Global Aquafeed Testing Market

Market Size in USD Billion

CAGR :

%

USD

3.04 Billion

USD

4.70 Billion

2024

2032

USD

3.04 Billion

USD

4.70 Billion

2024

2032

| 2025 –2032 | |

| USD 3.04 Billion | |

| USD 4.70 Billion | |

|

|

|

|

Global Aquafeed Testing Market Size

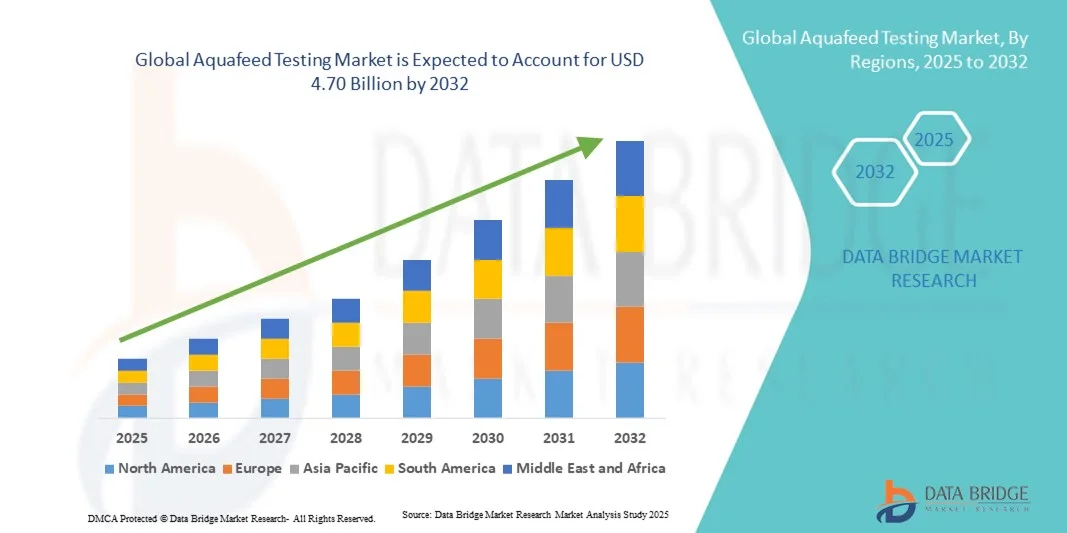

- The global Aquafeed Testing Market size was valued at USD 3.04 billion in 2024 and is expected to reach USD 4.70 billion by 2032, at a CAGR of 5.60% during the forecast period.

- The market growth is largely driven by the rising demand for high-quality and safe aquaculture feed, coupled with increasing regulatory compliance and quality standards across the aquaculture industry.

- Furthermore, growing awareness among consumers and producers regarding nutritional content, contaminant detection, and sustainable feed practices is propelling the adoption of advanced aquafeed testing solutions, thereby significantly enhancing the market’s growth.

Global Aquafeed Testing Market Analysis

- Aquafeed testing, involving the analysis of nutritional composition, contaminants, and additives in aquaculture feed, is becoming increasingly crucial for ensuring feed quality, regulatory compliance, and sustainable aquaculture practices in both commercial and industrial settings due to its role in improving fish health, growth performance, and food safety.

- The rising demand for aquafeed testing is primarily driven by increasing aquaculture production, stringent food safety regulations, and growing awareness among producers about feed quality and environmental sustainability.

- Asia-Pacific dominated the Global Aquafeed Testing Market with the largest revenue share of 35.6% in 2024, supported by advanced aquaculture infrastructure, high adoption of modern feed testing technologies, and a strong presence of key market players, with the U.S. witnessing significant growth in testing services and adoption of automated and rapid testing solutions by both large-scale and boutique aquaculture operations.

- North America is expected to be the fastest-growing region in the Global Aquafeed Testing Market during the forecast period due to rapid expansion of aquaculture activities, increasing seafood consumption, and rising investment in feed quality and safety measures.

- The fishmeal segment dominated the market with a revenue share of 38.5% in 2024, owing to its high protein content and widespread use in aquaculture feed formulations.

Report Scope and Global Aquafeed Testing Market Segmentation

|

Attributes |

Aquafeed Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Aquafeed Testing Market Trends

Enhanced Efficiency Through AI and Advanced Analytical Integration

- A significant and accelerating trend in the global Aquafeed Testing Market is the deepening integration of artificial intelligence (AI) and advanced analytical technologies into testing processes. This integration is significantly enhancing efficiency, accuracy, and predictive capabilities in feed quality assessment.

- For instance, some leading laboratories now utilize AI-powered spectral analysis and machine learning models to detect nutrient imbalances, contaminants, or adulterants in aquafeed with higher precision and in less time compared to traditional methods. Similarly, predictive modeling tools can forecast feed performance and fish growth outcomes based on compositional data, optimizing feed formulations.

- AI integration in aquafeed testing enables features such as pattern recognition in contaminant occurrence, predictive quality control, and automated anomaly detection. For example, Neogen and SGS utilize AI algorithms to improve pathogen detection accuracy and provide real-time alerts if feed quality parameters fall outside acceptable ranges.

- The seamless integration of AI-driven analytics with laboratory information management systems (LIMS) and cloud-based platforms facilitates centralized data management and real-time reporting. Through a single interface, producers and quality control teams can monitor multiple feed batches, track historical performance, and make data-driven decisions for sustainable aquaculture operations.

- This trend towards more intelligent, automated, and interconnected testing systems is fundamentally reshaping expectations for feed quality assurance. Consequently, companies such as Eurofins and Bureau Veritas are developing AI-enabled testing solutions with features like predictive risk assessment, rapid contaminant detection, and automated reporting dashboards.

- The demand for aquafeed testing solutions that offer enhanced AI-driven insights and automated analytical capabilities is growing rapidly across both large-scale and emerging aquaculture operations, as producers increasingly prioritize feed safety, efficiency, and sustainability.

Global Aquafeed Testing Market Dynamics

Driver

Growing Need Due to Rising Regulatory Standards and Feed Safety Awareness

- The increasing focus on food safety, regulatory compliance, and sustainable aquaculture practices is a significant driver for the heightened demand for aquafeed testing solutions.

- For instance, in 2024, Neogen Corporation announced the launch of advanced rapid testing kits designed to detect contaminants and ensure compliance with evolving international feed safety regulations. Such innovations by key companies are expected to drive market growth in the forecast period.

- As aquaculture producers become more aware of potential risks from contaminated or nutritionally imbalanced feed, aquafeed testing provides critical insights into nutritional composition, contaminant presence, and additive verification, offering a compelling improvement over traditional, less rigorous quality checks.

- Furthermore, the growing adoption of modern aquaculture technologies and the push for sustainable and traceable seafood production are making aquafeed testing an integral component of operational best practices, offering seamless integration with feed management and production monitoring systems.

- The ability to monitor feed quality in real time, ensure compliance with regulatory standards, and optimize feed formulations for better growth performance are key factors propelling the adoption of aquafeed testing across commercial and industrial aquaculture sectors. The trend towards automation, rapid testing kits, and user-friendly analytical solutions further contributes to market growth.

Restraint/Challenge

Concerns Regarding High Costs and Limited Awareness in Emerging Markets

- The relatively high cost of advanced aquafeed testing equipment and services poses a significant challenge to broader adoption, particularly among small-scale or emerging aquaculture operations. High-tech solutions such as AI-based analysis, rapid pathogen detection, or comprehensive nutrient profiling require substantial investment, which can be a barrier for price-sensitive producers.

- For instance, some smaller feed manufacturers in Southeast Asia and Africa remain reliant on basic manual testing or outsourced services due to budget constraints, limiting widespread market penetration.

- Addressing these challenges through affordable, scalable testing solutions, mobile testing kits, and flexible service models is crucial for expanding market reach. Companies such as SGS and Eurofins are emphasizing cost-effective and modular testing services to cater to smaller producers while maintaining accuracy and compliance.

- Additionally, limited awareness of the importance of feed testing for fish health, growth efficiency, and food safety can hinder adoption. Educating aquaculture producers about the long-term benefits of regular feed testing, regulatory compliance, and sustainable practices is essential.

- Overcoming these challenges through more accessible solutions, training programs, and strategic collaborations will be vital for sustained growth in the global aquafeed testing market.

Global Aquafeed Testing Market Scope

Aquafeed testing market is segmented on the basis of ingredient, additive, species, testing type, method of analysis, and function.

- By Ingredient

On the basis of ingredient, the Global Aquafeed Testing Market is segmented into soybean, fishmeal, corn, fish oil, additives, and others. The fishmeal segment dominated the market with a revenue share of 38.5% in 2024, owing to its high protein content and widespread use in aquaculture feed formulations. Fishmeal quality is critical for optimal growth and feed efficiency, driving rigorous testing for contaminants, nutrient composition, and heavy metals.

The soybean segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by increasing demand for plant-based proteins and sustainable alternatives to traditional fishmeal. Soybean-based feeds require detailed analysis to ensure amino acid balance, anti-nutritional factor mitigation, and regulatory compliance. The rising adoption of blended protein sources in aquafeed, along with heightened focus on sustainability and cost-efficiency, is further accelerating testing demand in this segment.

- By Additive

On the basis of additive, the market is segmented into amino acids, vitamins and minerals, probiotics and prebiotics, enzymes, antibiotics, antioxidants, and others. The amino acids segment dominated the market with a 34.7% share in 2024, driven by their critical role in supporting fish growth, health, and feed efficiency. Testing for amino acid levels ensures nutritional adequacy, optimal feed formulation, and regulatory compliance.

The probiotics and prebiotics segment is projected to witness the fastest CAGR of 21.2% during 2025–2032, supported by rising awareness of gut health, disease prevention, and improved digestion in aquaculture species. Increasing incorporation of functional additives to enhance immunity, survival rates, and growth performance is further driving the adoption of specialized testing services, particularly in high-value aquaculture operations and regions emphasizing sustainable practices.

- By Species

On the basis of species, the Global Aquafeed Testing Market is segmented into fish, crustaceans, mollusks, and others. The fish segment accounted for the largest market revenue share of 42.5% in 2024, reflecting the dominant global production of finfish and the critical need for feed quality assurance to ensure optimal growth and health. Fish feed testing includes protein, lipid, vitamin content, and contaminant analysis, which are essential for both farmed species and export-quality seafood.

The crustaceans segment is expected to register the fastest CAGR of 20.6% from 2025 to 2032, due to increasing shrimp and prawn aquaculture in Asia-Pacific and Latin America. The complexity of crustacean diets, susceptibility to disease, and high-value returns on investment drive stringent feed quality monitoring in this segment.

- By Function

On the basis of function, the market is segmented into health, digestion, palatability, and special nutrition. The health segment dominated the market with a 36.9% revenue share in 2024, driven by the increasing need for disease prevention, immune system support, and mortality reduction in aquaculture species. Feed testing ensures that health-promoting components such as vitamins, minerals, and bioactive compounds meet required standards.

The digestion segment is expected to witness the fastest CAGR of 19.9% during 2025–2032, fueled by the incorporation of enzymes, probiotics, and prebiotics in feeds to optimize nutrient absorption and reduce waste. Rising focus on feed efficiency, environmental sustainability, and growth performance is boosting demand for functional testing solutions across these specialized segments.

- By Testing Type

On the basis of testing type, the market is segmented into preliminary inspection, sampling, and others. The preliminary inspection segment dominated the market with a share of 41.2% in 2024, as initial quality assessment is crucial to detect visible contaminants, improper composition, or storage issues before comprehensive testing. Preliminary inspections help reduce operational risks and ensure regulatory compliance at an early stage.

The sampling segment is expected to register the fastest CAGR of 20.3% from 2025 to 2032, supported by the increasing adoption of statistically robust sampling methods and automation in feed testing workflows. Accurate sampling is essential for representative testing, particularly in large-scale feed production and commercial aquaculture operations.

- By Method of Analysis

On the basis of method of analysis, the market is segmented into moisture, crude protein (Kjeldahl method), crude fat, crude fibre, ash, sodium chloride, molasses analysis, anti-metabolite, and toxins in feeds. The crude protein analysis segment dominated the market with 39.6% revenue share in 2024, due to its importance in assessing feed nutritional quality and ensuring optimal growth rates.

The toxins analysis segment is expected to witness the fastest CAGR of 21.5% during 2025–2032, driven by rising regulatory standards for contaminants such as heavy metals, mycotoxins, and anti-nutritional factors in aquafeed. The increasing focus on food safety, traceability, and consumer health, particularly in export-oriented markets, is fueling the adoption of advanced analytical techniques, including rapid testing kits, chromatography, and spectroscopy-based methods.

Global Aquafeed Testing Market Regional Analysis

- Asia-Pacific dominated the Global Aquafeed Testing Market with the largest revenue share of 35.6% in 2024, driven by the region’s well-established aquaculture industry, stringent feed safety regulations, and high adoption of advanced analytical technologies.

- Producers and feed manufacturers in the region prioritize rigorous testing to ensure compliance with FDA, USDA, and international quality standards, as well as to optimize feed formulations for growth performance and sustainability.

- The widespread adoption is further supported by high investment in research and development, the presence of leading aquafeed testing service providers, and a technologically advanced infrastructure for laboratory analysis. These factors collectively make North America a hub for innovation in feed quality assurance, helping both commercial and industrial aquaculture operations meet regulatory requirements, improve operational efficiency, and produce high-quality seafood for domestic and global markets.

U.S. Aquafeed Testing Market Insight

The U.S. aquafeed testing market captured the largest revenue share of 81% in North America in 2024, driven by the country’s well-established aquaculture industry, stringent regulatory framework, and advanced feed quality monitoring practices. Producers increasingly prioritize comprehensive testing for nutrient composition, contaminants, and additives to ensure compliance with FDA and international standards. The growing adoption of automated laboratory technologies, high investment in research and development, and focus on sustainable aquaculture practices further propel the market. Moreover, the U.S. emphasis on high-value seafood exports necessitates robust testing protocols, making the nation a key hub for advanced aquafeed analysis.

Europe Aquafeed Testing Market Insight

The Europe aquafeed testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict EU regulations on feed safety, contaminants, and labeling standards. The increasing adoption of sustainable aquaculture practices, coupled with growing consumer demand for traceable, high-quality seafood, is fostering the uptake of advanced testing solutions. European producers are integrating sophisticated analytical techniques for nutrient profiling, toxin detection, and additive validation. The market growth spans commercial, industrial, and government aquaculture operations, reflecting a strong focus on compliance, quality assurance, and food safety.

U.K. Aquafeed Testing Market Insight

The U.K. aquafeed testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for high-quality, safe aquafeed and increased awareness of feed-related risks. Stringent food safety standards, coupled with the country’s strong aquaculture sector and focus on export-quality seafood, drive testing requirements. The adoption of innovative testing methods, including rapid analytical kits and automated laboratory instruments, is accelerating market growth. Additionally, the U.K.’s well-developed infrastructure for feed production and research supports the expansion of specialized aquafeed testing services across both commercial and residential aquaculture operations.

Germany Aquafeed Testing Market Insight

The Germany aquafeed testing market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s advanced aquaculture sector and strict compliance standards for feed safety and quality. Producers emphasize testing for protein, lipid, vitamin content, and contaminants to ensure regulatory adherence and product excellence. Germany’s focus on innovation, sustainability, and environmentally conscious aquaculture practices promotes the adoption of state-of-the-art analytical technologies. Integration of automated laboratories and advanced monitoring tools is increasingly prevalent, particularly in commercial and industrial aquaculture facilities.

Asia-Pacific Aquafeed Testing Market Insight

The Asia-Pacific aquafeed testing market is poised to grow at the fastest CAGR of 24% during 2025–2032, driven by rapid aquaculture expansion, urbanization, and rising disposable incomes in countries such as China, Japan, and India. The region’s growing demand for high-quality seafood, coupled with government initiatives to ensure feed safety and sustainable practices, is driving the adoption of advanced testing services. APAC is also emerging as a manufacturing hub for feed and analytical instruments, making testing solutions more accessible and affordable. Rising awareness about contaminants, nutritional profiling, and feed optimization is fueling the demand for aquafeed testing across commercial and industrial segments.

Japan Aquafeed Testing Market Insight

The Japan aquafeed testing market is gaining momentum due to the country’s technologically advanced aquaculture sector and strong focus on food safety and quality. Japanese producers prioritize rigorous testing to ensure optimal nutrient composition, minimize contaminants, and support sustainable practices. The integration of automated analytical tools and high-precision testing methods is fueling growth, particularly in high-value seafood production. Additionally, Japan’s aging population and demand for premium, traceable seafood are encouraging investments in feed quality monitoring solutions for both residential and commercial aquaculture operations.

China Aquafeed Testing Market Insight

The China aquafeed testing market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding aquaculture sector, growing middle class, and increasing regulatory focus on feed safety. The demand for high-quality, contaminant-free feed is rising across commercial farms and export-oriented operations. Government initiatives promoting sustainable aquaculture practices and smart feed monitoring systems are key growth drivers. Furthermore, the presence of domestic testing service providers and affordable analytical solutions is accelerating adoption, enabling producers to meet both domestic and international quality standards efficiently.

Global Aquafeed Testing Market Share

The Aquafeed Testing industry is primarily led by well-established companies, including:

• SGS (Switzerland)

• Eurofins Scientific (Luxembourg)

• Bureau Veritas (France)

• Intertek Group (U.K.)

• ALS Limited (Australia)

• TUV SUD (Germany)

• Merieux NutriSciences (France)

• NSF International (U.S.)

• Certis Analytical (U.S.)

• Covance Food Solutions (U.S.)

• Pace Analytical (U.S.)

• Neogen Corporation (U.S.)

• Evonik Industries (Germany)

• Romer Labs (Austria)

• Cargill (U.S.)

• DSM Nutritional Products (Netherlands)

• Eurofins AquaScience (Germany)

• Biomin Holding (Austria)

• Addcon (Germany)

• Novus International (U.S.)

What are the Recent Developments in Global Aquafeed Testing Market?

- In April 2023, Eurofins Scientific, a global leader in food and feed testing, launched a strategic initiative in South Africa to expand its aquafeed testing services. The initiative focuses on enhancing feed quality and safety for both commercial and industrial aquaculture operations, underscoring Eurofins’ commitment to delivering reliable, accurate, and region-specific testing solutions. By leveraging its global expertise and advanced analytical technologies, Eurofins is addressing local industry challenges while strengthening its position in the rapidly growing global aquafeed testing market.

- In March 2023, Mérieux NutriSciences, a prominent global feed testing provider, introduced an advanced nutrient profiling and contaminant detection service tailored for high-density aquaculture farms. The new solution enables precise analysis of proteins, fats, vitamins, and additives, ensuring feed compliance with safety regulations. This development highlights Mérieux NutriSciences’ dedication to improving feed quality, optimizing aquaculture nutrition, and supporting sustainable farming practices.

- In March 2023, Intertek Group plc successfully implemented a large-scale feed safety monitoring project across multiple aquaculture facilities in Bengaluru, India. The project utilized advanced testing methodologies to detect contaminants, toxins, and anti-nutritional factors in feed, enhancing the safety and reliability of local aquaculture products. The initiative underscores Intertek’s focus on leveraging innovative testing technologies to strengthen regulatory compliance and ensure high-quality aquafeed production.

- In February 2023, NSF International, a leading global certification and testing organization, partnered with major aquaculture associations in the Chesapeake Bay region to create a standardized aquafeed testing framework. This collaboration aims to improve feed safety, optimize nutritional content, and provide consistent quality assurance for commercial aquaculture operations. The initiative reflects NSF International’s commitment to driving innovation, transparency, and operational excellence in the aquafeed industry.

- In January 2023, SGS SA, a global leader in inspection, verification, testing, and certification, launched its new aquafeed analytical service, “SGS FeedPro Advanced,” at a leading international aquaculture conference. The service provides comprehensive testing for moisture, protein, fat, vitamins, minerals, and potential contaminants, enabling aquaculture producers to optimize feed formulations and ensure compliance with international standards. This initiative demonstrates SGS’s dedication to integrating cutting-edge analytical technologies into the aquafeed sector, enhancing feed safety, quality, and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.