Global Artificial Pancreas Systems Market

Market Size in USD Million

CAGR :

%

USD

310.21 Million

USD

591.53 Million

2024

2032

USD

310.21 Million

USD

591.53 Million

2024

2032

| 2025 –2032 | |

| USD 310.21 Million | |

| USD 591.53 Million | |

|

|

|

|

Artificial Pancreas Device Systems Market Size

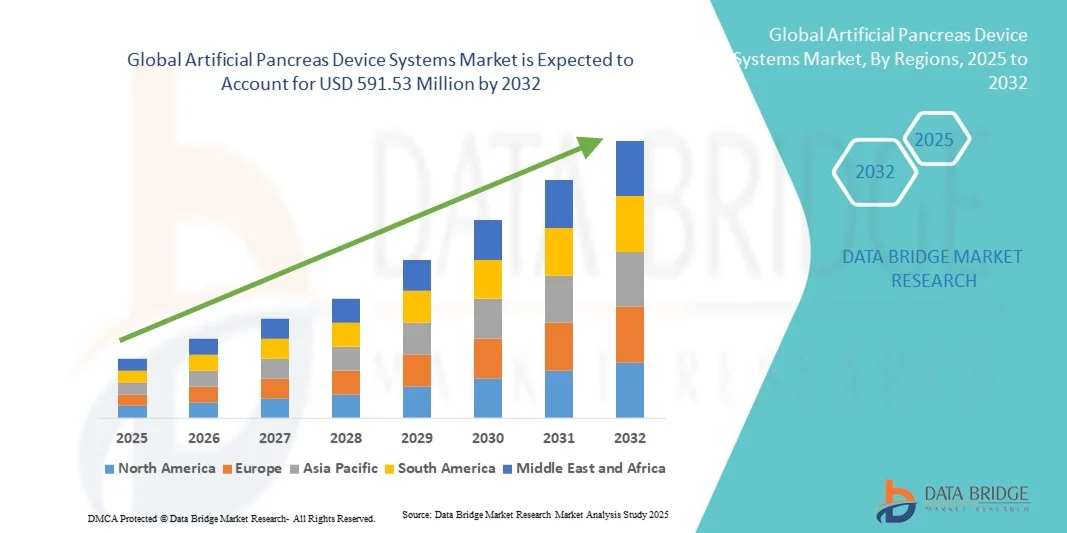

- The global artificial pancreas device systems market size was valued at USD 310.21 million in 2024 and is expected to reach USD 591.53 million by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in connected medical devices and diabetes management technologies, leading to greater digitalization in both clinical and home care settings

- Furthermore, rising patient demand for safe, user-friendly, and integrated solutions for blood glucose management is establishing artificial pancreas device systems as the preferred choice for automated insulin delivery. These converging factors are accelerating the adoption of these systems, thereby significantly boosting the market’s growth

Artificial Pancreas Device Systems Market Analysis

- The Artificial Pancreas Device Systems (APDS) market is witnessing significant growth due to increasing prevalence of diabetes, rising adoption of advanced insulin delivery technologies, and growing awareness about automated glucose management systems in both type 1 and type 2 diabetic patients

- The escalating demand for APDS is primarily fueled by technological advancements in continuous glucose monitoring (CGM) and insulin pump integration, increasing patient preference for automated therapy management, and rising healthcare expenditure

- North America dominated the artificial pancreas device systems market with the largest revenue share of 43.5% in 2024, characterized by advanced diabetes care infrastructure, high disposable incomes, and the presence of key industry players, with the U.S. experiencing substantial growth in APDS installations, particularly in hospitals, clinics, and homecare settings, driven by innovations from both established medtech companies and startups focusing on AI-enabled and automated glucose management features

- Asia-Pacific is expected to be the fastest growing region in the artificial pancreas device systems market during the forecast period, owing to increasing urbanization, rising prevalence of diabetes, growing healthcare awareness, and expanding access to advanced diabetes management technologies in countries such as China, India, and Japan

- The Threshold Suspended Device System (TSDS) segment dominated the artificial pancreas device systems market in 2024 with a revenue share of 74.9%, driven by its proven efficacy in preventing hypoglycemia and providing reliable insulin delivery adjustments

Report Scope and Artificial Pancreas Device Systems Market Segmentation

|

Attributes |

Artificial Pancreas Device Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Artificial Pancreas Device Systems Market Trends

Enhanced Convenience Through AI and Automated Glucose Management

- A significant and accelerating trend in the global artificial pancreas device systems market is the integration of artificial intelligence (AI) with advanced continuous glucose monitoring (CGM) and insulin delivery systems. This integration enables predictive insulin dosing, personalized glucose control, and enhanced convenience for patients managing diabetes

- For instance, some advanced closed-loop APDS, such as the MiniMed 780G system, use AI-driven algorithms to automatically adjust insulin delivery in real time, reducing the risk of hyperglycemia and hypoglycemia. Similarly, Tandem Diabetes’ t:slim X2 insulin pump integrates with Dexcom G6 CGM and provides predictive alerts and automatic basal insulin adjustments

- AI-enabled APDS provide features such as learning individual glucose patterns, suggesting optimized insulin dosing, and generating intelligent alerts for unusual glucose trends. Patients can receive real-time notifications on smartphones or wearable devices, enhancing diabetes management while reducing the cognitive burden of manual insulin calculations

- The seamless integration of APDS with mobile applications and cloud platforms allows centralized monitoring for patients, caregivers, and healthcare providers. Through a single interface, users can track glucose trends, adjust insulin therapy, and access telemedicine consultations, creating a connected and automated diabetes care ecosystem

- This trend towards intelligent, predictive, and interconnected APDS is fundamentally reshaping patient expectations for diabetes management. Consequently, companies such as Medtronic, Insulet, and Tandem Diabetes are developing next-generation AI-enabled APDS with features like automatic insulin delivery adjustment and remote monitoring through mobile apps

- The demand for APDS offering AI-driven glucose control and automated insulin delivery is growing rapidly across both residential and clinical settings, as patients and healthcare providers increasingly prioritize convenience, safety, and efficacy in diabetes management

Artificial Pancreas Device Systems Market Dynamics

Driver

Rising Prevalence of Diabetes and Demand for Automated Therapy

- The increasing prevalence of diabetes worldwide, coupled with a growing awareness of diabetes complications, is a significant driver for the adoption of APDS. Patients are seeking automated solutions that provide precise glucose management and improve quality of life

- For instance, in April 2024, Medtronic announced updates to its MiniMed™ 780G system, enhancing automated insulin delivery features and predictive glucose alerts. Such innovations by leading companies are expected to drive APDS market growth in the forecast period

- As patients and healthcare providers seek more efficient and effective diabetes management tools, APDS offer features such as real-time glucose monitoring, predictive insulin dosing, and remote data access, providing a compelling alternative to traditional insulin therapy

- Furthermore, increasing adoption of connected health devices, telemedicine, and mobile apps for diabetes management is making APDS an integral component of modern care, offering seamless integration with healthcare platforms

- The convenience of automated glucose control, reduced risk of hypo- and hyperglycemia, and the ability to monitor therapy remotely are key factors propelling the adoption of APDS in both home and clinical settings

Restraint/Challenge

High Costs and Regulatory Compliance Requirements

- The relatively high cost of APDS devices, including insulin pumps and continuous glucose monitoring systems, poses a challenge for widespread adoption, particularly in developing regions or among price-sensitive patients. Advanced AI-enabled systems often require premium pricing, which can limit accessibility

- In addition, APDS are highly regulated medical devices, and meeting stringent safety and efficacy standards across different countries can delay market entry and increase development costs

- Addressing these challenges through cost-effective production, insurance coverage expansion, and patient assistance programs is crucial for broader adoption. Companies such as Tandem Diabetes, Medtronic, and Insulet are increasingly focusing on reducing device costs, improving reimbursement pathways, and offering training programs for patients and healthcare providers

- While technological advancements are making devices more intuitive and user-friendly, awareness and education on proper usage remain essential to ensure safety and maximize clinical benefits

- Overcoming these barriers through improved affordability, regulatory compliance, patient education, and continuous technological innovation will be vital for sustained growth in the Artificial Pancreas Device Systems market

Artificial Pancreas Device Systems Market Scope

The market is segmented on the basis of device and end user.

- By Device

On the basis of device, the Artificial Pancreas Device Systems market is segmented into Threshold Suspended Device System (TSDS), Control-to-Range (CTR) System, and Control-to-Target (CTT) System. The Threshold Suspended Device System (TSDS) segment dominated the market in 2024 with a revenue share of 74.9%, driven by its proven efficacy in preventing hypoglycemia and providing reliable insulin delivery adjustments. TSDS systems are widely preferred among patients for their simplicity, safety, and integration with continuous glucose monitors (CGM). The established track record of TSDS devices, along with their compatibility with various insulin pumps, enhances their adoption in home care, hospitals, and clinics. Additionally, the growing awareness among patients and caregivers about hypoglycemia prevention contributes significantly to the dominance of this segment. Healthcare providers often recommend TSDS systems for elderly patients and those with type 1 diabetes due to their ease of use and robust safety features. Continuous software updates and AI-driven predictive algorithms in TSDS devices further enhance their performance, fostering confidence among users. Furthermore, reimbursement policies in major markets support the adoption of TSDS devices, making them accessible to a larger patient population. The market for TSDS devices is well-established in North America and Europe, with increasing penetration in Asia-Pacific as awareness and access improve. Overall, TSDS devices continue to set the benchmark for safety and reliability in APDS, reinforcing their leading position.

The Control-to-Target (CTT) System segment is anticipated to witness the fastest CAGR of 22.4% from 2025 to 2032. This rapid growth is fueled by its advanced automated glucose control, precise insulin dosing, and integration with AI algorithms that predict glucose trends. CTT systems offer enhanced patient convenience by continuously adjusting insulin delivery based on real-time glucose levels and individualized therapy profiles. The ability to connect with mobile apps and cloud-based monitoring platforms allows both patients and healthcare providers to track performance remotely, supporting personalized treatment. The segment is gaining traction in home care settings and clinical trials, where accurate and adaptive insulin delivery is critical. Innovation in CTT devices, including improved algorithms, smaller form factors, and user-friendly interfaces, further accelerates adoption. Rising prevalence of type 1 diabetes globally and increasing focus on closed-loop systems in emerging markets drive the CAGR. Moreover, strong investments from major players in R&D and the launch of next-generation CTT devices contribute to market expansion. The segment also benefits from awareness campaigns emphasizing the clinical benefits of automated glucose management. Insurance coverage and government initiatives for diabetes management are likely to further boost adoption. Overall, the CTT segment represents the future of intelligent, patient-centric APDS solutions.

- By End User

On the basis of end user, the Artificial Pancreas Device Systems market is segmented into Hospitals, Clinics, Home Care, Ambulatory Centre, and Others. The Home Care segment dominated the market in 2024 with a revenue share of 52.3%, driven by the increasing trend of at-home diabetes management, convenience, and the ability to integrate devices with personal mobile applications. Patients increasingly prefer home-based APDS solutions to reduce hospital visits and gain flexibility in managing insulin therapy. Home care adoption is further supported by the availability of user-friendly devices, telemedicine monitoring, and caregiver support. Rising awareness campaigns, coupled with growing prevalence of type 1 diabetes and elderly patients, reinforce the home care segment's dominance. The integration of APDS with digital health platforms enables real-time monitoring and data sharing with healthcare providers, enhancing patient confidence and adherence. Moreover, reimbursement policies in North America and Europe facilitate home use, while government initiatives in Asia-Pacific encourage adoption in urban households. The expansion of smart devices, cloud connectivity, and AI-based alerts also supports the growth of the home care segment. Additionally, manufacturers are introducing portable and compact APDS solutions tailored for home settings, enhancing usability and adoption. Overall, the home care segment benefits from convenience, patient empowerment, and healthcare cost reduction, making it the leading end-user segment.

The Hospitals segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by the growing need for advanced inpatient diabetes management solutions and integration with hospital monitoring systems. Hospitals are increasingly adopting APDS for critically ill patients and those undergoing surgery, where continuous glucose monitoring and automated insulin delivery are crucial for optimal outcomes. The segment growth is fueled by investments in healthcare infrastructure, increasing patient awareness, and the need for efficient and error-free insulin therapy. Integration with electronic health records (EHR) and hospital management systems facilitates real-time monitoring and therapy adjustments. Hospitals also leverage APDS for training healthcare staff and demonstrating closed-loop therapy benefits to patients transitioning to home care. Technological innovations, including AI-assisted dosing algorithms and cloud-based monitoring, enhance the reliability and accuracy of hospital-based APDS. Furthermore, rising prevalence of diabetes in both developed and emerging countries drives the demand for hospital-grade solutions. Partnerships between device manufacturers and hospital networks further accelerate adoption. Overall, hospitals represent a high-growth segment due to the clinical necessity and increasing institutional focus on automated diabetes management.

Artificial Pancreas Device Systems Market Regional Analysis

- North America dominated the artificial pancreas device systems market with the largest revenue share of 43.5% in 2024, driven by advanced diabetes care infrastructure, high disposable incomes, and the presence of key industry players

- The region witnessed substantial adoption of APDS across hospitals, clinics, and homecare settings, supported by innovations in AI-enabled and automated glucose management systems, which improve patient outcomes and streamline diabetes management

- Consumers and healthcare providers in the region highly value the convenience, real-time monitoring, and precision offered by APDS, which integrates continuous glucose monitoring with automated insulin delivery. The widespread adoption is further supported by technological awareness, increasing demand for remote patient monitoring, and a growing focus on personalized diabetes care solutions

U.S. Artificial Pancreas Device Systems Market Insight

The U.S. artificial pancreas device systems market captured the largest revenue share in 2024 within North America, driven by rapid adoption in hospitals, clinics, and homecare facilities. The growth is fueled by the increasing prevalence of diabetes, rising awareness of automated glucose management systems, and innovations from both established medtech companies and startups. Integration with mobile applications, AI-enabled predictive insulin delivery, and remote monitoring systems is significantly enhancing the efficiency and safety of diabetes management in both clinical and residential settings.

Europe Artificial Pancreas Device Systems Market Insight

The Europe artificial pancreas device systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations, rising prevalence of diabetes, and increasing adoption of automated glucose management systems. The demand for improved patient outcomes and efficient hospital-based diabetes management is encouraging the adoption of APDS across both residential and clinical environments.

U.K. Artificial Pancreas Device Systems Market Insight

The U.K. artificial pancreas device systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing awareness about diabetes care and the adoption of advanced glucose monitoring and insulin delivery systems. Hospitals, clinics, and homecare providers are increasingly installing APDS to enhance patient safety, reduce glycemic variability, and improve overall diabetes management.

Germany Artificial Pancreas Device Systems Market Insight

The Germany artificial pancreas device systems market is expected to expand at a considerable CAGR during the forecast period, fueled by technological advancements in diabetes care and strong adoption of automated insulin delivery systems. Germany’s advanced healthcare infrastructure and emphasis on innovative medical technologies are supporting growth in both clinical and homecare settings.

Asia-Pacific Artificial Pancreas Device Systems Market Insight

The Asia-Pacific artificial pancreas device systems market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising prevalence of diabetes, growing healthcare awareness, and expanding access to advanced diabetes management technologies. The region is witnessing adoption of APDS in hospitals, clinics, and homecare services, supported by government initiatives and local manufacturing of devices that improve affordability and accessibility.

Japan Artificial Pancreas Device Systems Market Insight

The Japan artificial pancreas device systems market is gaining momentum due to the country’s high-tech healthcare culture, aging population, and demand for convenient, reliable diabetes management solutions. Increasing adoption of APDS in hospitals, clinics, and residential care settings is enabling improved glycemic control and better patient outcomes.

China Artificial Pancreas Device Systems Market Insight

The China artificial pancreas device systems market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding middle class, rising prevalence of diabetes, and strong local manufacturing of APDS devices. Hospitals, clinics, and homecare facilities are increasingly deploying APDS to improve diabetes management efficiency and accessibility.

Artificial Pancreas Device Systems Market Share

The Artificial Pancreas Device Systems industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Tandem Diabetes Care, Inc. (U.S.)

- Insulet Corporation (U.S.)

- Beta Bionics (U.S.)

- BIGFOOT BIOMEDICAL, INC. (U.S.)

- Pancreum, Inc. (U.S.)

- INREDA DIABETIC B.V. (Netherlands)

- Diabeloop (France)

- Dexcom (U.S.)

- Abbott (U.S.)

- Senseonics (U.S.)

- Medtrum Technologies Inc. (China)

- Nemaura Medical (U.K.)

- Nova Biomedical (U.S.)

- Lilly USA, LLC. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

Latest Developments in Global Artificial Pancreas Device Systems Market

- In December 2023, Beta Bionics announced the nationwide launch of the iLet Bionic Pancreas automated insulin delivery system with the Dexcom G7 Continuous Glucose Monitoring (CGM) System in the United States. The system is designed to autonomously determine and deliver insulin doses to control blood-sugar levels for individuals aged 6 and older with type 1 diabetes. A firmware update allows users to integrate the iLet with the Dexcom G7 without requiring new hardware

- In December 2023, Tandem Diabetes Care launched the t:slim X2 insulin pump with Dexcom G7 integration in the United States. This integration enables real-time glucose data to adjust insulin delivery, enhancing automated insulin delivery systems. The t:slim X2 insulin pump was also made compatible with both the Dexcom G7 and Dexcom G6 CGM Systems in Canada in December 2024

- In August 2025, the University of Virginia Health System published a review highlighting the potential of artificial pancreas systems to expand to more type 1 diabetes patients through full automation. Current systems require user input for meals and exercise, but advancements aim to reduce these requirements, improving blood sugar management for a broader patient population

- In June 2025, the National Institute for Health and Care Excellence (NICE) reported that innovative hybrid closed-loop (HCL) systems are transforming the lives of thousands of children and young people with type 1 diabetes in the UK. These systems offer improved blood sugar control and can significantly impact daily life for families managing this condition

- In March 2025, at the 18th annual International Conference on Advanced Technologies & Treatments for Diabetes (ATTD) in Amsterdam, Dexcom announced updates on enhanced continuous glucose monitors, including the G7 model. The G7 demonstrated improved accuracy and integration capabilities with insulin delivery systems, reinforcing its status as a leading CGM brand

- In May 2025, Medtronic announced plans to spin off its diabetes business, including insulin pumps and continuous glucose monitoring systems, into a separate publicly traded company within 18 months. This strategic move aims to allow Medtronic to focus on its more profitable cardiovascular, neuroscience, and surgical device segments, while providing the diabetes division with dedicated resources for growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.