Global Artificial Fur Market

Market Size in USD Million

CAGR :

%

USD

288.34 Million

USD

1,124.94 Million

2024

2032

USD

288.34 Million

USD

1,124.94 Million

2024

2032

| 2025 –2032 | |

| USD 288.34 Million | |

| USD 1,124.94 Million | |

|

|

|

Artificial Fur Market Size

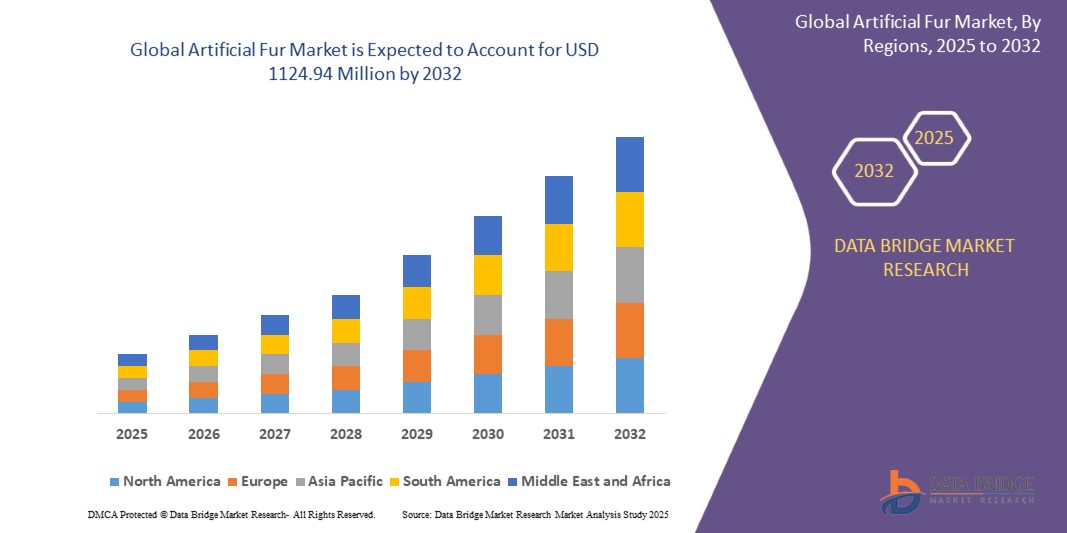

- The global Artificial Fur market was valued at USD 288.34 million in 2024 and is expected to reach USD 1124.94 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 18.55%, primarily driven by rising demand for sustainable and cruelty-free fashion

- This growth is driven by increasing consumer awareness about animal welfare and stringent regulatory policies restricting real fur usage

Artificial Fur Market Analysis

- Artificial Fur has gained widespread popularity due to the rising demand for sustainable fashion, increasing awareness of animal welfare, and advancements in textile technology. Modern innovations, such as plant-based fibers and biodegradable materials, have made artificial fur a preferred alternative in fashion, home décor, and automotive upholstery, boosting market growth

- The demand for artificial fur is significantly driven by stringent regulatory restrictions on real fur, growing adoption by luxury fashion brands, and an increasing shift toward eco-friendly consumer products

- North America dominates the Artificial Fur market, primarily due to strong consumer preference for ethical fashion, government support for sustainability policies, and the presence of leading apparel brands promoting fur-free collections

- For instance, in 2023, Stella McCartney launched a new collection of eco-friendly faux fur coats made from recycled polyester, reinforcing the shift toward sustainable luxury

- Globally, the artificial fur market is expanding rapidly, with innovations such as customizable textures, bio-based materials, and water-resistant coatings playing a pivotal role in market growth

Report Scope and Artificial Fur Market Segmentation

|

Attributes |

Artificial Fur Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Artificial Fur Market Trends

“Rising Demand for Sustainable and Customizable Artificial Fur Products”

- One of the key trends in the global Artificial Fur market is the increasing preference for eco-friendly and customizable fabrics, driven by growing consumer awareness of sustainability and ethical fashion

- These innovations include bio-based fibers and recycled materials, enhancing durability and softness while reducing environmental impact, making them ideal for luxury fashion and home décor applications

- For instance, many leading fashion brands are launching faux fur collections made from organic and biodegradable materials, catering to the rising demand for ethical alternative

- Manufacturers are also integrating advanced dyeing techniques and texture customization, ensuring a more realistic feel and enhanced appeal for high-end consumers

- This trend is reshaping the textile industry, making Artificial Fur more versatile, sustainable, and widely accepted in global fashion markets

Artificial Fur Market Dynamics

Driver

“Growing Adoption of Sustainable and Ethical Fashion”

- The increasing demand for cruelty-free and eco-friendly alternatives is driving the Artificial Fur market, as consumers and brands shift towards sustainable fashion

- Advancements in bio-based materials, recycled fibers, and water-efficient manufacturing are improving product quality and reducing environmental impact

- The fashion industry’s commitment to banning real fur, with major brands replacing it with high-quality synthetic fur, is accelerating market growth

For instance,

- In 2023, Stella McCartney introduced a new plant-based faux fur, reinforcing the brand’s focus on sustainability and ethical fashion

- In 2022, Gucci, Versace, and Burberry officially eliminated real fur from their collections, opting for luxury faux alternatives

- In 2021, ECOPEL partnered with Hugo Boss to develop a biodegradable artificial fur, further promoting innovation in sustainable textiles

- This shift is transforming the Artificial Fur industry, making it a key player in the future of ethical fashion and environmentally responsible textiles

Opportunity

“Expansion of Artificial Fur in Luxury and High-Street Fashion”

- The rising consumer demand for premium faux fur is driving its adoption in luxury fashion, as high-end brands seek sustainable yet aesthetically appealing alternatives

- Technological advancements in fabric innovation, including biodegradable fibers and high-performance synthetic materials, are enhancing the texture, warmth, and durability of artificial fur

- Growing celebrity endorsements, fashion runways, and retail expansions are further fueling the acceptance of ethical faux fur in the global market

For Instance,

- In 2024, Prada launched a new faux fur collection made from bio-based and recycled materials, appealing to environmentally conscious consumers

- In 2023, Balenciaga introduced a luxury artificial fur coat line, integrating plant-derived fibers to achieve a natural fur-like feel

- In 2022, H&M expanded its conscious collection, incorporating high-quality faux fur in winter apparel, targeting mass-market adoption

- This opportunity is reshaping the Artificial Fur industry, bridging the gap between sustainability and high fashion, ensuring long-term market growth

Restraint/Challenge

“Challenges in Achieving Sustainability and Cost Efficiency”

- The production of high-quality artificial fur faces challenges due to the high costs of eco-friendly raw materials and advanced manufacturing technologies

- Concerns over microplastic pollution from synthetic fibers are driving stricter regulatory policies, making compliance costly and complex for manufacturers

- Consumer skepticism regarding durability and authenticity compared to natural fur limits widespread adoption in premium fashion markets

For Instance,

- In 2024, the European Union proposed stricter regulations on synthetic textile waste, affecting artificial fur manufacturers' sustainability strategies

- In 2023, ECOPEL faced supply chain disruptions due to the increasing cost of recycled polyester and plant-based fibers, impacting production scalability

- In 2022, a report by the Sustainable Apparel Coalition highlighted that over 60% of consumers expressed concerns about the environmental impact of synthetic fur, influencing brand perception

- Addressing these challenges requires continued investment in bio-based alternatives, improved recycling processes, and greater consumer education on the benefits of artificial fur

Artificial Fur Market Scope

The market is segmented on the basis of material type, application, style, size, end-user, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Material Type |

|

|

By Application |

|

|

By Style |

|

|

By Size |

|

|

By End-User |

|

|

By Sales Channel |

|

Artificial Fur Market Regional Analysis

“North America is the Dominant Region in the Artificial Fur Market”

- North America holds the largest market share in the global Artificial Fur market, driven by increasing demand for sustainable fashion, rising consumer awareness of animal cruelty-free products, and a growing preference for eco-friendly alternatives

- The U.S. leads the region due to strong consumer demand for luxury faux fur apparel, a well-established network of ethical fashion brands, and government regulations discouraging the use of real animal fur

- The availability of innovative synthetic fibers, including biodegradable faux fur and plant-based alternatives, has further fueled market expansion

- In addition, growing interest in vegan fashion, increasing media coverage of sustainable clothing trends, and rising sales through e-commerce platforms contribute to the growth of the Artificial Fur market across North America

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to witness the highest CAGR in the Artificial Fur market, driven by increasing demand for sustainable fashion, rising consumer preference for ethical alternatives, and a growing shift toward vegan apparel

- Countries such as China, Japan, and South Korea are leading the market due to strong consumer interest in luxury faux fur, expanding retail distribution, and the influence of global fashion trends

- The rapid growth of e-commerce platforms, coupled with continuous innovations in plant-based synthetic fibers, is further accelerating market expansion

- In addition, government regulations restricting animal fur trade and rising investments in eco-friendly textile production are contributing to the rapid development of the Artificial Fur market across Asia-Pacific

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DealTask (North Macedonia)

- PELTEX FIBRES SARL (France)

- Sommers Plastic Products (U.S.)

- BOOHOO (U.K.)

- Marks and Spencer plc (U.K.)

- River Island (U.K.)

- Macy’s (U.S.)

- H & M Hennes & Mauritz AB (Sweden)

- Urban Outfitters, Inc. (U.S.)

- Wayfair LLC (U.S.)

- Etsy, Inc. (U.S.)

- John Lewis plc (U.K.)

- Donna Salyers Fabulous-Furs (U.S.)

- Monki (Sweden)

- F21 IPCo, LLC. (U.S.)

- Next Retail Ltd. (U.K.)

- AONO PILE CO., LTD (Japan)

Latest Developments in Global Artificial Fur Market

- In November 2024, Next introduced Forever Comfort Faux Fur Double Buckle Ankle Boots as a standout addition to holiday fashion. These stylish ankle boots feature a versatile design, making them a perfect fit for various outfits while delivering both comfort and festive charm

- In August 2023, Adrienne Landau announced its relaunch with faux fur and its first RTW collection. The release includes two collections available both in-store and online, resulting from a long-term licensing agreement with Meridian Brands

- In December 2020, Tissavel launched sustainable products using advanced technology. The company developed eco-friendly materials, incorporating recycled polyester, biodegradable Japanese rayon, and natural fibers such as cotton, wood, and alpaca

- In November 2020, ECOPEL partnered with Vanessa Bruno for the launch of Cannaba wool, reinforcing its ethical and eco-conscious commitment. This initiative aligns with Ecopel’s ‘Make a Change’ strategy, focusing on developing low-environmental-impact materials

- In November 2020, House of Fluff collaborated with a textile developer to introduce its plant-based BioFur collection. The range includes ultra-plush hoodies, pea coats, and zip-ups in various colors, all priced under USD 500

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ARTIFICIAL FUR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ARTIFICIAL FUR MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL ARTIFICIAL FUR MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 LIST OF KEY BUYERS, BY REGION

5.5 BRAND SHARE ANALYSIS, 2021, (%)

5.6 PORTER’S FIVE FORCES

5.7 VENDOR SELECTION CRITERIA

5.8 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 GLOBAL ARTIFICIAL FUR MARKET, BY RAW MATERIAL, 2020-2029, (KILO TONS) (USD MILLION)

7.1 OVERVIEW

7.2 ASP ANALYSIS, BY RAW MATERIAL, 2020-2029

7.3 100% ACRYLIC

7.4 100% POLYESTER

7.5 ACRYLIC AND ACRYLIC BLENDS

7.6 POLYESTER AND POLYESTER BLENDS

8 GLOBAL ARTIFICIAL FUR MARKET, BY PRODUCT, 2020-2029, (KILO TONS) (USD MILLION)

8.1 OVERVIEW

8.2 FAUX RABBIT

8.3 FAUX FOX

8.4 FAUX SHEARLING

8.5 SHEEPSKIN

8.6 FAKE MINK

8.7 CHINCHILLA

8.8 SABLE

8.9 LYNX

8.1 OTHERS

9 GLOBAL ARTIFICIAL FUR MARKET, BY STYLE, 2020-2029, 2020-2029, (KILO TONS) (USD MILLION)

9.1 OVERVIEW

9.2 SOLID PATTERN

9.3 ANIMAL PATTERN

10 GLOBAL ARTIFICIAL FUR MARKET, BY SIZE, 2020-2029, 2020-2029, (KILO TONS) (USD MILLION)

10.1 OVERVIEW

10.2 SHORT

10.3 MEDIUM

10.4 LONG

11 GLOBAL ARTIFICIAL FUR MARKET, BY APPLICATION, 2020-2029, (KILO TONS) (USD MILLION)

11.1 OVERVIEW

11.2 APPAREL

11.2.1 COATS

11.2.2 JACKETS

11.2.3 BLAZERS

11.2.4 DRESSES

11.3 UPHOLSTERY AND HOME TEXTILES

11.3.1 BLANKET AND THROWS

11.3.2 SOFA COVERS

11.3.3 DOOR MATS

11.3.4 CARPET RUGS

11.3.5 PILLOW

11.4 OTHER ACCESSORIES

11.4.1 BAGS

11.4.2 TOYS

11.4.3 SOCKS

11.4.4 BOOTS

11.4.5 CAPS

11.4.6 MOBILE COVERS

11.4.7 OTHERS

12 GLOBAL ARTIFICIAL FUR MARKET, BY END USE, 2020-2029, (KILO TONS) (USD MILLION)

12.1 OVERVIEW

12.2 MEN

12.3 WOMEN

12.4 KIDS

13 GLOBAL ARTIFICIAL FUR MARKET, BY GEOGRAPHY, 2020-2029, (KILO TONS) (USD MILLION)

13.1 GLOBAL ARTIFICIAL FUR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 SWITZERLAND

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 SINGAPORE

13.4.6 THAILAND

13.4.7 INDONESIA

13.4.8 MALAYSIA

13.4.9 PHILIPPINES

13.4.10 AUSTRALIA & NEW ZEALAND

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL ARTIFICIAL FUR MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL ARTIFICIAL FUR MARKET - COMPANY PROFILES

16.1 DEALTASK

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 PELTEX FIBRES SARL

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 SOMMERS PLASTIC PRODUCTS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 TEXFACTOR TEXTILES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BOOHOO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 MARKS AND SPENCER PLC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DRY LAKE

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 RIVER ISLAND

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 MACYS

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 H & M HENNES & MAURITZ AB

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 SHRIMPS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 WAYFAIR LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 ETSY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 JOHN LEWIS PLC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 DONNA SALYERS' FABULOUS-FURS

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 MONKI

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT UPDATES

16.17 F21 IPCO, LLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT UPDATES

16.18 NET DISTRIBUTION SERVICES PVT LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 NEXT RETAIL LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 AONO PILE CO., LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.