Global Artificial Organs Market

Market Size in USD Billion

CAGR :

%

USD

26.91 Billion

USD

49.08 Billion

2024

2032

USD

26.91 Billion

USD

49.08 Billion

2024

2032

| 2025 –2032 | |

| USD 26.91 Billion | |

| USD 49.08 Billion | |

|

|

|

|

Artificial Organ Market Size

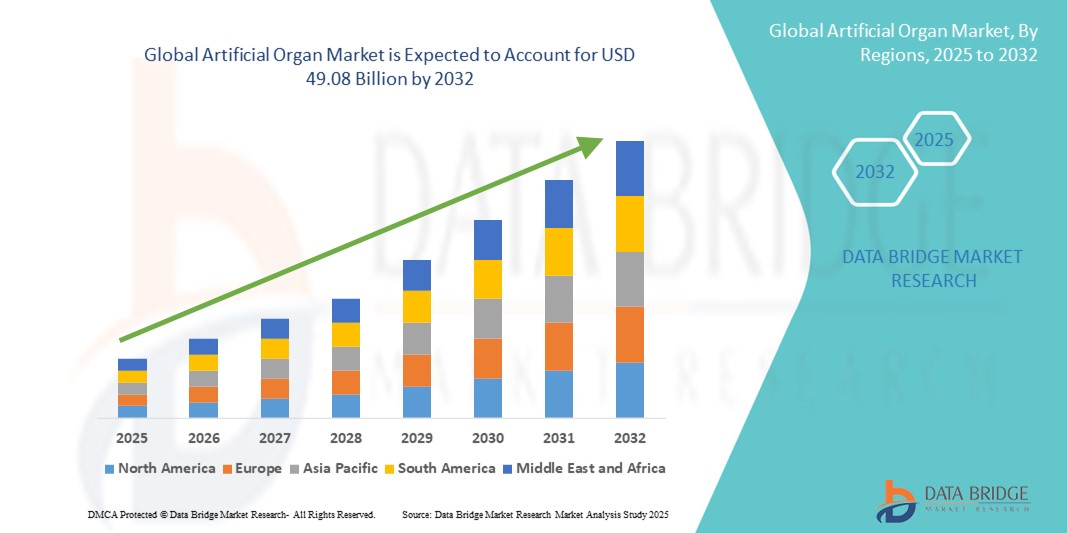

- The global artificial organ market size was valued at USD 26.91 billion in 2024 and is expected to reach USD 49.08 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases and organ failure cases, alongside a widening gap between organ demand and donor availability, prompting higher adoption of artificial organ solutions

- In addition, advancements in biomedical engineering, regenerative medicine, and supportive government initiatives are strengthening the role of artificial organs as vital life-saving alternatives. These contributing factors are fostering rapid innovation and adoption, thereby significantly propelling the industry's expansion

Artificial Organ Market Analysis

- Artificial organs, designed to replace the function of damaged or missing human organs, are becoming critical components in modern healthcare systems due to their ability to extend life expectancy, improve quality of life, and reduce dependency on donor transplants

- The growing demand for artificial organs is primarily fueled by the increasing prevalence of chronic diseases, rising incidence of organ failure, and the global shortage of organ donors, leading to an urgent need for viable, long-term solutions

- North America dominated the artificial organ market with the largest revenue share of 41.7% in 2024, attributed to advanced healthcare infrastructure, high healthcare spending, and continuous technological innovations, particularly in artificial hearts, kidneys, and liver support systems, with the U.S. leading adoption through significant investments in R&D and favorable reimbursement policies

- Asia-Pacific is expected to be the fastest growing region in the artificial organ market during the forecast period due to rising healthcare awareness, improving medical infrastructure, and an increasing patient population

- The artificial kidney segment dominated the artificial organ market with a market share of 38.5% in 2024, driven by the global surge in chronic kidney diseases and the high demand for dialysis alternatives

Report Scope and Artificial Organ Market Segmentation

|

Attributes |

Artificial Organ Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Organ Market Trends

Technological Innovations in Bioengineering and Organ Fabrication

- A major and transformative trend in the global artificial organ market is the continuous innovation in bioengineering and organ fabrication technologies, particularly through the advancement of 3D bioprinting, stem cell research, and bioartificial interfaces. These innovations are paving the way for more functional, patient-specific, and durable artificial organs

- For instance, researchers and companies are actively developing 3D bioprinted liver tissues and kidney structures using patient-derived cells, which may help reduce organ rejection rates and improve integration with human biological systems. Companies such as Organovo and Trestle Biotherapeutics are working on 3D-printed human tissues and regenerative solutions to bridge the transplant gap

- Bioartificial organs, such as hybrid devices combining synthetic scaffolds with living cells, are also gaining traction. These systems mimic the natural function of organs while reducing dependency on donor availability and immunosuppressants. For instance, artificial pancreases for diabetic patients and wearable artificial kidneys are progressing toward clinical use

- Furthermore, smart sensors and AI-driven monitoring systems are being integrated into artificial organ devices to track real-time performance and patient health data, enhancing safety and personalization. These intelligent feedback mechanisms can automatically adjust device functions to suit dynamic physiological conditions

- This trend is fundamentally shifting the artificial organ market from traditional mechanical replacements to highly sophisticated, personalized, and biologically integrated systems. As this innovation accelerates, it is expected to redefine the future of organ replacement therapy and expand access to life-saving solutions globally

Artificial Organ Market Dynamics

Driver

Rising Organ Failure Rates and Growing Transplant Shortage

- The increasing global incidence of organ failure due to aging populations, lifestyle-related diseases, and chronic health conditions is a major driver behind the growing demand for artificial organs. This demand is intensified by a critical shortage of organ donors, making artificial alternatives a necessary life-saving solution

- For instance, according to the Global Observatory on Donation and Transplantation (GODT), thousands of patients die each year while waiting for organ transplants due to limited donor availability. This has led governments and healthcare organizations to support the development and clinical adoption of artificial organs

- Artificial hearts, lungs, kidneys, and livers are gaining regulatory approvals in several regions, helping bridge the treatment gap while improving survival rates and quality of life. Furthermore, rising public and private investments in regenerative medicine and organ biofabrication are fueling the market’s growth

- The convenience of reduced transplant wait times, the ability to customize organs for individual patients, and lower risk of rejection are compelling factors driving adoption in both developed and emerging healthcare systems

- The increasing prevalence of lifestyle diseases such as diabetes, hypertension, and cardiovascular disorders is contributing significantly to the rise in organ failures, especially kidneys, livers, and hearts, thereby driving the demand for artificial organ solutions as effective long-term interventions

- Technological advancements in materials science, such as the use of biocompatible polymers and smart biomaterials, are enabling the development of next-generation artificial organs that better mimic natural functions, reduce complications, and enhance durability, thus increasing adoption in both hospitals and home-care settings

Restraint/Challenge

High Cost and Complex Regulatory Approval Process

- One of the key challenges in the artificial organ market is the high cost associated with the development, production, and clinical deployment of artificial organs, which limits affordability and access particularly in low- and middle-income regions

- In addition, navigating the complex and stringent regulatory approval processes for artificial organ devices poses a significant hurdle. Given the life-critical function of these devices, they must meet rigorous clinical safety, efficacy, and biocompatibility standards before receiving approval

- For instance, implantable artificial hearts and kidneys require extensive preclinical testing and long-term human trials, which lengthen time-to-market and increase R&D expenses. Regulatory bodies such as the FDA and EMA impose strict compliance requirements that can delay commercialization

- While innovation continues to bring down manufacturing costs and improve device reliability, the combination of affordability barriers and slow regulatory approvals remains a bottleneck. Addressing this challenge through public-private partnerships, regulatory harmonization, and cost-effective design innovations will be key to ensuring broader adoption and market sustainability

- Limited awareness and lack of skilled professionals for the implantation and maintenance of advanced artificial organs, especially in developing countries, hinder the market’s growth and restrict access to life-saving therapies in under-resourced regions

- Ethical concerns and cultural barriers surrounding artificial organ usage particularly bioartificial organs created using animal or genetically modified cells pose additional resistance to adoption in certain markets, impacting both acceptance and regulatory progression

Artificial Organ Market Scope

The market is segmented on the basis of organ type, material type, and type

- By Organ Type

On the basis of organ type, the artificial organ market is segmented into artificial heart, artificial kidney, artificial pancreas, artificial lungs, cochlear implants, artificial liver, and others. The artificial kidney segment dominated the market with the largest market revenue of 38.5% share in 2024, driven by the high global burden of chronic kidney disease (CKD) and the increasing demand for alternatives to dialysis and donor kidney transplants. The growing adoption of wearable and portable artificial kidney devices, especially in developed regions, is enhancing patient quality of life while reducing hospitalization.

The artificial heart segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising cases of end-stage heart failure and limited availability of donor hearts. Technological breakthroughs in total artificial hearts (TAH) and ventricular assist devices (VADs), along with improved biocompatibility and miniaturization, are significantly expanding treatment possibilities and driving adoption in both advanced and emerging healthcare systems.

- By Material Type

On the basis of material type, the artificial organ market is segmented into silicon, plastics, and steel. The silicon segment held the largest market revenue share in 2024 due to its superior biocompatibility, flexibility, and chemical stability, making it suitable for long-term implantation and repeated contact with biological tissues. Silicon is commonly used in cochlear implants, artificial pancreases, and soft-tissue prosthetics.

The plastics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by innovations in medical-grade polymers offering high durability, lightweight characteristics, and cost-efficiency. Plastics are increasingly utilized in the development of disposable components and structural parts of artificial organs, especially in kidney and liver support devices.

- By Type

On the basis of type, the artificial organ market is categorized into permanent artificial organs and temporary artificial organs. The permanent artificial organs segment accounted for the largest market share in 2024, as these devices such as cochlear implants and artificial pancreases—are designed for long-term replacement of lost organ function, thereby improving patient independence and reducing dependence on external care systems. Their growing acceptance, especially in managing chronic conditions, continues to drive this segment.

The temporary artificial organs segment is projected to grow at a substantial rate during the forecast period, particularly due to their increasing use in critical care scenarios. Devices such as extracorporeal membrane oxygenation (ECMO) systems and temporary ventricular assist devices are vital in bridging patients to transplant or recovery, gaining importance in trauma and emergency care settings.

Artificial Organ Market Regional Analysis

- North America dominated the artificial organ market with the largest revenue share of 41.7% in 2024, attributed to advanced healthcare infrastructure, high healthcare spending, and continuous technological innovations, particularly in artificial hearts, kidneys, and liver support systems, with the U.S. leading adoption through significant investments in R&D and favorable reimbursement policies

- Patients and healthcare providers in the region increasingly rely on artificial organs due to their ability to address the persistent shortage of donor organs, offering life-extending alternatives for conditions such as heart, kidney, and liver failure

- This strong market position is further supported by favorable reimbursement policies, a well-established regulatory framework, and active R&D initiatives by key players, making artificial organs a critical component of modern therapeutic strategies across the U.S. and Canada

U.S. Artificial Organ Market Insight

The U.S. artificial organ market captured the largest revenue share of 82.3% in North America in 2024, fueled by a high incidence of chronic diseases and advanced healthcare infrastructure. The nation’s robust R&D ecosystem, strong presence of key medical device companies, and favorable reimbursement landscape significantly support the adoption of artificial organs such as artificial hearts, kidneys, and cochlear implants. The increasing emphasis on innovative life-saving therapies, along with the rising demand for transplant alternatives, continues to accelerate market growth.

Europe Artificial Organ Market Insight

The Europe artificial organ market is projected to expand at a substantial CAGR throughout the forecast period, driven by a growing aging population, increasing organ failure cases, and supportive healthcare policies. The region shows a strong focus on biotechnology and medical innovation, fostering research in bioartificial organs and tissue engineering. Widespread government funding, coupled with collaborative efforts between academic and healthcare institutions, is enhancing access to advanced organ replacement solutions across both public and private healthcare sectors.

U.K. Artificial Organ Market Insight

The U.K. artificial organ market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the NHS’s increasing adoption of life-extending technologies and a focus on improving transplant waitlist outcomes. Rising public awareness of organ donation shortages and the growing adoption of artificial kidneys and cochlear implants are key contributors. In addition, the country's investment in biomedical innovation and a supportive regulatory framework are helping to advance clinical trials and accelerate commercialization.

Germany Artificial Organ Market Insight

The Germany artificial organ market is expected to expand at a considerable CAGR during the forecast period, driven by strong healthcare funding, a culture of innovation, and the growing demand for efficient transplant alternatives. Germany’s well-established medical device manufacturing sector, along with its emphasis on research and sustainability, is supporting the development of advanced artificial organs. The integration of digital health technologies into organ monitoring systems is further enhancing the adoption of artificial solutions in hospitals and specialized clinics.

Asia-Pacific Artificial Organ Market Insight

The Asia-Pacific artificial organ market is poised to grow at the fastest CAGR of 25.6% during the forecast period of 2025 to 2032, due to increasing healthcare investments, rising incidences of lifestyle diseases, and growing demand for transplant alternatives. Countries such as China, Japan, and India are witnessing surging demand for artificial kidneys, hearts, and cochlear implants, supported by rising awareness and improving healthcare access. Regional governments’ emphasis on medical infrastructure and innovation is further fostering a favorable environment for market expansion.

Japan Artificial Organ Market Insight

The Japan artificial organ market is gaining momentum due to the country's advanced medical technology landscape and a high prevalence of chronic illnesses associated with an aging population. Japan continues to lead in cochlear implant usage and shows growing interest in artificial pancreases and bioengineered tissues. Government-backed initiatives promoting digital health, alongside a highly skilled medical workforce, are accelerating the adoption of artificial organ systems in both hospitals and long-term care facilities.

India Artificial Organ Market Insight

The India artificial organ market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by a growing burden of end-stage organ diseases, rapid urbanization, and an expanding healthcare infrastructure. The country’s large patient pool, improving affordability, and increasing access to advanced treatment options are boosting demand for artificial kidneys and liver support systems. Moreover, the Indian government’s push toward affordable healthcare technologies and medical tourism is further positioning India as a key growth market for artificial organ solutions.

Artificial Organ Market Share

The artificial organ industry is primarily led by well-established companies, including:

- B. Braun SE (Germany)

- Boston Scientific Corporation (U.S.)

- Getinge AB. (Sweden)

- ABIOMED. (U.S.)

- Asahi Kasei Corporation (Japan)

- Berlin Heart (Germany)

- CARMAT (France)

- Jarvik Heart, Inc. (U.S.)

- Terumo Corporation (Japan)

- SynCardia Systems, LLC (U.S.)

- Nipro Europe Group Companies (Japan)

- Medtronic (Ireland)

- Organovo Holdings Inc. (U.S.)

- NexImmune (U.S.)

- Diabeloop SA (France)

- Admetsys (U.S.)

- Defymed (France)

- Pancreum, Inc. (U.S.)

- Beta Bionics Inc. (U.S.)

- Integra LifeSciences (U.S.)

What are the Recent Developments in Global Artificial Organ Market?

- In July 2025, The Texas Heart Institute (THI), BiVACOR, a clinical-stage medical device company, Baylor St. Luke’s Medical Center and Baylor College of Medicine announced the successful first-in-human implantation of the BiVACOR Total Artificial Heart (TAH) as part of the U.S. Food and Drug Administration (FDA) Early Feasibility Study (EFS). BiVACOR’s TAH is a titanium-constructed biventricular rotary blood pump with a single moving part that utilizes a magnetically levitated rotor that pumps the blood and replaces both ventricles of a failing heart

- In June 2025, CARMAT announced the first commercial implants of its Aeson artificial heart outside the European Union, performed in Israel. This expansion marks a significant step in the company's efforts to bring its innovative heart replacement technology to a global market

- In May 2025, BiVacor has received the FDA’s breakthrough device designation for its titanium Total Artificial Heart (TAH), which serves as a bridge to transplant for patients with end-stage heart failure. BiVacor’s TAH is based on rotary blood pump technology and approximately the size of an adult’s fist. It has no valves or flexing ventricle chambers, and its only moving part is a magnetically suspended double-sided centrifugal pump impeller

- In April 2025, CARMAT announced that it had received conditional approval from the FDA to initiate the second cohort of its Early Feasibility Study (EFS) for the Aeson® artificial heart in the United States. This milestone paves the way for U.S. patients to benefit from the device as early as the second half of 2025

- In February 2023, Cochlear Limited launched its next-generation cochlear implant system—the Cochlear Nucleus 8 Sound Processor—in select global markets. This new device offers enhanced sound clarity, connectivity, and comfort, underlining the company’s dedication to improving hearing outcomes through technological advancement. The launch also reflects rising consumer expectations for smarter, more discreet, and adaptable artificial sensory implants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.