Global Arrhythmia Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.93 Billion

USD

9.97 Billion

2024

2032

USD

5.93 Billion

USD

9.97 Billion

2024

2032

| 2025 –2032 | |

| USD 5.93 Billion | |

| USD 9.97 Billion | |

|

|

|

|

Arrhythmia Monitoring Devices Market Size

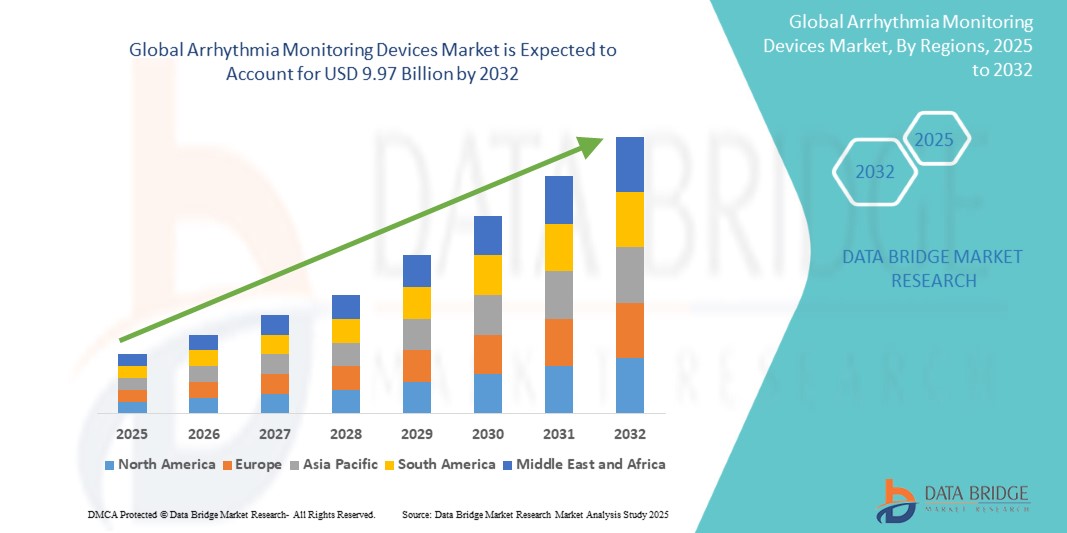

- The global arrhythmia monitoring devices market size was valued at USD 5.93 billion in 2024 and is expected to reach USD 9.97 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, particularly atrial fibrillation and other arrhythmias, coupled with the growing aging population, which demands effective monitoring solutions for early diagnosis and timely intervention

- Furthermore, rising adoption of advanced, user-friendly, and portable arrhythmia monitoring devices, along with integration of digital health technologies such as AI-driven analytics and remote monitoring platforms, is establishing these devices as a critical component of modern cardiac care. These converging factors are accelerating the uptake of arrhythmia monitoring solutions, thereby significantly boosting the industry’s growth.

Arrhythmia Monitoring Devices Market Analysis

- Arrhythmia monitoring devices, which enable continuous or intermittent tracking of abnormal heart rhythms, are becoming essential in modern cardiology due to their ability to support early diagnosis, improve patient outcomes, and reduce the risk of severe cardiac events through timely medical intervention

- The growing demand for arrhythmia monitoring devices is primarily driven by the increasing prevalence of cardiovascular disorders, technological advancements in wearable and implantable cardiac monitoring solutions, and a rising focus on preventive healthcare and remote patient monitoring

- North America dominated the arrhythmia monitoring devices market with the largest revenue share of 39.8% in 2024, supported by advanced healthcare infrastructure, high adoption of digital health technologies, and the strong presence of leading manufacturers, with the U.S. witnessing significant growth due to increasing awareness, reimbursement coverage, and integration of AI-powered cardiac monitoring solutions

- Asia-Pacific is expected to be the fastest-growing region in the arrhythmia monitoring devices market during the forecast period, fueled by rapid urbanization, rising disposable incomes, growing healthcare expenditure, and government initiatives promoting early detection of cardiovascular diseases

- The Electrocardiogram (ECG) Monitors segment dominated the arrhythmia monitoring devices market with the largest revenue share of 38.6% in 2024, owing to their widespread adoption in both hospital and outpatient settings for real-time arrhythmia detection. ECG monitors remain the standard diagnostic tool for identifying irregular heart rhythms due to their accuracy, accessibility, and integration with digital health platforms

Report Scope and Arrhythmia Monitoring Devices Market Segmentation

|

Attributes |

Arrhythmia Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Arrhythmia Monitoring Devices Market Trends

Enhanced Convenience Through Remote and Wearable Monitoring

- A significant and accelerating trend in the global arrhythmia monitoring devices market is the growing adoption of compact, wearable, and remote monitoring solutions such as Holter monitors, event recorders, and patch-based ECG devices. These technologies are enhancing patient convenience by enabling continuous rhythm tracking without disrupting daily activities

- For instance, the Zio XT patch by iRhythm Technologies provides up to 14 days of continuous ECG monitoring in a discreet, lightweight format, improving patient compliance and diagnostic accuracy. Similarly, Medtronic’s Reveal LINQ Insertable Cardiac Monitor allows long-term monitoring with minimally invasive implantation, offering physicians valuable insights into infrequent but potentially dangerous arrhythmias

- Advancements in arrhythmia monitoring devices include extended battery life, wireless data transmission, and user-friendly mobile applications that allow real-time data sharing with healthcare professionals. These features are significantly improving early detection and enabling faster clinical decision-making

- The seamless integration of arrhythmia monitoring devices with telehealth platforms and hospital information systems is also reshaping cardiac care delivery. Patients can now transmit ECG data remotely, reducing the need for frequent in-person visits while ensuring timely interventions

- This trend toward more convenient, accessible, and patient-centric monitoring solutions is fundamentally reshaping expectations in cardiology care. Consequently, companies such as Abbott, Philips, and GE Healthcare are developing advanced arrhythmia monitoring devices with enhanced accuracy, ease of use, and long-term reliability

- The demand for user-friendly arrhythmia monitoring devices that support remote diagnostics and long-term continuous monitoring is growing rapidly across hospitals, ambulatory care centers, and home healthcare settings, as patients and providers increasingly prioritize convenience and preventive care

Arrhythmia Monitoring Devices Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Disease Burden and Remote Monitoring Adoption

- The increasing prevalence of cardiovascular diseases (CVDs), including atrial fibrillation and other arrhythmias, coupled with the accelerating adoption of remote patient monitoring solutions, is a significant driver for the heightened demand for arrhythmia monitoring devices

- For instance, in March 2024, Abbott announced the FDA approval of its new Assert-IQ insertable cardiac monitor (ICM), designed to provide long-term continuous arrhythmia monitoring with Bluetooth-enabled connectivity. Such product launches are expected to drive the growth of the arrhythmia monitoring devices industry in the forecast period

- As patients and healthcare providers become more aware of the importance of early detection of cardiac abnormalities, arrhythmia monitoring devices are offering advanced features such as long-term ECG tracking, wireless data transmission, and real-time clinical reporting, providing a compelling upgrade over traditional diagnostic methods

- Furthermore, the growing popularity of telehealth and home-based care is making arrhythmia monitoring devices an integral part of remote healthcare ecosystems, offering seamless integration with hospital information systems and physician dashboards

- The convenience of continuous rhythm monitoring, timely detection of irregular heartbeats, and the ability to share ECG data with physicians via smartphone applications are key factors propelling the adoption of arrhythmia monitoring devices in hospitals, ambulatory care centers, and home healthcare. The trend towards wearable and minimally invasive devices, combined with increasing patient awareness, further contributes to market growth

Restraint/Challenge

Concerns Regarding Data Privacy, Accuracy, and High Initial Costs

- Concerns surrounding the data privacy and security vulnerabilities of connected healthcare devices, including arrhythmia monitoring systems, pose a significant challenge to broader market penetration. As these devices rely on network connectivity and cloud-based platforms, they are susceptible to potential data breaches, raising anxieties among patients and providers about the confidentiality of sensitive health information

- For instance, reports of vulnerabilities in connected medical devices have made some healthcare organizations cautious about rapid adoption of remote monitoring solutions without robust cybersecurity frameworks in place

- Addressing these concerns through compliance with strict data protection regulations (such as HIPAA and GDPR), the use of advanced encryption protocols, and regular software updates is crucial for building trust among patients and healthcare providers

- In addition, the relatively high initial cost of advanced arrhythmia monitoring devices compared to traditional ECG methods can be a barrier to adoption for healthcare systems in developing regions or cost-sensitive markets. While basic Holter monitors remain affordable, newer technologies such as implantable loop recorders and AI-enabled wearables often come with a higher price tag

- While prices are gradually declining due to increased competition and technological advancements, the perceived premium of these devices can still hinder widespread adoption, particularly in resource-limited settings

- Overcoming these challenges through government reimbursement programs, affordable device models, and improved cybersecurity measures will be vital for sustained market growth

Arrhythmia Monitoring Devices Market Scope

The market is segmented on the basis of type, application and end user.

• By Type

On the basis of type, the arrhythmia monitoring devices market is segmented into electrocardiogram (ECG) monitors, implantable monitors, holter monitors, and mobile cardiac telemetry. The electrocardiogram (ECG) monitors segment dominated the market with the largest revenue share of 38.6% in 2024, owing to their widespread adoption in both hospital and outpatient settings for real-time arrhythmia detection. ECG monitors remain the standard diagnostic tool for identifying irregular heart rhythms due to their accuracy, accessibility, and integration with digital health platforms.

The mobile cardiac telemetry (MCT) segment is projected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by increasing demand for continuous, remote patient monitoring and the integration of AI-powered analytics. MCT devices are particularly gaining traction among physicians for their ability to provide detailed diagnostic reports over extended periods, reducing hospital visits and enabling personalized treatment.

• By Application

On the basis of application, the arrhythmia monitoring devices market is segmented into tachycardia, bradycardia, atrial fibrillation, ventricular fibrillation, premature contraction, and others. The atrial fibrillation (AFib) segment accounted for the largest market revenue share of 34.7% in 2024, due to the rising global prevalence of AFib as the most common type of arrhythmia, especially among the elderly population. Increasing clinical focus on stroke prevention through early AFib detection has further fueled demand for continuous monitoring devices.

The ventricular fibrillation segment is expected to register the fastest CAGR of 20.5% from 2025 to 2032, as timely detection of life-threatening ventricular arrhythmias becomes critical in reducing mortality rates. Advancements in implantable monitors and wearable telemetry devices are supporting the adoption of these solutions for emergency cardiac care.

• By End-User

On the basis of end-user, the arrhythmia monitoring devices market is segmented into hospitals and diagnostic centers, and ambulatory centers. The hospitals and diagnostic centers segment held the largest market revenue share of 59.2% in 2024, attributed to the availability of advanced cardiac monitoring infrastructure, skilled cardiologists, and integration of monitoring devices with hospital EMR systems. Hospitals remain the primary hub for early diagnosis, treatment, and long-term arrhythmia management.

The ambulatory centers segment is anticipated to expand at the fastest CAGR of 19.1% from 2025 to 2032, driven by the shift toward outpatient and home-based cardiac monitoring. The rising need for cost-effective, portable, and patient-friendly devices is boosting adoption in ambulatory and remote care settings, aligning with the global trend of decentralized healthcare delivery.

Arrhythmia Monitoring Devices Market Regional Analysis

- North America dominated the arrhythmia monitoring devices market with the largest revenue share of 39.8% in 2024, supported by advanced healthcare infrastructure, high adoption of digital health technologies, and the strong presence of leading manufacturers

- The U.S. witnessed significant growth driven by increasing awareness of cardiac health, favorable reimbursement coverage

- The integration of AI-powered arrhythmia monitoring solutions into clinical practice

U.S. Arrhythmia Monitoring Devices Market Insight

The U.S. arrhythmia monitoring devices market captured the largest revenue share of 77% in 2024 within North America, fueled by the widespread adoption of wearable ECG devices, implantable loop recorders, and remote patient monitoring platforms. Rising cardiovascular disease prevalence, combined with government incentives for digital health adoption, is further accelerating growth. Increasing collaborations between healthcare providers and technology companies to develop AI-based diagnostic tools is also a key driver of the U.S. market.

Europe Arrhythmia Monitoring Devices Market Insight

The Europe arrhythmia monitoring devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising incidences of atrial fibrillation, supportive government initiatives for early disease detection, and strong demand for home-based cardiac monitoring solutions. European healthcare systems are increasingly investing in advanced monitoring technologies to reduce hospital readmissions and improve patient outcomes.

U.K. Arrhythmia Monitoring Devices Market Insight

The U.K. arrhythmia monitoring devices market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service’s (NHS) emphasis on preventive healthcare and remote monitoring. The increasing prevalence of heart rhythm disorders, coupled with strong patient awareness campaigns, is encouraging higher adoption of portable ECG devices and long-term monitoring solutions.

Germany Arrhythmia Monitoring Devices Market Insight

The Germany arrhythmia monitoring devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust healthcare system, strong focus on medical innovation, and a growing aging population prone to cardiovascular disorders. The demand for advanced implantable cardiac monitors and patch-based ECG devices is particularly strong in Germany, supported by favorable reimbursement policies and an emphasis on data security.

Asia-Pacific Arrhythmia Monitoring Devices Market Insight

The Asia-Pacific arrhythmia monitoring devices market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, rising disposable incomes, growing healthcare expenditure, and government initiatives promoting digital health and early detection of cardiovascular diseases. Countries such as China, Japan, and India are witnessing a surge in the adoption of wearable cardiac monitoring devices, supported by expanding healthcare access and local manufacturing capabilities.

Japan Arrhythmia Monitoring Devices Market Insight

The Japan arrhythmia monitoring devices market is gaining momentum due to the country’s advanced medical technology ecosystem, high prevalence of atrial fibrillation among the elderly, and strong government focus on remote healthcare solutions. Japan’s aging population is a major factor driving demand for long-term cardiac monitoring devices, while hospitals and clinics are increasingly adopting wireless ECG systems and AI-enabled diagnostic tools.

China Arrhythmia Monitoring Devices Market Insight

The China arrhythmia monitoring devices market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and government-backed healthcare reforms. China’s strong domestic manufacturing base, coupled with its rapid adoption of digital health solutions, is making arrhythmia monitoring devices more affordable and accessible. The push towards smart hospitals and smart city initiatives is further fueling demand for advanced cardiac monitoring solutions.

Arrhythmia Monitoring Devices Market Share

The arrhythmia monitoring devices industry is primarily led by well-established companies, including:

- iRhythm Technologies, Inc. (U.S.)

- Medi-Lynx Cardiac Monitoring, LLC. (U.S.)

- AliveCor, Inc. (U.S.)

- B-Secur (U.K.)

- CardioComm Solutions Inc. (Canada)

- General Electric Company (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Baxter (U.S.)

- Biotronik (Germany)

- OSI Systems, Inc. (U.S.)

- FUKUDA DENSHI (Japan)

- BioTelemetry (U.S.)

- Spacelabs Healthcare (U.S.)

Latest Developments in Global Arrhythmia Monitoring Devices Market

- In February 2021, Philips announced the completion of its acquisition of BioTelemetry, Inc., a U.S.-based leader in cardiac diagnostics and remote monitoring. This strategic move significantly expanded Philips’ capabilities in remote arrhythmia detection, ambulatory ECG, and cardiac data analytics, strengthening its position in the growing digital health and connected care market

- In July 2022, iRhythm Technologies secured FDA 510(k) clearance for its ZEUS System, which works with the Zio Watch (developed in collaboration with Verily). The system enables detection and characterization of atrial fibrillation (AFib), supporting both physicians and patients with accurate long-term monitoring capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.