Global Artificial Intelligence Ai Insurtech Market

Market Size in USD Million

CAGR :

%

USD

3,640.00 Million

USD

35,770.00 Million

2022

2030

USD

3,640.00 Million

USD

35,770.00 Million

2022

2030

| 2023 –2030 | |

| USD 3,640.00 Million | |

| USD 35,770.00 Million | |

|

|

|

|

Artificial Intelligence (AI) Insurtech Market Analysis and Size

The rising use of AI in the insuretech sector, particular for automated underwriting and claims processing, is changing the way insurance operations are handled. AI powered algorithms and machine learning models can promptly and correctly analyse risk profiles, allowing insurers to make more informed underwriting decisions. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

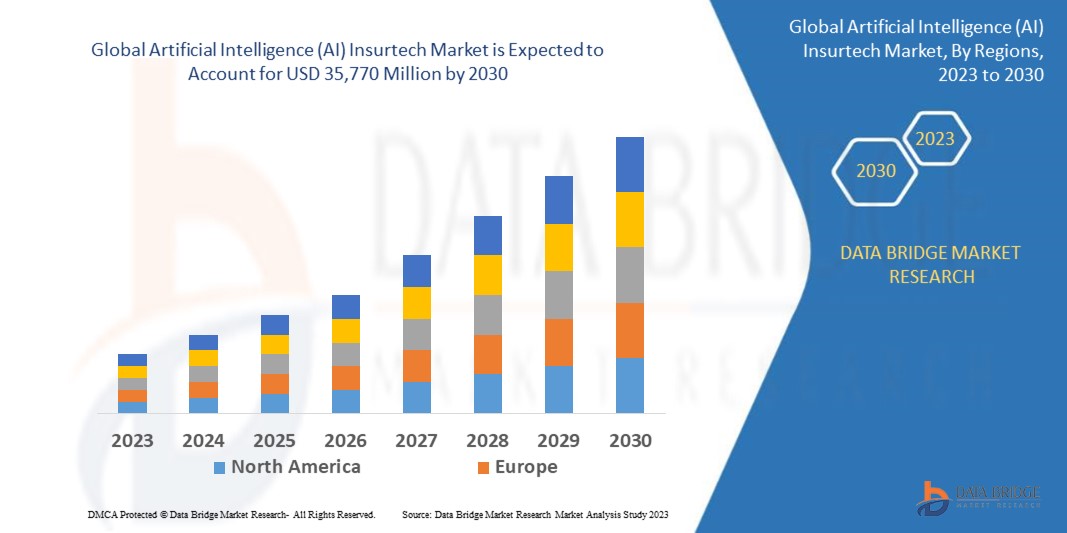

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030. “Hardware” segment dominates the component segment of the Global artificial intelligence (AI) insurtech market, as hardware allows the efficient execution of AI applications for tasks such as underwriting, claims processing and risk assessment in the insuretech sector, where data security and processing speed are crucial . In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Artificial Intelligence (AI) Insurtech Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Component (Hardware, Software, Services), Technology (Machine Learning and Deep Learning, Natural Language Processing (NLP), Machine Vision, Robotic Automation), Deployment Model (0n-Premises, Cloud), Enterprises Size (Large Enterprises, SMEs Enterprises), Application (Claims Management, Risk Management and Compliance, Chatbots, Others), Sector (Life Insurance, Health Insurance, Title Insurance, Auto Insurance, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia Pacific, South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and Rest of Middle East and Africa |

|

Market Players Covered |

Microsoft (U.S.), Infosys Limited (India), Tractable Ltd (U.S.), Insurify, Inc. (U.S.), Slice Insurance Technologies Inc., (U.S.), Google (U.S.), Oracle (U.S.), Amazon Web Services Inc. (U.S.), IBM (U.S.), Avaamo (U.S.), Cape Analytics (U.S.), Wipro (India), Acko General Insurance (India), Shift Technology (France), Quantemplate (U.K.), Zurich (Switzerland), Lemonade Insurance Agency, LLC (U.S.) |

|

Market Opportunities |

|

Market Definition

Artifical intelligence (AI) in insuretech market is dynamic industrial segment in which novel technologies, particularly artificial intelligence (AI) are used to revolutionize and optimize many parts of the insurance industry. This involves the use of AI in client interactions, underwriting, claims processing and risk assessment.

Global Artificial Intelligence (AI) Insurtech Market Dynamics

Drivers

- Faster Claims Processing in the Insurtech Business

AI technology has pushed automation to the forefront of claims processing procedures. Routine processes such as document verification and data entry are now automated, which reduces the time and manual effort required to handle the claims. It can detect potential cases of fraud or strange patterns in filings, allowing insurers to act quickly.

- Enhancement in Underwriting in the worldwide AI Insurtech Market

The insurers today have access to massive volumes of data and AI plays a crucial role in thoroughly analysing the data. AI algorithm examine numerous risk indicators involved with the insuring persons or companies, ranging from historical insurance data to financial records and health information using advanced data analysis.

Opportunities

- Enhancement in Customer Experience

AI-powered chatbots and virtual assistants can improve customer interactions by delivering quick support and answers to questions. Personalized product recommendations and pricing based on individual risk profiles can improve customer satisfaction. AI-assisted claims processing can speed up settlements, resulting to increased client loyalty.

Restraints/Challenges

- Rising in Concern about Data Privacy and Security

AI in insurtech is primarily reliant on gathering and analyzing massive volumes of sensitive customer data. Regulations such as GDPR and comparable legislation around the world put rigorous limits on how personal data can be handled and maintained.

- Encountering Problems with Data Quality and Availability

Data that is inaccurate or incomplete can lead to inaccurate prediction and risk assessments, Gaining access to essential data sources, particularly real time data, might be problematic. To properly exploit AI capabilities, insurtech companies must overcome data quality challenges and develop dependable data sources.

This global artificial intelligence (AI) insurtech market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global artificial intelligence (AI) insurtech market contact the Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In April 2023, Slice Labs Inc. partnered with Philadelphia Insurance Companies (PHLY) released a new digital small company product with an A.M. The companies have launched small business general liability in the United States. Slice's existing artisan contractors general liability (GL) product would be supplemented by the new product. That small business insurance product was available to agents through a network of over 200,000 agents via some of the major digital wholesalers and MGAs. That helped the companies to meet the needs and demand of their growing distribution base, and to provide agents with a 100% digital experience

- In March 2023, Insurify, Inc acquired Inspop USA, LLC. That strategic acquisition combined two leading online insurance shopping platforms under one larger scale entity, combining Insurify's cutting edge AI-powered technology, expert advice, and organic marketing expertise with Compare.com's robust consumer choice and long-established insurance experience. That combination enabled Insurify to utilize the benefits of the respective brands, platforms, and operations in order to efficiently deliver next-generation solutions to consumers and carrier partners. Insurify would keep the Compare.com brand

Global Artificial Intelligence (AI) Insurtech Market Scope

The global artificial intelligence (AI) insurtech market is segmented on the basis of component, technology, deployment model, enterprises size, application and sector. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

Technology

- Machine Learning and Deep Learning

- Natural Language Processing (NLP)

- Machine Vision

- Robotic Automation

Deployment Model

- 0n-Premises

- Cloud

Enterprises Size

- Large Enterprises

- SMEs Enterprises

Application

- Claims Management

- Risk Management and Compliance

- Chatbots

- Others

Sector

- Life Insurance

- Health Insurance

- Title Insurance

- Auto Insurance

- Others

Global Artificial Intelligence (AI) Insurtech Market Region Analysis/Insights

The global artificial intelligence (AI) insurtech market is analysed and market size insights and trends are provided by country, offering, deployment model, technology, enterprise size, application, end user as referenced above.

The countries covered in the global artificial intelligence (AI) insurtech market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, and Rest of Middle East and Africa.

North America dominates the artificial intelligence (AI) insurtech market due to the increasing adoption of new technologies to numerous AI solution providers in the region. Asia-Pacific is expected to be the fastest growing region due to the increasing government initiatives supporting digitalization. Moreover, growing investments on advanced technologies such as IoT and AI are raising the demand for AI across the insurance sector which will likely to enhance market growth within this region.

The region section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global Artificial Intelligence (AI) Insurtech Market Share Analysis

The global artificial intelligence (AI) insurtech market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global artificial intelligence (AI) insurtech market.

Some of the major players operating in the global artificial intelligence (AI) insurtech market are:

- Microsoft (U.S.)

- Infosys Limited (India)

- Tractable Ltd (U.S.)

- Insurify, Inc. (U.S.)

- Slice Insurance Technologies Inc., (U.S.)

- Google (U.S.)

- Oracle (U.S.)

- Amazon Web Services Inc. (U.S.)

- IBM (U.S.)

- Avaamo (U.S.)

- Cape Analytics (U.S.)

- Wipro (India)

- Acko General Insurance (India)

- Shift Technology (France)

- Quantemplate (U.K.)

- Zurich (Switzerland)

- Lemonade Insurance Agency, LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES MODEL

5.2 TECHNOLOGICAL ANALYSIS

5.3 PATENT ANALYSIS

6 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE AS A SERVICE (SAAS)

6.3 PLATFORM AS A SERVICE (PAAS)

6.4 INFRASTRUCTURE AS A SERVICE (IAAS)

6.5 CONSULTING

6.6 SYSTEM INTEGRATION

7 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING AND DEEP LEARNING

7.3 NATURAL LANGUAGE PROCESSING (NLP)

7.4 MACHINE VISION

7.5 ROBOTIC PROCESS AUTOMATION (RPA)

8 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 0N-PREMISES

8.3 CLOUD

9 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES ENTERPRIESES

10 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FRAUD DETECTION

10.3 CUSTOMER PROFILING AND SEGMENTATION

10.4 UNDERWRITING AND CLAIMS ASSESSMENT

10.5 CLAIMS MANAGEMENT AND PROCESS

10.6 RISK MANAGEMENT AND COMPLIANCE

10.7 CUSTOMER SERVICE

10.8 ANALYTICS

10.9 OTHERS

11 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY SECTOR

11.1 OVERVIEW

11.2 LIFE INSURANCE

11.2.1 BY OFFERING

11.2.1.1. SOFTWARE AS A SERVICE (SAAS)

11.2.1.2. PLATFORM AS A SERVICE (PAAS)

11.2.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.2.1.4. CONSULTING

11.2.1.5. SYSTEM INTEGRATION

11.3 HEALTH INSURANCE

11.3.1 BY OFFERING

11.3.1.1. SOFTWARE AS A SERVICE (SAAS)

11.3.1.2. PLATFORM AS A SERVICE (PAAS)

11.3.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.3.1.4. CONSULTING

11.3.1.5. SYSTEM INTEGRATION

11.4 TRAVEL INSURANCE

11.4.1 BY OFFERING

11.4.1.1. SOFTWARE AS A SERVICE (SAAS)

11.4.1.2. PLATFORM AS A SERVICE (PAAS)

11.4.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.4.1.4. CONSULTING

11.4.1.5. SYSTEM INTEGRATION

11.5 AUTO INSURANCE

11.5.1 BY OFFERING

11.5.1.1. SOFTWARE AS A SERVICE (SAAS)

11.5.1.2. PLATFORM AS A SERVICE (PAAS)

11.5.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.5.1.4. CONSULTING

11.5.1.5. SYSTEM INTEGRATION

11.6 BUSINESS INSURANCE

11.6.1 BY OFFERING

11.6.1.1. SOFTWARE AS A SERVICE (SAAS)

11.6.1.2. PLATFORM AS A SERVICE (PAAS)

11.6.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.6.1.4. CONSULTING

11.6.1.5. SYSTEM INTEGRATION

11.7 HOME INSURANCE

11.7.1 BY OFFERING

11.7.1.1. SOFTWARE AS A SERVICE (SAAS)

11.7.1.2. PLATFORM AS A SERVICE (PAAS)

11.7.1.3. INFRASTRUCTURE AS A SERVICE (IAAS)

11.7.1.4. CONSULTING

11.7.1.5. SYSTEM INTEGRATION

11.8 OTHERS

12 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, BY REGION

Global Artificial Intelligence (AI) Insurtech Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 SWITZERLAND

12.2.11 DENMARK

12.2.12 POLAND

12.2.13 SWEDEN

12.2.14 NORWAY

12.2.15 FINLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 SINGAPORE

12.3.7 THAILAND

12.3.8 MALAYSIA

12.3.9 INDONESIA

12.3.10 PHILIPPINES

12.3.11 NEW ZEALAND

12.3.12 VIETNAM

12.3.13 TAIWAN

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 ISRAEL

12.5.6 KUWAIT

12.5.7 OMAN

12.5.8 QATAR

12.5.9 BAHRAIN

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, SWOT ANALYSIS

15 GLOBAL ARTIFICIAL INTELLIGENCE (AI) INSURTECH MARKET, COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 INFOSYS LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 TRACTABLE LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SLICE INSURANCE TECHNOLOGIES INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 GOOGLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ORACLE

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 AMAZON WEB SERVICES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 IBM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 AVAAMO

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 CAPE ANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 SHIFT TECHNOLOGY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 QUANTEMPLATE

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OPENAI

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 APPLIED SYSTEMS, INC

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 PEGASYSTEMS INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 VERTAFORE, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 OPENTEXT CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 SALESFORCE, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 SAS INSTITUTE INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 SINGAPORE LIFE LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 BDEO

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 COWBELL CYBER, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 PIBIT.AI

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 RESERV INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 SYNCHRONO GROUP, INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.