Global Aspheric Lenses Market

Market Size in USD Billion

CAGR :

%

USD

176.27 Billion

USD

3,205.15 Billion

2024

2032

USD

176.27 Billion

USD

3,205.15 Billion

2024

2032

| 2025 –2032 | |

| USD 176.27 Billion | |

| USD 3,205.15 Billion | |

|

|

|

|

Aspheric Lenses Market Size

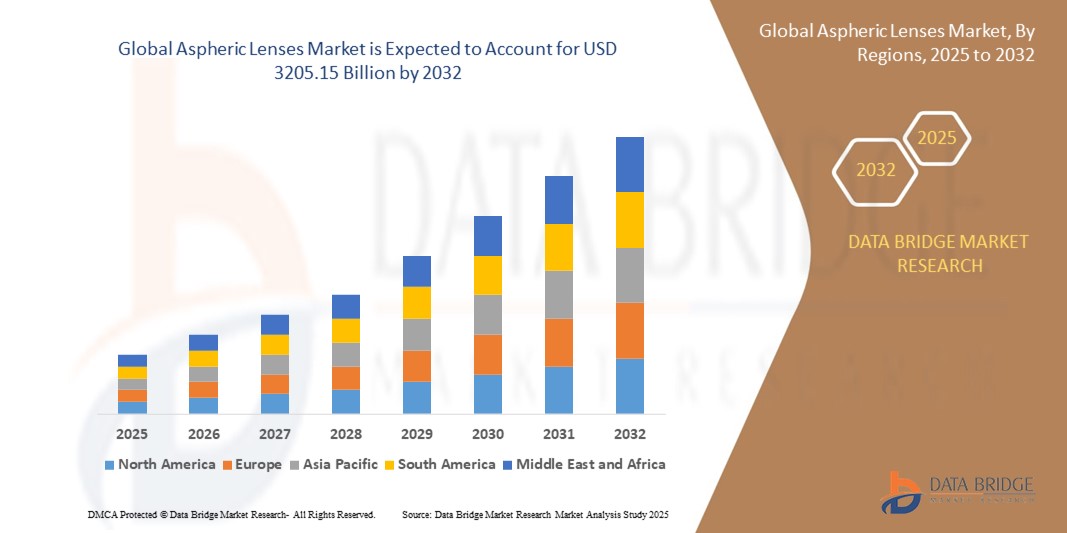

- The global aspheric lenses market size was valued at USD 176.27 billion in 2024 and is expected to reach USD 3205.15 billion by 2032, at a CAGR of 43.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for compact optical devices, rising adoption of aspheric lenses in smartphones and cameras, and advancements in vision correction technologies

- The widespread integration of aspheric lenses into augmented reality (AR) and virtual reality (VR) headsets is further accelerating market expansion across gaming and simulation industries

Aspheric Lenses Market Analysis

- The market is witnessing strong momentum due to the superior optical performance of aspheric lenses over traditional spherical lenses

- Applications in consumer electronics, medical devices, automotive sensors, and defense optics are driving demand

- North America dominated the aspheric lenses market with the largest revenue share in 2024, driven by strong demand in the consumer electronics, automotive, and medical imaging sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global aspheric lenses market, driven by strong industrialization, increasing production of smartphones and digital cameras, and the growing presence of optical component manufacturers in countries such as China, Japan, and South Korea

- The glass aspherical lens segment accounted for the largest revenue share in 2024, driven by its superior optical quality and durability. These lenses are extensively used in high-end cameras, medical instruments, and scientific equipment, where precision and reliability are critical. Their resistance to temperature variation and ability to minimize spherical aberration further support their dominant position in professional-grade optical systems

Report Scope and Aspheric Lenses Market Segmentation

|

Attributes |

Aspheric Lenses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption in Augmented and Virtual Reality Devices • Growing Demand from Advanced Medical Imaging Applications |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aspheric Lenses Market Trends

“Surging Use of Aspheric Lenses in Smartphone Cameras and Consumer Electronics”

- Increasing demand for high-quality mobile photography is encouraging smartphone manufacturers to use aspheric lenses to reduce image distortion and enhance clarity

- Consumer electronics such as tablets, smart glasses, and VR/AR devices rely on compact and high-performance optics, boosting adoption of aspheric lenses

- Aspheric lenses are preferred in smartphones due to their ability to maintain image sharpness while reducing the number of lens elements

- The trend toward slimmer, lighter devices has prompted the integration of more efficient aspheric lens systems in premium consumer gadgets

- For instance, Apple’s multi-lens iPhone camera setup uses aspheric elements to support advanced image processing and portrait modes

Aspheric Lenses Market Dynamics

Driver

“Expanding Applications in Automotive Optics and Lighting Systems”

- Automotive headlamps increasingly use aspheric lenses to create focused and adaptive lighting patterns that improve road visibility and safety

- Driver assistance technologies, such as LIDAR and night vision systems, benefit from the precision and reduced aberrations offered by aspheric optics

- The rise of electric vehicles has created demand for lightweight optical components that do not compromise performance

- Aspheric lenses also support in-vehicle systems such as HUDs and interior lighting, contributing to driver comfort and safety

- For instance, Audi’s Matrix LED headlights incorporate aspheric lens elements to deliver dynamically adjustable beam patterns

Restraint/Challenge

“High Manufacturing Costs and Complex Production Processes”

- Producing aspheric lenses requires advanced shaping, polishing, or molding technologies, which significantly raise production costs

- Precision manufacturing tolerances must be maintained to ensure performance, leading to more rigorous inspection and potential yield losses

- The specialized equipment and skilled labor needed for manufacturing aspheric optics can be a barrier for new market entrants

- High rejection rates and material waste during production hinder scalability and profitability, especially in custom or high-precision optics

- For instance, medical device companies that require custom-fitted optical lenses face increased costs due to the exacting tolerances needed for diagnostic accuracy

Aspheric Lenses Market Scope

The market is segmented on the basis of type, technology, coating type, application, and distribution channel.

- By Type

On the basis of type, the aspheric lenses market is segmented into glass aspherical lens, plastic aspherical lens, and others. The glass aspherical lens segment accounted for the largest revenue share in 2024, driven by its superior optical quality and durability. These lenses are extensively used in high-end cameras, medical instruments, and scientific equipment, where precision and reliability are critical. Their resistance to temperature variation and ability to minimize spherical aberration further support their dominant position in professional-grade optical systems.

The plastic aspherical lens segment is expected to witness the fastest growth from 2025 to 2032 due to its lightweight properties and cost-effective mass production. The segment’s growth is strongly supported by expanding use in compact consumer electronics such as smartphones, AR/VR headsets, and wearable tech. Manufacturers are increasingly favoring plastic lenses for portable devices to reduce weight while maintaining acceptable optical clarity.

- By Technology

On the basis of technology, the market is segmented into precision glass molding, hybrid molding, and diamond turning. The precision glass molding segment led the market in 2024, attributed to its capacity to mass-produce high-accuracy lenses with minimal post-processing. This technology is widely used for manufacturing optics in cameras, sensors, and automotive systems.

The diamond turning segment is expected to witness the fastest growth from 2025 to 2032, supported by its ability to create ultra-precise custom lenses for aerospace, medical imaging, and defense sectors. Its high versatility in crafting complex freeform surfaces adds to its growing demand across high-tech industries.

- By Coating Type

Based on coating type, the market is categorized into anti-reflective coatings, hydrophobic coatings, and oleophobic coatings. The anti-reflective coatings segment dominated in 2024 owing to its widespread application in minimizing glare and enhancing light transmission in lenses used for photography, consumer electronics, and automotive displays.

The hydrophobic coatings segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for smudge-resistant and water-repelling lenses in optical eyewear, smartphones, and high-performance sports gear.

- By Application

By application, the market is segmented into cameras and photography, medical devices, optical instruments, and automotive. The cameras and photography segment held the largest market share in 2024, supported by rising demand for high-resolution imaging and DSLR lens enhancements.

The automotive segment is expected to witness the fastest growth from 2025 to 2032, driven by the integration of aspheric lenses in advanced driver-assistance systems (ADAS), head-up displays (HUDs), and LED lighting for improved road visibility and safety.

- By Distribution Channel

On the basis of distribution channel, the aspheric lenses market is segmented into direct sales, distributors, and online retailers. The direct sales segment led the market in 2024, benefiting from established relationships between lens manufacturers and OEMs across high-precision industries such as healthcare and aerospace.

Online retailers is expected to witness the fastest growth from 2025 to 2032, due to the increasing popularity of e-commerce platforms, especially for standard or replacement optics in consumer and photography applications.

Aspheric Lenses Market Regional Analysis

- North America dominated the aspheric lenses market with the largest revenue share in 2024, driven by strong demand in the consumer electronics, automotive, and medical imaging sectors

- The region benefits from the presence of established optical manufacturers, advanced healthcare infrastructure, and increasing adoption of high-end cameras and precision optical instruments

- Rapid advancements in digital photography and growing use of aspheric lenses in ophthalmic applications are also contributing to regional market growth

U.S. Aspheric Lenses Market Insight

The U.S. aspheric lenses market captured the largest revenue share within North America in 2024, supported by its well-developed healthcare and defense sectors. Rising demand for high-performance imaging systems in medical diagnostics and surveillance technologies continues to boost product adoption. In addition, the growing popularity of premium smartphones and digital cameras has elevated the demand for compact, high-precision lenses. Technological innovations from local manufacturers, such as glass molding and diamond turning, are further reinforcing the U.S. position in the global market.

Europe Aspheric Lenses Market Insight

The Europe aspheric lenses market is expected to witness the fastest growth from 2025 to 2032, fuelled by increasing usage in automotive advanced driver-assistance systems (ADAS), biomedical devices, and optical instruments. The region's focus on energy efficiency and precision optics is promoting the adoption of high-quality lenses in both industrial and consumer sectors. Furthermore, strong presence of lens manufacturers and growing investments in photonics R&D are propelling the market forward across countries including Germany, France, and the Netherlands.

U.K. Aspheric Lenses Market Insight

The U.K. aspheric lenses market is expected to witness the fastest growth from 2025 to 2032, driven by expanding demand in the medical diagnostics, defense, and consumer electronics industries. With rising investments in optical research and innovation, the U.K. is becoming a significant contributor to Europe's photonics ecosystem. The presence of top-tier academic institutions and advanced manufacturing capabilities further enhance the market’s development prospects.

Germany Aspheric Lenses Market Insight

Germany is expected to witness the fastest growth from 2025 to 2032, owing to its strong industrial base and reputation for optical precision engineering. The country's thriving automotive industry is increasingly utilizing aspheric lenses in sensors and camera-based systems. Moreover, demand from machine vision, medical devices, and laser systems continues to support market growth, bolstered by ongoing advancements in lens coating and molding technologies.

Asia-Pacific Aspheric Lenses Market Insight

The Asia-Pacific region is expected to witness the fastest growth from 2025 to 2032, driven by booming consumer electronics and automotive sectors in countries such as China, Japan, South Korea, and India. The region's growing middle-class population and rising demand for smartphones and imaging devices are key growth drivers. Government initiatives supporting manufacturing and the development of local optical components industries are also accelerating adoption.

Japan Aspheric Lenses Market Insight

Japan’s aspheric lenses market is expected to witness the fastest growth from 2025 to 2032, driven by innovation in optical design and long-standing expertise in precision manufacturing. The country’s electronics and camera manufacturers continue to integrate aspheric lenses into high-end consumer products. In addition, demand for compact optical systems in robotic surgery, endoscopy, and diagnostics is contributing to growth. The Japanese market places strong emphasis on miniaturization and performance, fostering continued R&D in lens fabrication.

China Aspheric Lenses Market Insight

China leads the Asia-Pacific market in revenue share for aspheric lenses, backed by its rapidly expanding consumer electronics industry and government support for optical technologies. Rising demand for smartphones with enhanced cameras and wearable devices is propelling the market. The country is also a key supplier of plastic molded aspheric lenses, benefiting from large-scale production facilities and competitive manufacturing costs. China’s investment in smart infrastructure and surveillance technology continues to amplify the demand.

Aspheric Lenses Market Share

The Aspheric Lenses industry is primarily led by well-established companies, including:

- Canon India Pvt Ltd. (India)

- Panasonic Industry (Japan)

- HOYA (Japan)

- AGC Inc. (Japan)

- SCHOTT AG (Germany)

- ZEISS Group (Germany)

- Genius Electronic Optical (Taiwan)

- Largan Precision Co.,Ltd. (Taiwan)

- Asia Optical (Taiwan)

Latest Developments in Global Aspheric Lenses Market

- In October 2023, Hoya Corporation announced its acquisition of Gentec Electro-Optics, signaling a strategic expansion into the industrial and scientific aspheric lens market. By integrating Gentec's expertise in high-precision laser beam measurement and calibration systems, Hoya aims to bolster its position in specialized sectors, emphasizing diversification and technological advancement

- In September 2023, Canon launched the RF 15-30mm F/2.8L IS USM lens tailored for professional photographers and videographers. Featuring advanced aspheric elements, this wide-angle lens delivers exceptional sharpness and minimal distortion, meeting the exacting standards of precision and quality demanded by professionals in the field

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aspheric Lenses Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aspheric Lenses Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aspheric Lenses Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.