Global Argentine Wne Market

Market Size in USD Billion

CAGR :

%

USD

10.45 Billion

USD

10.69 Billion

2024

2032

USD

10.45 Billion

USD

10.69 Billion

2024

2032

| 2025 –2032 | |

| USD 10.45 Billion | |

| USD 10.69 Billion | |

|

|

|

|

Argentine Wine Market Size

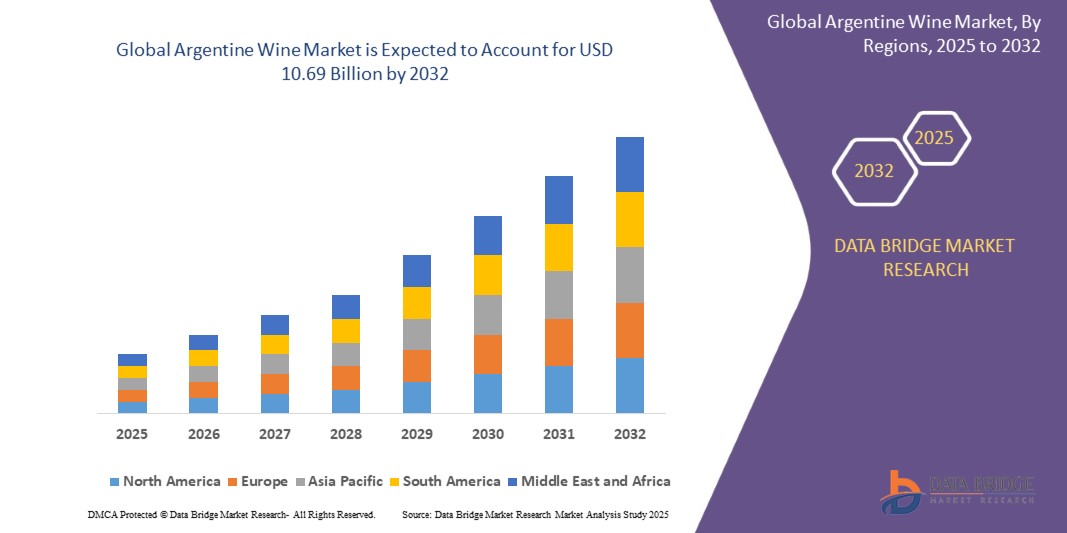

- The global Argentine wine market size was valued at USD 10.45 billion in 2024 and is expected to reach USD 10.69 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by Argentina’s strong global reputation for Malbec and premium red wines, which continue to drive both domestic consumption and international demand across key markets such as the U.S., U.K., and Europe

- Furthermore, rising consumer preference for affordable premium wines, combined with increasing adoption of sustainable and organic viticulture practices, is reinforcing Argentina’s position in the global wine industry. These converging factors are accelerating exports and expanding wine tourism, thereby significantly boosting the industry’s growth

Argentine Wine Market Analysis

- Argentine wine is a globally recognized product, led by its flagship Malbec varietal, alongside a diverse portfolio of red, white, and sparkling wines. The industry benefits from favorable climatic conditions, strong vineyard traditions, and growing investments in premiumization and sustainability

- The escalating demand for Argentine wines is primarily fueled by their competitive pricing compared to European alternatives, increasing visibility in international retail and hospitality sectors, and rising consumer inclination toward organic and eco-friendly production methods

- North America dominated Argentine wine market in 2024, due to strong import demand for premium Malbec and other Argentine varietals across the region

- Europe is expected to be the fastest growing region in the Argentine wine market during the forecast period due to the region’s established wine-drinking culture and rising preference for imported wines with distinctive profiles

- Red wine segment dominated the market with a market share of 61.9% in 2024, due to Argentina’s global reputation for producing high-quality Malbec, which remains the country’s flagship varietal. The strong export performance of Malbec and other red wines to key international markets such as the U.S., U.K., and Brazil further reinforces its leading position. Consumers also associate Argentine red wines with robust flavors, premium quality, and affordability, making them a preferred choice for both domestic and international consumption. Wineries continue to focus on innovation in red blends and sustainable vineyard practices, further cementing this segment’s dominance

Report Scope and Argentine Wine Market Segmentation

|

Attributes |

Argentine Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Argentine Wine Market Trends

“Rising High-Quality Wine Production”

- The Argentine wine market is gaining global recognition with a strong emphasis on producing high-quality wines that rival traditional European producers. Investments in advanced vineyard management, modern winemaking technologies, and sustainable farming practices are elevating the profile of Argentina as a premium wine exporter

- For instance, Catena Zapata has been instrumental in promoting Argentina’s Malbec on the global stage, shifting the country’s image from mass-market wine supplier to a producer of world-class vintages. Their focus on high-altitude vineyards has played a major role in enhancing quality and international reputation

- The increasing adoption of precision viticulture techniques is enabling Argentine winemakers to manage soil diversity, improve grape quality, and optimize vineyard output. These innovations are allowing Argentina to introduce wines with distinct character and terroir-driven appeal

- In addition, collaborations between local wineries and international investors have brought advanced knowledge and expertise into production processes. This has resulted in greater focus on aged varieties, elegant blends, and premiumization strategies across the global market

- Rising consumer preference for quality over quantity has positioned Argentine wines as attractive options in premium segments. Producers are focusing on exporting fewer but higher-value bottles to strengthen brand prestige and capture discerning consumers in key markets

- Altogether, the emphasis on quality has transformed Argentina’s wine sector into a globally competitive market. The steady shift from bulk production to high-end offerings ensures its continued role as a key player in international wine trade

Argentine Wine Market Dynamics

Driver

Rising Global Demand for Argentine Malbec and Premium Wines

- The global appetite for Malbec and premium Argentine wines is a key driver of market growth, driven by international recognition of taste, affordability, and distinct flavor profiles. Export markets are sustaining strong demand, particularly in North America and Europe

- For instance, Trapiche has expanded its international presence by offering premium Malbec and reserve wines across the United States and European markets. Their brands have captured attention for both affordability and consistent quality, enhancing Argentina’s export competitiveness

- The rising trend toward premium wine consumption is favoring Argentine producers as consumers worldwide opt for authentic and terroir-based experiences. Malbec, in particular, has become synonymous with Argentina, driving greater consumer loyalty to the category

- In addition, the growth of wine tourism in Mendoza is expanding Argentina’s wine identity globally. International tourists are directly experiencing the vineyards, strengthening brand awareness and enhancing global demand for bottled exports

- The convergence of premiumization, tourism, and global taste shifts positions Argentine wines as increasingly central in international markets. Strong demand for Malbec combined with diverse premium offerings ensures continued growth momentum for the national wine industry

Restraint/Challenge

Vulnerability to Climate Change Affecting Vineyard Yields

- The Argentine wine industry faces significant challenges due to vulnerability to climate change, which disrupts vineyard yields through irregular rainfall, frost, and rising temperatures. These climatic changes put pressure on both grape cultivation and overall production stability

- For instance, wineries in Mendoza and Patagonia have reported fluctuating yields linked to unpredictable weather patterns such as late frosts and drought conditions. Companies such as Bodega Norton have emphasized vineyard resilience practices, but climate variability continues to affect output

- Extreme weather events can reduce grape quality and alter flavor profiles, complicating the ability of winemakers to maintain consistency. This variability threatens export reliability, particularly in premium segments dependent on stable supply chains

- In addition, the need for increased irrigation due to drought conditions raises operational costs as water scarcity becomes more acute in cultivation regions. This places further financial pressure on wineries aiming to sustain quality and meet demand

- Addressing this challenge requires stronger investment in vineyard resilience, adaptive cultivation methods, and sustainable irrigation practices. Long-term strategies to mitigate climate risks will be vital to securing Argentina’s position in the global premium wine market

Argentine Wine Market Scope

The market is segmented on the basis of type, packaging, and distribution channel.

• By Type

On the basis of type, the Argentine wine market is segmented into red wine, white wine, and sparkling wine. The red wine segment dominated the largest market revenue share of 61.9% in 2024, owing to Argentina’s global reputation for producing high-quality Malbec, which remains the country’s flagship varietal. The strong export performance of Malbec and other red wines to key international markets such as the U.S., U.K., and Brazil further reinforces its leading position. Consumers also associate Argentine red wines with robust flavors, premium quality, and affordability, making them a preferred choice for both domestic and international consumption. Wineries continue to focus on innovation in red blends and sustainable vineyard practices, further cementing this segment’s dominance.

The sparkling wine segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for celebratory and lifestyle-oriented beverages. Growing urbanization, increasing young adult consumption, and rising wine culture adoption are fueling demand for sparkling wines across Argentina. In addition, local producers are investing in premiumization and experimenting with varieties beyond traditional champagne-style products, appealing to both domestic and export markets. The growth of wine tourism and pairing experiences in restaurants and events is further amplifying the demand for sparkling wines, positioning the segment as a key growth driver.

• By Packaging

On the basis of packaging, the Argentine wine market is segmented into bottles and casks. The bottles segment dominated the largest market revenue share in 2024, reflecting consumer preference for premium quality and the perception of bottled wine as superior in taste and presentation. Bottled wines are the standard choice for exports, where international buyers prioritize quality assurance and branding. The tradition of bottled wine consumption is deeply ingrained in Argentina, supported by a strong network of retail and hospitality outlets. Moreover, wineries are leveraging bottled packaging to highlight sustainability through lightweight glass and eco-friendly labels, reinforcing its dominance.

The casks segment is expected to witness the fastest growth rate from 2025 to 2032, driven by affordability, convenience, and growing demand among younger demographics and price-sensitive consumers. Cask packaging, often referred to as “bag-in-box,” offers longer shelf life after opening and appeals to households seeking casual, everyday wine consumption. Increasing acceptance of casks in supermarkets and off-trade channels is expanding accessibility and visibility. Wineries are also introducing higher-quality wines in cask formats, breaking the traditional stigma associated with lower-end quality, thereby accelerating its growth trajectory.

• By Distribution Channel

On the basis of distribution channel, the Argentine wine market is segmented into on-trade and off-trade. The off-trade segment held the largest market revenue share in 2024, supported by the dominance of supermarkets, hypermarkets, and wine specialty stores in Argentina. Consumers prefer off-trade purchases due to affordability, promotional offers, and the ability to explore a wide variety of brands and types. The strong presence of wine retail outlets across urban and semi-urban regions facilitates accessibility and reinforces consumer trust. Furthermore, rising e-commerce penetration is complementing the off-trade segment, allowing direct-to-consumer delivery options and subscription services.

The on-trade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing culture of dining out, premium wine experiences in restaurants, and the rise of wine bars in metropolitan cities. Increasing tourism in wine-producing regions such as Mendoza is boosting demand for on-trade sales, as visitors seek wine tastings and pairings at local wineries. On-trade channels also allow wineries to strengthen brand positioning by offering curated experiences, storytelling, and premium offerings. The shift toward experiential dining and social drinking culture is expected to accelerate this segment’s expansion in the coming years.

Argentine Wine Market Regional Analysis

- North America dominated the Argentine wine market with the largest revenue share in 2024, driven by strong import demand for premium Malbec and other Argentine varietals across the region

- Consumers in North America highly value the bold flavor profiles, affordability, and premium quality of Argentine wines, particularly Malbec, which has become a household name in the region

- The dominance is further reinforced by the wide presence of Argentine wines in supermarkets, wine specialty stores, and restaurants, alongside the rapid expansion of e-commerce and wine subscription platforms, making them easily accessible to consumers

U.S. Argentine Wine Market Insight

The U.S. accounted for the largest revenue share in the North American market in 2024, fueled by the rising popularity of imported wines and the growing culture of casual dining and wine pairings. Malbec has become one of the fastest-growing imported wine categories in the U.S., supported by promotional campaigns, wine clubs, and its affordability compared to French or Italian alternatives. Increasing online retail penetration and subscription-based wine delivery services are further boosting Argentine wine sales in the U.S.

Europe Argentine Wine Market Insight

The Europe wine market is projected to expand at the fastest CAGR during the forecast period, driven by the region’s established wine-drinking culture and rising preference for imported wines with distinctive profiles. Argentine wines, particularly Malbec, are gaining popularity in the U.K., Germany, and Spain, supported by strong distribution networks across both on-trade and off-trade channels. The growing demand for sustainable, organic, and fair-trade wines aligns with Argentina’s evolving production practices, further accelerating European adoption.

U.K. Argentine Wine Market Insight

The U.K. is anticipated to grow significantly as one of the leading importers of Argentine wines, fueled by the rising popularity of Malbec in both on-trade venues such as wine bars and restaurants, and off-trade channels through supermarkets and e-commerce. Affordable premium positioning continues to make Argentine wines a strong competitor against European offerings.

Germany Argentine Wine Market Insight

Germany is expected to witness robust growth, driven by consumer interest in organic and sustainable wines. The country’s retail-dominated wine market and its strong preference for affordable imports make it a favorable destination for Argentine wine producers seeking long-term growth opportunities.

South America Argentine Wine Market Insight

South America retained a substantial share in 2024, anchored by Argentina’s dominant production and consumption base. The deep-rooted wine culture in Argentina, coupled with favorable climatic conditions in Mendoza and San Juan, underpins the region’s significance. Strong export infrastructure and growing wine tourism also contribute to the market’s steady performance within South America.

Argentina Wine Market Insight

Argentina accounted for 88% of the South American market in 2024, supported by its role as the largest wine producer and exporter in the region. Its global leadership in Malbec production, combined with growing premiumization trends and sustainable vineyard practices, reinforces Argentina’s central position in both domestic and international markets.

Argentine Wine Market Share

The Argentine wine industry is primarily led by well-established companies, including:

- Catena Zapata (Argentina)

- Norton (Argentina)

- Susana Balbo (Argentina)

- Salentein (Argentina)

- Trapiche Argentina (Argentina)

- Alamos (Argentina)

- Zuccardi Valle de Uco. (Argentina)

- Chandon Argentina (Argentina)

- El Enemigo(Argentina),

- Finca El Origen (Argentina)

- La Posta (Argentina)

- LN Consulting (Argentina)

- Casarena (Argentina)

- Los Haroldos. Mendoza, Argentina (Argentina)

Latest Developments in Argentine Wine Market

- In April 2023, Provi, a leading online marketplace for beverage alcohol, introduced new product features designed to enhance the efficiency of the three-tier system. This move significantly impacts the wine market by improving the way distributors, retailers, and producers collaborate, ultimately streamlining procurement and distribution. By leveraging advanced digital solutions, Provi helps stakeholders minimize delays, reduce costs, and increase transparency across the supply chain, thereby strengthening the overall efficiency and competitiveness of the wine industry

- In March 2023, Ferrari Trento unveiled three new wines to commemorate major races in Las Vegas, Zandvoort, and Imola. This launch underscores the growing synergy between premium wine brands and lifestyle marketing, enhancing brand visibility among motorsport enthusiasts and luxury consumers. By linking fine wine with global sporting events, Ferrari Trento has positioned itself as a lifestyle brand that extends beyond traditional wine appreciation, creating new avenues for brand recognition and consumer engagement in international markets

- In September 2021, Familia Torres unveiled the latest vintage of their Antología Miguel Torres wine collection, showcasing their dedication to regenerative viticulture and sustainability. This initiative reinforced the winery’s leadership in sustainable winemaking, encouraging wider adoption of environmentally responsible practices in the global wine market. By aligning with consumer demand for eco-conscious products, Familia Torres elevated its brand reputation and also set a precedent for integrating climate action into premium wine production

- In July 2021, E. & J. Gallo Winery Group announced the launch of "The Language of Yes" collection in collaboration with Randall Grahm. This partnership introduced innovative, Southern France–inspired wines to the market, highlighting a blend of tradition and creativity. The collaboration strengthened Gallo’s premium portfolio and attracted a segment of consumers seeking authentic, artisanal-style wines, reinforcing the trend of diversification in product offerings within the global wine industry

- In May 2021, Concha y Toro introduced its Bonterra Organic Collection to key international markets, emphasizing organic production and sustainable farming practices. This development impacted the market by broadening the availability of certified organic wines, catering to the growing global demand for health-conscious and environmentally friendly beverages. By scaling organic offerings across multiple regions, Concha y Toro reinforced sustainability as a major growth driver in the modern wine industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.