Global Arachidonic Acid Market

Market Size in USD Million

CAGR :

%

USD

363.08 Million

USD

570.02 Million

2025

2033

USD

363.08 Million

USD

570.02 Million

2025

2033

| 2026 –2033 | |

| USD 363.08 Million | |

| USD 570.02 Million | |

|

|

|

|

Arachidonic Acid Market Size

- The global arachidonic acid market size was valued at USD 363.08 million in 2025 and is expected to reach USD 570.02 million by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the rising demand for infant formula and dietary supplements enriched with arachidonic acid to support brain and eye development

- Increasing consumer awareness about the health benefits of omega-6 fatty acids in promoting cardiovascular and cognitive health is driving market adoption

Arachidonic Acid Market Analysis

- The market is driven by increasing applications in infant nutrition, sports nutrition, and functional foods, where arachidonic acid is valued for its role in growth and immunity

- Growing research and development activities for sustainable production of arachidonic acid using microbial fermentation and algae-based sources are supporting market expansion

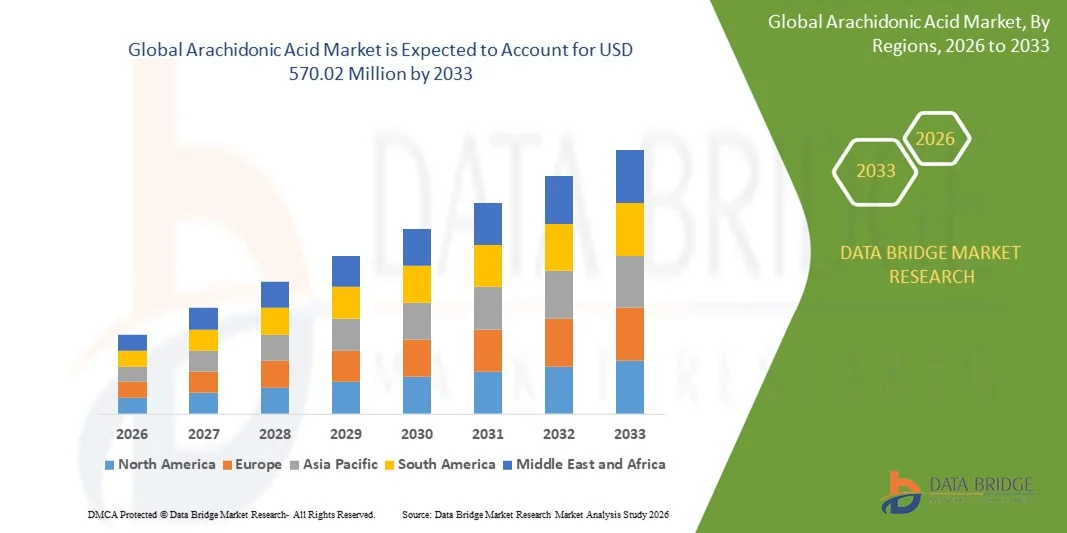

- North America dominated the arachidonic acid market with the largest revenue share of 32.45% in 2025, driven by increasing demand for functional foods, infant formulas, and nutritional supplements enriched with ARA

- Asia-Pacific region is expected to witness the highest growth rate in the global arachidonic acid market, driven by rapid urbanization, expanding infant formula and dietary supplement markets, and increasing awareness of nutritional benefits

- The Dry segment held the largest market revenue share in 2025, driven by its ease of handling, stability during storage, and convenient incorporation into powdered infant formulas, dietary supplements, and functional foods. Dry ARA formulations offer longer shelf life and better compatibility with diverse product matrices, making them a preferred choice for manufacturers

Report Scope and Arachidonic Acid Market Segmentation

|

Attributes |

Arachidonic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Arachidonic Acid Market Trends

Rise of Functional Nutrition and Infant Formula Applications

- The growing incorporation of arachidonic acid (ARA) in infant formula, dietary supplements, and functional foods is transforming the nutrition landscape by supporting brain, eye, and immune system development. The inclusion of ARA allows manufacturers to offer value-added products that meet consumer demands for enhanced health benefits. This trend is further supported by rising parental awareness about optimal infant nutrition and the preference for fortified products

- Increasing demand for ARA-enriched supplements in sports nutrition and clinical nutrition is accelerating market adoption. These applications are particularly relevant in regions with rising health awareness and nutritional supplementation needs, helping improve overall wellness and performance outcomes. In addition, ARA’s role in cognitive and inflammatory health is expanding its use across adult nutrition products

- The affordability and stability of modern ARA formulations make them suitable for widespread use in both commercial and consumer nutrition products. Easy integration into various food and supplement matrices supports product innovation and market growth. Manufacturers are increasingly leveraging microencapsulation and lipid-based delivery technologies to improve bioavailability and shelf stability

- For instance, in 2023, several infant formula manufacturers in Europe reported improved cognitive and visual development outcomes in infants after introducing ARA-enriched formulas, enhancing product value and consumer trust. Similar positive results were observed in clinical trials involving adult supplements, highlighting ARA’s broader health benefits

- While ARA adoption is increasing, long-term impact depends on continued innovation, regulatory compliance, and supply chain stability. Manufacturers must focus on high-quality sourcing, sustainable production methods, and continuous research to maintain consumer confidence and expand product applications globally

Arachidonic Acid Market Dynamics

Driver

Rising Awareness of Nutritional Benefits and Growing Demand for Functional Foods

- Increasing awareness of the health benefits of arachidonic acid, particularly in infant brain development and immune system support, is driving market adoption. Parents and healthcare providers are prioritizing ARA-enriched formulas and supplements to ensure optimal growth and health outcomes. Consumer preference for clean-label, naturally derived ingredients is also boosting market traction

- The demand for high-quality nutritional products in sports nutrition, clinical nutrition, and functional foods is encouraging manufacturers to incorporate ARA in their offerings. This trend is supported by evolving consumer preferences for natural, bioactive ingredients. In addition, the expansion of e-commerce platforms is enhancing global accessibility to ARA-enriched products

- Government regulations and health organization guidelines emphasizing proper infant and pediatric nutrition are supporting the expansion of ARA applications. Subsidies and awareness programs further boost adoption in developing and developed regions. Continuous clinical research validating ARA’s health effects strengthens regulatory approvals and market confidence

- For instance, in 2022, several North American nutrition companies launched fortified infant formulas and dietary supplements enriched with arachidonic acid, driving growth and market visibility. This initiative also influenced product innovation trends, with competitors developing next-generation ARA blends for diverse age groups

- While awareness and institutional support are key drivers, challenges remain in ensuring sustainable production, cost-effective formulations, and effective distribution to achieve widespread adoption. Market stakeholders are increasingly investing in supply chain optimization and partnerships with sustainable ingredient suppliers

Restraint/Challenge

High Cost of Production and Limited Availability of Sustainable Sources

- The high cost of arachidonic acid, particularly from natural or microbial fermentation sources, limits adoption among smaller manufacturers and low-margin nutrition products. Price-sensitive markets may face barriers to entry, slowing growth. Furthermore, fluctuations in raw material availability can create price volatility, affecting production planning

- Limited availability of sustainable and high-quality ARA sources can disrupt supply chains, especially in developing regions. Manufacturers must ensure consistent sourcing to maintain product quality and market reliability. In addition, the need for ethical and environmentally friendly production practices is placing pressure on suppliers to innovate

- Technical complexities in formulation and stability of ARA in food and supplement products may restrict usage, requiring specialized expertise and R&D investment. Improper formulation can reduce efficacy and consumer acceptance. Challenges include maintaining oxidative stability, preventing degradation during processing, and ensuring uniform dispersion in complex matrices

- For instance, in 2023, several infant formula producers in Asia reported delays in ARA-enriched product launches due to sourcing constraints and high raw material costs, affecting revenue growth and market penetration. Such delays highlighted the importance of strategic sourcing agreements and local manufacturing partnerships to mitigate risks

- While production technologies are evolving, addressing cost, supply chain, and formulation challenges is critical. Market players must focus on scalable, cost-efficient, and sustainable production methods to maximize long-term growth potential. Continuous investment in biotechnological fermentation and synthetic alternatives is expected to stabilize supply and broaden global adoption

Arachidonic Acid Market Scope

The market is segmented on the basis of form, source, and application.

- By Form

On the basis of form, the arachidonic acid (ARA) market is segmented into Dry and Liquid. The Dry segment held the largest market revenue share in 2025, driven by its ease of handling, stability during storage, and convenient incorporation into powdered infant formulas, dietary supplements, and functional foods. Dry ARA formulations offer longer shelf life and better compatibility with diverse product matrices, making them a preferred choice for manufacturers.

The Liquid segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its high bioavailability, ease of blending into oils, beverages, and liquid nutritional products, and suitability for applications in infant formulas, clinical nutrition, and functional beverages. Liquid ARA is increasingly favored for its rapid absorption and enhanced functional benefits in targeted nutrition solutions.

- By Source

On the basis of source, the ARA market is segmented into Animal and Plant. The Animal-derived segment held the largest market revenue share in 2025, attributed to its high concentration, established production processes, and widespread use in infant formulas and clinical nutrition. Manufacturers rely on animal-sourced ARA for consistent quality and proven efficacy in promoting brain, eye, and immune system development.

The Plant-derived segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for sustainable, vegan, and ethically sourced ingredients. Plant-based ARA, often derived from fungal or algal fermentation, is gaining popularity in functional foods, supplements, and infant nutrition, appealing to environmentally conscious and health-focused consumers.

- By Application

On the basis of application, the ARA market is segmented into Food & Beverage and Pharmaceuticals. The Food & Beverage segment held the largest market revenue share in 2025, driven by the extensive use of ARA in infant formulas, fortified foods, dietary supplements, and functional beverages. This segment benefits from increasing consumer awareness about nutritional enhancement and brain development.

The Pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising use of ARA in clinical nutrition, therapeutic formulations, and specialized medical supplements. Pharmaceutical applications leverage ARA’s anti-inflammatory properties and role in supporting cognitive and immune health, expanding its adoption across healthcare products.

Arachidonic Acid Market Regional Analysis

- North America dominated the arachidonic acid market with the largest revenue share of 32.45% in 2025, driven by increasing demand for functional foods, infant formulas, and nutritional supplements enriched with ARA

- Consumers in the region are increasingly focused on health, wellness, and cognitive development benefits, which is fueling the adoption of ARA-enriched products in both pediatric and adult nutrition segments

- This widespread adoption is further supported by rising disposable incomes, advanced manufacturing infrastructure, and growing awareness of bioactive nutrients, establishing ARA as a key ingredient in functional nutrition products

U.S. Arachidonic Acid Market Insight

The U.S. arachidonic acid market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of infant formula and dietary supplement industries. Consumers are prioritizing products that support brain, eye, and immune system development. The growing trend of fortified foods and nutritional beverages, combined with robust regulatory support and health awareness campaigns, further propels market growth. Moreover, the increasing integration of ARA in functional foods, infant nutrition, and clinical supplements is significantly contributing to the market’s expansion.

Europe Arachidonic Acid Market Insight

The Europe arachidonic acid market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the rising demand for functional foods, sports nutrition, and specialized dietary supplements. Increasing health consciousness and awareness of bioactive ingredients are encouraging manufacturers to fortify products with ARA. The region is experiencing significant growth across infant nutrition, clinical nutrition, and adult functional foods, with ARA being incorporated into both new product launches and reformulated offerings.

U.K. Arachidonic Acid Market Insight

The U.K. arachidonic acid market is expected to witness the fastest growth rate from 2026 to 2033, driven by growing awareness of infant brain development and the rising adoption of fortified dietary supplements. Health-conscious consumers and parents are increasingly opting for ARA-enriched products, encouraging manufacturers to expand their product portfolios. The U.K.’s strong e-commerce and retail infrastructure, coupled with regulatory support for functional foods, is expected to continue to stimulate market growth.

Germany Arachidonic Acid Market Insight

The Germany arachidonic acid market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for clinically backed nutritional products and infant formulas enriched with ARA. Germany’s well-established food and pharmaceutical industries, combined with a focus on innovation and high-quality nutrition standards, promote the adoption of ARA in both pediatric and adult nutrition applications. The integration of ARA into functional foods and dietary supplements is becoming increasingly prevalent, meeting the growing consumer preference for scientifically validated health benefits.

Asia-Pacific Arachidonic Acid Market Insight

The Asia-Pacific arachidonic acid market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health awareness, increasing urbanization, and expanding infant nutrition and dietary supplement industries in countries such as China, Japan, and India. Government initiatives promoting maternal and child nutrition, along with growing middle-class populations, are supporting market adoption. Furthermore, as APAC emerges as a manufacturing hub for ARA and related nutritional ingredients, the affordability and accessibility of ARA-enriched products are expanding to a wider consumer base.

Japan Arachidonic Acid Market Insight

The Japan arachidonic acid market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high focus on health and wellness, increasing demand for infant formulas, and functional foods targeting cognitive development. Japanese consumers prioritize quality and efficacy in nutritional products, and ARA adoption is driven by the growing number of fortified foods and dietary supplements. Moreover, Japan’s aging population is likely to spur demand for ARA-enriched clinical nutrition products, supporting both adult and pediatric applications.

China Arachidonic Acid Market Insight

The China arachidonic acid market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and high rates of nutritional awareness. China stands as one of the largest markets for infant formulas and functional foods, with ARA-enriched products becoming increasingly popular in both commercial and retail segments. Government initiatives promoting child nutrition, along with strong domestic manufacturers and competitive pricing, are key factors propelling the market in China.

Arachidonic Acid Market Share

The Arachidonic Acid industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- CABIO Bioengineering (Wuhan) Co Ltd (China)

- Cayman Chemical (U.S.)

- Guangdong Runke Bioengineering Co Ltd (China)

- DSM (Netherlands)

- A & Z Food Additives Co., Ltd (China)

- Merck KGaA (Germany)

- Wuhan Shu Ou Technology Co., Ltd. (China)

- Avanti Polar Lipids (U.S.)

- Bio-Techne (U.S.)

- Kingdomway Nutrition, Inc. (China)

- SUNTORY HOLDINGS LIMITED (Japan)

- Fraken Biochem Co., Ltd (China)

- CR International Co Ltd (China)

- DoubleNutra Biotech Co Ltd. (China)

- Martek Bio Sciences Group (U.S.)

- A.B. Enterprises (India)

- Acme Synthetic Chemicals (India)

Latest Developments in Global Arachidonic Acid Market

- In December 2024, Louis Dreyfus Company (LDC) completed the acquisition of BASF’s Food and Health Performance Ingredients business, including a production facility, a state-of-the-art research and development center in Illertissen, Germany, and three application labs outside the country. This strategic move expands LDC’s production capabilities, strengthens its R&D portfolio, and enhances innovation in food and health ingredients. The acquisition is expected to boost product development efficiency, accelerate market penetration, and reinforce LDC’s position in the global functional nutrition and specialty ingredients market

- In May 2023, Avanti Polar Lipids, LLC partnered with Bioz to launch Bioz Badges, an AI-driven tool providing real-time insights into the applications of the company’s products. This development allows researchers and customers to track where, how, and why Avanti’s products are being used globally in scientific studies. The initiative enhances customer engagement, supports informed product usage, and promotes transparency, ultimately strengthening Avanti’s visibility and credibility in the research and functional ingredient markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Arachidonic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Arachidonic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Arachidonic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.