Global Aquafeed Mycotoxin Binders And Modifiers Market

Market Size in USD Billion

CAGR :

%

USD

2.73 Billion

USD

3.79 Billion

2025

2033

USD

2.73 Billion

USD

3.79 Billion

2025

2033

| 2026 –2033 | |

| USD 2.73 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Global Aquafeed Mycotoxin Binders and Modifiers Market Size

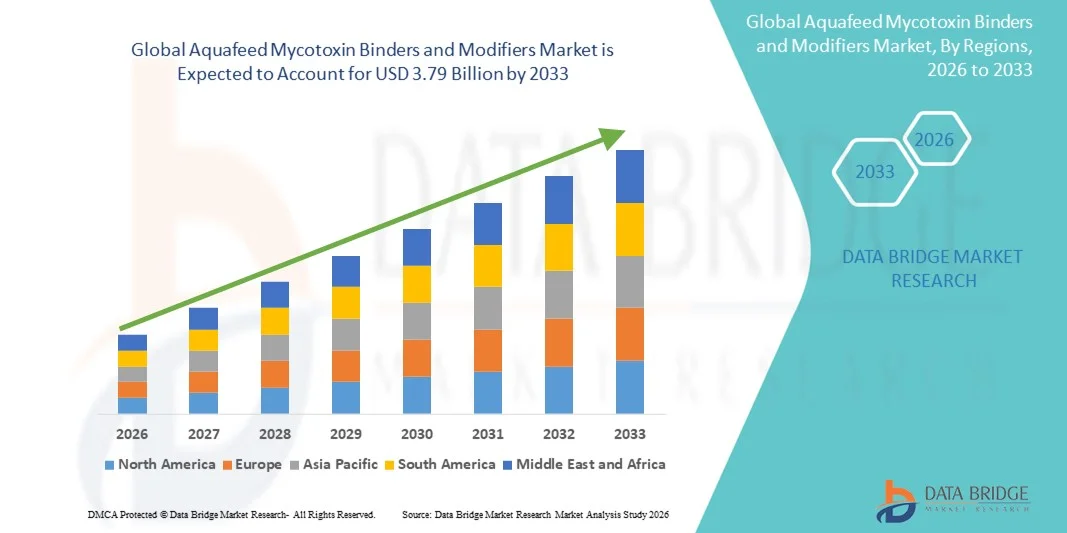

- The global Aquafeed Mycotoxin Binders and Modifiers Market was valued at USD 2.73 billion in 2025 and is projected to reach USD 3.79 billion by 2033, registering a CAGR of 4.20% during the forecast period.

- Market expansion is primarily driven by the increasing prevalence of mycotoxin contamination in aquaculture feed, which is pushing feed manufacturers and farmers to adopt advanced toxin-control solutions to protect aquatic animal health and improve production efficiency.

- Additionally, rising demand for high-quality, sustainable aquaculture products and growing emphasis on enhanced feed safety, immune support, and performance optimization are accelerating the integration of mycotoxin binders and modifiers, thereby significantly boosting overall market growth.

Global Aquafeed Mycotoxin Binders and Modifiers Market Analysis

- Aquafeed mycotoxin binders and modifiers, designed to neutralize or inhibit harmful mycotoxins present in aquaculture feed, are becoming increasingly essential in modern aquaculture systems across both small- and large-scale farming operations due to their ability to enhance feed safety, improve animal health, and support efficient production outcomes.

- The rising demand for these solutions is primarily driven by the growing incidence of mycotoxin contamination, heightened focus on aquatic animal welfare, and the increasing preference among farmers for reliable, science-backed additives that ensure better feed quality and reduce disease-related losses.

- North America dominated the Global Aquafeed Mycotoxin Binders and Modifiers Market with a revenue share of 32.2% in 2025, supported by advanced aquaculture practices, strong regulatory emphasis on feed safety, and the presence of leading feed additive manufacturers. The U.S. recorded substantial uptake of mycotoxin mitigation products, driven by innovations in binder formulations and enzyme-based modifiers.

- Asia-Pacific is expected to be the fastest-growing region in the Global Aquafeed Mycotoxin Binders and Modifiers Market during the forecast period, propelled by rapid aquaculture expansion, rising disposable incomes, and increasing awareness of feed quality management among producers.

- The mycotoxin binders segment dominated the market with the largest revenue share of 62.4% in 2025, driven by its wide adoption across commercial aquafeed due to cost-effectiveness, ease of inclusion, and proven ability to physically adsorb common mycotoxins such as aflatoxins and ochratoxin.

Report Scope and Global Aquafeed Mycotoxin Binders and Modifiers Market Segmentation

|

Attributes |

Aquafeed Mycotoxin Binders and Modifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Aquafeed Mycotoxin Binders and Modifiers Market Trends

Enhanced Protection Through Advanced Binder and Modifier Technologies

- A significant and accelerating trend in the Global Aquafeed Mycotoxin Binders and Modifiers Market is the growing integration of advanced biochemical, enzymatic, and nano-based technologies designed to deliver more precise and efficient mycotoxin neutralization. This evolution is greatly enhancing feed safety, nutrient utilization, and overall aquaculture productivity.

- For Instance, leading manufacturers are developing next-generation enzyme modifiers capable of specifically degrading highly resistant mycotoxins such as fumonisins and trichothecenes, offering farmers more reliable protection compared to traditional clay-based binders. Similarly, nanostructured adsorbents are being introduced to improve binding capacity without affecting essential nutrients in the feed.

- The incorporation of advanced biotechnology enables features such as targeted mycotoxin deactivation, improved stability across varying pH conditions, and enhanced compatibility with different aquafeed formulations. Certain formulations now utilize multi-mode action, combining adsorption, biotransformation, and immune-supporting components to deliver more intelligent and comprehensive protection for aquatic species.

- Seamless integration of these solutions into broader aquaculture management systems, including digital monitoring platforms, allows producers to track feed quality, predict contamination risks, and automatically adjust additive dosages to maintain optimal safety and performance. This contributes to a more unified and automated approach to aquaculture operations.

- This trend toward more advanced, intelligent, and highly efficient mycotoxin mitigation solutions is reshaping expectations for feed safety within the industry. As a result, companies such as Biomin, Alltech, and Adisseo are expanding their portfolios with AI-supported detection tools, multi-function modifiers, and next-generation binders designed for enhanced precision and protection.

- The demand for innovative, science-driven mycotoxin binders and modifiers is rising rapidly across both intensive and emerging aquaculture regions, as producers increasingly prioritize animal health, improved feed performance, and higher-quality yield outcomes

Global Aquafeed Mycotoxin Binders and Modifiers Market Dynamics

Driver

Growing Need Due to Rising Mycotoxin Risks and Expanding Aquaculture Production

- The increasing prevalence of mycotoxin contamination in aquafeed, combined with rapid growth in global aquaculture production, is a major driver behind the rising demand for aquafeed mycotoxin binders and modifiers.

- For instance, major industry players are developing advanced contamination-monitoring and toxin-neutralizing technologies to address escalating feed safety challenges. Such innovations are expected to significantly support market growth over the forecast period.

- As producers become more aware of the economic and health impacts of mycotoxins—including reduced growth performance, weakened immunity, and higher mortality—these additives offer critical protection, ensuring safer feed and healthier aquatic species.

- Furthermore, the expansion of intensive and commercial aquaculture operations, along with increasing adoption of specialized functional feed additives, is making mycotoxin binders and modifiers an integral component of modern aquaculture nutrition strategies.

- The benefits of improved feed quality, better disease resistance, and optimized production efficiency are key factors driving their adoption across both large-scale aquaculture enterprises and smallholder farms. The trend toward data-driven feed management and more sophisticated nutrition solutions further contributes to market expansion.

Restraint/Challenge

Concerns Regarding Product Cost and Variability in Mycotoxin Presence

- Cost-related concerns associated with premium binder and modifier formulations pose a challenge to widespread adoption, particularly in price-sensitive and developing aquaculture markets. High-performance enzymatic and multi-component products often come at a higher cost, making some producers hesitant to invest.

- For instance, fluctuations in raw material prices and the need for continuous quality testing can increase production costs, influencing the final price of mycotoxin-mitigation products.

- Additionally, variability in mycotoxin occurrence—driven by regional climate conditions, inconsistent storage practices, and differing feed ingredients—can lead some producers to underestimate contamination risks, reducing their willingness to adopt advanced mitigation solutions.

- Addressing these challenges through cost-effective product innovation, improved farmer education on the hidden costs of mycotoxin exposure, and wider availability of economical yet effective binder solutions will be essential for broader market penetration.

- While prices are gradually becoming more competitive, the perception of mycotoxin binders as a premium add-on can still hinder adoption among small-scale farmers who may not immediately recognize the long-term benefits. Enhanced awareness initiatives and accessible product options will be crucial for sustained market growth.

Global Aquafeed Mycotoxin Binders and Modifiers Market Scope

Aquafeed mycotoxin binders & modifiers market is segmented on the basis of product type, source, and form.

- By Product Type

On the basis of product type, the Global Aquafeed Mycotoxin Binders and Modifiers Market is segmented into mycotoxin binders and mycotoxin modifiers. The mycotoxin binders segment dominated the market with the largest revenue share of 62.4% in 2025, driven by its wide adoption across commercial aquafeed due to cost-effectiveness, ease of inclusion, and proven ability to physically adsorb common mycotoxins such as aflatoxins and ochratoxin. Binders continue to be preferred by aquaculture farmers looking for dependable, affordable solutions suitable for various feed formulations. Their compatibility with pelleted, extruded, and mash feeds further supports market penetration.

The mycotoxin modifiers segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for advanced biological and enzymatic solutions that can chemically degrade or biotransform complex mycotoxins such as fumonisins and trichothecenes. Rising investment in R&D and greater awareness of multi-mycotoxin contamination are accelerating adoption of modifiers for enhanced protection.

- By Source

On the basis of source, the market is segmented into inorganic and organic products. The inorganic segment dominated the market with a revenue share of 57.8% in 2025, primarily due to the widespread use of clay minerals such as bentonite, hydrated sodium calcium aluminosilicate (HSCAS), and zeolites. These minerals are readily available, cost-efficient, and highly effective in binding aflatoxins, making them a staple in aquafeed formulations. Their strong adsorption capacity, thermal stability, and long shelf life make inorganic binders the first choice for feed producers targeting preventive mycotoxin management.

The organic segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for enzyme-based, microbial, and yeast-derived solutions that offer targeted degradation of diverse mycotoxins. Organic solutions are gaining popularity as they support gut health, preserve nutrient availability, and provide broad-spectrum protection—key advantages in high-value aquaculture species.

- By Form

On the basis of form, the Global Aquafeed Mycotoxin Binders and Modifiers Market is segmented into dry and liquid formulations. The dry segment dominated the market with the largest revenue share of 68.3% in 2025, attributed to its superior stability, ease of transportation, and high compatibility with bulk feed manufacturing processes. Dry binders and modifiers—commonly available as powders and granules—are preferred for mass-scale feed production due to consistent mixing properties, longer shelf life, and lower logistical costs. Their efficiency in uniform distribution within pelleted and extruded feeds further supports their dominance.

The liquid segment is expected to exhibit the fastest CAGR from 2026 to 2033, driven by increasing usage in specialized feeds, hatchery diets, and recirculating aquaculture systems (RAS). Liquid formulations offer enhanced dispersibility, improved bioavailability, and greater precision in low-inclusion feed systems, making them ideal for high-value species and technologically advanced aquaculture operations.

Global Aquafeed Mycotoxin Binders and Modifiers Market Regional Analysis

- North America dominated the Global Aquafeed Mycotoxin Binders and Modifiers Market with the largest revenue share of 32.2% in 2025, driven by a strong emphasis on feed quality, stringent regulatory standards, and rising awareness of mycotoxin risks in aquaculture production.

- Producers in the region place high value on advanced feed safety solutions, adopting high-performance binders and biological modifiers to ensure optimal fish health, improved feed efficiency, and reduced economic losses associated with mycotoxin exposure.

- This widespread adoption is further supported by the presence of major aquaculture feed manufacturers, a technologically advanced farming environment, and continued investment in sustainable aquaculture practices, establishing mycotoxin binders and modifiers as essential components for both freshwater and marine aquaculture operations across North America.

U.S. Aquafeed Mycotoxin Binders and Modifiers Market Insight

The U.S. aquafeed mycotoxin binders and modifiers market captured the largest revenue share of 81% in 2025 within North America, supported by the rapid expansion of commercial aquaculture and rising awareness of feed safety management. Producers increasingly prioritize high-performance toxin mitigation solutions to address contamination risks associated with corn, soybean meal, and other commonly used feed ingredients. Growing dependence on advanced aquafeed formulations, along with a strong regulatory push for quality control and animal welfare, further strengthens market demand. Additionally, the growing integration of digital aquaculture technologies—such as real-time feed monitoring and predictive contamination analytics—is accelerating the adoption of enzymatic modifiers and precision binders across U.S. aquaculture farms.

Europe Aquafeed Mycotoxin Binders and Modifiers Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent feed safety regulations and the rising need for robust toxin-control measures in aquaculture operations. Increasing mycotoxin surveillance programs, combined with heightened awareness among European fish farmers, is fostering rapid adoption of both binder and modifier solutions. The region also benefits from advanced aquaculture industries in countries such as Norway, the U.K., and Spain, where producers prioritize premium feed additives to enhance fish health and productivity. Growing urbanization, rising seafood consumption, and a shift toward sustainable, high-quality aquafeed are further strengthening market growth in Europe.

U.K. Aquafeed Mycotoxin Binders and Modifiers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR due to increasing emphasis on feed quality, traceability, and aquaculture sustainability. Rising concerns about contamination, disease outbreaks, and productivity losses are encouraging fish farmers to adopt efficient mycotoxin mitigation solutions. The U.K.’s expanding aquaculture industry—particularly in salmon and trout farming—is driving continual demand for biological modifiers and high-efficiency binders. Moreover, the country’s strong research ecosystem and advanced feed manufacturing capabilities support the adoption of modern, science-driven toxin-control products across the aquafeed supply chain.

Germany Aquafeed Mycotoxin Binders and Modifiers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of feed safety, quality assurance, and sustainable aquaculture practices. Germany’s well-established infrastructure and strong focus on innovation promote the adoption of environmentally safe, high-performance mycotoxin mitigation products. Producers are increasingly favoring enzymatic and biological modifiers due to their effectiveness against multiple mycotoxins without impacting nutrient availability. The country’s emphasis on precision farming and advanced feed technologies aligns with the rising demand for premium aquafeed additives in both freshwater and marine aquaculture.

Asia-Pacific Aquafeed Mycotoxin Binders and Modifiers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rapid aquaculture expansion, rising disposable incomes, and technological advancements in China, India, Vietnam, Indonesia, and Japan. APAC accounts for the majority of global aquaculture output, making feed safety a critical priority. Government-backed initiatives promoting modern aquaculture systems and improved feed quality are accelerating market adoption. Additionally, APAC’s role as a global manufacturing hub for feed additives and raw materials enhances product affordability and accessibility, broadening demand for binders and modifiers across both small-scale and large-scale aquaculture farms.

Japan Aquafeed Mycotoxin Binders and Modifiers Market Insight

The Japan market is gaining momentum due to the country’s high-tech farming culture, strong focus on food safety, and demand for premium seafood products. Japanese aquaculture producers prioritize high-quality feed and advanced toxin-control measures to maintain strict standards for fish health and product quality. Integration of binders and modifiers with advanced feeding systems and IoT-based farm management tools is increasing nationwide. Additionally, Japan’s aging workforce is driving demand for automated and easy-to-manage aquaculture solutions, further supporting the adoption of efficient, low-maintenance mycotoxin mitigation products.

China Aquafeed Mycotoxin Binders and Modifiers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, driven by its massive aquaculture production capacity, expanding middle class, and rapid adoption of modern feed technologies. As one of the world’s largest aquafeed producers, China faces significant challenges related to mycotoxin contamination due to climatic conditions and heavy reliance on plant-based ingredients. This has accelerated demand for reliable binders and advanced modifiers across fish, shrimp, and specialty species. Strong domestic manufacturing, large-scale feed mills, and government support for safer and more efficient aquaculture practices continue to propel China’s market growth.

Global Aquafeed Mycotoxin Binders and Modifiers Market Share

The Aquafeed Mycotoxin Binders and Modifiers industry is primarily led by well-established companies, including:

• Biomin (Austria)

• Alltech (U.S.)

• Kemin Industries (U.S.)

• Adisseo (France)

• Cargill (U.S.)

• DSM (Netherlands)

• Novus International (U.S.)

• Nutreco (Netherlands)

• Evonik Industries (Germany)

• Chr. Hansen (Denmark)

• BASF (Germany)

• Prozoo (U.K.)

• Valagro (Italy)

• Novozymes (Denmark)

• Westland Feed Products (U.K.)

• Fermenta Biotech (India)

• Puratos Group (Belgium)

• Golden Grain Group (China)

• Biotech Feed Solutions (China)

• FeedWorks (Australia)

What are the Recent Developments in Global Aquafeed Mycotoxin Binders and Modifiers Market?

- In April 2024, Biomin (a DSM–Firmenich company), a global leader in mycotoxin risk management, expanded its Mycofix® production capacity in Southeast Asia to meet rising regional demand for advanced mycotoxin mitigation solutions. This strategic expansion aims to enhance supply chain efficiency and ensure timely availability of high-performance binders and modifiers for rapidly growing aquaculture markets. By leveraging its global R&D capabilities and regional manufacturing presence, Biomin is strengthening its position in the expanding Global Aquafeed Mycotoxin Binders and Modifiers Market.

- In March 2024, Alltech launched a next-generation enzymatic mycotoxin modifier designed specifically for high-value aquaculture species, including shrimp and salmon. The product enhances biotransformation efficiency for multiple mycotoxins, particularly DON and fumonisins. This innovation underscores Alltech’s ongoing commitment to delivering science-driven, precision nutrition solutions that address evolving feed contamination challenges in modern aquaculture systems.

- In March 2024, Kemin Industries introduced a new mycotoxin surveillance initiative in India, integrating rapid detection technologies with customized binder recommendations for aquafeed producers. This initiative supports safer and more resilient aquaculture operations by helping farmers identify contamination hotspots and implement targeted mitigation strategies. It highlights Kemin’s growing emphasis on supporting feed safety in emerging Asian aquaculture markets.

- In February 2024, Adisseo partnered with leading feed manufacturers in Latin America to launch a regional mycotoxin management platform, offering digital assessments, laboratory analysis, and tailored application of binder-modifier combinations. The collaboration aims to streamline toxin-control practices for aquaculture producers and improve feed quality consistency across the supply chain.

- In January 2024, Cargill unveiled an upgraded range of clay-based and biological mycotoxin solutions for aquafeed at a major international aquaculture conference, focusing on multi-toxin protection and improved nutrient retention. The launch reaffirms Cargill’s commitment to advancing feed safety technologies and supporting sustainable aquaculture production through innovative, research-backed additives.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.