Global Ar Cloud Market

Market Size in USD Billion

CAGR :

%

USD

7.07 Billion

USD

52.72 Billion

2025

2033

USD

7.07 Billion

USD

52.72 Billion

2025

2033

| 2026 –2033 | |

| USD 7.07 Billion | |

| USD 52.72 Billion | |

|

|

|

|

What is the Global AR Cloud Market Size and Growth Rate?

- The global AR cloud market size was valued at USD 7.07 Billion in 2025 and is expected to reach USD 52.72 Billion by 2033, at a CAGR of28.55% during the forecast period

- Rapid growth is driven by increasing adoption of augmented reality in smart cities, gaming, retail, healthcare, and navigation, rising demand for real-time spatial mapping and 3D visualization, expanding use of AI, computer vision, and edge computing, proliferation of 5G connectivity, and growing investments in immersive digital experiences, all of which are significantly accelerating AR Cloud market expansion

What are the Major Takeaways of AR Cloud Market?

- Rising deployment of AR-enabled smartphones, wearables, tablets, and head-mounted displays, along with increasing R&D activities in spatial computing and metaverse platforms, is creating substantial growth opportunities for the AR Cloud market across both developed and emerging economies

- However, challenges such as high infrastructure costs, data privacy and security concerns, lack of standardized AR Cloud frameworks, and complexity in managing large-scale spatial data may act as key restraining factors impacting the pace of market growth

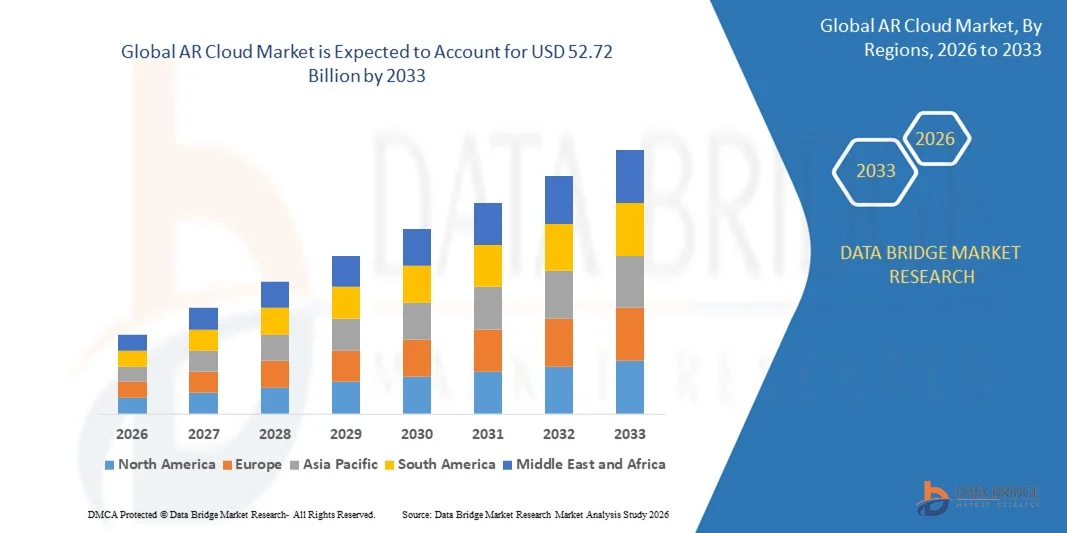

- North America dominated the AR Cloud market with a 32.05% revenue share in 2025, driven by strong growth in spatial computing, cloud infrastructure, AI integration, and immersive technology adoption across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 28.36% from 2026 to 2033, driven by rapid digital transformation, expanding cloud infrastructure, 5G rollout, and growing adoption of AR across China, Japan, India, South Korea, and Southeast Asia

- The Software segment dominated the market with an estimated 46.3% share in 2025, driven by rising adoption of spatial mapping platforms, cloud-based AR engines, visualization software, and AI-powered scene recognition tools

Report Scope and AR Cloud Market Segmentation

|

Attributes |

AR Cloud Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the AR Cloud Market?

Rapid Shift Toward Scalable, Real-Time, and Cloud-Native AR Infrastructure

- The AR cloud market is witnessing increasing adoption of cloud-native, real-time spatial computing platforms that enable persistent AR content, large-scale mapping, and multi-user experiences across devices

- Market players are focusing on high-performance spatial data processing, edge–cloud integration, and AI-driven scene understanding to support immersive AR applications

- Rising demand for lightweight, device-agnostic, and low-latency AR experiences is accelerating the use of cloud-based rendering and spatial anchors

- For instance, companies such as Microsoft, Google, Niantic, Apple, and Meta are enhancing AR Cloud capabilities through spatial mapping, VPS, digital twins, and AI-powered localization

- Increasing need for real-time collaboration, large-scale AR persistence, and cross-platform interoperability is driving adoption across enterprise and consumer use cases

- As AR experiences become more immersive and scalable, AR Clouds will remain central to spatial computing, metaverse development, and next-generation digital interaction

What are the Key Drivers of AR Cloud Market?

- Growing demand for persistent, shared, and location-based AR experiences across gaming, retail, navigation, and enterprise collaboration

- For instance, in 2024–2025, major players such as Niantic, Microsoft, and Apple expanded AR Cloud ecosystems through VPS, spatial anchors, and ARKit/ARCore upgrades

- Rapid adoption of 5G, edge computing, and AI-driven computer vision is significantly improving AR Cloud performance and scalability

- Increasing use of digital twins, smart cities, and industrial AR applications is boosting demand across automotive, manufacturing, and real estate sectors

- Rising penetration of AR-enabled smartphones, smart glasses, and head-mounted displays is expanding the AR Cloud user base

- Supported by sustained investments in cloud infrastructure, spatial AI, and immersive technologies, the AR Cloud market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the AR Cloud Market?

- High costs associated with large-scale spatial mapping, cloud processing, and real-time data synchronization limit adoption among smaller developers

- For instance, during 2024–2025, increased cloud computing costs and infrastructure scaling challenges affected deployment economics for AR platforms

- Complexity in managing data privacy, location accuracy, and real-time synchronization across devices poses technical challenges

- Limited standardization and interoperability across AR platforms, devices, and cloud environments slows ecosystem development

- Competition from device-centric AR solutions, offline AR frameworks, and proprietary ecosystems creates fragmentation

- To overcome these challenges, companies are investing in cost-efficient cloud architectures, open standards, AI optimization, and developer-friendly AR Cloud platforms

How is the AR Cloud Market Segmented?

The market is segmented on the basis of component, organization size, type, deployment, and end use.

- By Component

On the basis of component, the AR Cloud market is segmented into Hardware, Software, and Services. The Software segment dominated the market with an estimated 46.3% share in 2025, driven by rising adoption of spatial mapping platforms, cloud-based AR engines, visualization software, and AI-powered scene recognition tools. Software solutions form the core of AR Cloud ecosystems by enabling real-time localization, content persistence, and multi-user synchronization across devices. Continuous advancements in spatial computing, digital twins, and AI-driven analytics further support segment dominance.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for AR Cloud integration, deployment, maintenance, and customization services. Enterprises across retail, manufacturing, healthcare, and smart city projects are increasingly relying on managed services and consulting to deploy scalable AR Cloud infrastructures efficiently.

- By Organization Size

On the basis of organization size, the AR Cloud market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). Large Enterprises dominated the market with a 61.8% revenue share in 2025, owing to their strong financial capability, early adoption of immersive technologies, and large-scale deployment of AR Cloud platforms for training, digital twins, remote collaboration, and customer engagement. Major enterprises leverage AR Clouds to enhance operational efficiency, supply chain visibility, and workforce productivity.

The SMEs segment is projected to witness the fastest CAGR from 2026 to 2033, driven by declining cloud infrastructure costs, growing availability of SaaS-based AR platforms, and increased adoption of AR for marketing, visualization, and product demonstrations. Government-backed digital transformation initiatives and cloud accessibility are further accelerating AR Cloud penetration among SMEs.

- By Type

On the basis of type, the AR Cloud market is segmented into Marker-Based AR and Marker-Less AR. The Marker-Less AR segment dominated the market with a 58.4% share in 2025, as it enables more seamless, scalable, and immersive experiences without reliance on physical markers. Marker-less AR leverages SLAM, GPS, AI, and computer vision technologies, making it ideal for navigation, smart cities, retail, and industrial AR applications.

The Marker-Based AR segment is expected to grow steadily, particularly in controlled environments such as manufacturing floors, education, and maintenance training, where accuracy and repeatability are critical. However, the fastest growth momentum remains with marker-less AR due to rising demand for location-based services, persistent AR content, and large-scale outdoor deployments.

- By Deployment

On the basis of deployment, the AR Cloud market is segmented into Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment dominated the market with a 49.6% share in 2025, driven by its scalability, cost-efficiency, rapid deployment, and compatibility with AR applications requiring real-time data processing and global accessibility. Public cloud platforms are widely adopted for consumer-facing AR experiences, gaming, retail visualization, and navigation services.

The Hybrid Cloud segment is expected to register the fastest CAGR from 2026 to 2033, as enterprises seek a balance between data security and scalability. Hybrid deployment enables organizations to store sensitive spatial data on private infrastructure while leveraging public cloud resources for processing and visualization, making it ideal for healthcare, defense, and industrial use cases.

- By End Use

On the basis of end use, the AR Cloud market is segmented into Automotive, Aerospace & Defense, Healthcare, Manufacturing, Retail, Media & Entertainment, Real Estate & Construction, IT & Telecommunications, and Others. The Retail segment dominated the market with a 34.7% share in 2025, driven by widespread adoption of AR Cloud solutions for virtual try-ons, in-store navigation, immersive advertising, and personalized customer experiences.

The Manufacturing segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of AR-powered digital twins, remote assistance, predictive maintenance, and workforce training. Increasing Industry 4.0 initiatives and smart factory deployments are accelerating AR Cloud integration across global manufacturing environments.

Which Region Holds the Largest Share of the AR Cloud Market?

- North America dominated the AR Cloud market with a 32.05% revenue share in 2025, driven by strong growth in spatial computing, cloud infrastructure, AI integration, and immersive technology adoption across the U.S. and Canada. High penetration of advanced AR platforms, strong cloud service ecosystems, and early adoption of location-based and persistent AR solutions continue to fuel demand for AR Clouds across automotive visualization, smart manufacturing, healthcare training, media production, and enterprise collaboration use cases

- Leading companies in North America are continuously enhancing AR Cloud platforms with advanced spatial mapping, AI-powered localization, real-time rendering, and cloud-native deployment models, strengthening the region’s technological leadership. Sustained investments in AI, edge computing, 5G, and cloud infrastructure support long-term AR Cloud market expansion

- High concentration of skilled talent, robust startup ecosystems, and strong venture capital funding further reinforce North America’s leadership in the global AR Cloud market

U.S. AR Cloud Market Insight

The U.S. is the largest contributor within North America, supported by strong adoption of AR Cloud solutions across retail, manufacturing, defense, healthcare, and media sectors. Rapid development of AI-driven AR experiences, digital twins, and metaverse platforms is accelerating demand. Presence of major technology companies, cloud providers, and AR innovators further drives market growth.

Canada AR Cloud Market Insight

Canada contributes significantly to regional growth, driven by expanding AR research clusters, increasing adoption of immersive technologies, and government-supported digital innovation programs. Universities, startups, and enterprises are increasingly leveraging AR Clouds for smart city projects, industrial training, and visualization applications.

Asia-Pacific AR Cloud Market

Asia-Pacific is projected to register the fastest CAGR of 28.36% from 2026 to 2033, driven by rapid digital transformation, expanding cloud infrastructure, 5G rollout, and growing adoption of AR across China, Japan, India, South Korea, and Southeast Asia. Rising demand for immersive retail, smart manufacturing, and location-based AR services is accelerating regional growth.

China AR Cloud Market Insight

China leads Asia-Pacific due to strong government support, large-scale smart city initiatives, and massive investments in AR, AI, and cloud computing. High adoption across manufacturing, retail, and entertainment supports sustained market expansion.

Japan AR Cloud Market Insight

Japan shows steady growth driven by advanced robotics, automotive innovation, and precision manufacturing. Strong emphasis on reliability and high-performance immersive solutions supports AR Cloud adoption.

Which are the Top Companies in AR Cloud Market?

The AR cloud industry is primarily led by well-established companies, including:

- Microsoft Corporation (U.S.)

- Apple Inc. (U.S.)

- Google LLC (U.S.)

- Magic Leap, Inc. (U.S.)

- Niantic, Inc. (U.S.)

- Snap Inc. (U.S.)

- Vuzix Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- PTC Inc. (U.S.)

- Epson America, Inc. (U.S.)

- Ultraleap (U.K.)

- Nreal (China)

- Vuforia (PTC) (U.S.)

- Sony Corporation (Japan)

- Intel Corporation (U.S.)

- Samsung Electronics (South Korea)

- Meta Platforms, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Bosch Sensortec GmbH (Germany)

What are the Recent Developments in Global AR Cloud Market?

- In October 2025, Amazon Web Services, Inc. (AWS) (U.S.) entered into a strategic collaboration with Esri to integrate Esri’s geospatial AI platform, ArcGIS, with AWS’s cloud infrastructure, enabling enterprise-scale geospatial, AR, VR, and AR Cloud applications across multiple industries, reinforcing AWS’s influence in the AR Cloud market and supporting scalable, location-intelligent immersive experiences

- In July 2025, Niantic, Inc. (U.S.) announced a technology partnership with KOJIMA PRODUCTIONS to deliver immersive geospatial-AI-powered AR experiences in real-world environments, highlighting Niantic’s focus on building a persistent AR Cloud layer, and demonstrating the company’s commitment to bridging digital and physical experiences

- In May 2025, Google LLC (U.S.) introduced updates to its ARCore development platform, including enhanced Cloud Anchors for shared AR experiences, vertical-plane detection, and improved augmented image recognition, strengthening Google’s AR Cloud capabilities and enabling persistent, shared spatial content across devices

- In February 2025, Microsoft Corporation (U.S.) published guidance and sample tools combining World Locking Tools with Azure Spatial Anchors, demonstrating how to create stable, shareable coordinate spaces across devices and sessions, and providing critical building blocks for persistent AR Cloud functionality

- In November 2024, Niantic, Inc. (U.S.) launched the Niantic Spatial Platform, expanding Lightship map and Visual Positioning System (VPS) to one million locations in production, enabling persistent, shareable AR content at scale, and reinforcing its position as a leader in AR Cloud developer solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.