Global Aquafeed Preservatives Market

Market Size in USD Billion

CAGR :

%

USD

1.66 Billion

USD

2.31 Billion

2024

2032

USD

1.66 Billion

USD

2.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.66 Billion | |

| USD 2.31 Billion | |

|

|

|

|

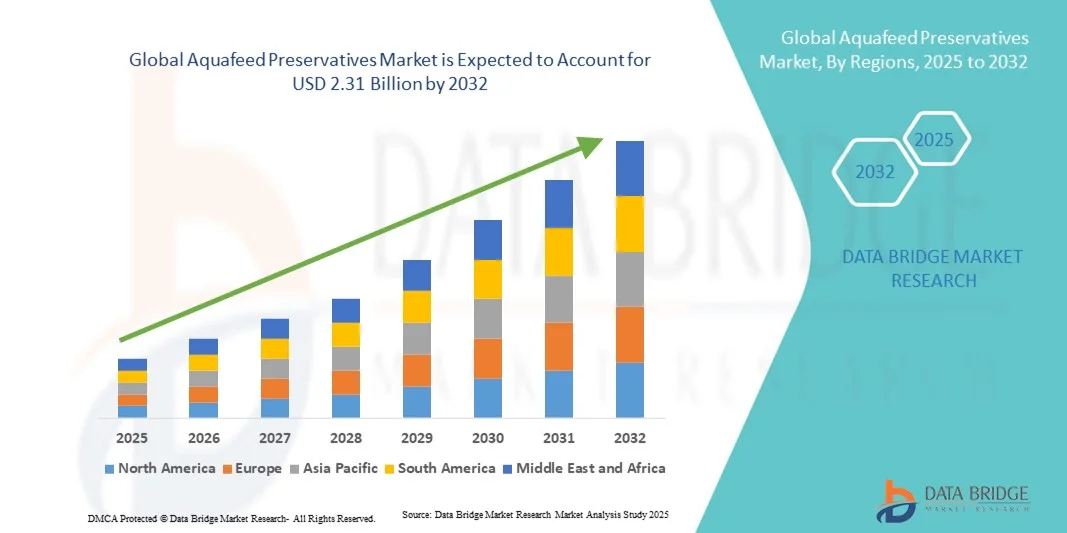

What is the Global Aquafeed Preservatives Market Size and Growth Rate?

- The global aquafeed preservatives market size was valued at USD 1.66 billion in 2024 and is expected to reach USD 2.31 billion by 2032, at a CAGR of 9.10% during the forecast period

- The high demand for natural preservatives is estimated to grow in the aquafeed preservatives market, as animal welfare is an everyday worry for fish farmers, which in turn is boosting the growth of the aquafeed preservatives market

- In addition, the growing acceptance of aquafeed containing prebiotics, essential oils and palatants, natural extracts and feed acidifiers is projected to boost the market growth in the forecast period. Increasing preference for plant-based preservatives, increase in seafood trade, growth in the aquaculture industry, benefits associated with feed acidifiers, better protein digestibility, healthier immune response, increased resource competence in aquaculture and growing demand for exotic and protein are some of the key determinants that will accelerate the growth of the market

What are the Major Takeaways of Aquafeed Preservatives Market?

- Rising government initiatives and improvement of innovative products as a source of protein will accelerate various new growth opportunities for the aquafeed preservatives market in the above-mentioned forecast period. Also, the growing awareness among the manufacturers regarding the preservatives is also boosting the market

- In addition, several factors counting growing population, rapid industrialization and urbanization across the world have enhanced the number of investors to invest the aquafeed preservatives market, which in turn is also fueling the growth of the aquafeed preservatives market

- North America dominated the aquafeed preservatives market with the largest revenue share of 36.2% in 2024, driven by the strong presence of leading aquaculture feed manufacturers, increasing focus on feed quality, and rising demand for safe, long-lasting feed solutions

- The Asia-Pacific aquafeed preservatives market is projected to record the fastest CAGR of 11.68% from 2025 to 2032, driven by rapid aquaculture expansion in countries such as China, India, Vietnam, and Indonesia

- The Feed Acidifiers segment dominated the market in 2024 with the largest revenue share of 38.6%, owing to their ability to control microbial growth, improve gut health, and enhance feed efficiency

Report Scope and Aquafeed Preservatives Market Segmentation

|

Attributes |

Aquafeed Preservatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aquafeed Preservatives Market?

Shift Toward Natural and Sustainable Preservation Solutions

- A major trend shaping the global aquafeed preservatives market is the increasing shift toward natural, eco-friendly, and sustainable preservation ingredients to ensure feed safety without compromising aquatic health or environmental balance. The growing demand for clean-label aquaculture products is driving this transition

- Manufacturers are replacing synthetic preservatives such as ethoxyquin with natural alternatives such as organic acids, tocopherols, and plant-based antioxidants, which maintain feed freshness while aligning with regulatory and consumer expectations

- For instance, Kemin Industries, Inc. (U.S.) launched natural antioxidant blends designed to enhance the shelf life of aquafeed while minimizing oxidative damage

- This movement reflects the aquaculture industry’s broader goal to balance feed efficiency, fish welfare, and environmental responsibility, ensuring compliance with evolving global sustainability standards and meeting the preferences of health-conscious consumers

What are the Key Drivers of Aquafeed Preservatives Market?

- The rising global demand for high-quality aquaculture products, coupled with increasing concerns about feed spoilage and nutrient degradation, is a key driver for the Aquafeed Preservatives market. Preservatives play a crucial role in maintaining feed stability during storage and transportation in humid environments

- For instance, in May 2024, BASF SE (Germany) expanded its feed additives portfolio with enhanced acidifier-based preservative systems to improve feed hygiene and microbial control

- Furthermore, the growing focus on feed cost optimization and minimizing waste in aquaculture operations drives the adoption of efficient preservative solutions. As fish and shrimp farming intensifies globally, maintaining feed freshness becomes vital for profitability

- The rising awareness of sustainable aquaculture practices and regulatory mandates on feed safety are further fueling product innovation. Companies are developing multi-functional preservatives that provide both antimicrobial protection and antioxidant properties, ensuring feed quality throughout the production cycle

Which Factor is Challenging the Growth of the Aquafeed Preservatives Market?

- One of the major challenges hindering market growth is the stringent regulatory environment governing the use of chemical preservatives in aquafeed formulations. Authorities in regions such as Europe and North America have imposed tight restrictions on synthetic additives due to concerns over fish health and environmental contamination

- For instance, regulatory scrutiny on compounds such as BHA, BHT, and ethoxyquin has led several manufacturers to reformulate their products or seek natural alternatives, increasing production costs

- Moreover, fluctuating prices of raw materials used in natural preservatives—such as organic acids and plant extracts—pose economic challenges for producers. Smaller feed mills often struggle to balance cost-efficiency with compliance

- Addressing these concerns through innovative preservation technologies, increased use of blended antioxidant systems, and enhanced collaboration between feed manufacturers and regulatory bodies will be critical for sustaining long-term growth in the aquafeed preservatives market

How is the Aquafeed Preservatives Market Segmented?

The market is segmented on the basis of ingredient, preservatives type, species, and source.

- By Ingredient

On the basis of ingredient, the aquafeed preservatives market is segmented into Anti-Parasitic, Feed Acidifiers, Prebiotics, Essential Oils and Natural Extracts, Palatants, and Others. The Feed Acidifiers segment dominated the market in 2024 with the largest revenue share of 38.6%, owing to their ability to control microbial growth, improve gut health, and enhance feed efficiency. These acidifiers extend feed shelf life by maintaining optimal pH levels, thereby preventing spoilage and ensuring nutrient stability.

The Essential Oils and Natural Extracts segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for natural, residue-free preservatives aligned with sustainable aquaculture practices. Their antimicrobial and antioxidant properties make them ideal for replacing synthetic additives.

- By Preservatives Type

On the basis of preservatives type, the aquafeed preservatives market is segmented into Amino Acids, Vitamins and Minerals, Probiotics and Prebiotics, Enzymes, Antibiotics, Antioxidants, and Others. The Antioxidants segment held the dominant market share of 41.2% in 2024, primarily due to their role in preventing lipid oxidation, preserving nutritional quality, and extending feed stability during storage and transport. Synthetic and natural antioxidants such as BHT, BHA, and tocopherols are widely used to reduce rancidity in high-fat aquafeeds.

The Probiotics and Prebiotics segment is anticipated to record the fastest CAGR from 2025 to 2032, as producers increasingly adopt biological preservation solutions to promote gut health and enhance feed efficiency. These natural alternatives align with growing consumer preference for antibiotic-free aquaculture products.

- By Species

On the basis of species, the aquafeed preservatives market is segmented into Fish, Crustaceans, Mollusks, and Others. The Fish segment dominated the market in 2024 with the largest revenue share of 56.4%, attributed to the vast scale of fish farming across Asia-Pacific and Europe, where feed preservation is critical to maintaining quality in humid storage conditions. Preservatives enhance the nutritional integrity of fish feed while minimizing mold and bacterial contamination.

The Crustaceans segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding shrimp and prawn farming industry, particularly in countries such as India, Thailand, and Vietnam. The high protein and fat content in crustacean feed necessitates advanced preservation solutions for longer shelf life.

- By Source

On the basis of source, the aquafeed preservatives market is segmented into Plants, Animals, and Microorganisms. The Plants segment accounted for the largest market share of 47.8% in 2024, owing to the rising preference for natural, eco-friendly, and non-toxic feed preservatives derived from herbs, spices, and essential oils. Plant-based compounds such as rosemary extract, oregano oil, and green tea polyphenols offer strong antioxidant and antimicrobial properties that maintain feed quality and safety.

The Microorganism segment is projected to register the fastest CAGR from 2025 to 2032, supported by the growing utilization of microbial-derived enzymes and organic acids that naturally enhance feed preservation. These bio-based solutions align with sustainability goals and reduce dependency on chemical additives.

Which Region Holds the Largest Share of the Aquafeed Preservatives Market?

- North America dominated the aquafeed preservatives market with the largest revenue share of 36.2% in 2024, driven by the strong presence of leading aquaculture feed manufacturers, increasing focus on feed quality, and rising demand for safe, long-lasting feed solutions. The region’s emphasis on sustainability and advanced feed technologies has further accelerated the adoption of preservative-based formulations to reduce waste and improve fish health

- Growing consumer preference for high-protein seafood and strict regulatory standards for aquaculture feed safety have boosted the integration of antioxidants, acidifiers, and natural preservatives across feed formulations

- This growth is also supported by technological innovation, R&D investments, and collaborations between feed producers and biotechnology companies, solidifying North America’s leadership in adopting advanced aquafeed preservation solutions for both freshwater and marine species

U.S. Aquafeed Preservatives Market Insight

The U.S. aquafeed preservatives market held the largest revenue share of 72% in 2024 within North America, primarily driven by the country’s well-developed aquaculture industry and rising seafood consumption. Increasing awareness regarding feed hygiene, coupled with the need to prevent microbial spoilage and oxidation, has led feed manufacturers to integrate chemical and biological preservatives. Moreover, major feed producers are investing in natural alternatives and organic preservatives to meet stringent U.S. FDA and EPA regulations on feed safety. The growing trend toward sustainable aquaculture practices and the use of plant-based feed additives also support long-term market expansion in the country.

Europe Aquafeed Preservatives Market Insight

The Europe aquafeed preservatives market is projected to expand steadily during the forecast period, supported by strict food safety standards and the region’s increasing focus on sustainable aquaculture. Feed manufacturers in Europe are emphasizing natural antioxidants, acidifiers, and organic acids to comply with regulatory norms and consumer demand for clean-label products. Countries such as Norway, Denmark, and Spain are witnessing rising adoption of eco-friendly preservation methods to extend feed shelf life and maintain nutrient stability under humid conditions. The region’s strong aquaculture infrastructure and continuous innovation in feed formulation are driving consistent demand for preservatives in both fish and crustacean feeds.

U.K. Aquafeed Preservatives Market Insight

The U.K. aquafeed preservatives market is expected to grow at a noteworthy CAGR during 2025–2032, driven by the expansion of aquaculture production and demand for high-quality feed ingredients. The U.K.’s commitment to environmental sustainability and reduction of chemical residues in feed is promoting the use of natural preservatives, particularly those derived from essential oils and plant extracts. In addition, growing investments in RAS (Recirculating Aquaculture Systems) and sustainable fish farming practices are encouraging the development of longer-lasting and nutrient-stable feed solutions, contributing to steady market growth.

Germany Aquafeed Preservatives Market Insight

The Germany aquafeed preservatives market is anticipated to register a considerable CAGR throughout the forecast period, supported by the country’s advanced biotechnology sector and preference for eco-conscious aquaculture operations. German feed producers are increasingly adopting antioxidants and microbial inhibitors to preserve feed quality and prevent fungal contamination during long storage periods. Strong government emphasis on sustainable food production and research investments in alternative protein sources further drive demand for effective, natural preservation techniques. The growing focus on reducing synthetic chemical usage aligns with Germany’s push toward greener aquaculture practices.

Which Region is the Fastest Growing Region in the Aquafeed Preservatives Market?

The Asia-Pacific aquafeed preservatives market is projected to record the fastest CAGR of 11.68% from 2025 to 2032, driven by rapid aquaculture expansion in countries such as China, India, Vietnam, and Indonesia. The region’s growing fish farming industry, coupled with rising seafood exports, is creating strong demand for feed preservatives that ensure product stability, nutrient retention, and extended shelf life. The push toward sustainable aquaculture practices and growing awareness about feed safety are also fueling adoption of both synthetic and natural preservatives. Moreover, government support for feed technology innovation and increased R&D in microbial and plant-derived preservation methods are expected to accelerate regional market growth.

Japan Aquafeed Preservatives Market Insight

The Japan aquafeed preservatives market is gaining momentum due to its technologically advanced aquaculture infrastructure and focus on feed efficiency. The use of antioxidants, amino acids, and probiotics in feed is becoming increasingly prevalent to maintain freshness and nutritional quality. In addition, Japan’s aging aquaculture workforce is adopting automated systems with preservative-infused feeds that require less manual monitoring, supporting industry modernization and steady growth.

China Aquafeed Preservatives Market Insight

The China aquafeed preservatives market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the nation’s expanding aquaculture base and government efforts to improve feed standards. High seafood demand and the presence of major feed manufacturers have led to increased usage of acidifiers, antioxidants, and enzymes to prevent spoilage and enhance productivity. Moreover, domestic companies are focusing on cost-effective, plant-based preservatives to meet export standards and reduce dependency on synthetic chemicals, positioning China as a major hub for preservative-enhanced aquafeed production in the global market.

Which are the Top Companies in Aquafeed Preservatives Market?

The aquafeed preservatives industry is primarily led by well-established companies, including:

- ADM (U.S.)

- BASF SE (Germany)

- Roquette Frères (France)

- Kemin Industries, Inc. (U.S.)

- Cargill Incorporated (U.S.)

- Thai Union Group (Thailand)

- Biomin (Austria)

- Growel Feeds (India)

- Aller Aqua Group (Denmark)

- Adisseo (France)

- DuPont (U.S.)

- Bentoli (U.S.)

- Delacon Biotechnik GmbH (Austria)

- Diana Group (France)

- MJI Universal Pte Ltd (Singapore)

- Alltech (U.S.)

- Norel Animal Nutrition (Spain)

- Biorigin (Brazil)

- Calanus AS (Norway)

- Lallemand, Inc. (Canada)

What are the Recent Developments in Global Aquafeed Preservatives Market?

- In March 2025, the International Fishmeal and Fish Oil Organisation (IFFO) reported a 29% year-on-year increase in global fish-meal production and a 34% rise in fish-oil output, primarily driven by Peru’s strong recovery in fishing activities. This surge highlights the sector’s resilience and reflects growing demand for sustainable aquafeed ingredients across global markets

- In October 2024, Cellana completed the acquisition of PhytoSmart, integrating algae-based nutritional supplements with large-scale aquafeed production. This strategic move strengthens Cellana’s position in the algae-derived protein market and supports its goal of advancing sustainable feed solutions worldwide

- In September 2024, Cargill expanded its Animal Nutrition and Health division by acquiring two U.S.-based feed mills from Compana Pet Brands. This acquisition enhances Cargill’s production capacity, strengthens supply chain efficiency, and reinforces its footprint in the North American animal nutrition market

- In April 2024, Pelagia announced the acquisition of U.K. seafood trader Ideal Foods, aiming to strengthen its fish meal and fish oil supply chain. The move enhances Pelagia’s global sourcing network and underlines its commitment to ensuring sustainable and reliable ingredient availability for aquaculture industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.