. The country’s advanced feed manufacturing infrastructure, along with strong regulatory oversight, supports the adoption of acidifiers in both freshwater and marine species. These trends are expected to encourage manufacturers and farmers to integrate acidifiers into commercial feed formulations.

Germany Aquafeed Acidifiers Market Insight

The Germany aquafeed acidifiers market is expected to witness significant growth from 2026 to 2033, driven by technological advancements in feed formulation and rising demand for sustainable aquaculture products. Germany’s focus on efficiency, product quality, and environmentally friendly aquaculture practices is encouraging adoption. Operators are increasingly using acidifiers to improve gut health, nutrient absorption, and feed conversion ratios, particularly in salmon and trout farming.

Asia-Pacific Aquafeed Acidifiers Market Insight

The Asia-Pacific aquafeed acidifiers market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing aquaculture production, rising disposable incomes, and growing demand for high-quality seafood in countries such as China, Japan, India, and Vietnam. Government initiatives promoting sustainable aquaculture, coupled with the region’s emergence as a major feed manufacturing hub, are driving affordability and accessibility of acidifiers. Adoption across carp, tilapia, shrimp, and other species is expanding rapidly.

Japan Aquafeed Acidifiers Market Insight

The Japan aquafeed acidifiers market is expected to witness robust growth from 2026 to 2033 due to the country’s advanced aquaculture technologies, emphasis on feed efficiency, and high demand for premium seafood. Acidifiers are increasingly used in diets for salmon, sea bass, and crustaceans to improve nutrient utilization and overall farm productivity. In addition, Japan’s regulatory framework and focus on sustainable aquaculture practices support widespread adoption.

China Aquafeed Acidifiers Market Insight

The China aquafeed acidifiers market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid growth in aquaculture production, technological adoption, and government support for sustainable feed practices. China remains a major hub for commercial aquafeed manufacturing, with acidifiers being integrated into diets for carp, tilapia, and shrimp. The focus on high-quality seafood, feed efficiency, and cost-effective production is propelling market growth across the country.

Aquafeed Acidifiers Market Share

The Aquafeed Acidifiers industry is primarily led by well-established companies, including:

• Roquette Frères (France)

• ADM Animal Nutrition (U.S.)

• Kemin Industries (U.S.)

• MJI Universal Pte Ltd. (Singapore)

• Skretting (Norway)

• Green Plains Inc. (U.S.)

• Cargill, Incorporated (U.S.)

• BIOMIN (Austria)

• Aller Aqua A/S (Denmark)

• Nutriad (Belgium)

• DuPont (U.S.)

• Delacon (Austria)

• Camlin Fine Sciences Ltd. (India)

• Diana Group (France)

• Alltech (U.S.)

• Norel S.A. (Spain)

• Calanus AS (Norway)

• Olmix Group (France)

• Lallemand, Inc. (Canada)

Latest Developments in Global Aquafeed Acidifiers Market

- In July 2025, Kemin Industries launched an enhancement of its AquaScience product line, focusing on lysophospholipids, enzymes, organic acids, and antioxidants. The development aims to improve nutrient absorption, control microbial spoilage, and extend feed shelf life, thereby supporting sustainable aquaculture. This initiative enhances feed conversion efficiency and fish health, driving greater adoption of advanced aquafeed solutions across the global market

- In July 2025, Alltech emphasized advancements in sustainable aquafeed through flexible plant-based formulations combined with multi-enzyme technologies. This development enhances nutrient utilization, promotes faster fish growth, reduces environmental impact, and lowers operational costs. The innovation strengthens the industry’s focus on responsible seafood production and sustainable expansion, positioning Alltech as a key driver of eco-efficient feed solutions

- In July 2024, Aker BioMarine completed the sale of its Feed Ingredients business to Aker Capital and American Industrial Partners. This strategic divestment allows the company to sharpen its core focus while highlighting the value and growth potential of the sold unit. The transaction signals strong industry confidence, attracting interest from multiple partners and potentially influencing market consolidation and investment trends in aquafeed ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.