Global Aquatic Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

62.77 Billion

USD

106.25 Billion

2025

2033

USD

62.77 Billion

USD

106.25 Billion

2025

2033

| 2026 –2033 | |

| USD 62.77 Billion | |

| USD 106.25 Billion | |

|

|

|

|

Aquatic Food Ingredients Market Size

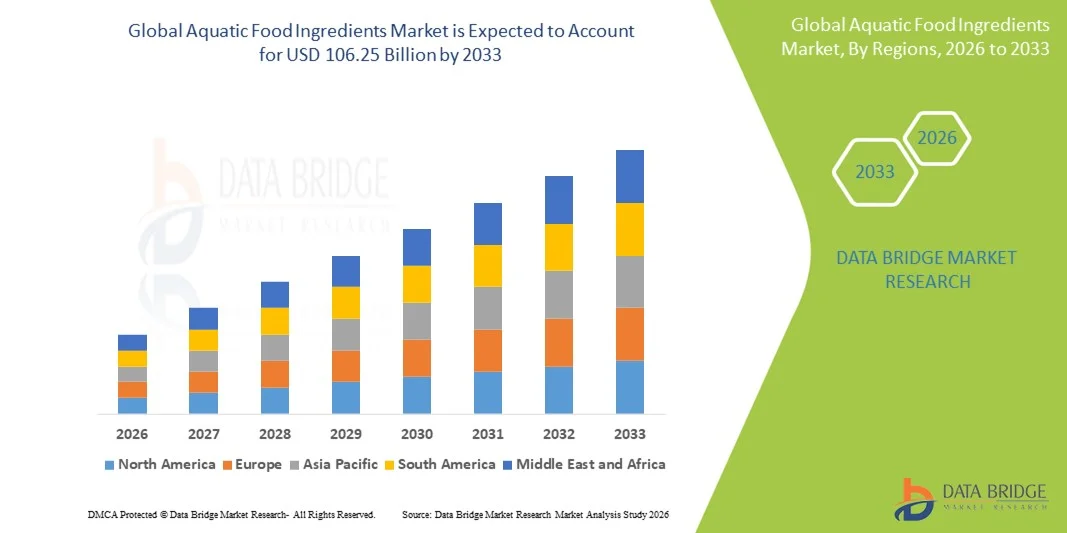

- The global aquatic food ingredients market size was valued at USD 62.77 billion in 2025 and is expected to reach USD 106.25 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by the rising demand for protein-rich and nutrient-dense food products

- Increasing adoption of functional ingredients sourced from marine ecosystems such as algae, fish oils, and seaweed

Aquatic Food Ingredients Market Analysis

- The global aquatic food ingredients market is expanding steadily due to the rising emphasis on health, wellness, and natural nutrition solutions

- Increasing research and innovation in marine biotechnology is boosting the development of high-value ingredients such as omega-3 concentrates, bioactive peptides, and algal extracts

- North America dominated the aquatic food ingredients market with the largest revenue share in 2025, driven by rising demand for nutrient-rich foods, growing consumption of marine-based supplements, and expanding applications of aquatic-derived proteins and omega-3 ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global aquatic food ingredients market, driven by large-scale aquaculture production, rising seafood consumption, and growing investments in marine ingredient processing technologies

- The dry form segment accounted for the largest market revenue share in 2025 due to its longer shelf life, ease of storage, and superior stability during transportation. Dry aquatic feeds are widely used in commercial aquaculture systems as they offer consistent nutrient delivery and better handling efficiency across various species

Report Scope and Aquatic Food Ingredients Market Segmentation

|

Attributes |

Aquatic Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Alltech (U.S.) • BENEO (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aquatic Food Ingredients Market Trends

Rise of Sustainable and Nutrient-Dense Marine Ingredient Utilization

- The increasing shift toward sustainable and nutrient-rich marine ingredients is transforming the aquatic food ingredients landscape as consumers and manufacturers focus on high-quality, traceable, and eco-friendly nutrition sources. Ingredients derived from algae, fish proteins, and marine plants are gaining strong traction due to their superior amino acid profiles, omega-rich content, and natural bioactive compounds, supporting rising demand across food and nutraceutical applications

- Growing interest in clean-label and minimally processed products is accelerating the adoption of aquatic-based ingredients that require fewer synthetic additives. Marine ingredients such as seaweed extracts, collagen, and fish peptides align with consumer preferences for natural functionality, driving their expanding use across beverages, sports nutrition, and fortified foods

- The rising popularity of plant-based seafood alternatives is further boosting the incorporation of marine-derived flavors, hydrocolloids, and texturizing agents. These ingredients enhance taste, structure, and nutritional value, supporting innovation in seafood analogues and sustainable protein development

- For instance, by late 2023, several European food manufacturers reported increased utilization of algae-based omega-3 concentrates in functional snacks and ready meals due to growing demand for natural nutrient fortification. This helped expand product availability across retail and online platforms

- While the trend is supported by strong consumer interest and industry innovation, long-term growth will require enhanced supply chain stability, sustainable harvesting practices, and continuous technological advancements in marine ingredient processing to meet rising global demand

Aquatic Food Ingredients Market Dynamics

Driver

Increasing Demand for High-Quality Marine Proteins and Functional Ingredients

- The global shift toward healthier, protein-rich diets is significantly boosting demand for aquatic food ingredients, driven by rising awareness of their superior nutritional value and bioactive properties. Marine proteins, peptides, and omega-3-rich extracts are becoming essential components in functional foods, sports nutrition, and dietary supplements

- Consumers increasingly recognize the benefits of marine-derived ingredients for heart health, cognitive function, and immunity enhancement, prompting greater integration across mainstream food categories. This dynamic is supported by the growing preference for nutrient-dense and naturally sourced ingredients

- Government-led nutrition initiatives and sustainability campaigns are encouraging adoption of responsibly sourced marine products. This has expanded the presence of aquatic ingredients in retail and food-service channels as brands tap into evolving health and sustainability trends

- For instance, in 2024, several North American food companies increased the incorporation of seaweed-based fibers and marine collagen in wellness-focused products to meet rising consumer demand for clean-label, functional nutrition

- Despite strong momentum, broader adoption will depend on technological innovation, sustainable sourcing frameworks, and greater consumer education to differentiate aquatic ingredients from plant and terrestrial alternatives

Restraint/Challenge

Supply Chain Vulnerabilities and Sustainability Concerns in Marine Ingredient Production

- The expansion of the aquatic food ingredients market is limited by supply chain fluctuations resulting from climate change, overfishing, and seasonal harvesting constraints. These factors affect the stability and reliability of raw material availability, leading to inconsistent production volumes and pricing

- Many regions face sustainability challenges due to limited regulation, inadequate monitoring, and fragmented marine resource management systems. These issues restrict the development of scalable and environmentally responsible ingredient production

- Processing and transportation challenges also hinder market penetration, particularly in regions with limited cold-chain infrastructure and marine processing capabilities. These logistical constraints reduce product quality and accessibility in global trade markets

- For instance, in 2023, several European importers reported temporary shortages of marine hydrocolloids due to disrupted seaweed harvesting cycles in key producing countries, affecting product availability for food manufacturers

- While technological advancements and sustainability certifications are expanding, long-term market growth will require strengthened traceability systems, diversified sourcing, and investment in resilient marine ecosystems to support stable ingredient supply

Aquatic Food Ingredients Market Scope

The market is segmented on the basis of type, source, form, and application.

- By Type

On the basis of type, the aquatic food ingredients market is segmented into starter feed, grower feed, finisher feed, and brooder feed. The starter feed segment held the largest market revenue share in 2025 due to rising demand for nutrient-dense formulations that support early-stage aquatic species development. These feeds offer enhanced digestibility and balanced nutrient profiles, making them essential for improving survival rates and growth performance in hatcheries and early production cycles.

The grower feed segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing aquaculture expansion and the need for high-efficiency feeds during intermediate growth phases. Grower feeds are widely preferred for their optimized protein-energy ratios and ability to support rapid biomass gain, making them crucial for commercial aquaculture operations aiming to improve productivity and reduce feed conversion costs.

- By Form

On the basis of form, the aquatic food ingredients market is segmented into dry, wet, moist, and others. The dry form segment accounted for the largest market revenue share in 2025 due to its longer shelf life, ease of storage, and superior stability during transportation. Dry aquatic feeds are widely used in commercial aquaculture systems as they offer consistent nutrient delivery and better handling efficiency across various species.

The moist form segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by increasing adoption of semi-moist feeds that provide enhanced palatability and digestibility. These feeds are especially preferred for species with higher protein requirements, supporting improved growth rates and feed intake in diverse aquaculture environments.

- By Ingredient

On the basis of ingredient, the aquatic food ingredients market is segmented into animal by-product, grain by-product, oils and fat, additives, and others. The animal by-product segment held the largest market revenue share in 2025 due to its rich protein content and compatibility with a wide range of aquatic species. These ingredients provide essential amino acids and nutrients required for healthy growth, making them a key component in high-performance feed formulations.

The additives segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for functional ingredients such as enzymes, vitamins, probiotics, and mineral premixes that enhance immunity, digestion, and overall feed efficiency. Increased focus on disease prevention and optimal nutrient utilization is further supporting the rapid expansion of this segment.

- By Application

On the basis of application, the aquatic food ingredients market is segmented into carp, rainbow trout, salmon, crustaceans, tilapia, catfish, seabass, groupers, and others. The carp segment accounted for the largest market revenue share in 2025 owing to its widespread farming across Asia-Pacific and the high demand for cost-effective feed ingredients that support efficient growth. Carp farming relies heavily on balanced feed formulations, contributing to strong ingredient consumption.

The salmon segment is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding salmon aquaculture in Europe and North America and the need for premium, nutrient-rich feed ingredients. High-value ingredients such as marine proteins, omega-rich oils, and specialized additives are increasingly being used to support superior flesh quality, higher survival rates, and optimized growth performance.

Aquatic Food Ingredients Market Regional Analysis

- North America dominated the aquatic food ingredients market with the largest revenue share in 2025, driven by rising demand for nutrient-rich foods, growing consumption of marine-based supplements, and expanding applications of aquatic-derived proteins and omega-3 ingredients

- Consumers in the region increasingly prefer functional foods and clean-label ingredients, with strong adoption across dietary supplements, processed foods, and fortified beverages

- This widespread uptake is further supported by high awareness of health and wellness, a strong nutraceutical industry, and rising use of value-added marine ingredients in food manufacturing, making aquatic food ingredients a preferred component in multiple end-use sectors

U.S. Aquatic Food Ingredients Market Insight

The U.S. aquatic food ingredients market captured the largest share in North America in 2025, fuelled by high demand for omega-3 fatty acids, protein concentrates, and marine collagen. Consumers are increasingly seeking sustainable and nutrient-dense ingredients, supporting strong growth across functional foods and dietary supplements. The rising interest in sports nutrition, combined with a well-established food processing sector and the presence of key ingredient manufacturers, continues to propel the market expansion in the country.

Europe Aquatic Food Ingredients Market Insight

The Europe aquatic food ingredients market is expected to witness notable growth from 2026 to 2033, driven by stringent quality regulations, increasing demand for natural ingredients, and rising consumption of seafood-based nutrition. Growing interest in plant–marine blended formulations, clean-label supplements, and fortified foods is boosting the adoption of aquatic-derived ingredients. The region is seeing rising utilization in bakery, beverages, nutraceuticals, and specialized nutrition products, supported by continuous innovation and sustainability-focused sourcing.

U.K. Aquatic Food Ingredients Market Insight

The U.K. aquatic food ingredients market is expected to experience strong growth from 2026 to 2033, supported by the increasing demand for high-quality marine proteins, algae-based ingredients, and omega-3 supplements. The rising focus on preventive health, combined with expanding applications in functional beverages and sports nutrition, is driving market advancement. Growing consumer preference for sustainably sourced marine ingredients is further supporting the country’s market development.

Germany Aquatic Food Ingredients Market Insight

The Germany aquatic food ingredients market is expected to witness significant growth from 2026 to 2033, driven by rising awareness of marine nutrition, technological advancements in ingredient extraction, and strong demand for premium health supplements. Germany’s focus on innovation, clean-label solutions, and high-quality food processing supports the adoption of aquatic-derived proteins, minerals, and lipids across both food and nutraceutical sectors. Sustainability-led purchasing behaviour further enhances market uptake.

Asia-Pacific Aquatic Food Ingredients Market Insight

The Asia-Pacific aquatic food ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by abundant marine resources, rising seafood consumption, and rapid expansion of food processing industries in countries such as China, Japan, and India. The region benefits from strong government support for aquaculture development and increasing demand for fortified foods and dietary supplements. Growing urbanization and a shift toward healthier lifestyles are further supporting market growth across APAC.

Japan Aquatic Food Ingredients Market Insight

The Japan aquatic food ingredients market is expected to witness strong growth from 2026 to 2033 due to its advanced food technology sector, high demand for marine-based functional ingredients, and strong consumer interest in wellness. The market is benefiting from increasing use of algae-derived omega-3s, marine collagen, and protein hydrolysates. Japan’s aging population is also driving demand for easily digestible, nutrient-rich aquatic ingredients used in specialized nutrition and functional foods.

China Aquatic Food Ingredients Market Insight

The China aquatic food ingredients market accounted for the largest share in Asia Pacific in 2025, supported by rapid urbanization, a growing middle-class population, and strong adoption of marine-based nutritional products. China is one of the largest producers and consumers of aquatic-derived ingredients, benefiting from extensive aquaculture activities and large-scale ingredient manufacturing. The rising popularity of fortified foods, supplements, and marine-sourced proteins continues to drive market expansion across the country.

Aquatic Food Ingredients Market Share

The Aquatic Food Ingredients industry is primarily led by well-established companies, including:

• Alltech (U.S.)

• BioMar (Denmark)

• Cargill, Incorporated (U.S.)

• Ridley Corporation Limited (Australia)

• Aller Aqua (Denmark)

• BENEO (Germany)

• Cermaq (Norway)

• Norel S.A (Spain)

• BIOMIN (Austria)

• ADM (U.S.)

• Avanti Feeds Ltd. (India)

• Calanus AS (Norway)

• AKER BIOMARINE ANTARCTIC AS (Norway)

• Nutreco (Netherlands)

• Purina Animal Nutrition LLC (U.S.)

• De Heus Animal Nutrition (Netherlands)

• NOVUS INTERNATIONAL (U.S.)

• Biostadt (India)

• NK Ingredients (Singapore)

• Marvesa (Netherlands)

• BENEO (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.