Global Artificial Intelligence Ai In Insurance Market

Market Size in USD Billion

CAGR :

%

USD

6.44 Billion

USD

63.27 Billion

2024

2032

USD

6.44 Billion

USD

63.27 Billion

2024

2032

| 2025 –2032 | |

| USD 6.44 Billion | |

| USD 63.27 Billion | |

|

|

|

|

Artificial Intelligence (AI) in Insurance Market Size

- The global artificial intelligence (AI) in insurance market was valued at USD 6.44 billion in 2024 and is expected to reach USD 63.27 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 33.06%, primarily driven by advancements in predictive analytics

- This growth is driven by factors such as better risk assessment & pricing, IoT integration and faster claims processing

Artificial Intelligence (AI) in Insurance Market Analysis

- Artificial intelligence in insurance refers to the use of artificial intelligence technologies such as machine learning, natural language processing, and predictive analytics to enhance risk assessment, claims processing, fraud detection, and customer engagement

- The market growth is driven by the increasing adoption of AI-powered automation, rising demand for real-time data analytics, and the need for enhanced fraud detection. As insurers embrace digital transformation, AI solutions are becoming essential for improving efficiency and reducing operational costs

- The integration of AI with big data, IoT, and cloud computing is reshaping the insurance landscape. AI-powered tools enable personalized policy pricing, automated underwriting, and predictive risk modeling, optimizing decision-making processes

- For instance, Lemonade, a digital-first insurance company, uses AI chatbots to process claims in minutes, while Allstate employs AI-driven analytics to optimize policy recommendations based on customer data

- The AI in insurance market is set for sustained growth, fueled by advancements in automation, real-time analytics, and AI-driven decision-making. Increasing investments in InsurTech and the demand for seamless digital experiences will further drive market expansion, with insurers prioritizing AI adoption to maintain competitiveness

Report Scope and Artificial Intelligence (AI) in Insurance Market Segmentation

|

Attributes |

Artificial Intelligence (AI) in Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Artificial Intelligence (AI) in Insurance Market Trends

“Increasing Use of AI-Driven Chatbots and Virtual Assistants”

- One prominent trend in the global artificial intelligence (AI) in insurance market is the increasing use of AI-driven chatbots and virtual assistants

- This trend is driven by insurers integrating conversational AI to handle inquiries, process claims, and offer personalized policy recommendations, reducing response times and improving efficiency

- For instance, GEICO’s virtual assistant, Kate, provides policyholders with real-time assistance, while Lemonade’s AI chatbot, Maya, facilitates seamless claims processing within minutes

- The increasing demand for digital-first, 24/7 customer service is accelerating the adoption of AI-powered chatbots in the insurance industry

- As insurers seek to reduce operational costs and enhance user experience, the role of conversational AI will continue to expand. Future advancements in emotional AI and voice recognition are expected to further refine chatbot capabilities, making interactions more human-like and personalized

Artificial Intelligence (AI) in Insurance Market Dynamics

Driver

“Rising Demand for Automated Claims Processing”

- The increasing reliance on artificial intelligence (AI) and automation is a key driver of growth in the AI in insurance market. As insurers shift from traditional claims handling to AI-powered automation, the need for efficient and accurate claims processing has become more critical than ever

- This transition is particularly evident in health, auto, and property insurance, where insurers are leveraging AI-driven claims automation to reduce processing times, detect fraud, and enhance customer experience

- With insurers handling vast amounts of claims data, the complexity of claims management has increased. Companies are now investing in AI-powered claims solutions to assess damages, verify documents, and ensure seamless policyholder interactions while reducing operational inefficiencies

- The growing customer preference for fast and digital-first claims settlements further fuels demand for AI-driven automation

- By integrating machine learning (ML) and natural language processing (NLP), insurers can improve decision-making, minimize human intervention, and enhance policyholder trust

For instance,

- Progressive Insurance employs AI-powered damage assessment tools in auto insurance, using computer vision to analyze accident photos and provide real-time repair estimates

- Allstate’s AI-based claims system detects fraudulent activities and ensures faster settlement by automating routine claim assessments

- With increasing investments in AI-driven automation and digital transformation, AI-powered claims processing will play a crucial role in reducing turnaround time, preventing fraudulent claims, and improving policyholder satisfaction, driving sustained market growth

Opportunity

“Expansion of AI-Powered Risk Assessment”

- The increasing adoption of AI-driven risk assessment models presents a significant opportunity in the AI in insurance market. Insurers are leveraging big data analytics, predictive modeling, and machine learning (ML) to enhance risk evaluation, personalize policies, and improve underwriting accuracy

- Traditional risk assessment methods rely on historical data and standardized criteria, often leading to inefficiencies in policy pricing and claim approvals. AI-powered tools analyze real-time behavioral and contextual data, enabling insurers to make more precise and dynamic risk evaluations

- AI-driven risk assessment enables insurers to customize premium rates based on real-time driving behavior (auto insurance), lifestyle habits (health insurance), and property usage patterns (home insurance)

For instance,

- Swiss Re employs AI-powered predictive models to evaluate climate risks, helping insurers underwrite property and catastrophe insurance more accurately

- Lemonade Inc., an AI-driven insurtech company, uses behavioral data and AI algorithms to assess risks and streamline underwriting, allowing instant policy approvals

- As the insurance industry shifts toward data-driven and customer-centric models, AI-powered risk assessment solutions will continue to drive efficiency, reduce losses, and enhance policyholder satisfaction, creating significant growth opportunities for market players

Restraint/Challenge

“Data Privacy and Regulatory Compliance”

- The widespread adoption of AI-driven solutions in insurance raises significant concerns regarding data privacy, security, and regulatory compliance. Insurers rely on vast amounts of personal, financial, and behavioral data to enhance risk assessment, claims processing, and fraud detection, making data protection a critical challenge

- Stringent regulations such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the U.S., and sector-specific laws such as the Health Insurance Portability and Accountability Act (HIPAA) impose strict guidelines on how insurers collect, process, and store customer data

- In addition, AI-driven decision-making in underwriting and claims processing has sparked concerns over algorithmic bias and lack of transparency

For instance,

- China’s Personal Information Protection Law (PIPL) has imposed strict regulations on foreign insurers operating in the country, impacting AI-driven data analytics and policy customization

- These regulatory and privacy challenges could slow down the adoption of AI in insurance, increasing compliance costs and limiting innovation. Insurers will need to balance AI advancements with strict regulatory adherence, potentially leading to slower market expansion and cautious AI implementation strategies in the coming years

Artificial Intelligence (AI) in Insurance Market Scope

The market is segmented on the basis of component, technology, deployment model, enterprises size, application, and sector.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Technology |

|

|

By Deployment Model |

|

|

By Enterprises Size

|

|

|

By Application |

|

|

By Sector |

|

Artificial Intelligence (AI) in Insurance Market Regional Analysis

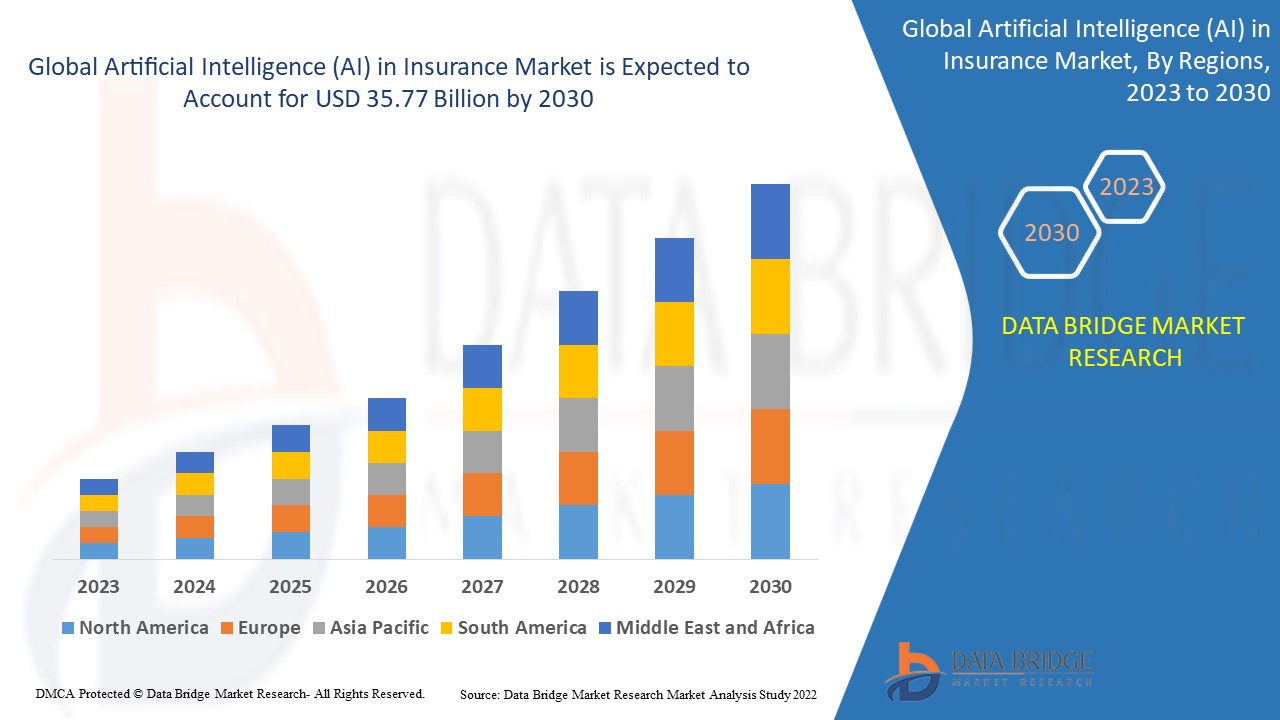

“North America is the Dominant Region in the Artificial Intelligence (AI) in Insurance Market”

- North America dominates the Artificial Intelligence (AI) in Insurance market, driven by the early adoption of AI-powered technologies, strong regulatory frameworks, and the presence of leading AI solution providers in the region

- The U.S. holds a significant share due to significant investments in AI-driven underwriting, claims automation, and fraud detection by major insurance companies

- The region's advanced IT infrastructure and high AI adoption rates among insurers further contribute to its market leadership. Companies in the U.S. and Canada are leveraging machine learning, natural language processing, and predictive analytics to enhance customer experience and operational efficiency

- In addition, regulatory initiatives promoting AI transparency and ethical AI usage have encouraged insurers to integrate AI-driven decision-making while maintaining compliance, reinforcing North America’s position as a dominant player in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Artificial Intelligence (AI) in Insurance market, driven by government-led digital transformation initiatives and increasing investments in AI-driven insurance technologies

- Countries such as China, India, and Japan are experiencing rapid digitalization, leading to the adoption of AI-powered chatbots, automated claims processing, and personalized policy pricing models to improve customer engagement and operational efficiency

- The expansion of insurtech startups, growing penetration of IoT-based risk assessment solutions, and rising demand for AI-driven fraud detection are further fueling market growth in the region

- As insurers in Asia-Pacific continue to integrate AI-driven analytics, telematics, and predictive modeling, the region presents significant opportunities for AI solution providers looking to expand in emerging insurance markets

Artificial Intelligence (AI) in Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft (U.S.)

- Infosys Limited (India)

- Tractable (U.K.)

- Insurify, Inc. (U.S.)

- Slice Insurance Technologies Inc (U.S.)

- Google (U.S.)

- Oracle (U.S.)

- Amazon Web Services Inc. (U.S.)

- IBM (U.S.)

- Avaamo (U.S.)

- CAPE Analytics (U.S.)

- Wipro (India)

- Acko General Insurance (India)

- Shift Technology (France)

- Quantemplate (U.K.)

- Zurich (Switzerland)

- Lemonade Inc. (U.S.)

Latest Developments in Global Artificial Intelligence (AI) in Insurance Market

- In June 2023, Simplifai, a company specializing in AI automation solutions, introduced Simplifai InsuranceGPT, the first proprietary GPT tool specifically designed for the insurance industry. This groundbreaking innovation is built on Simplifai's AI-powered, no-code platform, further enhancing the company's robust business process automation capabilities

- In January 2023, AI inside Inc., a company dedicated to democratizing AI through infrastructure and consulting services, launched a new DX solution. This solution facilitates the development of new insurance products by leveraging OCR-digitized semi-structured health certificates, specifically tailored for the life insurance sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 THE IMPACT OF AI ON THE FUTURE OF INSURANCE

5.9 AI DRIVEN INNOVATION IN THE INSURANCE SECTOR

6. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 PROCESSORS

6.2.1.1. MICROPROCESSING UNIT

6.2.1.2. GRAPHICS PROCESSING UNIT

6.2.1.3. FIELD PROGRAMMABLE GATE ARRAYS

6.2.1.4. OTHERS

6.2.2 MEMORY

6.2.3 NETWORK

6.3 SOFTWARE

6.3.1 SOFTWARE TOOL

6.3.1.1. DATA DISCOVERY

6.3.1.2. DATA QUALITY AND DATA GOVERNANCE

6.3.1.3. DATA VISUALIZATION

6.3.2 PLATFORM

6.4 SERVICES

6.4.1 MANAGED SERVICES

6.4.2 PROFESSIONAL SERVICES

7. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING

7.2.1 DEEP LEARNING

7.2.1.1. CONVOLUTIONAL NEURAL NETWORK (CNN)

7.2.1.2. RECURRENT NEURAL NETWORK (RNN)

7.2.1.3. GENERATIVE ADVERSARIAL NETWORKS (GAN)

7.2.2 SUPERVISED LEARNING

7.2.3 UNSUPERVISED LEARNING

7.2.4 REINFORCEMENT LEARNING

7.3 NATURAL LANGUAGE PROCESSING (NLP)

7.4 COMPUTER VISION

7.5 CONTEXT AWARENESS

7.6 ROBOTIC AUTOMATION

7.7 OTHERS

8. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 SMALL & MEDIUM SIZE ENTERPRISE

9.2.1 BY DEPLOYMENT MODE

9.2.1.1. CLOUD

9.2.1.2. ON-PREMISE

9.3 LARGE SIZE ENTERPRISE

9.3.1 BY DEPLOYMENT MODE

9.3.1.1. CLOUD

9.3.1.2. ON-PREMISE

10. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CLAIMS MANAGEMENT

10.3 RISK MANAGEMENT AND COMPLIANCE

10.4 CHATBOTS

10.5 FRAUD DETECTION

10.6 CUSTOMER RELATIONSHIP MANAGEMENT

10.7 CYBERSECURITY

10.8 OTHERS

11. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY END USER

11.1 OVERVIEW

11.2 INSURANCE COMPANIES

11.3 BROKERS

11.4 AGENTS

12. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY SECTOR

12.1 OVERVIEW

12.2 LIFE INSURANCE

12.2.1 BY COMPONENT

12.2.1.1. HARDWARE

12.2.1.2. SOFTWARE

12.2.1.3. SERVICES

12.3 HEALTH INSURANCE

12.3.1 BY COMPONENT

12.3.1.1. HARDWARE

12.3.1.2. SOFTWARE

12.3.1.3. SERVICES

12.4 TITLE INSURANCE

12.4.1 BY COMPONENT

12.4.1.1. HARDWARE

12.4.1.2. SOFTWARE

12.4.1.3. SERVICES

12.5 AUTO INSURANCE

12.5.1 BY COMPONENT

12.5.1.1. HARDWARE

12.5.1.2. SOFTWARE

12.5.1.3. SERVICES

12.6 OTHERS

13. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, BY GEOGRAPHY

13.1 GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. NORWAY

13.1.2.11. FINLAND

13.1.2.12. SWITZERLAND

13.1.2.13. DENMARK

13.1.2.14. SWEDEN

13.1.2.15. POLAND

13.1.2.16. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. NEW ZEALAND

13.1.3.7. SINGAPORE

13.1.3.8. THAILAND

13.1.3.9. MALAYSIA

13.1.3.10. INDONESIA

13.1.3.11. PHILIPPINES

13.1.3.12. TAIWAN

13.1.3.13. VIETNAM

13.1.3.14. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. OMAN

13.1.5.6. BAHRAIN

13.1.5.7. ISRAEL

13.1.5.8. KUWAIT

13.1.5.9. QATAR

13.1.5.10. REST OF MIDDLE EAST AND AFRICA

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, SWOT & DBMR ANALYSIS

16. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN INSURANCE MARKET, COMPANY PROFILE

16.1 IBM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 DAMCO GROUP

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 MICROSOFT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 AMAZON WEB SERVICES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 ORACLE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AVAAMO

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 SAP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 CAPE ANALYTICS

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 WIPRO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.10 SHIFT TECHNOLOGY

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 QUANTEMPLATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ZURICH

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 LEMONADE, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 SLICE INSURANCE TECHNOLOGIES INC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INSURIFY, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 INSURMI

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 PLANCK RESOLUTION LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 TRACTABLE LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 GOOGLE

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.20 INFOSYS LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 FLYREEL, INC. ( A PART OF LEXISNEXIS® RISK SOLUTIONS)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 ANADEA, INC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 WORKFUSION, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17. CONCLUSION

18. QUESTIONNAIRE

19. RELATED REPORTS

20. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.