Global Aquafeed Binders Market

Market Size in USD Billion

CAGR :

%

USD

67.50 Billion

USD

93.80 Billion

2024

2032

USD

67.50 Billion

USD

93.80 Billion

2024

2032

| 2025 –2032 | |

| USD 67.50 Billion | |

| USD 93.80 Billion | |

|

|

|

|

Global Aquafeed Binders Market Size

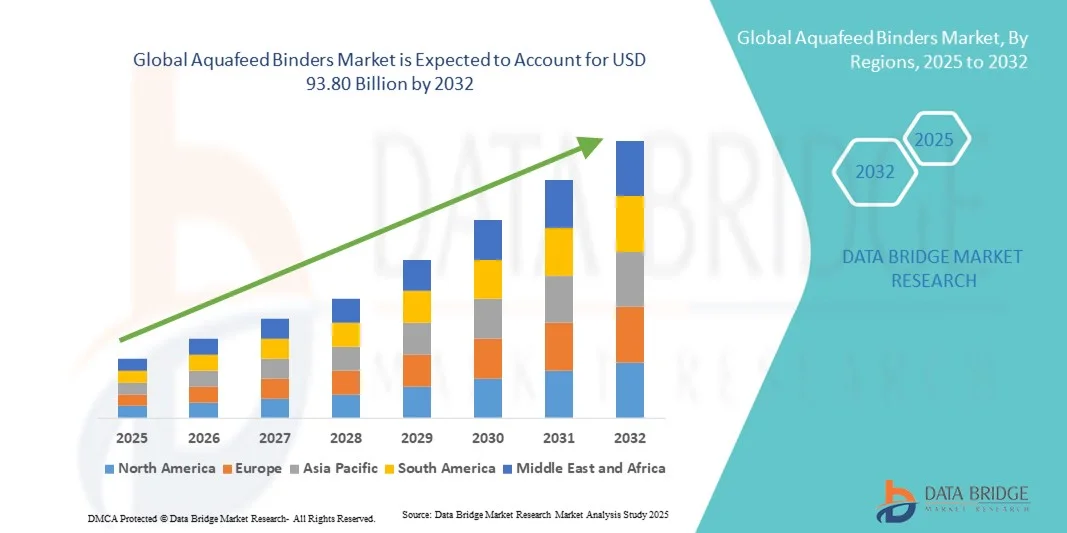

- The global Aquafeed Binders Market size was valued at USD 67.50 billion in 2024 and is projected to reach USD 93.80 billion by 2032, growing at a CAGR of 4.20% during the forecast period.

- The market expansion is primarily driven by the rising demand for high-quality aquafeed, technological advancements in feed formulation, and the increasing focus on sustainable aquaculture practices aimed at improving fish health and feed efficiency.

- In addition, the growing adoption of natural and eco-friendly binders, coupled with regulatory support for sustainable aquaculture development, is further propelling market growth, thereby creating lucrative opportunities for manufacturers and stakeholders in the aquafeed industry.

Global Aquafeed Binders Market Analysis

- Aquafeed binders, which are essential additives used to improve the stability, texture, and water durability of aquafeed pellets, are becoming increasingly vital in modern aquaculture systems across freshwater and marine environments due to their role in enhancing feed efficiency, minimizing nutrient loss, and promoting sustainable fish farming practices.

- The escalating demand for aquafeed binders is primarily fueled by the rapid growth of the aquaculture industry, increasing awareness of feed quality, and the rising need for cost-effective, environmentally friendly feed solutions that support optimal aquatic animal health and performance.

- Asia-Pacific dominated the Global Aquafeed Binders Market with the largest revenue share of 37.1% in 2024, driven by the region’s strong aquaculture production base, expanding seafood consumption, and government initiatives promoting sustainable aquafeed development, with China, India, and Vietnam emerging as major contributors to market expansion.

- North America is expected to be the fastest-growing region in the Global Aquafeed Binders Market during the forecast period due to rising investments in advanced aquaculture systems, growing demand for premium seafood products, and technological advancements in feed formulation and processing.

- The fishmeal segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its high protein content, amino acid balance, and digestibility, which make it a vital component in aquafeed formulations.

Report Scope and Global Aquafeed Binders Market Segmentation

|

Attributes |

Aquafeed Binders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Aquafeed Binders Market Trends

Technological Advancements in Binder Formulation and Performance Enhancement

- A significant and accelerating trend in the global Aquafeed Binders Market is the growing integration of advanced technologies and scientific innovation in binder formulation, aimed at improving pellet stability, nutrient retention, and overall feed performance in various aquaculture environments. This technological evolution is driving higher feed efficiency and supporting sustainable fish farming practices.

- For instance, companies like Cargill and BASF are investing heavily in bio-based and enzymatically modified binders that enhance water stability while reducing environmental impact. Similarly, Alltech is developing natural polymer-based binders that maintain pellet integrity even under high-moisture conditions, ensuring better nutrient utilization.

- Technological innovation in aquafeed binders also includes the development of smart formulation systems that use data analytics and predictive modeling to optimize binder concentration based on species type, feed composition, and water conditions. These advancements enable feed manufacturers to achieve consistent pellet quality with minimal waste.

- The integration of biotechnology and nanotechnology in binder production is further improving the binding strength and digestibility of aquafeed. For example, certain nanostructured binders can encapsulate nutrients, ensuring controlled release and enhanced absorption, thereby improving fish growth and health outcomes.

- This trend toward more intelligent, efficient, and sustainable binder solutions is transforming the aquafeed manufacturing landscape. Leading companies are increasingly focusing on research and innovation partnerships to develop next-generation binders that combine eco-friendliness, cost efficiency, and superior performance.

- The demand for technologically advanced aquafeed binders is growing rapidly across both commercial and small-scale aquaculture operations, as producers seek to optimize feed conversion ratios, improve product quality, and meet the rising global demand for sustainably farmed seafood.

Global Aquafeed Binders Market Dynamics

Driver

Growing Demand Driven by Expanding Aquaculture and Sustainable Feed Practices

- The increasing global demand for seafood, combined with the rapid expansion of aquaculture operations, is a significant driver for the heightened need for aquafeed binders. As aquaculture producers strive to improve feed efficiency and minimize environmental impact, the adoption of high-quality binders has become essential to maintain pellet integrity, water stability, and nutrient retention.

- For instance, in March 2024, Cargill announced the launch of a new line of bio-based aquafeed binders designed to reduce feed disintegration and nutrient leaching in aquatic environments. Such innovations by leading companies are expected to accelerate market growth in the forecast period.

- As aquaculture intensifies across regions such as Asia-Pacific and Latin America, the focus on sustainable and cost-efficient feed production has increased significantly. Aquafeed binders provide a reliable solution to enhance feed quality while reducing waste, thereby aligning with the industry’s growing emphasis on eco-friendly and efficient farming systems.

- Furthermore, the rising adoption of plant-based and organic feed ingredients has increased the demand for compatible natural binders that ensure pellet cohesion without chemical additives. Manufacturers are increasingly developing non-toxic, biodegradable, and functional binders to meet evolving regulatory and consumer expectations.

- The benefits of improved feed conversion ratios (FCRs), reduced feed loss, and better water quality are key factors propelling the adoption of advanced binder technologies across commercial fish and shrimp farming sectors. Additionally, innovations in biopolymer and starch-based binders are contributing to product diversification and enhanced performance.

Restraint/Challenge

Price Volatility of Raw Materials and Lack of Standardization

- The fluctuating prices of raw materials such as starches, gums, and alginates pose a significant challenge to the consistent production and pricing of aquafeed binders. Market volatility in agricultural commodities directly impacts production costs, especially for small and medium feed manufacturers.

- For instance, the rising cost of corn and cassava in 2024 led to increased binder prices, affecting feed producers in cost-sensitive regions like Southeast Asia and Africa. Such dependency on crop-based sources makes the market vulnerable to supply chain disruptions and seasonal variations.

- Another key restraint is the lack of global standardization in binder formulation and performance evaluation. Differences in feed composition, species requirements, and regional regulations make it difficult to establish uniform quality benchmarks, limiting large-scale commercialization.

- Addressing these challenges requires innovation in alternative raw materials, such as seaweed- or microbial-based binders, along with collaborative standard-setting efforts by regulatory bodies and industry stakeholders to ensure consistent product quality and safety.

- While technological advancements are helping reduce formulation costs and improve performance, achieving price stability and uniform quality across markets will remain critical for the sustained growth of the global aquafeed binders industry.

Global Aquafeed Binders Market Scope

Aquafeed binders market is segmented on the basis of ingredient, species, form, lifecycle, function, and sales channel.

- By Ingredient

On the basis of ingredient, the Global Aquafeed Binders Market is segmented into soybean, fishmeal, corn, fish oil, additives, and others. The fishmeal segment dominated the market with the largest revenue share of 38.6% in 2024, owing to its high protein content, amino acid balance, and digestibility, which make it a vital component in aquafeed formulations. Fishmeal-based binders enhance pellet cohesion and nutritional quality, supporting optimal fish growth and feed conversion efficiency. However, sustainability challenges and fluctuating raw material costs are prompting innovation in plant-based and microbial alternatives.

The additives segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in bio-based binding agents such as starches, gums, and alginates that offer superior pellet durability and water stability. Increasing demand for natural and eco-friendly feed solutions is further accelerating the use of functional additives as sustainable binder substitutes.

- By Species

On the basis of species, the Global Aquafeed Binders Market is segmented into fish, crustaceans, mollusks, and others. The fish segment dominated the market with the largest share of 55.3% in 2024, owing to the extensive scale of fish farming globally and the rising consumption of species such as salmon, tilapia, and catfish. Fish feed formulations demand high-quality binders to ensure pellet integrity and nutrient stability, particularly in intensive farming environments.

The crustaceans segment is projected to record the fastest CAGR from 2025 to 2032, driven by the expanding shrimp and prawn farming industries in Asia-Pacific and Latin America. High sensitivity of crustaceans to feed texture and water quality has prompted increasing adoption of specialized binders that minimize disintegration and nutrient leaching in aquatic systems. This trend is expected to significantly contribute to the market’s future growth trajectory.

- By Form

On the basis of form, the market is categorized into dry form, wet form, and moist form. The dry form segment accounted for the largest revenue share of 47.8% in 2024, attributed to its longer shelf life, easy handling, and compatibility with automated feed production systems. Dry binders are widely used in pelleted aquafeeds as they enhance durability and resist water breakdown, ensuring feed stability during storage and feeding.

The moist form segment is expected to witness the fastest CAGR from 2025 to 2032, due to its effectiveness in improving palatability and nutrient absorption for certain species. The rising preference for semi-moist and customized feeds in hatcheries and small-scale aquaculture farms is driving the adoption of moist binder formulations. Their ability to retain essential nutrients and reduce feed waste supports their growing use across diverse aquaculture systems.

- By Function

On the basis of function, the Global Aquafeed Binders Market is segmented into health, digestion, palatability, and special nutrition. The health segment dominated the market with a market share of 41.2% in 2024, supported by the growing emphasis on maintaining aquatic animal immunity and reducing disease outbreaks through nutritionally stable feed. Health-enhancing binders help preserve vitamin and mineral integrity while improving the physical quality of pellets.

The palatability segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing focus on feed acceptance and consumption efficiency among fish and crustaceans. Manufacturers are incorporating natural binders and flavor enhancers that improve texture, taste, and digestibility, contributing to higher feed intake and productivity. This trend aligns with the shift toward high-performance aquafeed formulations targeting optimal growth outcomes.

- By Sales Channel

On the basis of sales channel, the Global Aquafeed Binders Market is segmented into direct sales, indirect sales, hypermarkets/supermarkets, wholesalers, specialty stores, online, and other retail formats. The direct sales segment dominated the market with the largest share of 44.5% in 2024, due to strong relationships between aquafeed manufacturers and commercial fish farms that prefer bulk procurement for cost efficiency and consistent supply.

The online segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the increasing digitalization of agricultural and aquaculture supply chains. E-commerce platforms offer enhanced accessibility, price transparency, and convenience for small and medium-scale aquaculture producers. The growing adoption of online procurement channels, coupled with targeted marketing by major feed binder suppliers, is expected to further boost this segment’s expansion over the forecast period.

Global Aquafeed Binders Market Regional Analysis

- Asia-Pacific dominated the Global Aquafeed Binders Market with the largest revenue share of 37.1% in 2024, driven by the rapid expansion of aquaculture production, increasing seafood consumption, and growing government initiatives promoting sustainable aquafeed practices. Countries such as China, India, Vietnam, and Indonesia are leading contributors to market growth due to their large aquaculture bases and rising investments in feed technology.

- Producers in the region are increasingly adopting high-quality and eco-friendly binders to improve feed efficiency, reduce nutrient loss, and enhance water stability. This growing focus on feed optimization and environmental sustainability is fostering the demand for advanced binder solutions across both freshwater and marine aquaculture sectors.

- This strong market presence is further supported by increasing disposable incomes, technological advancements in aquafeed processing, and expanding export-oriented aquaculture industries, positioning Asia-Pacific as the key hub for global aquafeed binder production and consumption.

U.S. Aquafeed Binders Market Insight

The U.S. aquafeed binders market captured the largest revenue share of 78% in 2024 within North America, driven by the rapid expansion of the aquaculture industry and the growing demand for high-quality, sustainable feed solutions. Increasing focus on improving feed efficiency, minimizing nutrient loss, and enhancing water stability is propelling the adoption of advanced binder technologies. The U.S. market benefits from the strong presence of major players such as Cargill, Alltech, and Kemin Industries, who are investing in bio-based and environmentally friendly binder formulations. Moreover, rising awareness about sustainable seafood production and strict feed quality standards set by regulatory agencies are further boosting market growth across commercial aquaculture and research-based feed production sectors.

Europe Aquafeed Binders Market Insight

The Europe aquafeed binders market is projected to expand at a substantial CAGR during the forecast period, primarily driven by sustainability mandates and the growing adoption of eco-friendly aquaculture feed formulations. European aquaculture producers are increasingly focused on optimizing feed conversion ratios and maintaining water quality, creating strong demand for natural and biodegradable binders. The market growth is supported by regional efforts to reduce environmental impact, particularly in countries with well-established aquaculture industries such as Norway, Spain, and Denmark. Additionally, the emphasis on traceable and sustainable sourcing within the EU feed sector is fostering the adoption of innovative binder technologies that align with the region’s circular economy goals.

U.K. Aquafeed Binders Market Insight

The U.K. aquafeed binders market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in sustainable aquaculture and the growing demand for premium seafood products. Increasing awareness about water pollution control and feed waste reduction is encouraging feed manufacturers to incorporate efficient binding agents in formulations. The U.K.’s commitment to achieving environmentally responsible aquaculture practices, combined with advancements in feed technology and the presence of research-driven companies, is contributing to steady market expansion. Furthermore, the development of plant-based and functional binders tailored for cold-water species such as salmon is enhancing product innovation and competitiveness within the country’s aquafeed industry.

Germany Aquafeed Binders Market Insight

The Germany aquafeed binders market is expected to expand at a considerable CAGR throughout the forecast period, fueled by the country’s technological innovation, sustainability focus, and increasing demand for high-quality aquafeed. German aquaculture producers are prioritizing environmentally friendly production systems and efficient feed utilization, boosting demand for starch-based and alginate-based binders. Moreover, Germany’s strong research infrastructure and its emphasis on quality certification standards are promoting the use of scientifically validated binder formulations. The integration of digital monitoring tools in feed manufacturing and the adoption of circular economy principles are further enhancing the country’s aquafeed binder market growth.

Asia-Pacific Aquafeed Binders Market Insight

The Asia-Pacific aquafeed binders market is poised to grow at the fastest CAGR of 22.5% from 2025 to 2032, driven by the expanding aquaculture industry, increasing seafood consumption, and rising government support for sustainable fish farming. Countries such as China, India, Vietnam, Indonesia, and Thailand are leading the regional market due to their high aquaculture production and growing export-oriented seafood sectors. The region’s low production costs, expanding manufacturing capabilities, and adoption of innovative binder technologies are contributing to strong growth. Moreover, as APAC continues to position itself as the global aquaculture hub, the increasing use of natural and cost-effective binder materials is expected to enhance feed quality, sustainability, and profitability.

Japan Aquafeed Binders Market Insight

The Japan aquafeed binders market is gaining significant momentum, supported by the country’s technological advancement, focus on sustainable aquaculture, and demand for high-performance feeds. Japan’s aquaculture sector emphasizes feed stability, digestibility, and water quality management, creating strong demand for superior binder solutions. The integration of biopolymer and seaweed-based binders aligns with Japan’s environmental conservation goals. Additionally, the country’s advanced R&D infrastructure is fostering the development of specialized binder formulations for species such as tuna and yellowtail. The aging workforce and increased automation in aquaculture operations are also contributing to the demand for efficient, easy-to-handle feed products.

China Aquafeed Binders Market Insight

The China aquafeed binders market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s massive aquaculture production base, rapid urbanization, and rising domestic seafood demand. China is one of the world’s largest producers and consumers of aquafeed, with strong domestic manufacturing of both synthetic and natural binder products. Government initiatives promoting sustainable aquaculture practices and environmental protection are encouraging the use of biodegradable, plant-based binders over chemical alternatives. The presence of numerous feed manufacturers and research collaborations with global companies are further enhancing technological innovation and market competitiveness, solidifying China’s position as a key growth driver in the global aquafeed binders industry.

Global Aquafeed Binders Market Share

The Aquafeed Binders industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• BASF SE (Germany)

• Archer Daniels Midland Company (U.S.)

• DowDuPont Inc. (U.S.)

• Ingredion Incorporated (U.S.)

• Beneo GmbH (Germany)

• CP Kelco (U.S.)

• Alltech, Inc. (U.S.)

• Uniscope, Inc. (U.S.)

• Borregaard ASA (Norway)

• Kemin Industries, Inc. (U.S.)

• Diana Group (France)

• Zeus Biotech Pvt. Ltd. (India)

• Tate & Lyle PLC (U.K.)

• ADM Animal Nutrition (U.S.)

• AVEBE U.A. (Netherlands)

• Nutriad International NV (Belgium)

• South America Gelatin S.A. (Brazil)

• Chemcolloids Ltd. (Canada)

• Galactic S.A. (Belgium)

What are the Recent Developments in Global Aquafeed Binders Market?

- In April 2023, Cargill, a global leader in animal nutrition and aquaculture solutions, launched an innovative line of high-performance aquafeed binders in Southeast Asia, aimed at improving feed stability and nutrient retention for commercial fish farms. This initiative underscores the company's commitment to providing sustainable and effective feed solutions tailored to regional aquaculture needs. By leveraging its global R&D capabilities and advanced formulation technologies, Cargill is addressing local challenges in feed efficiency while reinforcing its position in the rapidly growing Global Aquafeed Binders Market.

- In March 2023, Alltech, a leader in sustainable feed solutions, introduced a new range of natural binder products specifically designed for shrimp and tilapia feeds. The advanced formulations focus on enhancing pellet durability and water stability, thereby reducing nutrient loss and improving overall aquaculture productivity. This product launch highlights Alltech's dedication to developing innovative and environmentally friendly aquafeed solutions that support both farm profitability and sustainability.

- In March 2023, Kemin Industries successfully deployed its BioBind™ aquafeed binder solutions in commercial fish farms across India, aimed at optimizing feed conversion ratios and minimizing environmental impact. The initiative leverages Kemin's expertise in functional ingredients to enhance feed performance and water quality, demonstrating the increasing importance of advanced binder technologies in sustainable aquaculture practices.

- In February 2023, Nutreco, a global animal nutrition company, announced a strategic partnership with major aquaculture producers in Latin America to implement specialized binder systems for high-value species such as salmon and trout. The collaboration is designed to improve feed stability, maintain nutrient integrity, and enhance operational efficiency, reinforcing Nutreco’s commitment to innovation and market leadership in the aquafeed binders sector.

- In January 2023, BIOMIN, a leading provider of feed additives and aquaculture solutions, unveiled its latest functional binder technology at the International Production & Processing Expo (IPPE) 2023. The new binder formulations are engineered to improve pellet hardness, water stability, and digestibility, providing aquaculture operators with more efficient and sustainable feed options. This launch reflects BIOMIN’s commitment to integrating advanced science and technology into aquafeed solutions, offering producers enhanced performance and environmental benefits.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.