Global Artificial Retina Market

Market Size in USD Billion

CAGR :

%

USD

22.48 Billion

USD

113.47 Billion

2025

2033

USD

22.48 Billion

USD

113.47 Billion

2025

2033

| 2026 –2033 | |

| USD 22.48 Billion | |

| USD 113.47 Billion | |

|

|

|

|

Artificial Retina Market Size

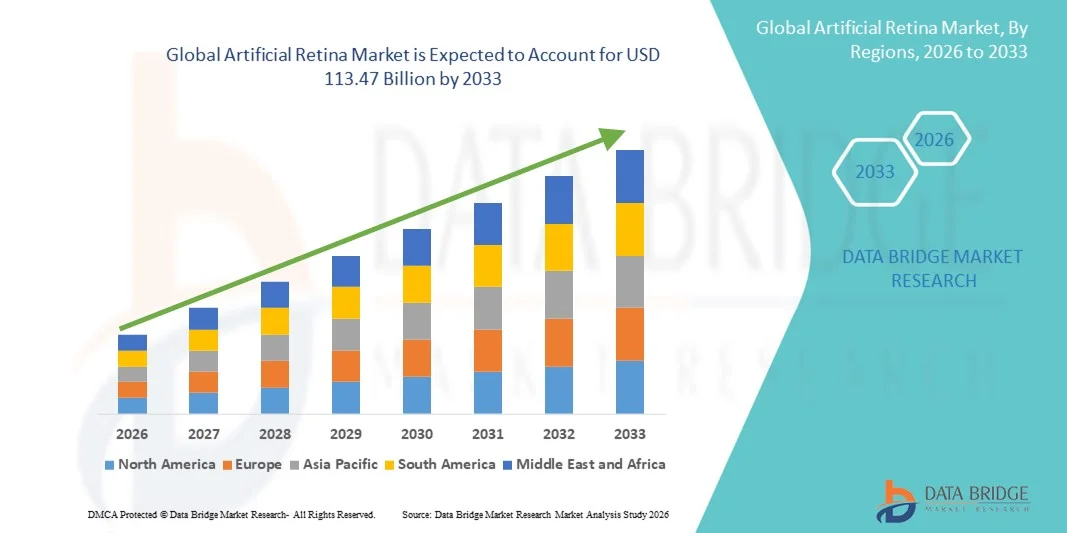

- The global artificial retina market size was valued at USD 22.48 billion in 2025 and is expected to reach USD 113.47 billion by 2033, at a CAGR of 22.43% during the forecast period

- The market growth is largely driven by rising prevalence of retinal degenerative diseases such as retinitis pigmentosa and age-related macular degeneration, along with continuous technological advancements in bionic vision systems, microelectronics, and neuroprosthetics

- Furthermore, increasing investments in ophthalmic R&D, growing awareness of vision restoration therapies, and supportive regulatory and reimbursement developments are positioning artificial retina solutions as a transformative approach to visual impairment management, thereby significantly boosting the industry’s growth

Artificial Retina Market Analysis

- Artificial retina systems, designed to restore partial vision through retinal implants and bionic eye technologies, are increasingly emerging as critical solutions for patients suffering from severe retinal degenerative disorders, offering improved visual perception and enhanced quality of life in clinical and research settings

- The escalating demand for artificial retina solutions is primarily driven by the rising global prevalence of vision loss conditions such as retinitis pigmentosa and age-related macular degeneration, coupled with continuous advancements in microelectrode arrays, image processing software, and neurostimulation technologies

- North America dominated the artificial retina market with the largest revenue share of 38.6% in 2025, supported by strong ophthalmic research infrastructure, early adoption of advanced medical devices, and the presence of leading innovators and clinical trial activity, particularly in the U.S., where favorable funding environments and regulatory pathways are accelerating technology development

- Asia-Pacific is expected to be the fastest growing region in the artificial retina market during the forecast period due to increasing prevalence of retinal disorders, expanding healthcare infrastructure, rising medical device investments, and growing adoption of advanced ophthalmic technologies across emerging economies

- Epiretinal implant segment dominated the artificial retina market with a market share of 41.8% in 2025, driven by its relatively advanced clinical adoption, established surgical procedures, and ongoing improvements in visual resolution and patient outcomes

Report Scope and Artificial Retina Market Segmentation

|

Attributes |

Artificial Retina Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Artificial Retina Market Trends

Advancements in AI-Enhanced Visual Processing

- A significant and accelerating trend in the global artificial retina market is the integration of artificial intelligence (AI) and advanced image processing algorithms into retinal implants, enhancing the quality and adaptability of restored vision

- For instance, Second Sight’s AI-powered Argus II platform uses real-time image enhancement to improve contrast and object recognition for patients with severe vision loss

- AI integration in artificial retina systems enables features such as adaptive stimulation patterns, personalized visual feedback, and predictive adjustments based on the patient’s visual environment. For instance, Pixium Vision’s PRIMA implant leverages AI to refine photodiode stimulation and optimize functional visual outcomes

- The seamless integration of AI with implantable devices facilitates improved clinical outcomes, allowing ophthalmologists to customize stimulation protocols and track patient progress through centralized digital interfaces

- This trend towards smarter, adaptive, and patient-specific visual restoration solutions is reshaping expectations for retinal prosthetics. Consequently, companies such as Bionic Vision Technologies are developing AI-enabled retinal implants with enhanced pattern recognition and low-light performance

- The demand for artificial retina systems incorporating AI-driven image processing is growing rapidly across clinical and research applications, as patients and physicians increasingly prioritize functional vision improvements and usability

- Increasing partnerships between technology firms and medical device manufacturers are accelerating the development of next-generation artificial retina systems with improved resolution, wireless connectivity, and implant longevity

Artificial Retina Market Dynamics

Driver

Rising Prevalence of Retinal Disorders and Vision Loss

- The increasing global prevalence of retinal degenerative diseases, such as retinitis pigmentosa and age-related macular degeneration, is a significant driver for the heightened demand for artificial retina solutions

- For instance, in March 2025, Pixium Vision announced expansion of its clinical trials for the PRIMA subretinal implant to address larger populations of AMD patients, indicating strong growth potential for AI-enabled prosthetic vision systems

- As patients and healthcare providers seek solutions to mitigate irreversible vision loss, artificial retina systems offer improved functional vision, independence, and quality of life, presenting a compelling alternative to conventional therapies

- Furthermore, supportive reimbursement policies, rising awareness of innovative ophthalmic technologies, and growing collaborations between device manufacturers and research institutions are making artificial retina solutions increasingly accessible

- The combination of clinical demand, technological innovation, and supportive healthcare infrastructure is propelling adoption of artificial retina implants in both developed and emerging markets

- Expanding geriatric population globally, which has a higher risk of retinal disorders, is driving long-term demand for advanced retinal prosthetics and vision restoration solutions

- Increasing government and private funding for ophthalmic R&D programs is accelerating innovation and commercialization of artificial retina systems, opening new market opportunities

Restraint/Challenge

Surgical Complexity and High Device Cost

- Concerns regarding the surgical implantation process and associated medical risks pose a significant challenge to broader market adoption, as artificial retina systems require specialized procedures and ophthalmic expertise

- For instance, high-profile clinical reports highlighting device migration or suboptimal stimulation outcomes have made some patients hesitant to opt for retinal implants

- Addressing these challenges through minimally invasive surgical techniques, enhanced device durability, and thorough physician training is crucial for building patient confidence. In addition, the relatively high cost of advanced artificial retina implants compared to conventional vision aids can be a barrier for price-sensitive patients

- While ongoing R&D and manufacturing innovations are gradually reducing costs, premium features such as high-resolution photodiode arrays and AI-driven image processing often carry a substantial price tag

- Overcoming these challenges through improved surgical protocols, patient education, and cost-effective device development will be vital for sustained growth in the artificial retina market

- Limited long-term clinical data on device efficacy and durability may create hesitation among physicians and patients, slowing adoption rates in certain regions

- Regulatory approval processes across different countries can be lengthy and complex, delaying market entry for innovative artificial retina systems and affecting global commercialization timelines

Artificial Retina Market Scope

The market is segmented on the basis of product type, disease indication, and end user.

- By Product Type

On the basis of product type, the artificial retina market is segmented into epiretinal implants, suprachoroidal implants, subretinal implants, and others. The epiretinal implant segment dominated the market with the largest revenue share of 41.8% in 2025, owing to its relatively advanced clinical adoption and well-established surgical procedures. Epiretinal implants are often preferred for patients with severe vision loss due to retinitis pigmentosa and offer a direct interface with the retinal ganglion cells. Their widespread availability, proven efficacy in multiple clinical trials, and integration with existing rehabilitation programs contribute to their market dominance. Companies such as Second Sight have leveraged epiretinal technology to achieve functional visual improvements in daily activities, enhancing patient independence. The reliability, long-term performance, and increasing physician familiarity with epiretinal implantation procedures reinforce its continued market leadership.

The subretinal implant segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by technological innovations such as miniaturized photodiode arrays and AI-driven image processing. Subretinal implants offer improved spatial resolution and natural image perception, making them increasingly attractive for age-related macular degeneration patients. The ability to restore partial vision through minimally invasive surgery, along with ongoing research collaborations, is driving rapid adoption. In addition, growing awareness among ophthalmologists and patients about the superior visual outcomes achievable with subretinal implants supports the segment’s high growth trajectory.

- By Disease Indication

On the basis of disease indication, the artificial retina market is segmented into retinitis pigmentosa (RP) and age-related macular degeneration (AMD). The retinitis pigmentosa segment dominated the market with the largest revenue share in 2025 due to the high prevalence of this inherited retinal degenerative disorder and the established clinical success of prosthetic vision solutions. Artificial retina systems have demonstrated significant functional vision restoration in RP patients, particularly through epiretinal and subretinal implants, supporting improved mobility and independence. Clinical trials and FDA-approved devices targeting RP patients have also strengthened physician and patient confidence. The segment benefits from early adoption in developed countries, availability of specialized ophthalmic centers, and strong R&D investments. The disease’s progressive nature further ensures consistent demand for innovative prosthetic solutions, sustaining market leadership.

The age-related macular degeneration (AMD) segment is expected to witness the fastest growth from 2026 to 2033 due to rising geriatric populations and increasing prevalence of AMD globally. AMD patients are increasingly seeking advanced artificial retina solutions, particularly subretinal implants, which can restore central vision and improve quality of life. Growing awareness of vision restoration therapies, reimbursement support, and technological advancements such as AI-enabled implants are accelerating adoption in this patient group. Emerging economies with expanding healthcare infrastructure are further supporting the rapid uptake of AMD-focused artificial retina solutions.

- By End User

On the basis of end user, the artificial retina market is segmented into ophthalmic centers, hospitals, research institutes, multi-specialty hospitals, and others. The ophthalmic centers segment dominated the market with the largest revenue share in 2025, owing to the specialized nature of implant surgeries and concentrated expertise required for patient selection, implantation, and post-operative care. Ophthalmic centers often provide dedicated rehabilitation programs and follow-up services, ensuring higher success rates for artificial retina procedures. The presence of experienced retinal surgeons, access to advanced surgical equipment, and clinical trial collaborations reinforce the segment’s dominance. Patients seeking prosthetic vision solutions often prefer ophthalmic centers for their comprehensive, tailored care and superior clinical outcomes.

The hospitals segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing investments in advanced ophthalmic infrastructure and the rising trend of hospital-based specialized vision restoration programs. Hospitals are expanding capabilities to include retinal implant surgeries, offering integrated care that combines surgical, post-operative, and rehabilitation services. The growing prevalence of AMD and RP among patients admitted to general and multi-specialty hospitals is increasing demand for artificial retina systems in these settings. In addition, partnerships between hospitals and medical device companies are accelerating technology adoption and accessibility.

Artificial Retina Market Regional Analysis

- North America dominated the artificial retina market with the largest revenue share of 38.6% in 2025, supported by strong ophthalmic research infrastructure, early adoption of advanced medical devices, and the presence of leading innovators and clinical trial activity, particularly in the U.S., where favorable funding environments and regulatory pathways are accelerating technology development

- Patients and healthcare providers in the region highly value the functional vision improvements, proven clinical outcomes, and access to advanced retinal implant systems such as epiretinal and subretinal devices

- This widespread adoption is further supported by favorable reimbursement policies, early adoption of innovative medical devices, well-established ophthalmic centers, and collaborations between leading device manufacturers and research institutions

U.S. Artificial Retina Market Insight

The U.S. artificial retina market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of retinal degenerative disorders and advanced healthcare infrastructure. Patients and ophthalmologists are increasingly prioritizing innovative solutions that restore partial vision and improve quality of life. The growing adoption of AI-enabled retinal implants and the availability of well-established rehabilitation programs further propels market growth. Moreover, strong funding for clinical trials, supportive regulatory pathways, and collaborations between leading device manufacturers and research institutions are significantly contributing to the market's expansion.

Europe Artificial Retina Market Insight

The Europe artificial retina market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of retinal diseases and supportive healthcare policies. Growing awareness among patients about vision restoration therapies and expanding clinical facilities are fostering the adoption of artificial retina systems. European consumers and ophthalmologists are also drawn to devices offering improved visual outcomes, safety, and reliability. The region is witnessing significant growth across specialized ophthalmic centers, hospitals, and research institutes, with retinal implants increasingly being incorporated into advanced treatment programs for both AMD and retinitis pigmentosa patients.

U.K. Artificial Retina Market Insight

The U.K. artificial retina market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of advanced ophthalmic therapies and increasing prevalence of retinal degenerative diseases. In addition, the demand for improved functional vision and enhanced patient independence is encouraging adoption among healthcare providers and patients. The U.K.’s well-developed healthcare infrastructure, alongside robust research collaborations and government support for innovative medical devices, is expected to continue stimulating market growth. The growing awareness of prosthetic vision solutions and availability of specialized ophthalmic centers further reinforce the market’s expansion.

Germany Artificial Retina Market Insight

The Germany artificial retina market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of advanced ophthalmic treatments and the demand for high-quality healthcare solutions. Germany’s emphasis on medical innovation, research, and well-established clinical infrastructure promotes the adoption of artificial retina systems, particularly in hospitals and ophthalmic centers. The integration of AI-enabled implants and advanced rehabilitation programs is also becoming increasingly prevalent, with a strong focus on patient safety, efficacy, and long-term clinical outcomes aligning with local healthcare standards and expectations.

Asia-Pacific Artificial Retina Market Insight

The Asia-Pacific artificial retina market is poised to grow at the fastest CAGR of 25% during 2026 to 2033, driven by increasing prevalence of retinal disorders, growing healthcare infrastructure, and rising investments in medical technology across countries such as China, Japan, and India. The region’s expanding awareness of vision restoration therapies and the establishment of specialized ophthalmic centers are driving adoption. Furthermore, government initiatives promoting advanced healthcare solutions and the presence of medical device manufacturers are enhancing the accessibility and affordability of artificial retina systems, supporting rapid market growth.

Japan Artificial Retina Market Insight

The Japan artificial retina market is gaining momentum due to the country’s advanced medical technology ecosystem, high awareness of vision restoration solutions, and growing prevalence of retinal degenerative diseases. The Japanese market places significant emphasis on improving quality of life through functional vision restoration, and adoption is driven by the increasing number of specialized ophthalmic centers and research initiatives. Integration of AI-enabled implants and advanced rehabilitation programs is fueling growth. Moreover, Japan’s aging population is likely to spur demand for artificial retina systems that provide easier-to-use and clinically effective vision restoration solutions across both clinical and research settings.

India Artificial Retina Market Insight

The India artificial retina market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing geriatric population, increasing prevalence of retinal disorders, and expanding healthcare infrastructure. India is emerging as a key market for ophthalmic innovations, and artificial retina systems are becoming increasingly adopted in hospitals, ophthalmic centers, and research institutes. The push towards advanced medical technologies, coupled with growing patient awareness and improving affordability of AI-enabled retinal implants, are key factors propelling market growth in India.

Artificial Retina Market Share

The Artificial Retina industry is primarily led by well-established companies, including:

- Nano Retina Ltd. (Israel)

- Axorus SAS (France)

- Bionic Vision Technologies (Australia)

- Bionic Sight, LLC (U.S.)

- A Neuron Electronic Corp. (Taiwan)

- ATLAS Neuroengineering (Belgium)

- Blackrock Europe GmbH (Germany)

- VisionCare Ophthalmic Technologies, Inc. (U.S.)

- Optobionics Corporation (U.S.)

- Intelligent Implants GmbH (Germany)

- iBIONICS Ltd. (Canada)

- Ocumetics Technology Corporation (Canada)

- LambdaVision, Inc. (U.S.)

- i Med Technology Inc. (Japan)

- GenSight Biologics SA (France)

- Retina Implant AG (Germany)

- Optic Sciences Corp (U.S.)

- MED EL (Austria)

- Carl Zeiss Meditec AG (Germany)

- Nidek Co., Ltd (Japan)

What are the Recent Developments in Global Artificial Retina Market?

- In October 2025, a new wireless retinal prosthesis (PRIMA) developed by Stanford Medicine & collaborators showed that patients with advanced age‑related macular degeneration regained functional vision, including the ability to read using the implant and specialized glasses in clinical trials, representing a breakthrough in form vision restoration

- In October 2025, a groundbreaking clinical trial of a surgically implanted PRIMA retinal microchip demonstrated that a majority of participants with advanced dry age‑related macular degeneration (AMD) regained meaningful central vision, enabling many to read letters, numbers, and words again a milestone described by experts as a potential “new era” in treating incurable blindness with prosthetic retinal technology

- In October 2025, results from the PRIMA system clinical trial demonstrated that a photovoltaic retinal implant enabled a majority of participants with dry AMD to read and recognize characters again a landmark achievement in prosthetic vision restoration

- In June 2025, the U.S. Food and Drug Administration (FDA) approved ENCELTO, a first‑of‑its‑kind surgically implanted retina‑related device designed to slow vision loss in people with macular telangiectasia type 2, marking a significant regulatory milestone for implantable retinal therapies

- In October 2024, positive preliminary results from the PRIMA retina implant trial were reported in Europe, showing meaningful improvements in visual acuity and reading ability among patients with geographic atrophy, helping pave the way for broader clinical adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.