Global Architectural Coatings Resins Market

Market Size in USD Billion

CAGR :

%

USD

31.00 Billion

USD

49.40 Billion

2024

2032

USD

31.00 Billion

USD

49.40 Billion

2024

2032

| 2025 –2032 | |

| USD 31.00 Billion | |

| USD 49.40 Billion | |

|

|

|

|

Architectural Coatings Resins Market Size

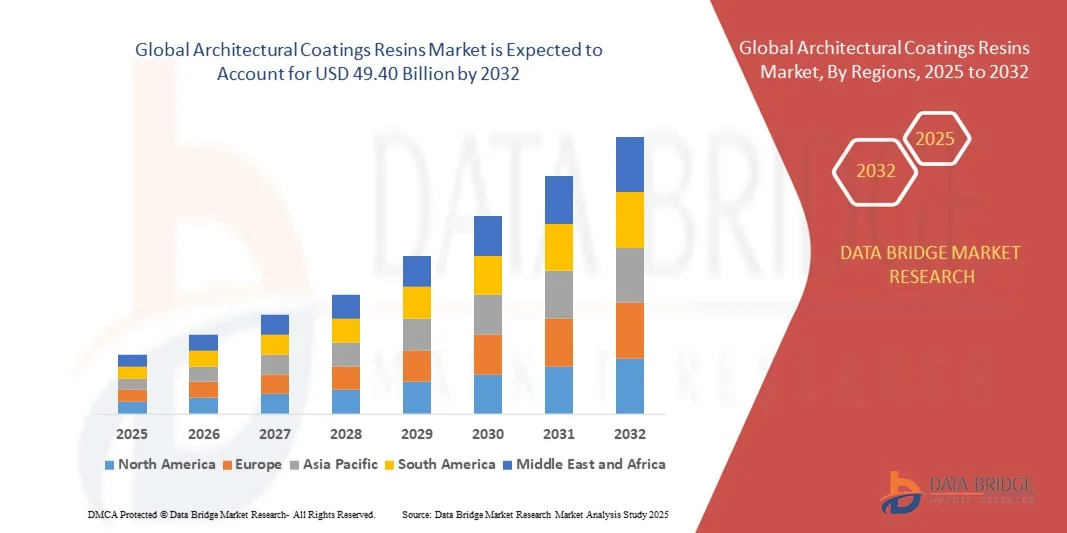

- The global architectural coatings resins market size was valued at USD 31.0 billion in 2024 and is expected to reach USD 49.40 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by the increasing construction and renovation activities across residential and commercial sectors, coupled with rising demand for durable, high-performance, and aesthetically appealing coatings. Growing awareness of eco-friendly and low-VOC coatings is further driving adoption of advanced resins in modern architectural applications

- Furthermore, rising consumer and professional preference for sustainable, versatile, and easy-to-apply coatings is establishing architectural coatings resins as the standard solution for both interior and exterior applications. These converging factors are accelerating the uptake of innovative resin technologies, thereby significantly boosting the industry’s growth

Architectural Coatings Resins Market Analysis

- Architectural coatings resins are specialized polymeric materials used to formulate interior, exterior, and specialty coatings, providing properties such as adhesion, durability, flexibility, and weather resistance. They form the backbone of paints and coatings, enabling high-performance finishes suitable for various surfaces in residential, commercial, and industrial applications

- The escalating demand for architectural coatings resins is primarily fueled by urbanization, infrastructure expansion, increasing disposable incomes, and growing consumer awareness of sustainable building materials. The rising emphasis on waterborne, low-VOC, and high-performance resin solutions is further enhancing market growth and adoption across global regions

- Asia-Pacific dominated the architectural coatings resins market with a share of 42.51% in 2024, due to rapid urbanization, large-scale housing projects, and significant growth in infrastructure development across emerging economies

- North America is expected to be the fastest growing region in the architectural coatings resins market during the forecast period due to increasing demand for sustainable coatings in residential, commercial, and institutional projects

- Professional segment dominated the market with a market share of 68.9% in 2024, due to the strong reliance of large-scale construction, renovation, and infrastructure projects on skilled contractors and applicators. Professionals prefer high-performance coatings that ensure durability, efficiency, and consistent quality, making them the dominant end-user group. The segment’s growth is further supported by rising urbanization, commercial building activities, and institutional developments, where professional expertise is essential for meeting project standards and timelines

Report Scope and Architectural Coatings Resins Market Segmentation

|

Attributes |

Architectural Coatings Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Architectural Coatings Resins Market Trends

Growth of Eco-Friendly, Low-VOC Resins

- The architectural coatings resins market is undergoing a transformation with increasing adoption of eco-friendly, low-VOC resin formulations. Growing awareness about environmental sustainability and stricter indoor air quality standards are pushing manufacturers and consumers toward greener options that provide both performance and reduced environmental impact

- For instance, BASF has introduced eco-friendly architectural coating solutions based on low-VOC resins, catering to green building requirements and sustainable construction practices. Similarly, AkzoNobel is focusing on developing bio-based and waterborne resin technologies that significantly reduce emissions while maintaining coating performance

- Low-VOC resins are being widely used in residential and commercial buildings to reduce volatile emissions, improve air quality, and meet regulatory benchmarks. Their popularity is rising in urban areas where environmental standards and consumer demand for healthier living spaces remain strong

- Shifts in consumer preferences toward sustainable products are accelerating demand for architectural coatings with resins that combine high durability, aesthetic appeal, and environmental compliance. This trend directly supports the adoption of coatings aligned with LEED certification and global green construction initiatives

- Manufacturers are also investing in research and innovation to expand applications of eco-friendly resins across diverse substrates such as concrete, wood, and metal. This diversification amplifies adoption and also fosters technological advances that improve coating longevity and performance

- The emphasis on eco-friendly, low-VOC resins marks a long-term structural change in the architectural coatings industry. As regulatory frameworks tighten and demand for sustainable construction grows, resin producers are focusing on green innovation as the foundation of future industry competitiveness

Architectural Coatings Resins Market Dynamics

Driver

Rising Construction and Renovation Activities

- The increasing pace of construction and renovation activity in both emerging and developed markets is a central driver for the architectural coatings resins market. Rising urbanization, infrastructure growth, and modernization of residential housing are boosting demand for high-performance coatings that rely on advanced resin technology

- For instance, Sherwin-Williams has expanded its coatings portfolio with resin-based solutions tailored for renovation projects, emphasizing durability, weather resistance, and sustainability. PPG Industries is also investing in advanced resin technologies suited for both interior and exterior architectural coatings to meet the growing construction sector demand

- Construction and renovation activities require coatings that offer protective, aesthetic, and functional benefits for building materials such as wood, concrete, and metal. Resin systems enable coatings to achieve superior adhesion, abrasion resistance, and long-term performance under harsh climatic conditions

- The rising income levels in emerging markets are spurring homeowners and businesses to invest in renovation, leading to increased coatings consumption. Coating resins play a critical role in delivering finishes that meet consumer expectations for style, quality, and longevity in construction projects

- The continuous demand generated by global construction and renovation underscores resins as foundational materials for the architectural coatings industry. Their versatile properties ensure growing relevance in shaping modern urban landscapes while catering to sustainability and quality expectations

Restraint/Challenge

Strict Environmental Regulations

- Strict environmental regulations governing emissions and chemical compositions present a major challenge for the architectural coatings resins market. Compliance requirements for VOC levels and hazardous material content limit the use of certain conventional resin formulations

- For instance, regulations set by the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) mandate stringent limits on volatile emissions from architectural coatings. Companies such as AkzoNobel and PPG Industries face ongoing challenges in reformulating products to meet these standards without compromising performance

- Adhering to such regulatory frameworks requires significant investments in R&D to develop compliant resins that maintain durability and cost efficiency. This increases operational burden for manufacturers, especially medium and small-scale players with limited resources for continuous innovation

- The challenge also extends to global markets as varying regional regulations create complexities for resin manufacturers supplying multiple geographies. Ensuring compliance across diverse standards can slow down product launches and increase overall production costs

- Addressing these challenges requires developing sustainable resin chemistries, scaling waterborne technologies, and expanding bio-based alternatives. Successfully adapting to strict regulations will determine long-term competitiveness and ensure the continued growth of eco-friendly architectural coatings resins

Architectural Coatings Resins Market Scope

The market is segmented on the basis of resin type, technology, coating type, user type, and application.

- By Resin Type

On the basis of resin type, the market is segmented into acrylic resin, alkyd resin, vinyl resin, polyurethane resin, and others. The acrylic resin segment dominated the largest revenue share in 2024, supported by its superior weather resistance, color retention, and quick-drying properties. Acrylic resins are widely preferred for exterior coatings in residential and commercial projects as they provide excellent protection against UV radiation and environmental degradation. Their compatibility with waterborne formulations further drives adoption as governments impose stricter regulations on VOC emissions. Growing demand for durable and eco-friendly coatings in both developed and emerging economies strengthens the dominance of acrylic resins.

The polyurethane resin segment is anticipated to witness the fastest growth from 2025 to 2032, owing to its outstanding durability, chemical resistance, and superior surface finish. Polyurethane-based coatings are gaining rapid traction in high-performance applications where long-lasting protection is critical, especially in non-residential projects. Their versatility in offering gloss, matte, and textured finishes makes them popular in modern architectural designs. Moreover, their ability to enhance abrasion resistance and extend coating life makes polyurethane resins an attractive choice for professional users seeking premium performance.

- By Technology

On the basis of technology, the market is segmented into waterborne coatings, solvent-borne coatings, and powder coatings. The waterborne coatings segment held the largest market revenue share in 2024, driven by the rising global focus on sustainable solutions and compliance with stringent environmental regulations. These coatings emit fewer VOCs compared to solvent-based alternatives, making them the preferred choice in both residential and commercial construction. Advancements in waterborne technology have also enhanced durability and adhesion, narrowing the performance gap with solvent-based systems. With end users and contractors increasingly demanding eco-friendly products, waterborne coatings continue to dominate the market.

The powder coatings segment is expected to grow at the fastest CAGR during 2025–2032, propelled by their zero-VOC content, excellent finish quality, and recyclability. Powder coatings offer superior resistance to chipping, scratching, and fading, making them highly suitable for both interior and exterior applications. Their application efficiency and minimal wastage further strengthen adoption among large-scale projects, particularly in commercial and industrial construction. In addition, ongoing innovations in low-temperature curing powders expand their usability across diverse architectural substrates, fueling rapid growth in the coming years.

- By Coating Type

On the basis of coating type, the market is segmented into interior, exterior, and others. The exterior coatings segment dominated the market in 2024, primarily due to their critical role in protecting buildings against harsh weather conditions, moisture, and UV radiation. Exterior coatings enhance durability and also improve aesthetics, making them essential in residential housing and large-scale infrastructure projects. Rising urbanization and demand for modern architectural designs have further amplified the need for high-performance exterior coatings with long-lasting finishes.

The interior coatings segment is anticipated to witness the fastest growth from 2025 to 2032, supported by growing consumer focus on aesthetic appeal, indoor air quality, and health-conscious living. Interior coatings with low-odor, anti-microbial, and washable properties are increasingly preferred in homes, offices, and healthcare facilities. The surge in renovation activities and personalization trends in home décor also contribute to rising demand. Furthermore, the popularity of DIY projects among homeowners boosts adoption of user-friendly interior coatings designed for easy application.

- By User Type

On the basis of user type, the market is segmented into DIY and professional. The professional segment accounted for the largest share of 68.9% in 2024, driven by the strong reliance of large-scale construction, renovation, and infrastructure projects on skilled contractors and applicators. Professionals prefer high-performance coatings that ensure durability, efficiency, and consistent quality, making them the dominant end-user group. The segment’s growth is further supported by rising urbanization, commercial building activities, and institutional developments, where professional expertise is essential for meeting project standards and timelines.

The DIY segment is projected to register the fastest growth rate from 2025 to 2032, fueled by the increasing popularity of home renovation projects and the availability of easy-to-apply products. Rising disposable incomes and the influence of home improvement media encourage consumers to take on painting projects independently. Manufacturers are responding with innovative packaging, ready-to-use kits, and low-odor formulations designed for hassle-free application. The trend of personalization and self-expression in interior design further accelerates DIY adoption, particularly in developed markets.

- By Application

On the basis of application, the market is segmented into residential and non-residential. The residential segment dominated the market in 2024, driven by rising urban housing developments, renovation projects, and consumer demand for aesthetic and protective coatings. Population growth and expanding middle-class households in emerging economies amplify the need for affordable and durable coating solutions. The increasing emphasis on eco-friendly paints in residential construction also adds to this segment’s market strength.

The non-residential segment is expected to witness the fastest growth from 2025 to 2032, as commercial, institutional, and industrial projects demand high-performance coatings with superior durability. Infrastructure investments in offices, retail, healthcare, and education facilities are boosting demand for long-lasting coatings with resistance to wear and harsh environments. Growing adoption of polyurethane and powder-based resins for premium finishes and sustainability compliance in non-residential projects further drives segment expansion.

Architectural Coatings Resins Market Regional Analysis

- Asia-Pacific dominated the architectural coatings resins market with the largest revenue share of 42.51% in 2024, driven by rapid urbanization, large-scale housing projects, and significant growth in infrastructure development across emerging economies

- The region’s cost-effective manufacturing base, increasing investments in sustainable resin production, and expanding presence of global coating manufacturers are accelerating market adoption

- Rising middle-class populations, government-backed smart city initiatives, and growing demand for eco-friendly coatings are contributing to widespread consumption of architectural coatings resins in both residential and commercial sectors

China Architectural Coatings Resins Market Insight

China held the largest share in the Asia-Pacific architectural coatings resins market in 2024, supported by its massive construction industry, strong government spending on infrastructure, and high demand for residential housing. The country’s dominance in resin production, coupled with availability of raw materials and scale economies, drives its leadership position. Increasing focus on low-VOC and waterborne coating solutions further boosts adoption across both urban and rural markets.

India Architectural Coatings Resins Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid urban housing demand, expansion of affordable housing projects, and rising disposable incomes. The government’s “Housing for All” and infrastructure development schemes are key drivers for architectural coatings resins. A surge in renovation projects, coupled with growing acceptance of eco-friendly waterborne coatings, strengthens India’s market position. In addition, the country’s growing DIY trend adds to the strong consumption outlook.

Europe Architectural Coatings Resins Market Insight

The Europe architectural coatings resins market is expanding steadily, supported by strict environmental regulations, growing demand for low-VOC coatings, and strong emphasis on sustainability. The region prioritizes high-performance coatings for both residential and non-residential applications, with rising investments in innovative resin technologies. Increasing adoption of waterborne and powder-based solutions in compliance with EU directives continues to enhance market growth.

Germany Architectural Coatings Resins Market Insight

Germany’s architectural coatings resins market is driven by its advanced construction practices, strong focus on energy-efficient buildings, and well-established chemical industry. The country emphasizes sustainable and eco-friendly coatings in line with green building standards. Innovation partnerships between coating manufacturers and research institutes foster development of high-performance resins tailored for both interior and exterior applications.

U.K. Architectural Coatings Resins Market Insight

The U.K. market benefits from strong demand in the renovation and refurbishment sector, supported by aging building stock and sustainability-focused government policies. Growing emphasis on waterborne and low-VOC coatings is shaping resin consumption patterns. The country’s active home improvement culture, coupled with rising investments in premium decorative finishes, further strengthens its architectural coatings resins market.

North America Architectural Coatings Resins Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for sustainable coatings in residential, commercial, and institutional projects. The region is experiencing strong trends in green building certifications and eco-friendly construction materials, boosting resin consumption. Reshoring of chemical production and innovations in high-performance resins are also contributing to market expansion.

U.S. Architectural Coatings Resins Market Insight

The U.S. accounted for the largest share in the North America architectural coatings resins market in 2024, supported by robust housing construction, steady non-residential building activity, and strong consumer preference for premium finishes. The presence of leading coating and resin manufacturers, combined with widespread adoption of waterborne technologies, underpins the country’s leadership. Ongoing investments in R&D for advanced and sustainable resin formulations continue to drive U.S. market dominance.

Architectural Coatings Resins Market Share

The architectural coatings resins industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Solvay (Belgium)

- Evonik Industries AG (Germany)

- Arkema (France)

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- PPG Industries, Inc. (U.S.)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Eastman Chemical Company (U.S.)

- Dow. (U.S.)

- Berger Paints India Limited (India)

- CARPOLY (China)

- ALLNEX GMBH (Germany)

- Jotun (Norway)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Stepan Company (U.S.)

- Masco Corporation (U.S.)

- Linetec (U.S.)

- Benjamin Moore & Co. (U.S.)

- FUJIKURA KASEI CO., LTD. (Japan)

Latest Developments in Global Architectural Coatings Resins Market

- In September 2024, Engineered Polymer Solutions (EPS) introduced EPS 2746, an all-acrylic polymer designed for flat through semi-gloss architectural coatings, formulated without fluorosurfactants and allowing near-zero VOC levels. This launch directly strengthens the market’s shift toward sustainable and regulatory-compliant products, offering formulators eco-friendly alternatives without compromising on performance. By addressing increasing environmental concerns and aligning with stricter emission standards, EPS 2746 reinforces the industry’s movement toward greener resins and boosts EPS’s competitive positioning in the eco-coatings segment

- In April 2024, EPS launched EPS 2210, an acrylic polymer optimized for elastomeric wall and roof coatings, featuring dirt pickup resistance, superior adhesion, and flexibility even at low temperatures. This development impacts the market by supporting the rising demand for durable exterior coatings that maintain reflective properties and withstand climatic variations. With global emphasis on energy efficiency and urban heat island mitigation, EPS 2210 strengthens the adoption of reflective roof systems and expands the scope of advanced acrylic resin applications in architectural coatings

- In April 2024, Armstrong World Industries acquired 3form, LLC, a leader in architectural resin and translucent design solutions used in partitions, walls, and lighting applications. This acquisition enhances Armstrong’s architectural specialties portfolio, enabling the company to combine design versatility with high-performance resin materials. For the market, the move expands application areas of resins beyond protective coatings into decorative and structural uses, showcasing the diversification potential of resin technology in modern architectural design

- In early 2024, Arkema completed the acquisition of Total’s coatings resins and photocure resins businesses, including Cray Valley, Cook Composites & Polymers, and Sartomer. This acquisition significantly impacts the market by consolidating Arkema’s leadership in coatings resins and broadening its product range, especially in acrylic technologies. The move strengthens its global footprint across Asia (India, Malaysia, China), enhances downstream integration, and ensures stronger R&D capabilities, reinforcing Arkema’s ability to meet rising demand for high-performance and specialty resins worldwide

- In 2024, Hexion partnered with Poland-based D&R Dispersions and Resins to produce VeoVa Silane resins, an isocyanate-free and moisture-curable resin alternative. This partnership marks a crucial development for the market as it addresses growing health and safety regulations while delivering high-performance coatings with enhanced durability, flexibility, and faster curing. By replacing hazardous chemistries with safer yet effective solutions, Hexion positions itself at the forefront of innovation in sustainable resin technologies, driving broader adoption of advanced resins in architectural, wood, and protective coatings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Architectural Coatings Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Architectural Coatings Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Architectural Coatings Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.