Global Aquafeed Enzymes Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

2.92 Billion

2025

2033

USD

1.39 Billion

USD

2.92 Billion

2025

2033

| 2026 –2033 | |

| USD 1.39 Billion | |

| USD 2.92 Billion | |

|

|

|

|

Aquafeed Enzymes Market Size

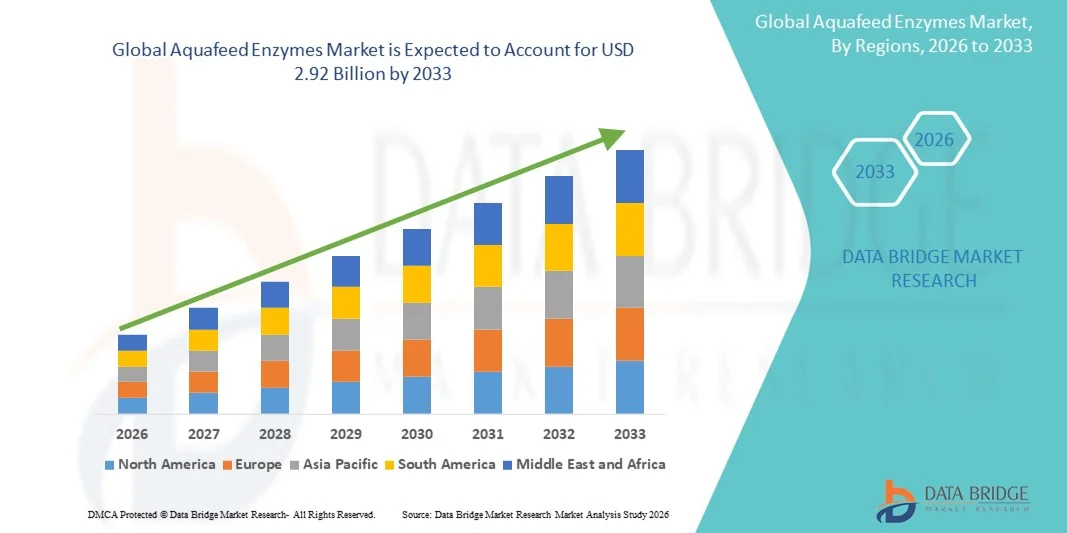

- The global aquafeed enzymes market size was valued at USD 1.39 billion in 2025 and is expected to reach USD 2.92 billion by 2033, at a CAGR of 9.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality aquaculture feed, rising fish consumption worldwide, and growing awareness regarding sustainable aquaculture production practices

- In addition, technological advancements in enzyme formulation and the incorporation of multi-enzyme blends are further boosting market expansion by improving feed efficiency and reducing environmental impact

Aquafeed Enzymes Market Analysis

- The market is witnessing robust growth due to the expanding aquaculture industry and the need to improve feed conversion efficiency and nutrient utilization in aquatic animals

- The adoption of feed enzymes is increasing as they enhance protein digestibility, reduce feed costs, and improve overall fish health and growth performance, supporting profitability and sustainability in aquaculture operations

- North America dominated the aquafeed enzymes market with the largest revenue share in 2025, driven by the strong aquaculture industry and high demand for nutritionally enhanced feed products. The region’s focus on sustainable aquaculture practices and improved feed conversion efficiency is supporting steady adoption of enzyme-based feed additives

- Asia-Pacific region is expected to witness the highest growth rate in the global aquafeed enzymes market, driven by growing seafood consumption, expanding aquaculture activities in countries such as China, India, and Vietnam, and increasing focus on enhancing feed conversion efficiency through enzyme supplementation

- The phytase segment held the largest market revenue share in 2025, driven by its ability to enhance phosphorus availability and reduce environmental waste. Phytase helps improve nutrient digestibility and supports cost-efficient feed formulations by enabling greater use of plant-based ingredients. Its effectiveness in improving feed conversion ratios has made it a preferred enzyme across aquafeed producers globally

Report Scope and Aquafeed Enzymes Market Segmentation

|

Attributes |

Aquafeed Enzymes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aquafeed Enzymes Market Trends

Increasing Demand For Sustainable And Efficient Aquaculture Feed Solutions

- The growing global focus on sustainable aquaculture practices is accelerating the demand for enzyme-based feed formulations. These enzymes enhance nutrient absorption and reduce feed waste, leading to improved feed conversion ratios and lower environmental impact. As aquaculture expands to meet the protein needs of a rising population, enzyme inclusion in feed is becoming an essential practice for efficient production

- The shift toward enzyme supplementation is also driven by the need to reduce dependence on fishmeal and other costly protein sources. Enzymes such as proteases, phytases, and carbohydrases help improve digestibility and nutrient release from plant-based feed ingredients. This transition supports both cost efficiency and environmental sustainability within the aquafeed industry

- Feed manufacturers are increasingly collaborating with biotechnology firms to develop customized enzyme blends suitable for specific aquatic species and feed compositions. These innovations are enhancing growth rates, immunity, and overall health in fish and shrimp, making enzyme-enhanced feed a preferred choice in commercial aquaculture operations

- For instance, in 2023, several aquafeed producers in Southeast Asia introduced enzyme-enriched feeds that improved protein utilization efficiency by over 20%, reducing overall feed costs and nitrogen discharge in aquaculture farms. Such initiatives highlight the growing alignment of feed innovation with sustainability goals

- While enzyme-enriched feeds are gaining traction, the market’s future growth depends on continuous R&D, regional customization, and farmer education. Manufacturers must focus on cost-effective enzyme formulations and expand accessibility in emerging aquaculture regions to sustain adoption

Aquafeed Enzymes Market Dynamics

Driver

Rising Aquaculture Production And Focus On Feed Efficiency

- The rapid expansion of aquaculture worldwide is significantly increasing the need for high-performance feed additives such as enzymes. With global seafood consumption rising, aquaculture producers are under pressure to improve productivity while maintaining environmental responsibility. Enzymes help achieve both by optimizing nutrient utilization and minimizing feed waste

- Feed efficiency is becoming a critical cost factor, as feed constitutes up to 60–70% of total production expenses. The use of enzymes such as amylases and proteases allows for the use of alternative plant proteins and reduces the reliance on fishmeal. This not only lowers costs but also promotes more sustainable feed formulations aligned with global sustainability goals

- Governments and industry bodies are promoting enzyme use as part of sustainable aquaculture initiatives. Increased awareness among farmers about the benefits of enzyme inclusion is also boosting adoption rates. As enzyme technologies evolve, their integration into multi-enzyme blends for species-specific applications is enhancing feed performance outcomes

- For instance, in 2024, aquafeed producers in Norway and Chile reported a 15–25% improvement in growth performance of salmon and trout when using advanced enzyme complexes in their feed formulations, reinforcing the value of enzymatic enhancement in modern aquaculture

- While the adoption curve is rising, challenges related to formulation cost, enzyme stability, and awareness in developing regions persist. Continuous technological advancements and training programs will be key to unlocking the full potential of enzyme-based feed systems

Restraint/Challenge

High Production Costs And Stability Issues Of Enzymes

- The cost of enzyme production remains a major barrier to mass adoption in aquafeed, particularly for small-scale feed producers. The production process involves advanced biotechnological techniques and strict quality controls, which contribute to higher prices compared to traditional feed additives. This limits enzyme use in cost-sensitive markets

- Enzyme stability during feed processing and storage is another critical challenge. High temperatures during feed extrusion or pelleting can degrade enzyme activity, reducing their effectiveness in the final product. This issue is particularly prevalent in regions with high humidity and inadequate storage infrastructure

- The lack of standardized regulatory frameworks for enzyme approval across various countries further slows down commercialization. Manufacturers face lengthy and costly registration processes, which delay product launches and regional market entry

- For instance, in 2023, feed manufacturers in India and Vietnam reported enzyme degradation rates of over 25% during pelleting due to inadequate temperature control, leading to suboptimal feed performance and economic losses. Such technical hurdles are prompting increased R&D in enzyme encapsulation and stabilization techniques

- While enzyme-based feed solutions hold immense promise, addressing production cost and stability challenges is essential. Industry players must focus on innovation in enzyme formulation, process optimization, and logistics efficiency to ensure wider adoption across global aquaculture markets

Aquafeed Enzymes Market Scope

The market is segmented on the basis of type, species, form, and source.

- By Type

On the basis of type, the aquafeed enzymes market is segmented into phytase, protease, carbohydrase, and others. The phytase segment held the largest market revenue share in 2025, driven by its ability to enhance phosphorus availability and reduce environmental waste. Phytase helps improve nutrient digestibility and supports cost-efficient feed formulations by enabling greater use of plant-based ingredients. Its effectiveness in improving feed conversion ratios has made it a preferred enzyme across aquafeed producers globally.

The protease segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to break down complex proteins into easily digestible amino acids. Protease enzymes are increasingly being incorporated into aquafeed to improve growth performance and nutrient utilization in fish and shrimp. Their role in reducing feed costs and enhancing gut health positions them as a critical component in modern aquaculture nutrition strategies.

- By Species

On the basis of species, the aquafeed enzymes market is segmented into fish, crustaceans, and mollusks. The fish segment held the largest market share in 2025, driven by the high global demand for fish products and the large-scale adoption of enzyme-supplemented feed in commercial aquaculture systems. Enzyme applications in fish feed enhance nutrient absorption, improve feed efficiency, and contribute to better growth rates and disease resistance.

The crustaceans segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by the expanding shrimp farming industry and the rising need for high-quality, digestible feed solutions. Enzymes are increasingly used in crustacean diets to improve shell development, nutrient assimilation, and immunity, aligning with the growing demand for sustainable shrimp production.

- By Form

On the basis of form, the aquafeed enzymes market is segmented into liquid and dry. The dry segment held the largest market revenue share in 2025, attributed to its longer shelf life, ease of storage, and compatibility with pelleted feed production processes. Dry enzyme formulations are widely adopted due to their stability and cost-effectiveness, especially in large-scale feed manufacturing operations.

The liquid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior blending capabilities and uniform distribution during feed production. Liquid enzymes are particularly suitable for post-pelleting application and customized feed formulations, offering flexibility and improved efficiency for specific aquaculture species.

- By Source

On the basis of source, the aquafeed enzymes market is segmented into microorganism, plant, and animal. The microorganism segment held the largest market share in 2025, driven by the high efficiency, scalability, and cost-effectiveness of microbial enzyme production. Enzymes derived from bacterial and fungal strains are widely used due to their stability under varied feed processing conditions and consistent performance in aquaculture diets.

The plant segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by increasing demand for natural and eco-friendly enzyme sources. Plant-derived enzymes are gaining attention due to their sustainable production methods and acceptance in regions with strict feed additive regulations, further supporting the shift toward cleaner and greener aquafeed solutions.

Aquafeed Enzymes Market Regional Analysis

- North America dominated the aquafeed enzymes market with the largest revenue share in 2025, driven by the strong aquaculture industry and high demand for nutritionally enhanced feed products. The region’s focus on sustainable aquaculture practices and improved feed conversion efficiency is supporting steady adoption of enzyme-based feed additives

- Producers in the region are increasingly incorporating enzymes such as phytase and protease to optimize nutrient absorption and reduce feed costs, aligning with environmental regulations targeting lower phosphorus and nitrogen emissions.

- This growth is further strengthened by advanced R&D capabilities, a strong presence of key enzyme manufacturers, and government support for sustainable aquaculture production, making North America a key hub for feed enzyme innovation.

U.S. Aquafeed Enzymes Market Insight

The U.S. aquafeed enzymes market captured the largest revenue share in 2025 within North America, fuelled by rising fish farming operations and the demand for high-performance feeds that enhance growth and immunity. The increasing emphasis on sustainable aquaculture and efficient nutrient utilization drives the integration of enzyme-based feed solutions. Furthermore, the presence of leading feed producers and biotechnological advancements are supporting continuous product innovation and adoption.

Europe Aquafeed Enzymes Market Insight

The Europe aquafeed enzymes market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict environmental regulations and the region’s focus on sustainable aquaculture production. European aquafeed producers are actively replacing synthetic additives with enzyme-based solutions to improve digestibility and reduce waste. The demand is also supported by government incentives for eco-friendly feed practices and growing consumer preference for sustainably sourced seafood.

U.K. Aquafeed Enzymes Market Insight

The U.K. aquafeed enzymes market is expected to witness steady growth from 2026 to 2033, driven by the country’s emphasis on sustainable aquaculture and feed efficiency improvements. The rising production of farmed fish species such as salmon and trout is encouraging feed manufacturers to integrate enzymes that enhance nutrient absorption and reduce waste output. Moreover, strong regulatory focus on environmental protection and reduced reliance on synthetic additives is promoting wider adoption of enzyme-based feed formulations across commercial aquaculture operations.

Germany Aquafeed Enzymes Market Insight

The Germany aquafeed enzymes market is expected to witness robust growth from 2026 to 2033, driven by the country’s strong focus on sustainable aquaculture practices and high-quality feed production. The increasing adoption of advanced enzyme technologies to improve feed digestibility and nutrient conversion efficiency is supporting market expansion. Furthermore, Germany’s emphasis on reducing environmental impact through eco-friendly feed additives, along with ongoing research collaborations between feed manufacturers and biotechnology firms, is accelerating the adoption of enzyme-based aquafeed solutions.

Asia-Pacific Aquafeed Enzymes Market Insight

The Asia-Pacific aquafeed enzymes market is expected to witness the fastest growth rate from 2026 to 2033, driven by the expansion of aquaculture in countries such as China, India, Vietnam, and Indonesia. The region’s increasing demand for high-yield, cost-effective aquafeed solutions is boosting the use of enzymes to improve nutrient utilization and reduce feed waste. In addition, government programs promoting sustainable fish farming and technological collaborations with global feed enzyme companies are accelerating market growth.

China Aquafeed Enzymes Market Insight

The China aquafeed enzymes market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by the country’s massive aquaculture output and focus on improving feed efficiency. The use of enzymes in aquafeed is expanding rapidly to support large-scale fish and shrimp production, with local manufacturers increasingly investing in enzyme formulation technologies. Moreover, the rise of environmentally responsible aquaculture practices and the government’s focus on feed optimization are major factors supporting market expansion.

Japan Aquafeed Enzymes Market Insight

The Japan aquafeed enzymes market is expected to witness significant growth from 2026 to 2033, fuelled by advancements in aquaculture technology and increasing demand for premium seafood. The country’s focus on precision feeding and efficient nutrient utilization is driving the use of enzymes such as phytase and protease in feed formulations. In addition, the growing trend toward sustainable marine farming and collaboration between domestic feed producers and biotechnology companies are enhancing enzyme integration within Japan’s aquafeed industry.

Aquafeed Enzymes Market Share

The Aquafeed Enzymes industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• Novozymes (Denmark)

• Cargill, Incorporated (U.S.)

• ADM (U.S.)

• DuPont (U.S.)

• ABF Ingredients (U.K.)

• DSM (Netherlands)

• BEHN MEYER (Germany)

• Azelis S.A. (Belgium)

• Adisseo (France)

• NOVUS INTERNATIONAL (U.S.)

• Rossari Biotech Limited (India)

• Chr. Hansen Holding A/S (Denmark)

• BIO-CAT (U.S.)

• BioResource International, Inc. (U.S.)

• Bioproton Pty Ltd. (Australia)

• Alltech (U.S.)

• Advanced Enzyme Technologies (India)

• Karyotica Biologicals Pvt Ltd. (India)

• Caprienzymes (India)

Latest Developments in Global Aquafeed Enzymes Market

- In February 2025, DSM-Firmenich announced a strategic divestment by dissolving the Feed Enzyme Alliance through an agreement with Novonesis. Under the deal, Novonesis acquired DSM-Firmenich’s stake for EUR 1.5 billion in cash. This move allows DSM-Firmenich to streamline its portfolio and focus on its core nutrition and health segments, while Novonesis strengthens its position in the global feed enzyme market. The acquisition is expected to enhance Novonesis’ technological capabilities, expand its product offerings, and increase competitiveness in sustainable aquaculture solutions. Overall, the development marks a significant shift in market dynamics, fostering consolidation and innovation within the feed enzyme industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.