Global Artificial Organ Bank Market

Market Size in USD Billion

CAGR :

%

USD

15.20 Billion

USD

26.60 Billion

2025

2033

USD

15.20 Billion

USD

26.60 Billion

2025

2033

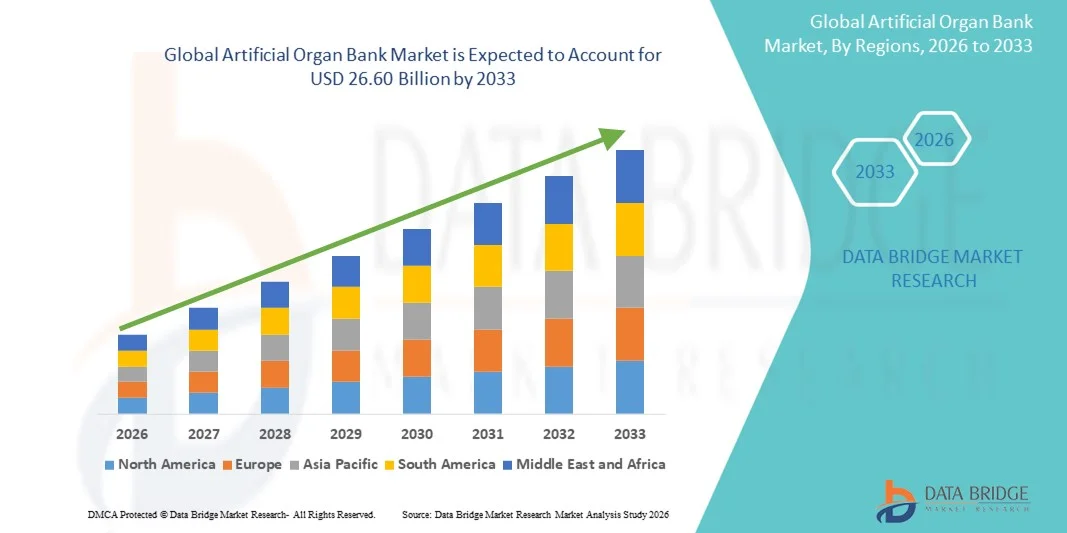

| 2026 –2033 | |

| USD 15.20 Billion | |

| USD 26.60 Billion | |

|

|

|

|

Artificial Organ Bank Market Size

- The global artificial organ bank market size was valued at USD 15.20 billion in 2025 and is expected to reach USD 26.60 billion by 2033, at a CAGR of 7.25% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced organ preservation technologies and continuous innovation in biobanking and tissue engineering, leading to improved organ storage, enhanced transplant success rates, and increased digitalization in hospitals, research institutes, and organ transplant centers

- Furthermore, rising demand for efficient, safe, and long-term organ storage solutions, coupled with increasing prevalence of organ failure, rising organ transplant procedures, and growing focus on personalized medicine, is establishing artificial organ banks as essential infrastructure in modern healthcare. These converging factors are accelerating the uptake of Artificial Organ Bank solutions, thereby significantly boosting the industry's growth

Artificial Organ Bank Market Analysis

- Artificial organ banks, including tissue and organ preservation systems, biorepositories, and cryogenic storage solutions, are increasingly vital components of modern healthcare infrastructure due to their ability to extend organ viability, improve transplant success rates, and support research in regenerative medicine and personalized therapies

- The escalating demand for artificial organ banks is primarily fueled by rising prevalence of organ failure, increasing number of transplant procedures, advancements in organ preservation technologies, and growing focus on personalized and regenerative medicine

- North America dominated the artificial organ bank market with the largest revenue share of approximately 38.9% in 2025, supported by advanced healthcare infrastructure, high organ transplant volumes, strong presence of key industry players, and growing adoption of state-of-the-art preservation technologies in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the artificial organ bank market during the forecast period due to rising healthcare expenditure, increasing number of organ transplant centers, growing awareness about organ preservation solutions, and expanding adoption of advanced biobanking technologies across countries such as China, India, and Japan

- The Mechanical segment held the largest market revenue share of 55.2% in 2025, attributed to the widespread use of mechanical perfusion systems and organ transport devices that maintain organ viability

Report Scope and Artificial Organ Bank Market Segmentation

|

Attributes |

Artificial Organ Bank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Organovo Holdings, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Artificial Organ Bank Market Trends

Technological Advancements in Artificial Organ Bank

- A significant and accelerating trend in the global artificial organ bank market is the increasing focus on the development of bioengineered and 3D-printed organs for transplantation

- For instance, research initiatives and clinical trials are now exploring the use of patient-specific organs created from stem cells and biocompatible scaffolds, aiming to reduce rejection risks and improve transplant success rates

- Furthermore, integration of advanced cryopreservation and organ storage technologies is enhancing the longevity and viability of organs during transportation, enabling broader geographical distribution and faster transplantation procedures

- The trend toward personalized and regenerative medicine solutions is also driving innovation in organ bank infrastructure, such as automated tissue processing and quality monitoring systems

- Global awareness about organ shortages and the need for rapid transplantation is fueling investment in artificial organ banks across developed and emerging markets

- These developments are reshaping transplantation protocols, allowing healthcare providers to manage organ supply more effectively and potentially reduce waiting times for patients

Artificial Organ Bank Market Dynamics

Driver

Increasing Demand Due to Organ Shortages and Transplantation Needs

- The rising prevalence of organ failure cases worldwide, including kidney, liver, and heart diseases, is a key driver of growth for the artificial organ bank market

- For instance, according to the World Health Organization, millions of patients remain on organ transplant waiting lists due to limited availability of donor organs

- Artificial organ banks provide solutions by storing bioengineered or donor organs under optimal conditions, improving accessibility for urgent transplantation needs

- Furthermore, increasing government initiatives and funding for organ donation awareness programs are boosting the development of organ banks in regions such as North America, Europe, and Asia-Pacific

- The adoption of advanced storage, preservation, and distribution technologies is helping hospitals and transplant centers meet growing transplantation demands efficiently

Restraint/Challenge

High Costs and Regulatory Barriers

- The high cost of developing and maintaining artificial organ banks poses a challenge, especially for hospitals and healthcare providers in developing countries. Expenses related to bioprinting organs, advanced preservation equipment, and specialized storage facilities are significant barriers

- Regulatory hurdles related to organ storage, tissue engineering, and transplantation approval processes slow down market adoption

- For instance, in 2024, the U.S. FDA delayed approval of a major bioengineered liver preservation protocol due to stringent safety and efficacy testing requirements, highlighting the challenges of regulatory compliance

- Lack of standardized protocols for quality assessment, organ compatibility, and safety of bioengineered organs increases operational risk and slows adoption

- Technical challenges, such as ensuring long-term viability of stored organs, preventing contamination, and maintaining functional integrity during storage and transport, further hinder market growth

- Limited availability of skilled personnel trained in tissue engineering, organ preservation, and advanced storage techniques can impact the operational efficiency of artificial organ banks

- Ethical and social concerns, including patient consent for organ storage and usage of bioengineered tissues, can influence public perception and regulatory approvals

- Infrastructural limitations in emerging regions, such as inconsistent electricity supply, lack of advanced cold-chain logistics, and insufficient hospital infrastructure, restrict the expansion of artificial organ banks in certain geographies

- The market is also challenged by the need for continuous research investment to improve organ storage technologies, which can strain budgets and delay commercialization

Artificial Organ Bank Market Scope

The market is segmented on the basis of product type, technology, and bionics.

- By Product Type

On the basis of product type, the Artificial Organ Bank market is segmented into Kidney, Heart, Liver, Pancreas, Blood Vessels, Eyes, and Ears. The Kidney segment dominated the largest market revenue share of 38.5% in 2025, driven by the high prevalence of chronic kidney disease globally and the increasing demand for kidney transplants. The segment benefits from the growing availability of preserved donor kidneys, improvements in storage and transportation technologies, and rising awareness of organ donation programs. Hospitals and transplant centers often prioritize kidney storage due to shorter ischemic tolerance compared to other organs, which increases reliance on organized organ banks. Furthermore, government support for kidney donation and transplant programs in countries like the U.S., Germany, and Japan reinforces market dominance. The segment’s growth is fueled by both rising patient volumes and technological innovations in organ preservation.

The Heart segment is anticipated to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by increasing cases of cardiovascular diseases, rising heart transplant procedures, and technological advancements in heart preservation systems. The segment is witnessing heightened R&D investments in perfusion systems and cryopreservation technologies, enabling longer storage times and safer transplantation. The growing geriatric population and increasing incidence of heart failure globally are boosting demand. Countries such as the U.S., France, and South Korea are experiencing rapid adoption of advanced heart organ banking techniques, driving high growth rates. Additionally, collaborations between hospitals, research institutes, and private organ banks are accelerating innovation and deployment in this segment.

- By Technology

On the basis of technology, the market is segmented into Electrical and Mechanical. The Mechanical segment held the largest market revenue share of 55.2% in 2025, attributed to the widespread use of mechanical perfusion systems and organ transport devices that maintain organ viability. Hospitals and organ banks favor mechanical technologies for their reliability, reduced risk of organ damage during transport, and established regulatory approvals. This segment dominates particularly in mature markets such as the U.S., Germany, and Japan, where high infrastructure availability supports mechanical systems. The strong adoption is further supported by continuous improvements in automated organ handling and perfusion systems that ensure consistent organ quality.

The Electrical segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, driven by innovations in electrically powered organ preservation systems, sensors for real-time organ monitoring, and advanced cooling technologies. Increasing R&D investments in electrical perfusion pumps, organ preservation devices, and AI-based organ viability monitoring systems are fueling growth. Emerging markets, including India, Brazil, and China, are witnessing rapid adoption due to technological collaborations with international organ storage solution providers. Additionally, rising awareness of electrically enhanced preservation methods in academic and research institutions supports the accelerating market penetration.

- By Bionics

On the basis of bionics, the market is segmented into Vision Bionic, Ear Bionic, Cardiac Bionic, Brain Bionic, and Limbs Bionic. The Cardiac Bionic segment dominated the largest market revenue share of 33.8% in 2025, driven by the rising prevalence of cardiovascular diseases and the increasing demand for artificial hearts and ventricular assist devices. Advanced cardiac bionics solutions have improved patient survival and quality of life, supporting broad adoption in hospitals and specialized cardiac centers. The segment’s dominance is further reinforced by ongoing government healthcare programs in countries such as the U.S., Germany, and Japan, along with private investments in cardiac device innovation. Continuous clinical trials and successful transplant outcomes continue to drive market confidence in cardiac bionics.

The Vision Bionic segment is anticipated to witness the fastest CAGR of 23.5% from 2026 to 2033, fueled by technological innovations in retinal implants, prosthetic vision systems, and neural interfacing technologies. Rising incidences of blindness due to age-related macular degeneration and diabetic retinopathy in developed and emerging economies are driving demand. Countries like the U.S., Germany, and Japan are early adopters, with significant clinical trials and commercial launches of retinal prosthetics. Investment in R&D for vision restoration and increasing collaborations between medical device companies and research institutes accelerate growth. The segment benefits from the increasing awareness of bionic vision solutions and their life-changing impact for patients.

Artificial Organ Bank Market Regional Analysis

- North America dominated the artificial organ bank market with the largest revenue share of approximately 38.9% in 2025

- Supported by advanced healthcare infrastructure, high organ transplant volumes, strong presence of key industry players, and growing adoption of state-of-the-art preservation technologies in the U.S.

- The market growth is further fueled by increasing investments in organ banking research, rising awareness about organ preservation solutions, and the presence of well-established hospitals and transplant centers

U.S. Artificial Organ Bank Market Insight

The U.S. artificial organ bank market captured the largest revenue share within North America in 2025, driven by the rapid expansion of organ transplant programs and the increasing adoption of advanced organ preservation technologies. Hospitals and transplant centers are increasingly leveraging automated storage and biobanking solutions to enhance organ viability and optimize transplant outcomes. Additionally, government initiatives supporting organ donation and biobanking research are expected to further propel the market during the forecast period.

Europe Artificial Organ Bank Market Insight

The Europe artificial organ bank market is projected to grow at a significant CAGR during the forecast period, driven by increasing organ transplant procedures, stringent regulatory guidelines for organ preservation, and rising awareness about advanced biobanking solutions. Countries such as Germany, the U.K., and France are witnessing enhanced adoption of automated storage and preservation technologies in hospitals and transplant centers. The market growth is further supported by increasing investments in healthcare infrastructure and research initiatives in organ transplantation.

U.K. Artificial Organ Bank Market Insight

The U.K. artificial organ bank market is anticipated to grow steadily during the forecast period, driven by increasing organ transplant volumes, government-supported organ donation programs, and growing adoption of advanced organ preservation technologies. Hospitals and research institutions are integrating modern biobanking solutions to improve organ storage efficiency and transplant success rates, which is expected to boost market expansion.

Germany Artificial Organ Bank Market Insight

The Germany artificial organ bank market is expected to expand at a notable CAGR during the forecast period, fueled by well-developed healthcare infrastructure, high organ transplant activity, and the increasing adoption of technologically advanced organ storage solutions. The integration of automated biobanking systems in hospitals and transplant centers, along with a strong focus on innovation in organ preservation, is driving market growth.

Asia-Pacific Artificial Organ Bank Market Insight

The Asia-Pacific artificial organ bank market is expected to be the fastest-growing region during the forecast period, driven by rising healthcare expenditure, increasing number of organ transplant centers, growing awareness about organ preservation solutions, and expanding adoption of advanced biobanking technologies across countries such as China, India, and Japan. The market is further boosted by government initiatives supporting organ donation, expanding healthcare infrastructure, and the rapid modernization of hospitals and research centers.

Japan Artificial Organ Bank Market Insight

The Japan artificial organ bank market is gaining momentum due to rising organ transplant procedures, advanced healthcare facilities, and increasing awareness of organ preservation technologies. Hospitals are increasingly implementing automated storage and biobanking solutions to maintain organ viability and improve transplantation outcomes. The aging population and focus on improving healthcare delivery are further expected to drive market growth.

China Artificial Organ Bank Market Insight

The China artificial organ bank market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, growing number of organ transplant centers, and high adoption of advanced organ preservation technologies. Increasing awareness about organ preservation and government initiatives promoting organ donation are key factors propelling the market. The availability of cost-effective biobanking solutions and strong domestic manufacturing capabilities further support market growth.

Artificial Organ Bank Market Share

The Artificial Organ Bank industry is primarily led by well-established companies, including:

• Organovo Holdings, Inc. (U.S.)

• Terumo Corporation (Japan)

• Baxter International Inc. (U.S.)

• Abbott (U.S.)

• Stryker Corporation (U.S.)

• Boston Scientific Corporation (U.S.)

• Edwards Lifesciences Corporation (U.S.)

• Nipro Corporation (Japan)

• Cook Medical (U.S.)

• Carmat SA (France)

• Carmat Bionics (France)

• SynCardia Systems, LLC (U.S.)

• LivaNova PLC (U.K.)

• Biocon Limited (India)

• Miromatrix Medical Inc. (U.S.)

• XenoTherapeutics, Inc. (U.S.)

• Organ Recovery Systems, Inc. (U.S.)

• Humacyte, Inc. (U.S.)

• Revivicor, Inc. (U.S.)

Latest Developments in Global Artificial Organ Bank Market

- In February 2025, OrganOx, a UK‑based medtech spin‑out specializing in organ preservation technologies, raised USD 142 million in new funding to expand its operations in the United States and accelerate development of next‑generation liver preservation systems that improve organ viability for transplant procedures. OrganOx’s devices have been used in over 5,000 clinical transplants and leverage warm blood perfusion to maintain donor livers at body‑like conditions, significantly enhancing outcomes compared with traditional cold storage. This expansion positions the company as a leader in organ preservation technologies that underpin artificial organ bank logistics and supply chain innovations

- In August 2025, Paragonix Technologies (part of Getinge Group) announced at the World Transplant Congress 2025 its advanced organ preservation and transport solutions, showcasing breakthrough research in hypothermic and controlled preservation techniques that improve long‑term outcomes for solid organ transplants. Presentations highlighted clinical data and innovations in real‑time digital tracking of donor organs during transport, critical for enhancing organ bank efficiency and expanding transplant readiness globally

- In March 2025, Chinese researchers reported in Nature the successful temporary implantation of a gene‑edited pig liver into a human patient, where the xenotransplanted liver produced bile and albumin for over 10 days without signs of acute rejection, marking a key step toward biologically sourced organ alternatives that could one day feed artificial organ banks. This work builds on a series of xenotransplantation breakthroughs in genetically modified pig organs and reflects global efforts to expand organ supply

- In July 2023, Boston Scientific (USA) completed the acquisition of a 3D bioprinting startup to bolster its capabilities in regenerative medicine and bio‑engineered tissues, enabling future development of patient‑specific artificial organs and implants that could be stored in organ banks for personalized therapeutic use. This strategic move reflects a broader industry transition toward 3D bioprinting and personalized organ solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.