Global Artificial Heart Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

8.04 Billion

2025

2033

USD

2.49 Billion

USD

8.04 Billion

2025

2033

| 2026 –2033 | |

| USD 2.49 Billion | |

| USD 8.04 Billion | |

|

|

|

|

Artificial Heart Market Size

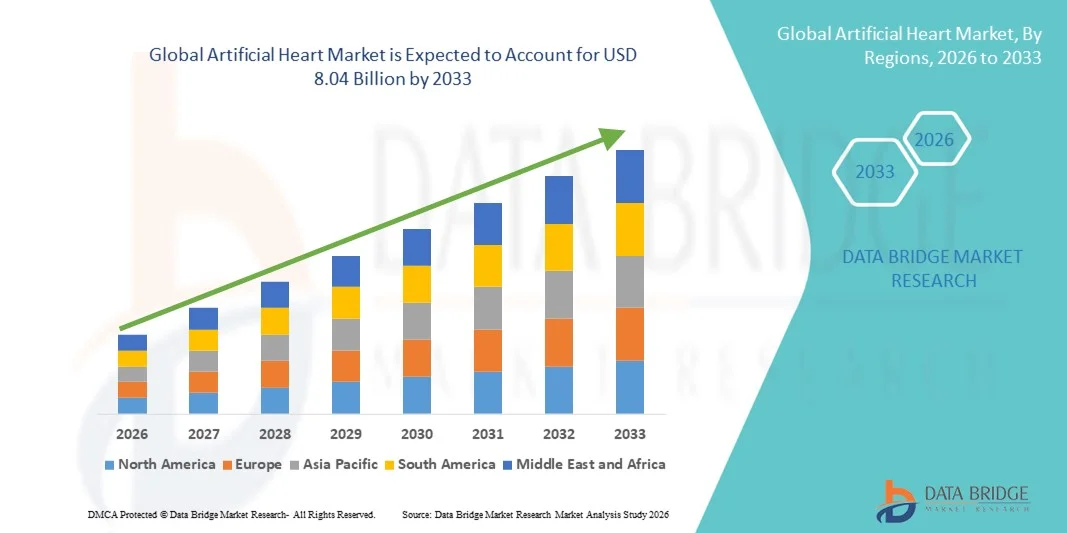

- The global artificial heart market size was valued at USD 2.49 billion in 2025 and is expected to reach USD 8.04 billion by 2033, at a CAGR of 15.78% during the forecast period

- The market growth is largely fueled by the rising prevalence of end-stage heart failure, advancements in cardiovascular technologies, and increasing investments in innovative ventricular assist devices and total artificial hearts

- Furthermore, growing awareness about advanced cardiac care, coupled with the increasing number of heart transplants and supportive government initiatives, is positioning artificial hearts as a vital solution for patients with severe cardiac conditions. These converging factors are accelerating the adoption of artificial heart devices, thereby significantly driving the industry's growth

Artificial Heart Market Analysis

- Artificial hearts, providing mechanical circulatory support for patients with end-stage heart failure, are increasingly vital components of advanced cardiac care in both hospitals and specialized cardiac centers due to their life-saving capabilities, improved patient outcomes, and integration with monitoring technologies

- The escalating demand for artificial hearts is primarily fueled by the rising prevalence of cardiovascular diseases, growing awareness of advanced heart failure treatments, and an increasing number of patients awaiting heart transplants

- North America dominated the artificial heart market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key medical device manufacturers, with the U.S. witnessing significant growth in artificial heart implantations, particularly in specialized cardiac centers, driven by innovations in total artificial hearts and ventricular assist devices

- Asia-Pacific is expected to be the fastest growing region in the artificial heart market during the forecast period due to increasing healthcare investments, rising prevalence of heart diseases, and growing adoption of advanced cardiac therapies

- Bioanalytical testing services segment dominated the artificial heart market with a market share of 42.8% in 2025, driven by their critical role in ensuring the safety, efficacy, and quality of artificial heart devices through comprehensive analysis and testing protocols

Report Scope and Artificial Heart Market Segmentation

|

Attributes |

Artificial Heart Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Artificial Heart Market Trends

Advancements in Biocompatible and Durable Artificial Hearts

- A significant and accelerating trend in the global artificial heart market is the development of biocompatible and long-lasting total artificial hearts and ventricular assist devices, which are improving patient survival and quality of life

- For instance, the SynCardia Total Artificial Heart features advanced materials and design improvements that reduce complications and extend device longevity, allowing patients to wait safely for heart transplants

- Innovations are also focused on miniaturization and enhanced energy efficiency, enabling patients to experience greater mobility and comfort, while integrated sensors provide real-time monitoring of device performance

- The integration of digital monitoring systems with artificial hearts allows clinicians to remotely track patient vitals and device function, enabling proactive interventions and improving clinical outcomes

- Research into wireless power transfer and rechargeable battery systems is gaining traction, potentially reducing the need for frequent hospital visits and improving patient independence

- This trend towards more durable, intelligent, and patient-friendly artificial heart systems is fundamentally reshaping expectations for advanced cardiac care, encouraging further research and development by leading manufacturers

- The demand for artificial hearts with improved biocompatibility, enhanced durability, and real-time monitoring is growing rapidly across both hospital and specialized cardiac care centers, as clinicians seek better outcomes for patients with end-stage heart failure

Artificial Heart Market Dynamics

Driver

Rising Prevalence of Heart Failure and Cardiovascular Diseases

- The increasing prevalence of end-stage heart failure and other cardiovascular diseases is a significant driver for the heightened demand for artificial heart devices in advanced cardiac care

- For instance, in March 2025, Abbott announced the expansion of its heart failure therapy programs, focusing on ventricular assist devices to meet growing patient needs, which is expected to boost artificial heart adoption

- As patient awareness of advanced treatment options increases, artificial hearts provide life-saving solutions for those ineligible for immediate heart transplants, positioning them as critical medical devices

- Furthermore, the growing number of heart transplants and transplant waiting lists worldwide is driving hospitals and cardiac centers to adopt artificial hearts as bridging or long-term solutions

- Technological advancements in device miniaturization, energy efficiency, and real-time monitoring, coupled with increasing investments by healthcare providers, are further propelling the adoption of artificial hearts

- Rising government initiatives and healthcare funding to improve cardiac care infrastructure in emerging economies are expanding access to artificial heart therapies

- Collaboration between medical device companies and research institutions to develop next-generation artificial hearts is accelerating innovation, creating new growth opportunities in the market

Restraint/Challenge

High Costs and Regulatory Hurdles

- The high cost of artificial heart devices, coupled with stringent regulatory approval requirements, poses a significant challenge to broader market adoption, particularly in developing regions

- For instance, complex clinical trials and regulatory scrutiny by agencies such as the FDA and EMA can delay product launches and increase development costs, limiting market penetration

- Addressing these cost and regulatory challenges through innovative financing models, reimbursement strategies, and streamlined approval processes is critical for broader accessibility

- In addition, potential complications such as thrombosis, infection, or device malfunction raise clinical concerns that require extensive patient monitoring and specialized training for healthcare providers

- While technological advancements continue to improve outcomes, the combination of high device costs, regulatory hurdles, and clinical risks may hinder widespread adoption, particularly among smaller hospitals and budget-constrained healthcare systems

- Limited patient awareness and acceptance of artificial heart technology in certain regions can slow market adoption, requiring targeted education and awareness programs

- Challenges in integrating artificial heart systems with hospital IT and monitoring infrastructure can increase operational complexity, potentially impacting adoption in smaller or resource-limited healthcare centers

Artificial Heart Market Scope

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the global artificial heart market is segmented into bioanalytical testing services, physical characterization services, method development and validation services, raw material testing services, batch-release testing services, stability testing, microbial testing services, and environmental monitoring services. The Bioanalytical Testing Services segment dominated the market with the largest market revenue share of 42.8% in 2025, driven by its critical role in evaluating the pharmacokinetics and safety profiles of artificial heart components and associated therapies. Hospitals and research institutions rely on bioanalytical testing to ensure device compatibility with human physiology and reduce post-implantation complications. The segment’s prominence is also fueled by stringent regulatory requirements demanding robust bioanalytical data before clinical use. Increasing investments in R&D by medical device companies to enhance artificial heart performance further contribute to the segment’s dominance. The growing focus on personalized medicine and patient-specific device validation amplifies the demand for bioanalytical services. Continuous innovations in bioanalytical methodologies, including high-throughput screening and biomarker analysis, are reinforcing its leading market position.

The Method Development and Validation Services segment is anticipated to witness the fastest growth rate of 22.3% from 2026 to 2033, fueled by the rising need to standardize testing protocols and ensure reproducibility of results for artificial heart devices. These services help manufacturers optimize device testing procedures, reduce development timelines, and comply with global regulatory frameworks. Growing complexity of artificial heart materials and integration with electronic monitoring systems necessitate precise validation methods. The segment benefits from increasing collaborations between device manufacturers and specialized contract research organizations (CROs) to accelerate product development. Technological advancements in assay development, automation, and analytical software are further supporting rapid adoption. Method development and validation services are becoming essential for companies aiming to bring safer and more effective artificial heart solutions to market efficiently.

- By End-User

On the basis of end-user, the artificial heart market is segmented into pharmaceutical and biopharmaceutical companies, medical device companies, and contract research organizations (CROs). The Medical Device Companies segment dominated the market with the largest revenue share of 48.2% in 2025, driven by their role in the design, development, and commercialization of total artificial hearts and ventricular assist devices. These companies invest heavily in R&D, clinical trials, and post-market surveillance, ensuring high-quality devices that meet stringent safety standards. Their dominance is reinforced by established distribution networks and collaborations with hospitals and cardiac centers. In addition, technological innovations, such as wireless monitoring and AI-integrated systems, are primarily led by medical device companies. Market leaders such as SynCardia and Abbott focus on delivering patient-centric solutions, thereby strengthening their market presence. The ongoing introduction of next-generation artificial hearts with improved durability and reduced complications is further consolidating their position.

The Contract Research Organizations (CROs) segment is expected to witness the fastest CAGR from 2026 to 2033, driven by their increasing involvement in preclinical testing, bioanalytical services, and regulatory support for artificial heart manufacturers. CROs provide specialized expertise in method development, validation, and clinical trial management, helping device companies accelerate product development while minimizing risk. Their growth is supported by rising outsourcing trends among manufacturers seeking cost-effective and efficient testing solutions. CROs also enable scalability of research operations for both established and emerging players. Increasing partnerships with medical device companies in emerging markets are further propelling CRO adoption. The segment’s flexibility and technical capabilities position it as a key growth engine for the artificial heart market in the forecast period.

Artificial Heart Market Regional Analysis

- North America dominated the artificial heart market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key medical device manufacturers

- Patients and healthcare providers in the region highly value the life-saving capabilities, improved patient outcomes, and integration of artificial hearts with real-time monitoring and remote management systems

- This widespread adoption is further supported by strong R&D capabilities, a well-established medical device manufacturing ecosystem, and favorable reimbursement policies, establishing artificial hearts as a critical solution for end-stage heart failure in both hospitals and specialized cardiac centers

U.S. Artificial Heart Market Insight

The U.S. artificial heart market captured the largest revenue share of 79% in 2025 within North America, fueled by the rising prevalence of end-stage heart failure and advanced cardiac care infrastructure. Hospitals and specialized cardiac centers are increasingly adopting total artificial hearts and ventricular assist devices to bridge patients to transplantation. The strong focus on R&D by leading medical device manufacturers, coupled with favorable reimbursement policies, further propels market growth. In addition, integration of artificial hearts with remote monitoring and digital health platforms is enhancing patient outcomes. The U.S. market also benefits from a well-established clinical trial ecosystem, facilitating the rapid introduction of next-generation devices. Overall, patient awareness and technological adoption are key drivers of market expansion in the country.

Europe Artificial Heart Market Insight

The Europe artificial heart market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing cardiovascular disease prevalence and stringent regulatory frameworks for cardiac care. Rising investments in healthcare infrastructure and advanced cardiac centers are fostering the adoption of artificial hearts. European hospitals emphasize patient safety and efficacy, which encourages the use of next-generation ventricular assist devices and total artificial hearts. Growth is observed across both transplant bridging and long-term support applications. In addition, increasing collaborations between medical device companies and research institutions are promoting innovation. Government healthcare initiatives and favorable reimbursement policies further support market growth in the region.

U.K. Artificial Heart Market Insight

The U.K. artificial heart market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing incidence of heart failure and a growing focus on advanced cardiac care. Hospitals and specialty clinics are adopting artificial hearts as critical solutions for patients awaiting heart transplants. The U.K.’s robust healthcare system and investment in cutting-edge medical technologies encourage early adoption. In addition, patient awareness campaigns and clinical expertise in cardiac management are contributing to market expansion. The presence of key manufacturers and supportive regulatory frameworks further stimulate growth. Overall, the demand for life-saving, technologically advanced artificial heart solutions is increasing steadily across the country.

Germany Artificial Heart Market Insight

The Germany artificial heart market is expected to expand at a considerable CAGR during the forecast period, fueled by high cardiovascular disease prevalence and a focus on technologically advanced medical treatments. German hospitals and cardiac centers emphasize patient safety, device efficacy, and post-implantation monitoring, driving adoption. The well-developed healthcare infrastructure and strong emphasis on innovation enable integration of artificial hearts with monitoring systems and remote patient management. In addition, government funding and health insurance support for advanced cardiac therapies further promote market growth. Germany’s commitment to research and development also facilitates clinical trials for next-generation artificial hearts. Rising patient awareness about end-stage heart failure management supports continued expansion in the region.

Asia-Pacific Artificial Heart Market Insight

The Asia-Pacific artificial heart market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2026 to 2033, driven by increasing prevalence of cardiovascular diseases, rapid urbanization, and growing healthcare investments in countries such as China, Japan, and India. The region’s rising focus on advanced cardiac care and transplant programs is accelerating adoption of total artificial hearts and ventricular assist devices. Government initiatives to improve healthcare infrastructure, coupled with expanding hospital networks, are facilitating accessibility. In addition, collaborations between global device manufacturers and local healthcare providers are improving awareness and availability. Technological adoption and cost-effective manufacturing in the region further support market expansion. The growing middle-class population and increasing patient awareness are significant factors driving APAC market growth.

Japan Artificial Heart Market Insight

The Japan artificial heart market is gaining momentum due to the country’s high incidence of cardiovascular diseases, advanced healthcare infrastructure, and strong focus on patient-centered care. Hospitals and cardiac centers are increasingly using artificial hearts for patients awaiting transplantation and for long-term circulatory support. Integration with digital health and remote monitoring systems enhances patient management and outcomes. Japan’s aging population further drives demand for reliable and easy-to-manage artificial heart solutions. In addition, collaborations with global medical device companies facilitate the introduction of next-generation devices. Clinical expertise and patient awareness campaigns continue to support market adoption.

India Artificial Heart Market Insight

The India artificial heart market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cardiovascular disease prevalence, rapid urbanization, and expanding hospital infrastructure. Increasing awareness about advanced cardiac therapies and rising investments in specialized cardiac care centers are driving adoption. India is emerging as a key market for ventricular assist devices and total artificial hearts due to affordability initiatives and collaborations with global medical device manufacturers. Government programs promoting advanced healthcare technologies and transplant support further fuel growth. In addition, increasing patient awareness and rising disposable incomes among the middle class contribute to market expansion. Accessibility, cost-effective solutions, and technological adoption are key factors propelling the artificial heart market in India.

Artificial Heart Market Share

The Artificial Heart industry is primarily led by well-established companies, including:

- BiVACOR, Inc. (U.S.)

- CARMAT SA (France)

- Scandinavian Real Heart AB (Sweden)

- Jarvik Heart, Inc. (U.S.)

- Berlin Heart GmbH (Germany)

- Abbott (U.S.)

- Medtronic (Ireland)

- Abiomed, Inc. (U.S.)

- SynCardia Systems (U.S.)

- Thoratec Corporation (U.S.)

- HeartMate (U.S.)

- EXCOR ACTIVE (Germany)

- INCOR VAD (Germany)

- HeartWare HVAD (U.S.)

- FineHeart S.A. (France)

- ReinHeart TAH GmbH (Germany)

- Getinge AB (Sweden)

- LivaNova PLC (U.K.)

- Sun Medical Technology Research Corporation (Japan)

- Cleveland Heart (U.S.)

- OregonHeart, Inc. (U.S.)

What are the Recent Developments in Global Artificial Heart Market?

- In November 2025, SynCardia Systems successfully completed the first in‑vivo implantations of its next‑generation fully implantable Emperor Total Artificial Heart (TAH), marking a significant milestone toward next‑generation artificial heart technology. The positive outcomes observed in these first implants indicate progress toward a fully implantable successor to the clinically proven SynCardia Total Artificial Heart platform, enhancing prospects for future patient care

- In May 2025, the BiVACOR Total Artificial Heart received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA), positioning this titanium‑based TAH for accelerated development and regulatory engagement. This designation reflects the potential of the device to significantly improve outcomes for people with severe heart failure as a bridge to transplant

- In March 2025, BiVACOR’s Total Artificial Heart was successfully implanted in a patient at St Vincent’s Hospital in Sydney, and the patient survived over 100 days with the device, marking a world‑first clinical breakthrough where a patient was discharged with an artificial heart functioning as a bridge to transplant

- In February 2025, CARMAT achieved the milestone of 100 implants of its Aeson® Total Artificial Heart across multiple European clinical sites, demonstrating growing adoption and clinical momentum for this advanced bioprosthetic artificial heart technology as part of ongoing studies in France and beyond

- In July 2024, the Texas Heart Institute performed the first‑in‑human implantation of the BiVACOR Total Artificial Heart as part of an FDA early feasibility study, representing a key step in evaluating a novel magnetically levitated rotary artificial heart system in clinical use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.