Global Artificial Blood Substitutes Market

Market Size in USD Million

CAGR :

%

USD

9.66 Million

USD

42.69 Million

2024

2032

USD

9.66 Million

USD

42.69 Million

2024

2032

| 2025 –2032 | |

| USD 9.66 Million | |

| USD 42.69 Million | |

|

|

|

|

Artificial Blood Substitutes Market Size

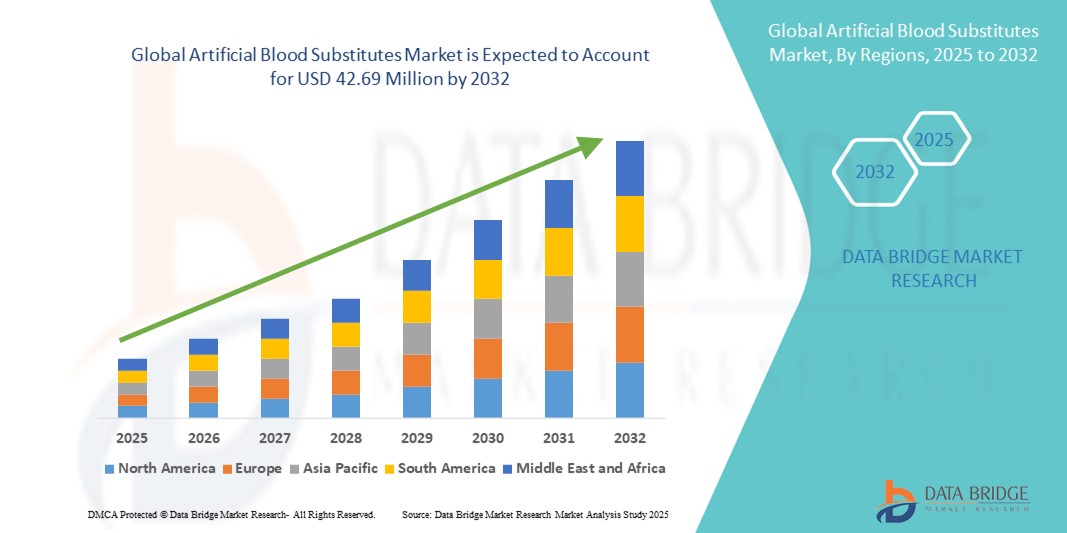

- The global artificial blood substitutes market size was valued at USD 9.66 million in 2024 and is expected to reach USD 42.69 million by 2032, at a CAGR of 20.40% during the forecast period

- The market growth is primarily driven by the increasing demand for artificial blood substitutes due to rising prevalence of blood-related disorders, surgical procedures, trauma cases, and chronic anemia across the globe. Advancements in biotechnology and ongoing research to develop safer, more effective blood alternatives are further propelling market expansion

- Furthermore, the growing focus on reducing dependency on donor blood, addressing shortages, and ensuring readily available blood products in emergency and surgical settings is boosting adoption of artificial blood substitutes. Supportive regulatory approvals, clinical trials, and investments in next-generation hemoglobin-based oxygen carriers and platelet substitutes are accelerating industry growth

Artificial Blood Substitutes Market Analysis

- Artificial Blood Substitutes, designed to mimic the oxygen-carrying function of human blood, are increasingly critical in modern healthcare, particularly for trauma care, surgeries, and chronic anemia management, due to their ability to overcome blood supply shortages, reduce infection risks, and provide longer shelf life compared to donor blood

- The escalating demand for artificial blood substitutes is primarily driven by rising global blood shortages, increasing surgical procedures, growing prevalence of chronic anemia and hemorrhagic conditions, and technological advancements in hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based solutions

- North America dominated the artificial blood substitutes market with the largest revenue share of 38.65% in 2024, supported by advanced healthcare infrastructure, high adoption rates of novel therapies, favourable regulatory frameworks, and the strong presence of leading pharmaceutical and biotech companies. The U.S. is witnessing substantial growth due to increased trauma cases, rising demand for emergency care solutions, and advancements in next-generation oxygen therapeutics

- Asia-Pacific is expected to be the fastest-growing region in the artificial blood substitutes market during the forecast period, fueled by rapid urbanization, rising disposable incomes, expanding healthcare access, and government initiatives promoting blood safety and early intervention for critical care

- The Hemoglobin-Based Oxygen Carriers (HBOCs) segment dominated the artificial blood substitutes market with a share of 61% in 2024, attributable to their well-established clinical applications, superior oxygen-carrying efficiency, and seamless integration with existing transfusion protocols

Report Scope and Artificial Blood Substitutes Market Segmentation

|

Attributes |

Artificial Blood Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Blood Substitutes Market Trends

Rising Adoption of Artificial Blood Substitutes in Critical Care and Surgery

- A significant and accelerating trend in the global artificial blood substitutes market is the increasing adoption of these products in emergency care, trauma management, and surgical procedures. Hospitals and clinics are turning to substitutes such as Hemoglobin-Based Oxygen Carriers (HBOCs) and Perfluorocarbons (PFCs) to address blood shortages and improve patient outcomes during critical interventions

- For instance, in major Asia-Pacific and U.S. hospitals, artificial blood substitutes are being integrated into trauma units and surgical theaters to ensure immediate oxygen delivery when donor blood is unavailable, minimizing delays and reducing risks of transfusion-transmitted infections

- The use of artificial blood substitutes also supports elective and high-risk surgeries where blood loss is anticipated. Products like OxyVita and Hemoglobin Oxygen Therapeutics provide oxygen-carrying capabilities that maintain tissue perfusion, reduce complications, and improve recovery times

- The expansion of hospital and clinical adoption is complemented by growing investments in research and development for synthetic and recombinant blood products. These innovations focus on increasing safety, extending shelf life, and improving oxygen delivery efficiency, making substitutes more reliable and broadly applicable

- This trend towards widespread clinical integration of artificial blood substitutes is fundamentally reshaping transfusion practices, particularly in regions facing chronic blood supply shortages. As a result, manufacturers are increasingly collaborating with hospitals, research institutes, and government health programs to expand availability and streamline regulatory approvals

- The demand for artificial blood substitutes is rising rapidly across both developed and emerging markets, driven by the need for safer, more accessible, and efficient alternatives to donor blood in critical care, surgical, and neonatal applications

Artificial Blood Substitutes Market Dynamics

Driver

Growing Need Due to Blood Shortages and Expanding Clinical Applications

- The increasing prevalence of blood shortages worldwide, coupled with the rising demand for safe and effective alternatives in critical care, surgeries, and emergency medicine, is a significant driver for the heightened adoption of Artificial Blood Substitutes

- For instance, hospitals and trauma centers across Asia-Pacific and North America are increasingly integrating Hemoglobin-Based Oxygen Carriers (HBOCs) and Perfluorocarbons (PFCs) into transfusion protocols to address donor blood scarcity, particularly in regions with limited voluntary blood donations. Such strategies by leading healthcare providers are expected to drive Artificial Blood Substitutes market growth in the forecast period

- As healthcare facilities become more aware of the risks associated with donor blood—such as transfusion-transmitted infections, compatibility issues, and short shelf life—artificial blood substitutes offer safe, readily available oxygen-carrying alternatives that reduce dependency on donor supplies

- Furthermore, the expanding use of these substitutes in neonatal care, organ transplantation, trauma management, and elective surgeries is increasing their clinical relevance, prompting hospitals and blood banks to incorporate them into routine protocols

- The ease of storage, longer shelf life, and reduced risk of immune reactions compared to donor blood products are key factors propelling the adoption of Artificial Blood Substitutes across hospitals, clinics, and research institutions globally

Restraint/Challenge

Concerns Regarding Regulatory Approval and High Costs

- Regulatory hurdles surrounding safety, efficacy, and clinical approval of Artificial Blood Substitutes pose a significant challenge to wider market penetration. Each product requires rigorous clinical trials, regulatory scrutiny, and compliance with stringent guidelines before widespread adoption

- For instance, the approval timelines for Hemoglobin-Based Oxygen Carriers (HBOCs) in several countries have delayed market entry, making some healthcare providers hesitant to adopt these solutions immediately

- Addressing these regulatory concerns through robust clinical evidence, transparent safety data, and alignment with national and international health authorities is crucial for building institutional trust

- In addition, the relatively high initial cost of Artificial Blood Substitutes compared to conventional blood products can act as a barrier to adoption, particularly for smaller hospitals, clinics, or blood banks in developing regions. While ongoing R&D and scaled production are gradually reducing costs, premium-priced products for specialized applications such as neonatal care or organ transplantation remain a challenge

- Overcoming these challenges through faster regulatory approvals, improved manufacturing efficiency, and cost optimization will be vital for sustained growth and broader market adoption of Artificial Blood Substitutes

Artificial Blood Substitutes Market Scope

The market is segmented on the basis of product type, source, application, and end-user.

- By Product Type

On the basis of product type, the artificial blood substitutes market is segmented into Perfluorocarbons (PFCs) and Hemoglobin-Based Oxygen Carriers (HBOCs). The Hemoglobin-Based Oxygen Carriers (HBOCs) segment dominated the market with a share of 61% in 2024, attributable to their well-established clinical applications, superior oxygen-carrying efficiency, and seamless integration with existing transfusion protocols. HBOCs are widely employed in emergency medicine, complex surgical interventions, and for patients with chronic anemia, as they ensure rapid and reliable oxygen delivery while maintaining a longer shelf life compared to conventional blood products. These substitutes are also valued for their versatility in critical care settings, making them a preferred choice among healthcare providers.

The Perfluorocarbons (PFCs) segment is projected to witness the fastest CAGR of 8.5% from 2025 to 2032, driven by technological advancements in synthetic oxygen carriers, increasing investments in research and development, and expanding adoption in trauma care, critical care units, and other medical scenarios where efficient oxygen transport is essential for patient survival and recovery.

- By Source

On the basis of source, the artificial blood substitutes market is segmented into Human Blood, Animal Blood, Microorganism-Based Recombinant Hemoglobin, Synthetic Polymers, and Stem Cells. The human blood-derived substitutes held the largest revenue share of 47% in 2024, largely due to their high oxygen-carrying capacity, established clinical safety profile, and widespread acceptance in traditional transfusion practices. These substitutes are extensively utilized in emergency medicine, surgeries, and chronic anemia management, offering reliable and predictable oxygen delivery.

Meanwhile, microorganism-based recombinant hemoglobin and synthetic polymer sources are expected to experience the fastest growth during the forecast period, fueled by innovations in bioengineering and synthetic biology. Such advancements enable scalable and cost-effective production of artificial blood substitutes while minimizing immunogenic risks, making them increasingly attractive for broader clinical adoption. Stem cell-derived substitutes are also gaining momentum due to their regenerative potential, compatibility with personalized medicine, and prospects for long-term therapeutic applications.

- By Application

On the basis of application, the artificial blood substitutes market is segmented into cardiovascular diseases, malignant neoplasms, injuries, neonatal conditions, organ transplant, and maternal conditions. The cardiovascular diseases segment dominated the market with a market share of 36% in 2024, driven by the rising prevalence of heart failure, ischemic disorders, and complex surgical procedures that necessitate effective oxygen delivery. These substitutes are crucial in maintaining tissue oxygenation during cardiovascular surgeries and critical care management.

The organ transplant and neonatal conditions segments are projected to witness the fastest CAGRs of 10.2% and 9.8%, respectively, from 2025 to 2032, supported by technological advancements in oxygen therapeutics, increasing awareness of transfusion alternatives, and the growing complexity of surgical interventions requiring temporary or supplemental oxygen carriers. Additionally, the adoption of artificial blood substitutes in neonatal care ensures safer management of preterm and critically ill infants, while in organ transplants, they enhance patient outcomes by maintaining oxygenation in high-risk procedures.

- By End-User

On the basis of end-user, the artificial blood substitutes market is segmented into hospitals and clinics, blood banks, and others. Hospitals and clinics dominated the market with an share of 65% in 2024, reflecting the consistently high demand for artificial blood substitutes in surgical procedures, trauma management, and the treatment of chronic anemia. These facilities rely on artificial blood substitutes to maintain patient oxygenation during complex interventions and to ensure a reliable supply for emergency cases.

The Blood Banks segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032, driven by the increasing integration of artificial blood substitutes into emergency preparedness programs, their use as alternatives for rare blood types, and expanding adoption across both national and regional blood supply networks. Additionally, blood banks are leveraging these substitutes to reduce dependency on conventional donations and improve readiness for high-demand situations. The “Others” segment, which includes research institutions, specialized healthcare facilities, and clinical trial centers, is also playing an increasingly important role by advancing innovation, supporting product development, and fostering the adoption of artificial blood substitutes in niche and experimental applications.

Artificial Blood Substitutes Market Regional Analysis

- North America dominated the artificial blood substitutes market with the largest revenue share of 38.65% in 2024, supported by its advanced healthcare infrastructure, high adoption rates of novel therapies, favorable regulatory frameworks

- The strong presence of leading pharmaceutical and biotech companies

- Furthermore, growing awareness of the risks associated with donor blood shortages and the adoption of artificial blood substitutes in critical care, surgical procedures, and organ transplantation are contributing to the region’s market dominance

U.S. Artificial Blood Substitutes Market

The U.S. artificial blood substitutes market is expected to witness steady growth over the forecast period, supported by advanced healthcare infrastructure, high prevalence of trauma and surgical procedures, and strong focus on transfusion safety. Hospitals and emergency care centers across the U.S. are increasingly adopting artificial blood substitutes for critical applications such as cardiovascular surgeries, oncology treatments, and trauma management. Furthermore, ongoing clinical research, government initiatives promoting blood safety, and favorable insurance reimbursement policies are driving widespread acceptance and adoption of these substitutes, reinforcing the U.S. as a key market in North America.

Europe Artificial Blood Substitutes Market Insight

The Europe artificial blood substitutes market is projected to expand steadily over the forecast period, driven by well-established healthcare systems, stringent regulatory standards for transfusion safety, and rising investment in advanced therapeutic solutions. Countries such as Germany, France, and the U.K. are witnessing higher adoption of artificial blood substitutes in hospital settings, particularly for cardiovascular emergencies, oncology care, and neonatal interventions. Increasing research initiatives, public awareness campaigns on blood safety, and favorable reimbursement policies are further supporting market growth in the region.

U.K. Artificial Blood Substitutes Market Insight

The U.K. artificial blood substitutes market is expected to grow at a notable CAGR during the forecast period, propelled by increasing focus on patient safety, hospital preparedness, and emergency care management. Rising adoption of hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based blood substitutes in surgical procedures and trauma care is accelerating market growth. Furthermore, the U.K.’s advanced healthcare infrastructure and strong emphasis on clinical innovation are contributing to the adoption of artificial blood substitutes across both public and private hospitals.

Germany Artificial Blood Substitutes Market Insight

The Germany artificial blood substitutes market is anticipated to expand significantly, driven by a well-developed healthcare system, high adoption of advanced medical technologies, and robust R&D investments in next-generation oxygen therapeutics. Increasing demand for blood substitutes in critical care, surgeries, and organ transplantation, along with government initiatives promoting blood safety, are key factors fueling market growth. Moreover, Germany’s strong pharmaceutical and biotech ecosystem enables early adoption of innovative therapies, reinforcing the region’s market position.

Asia-Pacific Artificial Blood Substitutes Market Insight

The Asia-Pacific artificial blood substitutes market is expected to witness the fastest CAGR during the forecast period, fueled by rapid urbanization, rising disposable incomes, expanding healthcare access, and increasing government initiatives to promote blood safety and early intervention for critical care. Countries such as China, India, and Japan are emerging as key markets due to growing investments in hospital infrastructure, increased trauma and surgical cases, and a rising focus on improving emergency care outcomes. The region also benefits from increasing domestic production capabilities for artificial blood substitutes, enhancing affordability and accessibility across hospitals, clinics, and blood banks.

Japan Artificial Blood Substitutes Market Insight

The Japan artificial blood substitutes market is gaining momentum due to the country’s highly advanced healthcare infrastructure, increasing geriatric population, and rising demand for efficient emergency care solutions. Artificial blood substitutes are being increasingly integrated into trauma care, surgical procedures, and neonatal interventions. The government’s focus on blood safety and hospital preparedness, combined with technological advancements in next-generation oxygen therapeutics, is supporting market growth.

China Artificial Blood Substitutes Market Insight

The China artificial blood substitutes market accounted for the largest market revenue share within Asia-Pacific in 2024, supported by the country’s rapidly expanding healthcare infrastructure, increasing patient pool, and high prevalence of trauma and surgical cases. Government initiatives to enhance blood safety, rising investments in hospitals, and the growing focus on early intervention and critical care management are driving the adoption of artificial blood substitutes. In addition, domestic manufacturers are expanding production capabilities, making these therapies more accessible and affordable across urban and semi-urban hospitals and clinics.

Artificial Blood Substitutes Market Share

The artificial blood substitutes industry is primarily led by well-established companies, including:

- Aurum Biosciences (U.K.)

- HEMARINA (France)

- Hemoglobin Oxygen Therapeutics LLC (U.S.)

- KaloCyte, Inc. (U.S.)

- SpheriTech Ltd. (U.K.)

- Centrum Medyczne VisusMed (Poland)

- OPKO Health, Inc. (U.S.)

- NuvOx Therapeutics (U.S.)

- Prolong Pharmaceuticals, LLC (U.S.)

- GC Corp. (South Korea)

- NanoBlood LLC (U.S.)

- Scarlet Therapeutics Limited (U.S.)

- Vivosang (U.S.)

Latest Developments in Global Artificial Blood Substitutes Market

- In June 2025, researchers in Japan announced the development of a universal artificial blood product that can be stored for several years, addressing key challenges in blood supply and storage. This virus-free artificial blood aims to enhance emergency and remote medical care by providing a reliable and widely applicable blood substitute

- In February 2025, researchers at North Carolina State University and the University of North Carolina at Chapel Hill developed synthetic blood platelets made from hydrogel nanoparticles. These artificial platelets can be freeze-dried and rehydrated, making them easier to store and transport, potentially serving alongside natural platelets in emergencies, rural hospitals, or battlefields

- In June 2025, Brandeis University joined a pioneering effort to develop artificial blood, aiming to transform the future of emergency medicine, surgery, and trauma care. This collaboration reflects the growing interest and investment in artificial blood research

- In February 2023, Case Western Reserve University played a primary role in a USD46.4 million federally funded project to develop a freeze-dried blood substitute. This project aims to create a product with the potential to save thousands of lives in trauma situations.

- In November 2021, researchers at Stanford Blood Center discussed the challenges and progress in developing artificial blood substitutes. They highlighted the potential of synthetic blood to address blood shortages and improve patient care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.